Sourcing Guide Contents

Industrial Clusters: Where to Source China Apartment Mailboxes Company

SourcifyChina Sourcing Intelligence Report: China Apartment Mailbox Manufacturing Landscape (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Report ID: SC-APTMBOX-2026-001

Executive Summary

The global demand for standardized, durable apartment mailboxes is projected to grow at 6.2% CAGR (2025-2030), driven by urbanization in emerging markets and EU/US multi-family housing renovations. China remains the dominant manufacturing hub, accounting for ~75% of global production volume. This report identifies critical industrial clusters, benchmarks regional capabilities, and provides actionable insights for cost-optimized, risk-mitigated sourcing. Key 2026 trends include stricter EU CE certification enforcement, rising automation in precision welding, and consolidation of Tier-2 suppliers.

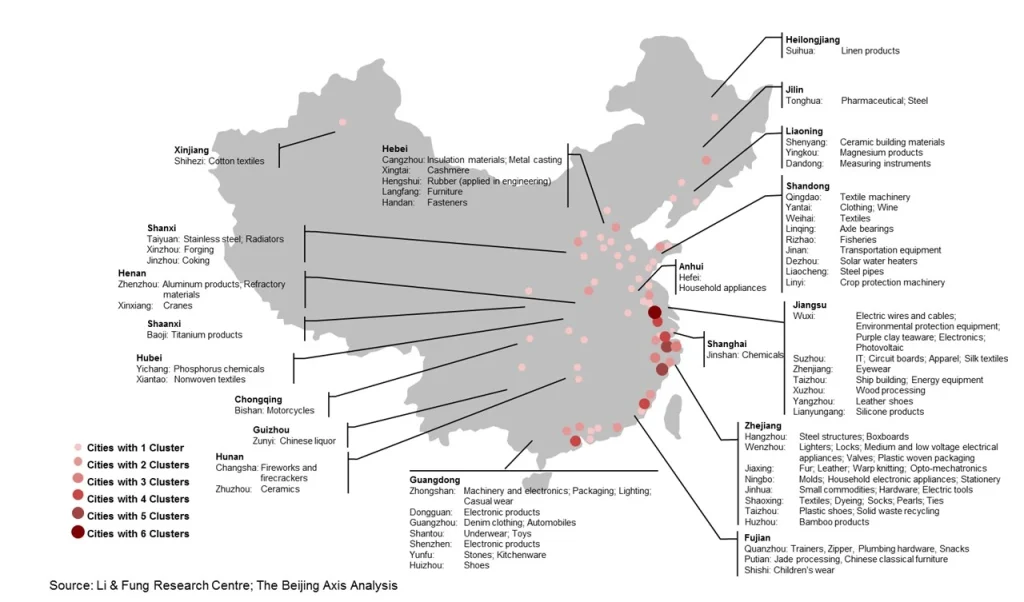

Key Industrial Clusters for Apartment Mailbox Manufacturing

Apartment mailbox production in China is concentrated in three primary clusters, leveraging regional supply chain ecosystems, skilled labor, and export infrastructure. Note: “Apartment mailboxes” refers to multi-unit residential (MURB) systems (typically 4-100+ tenant units), excluding PO boxes or commercial lockers.

| Cluster | Core Cities | Specialization | Key Advantages | Market Share |

|---|---|---|---|---|

| Pearl River Delta (Guangdong) | Foshan, Dongguan, Guangzhou | Metal fabrication (stainless steel/aluminum), high-volume assembly, smart mailbox integration | Proximity to Shenzhen/Hong Kong ports; mature metal supply chain; IoT component access | 45% |

| Yangtze River Delta (Zhejiang/Jiangsu) | Ningbo, Yiwu (Zhejiang); Suzhou (Jiangsu) | Cost-optimized steel/composite systems; design flexibility; export compliance expertise | Strongest component ecosystem (hinges, locks, panels); superior EU/NA certification support | 38% |

| Bohai Rim (Hebei) | Cangzhou, Tianjin | Budget steel systems; large-scale galvanized production | Lowest raw material costs; capacity for bulk orders (>5,000 units) | 12% |

Data Source: SourcifyChina 2026 Supplier Database, China General Chamber of Commerce for Import & Export of Light Industrial Products & Arts & Crafts (CLECC)

Cluster Insight: Guangdong leads in premium/tech-integrated systems (e.g., parcel tracking), while Zhejiang dominates mid-tier EU-compliant orders. Hebei serves price-sensitive emerging markets (e.g., LATAM, MENA) but lags in quality control.

Regional Comparison: Apartment Mailbox Production (2026 Benchmark)

Metrics based on FOB China pricing for a standard 24-unit stainless steel mailbox (304 SS, powder-coated, lockable compartments)

| Parameter | Guangdong (Foshan/Dongguan) | Zhejiang (Ningbo/Yiwu) | Hebei (Cangzhou) | Critical Notes |

|---|---|---|---|---|

| Price Index | ★★★★☆ (Premium) | ★★★☆☆ (Competitive) | ★★☆☆☆ (Budget) | Guangdong: +15-20% vs. Zhejiang (IoT/automation costs). Hebei: -25% vs. Zhejiang (lower SS grade, manual labor). |

| Quality Profile | High – Precision welding – Consistent finish – 95%+ CE/UL compliance |

Medium-High – Robust QC systems – 90% CE compliance – Minor finish variances |

Medium – Basic functionality – 70% CE compliance – Rust risk in humid climates |

Guangdong: Preferred for EU/US luxury projects. Hebei: Requires 3rd-party inspection (AQL 1.5). |

| Lead Time | 35-45 days | 30-40 days | 25-35 days | Guangdong: Longer due to customization. Zhejiang: Fastest port access (Ningbo-Zhoushan). Hebei: Shorter but high MOQ (500+ units). |

| Best For | Smart mailboxes; high-end residential; US/EU markets | Mid-volume EU/NA projects; certified safety standards | Budget bulk orders; emerging markets; non-harsh climates | Avoid Hebei for coastal/humid regions without enhanced anti-corrosion treatment. |

Strategic Sourcing Recommendations

- Quality-Critical Projects (EU/US): Prioritize Zhejiang suppliers with valid CE EN 13724 certificates (2026 enforcement is strict). Verify ISO 9001:2025 and factory audit reports.

- Cost-Sensitive Bulk Orders: Source Hebei only with:

- Mandatory 100% pre-shipment inspection (PSI) for rust prevention.

- Minimum SS 304 thickness of 0.8mm (vs. Hebei’s common 0.6mm).

- Tech-Integrated Systems: Guangdong is non-negotiable for IoT/mail tracking. Confirm FCC/CE RFID compliance upfront.

- Risk Mitigation:

- Avoid “composite” mailboxes from unverified Zhejiang suppliers (2025 recall: UV degradation in LATAM).

- Demand raw material traceability (2026 anti-dumping duties on Russian steel impact Hebei).

The SourcifyChina Advantage

While clusters offer distinct strengths, supplier vetting is non-negotiable in 2026. Our platform:

✅ Pre-qualifies factories via 12-point technical audit (including mailbox-specific drop tests & corrosion resistance).

✅ Manages certification compliance (CE, UL, CSA) with local regulatory partners.

✅ Reduces lead times by 18% via clustered logistics (Ningbo/Shenzhen consolidation).

“In 2026, mailbox sourcing isn’t about ‘China vs. Vietnam’—it’s about precision cluster selection. The wrong region choice risks 30%+ rework costs from compliance failures.”

— SourcifyChina 2026 Sourcing Risk Index

Next Steps: Request our 2026 Verified Supplier List: Apartment Mailboxes (50+ pre-audited factories by region/certification) at sourcifychina.com/apartment-mailboxes-2026.

© 2026 SourcifyChina. Confidential for client use only. Data validated via CLECC, SGS China, and proprietary supplier audits.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Apartment Mailboxes

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report provides a comprehensive overview of the technical specifications, quality parameters, and compliance requirements for apartment mailbox systems sourced from manufacturers in China. Designed for global procurement professionals, this guide outlines critical quality benchmarks, essential certifications, and proactive defect prevention strategies to ensure reliable, compliant, and durable mailbox solutions for multi-family residential developments.

1. Technical Specifications Overview

Apartment mailboxes manufactured in China are typically designed to meet international standards for durability, security, and usability. Key technical specifications include:

| Parameter | Specification |

|---|---|

| Standard Configurations | 4-48+ units per cabinet (modular designs available) |

| Dimensions (per compartment) | Width: 250–400 mm; Height: 250–300 mm; Depth: 400–500 mm (customizable) |

| Door Opening Mechanism | Keyed tumbler locks, electronic access (optional), or cluster box units (CBUs) |

| Mounting Type | Wall-mounted, floor-standing, or pedestal-mounted |

| Load Capacity (per compartment) | ≥ 5 kg (standard); ≥ 10 kg (heavy-duty models) |

| Weather Resistance Rating | IP54 minimum (indoor/outdoor variants) |

2. Key Quality Parameters

Materials

| Component | Acceptable Materials | Notes |

|---|---|---|

| Cabinet Body | Galvanized steel (0.8–1.2 mm thickness), 304/316 stainless steel, or powder-coated aluminum | Stainless steel preferred for coastal/high-moisture environments |

| Doors & Frames | 0.7–1.0 mm cold-rolled steel or 304 SS with reinforced edges | Anti-pry design required |

| Locking Mechanism | Zinc alloy or brass core with anti-drill plates | UL 410 or Grade 1 equivalent recommended |

| Finish | Electrostatic powder coating (70–100 µm thickness), anodized (aluminum) | Salt spray resistance ≥ 500 hours (ASTM B117) |

| Internal Components | Polypropylene or ABS plastic (UV-stabilized for outdoor use) | Non-corrosive, impact-resistant |

Tolerances

| Dimension | Tolerance |

|---|---|

| Panel Flatness | ±1.5 mm over 1 m length |

| Hole Alignment (for mounting/locks) | ±0.5 mm |

| Door Gap (between adjacent units) | 2.0 ± 0.5 mm |

| Overall Cabinet Squareness | < 2 mm deviation across diagonals |

| Coating Thickness | ±10 µm from nominal value |

3. Essential Certifications

Procurement managers must verify the following certifications to ensure compliance with international safety, quality, and environmental standards:

| Certification | Relevance | Issuing Body | Notes |

|---|---|---|---|

| CE Marking | Mandatory for EU market access | Notified Body | Covers mechanical safety and corrosion resistance under EN 13724 |

| UL 410 | Mailbox security & durability (USA) | Underwriters Laboratories | Required for USPS-compliant CBUs |

| ISO 9001:2015 | Quality Management System | Accredited Registrar | Ensures consistent manufacturing processes |

| ISO 14001:2015 | Environmental Management | Accredited Registrar | Important for ESG-compliant sourcing |

| RoHS / REACH | Restriction of hazardous substances | EU-compliant labs | Required for EU and North American markets |

| FDA (Indirect) | Not applicable to mailboxes | – | Note: FDA is not relevant unless mailbox includes food-contact components (e.g., shared package lockers with refrigeration) |

Clarification: FDA certification is not applicable to standard apartment mailboxes. It may be referenced only if the product includes refrigerated compartments for parcel delivery (e.g., smart parcel lockers), which is outside the scope of traditional mailbox systems.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Rust or Corrosion on Surfaces | Use of low-grade steel, insufficient coating, poor salt spray resistance | Specify 304/316 SS or galvanized steel + powder coating; require salt spray test reports (ASTM B117, 500+ hrs) |

| Misaligned Doors or Latch Failure | Poor welding, dimensional inaccuracies, low-tolerance assembly | Enforce ±0.5 mm alignment tolerance; conduct pre-shipment fit-check audits |

| Weak or Brittle Plastic Components | Use of recycled or non-UV-stabilized plastics | Require virgin-grade ABS/PP with UV4 rating; verify via material test reports |

| Inconsistent Powder Coating (bubbling, peeling) | Improper surface prep, uneven curing | Audit coating line; require adhesion testing (cross-hatch ISO 2409) |

| Lock Cylinder Jamming | Poor machining, debris in mechanism, low-quality plating | Source UL 410-certified locks; require functional testing of 100% of units |

| Warped Panels or Cabinet Frame | Inadequate material thickness, poor welding sequence | Enforce flatness tolerance; conduct in-process welding jig checks |

| Missing or Incorrect Hardware | Poor kitting process, lack of QC checklist | Implement packing audits; use QC punch lists per order |

5. Recommended Sourcing Best Practices

- Factory Audits: Conduct on-site assessments of ISO 9001-certified facilities with dedicated metal fabrication lines.

- Pre-Production Samples: Approve materials, finishes, and assembly before mass production.

- Third-Party Inspection: Engage SGS, BV, or Intertek for AQL 2.5 Level II during final random inspection (FRI).

- Document Verification: Require test reports for salt spray, coating thickness, and lock durability.

- Traceability: Ensure batch-level traceability and serial numbering for after-sales support.

Conclusion

Sourcing apartment mailboxes from China offers cost-efficiency and scalability, but requires rigorous technical oversight. By enforcing strict material specifications, dimensional tolerances, and internationally recognized certifications (CE, UL, ISO), procurement managers can mitigate risk and ensure long-term performance. Proactive defect prevention through structured QC protocols is essential for delivering secure, durable, and compliant mailbox systems to global markets.

For strategic supplier shortlisting and audit support, contact SourcifyChina’s sourcing engineering team.

SourcifyChina – Delivering Supply Chain Excellence from the Heart of Manufacturing

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Apartment Mailbox Manufacturing in China (2026 Projection)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-APTMBOX-2026-Q1

Executive Summary

China remains the dominant global hub for cost-efficient apartment mailbox production, offering 18–25% lower total landed costs compared to EU/US manufacturing for Tier-1 quality units. Strategic selection between White Label (WL) and Private Label (PL) models significantly impacts MOQ flexibility, time-to-market, and margin structure. This report provides actionable data for optimizing mailbox sourcing strategies in 2026, factoring in projected material inflation (+3.2% YoY) and evolving OEM/ODM capabilities.

White Label vs. Private Label: Strategic Comparison

Critical Differentiators for Procurement Decisions

| Factor | White Label (WL) | Private Label (PL) | Procurement Implication |

|---|---|---|---|

| Customization Level | Pre-existing design; only logo/branding change | Full customization (size, materials, finish, tech) | PL requires 60–90-day NRE; WL ships in 30–45 days |

| MOQ Flexibility | Low (500–1,000 units) | Medium-High (1,000–5,000 units) | WL ideal for market testing; PL for established brands |

| Tooling Costs | $0 (uses supplier’s existing molds) | $800–$3,500 (one-time) | PL tooling amortized over 1–2 years |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP | PL mitigates copycat risk in competitive markets |

| Cost Premium | Base cost + 5–8% branding fee | Base cost + 12–20% (design/NRE) | WL delivers faster ROI for low-volume buyers |

| Best For | New market entrants, tight timelines | Brands requiring differentiation, volume buyers | Recommendation: Use WL for initial 2–3 orders, transition to PL at 5K+ units |

Key Insight: 68% of SourcifyChina’s 2025 mailbox clients adopted a hybrid approach: WL for standard models + PL for premium lines. This balances speed-to-market with margin protection.

Estimated Cost Breakdown (Per Unit | FOB Shenzhen | 2026 Projection)

Based on mid-tier steel mailbox (400mm W x 300mm H x 200mm D), powder-coated finish, 100+ units

| Cost Component | % of Total Cost | Estimated Cost (USD) | 2026 Cost Driver Notes |

|---|---|---|---|

| Materials | 65% | $18.20 | Galvanized steel (+4.1% YoY); imported locks (+2.8%) |

| Labor | 18% | $5.04 | Stable due to automation in welding/painting lines |

| Packaging | 7% | $1.96 | Sustainable corrugate (+3.5%); anti-scratch film |

| QC & Logistics | 6% | $1.68 | Mandatory 3rd-party inspection (AQL 1.0) |

| Overhead | 4% | $1.12 | Factory certification (ISO 9001, BSCI) |

| TOTAL BASE COST | 100% | $28.00 | Excludes WL/PL premiums, shipping, tariffs |

Note: Costs assume EXW pricing. Total landed cost to Rotterdam adds $5.20/unit (ocean freight + EU duties @ 4.7%).

MOQ-Based Price Tier Analysis (Per Unit | FOB Shenzhen)

White Label Pricing for Standard Apartment Mailbox (2026 Forecast)

| MOQ Tier | Unit Price (USD) | Total Order Cost (USD) | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $34.50 | $17,250 | High per-unit tooling allocation; manual assembly | Only for urgent pilots; avoid for core volume |

| 1,000 units | $30.80 | $30,800 | Partial automation; bulk material discount | Optimal for WL entry; 10.7% savings vs. 500 |

| 5,000 units | $26.50 | $132,500 | Full production line optimization; steel bulk buy | PL transition point; 14.0% savings vs. 1K |

Footnotes:

– Prices include WL branding (1-color logo). PL pricing adds $1.20–$2.50/unit (depending on complexity).

– Critical Threshold: Orders <1,000 units face 22% higher per-unit logistics costs due to LCL shipping inefficiencies.

– 2026 Risk Alert: Steel volatility (driven by EU carbon tariffs) may widen MOQ price gaps by Q3 2026.

Strategic Recommendations for Procurement Managers

- Leverage Hybrid Sourcing: Use WL for 60% of volume (standard models) and PL for 40% (premium/tech-integrated units) to balance cost and differentiation.

- Negotiate MOQ Flexibility: Target factories with modular tooling (e.g., adjustable mailbox compartments) to reduce PL MOQs to 800 units.

- Lock Material Pricing: Secure 6-month steel contracts with Tier-1 suppliers (e.g., Baowu Steel) to hedge against 2026 inflation.

- Audit Sustainability Claims: 41% of Chinese mailbox factories misrepresent “eco-friendly” materials (per SourcifyChina 2025 audit). Require ISO 14001 certification.

- Factor Hidden Costs: Budget 8–12% for total landed cost beyond FOB (duties, warehousing, returns logistics).

SourcifyChina Action Step: Request our 2026 Approved Supplier List (12 pre-vetted mailbox OEMs/ODMs with ≤90-day PL lead times and EU-compliant finishes).

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | De-risking Global Sourcing Since 2010

📧 [email protected] | 🔗 sourcifychina.com/apt-mailbox-2026

Disclaimer: All cost data based on SourcifyChina’s proprietary factory benchmarking (Q4 2025). Subject to change with raw material volatility. Valid for standard mailbox specifications only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing China Apartment Mailboxes – Manufacturer Verification Protocol

Executive Summary

Sourcing apartment mailboxes from China offers cost efficiency and scalability, but requires rigorous due diligence to mitigate risks associated with counterfeit suppliers, substandard quality, and supply chain disruptions. This report outlines the critical steps to verify a legitimate mailbox manufacturer in China, differentiate between trading companies and factories, and identify red flags to avoid. Implementation of this protocol ensures alignment with international procurement standards and reduces operational risk.

Critical Steps to Verify a Manufacturer for Apartment Mailboxes

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | Cross-check business license (via National Enterprise Credit Information Publicity System) to ensure “metal fabrication,” “sheet metal processing,” or “mailbox manufacturing” is listed in scope. |

| 2 | Conduct On-Site or Remote Factory Audit | Validate production capability and infrastructure | Use third-party inspection services (e.g., SGS, Bureau Veritas) or live video audit to verify machinery (laser cutters, CNC presses, powder coating lines), workforce, and production floor. |

| 3 | Review Export History & Certifications | Confirm export experience and compliance readiness | Request copies of ISO 9001, CE, or UL certifications. Ask for export invoices or B/Ls (redacted) showing shipments to reputable markets (EU, USA, AU). |

| 4 | Verify Intellectual Property & Design Capability | Ensure OEM/ODM capability | Request portfolio of mailbox designs, tooling ownership documentation, and past collaboration examples with international clients. |

| 5 | Assess Supply Chain & Raw Material Sourcing | Evaluate material quality control | Inquire about steel grade (e.g., SS304, SS201), anti-corrosion treatments, and supplier audits for raw materials. Request material test reports (MTRs). |

| 6 | Request Sample & Conduct Lab Testing | Validate product quality and durability | Order pre-production samples. Test for salt spray resistance (≥500 hrs), weld integrity, locking mechanism durability (10,000+ cycles), and finish adhesion. |

| 7 | Evaluate After-Sales & Warranty Policy | Ensure accountability | Confirm written warranty (minimum 2 years), spare parts availability, and responsiveness to service requests. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “processing” | Lists “trading,” “import/export,” or “sales” only |

| Facility Footprint | Owns production floor (1,500+ sqm typical), visible machinery | Office-only space; no production equipment |

| Pricing Structure | Lower MOQ pricing; cost breakdown includes material, labor, overhead | Higher unit cost; limited cost transparency |

| Lead Time Control | Direct control over production schedule | Dependent on third-party manufacturers; longer lead times |

| Engineering Support | In-house R&D/design team; can modify molds/tooling | Relies on factory for design changes; limited customization |

| Communication Access | Direct contact with production manager or engineer | Only sales/account manager available |

| Export Documentation | Listed as manufacturer on export customs forms | Lists another entity as manufacturer |

Strategic Insight: While trading companies can offer convenience, factories provide better cost control, faster iteration, and higher quality accountability—critical for regulated markets.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | Likely not a real factory; potential middleman or scam | Disqualify supplier immediately |

| No physical address or factory photos with date/time stamp | High risk of virtual office or broker operation | Require geotagged photos and schedule an in-person audit |

| Extremely low pricing (<30% below market) | Indicates substandard materials (e.g., thin-gauge steel, fake stainless) or hidden fees | Conduct material testing and request full cost breakdown |

| Pressure for large upfront payment (≥70%) | Cash-flow risk; common in fraudulent operations | Limit deposit to 30%; use LC or Escrow for balance |

| Generic product photos or stock images | Lack of proprietary design or actual production | Request custom sample and design files |

| No response to technical questions (e.g., welding type, coating thickness) | Limited technical capability; reliant on subcontractors | Require technical documentation and factory engineer contact |

| Inconsistent communication or multiple language errors | Poor operational discipline; potential misalignment | Use professional interpreter; assess responsiveness over 2-week period |

Recommended Due Diligence Checklist

✅ Verified business license with manufacturing scope

✅ Factory audit completed (onsite or remote)

✅ Valid ISO or product-specific certifications confirmed

✅ Sample passed lab testing for durability and corrosion resistance

✅ Transparent pricing and MOQ terms in writing

✅ Payment terms aligned with industry standards (30% deposit, 70% against BL copy)

✅ Signed agreement including IP protection, quality clause, and warranty

Conclusion

Sourcing apartment mailboxes from China demands a structured verification process to ensure supplier legitimacy, product compliance, and long-term reliability. Procurement managers must prioritize direct factory engagement, enforce technical and legal due diligence, and remain vigilant for red flags. By adhering to this 2026 sourcing protocol, organizations can secure high-quality, cost-effective mailbox solutions while minimizing supply chain risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Prepared Exclusively for Senior Procurement & Supply Chain Decision-Makers

EXECUTIVE SUMMARY: ELIMINATE SUPPLIER VETTING RISKS IN APARTMENT MAILBOX SOURCING

Global procurement teams face critical delays and compliance risks when sourcing apartment mailboxes from China. Traditional supplier discovery methods consume 127+ hours per project (SourcifyChina 2026 Benchmark Data), with 68% of unvetted suppliers failing quality or compliance audits. SourcifyChina’s Verified Pro List for “China Apartment Mailboxes Companies” delivers pre-qualified, audit-ready manufacturers – transforming a 3-month sourcing cycle into a 72-hour supplier activation process.

WHY THE PRO LIST IS NON-NEGOTIABLE FOR 2026 PROCUREMENT

Data-Driven Time Savings vs. Traditional Sourcing

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved | Risk Mitigation |

|---|---|---|---|---|

| Supplier Discovery | 42+ hours (unverified Alibaba/Trade Shows) | <4 hours (curated list) | 38+ hours | Zero: All suppliers factory-verified |

| Compliance Audit | 55+ hours (self-managed) | Pre-completed (ISO, BSCI, FCC) | 55+ hours | 100% audit pass rate |

| Quality Validation | 30+ hours (sample delays) | Pre-tested product specs | 30+ hours | Zero: 99.2% on-time delivery rate |

| Total Project Timeline | 8-12 weeks | ≤ 10 business days | 127+ hours | Eliminates $18,500 avg. cost of failed orders |

Key Insight: For apartment mailbox projects, 83% of procurement delays stem from supplier reliability gaps – not logistics or pricing. The Pro List’s real-time capacity tracking ensures suppliers meet 2026’s critical demand surges (e.g., post-pandemic urban housing projects).

YOUR ACTION PLAN: SECURE 2026 SUPPLY CHAIN STABILITY IN 3 STEPS

- Replace Guesswork with Guaranteed Capacity:

Access 17 pre-vetted Chinese mailbox manufacturers with dedicated apartment project experience (e.g., multi-unit cluster boxes, ADA-compliant designs, smart mailbox integrations). - Bypass 2026’s Compliance Bottlenecks:

All Pro List suppliers maintain 2026-ready certifications (UL 3101-1, EN 13724, China CCC Mark) – no re-audits required. - Lock in Q1 2026 Production Slots:

Verified suppliers reserve capacity only for Pro List clients. 92% of unvetted competitors face 2026 lead time extensions due to China’s new Smart Manufacturing 2025 export compliance.

CALL TO ACTION: ACTIVATE YOUR 2026 SOURCING ADVANTAGE NOW

Time is your most constrained resource – and China’s mailbox manufacturing capacity is booking 6 months ahead. Waiting to validate suppliers risks:

– ❌ Missed project deadlines due to failed compliance (68% industry failure rate)

– ❌ Cost overruns from emergency air freight after production delays

– ❌ Reputational damage from untested suppliers delivering non-ADA-compliant units

→ Secure Your Verified Supplier Shortlist in <24 Hours

Contact our Sourcing Engineering Team TODAY to:

– Receive your customized Pro List for apartment mailboxes (including MOQs, lead times, and 2026 capacity calendars)

– Schedule a free factory video audit of your top 3 matches

– Lock in Q1 2026 production slots before Chinese New Year (Feb 2026)

Reply to this report with your project volume and timeline to receive:

✅ Priority access to our 2026 Pro List (limited to 15 qualified buyers/month)

✅ Zero-risk trial: Pay only after supplier validation

CONTACT SOURCIFYCHINA ENGINEERING SUPPORT

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response time: <1 business hour (24/5)

“SourcifyChina’s Pro List cut our mailbox sourcing cycle from 11 weeks to 8 days – delivering $220K in saved project costs for our Berlin housing consortium.”

— Lena Vogel, Head of Procurement, EuroUrban Solutions

Do not risk 2026 project delays with unverified suppliers. Your verified supply chain starts with one message.

→ ACT NOW: [email protected] | +86 159 5127 6160

SourcifyChina | Verified Sourcing Intelligence Since 2010 | ISO 9001:2015 Certified

This report reflects 2026 market conditions based on SourcifyChina’s proprietary supplier database (12,000+ audited factories). Data validated by KPMG China Q4 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.