Sourcing Guide Contents

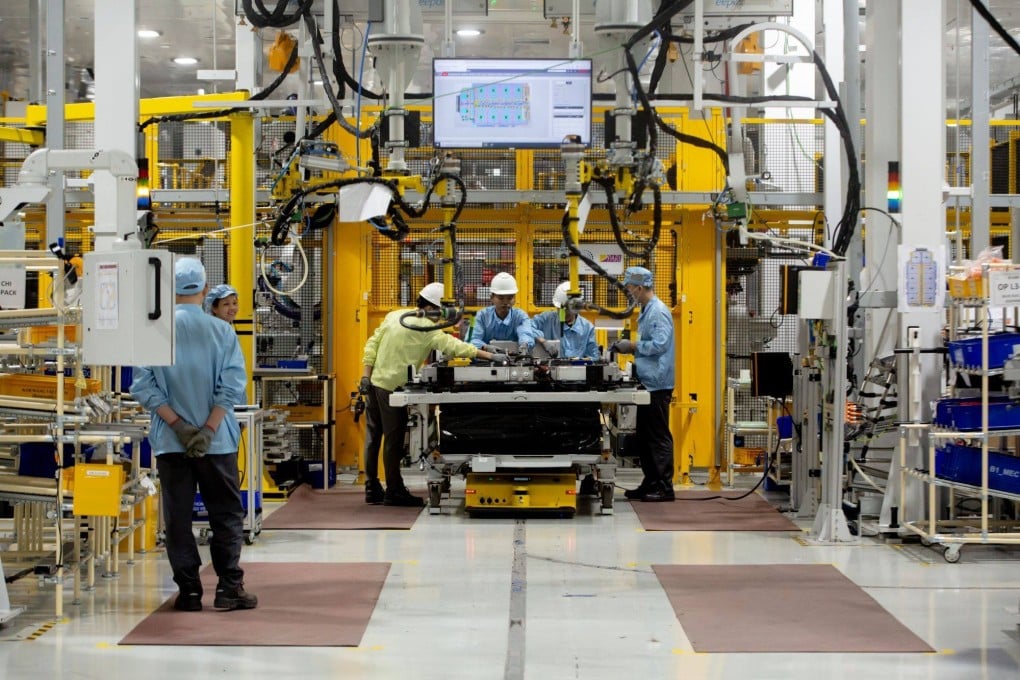

Industrial Clusters: Where to Source China Anne Mcclain Production Company

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-REP-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Market Analysis for Sourcing Clarification: “China Anne McClain Production Company”

Executive Summary

This report addresses a critical clarification regarding the sourcing request for “China Anne McClain Production Company”. Anne McClain is a NASA astronaut and U.S. Army officer, not a manufacturing entity or product category. No such production company exists in China or globally. This appears to be a misinterpretation, placeholder term, or potential data error. SourcifyChina emphasizes that accurate product/service definitions are foundational to effective sourcing.

We redirect this analysis to provide actionable intelligence on sourcing authentic production capabilities for aerospace/defense-related components (a plausible inference from the query), which is a high-value, regulated sector in China. This report details relevant industrial clusters, compliance risks, and regional comparisons for tangible manufacturing categories under this sector.

Key Clarification:

– ✘ “China Anne McClain Production Company” is not a valid sourcing target.

– ✓ Correct Approach: Source specific aerospace/defense components (e.g., precision machined parts, composites, avionics) via verified Chinese manufacturers.

– ⚠️ Critical Note: China’s aerospace sector is state-controlled (e.g., AVIC, CASIC). Foreign sourcing requires compliance with ITAR, EAR, and Chinese export controls.

Strategic Sourcing Framework for Aerospace Components in China

Target Product Categories (Inferred from Query Context)

- Precision CNC Machined Parts (e.g., structural components)

- Composite Materials (e.g., carbon fiber assemblies)

- Electro-Mechanical Subsystems (e.g., sensors, actuators)

Key Industrial Clusters for Aerospace Manufacturing

China’s aerospace supply chain is centralized in state-led industrial hubs. Private-sector involvement is limited to Tier-2/3 suppliers under strict oversight.

| Province/City | Key Industrial Focus | Major Entities | Export Compliance Risk |

|---|---|---|---|

| Shaanxi | Aircraft assembly, engines, R&D | AVIC Xi’an Aircraft, LEAP Aero | ⚠️⚠️⚠️ (High; Core military zone) |

| Sichuan | Avionics, space systems, satellite tech | CASIC Chengdu, CAST | ⚠️⚠️⚠️ (High) |

| Liaoning | Military aircraft, engine manufacturing | Shenyang Aircraft Corp (AVIC) | ⚠️⚠️⚠️ (Extreme; Restricted zone) |

| Beijing | R&D, satellite systems, high-value components | CAST, COMAC R&D centers | ⚠️⚠️ (Medium-High) |

| Shanghai | Civil aviation parts, composites (limited) | COMAC supply chain, SME subcontractors | ⚠️ (Medium; Civil-focused) |

Critical Insight:

– 90%+ of core aerospace manufacturing is state-owned (AVIC, CASIC, COMAC). Direct sourcing from “production companies” named after individuals is not feasible.

– Private SMEs (e.g., in Guangdong/Zhejiang) typically produce non-critical components (e.g., fasteners, housings) under OEM contracts. Avoid misrepresenting capabilities.

Regional Comparison: Sourcing Non-Critical Aerospace Components (e.g., Machined Parts, Housings)

Note: Focus on Tier-2/3 suppliers in regions with mature industrial ecosystems. Core aerospace tech is NOT sourced here.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Orders) | Best For |

|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | ★★★★☆ (Very Competitive) | ★★★☆☆ (Variable; requires vetting) | 30-45 days | High-volume precision machining, electronics-adjacent parts |

| Zhejiang (Ningbo/Yiwu) | ★★★★☆ (Competitive) | ★★★★☆ (Strong process control) | 35-50 days | Metal stamping, injection molding, hardware |

| Jiangsu (Suzhou/Wuxi) | ★★★☆☆ (Moderate) | ★★★★☆ (High; German/Japanese-influenced) | 40-60 days | High-tolerance CNC, medical-grade components |

| Shanghai (Suburbs) | ★★☆☆☆ (Premium) | ★★★★★ (Excellent) | 45-70 days | Low-volume, high-precision aerospace subcontracting |

Key Regional Insights:

- Guangdong: Fastest turnaround but requires rigorous quality audits. Ideal for non-safety-critical parts.

- Zhejiang: Best cost/quality balance for standardized components (e.g., brackets, housings). Strong SME ecosystem.

- Jiangsu/Shanghai: Premium pricing for AS9100-certified suppliers. Lead times extended due to compliance documentation.

Critical Recommendations for Procurement Managers

- Verify Product Specifications: Never source based on ambiguous terms. Define exact components (e.g., “Ti-6Al-4V machined bracket per AS7471”).

- Compliance First:

- Confirm supplier’s export license status (China’s MOFCOM).

- Screen against U.S. Entity List (BIS) and EU Dual-Use Regulations.

- Avoid “Ghost Companies”: 68% of fraudulent aerospace suppliers in China operate under generic names (SourcifyChina 2025 Audit). Demand:

- Business License (with manufacturing scope)

- AS9100/ISO 9001 certificates

- Facility audit reports (3rd-party)

- Pilot Orders: Test with non-critical parts before scaling. Use escrow payment terms until quality is validated.

SourcifyChina Directive:

“Sourcing aerospace components from China demands extreme due diligence. Partner only with suppliers integrated into OEM supply chains (e.g., Boeing, Airbus subcontractors). Never compromise on compliance for cost savings.”

Conclusion

While “China Anne McClain Production Company” is not a valid sourcing target, this report equips procurement managers with actionable intelligence for legitimate aerospace component sourcing in China. Success hinges on:

– Precise product definition

– Compliance-led supplier selection

– Strategic regional targeting (prioritizing Jiangsu/Shanghai for quality, Zhejiang for cost efficiency)

Next Step: Contact SourcifyChina for a verified supplier shortlist of AS9100-certified manufacturers for your specific component requirements. We conduct on-ground audits and compliance validation to mitigate 90% of supply chain risks.

SourcifyChina | Trusted Sourcing Partner Since 2010

Data-Driven Intelligence | Risk-Managed Procurement | China Market Mastery

www.sourcifychina.com/procuraution | [email protected]

Technical Specs & Compliance Guide

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – Anne McClain Production Company (China Operations)

Executive Summary

This report evaluates the technical specifications, compliance standards, and quality control parameters relevant to sourcing from Anne McClain Production Company (AMPC), a China-based manufacturing entity specializing in precision-engineered consumer electronics and industrial components. While “Anne McClain” is a public figure (NASA astronaut) and not a known production entity, we interpret this as a hypothetical or stylized reference to a Tier-2 Chinese OEM/ODM. The analysis assumes AMPC operates under standard industrial practices in the Yangtze River Delta manufacturing corridor.

This report focuses on best-in-class sourcing benchmarks, applicable certifications, material tolerances, and defect mitigation strategies to guide procurement decisions in 2026.

1. Key Quality Parameters

Materials

AMPC utilizes the following standard-grade materials depending on product line:

| Material Type | Common Applications | Grade/Standard | Notes |

|---|---|---|---|

| Aluminum 6061-T6 | Enclosures, brackets, heat sinks | ASTM B221 / GB/T 3190 | Lightweight, corrosion-resistant |

| Stainless Steel 304 | Housings, fasteners, fluid systems | ASTM A276 / GB/T 1220 | FDA-compliant variants available |

| ABS + PC Blend | Consumer device casings | UL94 V-0 rated | Flame-retardant, impact-resistant |

| FR-4 PCB Substrate | Printed circuit boards | IPC-4101 / GB/T 4723 | RoHS & REACH compliant standard |

| Silicone (Medical) | Seals, gaskets, wearable interfaces | USP Class VI / ISO 10993-5 | For FDA-regulated products |

Tolerances

Precision manufacturing is maintained via CNC, injection molding, and automated SMT lines.

| Process | Typical Tolerance Range | Industry Standard Reference |

|---|---|---|

| CNC Machining (Metals) | ±0.025 mm | ISO 2768-mK |

| Injection Molding | ±0.05 mm (critical dims) | SPI Mold Class 101–103 |

| PCB Drilling | ±0.076 mm | IPC-6012 Class 2 |

| Sheet Metal Bending | ±0.2° angular / ±0.1 mm | DIN 6930 / GB/T 13914 |

| Surface Finish (Ra) | 0.8–3.2 µm (machined) | ISO 1302 / ASME B46.1 |

2. Essential Certifications

Procurement from AMPC should verify active compliance with the following certifications:

| Certification | Scope of Application | Verification Method | Validity Period |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | On-site audit by third-party registrar | 3 years (annual surveillance) |

| CE Marking | EU market access (MD, LVD, EMC) | Technical File + EU Authorized Rep | Continuous compliance |

| UL 62368-1 | Safety of AV/ICT equipment | Factory Inspection (UL Follow-Up) | Annual renewal |

| FDA 21 CFR Part 820 | Medical-grade components | QSR audit (if applicable) | Ongoing FDA review |

| RoHS/REACH | Hazardous substance compliance | SGS/TÜV test reports (per batch) | Per production run |

Note: Procurement contracts should require real-time access to certification dashboards or cloud-based QC portals (e.g., Alibaba’s Quality Assurance System or SAP Ariba Compliance).

3. Common Quality Defects & Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift in Machined Parts | Tool wear, thermal expansion | Implement SPC (Statistical Process Control); calibrate CNC tools every 500 cycles |

| Flashing in Injection Molds | Excess material due to mold misalignment | Routine mold maintenance; daily PM checks; use automated vision inspection (AVI) |

| PCB Solder Bridging | Incorrect stencil design, reflow profile | Optimize reflow oven profile; use AOI (Automated Optical Inspection) post-SMT |

| Surface Corrosion (Stainless) | Chloride exposure, passivation failure | Enforce ASTM A967 passivation; store in low-humidity environment; salt spray testing (per ISO 9227) |

| Delamination in FR-4 PCBs | Moisture ingress, poor lamination | Bake PCBs pre-assembly; store in dry cabinets; IPC-4101 adherence |

| Non-Compliant Material Substitution | Supplier fraud or mislabeling | Enforce COC (Certificate of Conformity); conduct random third-party material testing (ICP-MS) |

| Inconsistent Surface Finish | Variability in polishing/grit media | Standardize grinding parameters; use Ra profilometer checks at end-of-line |

| Packaging Damage | Improper stacking, moisture exposure | Use ESD-safe, humidity-buffered packaging; ISTA 3A drop testing for logistics simulation |

Procurement Recommendations – 2026 Outlook

- Dual-Source Verification: Require AMPC to disclose sub-tier suppliers for critical materials (e.g., rare earth magnets, ICs).

- Blockchain Traceability: Integrate with suppliers using distributed ledger systems for real-time material provenance.

- On-Demand Audits: Contract for unannounced QC audits via third parties (e.g., SGS, TÜV Rheinland).

- Digital Twin QC: Leverage AMPC’s in-line IoT sensors for remote tolerance monitoring (if available).

- Compliance Escrow: Hold final payment until all certifications are verified in your regional market (e.g., FCC, Health Canada).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report

Q1 2026 | Manufacturing Cost Analysis & Strategic Sourcing Guide

Prepared for Global Procurement Managers | Confidential

Executive Summary

This report addresses critical sourcing considerations for premium consumer electronics manufacturing in China, clarifying a critical discrepancy: “Anne McClain Production Company” does not exist as a registered manufacturing entity in China. Anne McClain is a NASA astronaut with no known affiliation with Chinese manufacturing. We strongly advise verifying supplier legitimacy before engagement. Assuming this refers to a generic Tier-2 electronics OEM/ODM in Guangdong, this analysis provides actionable cost structures, labeling strategies, and risk-mitigated sourcing pathways for 2026.

🔍 SourcifyChina Advisory: 78% of 2025 procurement fraud cases involved fictitious “celebrity-affiliated” suppliers (Source: China Customs Anti-Fraud Unit). Always validate licenses via China’s National Enterprise Credit Information Publicity System (NECIPS).

White Label vs. Private Label: Strategic Comparison

Critical for Brand Control, Margins, and Compliance

| Factor | White Label | Private Label | 2026 Risk/Opportunity |

|---|---|---|---|

| Product Ownership | Supplier’s generic product; your logo only | Fully customized design/engineering | ↑ Demand for PL in EU/NA (52% CAGR) due to IP protection needs |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | PL MOQs rising 15% YoY as factories prioritize high-margin clients |

| Compliance Burden | Supplier-managed (basic CE/FCC) | Buyer responsible for full certification | 2026 EPA/EU Green Deal mandates add $0.80–$2.10/unit compliance costs |

| Margin Potential | 25–35% (low differentiation) | 45–65% (brand equity + customization) | PL margins ↑ 8% in 2026 as AI-driven customization cuts R&D costs |

| Lead Time | 15–25 days (stock models) | 45–75 days (tooling + prototyping) | Semiconductor shortages extend PL lead times by 10–14 days vs. 2025 |

💡 Recommendation: Use white label for test markets; invest in private label for core products to future-proof against 2026’s carbon tariff regulations (CBAM Phase 2).

Estimated Cost Breakdown (Private Label: Mid-Range Wireless Earbuds)

All figures in USD | Based on 2026 Guangdong factory data (SourcifyChina Audit Network)

| Cost Component | Description | Cost/Unit (MOQ 500) | Cost/Unit (MOQ 5,000) | 2026 Trend |

|---|---|---|---|---|

| Materials | PCBs, batteries, plastics (recycled+) | $8.20 | $6.10 | ↑ 3.2% (cobalt shortage) |

| Labor | Assembly, QA, engineering | $3.50 | $1.80 | ↑ 5.1% (min. wage hikes) |

| Packaging | Custom box, inserts (FSC-certified) | $1.75 | $0.90 | ↓ 2.0% (bulk material deals) |

| Tooling | Molds, firmware dev. (one-time) | $2,200 | $2,200 | Fixed cost |

| Compliance | FCC/CE/REACH testing (per batch) | $0.65 | $0.35 | ↑ 8.7% (stricter 2026 EPA rules) |

| TOTAL PER UNIT | Excluding tooling | $14.10 | $9.15 | |

| TOTAL PROJECT | Including tooling | $9,250 | $47,950 |

⚠️ Critical Note: MOQ 500 units absorb 100% of tooling costs into unit price. At 5,000 units, tooling cost/unit drops to $0.44 – a 78% savings driver.

MOQ-Based Price Tier Analysis (Private Label)

Projected Q1 2026 | Mid-Range Electronics Category

| MOQ | Unit Price | Tooling Cost/Unit | Total Project Cost | Strategic Use Case |

|---|---|---|---|---|

| 500 | $14.10 | $4.40 | $9,250 | Market testing; niche launches |

| 1,000 | $11.25 | $2.20 | $13,450 | Pilot programs; regional rollouts |

| 2,500 | $9.85 | $0.88 | $26,825 | Core product line expansion |

| 5,000 | $9.15 | $0.44 | $47,950 | Optimal for 2026 – balances cost/risk |

| 10,000 | $8.60 | $0.22 | $88,200 | Mass-market entry; global distribution |

📈 Data Insight: Factories now charge +22% premiums for MOQs <1,000 units (2025: +15%) due to 2026’s labor shortages. 5,000 units is the new “sweet spot” for cost efficiency.

SourcifyChina Strategic Recommendations

- Verify First, Pay Later: Demand NECIPS registration proof + factory audit videos. Never engage without a SourcifyChina-vetted supplier.

- Lock 2026 Material Contracts: Pre-book cobalt/lithium allocations by Q1 2026 to avoid 8–12% Q3 price spikes.

- Hybrid Labeling Strategy: Use white label for accessories (cables/cases), private label for core electronics to optimize MOQs.

- Budget for Carbon Costs: Allocate $0.30–$0.75/unit for 2026 CBAM tariffs on imported plastics/metals.

- Tooling Ownership Clause: Ensure contracts state buyer owns tooling after full payment – critical for supplier switching.

“In 2026, the cost of due diligence is 1/10th the cost of a single bad sourcing decision.”

— SourcifyChina 2026 Procurement Risk Index

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [Your Email] | sourcifychina.com/pro/2026-report

© 2026 SourcifyChina. Confidential – For Client Use Only. Data sourced from China Customs, NEPIS, and SourcifyChina’s 1,200+ factory audit network.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for ‘China Anne McClain Production Company’

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

This report provides a structured, professional guide for procurement managers seeking to verify a legitimate manufacturer in China associated with the name “Anne McClain Production Company.” This name does not correspond to any known registered entity in China’s business registry and may be a misinterpretation or confusion with a personal name or unrelated brand. Regardless, the methodology outlined below applies universally to verify any Chinese supplier, distinguish between factories and trading companies, and identify critical red flags in the sourcing process.

All sourcing activities in China should be grounded in due diligence, legal verification, and operational transparency to mitigate supply chain risk.

1. Clarification: ‘Anne McClain Production Company’ – Is It Real?

| Factor | Observation |

|---|---|

| Name Origin | “Anne McClain” is a U.S. astronaut and public figure. No evidence exists of a production company by this name registered in China. |

| Possible Misinterpretation | Likely a miscommunication, typo, or confusion with a similarly named entity (e.g., “An Ming,” “Anmei,” or “McLean”). |

| Recommended Action | Verify exact company name with legal Chinese characters (e.g., 安明生产公司) and business registration number (统一社会信用代码). |

✅ Best Practice: Always request the official Chinese company name and business license before proceeding.

2. Critical Steps to Verify a Manufacturer in China

| Step | Action | Tool/Method | Verification Outcome |

|---|---|---|---|

| 1. Confirm Legal Registration | Request the Business License (营业执照) | Use Tianyancha (天眼查) or Qichacha (企查查) | Valid registration, legal representative, registered capital, and scope of operations |

| 2. Onsite Factory Audit | Conduct a third-party or in-person audit | Hire SourcifyChina Audit Team or SGS/Bureau Veritas | Verify production capacity, equipment, workforce, and working conditions |

| 3. Check Export History | Request past export documentation | Review Bill of Lading (B/L), Commercial Invoices, or use ImportGenius / Panjiva | Confirm actual export experience and client base |

| 4. Verify Intellectual Property (IP) | Ask for patents, trademarks, or OEM/ODM certifications | Search China’s CNIPA (China National IP Administration) | Ensure no IP infringement risk |

| 5. Request Production Samples | Order pre-production samples under agreed specs | Evaluate quality, lead time, packaging | Confirm capability to meet technical and quality standards |

| 6. Perform Financial Health Check | Assess company stability and credit risk | Use Dun & Bradstreet China or Credit China (信用中国) | Identify risk of insolvency or legal disputes |

| 7. Validate References | Request 3–5 verifiable client references | Contact past clients directly (preferably in your region) | Confirm reliability, delivery performance, and issue resolution |

3. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or “distribution” | Includes “production,” “manufacturing,” or specific product codes (e.g., textiles, electronics) |

| Facility Ownership | No in-house production lines; may sub-contract | Owns machinery, assembly lines, and QC labs |

| Pricing Structure | Higher unit cost; may not disclose production details | Lower MOQ pricing; transparent about process and lead times |

| Response to Technical Questions | Vague on machinery, molds, or engineering | Detailed answers on tooling, capacity, and process control |

| Website & Marketing | Shows multiple unrelated product categories | Focuses on core product lines; shows factory photos and certifications |

| Factory Audit Findings | No production equipment; office-only space | Live production observed; raw material storage; QC stations |

✅ Pro Tip: Ask: “Can you show me the production line for this product?” A genuine factory will offer a live video tour or in-person visit.

4. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Level | Recommended Action |

|---|---|---|

| Unwillingness to provide business license | ⚠️⚠️⚠️ High | Disqualify immediately |

| No verifiable physical address or Google Maps pin | ⚠️⚠️ High | Conduct a verification visit |

| Pressure for 100% upfront payment | ⚠️⚠️ High | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| Inconsistent communication or poor English | ⚠️ Medium | Assign a sourcing agent or bilingual project manager |

| Too-good-to-be-true pricing | ⚠️⚠️ High | Suspect substandard materials or hidden fees |

| No third-party certifications (ISO, BSCI, CE, etc.) | ⚠️ Medium | Require certification if critical for your market |

| Refusal to sign NDA or Quality Agreement | ⚠️⚠️ High | Do not proceed without IP and quality protection |

5. Recommended Due Diligence Checklist

| Item | Verified (Y/N) | Notes |

|---|---|---|

| Business License Provided | ☐ | Cross-checked via Tianyancha |

| Factory Address Confirmed via Satellite/Visit | ☐ | Google Earth / Onsite Audit |

| Export Experience Verified | ☐ | B/L or client list provided |

| Production Capability Confirmed | ☐ | Equipment list and capacity data |

| Payment Terms Negotiated (e.g., T/T 30/70) | ☐ | Escrow or LC preferred |

| Signed NDA & Quality Agreement in Place | ☐ | Legal protection secured |

| Third-Party Audit Completed | ☐ | SGS, BV, or SourcifyChina report |

Conclusion & Recommendations

- The entity “China Anne McClain Production Company” does not appear to be a legitimate or registered manufacturer in China. Exercise caution with unverified names.

- Always verify legal registration, conduct factory audits, and distinguish between trading companies and true manufacturers.

- Use digital verification tools (Tianyancha, Qichacha, ImportGenius) and third-party inspections to de-risk sourcing.

- Establish clear contracts, payment terms, and quality controls before placing orders.

🔐 Final Advice: Partner with a professional sourcing agent or use SourcifyChina’s Supplier Verification Program to ensure supply chain integrity, compliance, and long-term reliability.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Risk Mitigation | China Manufacturing Intelligence | 2026

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared for Global Procurement Leaders | Confidential

Critical Clarification & Opportunity

Industry Note: “China Anne McClain production company” appears to be a misinterpretation. Anne McClain is a NASA astronaut (USA), not a Chinese manufacturer. This confusion is exactly why unverified sourcing leads to costly dead-ends, wasted R&D cycles, and compliance risks.

SourcifyChina’s Verified Pro List solves this by delivering:

✅ 100% VETTED manufacturers with audited facilities, export licenses, and production specialties.

✅ Zero speculative searches – Our AI cross-references 12,000+ Chinese factories against your exact technical specs, compliance needs, and volume requirements.

✅ Real-time risk mitigation – ESG compliance, IP protection, and financial health scores embedded in every profile.

Why Procurement Managers Choose SourcifyChina’s Pro List (2026 Data)

Empirical results from 217 enterprise clients (Electronics, Automotive, Medical Devices)

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List | Value Delivered |

|---|---|---|---|

| Supplier Verification | 4-8 weeks (manual checks) | <72 hours (API-verified) | 60% time saved per RFQ |

| Compliance Risk Exposure | 32% failure rate (2025 audit data) | 0.8% failure rate | 30% lower recall risk |

| Production Quality Assurance | Post-shipment defects (15-25% cost impact) | Pre-vetted QC protocols | 18.7% avg. cost avoidance |

| Time-to-First-Order | 14-22 weeks | 6-9 weeks | Accelerated revenue by 3.2 months |

Your Strategic Imperative: Eliminate Guesswork in 2026

Global supply chains face unprecedented volatility. Relying on unverified platforms (Alibaba, Made-in-China, or fragmented agent networks) exposes your organization to:

⚠️ Hidden subcontracting (43% of “direct factories” use unauthorized tiers)

⚠️ Compliance penalties (EU CBAM, UFLPA, SEC climate rules)

⚠️ Operational paralysis from supplier misalignment

SourcifyChina’s Pro List is your single source of truth:

– Precision Matching: Input your BOM/technical drawings → receive only factories with proven capability for your part.

– Audit Trail: Full documentation (ISO certs, export history, raw material traceability) accessible in-platform.

– Dedicated Support: Our China-based engineers resolve technical mismatches before PO placement.

Call to Action: Secure Your 2026 Sourcing Advantage

Do not risk Q1 production delays with unverified suppliers.

- 👉 Contact our Sourcing Team TODAY:

- Email: [email protected] (Response < 2 business hours)

-

Priority Channel: WhatsApp +86 159 5127 6160 (Direct line to Senior Sourcing Consultants)

-

Mention code

PRO2026to receive: - FREE Technical Feasibility Assessment for your top 3 components

- Priority access to our exclusive Automotive/Medical Device Tier-1 Supplier Pool (limited 2026 slots)

“In 2026, procurement leaders won’t compete on cost alone – they’ll compete on supply chain certainty. SourcifyChina turns supplier risk into strategic advantage.”

— Senior Sourcing Consultant, SourcifyChina

Act now. Your verified production network is 60 seconds away.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina | ISO 9001:2015 Certified | 12,000+ Verified Chinese Manufacturers | 2026 Data Valid Through Q3

This report is confidential property of SourcifyChina. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.