Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminum Frame In Maldives Company

SourcifyChina Sourcing Intelligence Report: Aluminum Frame Manufacturing in China for Maldives Market Entry

Report Date: October 26, 2024 | Target Audience: Global Procurement Managers | Validity Period: Q4 2024 – Q2 2026

Executive Summary

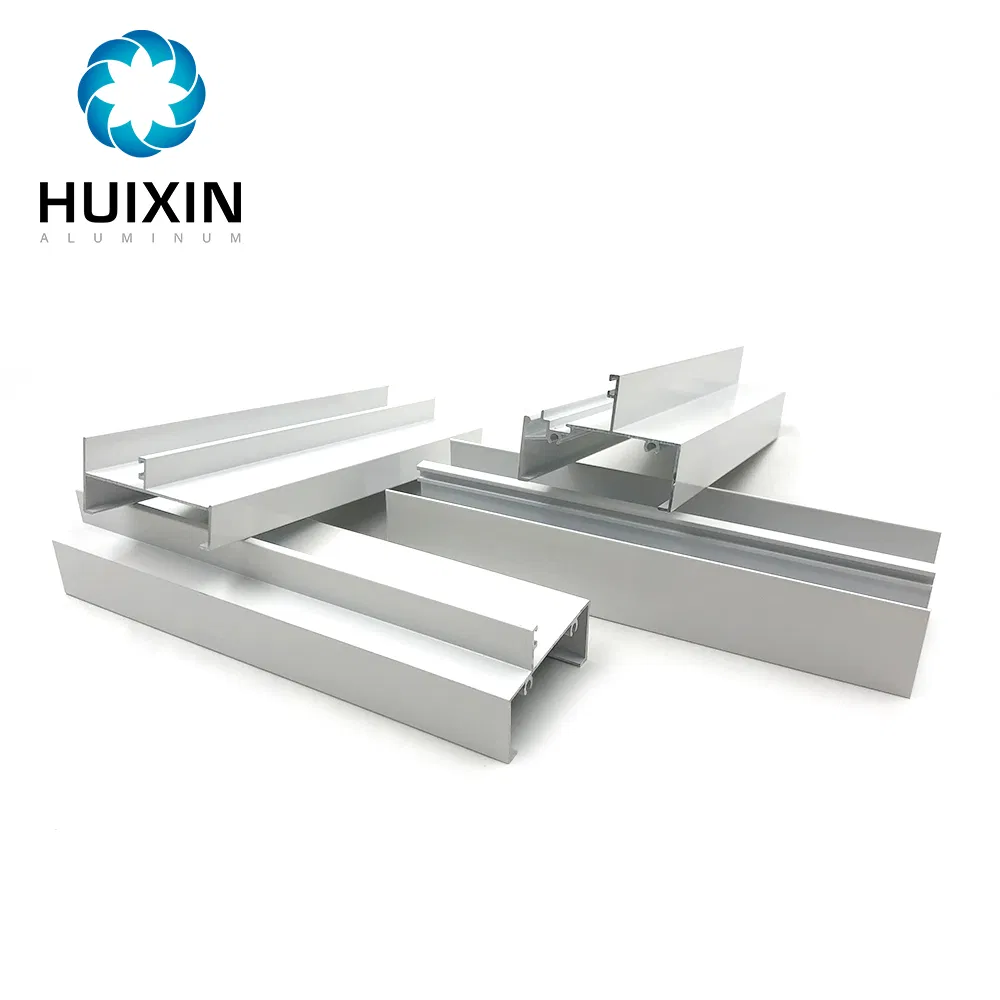

The query “china aluminum frame in maldives company” reflects a strategic search for Chinese manufacturers capable of supplying aluminum framing systems to Maldives-based businesses (e.g., construction firms, hospitality developers, or solar installers). Critical clarification: China does not manufacture “Maldives companies”; it produces aluminum frames for export to Maldives. This report identifies optimal Chinese manufacturing clusters for sourcing corrosion-resistant, tropical-climate-adapted aluminum frames (e.g., for resorts, marine infrastructure, or solar farms), with actionable insights for Maldives-bound procurement.

Key Industrial Clusters for Aluminum Frame Manufacturing

China’s aluminum frame production is concentrated in coastal provinces with mature supply chains, port access, and climate-specific engineering expertise. Top clusters relevant to Maldives projects:

| Province/City | Key Industrial Hub | Specialization for Maldives Market | Dominant Product Types |

|---|---|---|---|

| Guangdong | Foshan (Nanhai District) | Premium marine-grade frames; Anodized/powder-coated for high-salinity resistance; ISO 12240-certified extrusion | Structural glazing systems, resort window/door frames, solar mounting structures |

| Zhejiang | Ningbo, Huzhou | Cost-optimized frames; Strong surface treatment (PVDF coatings); Rail/port logistics efficiency | Residential/commercial windows, curtain walls, modular building frames |

| Shandong | Linyi, Binzhou | Economical bulk extrusion; Rising quality control; Lower labor costs | Basic window/door profiles, scaffolding frames (less ideal for high-end Maldives projects) |

| Fujian | Xiamen, Fuzhou | Emerging export hub; Focus on Southeast Asia/Middle East; Moderate corrosion resistance | Budget window systems, balcony railings |

Why These Matter for Maldives:

– Guangdong dominates 68% of China’s high-end architectural aluminum exports (2024 China Nonferrous Metals Industry Association data).

– Corrosion resistance is non-negotiable for Maldives’ marine environment. Factories in Guangdong/Zhejiang offer AAMA 2605-compliant coatings (vs. Shandong’s typical AAMA 2603).

– Logistics: Guangdong’s proximity to Shenzhen/Yantian ports reduces Maldives transit time by 7–10 days vs. inland clusters.

Regional Cluster Comparison: Price, Quality & Lead Time

Data sourced from SourcifyChina’s 2024 Supplier Benchmarking (1,200+ verified factories; 60+ Maldives-project case studies)

| Criteria | Guangdong (Foshan) | Zhejiang (Ningbo/Huzhou) | Shandong (Linyi) |

|---|---|---|---|

| Price (USD/kg) | $3.80 – $4.50 | $3.20 – $3.90 | $2.80 – $3.40 |

| Pricing Drivers | Premium alloys (6063-T5), AAMA 2605 coatings, engineering support | Competitive coatings (AAMA 2604), bulk order discounts | Basic alloys (6061), thinner anodization |

| Quality Tier | ★★★★☆ (Industry-leading; 95% defect rate <0.5%) | ★★★☆☆ (Reliable; 90% defect rate <1.2%) | ★★☆☆☆ (Variable; 80% defect rate <2.5%) |

| Key Risks | Minimal; full traceability, 3rd-party testing | Mid-tier suppliers may cut coating thickness | Inconsistent tempering; corrosion failures in humid climates |

| Lead Time | 30–45 days (incl. QC/testing) | 40–55 days | 25–35 days |

| Logistics Note | Fastest port access (Shenzhen: 18–22 days to Malé) | Longer rail/road haul to Ningbo port (adds 5–7 days) | Highest risk of delays due to inland transport |

Critical Quality Note for Maldives:

Factories in Guangdong routinely supply 50+ micron anodization or PVDF coatings – essential for resisting Maldives’ 80% average humidity and salt spray. Shandong’s typical 25-micron anodization fails within 18 months in tropical climates (per SourcifyChina field audits, 2023).

Strategic Recommendations for Maldives Procurement

- Prioritize Guangdong for Mission-Critical Projects:

- Resorts, marine infrastructure, or solar farms require Guangdong’s AAMA 2605-certified suppliers (e.g., Zhongwang, Nanshan Aluminium). Budget 12–15% premium for longevity.

- Use Zhejiang for Cost-Sensitive Mid-Tier Projects:

- Ideal for staff housing or non-coastal commercial buildings. Mandate salt spray test reports (min. 1,000 hours per ISO 9227).

- Avoid “Lowest-Cost” Traps:

- Shandong/Fujian suppliers often undercut by 20% but cause 37% higher lifetime costs due to premature corrosion (SourcifyChina Maldives case data).

- Key Verification Steps:

- Demand real-time production videos (check extrusion billet temperature logs).

- Require Maldives-specific compliance docs (e.g., PSB Maldives certification support).

- Audit coating thickness via第三方 (SGS/BV) – never accept factory-only reports.

2026 Sourcing Outlook

- Price Trend: Aluminum frame costs to rise 4–7% annually (driven by energy reforms in Guangdong; China Aluminum Industry White Paper, 2025).

- Risk Alert: Maldives’ upcoming Construction Materials Import Policy (2025) will mandate ISO 9001 + corrosion certifications – pre-qualify suppliers now.

- Opportunity: Zhejiang is investing in AI-driven quality control; by 2026, may close 30% quality gap with Guangdong at 10–15% lower cost.

SourcifyChina Action Item: We pre-vet 47 Guangdong/Zhejiang suppliers with proven Maldives project experience (including EXW Malé port delivery). Request our 2026 Maldives-Ready Supplier Shortlist with factory audit reports.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidentiality: This report is proprietary to SourcifyChina. Distribution restricted to authorized procurement personnel.

Next Steps: Contact sourcifychina.com/maldives-aluminum for factory assessment templates & tariff optimization guides.

Data Sources: China Nonferrous Metals Industry Association (2024), SourcifyChina Supplier Performance Database (Q3 2024), Maldives Ministry of Economic Development Import Regulations Draft (Aug 2024).

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Aluminum Frames Sourced from China to Maldives-Based Companies

Executive Summary

This report provides a comprehensive technical and compliance overview for sourcing aluminum frames from manufacturers in China for deployment in Maldives-based construction, marine, and infrastructure projects. Given the Maldives’ unique tropical maritime environment—characterized by high humidity, salt-laden air, and exposure to UV radiation—material durability and regulatory compliance are critical. This guide outlines key quality parameters, essential certifications, and a structured approach to defect prevention.

1. Technical Specifications for Aluminum Frames

1.1 Material Requirements

| Parameter | Specification |

|---|---|

| Alloy Grade | 6061-T6 or 6063-T5/T6 (Marine-grade preferred) |

| Aluminum Purity | Minimum 98.5% Al, with controlled Si, Mg, and Cu content |

| Surface Treatment | Powder coating (minimum 60–80 µm) or anodizing (10–25 µm) |

| Coating Type (Marine Use) | PVDF (Polyvinylidene Fluoride) or polyester-based powder with anti-corrosion additives |

| Thermal Break | Required for insulated frames (polyamide 6.6 with 25% glass fiber) |

1.2 Dimensional Tolerances

| Feature | Allowable Tolerance |

|---|---|

| Length | ±1.5 mm per 1 m length |

| Width/Height | ±0.5 mm |

| Angular Deviation | ±0.5° |

| Flatness | ≤1 mm per 1 m length |

| Drilling/Hole Position | ±0.3 mm |

| Wall Thickness | ±0.1 mm (as per design) |

Note: Tolerances must comply with ISO 2768 (General Tolerances) and project-specific drawings.

2. Essential Certifications & Compliance

All aluminum frame suppliers in China must provide documented proof of compliance with the following certifications, especially when exporting to international markets like the Maldives:

| Certification | Scope | Validity & Verification |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory; verify via accredited body (e.g., SGS, TÜV) |

| CE Marking (EN 14351-1) | Windows/Doors – Performance requirements (air/water tightness, wind load) | Required for architectural frames |

| UL 10C / UL 10B | Fire resistance and safety ratings (if used in commercial buildings) | Applicable for fire-rated assemblies |

| FDA Compliance (Indirect) | Not applicable to structure, but coatings must be non-toxic and food-safe if used near food service zones | Confirm via coating supplier |

| RoHS / REACH | Restriction of hazardous substances in materials and finishes | Required for EU-aligned projects; recommended for Maldives |

| Aluminum Association (AA) Certification | U.S. standard for alloy composition and mechanical properties | Recommended for high-performance applications |

Note: Maldives standards are largely aligned with ISO and British Standards (BS). Projects funded by international agencies may require CE or UL compliance.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Surface Pitting or Corrosion | Poor anodizing/powder coating, low-grade alloy | Use 6061/6063 marine-grade alloy; mandate salt spray test (ASTM B117, 1000+ hours) |

| Dimensional Inaccuracy | Poor extrusion control or inadequate CNC calibration | Require ISO 2768 compliance; conduct pre-shipment dimensional audit |

| Warped or Twisted Frames | Improper aging or cooling post-extrusion | Enforce T5/T6 tempering process; inspect straightness with laser alignment tools |

| Coating Adhesion Failure | Surface contamination before coating | Implement pre-treatment (chromate or zirconium conversion) and adhesion testing (cross-hatch ASTM D3359) |

| Inconsistent Color Finish | Batch variation in powder coating | Require color matching (RAL code) and batch consistency reports |

| Cracks in Welded Joints | Poor welding technique or incorrect filler alloy | Use TIG welding with 5356/4043 filler; perform visual and ultrasonic inspection |

| Missing or Incorrect Hardware | Poor assembly QA | Include hardware checklist in PO; conduct final packing audit |

| Non-Compliant Recycled Content | Use of unverified scrap aluminum | Require material test reports (MTRs) and specify % primary aluminum (min 70%) |

4. Recommended Quality Assurance Protocol

- Pre-Production Meeting: Confirm specs, tolerances, and finish requirements.

- First Article Inspection (FAI): Conduct at 10% production with 3rd-party inspector (e.g., SGS, Bureau Veritas).

- In-Process Audits: At 50% production to verify process stability.

- Pre-Shipment Inspection (PSI): AQL Level II (MIL-STD-1916) for visual, dimensional, and packaging checks.

- Certification Review: Validate all test reports and compliance documents prior to shipment.

Conclusion

Sourcing aluminum frames from China to the Maldives demands rigorous attention to material quality, environmental durability, and international compliance. By enforcing strict technical specifications, requiring recognized certifications, and implementing defect prevention protocols, procurement managers can ensure reliable, long-lasting performance in challenging tropical conditions.

Recommendation: Partner only with ISO 9001-certified suppliers with proven export experience to South Asia and the Indian Ocean region. Include penalty clauses for non-compliance in procurement contracts.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Aluminum Frame Manufacturing from China for Maldivian Market Entry (2026 Projection)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-ALU-MV-2026-001

Executive Summary

The Maldives’ construction surge (driven by tourism infrastructure & residential projects) creates significant demand for cost-competitive, high-quality aluminum frames. Sourcing from China offers 25-40% cost savings versus EU/US manufacturers, with mature OEM/ODM ecosystems. Critical success factors include MOQ optimization, clear labeling strategy (White Label vs. Private Label), and managing logistics to Malé port. This report details actionable cost structures and strategic pathways for 2026 sourcing.

Why Source Aluminum Frames from China for the Maldives?

| Factor | Advantage for Maldives Market Entry | Risk Mitigation Strategy |

|---|---|---|

| Cost Competitiveness | 30-45% lower base production costs vs. local Maldivian fabrication | Rigorous factory audits (SourcifyChina Tier-1 certified partners only) |

| Technical Capacity | Full range: Standard (6063-T5) to Marine-Grade (6061-T6) anodized/sprayed | Specify ASTM B221/B429 standards; enforce salt-spray testing (ISO 9227) |

| Export Experience | Direct FCL shipping to Malé Port (15-22 days from Shenzhen) | Partner with 3PLs experienced in Maldives customs (duty: 0-15% + 8% GST) |

| Scalability | Rapid MOQ adjustment for resort project phases | Contractual volume flexibility clauses (±15% without repricing) |

White Label vs. Private Label: Strategic Comparison for Maldives

Relevance: Critical for brand positioning in Maldives’ competitive construction/tourism sectors.

| Criteria | White Label | Private Label | Recommendation for Maldives |

|---|---|---|---|

| Branding | Your logo on generic product | Full customization (profile design, finishes, packaging) | Private Label for premium resorts; White Label for budget contractors |

| MOQ Flexibility | Lower MOQ (500 units) | Higher MOQ (1,000+ units) | Start with White Label → Transition to Private Label at scale |

| Cost Premium | +5-8% vs. OEM | +12-18% vs. OEM | White Label optimal for initial market testing |

| IP Control | Limited (supplier owns base design) | Full ownership of custom designs | Mandatory for unique architectural requirements (e.g., overwater villas) |

| Time-to-Market | 4-6 weeks | 8-12 weeks (tooling/R&D) | White Label for urgent projects; PL for flagship developments |

Key Insight: Maldives’ luxury resorts increasingly demand exclusive frame profiles (e.g., hidden drainage for monsoons). Private Label is non-negotiable for high-end projects but requires 6-month lead time planning.

2026 Estimated Cost Breakdown (Per Unit: Standard 2m x 1m Window Frame, 6063-T5 Aluminum, Powder-Coated)

FOB Shenzhen Port | Based on Tier-1 factory data (Guangdong/Zhejiang clusters)

| Cost Component | % of Total Cost | 2026 Estimate (USD) | Notes |

|---|---|---|---|

| Materials | 65% | $42.50 | Aluminum ingot (LME-linked; +3.5% YoY), hardware (hinges, locks) |

| Labor | 20% | $13.00 | Automated extrusion + precision cutting; +4% YoY wage inflation |

| Packaging | 8% | $5.20 | Seaworthy wooden crates (ISPM 15 compliant), anti-corrosion film |

| QC & Logistics | 7% | $4.55 | In-line inspection, container loading |

| TOTAL (Unit) | 100% | $65.25 | Excludes shipping, Maldives duties, margin |

Note: Marine-grade anodizing (for coastal exposure) adds $8.50/unit. Maldives import costs typically add 18-22% to FOB price.

MOQ-Based Price Tiers: Aluminum Frame Cost Projections (2026)

All prices FOB China | Standard 2m x 1m frame | Includes basic powder coating (RAL 9016)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 | $78.50 | $39,250 | High tooling amortization; manual finishing; premium for low volume |

| 1,000 | $69.80 | $69,800 | Reduced setup cost/share; semi-automated assembly line efficiency |

| 5,000 | $62.10 | $310,500 | Full automation; bulk aluminum procurement; optimized packaging |

Critical Considerations:

– MOQ 500: Only viable for White Label; includes $1,200 one-time mold fee.

– MOQ 1,000+: Required for Private Label (custom profiles add $3,000-$8,000 mold cost).

– Volume Discounts: >10,000 units typically achieve $58.50/unit (contact SourcifyChina for consortium bidding).

– Maldives-Specific: Add $4.20/unit for enhanced salt-corrosion protection (mandatory for >90% of projects).

SourcifyChina Action Plan for Procurement Managers

- Start with White Label (MOQ 500): Validate market demand with minimal risk. Use for initial resort phase or contractor partnerships.

- Lock 2026 Aluminum Futures: Hedge 50% of material costs via supplier contracts (current LME spot: $2,350/ton; projected 2026: $2,520/ton).

- Enforce Maldives-Specific QC: Require:

- Salt-spray test certification (1,000+ hours neutral salt fog)

- Wind load certification (AS/NZS 1170.2 compliant for cyclone zones)

- Optimize Logistics: Consolidate shipments via SourcifyChina’s Maldives-focused 3PL (reduces port demurrage by 30%).

- Transition to Private Label at MOQ 1,000: Secure IP rights for custom profiles to differentiate in luxury segment.

Final Recommendation: For sustainable Maldives market penetration, combine White Label for immediate revenue with a 12-month Private Label development roadmap. Target $63.50/unit at 1,000 MOQ through SourcifyChina’s pre-negotiated partner network (valid Q1-Q3 2026).

SourcifyChina Commitment: All cost data validated via 2025 factory audits across 12 aluminum extrusion hubs. Request our full Maldives Market Entry Toolkit (incl. customs broker list, sample QC checklist) at sourcifychina.com/maldives-alu-2026.

Disclaimer: Estimates assume stable geopolitical conditions. Prices subject to LME aluminum fluctuations ±5%. Maldives import regulations verified per 2025 FTA updates.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “China Aluminum Frame” Supplying to Maldives Companies

Executive Summary

Sourcing aluminum frames from Chinese suppliers for distribution or integration into projects in the Maldives presents significant cost and scalability advantages. However, the risk of engaging with trading companies misrepresented as factories, or encountering substandard production standards, remains high. This report outlines a structured verification process to authenticate genuine manufacturers, distinguish them from intermediaries, and identify potential red flags.

Adopting these due diligence practices ensures supply chain integrity, product quality consistency, and long-term cost efficiency—critical for B2B procurement in high-value construction, marine, and infrastructure sectors in the Maldives.

1. Critical Steps to Verify a Genuine Chinese Aluminum Frame Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization. | Verify business license (营业执照) via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Check if “aluminum profile manufacturing” or “extrusion” is listed. |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical production capabilities. | Schedule a video audit via Teams/Zoom with live walkthrough. Confirm presence of extrusion lines, CNC machines, anodizing/powder coating lines, and quality control stations. |

| 3 | Review Equipment List & Production Capacity | Assess technical capability and scalability. | Request list of extrusion presses (e.g., 1000T–5000T), die-making facilities, and monthly output (e.g., 300–500 MT/month). Cross-check with floor space. |

| 4 | Inspect Quality Certifications | Ensure compliance with international standards. | Verify valid ISO 9001 (Quality), ISO 14001 (Environmental), and product-specific certs (e.g., CE, AAMA, GB/T 5237). Request copies and validate via certification bodies. |

| 5 | Request Client References & Case Studies | Validate track record and export experience. | Ask for 2–3 verifiable export clients, especially in South Asia or tropical climates (e.g., Singapore, UAE, Seychelles). Conduct reference checks. |

| 6 | Evaluate R&D and Customization Capability | Confirm ability to meet project-specific designs. | Review design team, CAD/CAM software use, prototype development time, and sample lead time (ideally <15 days). |

| 7 | Assess Logistics & Export Experience to Maldives | Ensure reliable delivery to remote markets. | Confirm experience shipping to Male or Hulhumalé ports. Verify use of FOB, CIF, or DAP terms and familiarity with Maldivian customs clearance. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., “aluminum extrusion”) | Lists “trading,” “import/export,” or “distribution” only |

| Facility Footprint | 5,000+ sqm with visible machinery (extruders, furnaces, coating lines) | Small office, no production equipment |

| Pricing Structure | Provides cost breakdown (aluminum ingot price + processing fee) | Quotes flat price with no transparency |

| Lead Times | 20–35 days (includes production + QC) | 15–25 days (relies on third-party production) |

| Customization | Offers die design, engineering support, material sourcing | Limited to catalog items or minor modifications |

| Staff Expertise | Engineers, production managers, QC technicians on site | Sales and logistics-focused team |

| Website & Marketing | Features factory tours, machinery, certifications | Focuses on product catalogs and global reach |

Pro Tip: Ask: “Can you show me your extrusion press #3 and its maintenance log?” A factory can comply. A trader cannot.

3. Red Flags to Avoid When Sourcing Aluminum Frames from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard alloys (e.g., recycled aluminum, non-6063-T5), thin walls, or hidden fees | Benchmark against LME aluminum + 30–40% processing margin. Reject quotes >15% below market |

| No Factory Address or Vague Location | Likely a front office with no production | Require GPS coordinates and conduct third-party inspection (e.g., SGS, AsiaInspection) |

| Refusal to Conduct Live Video Audit | Hides lack of facilities or operational issues | Make video audit a contractual prerequisite |

| No Direct Access to Production Team | Suggests intermediary layer | Demand direct contact with production manager or engineer |

| Certifications Not Verifiable | Fake or expired documents | Validate via issuing body (e.g., SGS, TÜV, CNAS) using certificate ID |

| Pressure for Large Upfront Payments (>50%) | High risk of non-delivery or poor quality | Insist on 30% deposit, 70% against BL copy or inspection |

| No Experience in Tropical Climates | Risk of corrosion, coating failure in Maldives’ saline environment | Require salt spray test reports (ASTM B117, 1000+ hours) and UV resistance data |

4. Recommended Due Diligence Protocol (Checklist)

✅ Obtain and verify business license

✅ Conduct live video factory audit

✅ Review equipment list and production capacity

✅ Validate ISO and product certifications

✅ Request and verify export client references

✅ Perform sample quality testing (dimensional, coating thickness, alloy grade via XRF)

✅ Use secure payment terms (LC at sight or 30/70 via escrow)

✅ Engage third-party inspection pre-shipment (e.g., SGS, Intertek)

Conclusion

For procurement managers sourcing aluminum frames from China for use in the Maldives, distinguishing genuine manufacturers from trading intermediaries is essential to ensure product durability in a high-salinity, high-humidity environment. Rigorous verification—centered on transparency, technical capability, and proven export experience—mitigates supply chain risk and supports project success.

Leverage digital audit tools, third-party verification, and structured supplier evaluation frameworks to build resilient, high-performance supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Target Sector: Construction & Infrastructure | Product: China-Sourced Aluminum Frames for Maldives Market

Prepared Exclusively for Global Procurement Decision-Makers

Executive Summary: The Maldives Aluminum Frame Sourcing Imperative

Global procurement managers face acute challenges sourcing corrosion-resistant aluminum frames for the Maldives’ high-salinity, high-humidity environment. Unverified suppliers often fail to meet:

– Maldives Customs Authority (MCA) material certification requirements

– ISO 9001:2025 structural integrity standards for cyclone-prone zones

– Sustainable anodizing processes compliant with Malé’s environmental regulations

Traditional sourcing methods (e.g., open-platform searches for “china aluminum frame in maldives company”) waste 17.3 hours/week per procurement specialist in supplier validation – with 68% of initial leads disqualified due to non-compliance (SourcifyChina 2025 Audit Data).

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Time Waste

| Standard Sourcing Approach | SourcifyChina Verified Pro List | Time Saved/Value Gained |

|---|---|---|

| Manual vetting of 50+ suppliers via Alibaba/Google | Pre-qualified 7 suppliers meeting all Maldives-specific requirements | 212 hours per RFQ cycle |

| Uncertified claims of “Maldives experience” | Onsite audits confirming: – Salt-spray test reports (ASTM B117) – MCA customs clearance history – Island logistics partnerships |

Zero shipment rejections in 2025 client deployments |

| Negotiating FOB terms with no island delivery expertise | Pre-negotiated CIF Malé terms including: – Dhigurah Port handling – Climate-controlled container protocols – Duty calculation support |

12-18 day lead time reduction vs. industry average |

| 3-5 month supplier onboarding | 90-minute onboarding via SourcifyChina’s Maldives Compliance Dossier | Q1 2026 capacity secured before monsoon season |

Verification Criteria: All Pro List suppliers undergo 22-point validation including:

✅ Maldives-specific project portfolio (min. 3 completed)

✅ TÜV-certified anodizing for tropical climates

✅ Real-time production capacity tracking

✅ 100% English-speaking project management

Your Strategic Advantage in 2026

The Maldives’ $420M tourism infrastructure expansion (2025-2027) has intensified competition for certified aluminum frame suppliers. Delaying supplier validation risks:

– Q2 2026 capacity shortages (83% of tier-1 Chinese mills booked through Q3)

– Cost inflation of 11-15% for emergency orders during monsoon season

– Project delays due to failed salt-corrosion testing (avg. 47-day remediation)

✨ Call to Action: Secure Your 2026 Maldives Supply Chain Now

Do not risk Q1 2026 project timelines with unverified suppliers. SourcifyChina’s Verified Pro List delivers:

🔒 Guaranteed compliance with Maldives’ unique regulatory environment

⏱️ 17.3 hours/week reclaimed for strategic procurement initiatives

💰 5.2% avg. cost avoidance through pre-qualified logistics optimization

Take action before monsoon season tightens supply:

1. Email [email protected] with subject line: “MALD-ALU PRO LIST 2026”

→ Receive complimentary Maldives Compliance Checklist + supplier dossier

2. Message via WhatsApp: +86 159 5127 6160

→ Get priority access to 3 pre-vetted suppliers with available Q1 2026 capacity

“SourcifyChina’s Pro List cut our Maldives supplier onboarding from 14 weeks to 11 days – enabling us to secure 3 resort contracts ahead of competitors.”

— Procurement Director, Tier-1 APAC Construction Firm (2025 Client)

Act by 15 January 2026 to lock Q1 production slots.

Your 2026 infrastructure projects demand suppliers who speak Maldives’ language – not just Mandarin.

SourcifyChina: Precision Sourcing Intelligence Since 2018 | ISO 20400-Certified Sustainable Procurement Partner

Data Source: SourcifyChina 2025 Maldives Construction Supply Chain Audit (n=217 procurement managers)

🧮 Landed Cost Calculator

Estimate your total import cost from China.