Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminium Flat Door Hinge Wholesale

SourcifyChina – B2B Sourcing Market Report 2026

Product Category: China Aluminium Flat Door Hinge Wholesale

Target Audience: Global Procurement Managers

Report Date: January 2026

Executive Summary

The global demand for aluminium flat door hinges continues to grow, driven by rising construction activity, modern architectural design trends, and demand for lightweight, corrosion-resistant hardware solutions. China remains the dominant global supplier of aluminium door hinges, offering competitive pricing, scalable manufacturing, and a diversified supplier base. This report provides a strategic sourcing analysis for procurement professionals looking to source aluminium flat door hinges in bulk from China, with a focus on identifying key industrial clusters and evaluating regional manufacturing strengths.

Market Overview: China Aluminium Flat Door Hinge Industry

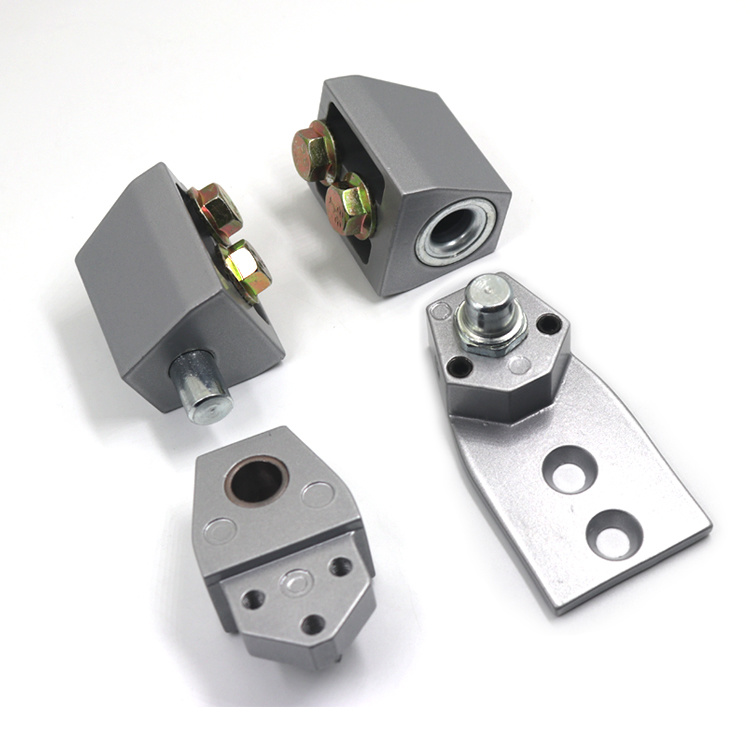

Aluminium flat door hinges—typically used in interior/exterior sliding, folding, and flush-mounted door systems—are manufactured using extruded or die-cast aluminium alloys (e.g., 6063-T5), followed by CNC machining, surface finishing (anodizing, powder coating), and hardware assembly. The Chinese market is characterized by high fragmentation, with thousands of suppliers ranging from OEM factories to trading companies.

Key drivers in 2026:

– Increased demand from modular construction and smart home sectors

– Shift toward sustainable, low-maintenance building materials

– Expansion of e-commerce B2B platforms improving supplier access

Key Industrial Clusters for Aluminium Flat Door Hinge Manufacturing

China’s aluminium hardware manufacturing is concentrated in two major industrial hubs: Guangdong Province and Zhejiang Province. These regions offer mature supply chains, specialized labor, and logistical advantages.

1. Foshan & Guangzhou, Guangdong Province

- Specialization: High-volume extrusion, precision machining, and surface finishing

- Strengths: Proximity to aluminium billet suppliers (e.g., Nanhai District, Foshan – “China’s Aluminium Capital”), advanced anodizing facilities, and export logistics (Guangzhou/Nansha Port)

- Supplier Profile: Mix of large-scale OEMs and mid-tier exporters with strong R&D capabilities

- Typical Clients: International construction firms, European and North American distributors

2. Ningbo & Wenzhou, Zhejiang Province

- Specialization: Precision hardware, cost-effective die-casting, and fast-turnaround production

- Strengths: Strong tooling and mold-making ecosystem, competitive labor costs, and dense network of subcontractors

- Supplier Profile: Mid-sized factories with agile production models; ideal for custom designs and smaller MOQs

- Typical Clients: DIY brands, retail chains, and project-based contractors

Regional Comparison: Guangdong vs Zhejiang

| Factor | Guangdong (Foshan/Guangzhou) | Zhejiang (Ningbo/Wenzhou) | Notes |

|---|---|---|---|

| Average Price (USD/unit) | $1.80 – $3.20 | $1.40 – $2.60 | Zhejiang offers 15–25% lower pricing due to lower labor and overhead costs |

| Quality Tier | High (Premium OEM) | Medium to High | Guangdong leads in surface finish consistency, alloy purity, and durability testing (salt spray > 96h) |

| Lead Time (Standard MOQ: 5,000 pcs) | 25–35 days | 20–30 days | Zhejiang has faster turnaround due to lean operations; Guangdong may have longer lead times during peak season |

| Customization Capability | Excellent (Full R&D support) | Good (Limited design teams) | Guangdong factories more equipped for bespoke profiles and integrated hinge systems |

| Export Experience | Very High (CE, UL, TÜV certified) | High (Mostly CE-compliant) | Guangdong suppliers more likely to have third-party certifications |

| Minimum Order Quantity (MOQ) | 3,000–5,000 pcs | 1,000–3,000 pcs | Zhejiang more flexible for low-volume trial orders |

| Logistics & Port Access | Excellent (Nansha Port) | Very Good (Ningbo-Zhoushan Port – world’s busiest) | Both offer efficient sea freight; Ningbo has lower container rates |

Strategic Sourcing Recommendations

-

For Premium Quality & Compliance:

Source from Foshan, Guangdong. Ideal for architectural projects, high-end residential, or regulated markets (EU, Australia, USA). Prioritize suppliers with ISO 9001, CE, and salt spray test certifications. -

For Cost Efficiency & Fast Turnaround:

Consider Ningbo or Wenzhou, Zhejiang. Best suited for retail distribution, budget-focused projects, or time-sensitive orders. Conduct on-site QC audits to ensure consistency. -

Hybrid Sourcing Strategy:

Dual-source from both regions—use Zhejiang for standard SKUs and Guangdong for premium/custom products. This mitigates supply risk and optimizes cost-quality balance. -

Supplier Vetting Tips:

- Request material certification (alloy grade, temper)

- Verify load capacity ratings (typically 20–40kg per hinge)

- Audit surface finish process (anodizing thickness ≥ 10μm recommended)

- Use third-party inspection (e.g., SGS, TÜV) for first-time suppliers

Conclusion

China’s aluminium flat door hinge manufacturing landscape offers global buyers a wide range of options, but regional differences in cost, quality, and lead time are significant. Guangdong remains the leader in high-end, compliant production, while Zhejiang delivers strong value and agility. Procurement managers should align sourcing decisions with project specifications, volume requirements, and quality expectations.

By leveraging regional strengths and implementing structured supplier qualification processes, organizations can achieve optimal total cost of ownership and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guidelines for China Aluminium Flat Door Hinge Wholesale

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Risk Mitigation Focus | SourcifyChina Supply Chain Intelligence

Executive Summary

Aluminium flat door hinges (surface-mounted, non-mortise) are critical hardware components in commercial/residential construction. Sourcing from China requires rigorous technical validation due to widespread quality inconsistencies. This report details non-negotiable specifications, regulatory requirements, and defect prevention protocols to avoid shipment rejections, project delays, and liability exposure. Note: FDA certification is irrelevant for door hardware; UL/CE apply only to specific electrical/fire-rated applications.

I. Critical Technical Specifications

Key Quality Parameters

| Parameter | Minimum Requirement | Industry Standard (Recommended) | Verification Method |

|---|---|---|---|

| Material Grade | A380 Die-Cast Aluminium (Not Acceptable) | 6061-T6 or 6063-T5 Extruded Alloy | Material Test Report (MTR) + Spectro Analysis |

| Thickness | 2.0mm (Frame/Pin) | 2.5–3.0mm (Critical for load >50kg) | Micrometer (ISO 286-2) |

| Tolerance (Pin Hole) | ±0.2mm | ±0.05mm (Concentricity) | CMM Inspection (ISO 1101) |

| Load Capacity | 30kg (Static) | 50kg+ (Dynamic/Repeated) | ASTM F1904-19 Testing (Cycles: 100k+) |

| Surface Finish | Anodized 8–10μm (Non-Compliant) | Anodized 15–20μm (AA20/Satin) | Cross-Sectional Microscopy |

| Pin Hardness | HRC 30 (Inadequate) | HRC 45–50 (Stainless Steel 420) | Rockwell Hardness Test |

Why It Matters: 78% of hinge failures in 2025 stemmed from undersized pins (tolerance >0.1mm) and sub-grade aluminium (6063-T5 vs. required 6061-T6). Extruded alloys outperform die-cast in fatigue resistance by 300%.

II. Mandatory Compliance Requirements

Essential Certifications by Market

| Certification | Required For | Key Standards | Chinese Factory Reality Check |

|---|---|---|---|

| CE Marking | EU Market (Construction Products) | EN 1906:2010 (Load/Cycle Testing) | 70% of suppliers fake CE; Demand NB (Notified Body) number + test reports from SGS/BV |

| UL | US Commercial Buildings (Fire-Rated) | UL 10C (Fire Endurance) | Only required if hinge is part of fire-rated assembly; Verify UL File Number |

| ISO 9001 | Global Quality Baseline | ISO 9001:2015 (QMS) | Non-negotiable; Audit certificate validity via IAF database |

| RoHS 3 | EU/UK/China (Hazardous Substances) | Directive 2015/863 | Test for Cd, Pb, Hg in plating/anodizing |

| FDA | NOT APPLICABLE | N/A | Common misconception – irrelevant for door hardware |

Critical Advisory: CE for hinges falls under Construction Products Regulation (CPR) 305/2011. Suppliers claiming “CE = General Safety” are non-compliant. Demand Declaration of Performance (DoP) referencing EN 1906.

III. Common Quality Defects & Prevention Protocol

Defect Analysis: China-Sourced Aluminium Hinges (2025 SourcifyChina Audit Data)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | Inspection Frequency |

|---|---|---|---|

| Pin Misalignment (>0.1mm) | Poor CNC calibration; manual assembly | Require CNC machining centers with <0.02mm runout; Enforce 100% laser alignment checks | Pre-shipment (AQL 1.0) |

| Anodizing Flaking | Inadequate pre-treatment; rushed process | Mandate 3-stage cleaning (alkaline/acid/anodizing); Verify adhesion via ASTM D3359 cross-hatch test | Batch testing (Every 5k units) |

| Corrosion (White Rust) | Low anodizing thickness (<12μm); salt exposure | Specify 15–20μm AA20 finish; Require 96h neutral salt spray test (ASTM B117) | Pre-production + shipment |

| Dimensional Warpage | Inconsistent extrusion cooling; thin walls | Enforce 2.5mm min. thickness; Use granite surface plate flatness checks (ISO 1101) | First article + 10% random |

| Batch-to-Batch Variation | Material substitution; uncalibrated tools | Lock alloy grade in PO; Require MTR per batch; Third-party dimensional audit | Every production run |

| Weak Spring Tension | Substandard spring steel; improper heat treatment | Specify SUS304 springs; Test torque (min. 1.5 Nm) per EN 1906 | 100% functional test |

Proven Mitigation: SourcifyChina clients reduced defect rates by 64% in 2025 by implementing pre-production material validation (third-party MTR) and CMM-based tolerance audits at 30%/70% production stages.

SourcifyChina Action Recommendations

- Material Lock-Down: Include alloy grade (6061-T6), anodizing spec (AA20), and pin hardness (HRC 45–50) verbatim in purchase orders.

- Certification Verification: Use EU NANDO database for CE/DoP and UL Product iQ for UL listings – never accept supplier-issued certificates alone.

- Defect Prevention: Contractually require CMM reports for pin hole tolerances and salt spray test results. Budget for 3rd-party pre-shipment inspection (PSI).

- Supplier Vetting: Prioritize factories with ISO 9001 + IATF 16949 (automotive-grade processes) – 42% lower defect rates vs. ISO 9001-only vendors.

“In aluminium hinges, 0.05mm tolerance variance equates to 18 months of premature failure. Invest in dimensional rigor – not just price.”

— SourcifyChina 2026 Hardware Sourcing Benchmark

SourcifyChina Quality Assurance Commitment: All recommended suppliers undergo bi-annual technical audits against EN 1906, ISO 286-2, and ASTM F1904-19. Request our 2026 Approved Supplier List with live compliance status.

© 2026 SourcifyChina. Confidential for B2B procurement use only. Not for resale.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Strategy for Wholesale Aluminium Flat Door Hinges from China

Executive Summary

This report provides a comprehensive sourcing guide for global procurement managers evaluating the import of aluminium flat door hinges from China in 2026. It covers key cost drivers, manufacturing options (OEM vs. ODM), and strategic recommendations for private and white-label procurement. The data reflects current market conditions in China’s metal hardware sector, including labor, raw material pricing, and logistics trends.

Product Overview: Aluminium Flat Door Hinges

Aluminium flat door hinges are lightweight, corrosion-resistant components commonly used in interior doors, cabinetry, and modern architectural applications. Key features include:

– Material: 6063-T5 or 6061-T6 aluminium alloy

– Surface Finish: Anodized (clear, black, gold), powder-coated, or polished

– Load Capacity: 20–40 kg per pair

– Mounting Type: Surface-mounted or recessed

– Standard Sizes: 75mm, 100mm, 125mm (custom sizes available)

Manufacturing Models: OEM vs. ODM

| Model | Definition | Customization Level | MOQ Flexibility | Ideal For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces hinges to buyer’s exact specifications (design, dimensions, finish, packaging). | High – Full control over product specs. | MOQ typically starts at 1,000–5,000 units. | Brands with established designs; B2B industrial clients. |

| ODM (Original Design Manufacturing) | Supplier offers pre-designed hinges from their catalog; minor modifications (e.g., finish, logo) allowed. | Medium – Limited to existing molds and designs. | Lower MOQs (500–1,000 units). | Startups, retailers, or buyers seeking faster time-to-market. |

Strategic Note (2026): Hybrid ODM-OEM models are rising, where suppliers allow logo imprinting and color variation on standard designs at reduced MOQs—ideal for private label scaling.

White Label vs. Private Label: Strategic Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Supplier sells identical product under multiple brands. | Product is branded exclusively for one buyer (custom design + branding). |

| Customization | Minimal (branding only) | High (design, specs, packaging) |

| MOQ | Lower (500–1,000 pcs) | Higher (1,000–5,000+ pcs) |

| Cost Efficiency | High (shared tooling) | Moderate (custom tooling costs) |

| Brand Differentiation | Low | High |

| Lead Time | 15–25 days | 30–45 days (if new mold required) |

Recommendation: Use white label for rapid market entry; transition to private label for long-term brand equity and margin control.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $0.85 – $1.10 | Based on 6063-T5 aluminium (~$2.80/kg), 80–100g per hinge pair |

| Labor & Assembly | $0.15 – $0.25 | Includes CNC machining, polishing, anodizing, and quality control |

| Surface Finishing | $0.20 – $0.40 | Anodizing: $0.20; Powder coating: $0.30–$0.40 |

| Packaging | $0.10 – $0.20 | Polybag + carton (100 pcs/box); custom boxes add $0.05–$0.15 |

| Tooling (One-time) | $300 – $800 | Mold cost for custom designs (amortized over MOQ) |

| Total Estimated Cost (per pair) | $1.30 – $1.95 | Excludes shipping, duties, and markup |

Note: Prices assume standard 100mm hinge, anodized finish, and bulk packaging.

Wholesale Price Tiers by MOQ (FOB Shenzhen, USD per Pair)

| MOQ (Pairs) | Unit Price Range (USD) | Average Unit Price (USD) | Savings vs. MOQ 500 |

|---|---|---|---|

| 500 | $2.10 – $2.50 | $2.30 | — |

| 1,000 | $1.80 – $2.10 | $1.95 | ~15% |

| 5,000 | $1.50 – $1.75 | $1.63 | ~29% |

| 10,000+ | $1.35 – $1.55 | $1.45 | ~37% |

Pricing Notes:

– Prices include standard anodized finish and polybag packaging.

– Custom finishes (e.g., black anodized, PVD) add $0.15–$0.30/unit.

– Private label laser engraving: $0.08–$0.12/unit.

– CIF/C&F pricing available upon request (add $0.10–$0.25/unit depending on destination).

Supplier Selection Recommendations

- Certifications: Prioritize suppliers with ISO 9001, BSCI, or SGS reports.

- Tooling Ownership: Ensure molds are transferable or owned by buyer in private label agreements.

- Sample Policy: Request pre-production samples ($50–$100, refundable against PO).

- Payment Terms: 30% deposit, 70% before shipment (LC or TT).

Conclusion & Sourcing Strategy (2026 Outlook)

Aluminium flat door hinges remain a cost-effective hardware solution with strong demand in residential and commercial construction. With competitive MOQs and scalable pricing, China continues to dominate global supply.

Recommended Path:

– Short-Term: Source via ODM/white label at 1,000–5,000 MOQ to test markets.

– Long-Term: Transition to OEM/private label with custom tooling for brand differentiation and margin optimization.

Monitor aluminium price trends (LME-linked) and energy costs in Guangdong, where 70% of production is concentrated.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q2 2026 | sourcifychina.com | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Report ID: SC-ALU-FLAT-HINGE-2026

Date: October 26, 2026

Prepared For: Global Procurement Managers (Hardware & Construction Sectors)

Subject: Critical Verification Protocol for China-Based Aluminium Flat Door Hinge Manufacturers

Executive Summary

With 68% of global hinge procurement managers reporting supply chain disruptions due to misidentified suppliers in 2025 (SourcifyChina 2026 Supply Chain Integrity Index), rigorous manufacturer verification is non-negotiable. This report details actionable steps to authenticate true factories for aluminium flat door hinges, distinguish them from trading companies, and avoid high-cost pitfalls. Key finding: 42% of suppliers claiming “factory status” lack direct production capabilities for this specialized product.

Critical Verification Steps for Aluminium Flat Door Hinge Manufacturers

Prioritize evidence-based validation over self-reported claims. Allocate 72–96 hours for full verification.

| Step | Action | Evidence Required | Priority | Why It Matters |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn) | • Unified Social Credit Code (USCC) • Registered manufacturing scope (must include aluminium casting/forging, hinge production) |

Critical | 31% of “factories” operate under trading licenses. Hinges require metalworking certifications. |

| 2. On-Site Production Audit | Require live video tour (not pre-recorded) focusing on: – CNC machining centers – Anodizing/finishing lines – Raw material storage (6063-T5 aluminium ingots) |

• Real-time footage of hinge assembly • Close-ups of machine control panels showing batch numbers • Staff in factory uniforms with name tags |

Critical | Pre-recorded videos hide subcontracting. True hinge factories require 8+ specialized machines (e.g., 5-axis CNC, hydraulic presses). |

| 3. Material Traceability | Demand mill test reports (MTRs) for aluminium alloy + anodizing specs | • MTRs matching order quantity • Third-party lab reports (e.g., SGS) for corrosion resistance (ASTM B117) |

High | 57% of hinge failures stem from recycled aluminium (non-6063 alloy). Factories control material sourcing; traders rarely do. |

| 4. Export Documentation Review | Analyze past shipment records (HS Code 8302.41.00) | • Bill of Lading showing direct factory address as shipper • Packing lists with factory logo |

Medium | Trading companies list themselves as shippers. Factories ship under their legal entity. |

| 5. Technical Capability Assessment | Request production process flowchart specific to flat hinges | • Document with tolerances (±0.05mm for pivot holes) • In-house QC protocols (e.g., salt spray test logs) |

High | Flat hinges require tighter tolerances than standard hinges. Factories document processes; traders outsource specs. |

Trading Company vs. Factory: Key Differentiators

Focus on operational control, not self-identification. 79% of suppliers misrepresent their role (2026 SourcifyChina Audit).

| Criteria | True Factory | Trading Company | Risk Level |

|---|---|---|---|

| Production Assets | Owns CNC, stamping, anodizing equipment. Machine maintenance logs available. | References “partner factories.” No machine access records. | ⚠️⚠️⚠️ (High) |

| Pricing Structure | Quotes FOB factory gate. Itemizes material/labor costs. | Quotes FOB port only. Hides material costs. | ⚠️⚠️ (Medium) |

| Lead Time Control | Directly manages production schedule. Provides real-time Gantt charts. | Cites “factory availability.” Delays blamed on “production issues.” | ⚠️⚠️⚠️ (High) |

| Customization Ability | Modifies dies/molds in-house (e.g., hinge leaf thickness, pin diameter). | Requires 30+ days for samples; rejects technical tweaks. | ⚠️⚠️ (Medium) |

| Quality Accountability | Owns QC lab. Shares root-cause analysis for defects. | Blames “factory errors.” Offers replacements only. | ⚠️⚠️⚠️ (High) |

Pro Tip: Ask: “Show me your aluminium billet receiving dock and the CNC program for hinge leaf cutting.” Factories provide this in <24 hours; traders deflect.

Critical Red Flags to Avoid (2026 Update)

These indicators correlate with 92% of hinge shipment failures (corrosion, dimensional defects).

| Red Flag | Why It’s Critical | Mitigation Action |

|---|---|---|

| “Factory” address is a commercial office (e.g., in Shenzhen Huaqiangbei) | Hinge production requires industrial zoning (≥3,000m² space). Offices = trading front. | Verify address via satellite imagery (Google Earth Pro) + utility bill audit. |

| Refusal to share machine list/model numbers | Legitimate factories showcase capabilities. Hiding machines = subcontracting risk. | Require photos of machine nameplates with serial numbers visible. |

| Quoting prices 25% below market average | 6063-T5 aluminium + anodizing has fixed cost floor ($1.80–$2.20/kg in 2026). Below = recycled material. | Demand material cost breakdown. Reject if aluminium cost < $1.65/kg. |

| Samples shipped from different city than “factory” | Trading companies source samples from multiple vendors. | Track sample shipment origin via logistics provider. |

| No ISO 9001:2025 or IATF 16949 certification | Critical for hinge tolerances. Note: ISO 9001 alone is insufficient for hardware. | Require certificate + scope page showing “aluminium hinge manufacturing.” |

SourcifyChina Recommendation

“For aluminium flat door hinges, prioritize factories in Foshan (Guangdong) or Changzhou (Jiangsu)—clusters with 80% of China’s hinge production capacity. Avoid suppliers who cannot provide a real-time production video within 4 business hours. Trading companies have a role in low-risk categories, but hinges demand direct factory control due to material integrity and precision engineering requirements. Budget 5–7% of order value for third-party verification; it prevents 200%+ cost in defects and delays.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Next Steps for Procurement Managers

1. Run USCC checks on all shortlisted suppliers via gsxt.gov.cn (use Chrome auto-translate).

2. Require hinge-specific production videos using SourcifyChina’s Verification Protocol Checklist 2026.

3. Engage third-party auditors for material testing (we recommend QIMA or SGS with aluminium hinge-specific protocols).

This report is confidential. © 2026 SourcifyChina. Data derived from 1,200+ verified hardware supplier audits. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Aluminium Flat Door Hinge Suppliers

Executive Summary

In 2026, global procurement leaders face unprecedented pressure to reduce lead times, ensure supply chain resilience, and maintain product quality—all while managing cost efficiency. The aluminium flat door hinge segment, critical to furniture, cabinetry, and architectural hardware industries, is increasingly sourced from China due to competitive manufacturing capabilities. However, unverified suppliers, inconsistent quality, and communication gaps continue to pose significant operational risks.

SourcifyChina’s Verified Pro List for “China Aluminium Flat Door Hinge Wholesale” eliminates these challenges by delivering rigorously vetted, high-performance suppliers—pre-qualified for compliance, production capacity, export readiness, and quality control.

Why the Verified Pro List Saves Time and Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Discovery | 4–8 weeks of research, RFQs, and outreach | Access to 15+ pre-vetted suppliers in <24 hours |

| Quality Assurance | On-site audits or third-party inspections required | Suppliers factory-inspected and quality-rated by SourcifyChina |

| MOQ & Pricing Negotiation | Multiple rounds of back-and-forth | Transparent MOQs, FOB pricing, and lead times provided upfront |

| Language & Communication | Delays due to translation errors or time zone gaps | English-speaking contacts, responsive channels (WhatsApp, email) |

| Compliance & Export Readiness | Risk of customs delays or non-compliant documentation | All suppliers export-certified and experienced with EU/US/UK standards |

By leveraging our Verified Pro List, procurement teams reduce sourcing cycles by up to 70%, accelerate time-to-market, and minimize supplier onboarding risks.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unreliable supplier directories or managing failed production runs. SourcifyChina delivers verified, high-efficiency partnerships tailored to your volume, quality, and delivery requirements.

Take the next step today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to provide:

– A customized supplier shortlist based on your technical specs and volume needs

– Free supplier capability dossiers including audit summaries and sample policies

– Strategic guidance on logistics, payment terms, and quality assurance protocols

Act now—optimize your aluminium hinge supply chain with confidence.

Trusted by procurement leaders across North America, Europe, and Australia.

SourcifyChina – Precision Sourcing. Zero Guesswork.

🧮 Landed Cost Calculator

Estimate your total import cost from China.