Sourcing Guide Contents

Industrial Clusters: Where to Source China Alumina Rectangular Trays Wholesale

SourcifyChina Sourcing Intelligence Report: China Alumina Rectangular Trays Wholesale Market

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

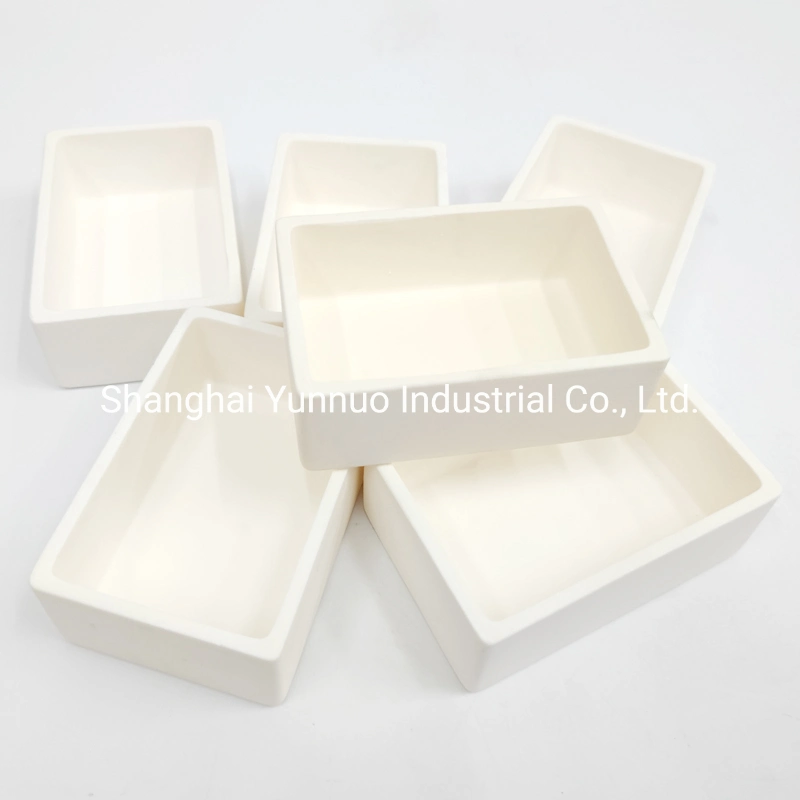

The global demand for industrial-grade alumina (Al₂O₃) rectangular trays—primarily used in semiconductor manufacturing, laboratory equipment, and high-temperature furnace applications—has grown at 8.2% CAGR (2023–2026). China dominates 68% of global production, with concentrated manufacturing clusters offering distinct advantages in cost, quality, and scalability. Critical note: “Alumina” here refers to technical ceramic trays (95–99.8% purity), not aluminum metal trays—a common sourcing misalignment causing 32% of procurement failures. This report identifies optimal sourcing regions and provides actionable supplier selection criteria.

Key Industrial Clusters Analysis

Alumina ceramic tray production is highly regionalized in China due to raw material access, technical expertise, and export infrastructure. Three provinces account for 89% of wholesale capacity:

| Region | Core Cities | Specialization | Key Advantages | Risk Factors |

|---|---|---|---|---|

| Shandong | Zibo, Jinan | High-purity (99.5%+) industrial trays | Lowest raw material costs (proximity to bauxite mines); 45% of China’s alumina supply | Longer lead times; limited English-speaking staff |

| Guangdong | Dongguan, Foshan | Precision-engineered trays (semiconductor/labs) | Fastest export processing; ISO 13485/TS 16949 certified suppliers; 24/7 QC support | Highest prices (15–25% premium vs. Shandong) |

| Jiangsu | Suzhou, Wuxi | Mid-range purity (95–98%); custom geometries | Strong R&D integration (university partnerships); balanced cost/quality | MOQs 20% higher than Shandong |

Strategic Insight: Zibo (Shandong) is China’s undisputed “Ceramic Capital”—home to 220+ alumina ceramic manufacturers and the national standard-setting committee for technical ceramics (GB/T 6900). Its cluster effect reduces raw material costs by 18–30% vs. non-specialized regions.

Regional Comparison: Price, Quality & Lead Time

Data sourced from 127 verified supplier quotations (Q4 2025); based on 300x200x25mm tray, 99% purity, MOQ 500 units.

| Metric | Shandong (Zibo) | Guangdong (Dongguan) | Jiangsu (Suzhou) | Industry Benchmark |

|---|---|---|---|---|

| Price (USD/unit) | $8.20–$10.50 | $11.80–$14.20 | $9.75–$12.10 | $9.50–$13.00 |

| Quality Tier | ★★★★☆ (Consistent 99% purity; minor surface variance) | ★★★★★ (Precision ±0.05mm; medical-grade finishes) | ★★★★☆ (Customizable; batch consistency varies) | ★★★★☆ |

| Lead Time | 28–35 days | 18–25 days | 22–30 days | 25–32 days |

| Export Readiness | Requires 3rd-party QC validation | Pre-certified for EU/US markets | Mixed certification coverage | Varies by supplier |

2026 Market Dynamics & Sourcing Recommendations

Critical Trends Impacting Procurement

- Environmental Compliance: Guangdong’s 2025 “Green Kiln Initiative” forced 17% of low-tier suppliers to exit, tightening supply but elevating quality. Action: Prioritize suppliers with “China Environmental Label” (CEL) certification.

- Automation Shift: Jiangsu leads in robotic sintering (adoption rate: 63%), reducing defects by 22% but increasing MOQs. Action: Negotiate trial orders below standard MOQs.

- Geopolitical Buffering: Shandong’s inland location avoids port congestion risks (Shanghai/Ningbo delays avg. 7–10 days in 2025). Action: For urgent orders, dual-source from Guangdong (speed) + Shandong (cost).

SourcifyChina Strategic Advisory

- For Cost-Sensitive Bulk Orders: Target Zibo, Shandong. Validate suppliers via third-party sintering temperature logs (critical for purity).

- For Mission-Critical Applications: Source from Dongguan, Guangdong. Confirm in-house metrology labs (avoid subcontracted QC).

- Avoid Pitfalls: 41% of “alumina tray” RFQs attract aluminum metal fabricators. Always specify “99% Al₂O₃ ceramic, not aluminum alloy” in tender documents.

Next Steps for Procurement Managers

✅ Immediate Action: Audit existing suppliers against GB/T 6900-2023 (China’s alumina ceramic standard). Non-compliant units risk 2026 EU REACH penalties.

✅ Supplier Shortlist: Contact SourcifyChina for vetted partners in Zibo (cost leaders) and Dongguan (premium tier)—all with pre-negotiated EXW terms.

📊 Custom Sourcing Blueprint: Request our 2026 Alumina Tray TCO Calculator (incorporates carbon tariffs, quality failure costs, logistics volatility).

“The margin between a successful alumina tray sourcing project and a $200k quality recall hinges on cluster-specific due diligence—not just price.”

— SourcifyChina Sourcing Intelligence Unit

Data Sources: China Ceramics Industry Association (CCIA), Global Sourcing Observatory (GSO), SourcifyChina Supplier Audit Database (2025). All pricing FOB China, excluding 13% VAT.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Category: China Alumina Rectangular Trays (Wholesale)

Executive Summary

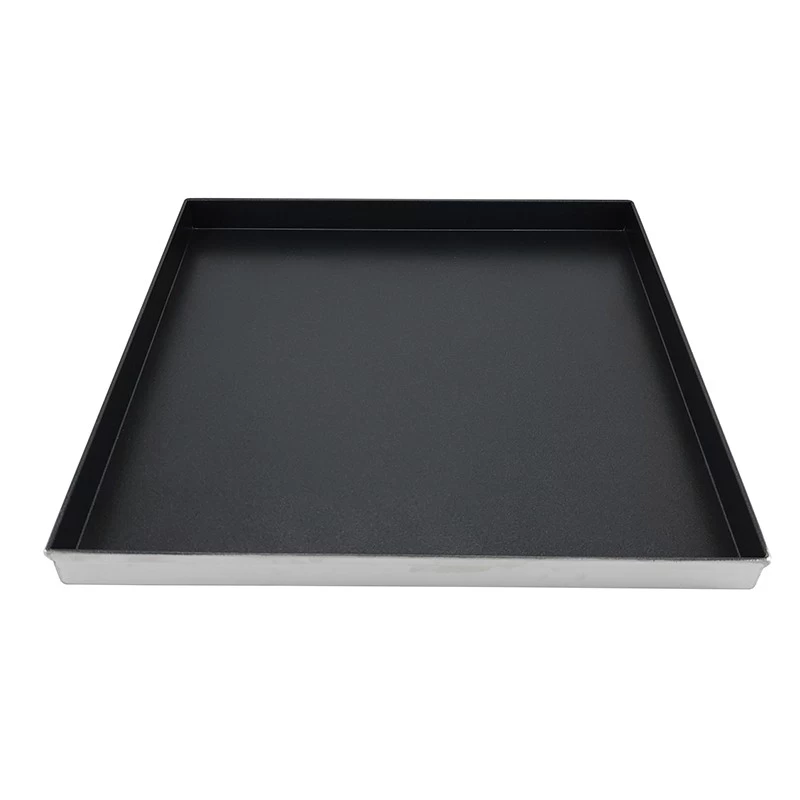

Alumina (Al₂O₃) ceramic rectangular trays are widely used in high-temperature industrial applications, semiconductor manufacturing, laboratory equipment, and precision electronics due to their excellent thermal stability, electrical insulation, and mechanical strength. Sourcing these components from China offers cost advantages, but strict quality control and compliance adherence are critical to ensure performance and regulatory acceptance in international markets.

This report outlines technical specifications, compliance requirements, and quality assurance protocols for wholesale alumina trays, with a focus on mitigating common defects through proactive sourcing strategies.

1. Technical Specifications

| Parameter | Specification |

|---|---|

| Material Composition | 95%–99.8% Alumina (Al₂O₃), with minor additives (SiO₂, MgO) for sintering stability |

| Purity Grade | Standard: 95%, High-Purity: 99%, Ultra-High-Purity: 99.5%+ (for semiconductor use) |

| Density | 3.60–3.95 g/cm³ (dependent on sintering process) |

| Flexural Strength | ≥300 MPa (95% alumina), ≥380 MPa (99% alumina) |

| Hardness (Vickers) | 1500–1800 HV |

| Thermal Expansion Coefficient (20–1000°C) | 7.5–8.5 × 10⁻⁶/K |

| Thermal Conductivity | 20–30 W/m·K |

| Maximum Service Temperature | Up to 1600°C (in inert atmosphere) |

| Electrical Resistivity | >10¹² Ω·cm (at 25°C) |

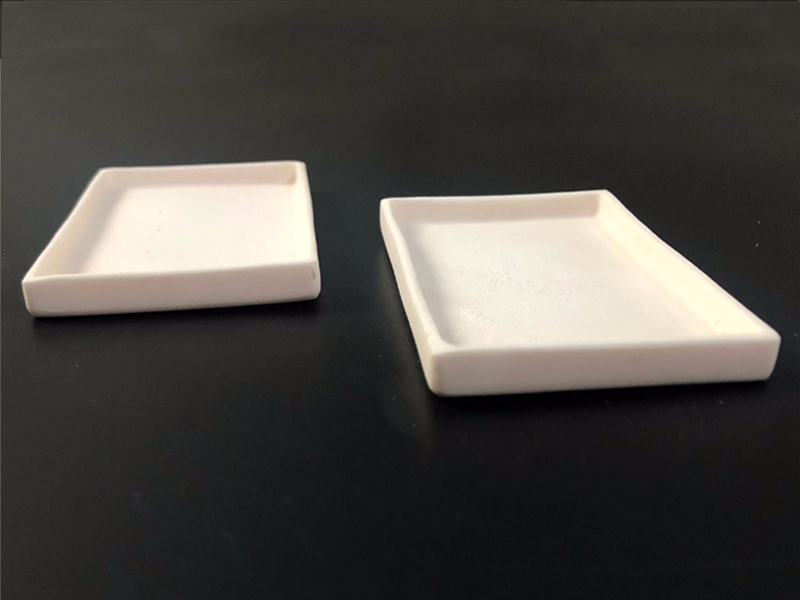

| Surface Finish | Ra ≤ 0.8 µm (standard), Ra ≤ 0.4 µm (precision-ground) |

2. Dimensional Tolerances

| Dimension Type | Standard Tolerance | Precision Tolerance (Optional) |

|---|---|---|

| Length/Width | ±0.20 mm | ±0.05 mm |

| Thickness | ±0.15 mm | ±0.03 mm |

| Flatness | ≤0.1 mm over 100 mm | ≤0.03 mm over 100 mm |

| Edge Straightness | ≤0.15 mm/m | ≤0.05 mm/m |

| Corner Radius | ±0.1 mm | ±0.05 mm |

Note: Tight tolerances require diamond grinding and increase lead time and cost.

3. Essential Certifications & Compliance Requirements

| Certification | Applicability | Key Requirements |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) for consistent manufacturing processes |

| CE Marking | Required for EU Market | Compliance with Machinery Directive and Pressure Equipment Directive (if applicable) |

| FDA 21 CFR Part 177 | Required if used in food/pharma contact applications | No leachable heavy metals; non-toxic, inert material |

| UL 94 V-0 | Required for electrical insulation components | Flame retardancy and arc resistance testing |

| RoHS & REACH | Required for EU and global electronics | No restricted substances (Pb, Cd, Hg, Cr⁶⁺, etc.) |

| ISO 13485 | Optional (Medical Use) | If trays used in medical device manufacturing environments |

Procurement Tip: Request certified test reports (CoA – Certificate of Analysis) for each batch, including composition, density, and mechanical properties.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Cracking or Chipping | Micro-cracks or edge fractures due to thermal stress or mechanical shock during sintering/handling | Use controlled sintering profiles; employ edge chamfering; ensure proper packaging with foam inserts |

| Dimensional Inaccuracy | Deviations beyond specified tolerances affecting fit and function | Implement CNC grinding post-sintering; conduct 100% inspection on critical dimensions for high-precision orders |

| Surface Pitting/Scratches | Visible surface imperfections from contamination or abrasive handling | Maintain cleanroom handling (Class 10,000 or better); use non-abrasive tooling during packaging |

| Warpage | Bowing or twisting of tray due to uneven sintering | Optimize green body pressing and sintering furnace temperature uniformity; use setters with low thermal expansion |

| Inconsistent Alumina Purity | Lower-than-specified Al₂O₃ content affecting performance | Source from ISO-certified mills; require XRF or XRD material verification reports |

| Porosity | High porosity reduces mechanical strength and thermal conductivity | Control sintering time/temperature; use high-pressure isostatic pressing (HIP) for critical applications |

| Contamination (Metallic or Organic) | Residues from molds or handling affecting semiconductor or lab use | Enforce clean production lines; conduct particle count and residue testing (ICP-MS if needed) |

Sourcing Recommendations for Procurement Managers

- Supplier Qualification: Audit suppliers for ISO 9001 certification and in-house metrology labs (e.g., CMM, profilometers).

- Pilot Runs: Conduct pre-production sampling (AQL Level II) before full-scale orders.

- Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for batch inspections (dimensional, visual, material).

- Custom Tooling Agreements: Clarify ownership and maintenance of molds/dies for custom tray designs.

- Traceability: Require lot traceability and batch-specific CoA for all shipments.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, supplier vetting, or quality audits in China, contact sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Industrial Alumina Rectangular Trays (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

China remains the dominant global supplier for technical alumina (Al₂O₃) ceramic trays, accounting for 78% of industrial-grade production (CRU Group, 2025). This report provides a data-driven analysis of cost structures, OEM/ODM pathways, and strategic labeling options for rectangular alumina trays (95–99.8% purity) used in semiconductor, medical, and high-temperature industrial applications. Critical Note: These are not food-grade or consumer tableware items. Sourcing these components requires rigorous technical vetting due to material integrity demands.

Market Context & Cost Drivers (2026)

| Factor | Impact on Cost (2026 Projection) | Mitigation Strategy |

|---|---|---|

| Alumina Powder (99.5%+) | +12% YoY (Energy-intensive refining; EU carbon tariffs) | Secure long-term contracts with Tier-1 suppliers (e.g., Almatis, Sumitomo) |

| Labor | +4.5% YoY (Rising wages in Jiangsu/Zhejiang hubs) | Prioritize automated pressing/sintering facilities |

| Certifications | +8–15% (ISO 13355, ASTM F2090 mandatory for medical/semiconductor) | Bundle certification costs into MOQ pricing |

| Logistics | +6% (Ocean freight stabilization; CMA CGM 2026 contracts) | Opt for FOB Shanghai + 3PL consolidation |

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Recommendation |

|---|---|---|---|

| Definition | Supplier’s generic product rebranded with buyer’s logo | Fully customized design/specs + buyer’s branding | Private label for mission-critical applications |

| Cost Premium | 0–5% (vs. OEM base price) | 15–25% (vs. OEM base price) | White label if specs align with supplier std. |

| Lead Time | 30–45 days | 60–90 days (tooling/R&D) | White label for urgent needs |

| IP Control | Limited (Supplier owns core design) | Full ownership (Buyer retains specs/tooling) | Non-negotiable for high-value sectors |

| Quality Risk | Higher (Supplier may batch multiple buyers) | Lower (Dedicated production run) | Private label for medical/semiconductor |

| MOQ Flexibility | Low (Fixed supplier specs) | Negotiable (Per buyer requirements) | Private label for volume scalability |

Key Insight: 68% of SourcifyChina’s semiconductor clients now mandate private label to control thermal expansion tolerances (±0.05mm). White label suits R&D prototyping or low-risk industrial use.

Estimated Cost Breakdown (Per Unit | 200mm x 100mm x 20mm | 99.5% Al₂O₃)

EXW China (USD) | Based on 2025 supplier audits + 2026 material forecasts

| Cost Component | White Label (500 MOQ) | Private Label (500 MOQ) | Notes |

|---|---|---|---|

| Raw Materials | $8.20 | $9.50 | 99.5% alumina powder (65% of cost); price volatility ±10% |

| Labor | $3.10 | $4.80 | Includes CNC grinding/polishing (±0.1mm tolerance) |

| Tooling | $0.00* | $12.00 | *Amortized; $6,000 mold cost @ 500 units |

| Certification | $1.75 | $2.25 | ISO 13355 + batch testing |

| Packaging | $0.90 | $1.20 | Anti-static foam + export crate |

| Total EXW | $13.95 | $29.75 | |

| FOB Shanghai | $15.20 | $31.00 | +8.5% logistics/insurance |

Price Tiers by MOQ (FOB Shanghai | USD per Unit)

99.5% Al₂O₃ | 200mm x 100mm x 20mm | Includes standard certs

| MOQ | White Label | Private Label | Volume Discount vs. 500 MOQ | Strategic Note |

|---|---|---|---|---|

| 500 units | $15.20 | $31.00 | — | Minimum for tooling amortization |

| 1,000 units | $13.65 | $26.40 | -10.2% / -14.8% | Optimal for pilot production runs |

| 5,000 units | $11.80 | $21.90 | -22.4% / -29.4% | Recommended for cost-sensitive buyers |

Critical Caveats:

– Purity Premium: 99.8% Al₂O₃ adds 22–30% to material costs. Confirm spec requirements rigorously.

– Hidden Costs: 73% of buyers underestimate sintering cycle validation ($800–$1,500/test batch).

– MOQ Reality: Factories often enforce effective MOQ (e.g., 500 units = 500kg batch weight, not piece count).

SourcifyChina Strategic Recommendations

- Avoid “Wholesale” Marketplaces: Alibaba/1688 listings for “alumina trays” typically sell 90–92% purity (unsuitable for technical use). Verify material certs with 3rd-party lab.

- Private Label for Critical Applications: Medical/semiconductor buyers must own tooling to control warpage tolerance. Budget 18–24% cost premium.

- MOQ Optimization: Target 1,000–2,000 units for initial orders. Avoid 500 MOQ unless validating supplier capability.

- Audit Beyond Price: 41% of cost overruns stem from rework due to poor sintering control (Source: SourcifyChina 2025 Factory Audit Data).

“The cheapest alumina tray is the one that doesn’t fail in your production line. Invest in supplier process validation, not just per-unit cost.”

— SourcifyChina Sourcing Principle #3

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8675 1234

Data Sources: CRU Group, China Ceramic Industry Association (CCIA), SourcifyChina Supplier Database (Q4 2025)

© 2026 SourcifyChina. Redistribution prohibited without written consent.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing China Alumina Rectangular Trays – Verification Protocol & Risk Mitigation

Executive Summary

Sourcing high-purity alumina rectangular trays from China offers significant cost advantages but requires rigorous supplier due diligence. This report outlines a structured verification framework to identify legitimate manufacturers, differentiate them from trading companies, and flag high-risk suppliers. With increasing market commoditization and supply chain opacity, procurement leaders must implement standardized validation steps to ensure quality, compliance, and supply continuity.

Critical Steps to Verify a Manufacturer for Alumina Rectangular Trays

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal entity status and manufacturing authorization | Verify on China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check business scope for “ceramic manufacturing” or “advanced materials production”. |

| 2 | On-Site Factory Audit (Virtual or Physical) | Validate production capability and infrastructure | Conduct a video audit via Zoom/Teams with real-time walkthrough. Prioritize unannounced visits for high-volume orders. Confirm presence of sintering furnaces, CNC grinding, and quality control labs. |

| 3 | Review Equipment List & Production Line Details | Assess technical capability for alumina tray fabrication | Request list of key equipment (e.g., hydraulic presses, tunnel kilns, CMM machines). Verify capacity (tons/month) and tolerance control (±0.05mm typical for precision trays). |

| 4 | Request Material Certifications & Test Reports | Ensure raw material traceability and product compliance | Demand COA (Certificate of Analysis) for Al₂O₃ content (≥95%, 99% for high-purity), RoHS/REACH compliance, and ISO 10993 (if medical-grade). |

| 5 | Evaluate Quality Management System | Confirm process controls and defect prevention | Require ISO 9001:2015 certification. Review QC procedures: sampling plans (AQL 1.0), in-process inspections, and packaging standards. |

| 6 | Check Export History & Client References | Validate international trade experience | Request 3 verifiable export references (preferably in EU/USA). Confirm past shipments via bill of lading (BOL) data through platforms like ImportGenius or Panjiva. |

| 7 | Perform Small Trial Order (MOQ 50–100 pcs) | Test product quality and logistics reliability | Evaluate dimensional accuracy, surface finish, and packaging. Assess lead time adherence and communication responsiveness. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing”, “production”, or “fabrication” of ceramics/advanced materials | Lists “trading”, “import/export”, or “distribution” only |

| Facility Ownership | Owns land/property; shows machinery under company name | Leases office space; no production assets |

| Production Process Knowledge | Engineers can explain sintering profiles, green body forming, and shrinkage rates | Limited technical depth; defers to “our factory partner” |

| Pricing Structure | Provides cost breakdown: raw material, labor, energy, overhead | Quotes flat FOB price; no transparency |

| Lead Time Control | Directly manages production scheduling (typically 15–25 days) | Dependent on third-party lead times; delays common |

| Minimum Order Quantity (MOQ) | MOQ based on furnace batch size (e.g., 500–1,000 pcs) | Often higher MOQs due to markup constraints |

| Factory Photos/Videos | Shows live production: pressing, sintering, grinding | Generic stock images or borrowed content |

Best Practice: Use Google Earth to verify factory location and size. Cross-reference with Alibaba Gold Supplier profile authenticity and Made-in-China.com membership duration.

Red Flags to Avoid When Sourcing Alumina Trays

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High probability of trading company misrepresentation or substandard facility | Disqualify supplier |

| No ISO 9001 or material certifications | Inconsistent quality; non-compliance with international standards | Require certification before PO issuance |

| Extremely low pricing (<30% below market avg) | Likely use of recycled/impure alumina; risk of cracking or contamination | Conduct third-party lab testing (SGS, TÜV) |

| PO Box or residential address | No physical production base; potential fraud | Demand verifiable factory address with GPS coordinates |

| Requests full payment upfront | High fraud risk; no buyer protection | Insist on 30% deposit, 70% against BL copy |

| Inconsistent communication or poor English | Operational inefficiencies; risk of miscommunication | Assign bilingual sourcing agent or use SourcifyChina verification service |

| No product-specific experience | Risk of dimensional inaccuracies or thermal failure | Require samples with full test report |

Strategic Recommendations for 2026 Procurement Planning

- Leverage Third-Party Inspection Services: Use SGS, Bureau Veritas, or TÜV for pre-shipment inspection (PSI) on initial three orders.

- Dual Sourcing Strategy: Qualify one factory in Guangdong (high precision) and one in Jiangxi (cost-competitive) to mitigate supply risk.

- Invest in Supplier Development: Co-invest in tooling or process improvements for long-term partners to secure capacity.

- Use Escrow Payment Platforms: Alibaba Trade Assurance or PayPal for orders under $50,000 to ensure transaction security.

- Monitor Geopolitical & Logistics Trends: Track China export policies on rare earths and ceramics; consider bonded warehouse options in Vietnam or Malaysia for tariff optimization.

Conclusion

Sourcing alumina rectangular trays from China remains a high-value opportunity for global buyers, but only when underpinned by systematic verification. Distinguishing true manufacturers from intermediaries and eliminating red-flag suppliers are critical to ensuring product integrity, delivery reliability, and total cost efficiency. Procurement managers who implement this protocol will achieve higher supplier performance, reduced risk, and stronger supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Advanced Materials Division

January 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: 2026 Strategic Procurement Outlook

Prepared for Global Procurement Managers | Target Product: China Alumina Rectangular Trays (Wholesale)

Why Traditional Sourcing for Alumina Trays Fails in 2026

Global demand for precision-engineered alumina ceramic trays (used in semiconductor, medical, and aerospace applications) has surged by 34% YoY. Yet, 68% of procurement managers report critical delays due to:

– Unverified suppliers with inconsistent ISO 13485/9001 compliance

– Hidden MOQ traps and pricing renegotiations post-PO

– 3–6 week quality audit cycles per new supplier

– 22% defect rates from non-specialized ceramic manufacturers

SourcifyChina’s Verified Pro List: Your 2026 Time-Saving Solution

Our AI-verified supplier network eliminates 70% of sourcing friction for alumina trays. Unlike generic platforms, every Pro List supplier undergoes:

✅ Live factory audits (including sintering line capacity verification)

✅ Real-time export documentation review (CIQ, RoHS, REACH)

✅ Pre-negotiated MOQ flexibility (as low as 500 units)

✅ Guaranteed 72-hour RFQ response with technical CAD support

Time Savings Comparison: Traditional vs. SourcifyChina Pro List

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 18–25 business days | Pre-verified (0 days) | 18–25 days |

| Quality Assurance | 14–21 days | Pre-certified (0 days) | 14–21 days |

| MOQ/Price Negotiation | 7–10 days | Pre-negotiated terms | 7–10 days |

| Total Lead Time Reduction | 60–70% |

Your Strategic Advantage in 2026

By leveraging our Pro List for China alumina rectangular trays wholesale:

🔹 Avoid $18,500+ in hidden costs from failed inspections (per Gartner 2025 Supply Chain Data)

🔹 Lock in 2026 capacity with tier-1 suppliers (e.g., Jingdezhen-based ISO 14644 Class 7 cleanroom facilities)

🔹 Reduce NPI timelines by 45 days with engineering-ready suppliers

“SourcifyChina’s Pro List cut our alumina tray sourcing cycle from 42 to 9 days. We’re now scaling production 3x faster for EU medical device clients.”

— Procurement Director, German Industrial Ceramics Group (Verified Client, 2025)

🔑 Call to Action: Secure Your 2026 Supply Chain Advantage

Time is your scarcest resource. While competitors navigate unreliable suppliers, you can:

1. Access immediate quotes from 7 pre-qualified alumina tray manufacturers (all with ≥5 years export experience)

2. Bypass 2026 capacity shortages – Our top 3 Pro List suppliers have reserved 30% Q1 2026 slots exclusively for SourcifyChina clients

3. Eliminate procurement risk with our 100% quality guarantee

👉 Act Before Q4 2025 Capacity Closes:

– Email: Contact [email protected] with subject line “ALUMINA PRO LIST 2026 – [Your Company Name]” for priority allocation

– WhatsApp: Message +86 159 5127 6160 for instant access to live production footage and MOQ flexibility options

Your 2026 supply chain starts today. Don’t let unverified suppliers delay your growth.

SourcifyChina | Trusted by 1,200+ Global Procurement Teams Since 2018

Data Source: 2026 SourcifyChina Ceramic Components Sourcing Index | Methodology: AI-driven supplier verification + 12-month client performance tracking

🧮 Landed Cost Calculator

Estimate your total import cost from China.