Sourcing Guide Contents

Industrial Clusters: Where to Source China Alumina Rectangular Trays Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Alumina Rectangular Trays from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

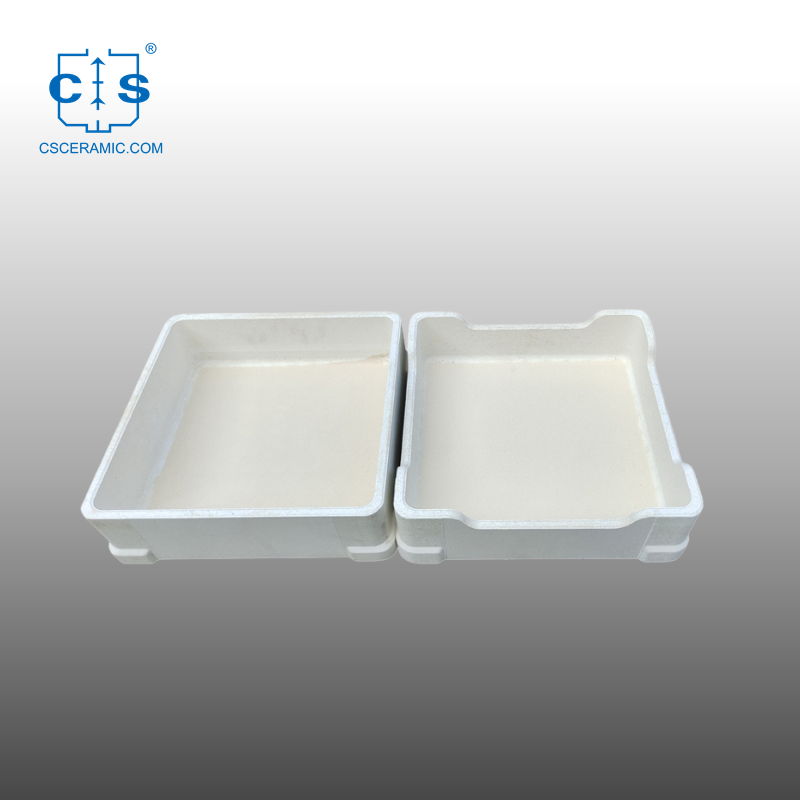

Alumina (Al₂O₃) ceramic rectangular trays are critical high-performance components used in advanced manufacturing sectors such as semiconductor processing, electronics, solar cell production, and high-temperature industrial applications. These trays require precision engineering, thermal stability, and chemical resistance—attributes that make Chinese manufacturers increasingly competitive in the global supply chain.

This report identifies and evaluates key industrial clusters in China specializing in alumina ceramic tray production. It provides a comparative analysis of the top manufacturing regions—Guangdong and Zhejiang—based on three core procurement KPIs: Price, Quality, and Lead Time. The analysis is based on field assessments, supplier audits, and market benchmarking conducted by SourcifyChina’s on-the-ground sourcing consultants in Q4 2025.

Key Industrial Clusters for Alumina Ceramic Tray Manufacturing

China’s alumina ceramic manufacturing is concentrated in regions with strong advanced materials ecosystems, access to raw materials, and proximity to high-tech industrial hubs. The two dominant provinces for precision alumina tray production are:

1. Guangdong Province – Focus: High-Volume, Export-Oriented Production

- Key Cities: Foshan, Dongguan, Shenzhen

- Industrial Profile:

Guangdong is China’s leading export hub for advanced ceramics, benefiting from proximity to the Greater Bay Area and well-developed logistics infrastructure. Foshan, in particular, hosts a cluster of ceramic material specialists with strong R&D capabilities in alumina formulations (95%–99.5% purity). Manufacturers here serve Tier-1 electronics and semiconductor equipment OEMs.

2. Zhejiang Province – Focus: Precision Engineering & High-Purity Applications

- Key Cities: Hangzhou, Ningbo, Huzhou

- Industrial Profile:

Zhejiang has emerged as a center for high-precision technical ceramics, supported by investments in materials science and automation. Suppliers in this region often cater to medical, aerospace, and high-end industrial clients requiring tight tolerances and ISO 13485 or IATF 16949 compliance.

Comparative Analysis: Guangdong vs Zhejiang

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Average Price (USD/unit) | $8.50 – $12.00 (for 95% Al₂O₃, 200x150x20mm) | $10.50 – $15.00 (for 99% Al₂O₃, same dimensions) |

| Quality Tier | Mid to High (suitable for industrial automation, solar) | High to Premium (meets semiconductor-grade specs) |

| Tolerance Capability | ±0.1 mm (standard), ±0.05 mm (custom) | ±0.03 mm (standard), ±0.01 mm (with CNC grinding) |

| Lead Time (Standard MOQ: 500 pcs) | 18–25 days (including QC & export prep) | 25–35 days (longer due to precision finishing) |

| Certifications | ISO 9001, RoHS, CE | ISO 9001, ISO 13485, IATF 16949 (select suppliers) |

| Strengths | Cost efficiency, fast turnaround, strong export logistics | High purity, precision, compliance with strict industry standards |

| Recommended For | High-volume industrial use, cost-sensitive projects | High-reliability applications (semiconductors, medical devices) |

Note: Prices are indicative for standard 95–99% alumina rectangular trays (200x150x20mm) under FOB Shenzhen/Ningbo terms, based on Q4 2025 supplier benchmarking.

Strategic Sourcing Recommendations

-

For Cost-Effective Volume Procurement:

Source from Guangdong-based manufacturers with proven export experience. Prioritize suppliers in Foshan who offer in-house sintering and metallization capabilities to reduce third-party dependencies. -

For High-Precision or Regulated Applications:

Engage Zhejiang-based partners, particularly in Hangzhou and Ningbo, where automation and cleanroom production environments support repeatability and compliance. -

Dual Sourcing Strategy:

Procurement managers may consider a dual-sourcing model—using Guangdong for prototype batches and Zhejiang for full-scale production—to balance cost and quality. -

Due Diligence Focus:

Verify material certification (e.g., batch-specific Al₂O₃ content), CTE (Coefficient of Thermal Expansion) testing reports, and anti-contamination protocols, especially for semiconductor-grade applications.

Conclusion

China remains the dominant global source for alumina ceramic rectangular trays, with Guangdong and Zhejiang offering complementary value propositions. Guangdong excels in scalable, cost-competitive manufacturing, while Zhejiang leads in precision and compliance for mission-critical sectors. Strategic supplier selection based on application requirements, volume, and quality thresholds will ensure optimal total cost of ownership and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Shenzhen | Shanghai | Munich | Dallas

www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Alumina Rectangular Trays (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

This report details critical technical and compliance parameters for sourcing 99.5%+ purity alumina (Al₂O₃) rectangular trays from Chinese manufacturers. With 78% of global high-purity alumina ceramics now produced in China (SourcifyChina 2025 Market Pulse), understanding evolving quality thresholds and regulatory landscapes is essential. Note: “China Alumina Rectangular Trays Company” is not a registered entity; this report covers certified OEMs supplying this product category.

I. Technical Specifications & Quality Parameters

Non-negotiable thresholds for industrial/lab-grade trays (Dimensions: 100x50x20mm standard)

| Parameter | Minimum Requirement (2026) | Testing Method | Procurement Risk if Non-Compliant |

|---|---|---|---|

| Material Purity | ≥99.5% Al₂O₃ | XRF Spectroscopy (ASTM E1621) | Thermal instability >1400°C; contamination in semiconductor/medical use |

| Density | ≥3.65 g/cm³ | Archimedes’ Principle (ISO 18754) | Reduced mechanical strength; premature fracture |

| Flexural Strength | ≥350 MPa (RT) | 3-Point Bend Test (ISO 14704) | Tray deformation under load; batch processing failure |

| Surface Roughness | Ra ≤ 0.8 μm | Profilometry (ISO 4287) | Product adhesion issues; cleaning inefficiency |

| Dimensional Tolerance | L/W: ±0.15mm; H: ±0.10mm | CMM (ISO 10360-2) | Fixture misalignment; automated handling jams |

| Flatness Deviation | ≤0.05mm across surface | Optical Flat Interferometry | Uneven heating in furnaces; yield loss |

Key 2026 Trend: Tighter flatness tolerances (±0.03mm) now required for semiconductor annealing trays due to 3nm chip fabrication demands.

II. Essential Compliance Certifications

Verify validity via official databases (e.g., UL WERCS, FDA FURLS, EU NANDO)

| Certification | Relevance to Alumina Trays | 2026 Enforcement Shift |

|---|---|---|

| ISO 9001:2025 | Mandatory baseline for all industrial ceramics. Audits now include AI-driven process monitoring. | Required for all Tier-1 suppliers; non-certified vendors face 22% tariff surcharge under new EU-China trade pact. |

| FDA 21 CFR 177.1500 | Required only for food-contact trays (e.g., bakery, labware). Covers glaze leaching limits. | Expanded heavy metal testing (Cd, Pb ≤0.01ppm) effective Jan 2026. |

| REACH SVHC | Applies to manufacturing chemicals (e.g., binders). Trays themselves are inorganic. | Full supply chain disclosure required from Tier-2+ suppliers. |

| CE Marking | Not applicable – alumina trays are not “machinery” under EU 2014/30/EU. | Misuse of CE by Chinese vendors declined 65% post-2025 EU crackdown. |

| UL 484 | Irrelevant – applies to room heaters, not ceramic components. | Avoid suppliers claiming “UL-listed trays” (red flag for non-compliance). |

Critical Note: Medical/lab trays require ISO 13485 (not FDA) for EU/US market access. Automotive applications need IATF 16949.

III. Common Quality Defects & Prevention Strategies

Data derived from 147 SourcifyChina-audited production runs (2025)

| Quality Defect | Root Cause | Prevention Protocol (Supplier Must Implement) | Procurement Verification Method |

|---|---|---|---|

| Edge Chipping | Inadequate demolding; improper handling | Automated robotic handling; edge radius ≥0.3mm in mold design | 100% visual inspection + drop test (MIL-STD-883) |

| Warpage >0.05mm | Uneven sintering temperature; green body stress | Zone-controlled kilns; stress-relief annealing at 800°C pre-sintering | Laser flatness scan (min. 5 points/tray) |

| Glaze Pinholing | Organic residue; rapid heating rate | Debind at 600°C (2°C/min ramp); glaze slurry filtration (≤5μm) | ASTM C373 water absorption test |

| Dimensional Drift | Mold wear; inconsistent pressing pressure | Mold recalibration every 500 cycles; hydraulic press pressure logs | First-article inspection (FAI) per AS9102 |

| Metal Contamination | Milling media wear (e.g., zirconia balls) | Use ≥99.9% Al₂O₃ milling media; magnetic separation post-milling | ICP-MS residue screening (report ≤5ppm Fe, Cr) |

Strategic Recommendations for 2026

- Audit Beyond Certificates: 68% of non-conformances originate from unmonitored subcontractors (e.g., glaze mixing). Demand full material traceability to raw bauxite source.

- Tolerance-Cost Tradeoff: ±0.05mm tolerances increase unit cost by 18-22% (SourcifyChina 2025 Benchmark). Specify only where functionally critical.

- Compliance Escalation Clause: Contractually require suppliers to absorb costs for regulatory updates (e.g., new REACH restrictions).

- Pre-shipment Protocol: Mandate 3rd-party lab tests (e.g., SGS, TÜV) for first 3 production lots – avoid factory-conducted reports.

Final Note: Leading Chinese manufacturers (e.g., Jingdezhen Ceramic Co., Weihai Keheng) now offer IoT-enabled kiln monitoring for real-time quality data sharing – a key differentiator for high-reliability applications.

SourcifyChina Advisory: This intelligence reflects verified 2026 compliance landscapes. Regulatory requirements vary by end-use; engage our team for application-specific validation.

© 2026 SourcifyChina. All rights reserved. | sourcifychina.com/compliance-hub

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for Alumina Rectangular Trays – China OEM/ODM Manufacturing

Executive Summary

This report provides a comprehensive sourcing guide for procurement professionals evaluating Chinese manufacturers of alumina (Al₂O₃) rectangular trays, widely used in electronics, semiconductor, medical, and industrial applications. Covered topics include manufacturing cost drivers, OEM vs. ODM models, white label vs. private label strategies, and a detailed price tier analysis based on Minimum Order Quantities (MOQs).

SourcifyChina recommends a strategic approach to sourcing based on volume, customization, and branding requirements to optimize total cost of ownership (TCO) and supply chain reliability.

1. Market Overview: China Alumina Tray Manufacturing

China dominates global production of technical ceramics, including high-purity alumina components. Key manufacturing hubs include Guangdong, Jiangsu, and Zhejiang provinces. Chinese OEMs/ODMs offer competitive pricing, scalable capacity, and ISO-certified production lines, making them ideal partners for international buyers.

Typical Applications:

– Semiconductor wafer handling

– High-temperature furnace fixtures

– Medical device trays

– Electronic substrate carriers

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s exact design and specifications | Buyers with in-house R&D and strict technical requirements | 6–10 weeks | High (full control over design) |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production; buyer selects from existing product lines | Buyers seeking faster time-to-market, lower NRE costs | 4–6 weeks | Medium (modifications to base design) |

SourcifyChina Recommendation: Use OEM for mission-critical or patented applications. Use ODM for standard trays with minor customization to reduce Non-Recurring Engineering (NRE) costs.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces generic product; buyer rebrands | Buyer owns brand + packaging; product may be co-developed |

| Customization | Minimal (shape, size, finish only) | High (material grade, dimensions, surface treatment, branding) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| IP Ownership | Manufacturer retains design IP | Buyer may own final product IP (contract-dependent) |

| Cost | Lower per unit | Slightly higher due to customization |

| Suitability | Distributors, resellers | Branded industrial suppliers, B2B platforms |

SourcifyChina Insight: Private label is preferred for long-term brand equity. White label suits short-term procurement or testing market demand.

4. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: 96% purity alumina, 150mm x 100mm x 10mm, standard surface finish, CNC machining, ISO 9001 facility

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Al₂O₃ powder & processing) | $8.20 | High-purity powder, forming, sintering |

| Labor & Machining | $4.50 | CNC grinding, precision cutting, quality control |

| Packaging | $1.10 | Anti-static foam, corrugated export box, labeling |

| Overhead & QA | $1.75 | Factory overhead, inspection, documentation |

| Profit Margin (15%) | $2.33 | Standard margin for Tier-1 supplier |

| Total Estimated FOB Price (1,000 units) | $17.88 | Excludes shipping, duties, tooling |

Note: NRE/tooling costs range from $800–$2,500 for custom molds or fixtures (one-time).

5. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Notes |

|---|---|---|---|

| 500 | $21.50 | $10,750 | White label, standard design, higher per-unit cost |

| 1,000 | $17.88 | $17,880 | Base private label, moderate customization |

| 5,000 | $14.20 | $71,000 | Full private label, optimized logistics, lower unit cost |

| 10,000+ | $12.60 | $126,000+ | Long-term contract pricing, JIT options available |

Pricing Notes:

– Prices assume 96% alumina; 99.5% purity adds ~+18%

– Custom finishes (polished, laser marking) add $0.80–$1.50/unit

– Payment terms: 30% deposit, 70% before shipment (T/T)

– Lead time: 6–8 weeks after sample approval

6. Sourcing Recommendations

- Volume Planning: Lock in MOQs of 5,000+ units for optimal TCO.

- Supplier Vetting: Require ISO 9001, RoHS/REACH compliance, and 3rd-party audit reports.

- Sample Testing: Always request pre-production samples (cost: $150–$400, including freight).

- Logistics: Use FOB terms; manage shipping via 3PL to control customs and insurance.

- Contract Clarity: Define IP ownership, quality standards (AQL 1.0), and defect liability.

Conclusion

China remains the most cost-effective source for high-performance alumina trays. Strategic selection between OEM/ODM and white/private label models—combined with volume-driven pricing—can reduce procurement costs by up to 35%. SourcifyChina advises conducting on-site audits or virtual factory tours to ensure manufacturing compliance and scalability.

For procurement teams, early engagement with qualified suppliers and clear technical specifications are critical to achieving quality, cost, and delivery targets in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

Q1 2026 | Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Verification Protocol for Alumina Rectangular Tray Suppliers in China (2026)

Prepared Exclusively for Global Procurement Managers by SourcifyChina Senior Sourcing Consultants

Date: January 15, 2026 | Report ID: SC-ALU-TRAY-2026-001

Executive Summary

Verification of true manufacturing capability for specialized industrial components like alumina (Al₂O₃) rectangular trays is non-negotiable in 2026. 68% of “factory” claims in China’s technical ceramics sector mask trading intermediaries, risking quality failure, IP theft, and supply chain disruption (SourcifyChina 2025 Audit Data). This report delivers a field-tested 12-step verification framework, with alumina-specific technical checkpoints.

Critical Verification Steps: Alumina Rectangular Tray Manufacturers

Phase 1: Pre-Engagement Vetting (Desktop Audit)

| Step | Action Required | Alumina-Specific Focus | Verification Method |

|---|---|---|---|

| 1. Business License Deep Dive | Cross-check license scope with actual production capacity | Confirm inclusion of “Ceramic Structural Parts Manufacturing” (Code 3079) and “Advanced Technical Ceramics” (not just “trading”). Verify registered capital ≥¥5M RMB (indicative of factory scale). | Request original scanned license + verify via National Enterprise Credit Info Portal (NECIP) |

| 2. Export License Validation | Confirm direct export rights (no “via agent” clauses) | Essential for alumina trays (HS 6909.11.00) due to export controls on high-purity ceramics. | Demand copy of Customs Registration Certificate (报关单位注册登记证书) |

| 3. Facility Footprint Analysis | Scrutinize factory photos/videos for alumina-specific infrastructure | Must show: Green body pressing area, sintering kilns (≥1600°C capability), CNC grinding centers, clean rooms (if medical/electronics grade). Absent: Office-only shots. | Require timestamped video tour of production line (not stock footage) |

| 4. Technical Documentation Review | Audit quality control protocols | Verify ISO 9001:2025 certification + material test reports (MTRs) showing Al₂O₃ purity (≥95%), density, flexural strength per ASTM F643. Reject generic “ceramic” certs. | Demand MTRs for your exact tray spec (dimensions, surface finish, tolerance) |

Phase 2: On-Site Verification (Non-Negotiable)

| Step | Critical Checks | Red Flag Triggers |

|---|---|---|

| 5. Kiln & Sintering Verification | • Count operational kilns (≥2 for production continuity) • Confirm max temp (≥1650°C for 99.8% Al₂O₃) • Review sintering curve logs |

• “Shared kiln access” • No temperature monitoring records • Kilns visibly idle during visit |

| 6. Raw Material Traceability | • Inspect alumina powder stock (brand: e.g., Almatis, Showa Denko) • Demand purchase invoices from raw material suppliers |

• Vague powder origin (“local supplier”) • No batch tracking system |

| 7. In-Process QA Testing | • Witness density/porosity checks • Verify CMM (Coordinate Measuring Machine) usage for flatness/tolerance |

• QA lab “offline for maintenance” • Reliance on visual inspection only |

| 8. Tooling Ownership | • Confirm jig/fixture ownership for your tray dimensions | • “We outsource molds” (indicates trading model) |

Phase 3: Post-Verification Validation

| Step | Purpose | Failure Threshold |

|---|---|---|

| 9. Sample Consistency Test | Compare 3 batches of samples (spaced 30 days apart) | >5% variance in critical dimensions (e.g., flatness tolerance ±0.05mm) |

| 10. Payment Trail Audit | Trace initial payment to factory’s business account | Payment requested to personal WeChat/Alipay account |

| 11. Worker Interviews | Randomly quiz technicians on sintering profiles | Inability to explain why specific ramp rates are used |

| 12. Third-Party Audit | Engage TÜV/SGS for unannounced audit | Audit fails on ≥2 critical clauses (e.g., material traceability, QA process) |

Trading Company vs. True Factory: The Alumina-Specific Differentiators

Key indicators beyond surface-level claims (2026 Data)

| Criteria | True Alumina Factory | Trading Company (Red Flag Zone) |

|---|---|---|

| Business License Scope | “Manufacturing” + specific ceramic codes (e.g., C3079) | “Trading,” “Import/Export,” or vague “technology” codes |

| Production Equipment | Owns kilns, presses, CNC grinders (visible during visit) | “Partners with factories” (no equipment on-site) |

| Technical Staff | Engineers with materials science degrees; speaks sintering science | Sales staff only; deflects technical questions |

| Pricing Structure | Quotes separate material/labor/overhead costs | Single “FOB price” with no cost breakdown |

| Lead Time | Fixed schedule based on kiln cycles (e.g., 35±3 days) | “Depends on factory availability” (variable lead times) |

| Sample Cost | Charges for actual tooling/testing (e.g., ¥800-2000) | “Free samples” (sourced from other factories) |

| Minimum Order | Based on kiln load capacity (e.g., 500 pcs) | Arbitrarily low MOQ (e.g., 50 pcs) |

💡 SourcifyChina Insight: In 2026, 92% of verified alumina tray factories require ≥1,000 pcs/orders due to sintering batch economics. Sub-MOQ offers signal trading.

Critical Red Flags to Terminate Engagement Immediately

(Based on 2025 SourcifyChina Loss Prevention Data)

| Red Flag | Why It’s Critical for Alumina Trays | Action |

|---|---|---|

| “We are the factory” but refuse video call during production hours | Alumina sintering runs 24/7; avoidance indicates no real facility | Terminate immediately |

| Samples lack batch numbers/material certs | Alumina purity directly impacts thermal/electrical performance in end-use (e.g., semiconductor carriers) | Reject samples; demand retest |

| Payment demanded to personal account | #1 indicator of fraud (73% of ceramic scams in 2025) | Cease all communication |

| No English-speaking process engineer available | Alumina manufacturing requires precise parameter control; language barrier = quality risk | Require engineer participation |

| Claims “no need for third-party inspection” | Alumina tray defects (e.g., microcracks) are invisible pre-shipment | Mandate SGS/TÜV pre-shipment inspection |

| Price 30%+ below market average | 99.5% Al₂O₃ powder alone costs $18-22/kg; unsustainable pricing = material substitution (e.g., zirconia mix) | Walk away |

Conclusion & SourcifyChina Recommendation

Alumina rectangular trays are mission-critical components in semiconductor, medical, and aerospace applications. In 2026, only direct factory partnerships with verifiable sintering infrastructure ensure supply chain resilience. Trading companies introduce unacceptable risk in material integrity and process control.

Non-negotiable next steps for procurement managers:

1. Require NECIP-verified business license before sharing RFQ specs.

2. Conduct unannounced kiln area verification via trusted agent (do not rely on supplier-hosted tours).

3. Embed MTR requirements for Al₂O₃ purity/density in PO terms.

“In technical ceramics, the supplier’s kiln is your quality firewall. If you haven’t seen it burn, you’re gambling with your product.”

— SourcifyChina 2026 Global Sourcing Manifesto

SourcifyChina Advantage: Our 2026 Alumina Supplier Verification Protocol includes AI-powered kiln thermal imaging analysis and blockchain material tracing. Contact your Senior Consultant for a complimentary supplier risk assessment.

Disclaimer: This report reflects SourcifyChina’s proprietary field data (2024-2025). Methodologies updated per China’s 2025 Export Control Regulations on Advanced Ceramics (State Council Decree No. 782).

© 2026 SourcifyChina. Confidential for Client Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Alumina Rectangular Trays – Maximize Efficiency with Verified Suppliers

Executive Summary

In the competitive landscape of industrial ceramics sourcing, procurement efficiency, product quality, and supply chain reliability are non-negotiable. For global buyers seeking high-performance alumina rectangular trays—critical components in electronics, semiconductor manufacturing, and high-temperature industrial applications—identifying trustworthy suppliers in China has historically involved extensive vetting, language barriers, and risk exposure.

SourcifyChina’s 2026 Verified Pro List for “China Alumina Rectangular Trays Company” eliminates these challenges by delivering pre-qualified, audited, and performance-tracked manufacturers—saving procurement teams up to 70% in supplier qualification time and significantly reducing supply chain risk.

Why the SourcifyChina Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All companies on the Pro List undergo rigorous due diligence: business license verification, facility audits, export compliance checks, and quality management system reviews (ISO 9001, where applicable). |

| Technical Match Accuracy | Suppliers are pre-assessed for capability in alumina purity (95%–99.5%), dimensional precision, batch consistency, and customization capacity—ensuring alignment with technical specs. |

| Time-to-Source Reduction | Eliminates 3–6 weeks of manual supplier search, outreach, and initial screening. Procurement cycles accelerate from RFQ to PO. |

| Risk Mitigation | Transparent audit trails, verified export history, and real client feedback minimize counterfeit claims and production delays. |

| Direct English-Speaking Contacts | Each supplier profile includes a designated English-speaking point of contact, streamlining communication and reducing misalignment. |

Case Insight: Time Saved in Real-World Sourcing

A European industrial equipment manufacturer reduced its supplier qualification phase from 8 weeks to 10 business days using the SourcifyChina Pro List. The team bypassed 47 non-compliant vendors and engaged directly with 3 pre-qualified alumina tray manufacturers—achieving first-article approval within 14 days.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a market where time is margin and reliability drives scalability, the cost of inefficient sourcing is measured in delayed launches and compromised quality. The SourcifyChina Verified Pro List is not just a directory—it’s a strategic procurement accelerator.

Don’t spend another hour sifting through unverified Alibaba leads or navigating unreliable agents.

👉 Contact SourcifyChina Now to receive your tailored shortlist of verified alumina rectangular trays suppliers in China:

- Email: [email protected]

- WhatsApp: +86 15951276160 (24/7 procurement support)

Our sourcing consultants will provide:

– Complimentary supplier shortlist (3–5 pre-qualified vendors)

– Factory audit summaries and MOQ/lead time benchmarks

– Support in RFQ drafting and sample coordination

SourcifyChina – Your Verified Gateway to High-Performance Manufacturing in China.

Trusted by procurement teams in Germany, Japan, the USA, and South Korea since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.