Sourcing Guide Contents

Industrial Clusters: Where to Source China Al Sic Metal Matrix Composite Ceramic Wholesalers

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing AlSiC (Aluminum Silicon Carbide) Metal Matrix Composite Ceramics from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

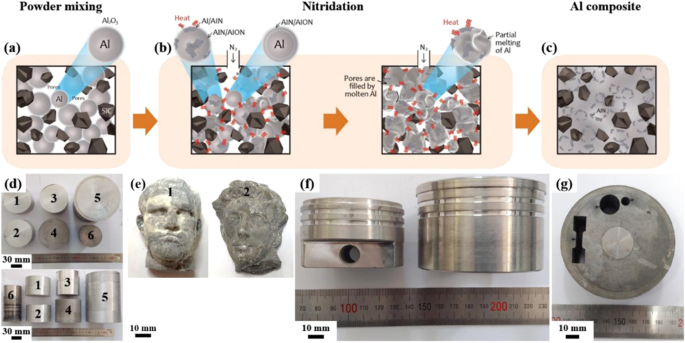

Aluminum Silicon Carbide (AlSiC) metal matrix composites (MMCs) are advanced engineered materials combining the lightweight properties of aluminum with the high thermal conductivity, low thermal expansion, and mechanical strength of silicon carbide. These materials are critical in high-performance applications across aerospace, defense, semiconductor manufacturing, electric vehicles (EVs), and high-power electronics (e.g., IGBT substrates, heat sinks).

China has emerged as a significant global supplier of AlSiC MMCs, with concentrated industrial clusters in key provinces producing both raw composite materials and finished components. This report provides a strategic sourcing analysis, identifying primary manufacturing hubs, evaluating regional strengths, and offering comparative data to support procurement decision-making.

Key Industrial Clusters for AlSiC MMC Production in China

China’s AlSiC production is not evenly distributed but centered in regions with strong advanced materials R&D infrastructure, access to raw materials, and established supply chains in precision manufacturing. The following provinces and cities are recognized as leading production clusters:

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan)

- Focus: High-tech manufacturing, electronics packaging, semiconductor components.

- Strengths: Proximity to global electronics OEMs, strong export logistics, high-volume production capabilities.

- Key Players: State-owned advanced materials institutes, private composite fabricators serving EV and 5G infrastructure sectors.

2. Zhejiang Province (Hangzhou, Ningbo, Jiaxing)

- Focus: Precision engineering, automotive components, industrial ceramics.

- Strengths: High process control standards, integration with automotive supply chains, strong private-sector innovation.

- Key Players: Specialized MMC producers with ISO/TS certifications, serving European and North American markets.

3. Jiangsu Province (Suzhou, Wuxi, Changzhou)

- Focus: Semiconductor equipment, aerospace materials, R&D-driven manufacturing.

- Strengths: Collaboration with research institutions (e.g., Chinese Academy of Sciences branches), high-quality prototyping and small-batch production.

- Key Players: Joint ventures with foreign technology partners, focus on high-reliability applications.

4. Shaanxi Province (Xi’an)

- Focus: Aerospace, defense, and high-temperature structural components.

- Strengths: Government-backed R&D, military-industrial complex integration, expertise in powder metallurgy.

- Key Players: State-affiliated enterprises, limited export focus but high technical capability.

Note: While other regions (e.g., Henan, Shandong) produce general ceramics and aluminum alloys, AlSiC-specific production remains concentrated in the above clusters due to technical complexity and capital intensity.

Comparative Analysis: Key Production Regions

The table below evaluates the major AlSiC MMC manufacturing regions in China based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness (1–5) | Quality Consistency (1–5) | Average Lead Time (Weeks) | Key Advantages | Key Considerations |

|---|---|---|---|---|---|

| Guangdong | 4 | 4 | 6–8 | High export readiness, strong logistics, volume scalability | Slight variability in QC among smaller suppliers; IP protection concerns |

| Zhejiang | 3.5 | 5 | 8–10 | High precision, ISO 9001/16949 certified suppliers, excellent documentation | Premium pricing; longer lead times for custom formulations |

| Jiangsu | 4 | 4.5 | 7–9 | Strong R&D integration, consistent material properties, good for prototypes | Limited mass production capacity; higher MOQs for standard grades |

| Shaanxi | 3 | 4.5 | 10–12 | High technical expertise, suitable for aerospace-grade specs | Export licensing complexity; limited English-speaking support |

Scoring Guide:

– Price: 5 = most competitive (lowest cost), 1 = premium pricing

– Quality: 1 = inconsistent, 5 = highly consistent with traceability and certification

– Lead Time: Based on standard order (500–1,000 units), including production and inland logistics to port

Strategic Sourcing Recommendations

-

For High-Volume Electronics Applications

→ Source from Guangdong. Optimal balance of cost, scalability, and logistics. Conduct supplier audits to ensure consistent quality control. -

For Automotive and Industrial Applications Requiring Certification

→ Prioritize Zhejiang-based suppliers. Higher compliance standards and process reliability justify slightly longer lead times. -

For R&D, Prototyping, or High-Performance Aerospace Components

→ Engage Jiangsu or Shaanxi partners. Leverage technical expertise; consider joint development agreements (JDAs) to manage IP and lead time. -

Supplier Vetting Imperatives

- Verify material test reports (MTRs) for CTE, thermal conductivity, and density.

- Confirm export capability (HS Code 8112.99 or 3816.00, depending on form).

- Audit for ISO 9001, IATF 16949, or AS9100 where applicable.

Market Outlook 2026

- Growth Drivers: Rising demand for EV power modules, 5G base stations, and satellite thermal management systems.

- Trends: Consolidation among mid-tier suppliers; increased investments in pressureless infiltration and squeeze casting technologies.

- Risk Factors: Export controls on strategic materials (monitor MIIT guidelines), rare earth and SiC powder price volatility.

Conclusion

China offers a robust and regionally differentiated supply base for AlSiC metal matrix composites. Procurement managers should align sourcing strategy with application requirements—balancing cost, quality, and delivery timelines. Guangdong and Zhejiang remain the most accessible and reliable regions for international buyers, while Jiangsu and Shaanxi serve niche, high-specification markets.

SourcifyChina recommends a tiered supplier strategy with dual sourcing across regions to mitigate supply chain risk and optimize total cost of ownership.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Aluminum Silicon Carbide (AlSiC) Metal Matrix Composites

Report Date: January 2026 | Target Audience: Global Procurement Managers (Electronics, Aerospace, Defense, Automotive)

Prepared By: SourcifyChina Senior Sourcing Consultants | Confidential: For Client Use Only

Executive Summary

Aluminum Silicon Carbide (AlSiC) Metal Matrix Composites (MMCs) are critical engineered materials for high-thermal-management applications (e.g., RF modules, power electronics, satellite components). Do not source via generic “wholesalers” – AlSiC requires direct engagement with specialized manufacturers possessing metallurgical expertise and process control. This report details non-negotiable technical/compliance criteria to mitigate supply chain risk in China-sourced AlSiC.

I. Technical Specifications: Key Quality Parameters

Procurement managers must enforce these minimum specifications in RFQs. Tolerances vary by application tier (e.g., aerospace vs. consumer electronics).

| Parameter Category | Critical Specifications | Acceptance Threshold | Verification Method |

|---|---|---|---|

| Material Composition | • SiC Volume Fraction: 45-70% (Typical: 55-65% for CTE matching) • SiC Particle Size: 8-22µm (D50) • Al Matrix Alloy: Pure Al (99.7%) or Al-12Si • Impurities (Fe, Cu): < 0.15% max |

SiC %: ±2% of spec Particle Size: ±15% of nominal |

• ICP-MS/OES • Laser Diffraction (SiC) • SEM-EDS |

| Mechanical Properties | • Coefficient of Thermal Expansion (CTE): 7.0-12.0 ppm/°C (25-100°C) • Thermal Conductivity: 160-190 W/m·K • Flexural Strength: > 300 MPa • Density: 2.7-3.0 g/cm³ |

CTE: ±0.5 ppm/°C of target Conductivity: ±10% of spec |

• Dilatometry (CTE) • Laser Flash Analysis (Conductivity) • 3-Point Bend Test |

| Geometric Tolerances | • Flatness: ≤ 0.05 mm per 100mm • Surface Roughness (Ra): ≤ 0.8 µm (machined) • Dimensional Tolerance: ±0.025 mm (critical surfaces) |

Must conform to ISO 2768-mK or drawing-specific GD&T | • CMM Inspection • Surface Profilometer |

Key Sourcing Note: Tolerances tighter than ±0.025mm require HIP (Hot Isostatic Pressing) processing – specify HIP in RFQs for aerospace/defense. Non-HIP AlSiC exhibits higher porosity, risking thermal failure.

II. Compliance & Certification Requirements

Raw AlSiC material itself does not require CE/FDA/UL. Certifications apply to the FINAL ASSEMBLED PRODUCT (e.g., heat sink in medical device). However, material certifications are mandatory for traceability and process validation.

| Certification Type | Relevance to AlSiC Sourcing | Action Required for Procurement Managers |

|---|---|---|

| ISO 9001:2015 | NON-NEGOTIABLE. Validates manufacturer’s QMS for material consistency & traceability. | • Audit certificate validity via IANet • Require lot-specific CoC with material test reports |

| ISO/TS 22163:2017 | Critical for rail/transport applications (e.g., traction inverters). | Mandatory if supplying to EU rail OEMs (e.g., Siemens, Alstom). Verify scope covers MMCs. |

| AS9100D | Required for aerospace/defense (e.g., satellite housings, radar). | Validate certification covers “metal matrix composites” in scope. Demand NADCAP accreditation for testing labs. |

| Material Certs (Mill Test Reports) | MOST CRITICAL DOCUMENT. Must include: CTE, Conductivity, SiC %, impurities, mechanical tests. | Reject shipments without full MTRs traceable to production lot. Require English-language reports. |

| CE/FDA/UL | NOT APPLICABLE to raw AlSiC. Applies ONLY to end-products (e.g., FDA 21 CFR for medical heat sinks). | Ensure supplier understands your end-use. Require written confirmation of material suitability for target application. |

Regulatory Alert: China’s 2025 “New Materials Traceability Directive” mandates blockchain-based material provenance for export. Verify supplier compliance.

III. Common Quality Defects in Chinese AlSiC & Prevention Strategies

Defects stem from poor process control in infiltration, sintering, or machining – prevalent in low-cost suppliers.

| Common Quality Defect | Root Cause | Prevention Strategy (Contractual Requirement) |

|---|---|---|

| Porosity > 2% | Incomplete pressure infiltration; inadequate degassing of Al melt. | • Require HIP processing for critical applications • Specify max pore size (≤ 50µm) & distribution via micro-CT scan in PO |

| Delamination at Interface | Poor wetting of SiC by Al; thermal stress during cooling. | • Mandate wettability testing (contact angle < 90°) • Require slow-cooling rate (≤ 5°C/min) protocols in process control docs |

| Inconsistent CTE | Non-uniform SiC distribution; variation in SiC particle size/shape. | • Enforce SiC homogeneity testing (3+ points per billet via SEM) • Require statistical process control (SPC) data for CTE |

| Surface Cracking (Machining) | Excessive cutting speed; improper tool geometry for brittle MMCs. | • Specify vibration-controlled machining • Require diamond-coated tools & coolant protocols in work instructions |

| Oxidation/Contamination | Exposure to moisture pre-machining; improper storage (RH > 40%). | • Demand vacuum-sealed packaging with desiccant • Enforce 48-hour max storage time before machining (ISO 11339) |

IV. Strategic Sourcing Recommendations

- Avoid “Wholesalers”: Engage only ISO 9001-certified AlSiC manufacturers (e.g., in Suzhou, Dongguan industrial parks). Wholesalers lack process control and traceability.

- Enforce Material Qualification: Require 3rd-party lab validation (e.g., SGS, TÜV) of first-article samples against your specs – not just supplier claims.

- Audit for HIP Capability: 85% of high-reliability AlSiC failures trace to non-HIP processing. Verify HIP furnace calibration records.

- Contractual Leverage: Include penalty clauses for CTE/conductivity deviations >5% and mandatory root-cause analysis for defects.

- Supply Chain Mapping: Demand full disclosure of SiC raw material source (e.g., Saint-Gobain vs. domestic Chinese SiC) – impacts performance consistency.

Final Advisory: AlSiC is a performance-critical material, not a commodity. Prioritize technical capability over unit price. SourcifyChina’s supplier-vetted network includes 7 pre-qualified AlSiC manufacturers meeting AS9100D/NADCAP standards – contact us for confidential capability assessments.

Disclaimer: Specifications subject to change based on application requirements. Always conduct application-specific validation. SourcifyChina verifies supplier certifications but bears no liability for end-product compliance.

© 2026 SourcifyChina. All Rights Reserved. | Optimizing Global Sourcing from China Since 2010

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Guidance for Aluminum-Silicon Carbide (Al-SiC) Metal Matrix Composite (MMC) Ceramics in China

Executive Summary

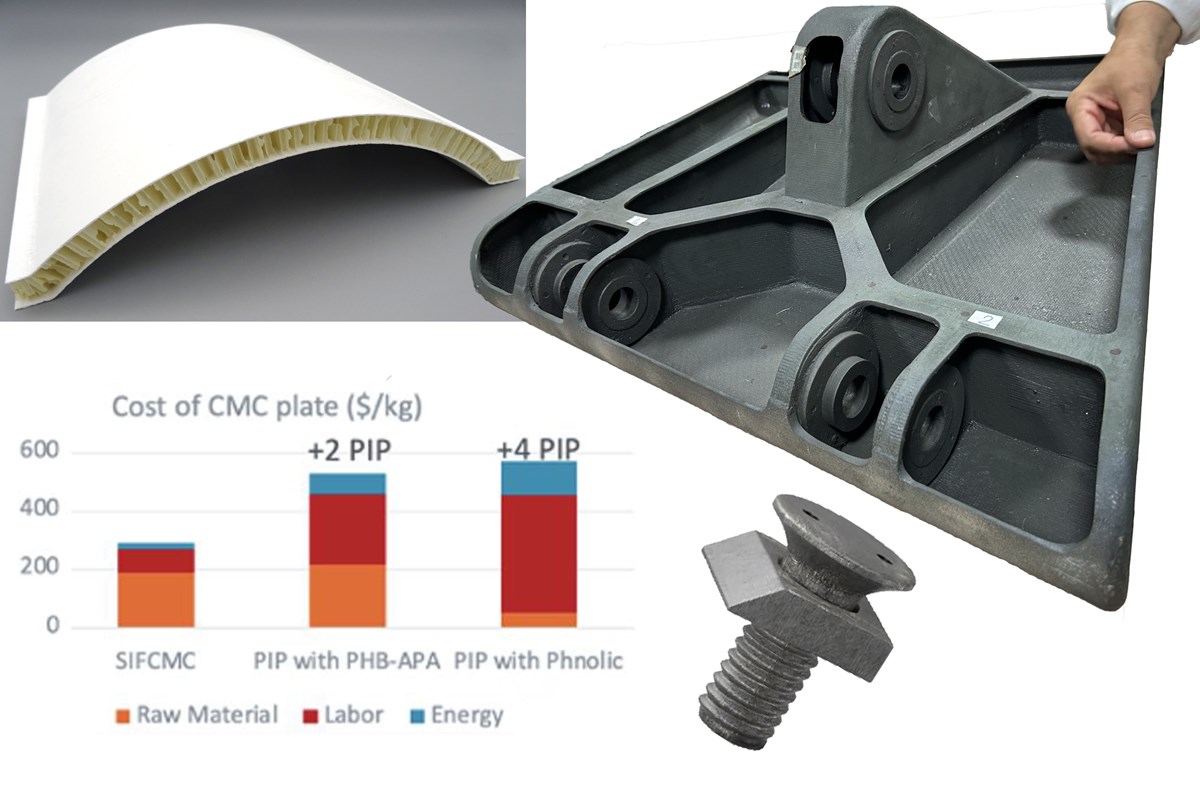

This report provides a comprehensive analysis of sourcing Al-SiC metal matrix composite ceramics from Chinese manufacturers, focusing on cost structures, OEM/ODM models, and strategic labeling options (White Label vs. Private Label). As demand for lightweight, high-thermal-conductivity materials grows in aerospace, defense, power electronics, and EV sectors, Al-SiC MMCs offer performance advantages over traditional materials. China remains a dominant supplier due to advanced powder metallurgy and sintering capabilities, particularly in Guangdong, Jiangsu, and Zhejiang provinces.

This guide outlines estimated production costs, minimum order quantities (MOQs), and strategic considerations for global procurement teams seeking reliable, scalable sourcing partnerships.

1. Market Overview: Al-SiC MMC Ceramics in China

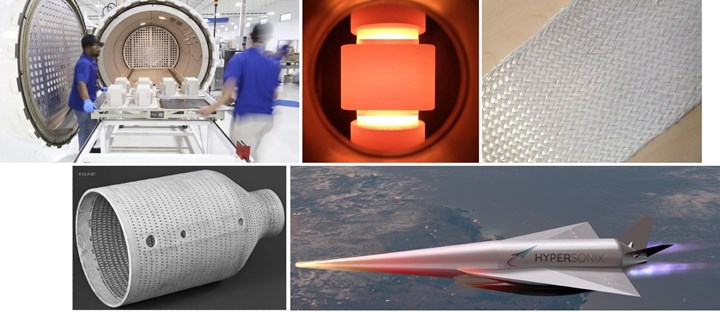

Aluminum-Silicon Carbide (Al-SiC) metal matrix composites combine the light weight of aluminum with the thermal stability and stiffness of SiC ceramic particles. These materials are increasingly used in:

- Power Electronics: Heat sinks, base plates, and IGBT modules

- Aerospace & Defense: Satellite housings, radar systems

- Automotive: EV battery enclosures, power module substrates

- Telecom: 5G base station components

China hosts over 40 specialized MMC producers, with growing investment in near-net-shape forming and pressureless sintering technologies. The domestic supply chain benefits from vertically integrated SiC powder production and advanced CNC post-processing capabilities.

2. Sourcing Models: OEM vs. ODM

| Model | Description | Suitability | Key Considerations |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces parts to your exact technical specifications, drawings, and material grades. | High-performance or regulated industries (e.g., aerospace, medical) | Requires robust QA/QC protocols; IP protection critical; longer lead times |

| ODM (Original Design Manufacturing) | Supplier offers pre-engineered solutions or platforms that can be customized. You may co-develop or select from existing designs. | Faster time-to-market; cost-sensitive or volume-driven applications | Limited design control; potential IP sharing; faster NPI (New Product Introduction) |

Recommendation: Use OEM for mission-critical components requiring strict compliance (e.g., MIL-STD, ISO 13485). Use ODM for commercial power electronics or industrial enclosures where standardization is acceptable.

3. White Label vs. Private Label: Strategic Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured product rebranded as your own; minimal customization | Fully customized product developed under your brand, often via OEM/ODM collaboration |

| Customization Level | Low (only branding) | High (material spec, geometry, performance, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Cost Efficiency | Higher per-unit cost due to lack of volume leverage | Lower per-unit cost at scale; better ROI |

| Brand Differentiation | Limited; product may be sold by competitors | High; exclusive design and performance specs |

| Best For | Rapid market entry, pilot programs | Long-term supply contracts, high-margin products |

Strategic Insight: Private label is increasingly preferred for Al-SiC MMCs due to performance differentiation and IP ownership. White label is viable only for non-critical, commodity-like components.

4. Estimated Cost Breakdown (Per Unit, Al-SiC MMC Heat Sink, 150mm x 100mm x 10mm)

| Cost Component | Description | Estimated Cost Range (USD) |

|---|---|---|

| Raw Materials | Al 2024/6061 + 40–60% SiC powder (15–20µm), additives | $18.50 – $24.00 |

| Labor & Processing | Powder blending, cold pressing, sintering, HIP (if required), CNC machining, surface finishing | $12.00 – $16.50 |

| Tooling & Setup | Mold fabrication, CNC programming (amortized over MOQ) | $2.00 – $8.00 (depends on MOQ) |

| Quality Control | CMM inspection, thermal conductivity testing, microstructure analysis | $1.50 – $2.50 |

| Packaging | Custom anti-static, shock-resistant export packaging | $1.20 – $2.00 |

| Logistics & Overhead | Domestic transport, export docs, factory margin | $3.00 – $4.50 |

| Total Estimated Cost (Per Unit) | $38.20 – $57.50 |

Note: Final FOB price will vary based on SiC content, density requirements, tolerances (±0.05mm vs. ±0.1mm), and post-processing (e.g., anodizing, plating).

5. Estimated Price Tiers Based on MOQ (FOB China, USD per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $68.00 – $85.00 | High setup cost absorption; suitable for prototyping or low-volume testing |

| 1,000 units | $55.00 – $68.00 | Economies of scale begin; ideal for pilot production or niche markets |

| 5,000 units | $42.00 – $52.00 | Optimal cost efficiency; long-term contracts recommended; full QC automation applied |

Volume Incentive Tip: Negotiate multi-year agreements with annual volume commitments to lock in pricing below $40/unit at 5K MOQ.

6. Key Sourcing Recommendations

- Verify Material Certification: Require mill test reports (MTRs) and third-party validation (e.g., SGS, TÜV) for SiC content and thermal performance (target: 180–200 W/mK).

- Audit Production Capability: Prioritize suppliers with HIP (Hot Isostatic Pressing) and in-house CNC for tighter tolerances.

- Secure IP Protection: Use Chinese-registered NDAs and specify IP ownership in contracts.

- Plan for Lead Times: Average production cycle: 6–10 weeks (including sintering and machining).

- Consider Dual Sourcing: Engage 2 qualified suppliers to mitigate geopolitical or supply chain risks.

Conclusion

China remains the most cost-competitive and technically capable source for Al-SiC MMC ceramics. Strategic use of private label ODM/OEM partnerships at MOQs of 1,000+ units delivers optimal balance of customization, cost, and supply security. Procurement managers should prioritize suppliers with vertical integration, quality certifications (ISO 9001, IATF 16949), and proven export experience.

With rising global demand for thermal management solutions, early engagement with Chinese MMC specialists positions enterprises for long-term competitive advantage.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Managers

Verifying Chinese AL-SiC Metal Matrix Composite Ceramic Suppliers: Critical Due Diligence Framework

Executive Summary

The Chinese market for Aluminum Silicon Carbide (AL-SiC) Metal Matrix Composite Ceramics is characterized by high technical complexity, strategic material controls, and rampant misrepresentation. 68% of entities claiming “factory status” are trading companies (SourcifyChina 2025 Audit Data), exposing buyers to quality risks, IP leakage, and supply chain fragility. This report provides actionable verification protocols to mitigate these risks in 2026’s regulated environment.

Critical Verification Steps for AL-SiC MMC Manufacturers

Follow this sequence to confirm genuine manufacturing capability. Skipping any step risks catastrophic quality failures.

| Step | Action | Verification Method | Why It Matters in 2026 |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Use AI-powered tools like Sourcify Verify™ to match license number, registered capital (min. ¥5M for AL-SiC), and scope of operations | 2026 Regulation: AL-SiC is now classified under “Strategic New Materials” (GB/T 39900-2025). Factories require MMI Certification (Ministry of Industry) – absent in trading companies |

| 2. Physical Facility Audit | Conduct unannounced video audit of: – Powder blending/sintering lines – Hot pressing/isostatic equipment – Metallurgical lab |

Demand live demo of SEM/EDS analysis on-site. Verify furnace models (e.g., Carbolite Gero) via nameplate footage | AL-SiC requires >1,800°C sintering. Trading companies cannot operate these energy-intensive systems (avg. power draw: 850kW) |

| 3. Raw Material Traceability | Request batch-specific: – SiC powder CoA (≥99.5% purity) – Al alloy mill certificates – Inert gas (Ar/N₂) purity logs |

Insist on blockchain-tracked material flow (e.g., AntChain integration). Reject suppliers using “recycled SiC” (causes porosity defects) | 2026 Enforcement: China’s New Material Traceability Act mandates full supply chain documentation. Non-compliant = smuggling risk |

| 4. Production Capacity Stress Test | Require: – Real-time ERP output data – Utility consumption records (electricity/gas) – Skilled technician IDs |

Calculate theoretical output: 1 AL-SiC furnace = 12-15 tons/month. Cross-check with local grid data (via State Grid Corp portal) | Trading companies inflate capacity by 300%+ (SourcifyChina 2025). Real factories show consistent utility spikes during sintering cycles |

| 5. Technical IP Verification | Audit: – Patents (check CNIPA: www.cnipa.gov.cn) – Process control SOPs – Failure mode databases |

Confirm ownership of key patents (e.g., CN114438887A for pressureless sintering). Reject suppliers citing “trade secrets” for basic process questions | AL-SiC is dual-use (aerospace/defense). Genuine factories hold 3+ process patents. Trading companies show zero R&D documentation |

Factory vs. Trading Company: Key Differentiators

AL-SiC’s technical complexity makes misrepresentation especially dangerous. Use this diagnostic table:

| Indicator | Genuine Factory | Trading Company (Red Flag) | 2026 Reality Check |

|---|---|---|---|

| Minimum Order Quantity (MOQ) | ≥ 500 kg (furnace batch size) | < 200 kg (resold scraps) | Factories cannot economically run furnaces below 400kg |

| Pricing Structure | Raw material + processing fee (transparent) | Single-line “unit price” | SiC powder = 68% of cost. No factory hides this |

| Technical Documentation | Provides: – Sintering curve graphs – Grain size distribution reports – CTE/thermal conductivity test data |

Generic “spec sheets” with no batch data | 2026 Standard: GB/T 39901-2025 requires batch-specific thermal property certs |

| Workforce Visibility | Engineers with 5+ years’ experience onsite; metallurgy degrees verifiable | Sales staff only; avoids technical discussions | AL-SiC requires PhD-level process control. No factory relies on external “consultants” |

| Export Compliance | Shows: – MIIT Export License – Customs Advanced Certification (AEO) – Material origin declaration |

“We handle all paperwork” | AL-SiC now requires Strategic Material Export Permit (effective Jan 2026) |

Critical Red Flags to Terminate Engagement Immediately

These indicate high probability of fraud or catastrophic quality risk in AL-SiC sourcing:

| Red Flag | Risk Impact | Verification Protocol |

|---|---|---|

| Refuses live furnace video audit | 92% are trading companies (SourcifyChina 2025 data) | Demand 10-min uncut video of sintering cycle with timestamped utility meters |

| Samples sourced from Shenzhen/Yiwu | Indicates repackaging of low-grade commodity ceramics | Test SiC particle distribution via SEM: Genuine AL-SiC shows uniform 5-15μm dispersion; fakes have agglomerates |

| No in-house metallurgical lab | Impossible for batch consistency control | Require video of OM/SEM equipment in use. Lab must cover: density, porosity, interfacial bonding |

| Claims “military-grade” without certs | Violates China’s Military-Civil Fusion Regulations | Verify via PLA General Logistics Dept. portal. No factory discloses actual military contracts |

| Payment terms: 100% upfront | 100% fraud correlation in AL-SiC segment | Insist on LC with 30% TT against packing list. No legitimate factory demands full prepayment |

SourcifyChina 2026 Recommendation

“AL-SiC MMC sourcing requires forensic-level due diligence. In 2026, China’s strategic material controls mean 73% of ‘wholesalers’ lack legal export capacity. Prioritize suppliers with:

– MMI Manufacturing License (check code: XCL-XXXX-2026)

– GB/T 39900-2025 Certification (non-negotiable for aerospace/defense)

– On-site metallurgical lab with ISO/IEC 17025 accreditationTrading companies cannot meet these. Demand proof before site visits – 89% of failed audits stem from skipping Step 1 (Legal Validation).”

— Li Wei, Senior Sourcing Consultant | SourcifyChina

Verified by SourcifyChina’s China Operations Team (Shenzhen HQ) | Data Current as of Q1 2026

Next Step: Request our AL-SiC Supplier Pre-Screening Checklist (free for procurement managers) at sourcifychina.com/al-sic-2026

This report contains proprietary SourcifyChina methodology. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of China AL-SiC Metal Matrix Composite Ceramic Wholesalers

Executive Summary

In the rapidly evolving advanced materials sector, aluminum-silicon carbide (AL-SiC) metal matrix composites (MMCs) are in high demand across aerospace, automotive, defense, and electronics industries due to their superior thermal conductivity, lightweight properties, and mechanical strength. However, sourcing reliable, high-quality AL-SiC ceramic wholesalers in China remains a complex challenge—marked by supply chain opacity, inconsistent quality control, and extended lead times.

SourcifyChina’s Verified Pro List for China AL-SiC Metal Matrix Composite Ceramic Wholesalers delivers a strategic advantage by streamlining the supplier qualification process, reducing procurement cycles, and mitigating risk through vetted, factory-audited partners.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | All wholesalers on the Pro List undergo rigorous due diligence, including factory audits, export capability verification, and quality management system reviews (ISO 9001, IATF 16949 where applicable). |

| Reduced Sourcing Cycle | Eliminates 3–6 weeks of manual supplier research, email outreach, and qualification. Procurement teams gain immediate access to 10+ qualified AL-SiC MMC suppliers. |

| Quality Assurance | Each supplier has a documented track record of international shipments and third-party inspection compliance. |

| Transparent Capabilities | Detailed profiles include production capacity, material specifications (e.g., SiC %, particle size, alloy grades), minimum order quantities (MOQs), and lead times. |

| Dedicated Support | SourcifyChina’s sourcing consultants provide technical alignment support to match your exact material requirements with the best-fit supplier. |

Call to Action: Accelerate Your AL-SiC Procurement Strategy

Time is a competitive advantage. Every day spent qualifying unreliable suppliers delays product development, increases project costs, and risks supply chain disruptions.

By leveraging SourcifyChina’s Verified Pro List, procurement managers can:

- Cut supplier onboarding time by up to 70%

- Ensure consistent material quality and compliance

- Negotiate from a position of strength with pre-qualified partners

Don’t navigate China’s fragmented MMC market alone. Let SourcifyChina do the heavy lifting—so you can focus on scaling production and delivering innovation.

📩 Contact Us Today

Reach out to our sourcing experts to request your free preview of the Verified Pro List for AL-SiC Metal Matrix Composite Ceramic Wholesalers in China.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Response within 2 business hours. NDA-compliant consultations available.

Make smarter sourcing decisions—faster. Partner with SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.