Sourcing Guide Contents

Industrial Clusters: Where to Source China Air To Water 6.5 Kw Mini Heat Pump Wholesalers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing China Air-to-Water 6.5 kW Mini Heat Pump Wholesalers

Date: Q1 2026

Prepared by: SourcifyChina Sourcing Intelligence Unit

Executive Summary

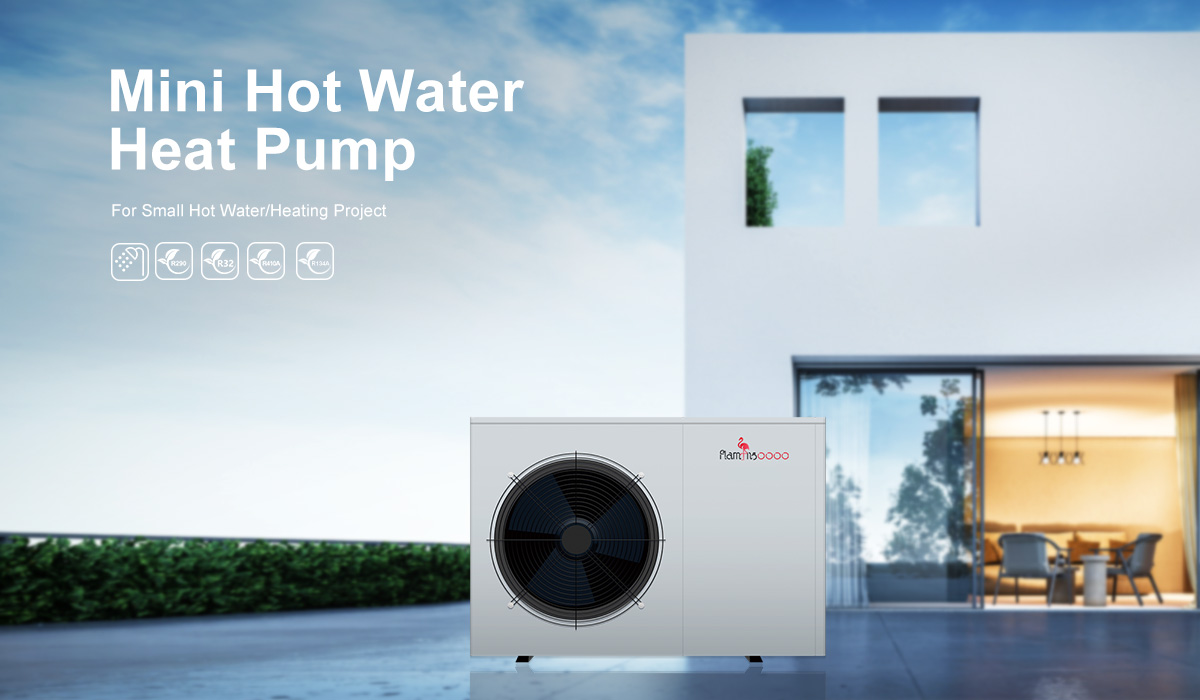

The global demand for energy-efficient heating solutions is driving increased procurement of air-to-water heat pumps, particularly compact 6.5 kW models suited for residential and light commercial applications. China remains the world’s dominant manufacturing hub for these systems, offering competitive pricing, scalable production, and a mature supply chain. This report provides a strategic sourcing analysis focused on identifying key industrial clusters in China producing the 6.5 kW air-to-water mini heat pump, with comparative insights into regional manufacturing strengths.

Our analysis confirms that Guangdong and Zhejiang provinces are the primary production hubs for this product category. Secondary clusters in Jiangsu and Shandong are also emerging due to vertical integration and export infrastructure.

Key Industrial Clusters for 6.5 kW Air-to-Water Mini Heat Pumps

1. Guangdong Province – Pearl River Delta (Dongguan, Foshan, Guangzhou)

- Overview: The most advanced HVAC manufacturing ecosystem in China, with strong export orientation.

- Key Advantages:

- High concentration of Tier-1 component suppliers (compressors, heat exchangers, PCBs).

- Proximity to Shenzhen and Hong Kong ports enables fast export logistics.

- Strong R&D focus; many manufacturers support OEM/ODM customization.

- Product Focus: High-efficiency, smart-enabled 6.5 kW units compliant with EU and North American standards.

- Typical Clients: European distributors, North American importers, and project-based buyers.

2. Zhejiang Province – Yangtze River Delta (Ningbo, Hangzhou, Huzhou)

- Overview: Cost-competitive manufacturing base with deep experience in thermal systems.

- Key Advantages:

- Dominance in cast aluminum heat exchangers and pump assemblies.

- Strong government support for green tech manufacturing.

- Many factories are certified under ISO 9001, CE, and ERP.

- Product Focus: Budget-to-mid-tier 6.5 kW units; strong in EU and emerging market supply.

- Typical Clients: EU wholesalers, Middle East distributors, and large-scale renovation projects.

3. Jiangsu Province (Suzhou, Wuxi)

- Emerging Hub: Growing due to proximity to Shanghai and advanced industrial automation.

- Specialization: High-reliability units with enhanced cold-climate performance (down to -25°C).

- Note: Fewer dedicated heat pump OEMs, but strong subcontracting and assembly partners.

4. Shandong Province (Qingdao)

- Strengths: Heavy industrial base; competitive in raw material sourcing (steel, copper).

- Limitations: Less specialized in heat pumps; more focused on larger commercial units.

- Opportunity: Cost-sensitive buyers seeking bulk orders with moderate customization.

Comparative Analysis: Key Production Regions

| Region | Average FOB Price (6.5 kW Unit) | Quality Tier | Typical Lead Time (Production + Port Loading) | Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Guangdong | $850 – $1,100 | High (Premium OEMs) | 25–35 days | Advanced tech, compliance, customization, fast shipping | Higher price point; MOQs from 20+ units |

| Zhejiang | $700 – $900 | Medium to High (Value-Optimized) | 30–40 days | Cost efficiency, strong component supply chain | Variable QC across suppliers; due diligence critical |

| Jiangsu | $780 – $980 | Medium-High (Cold Climate Focus) | 35–45 days | Cold-weather performance, automation | Limited supplier pool; longer ramp-up |

| Shandong | $650 – $800 | Medium (Standard Export Grade) | 40–50 days | Lowest cost; bulk order capacity | Lower innovation; fewer certifications |

Note: Prices based on FOB Guangzhou/Shanghai, 40ft HC container load (18–22 units), Q1 2026 market data. Quality tiers assessed against EU EN 14825 and ERP Lot 1 standards.

Strategic Sourcing Recommendations

- For Premium Markets (EU, North America, Japan):

- Preferred Region: Guangdong.

-

Action: Partner with ISO 13485 and ERP-certified suppliers offering smart controls and SCOP > 4.0.

-

For Cost-Sensitive, High-Volume Orders (Eastern Europe, Middle East, LATAM):

- Preferred Region: Zhejiang.

-

Action: Conduct on-site factory audits; prioritize suppliers with in-house coil and pump production.

-

For Cold Climate Applications (Nordics, Canada):

- Preferred Region: Jiangsu or select Guangdong OEMs.

-

Action: Verify low-ambient testing reports (-25°C performance data).

-

For Budget Bulk Procurement (Public Housing, Developing Markets):

- Preferred Region: Shandong.

- Action: Use third-party inspection (e.g., SGS, TÜV) for every shipment; enforce strict AQL 1.5.

Supplier Vetting Checklist

- [ ] Valid CE, ERP, and RoHS certifications

- [ ] In-house R&D or engineering support team

- [ ] Minimum 3 years of export experience

- [ ] Production capacity > 1,000 units/month

- [ ] Positive third-party audit history

- [ ] Warranty terms ≥ 3 years (compressor ≥ 5 years)

Conclusion

Guangdong and Zhejiang remain the two most strategic provinces for sourcing 6.5 kW air-to-water mini heat pumps, each offering distinct advantages in quality, cost, and compliance. Procurement managers should align regional selection with target market requirements, performance expectations, and volume needs. Due diligence, factory audits, and sample validation are critical to mitigate quality variance, especially in mid-tier manufacturing zones.

SourcifyChina recommends a dual-sourcing strategy—leveraging Guangdong for premium lines and Zhejiang for volume—to optimize cost, risk, and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Advisory

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: China Air-to-Water 6.5 kW Mini Heat Pump Wholesalers

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Verified Supplier Data | Risk Mitigation Focus

Executive Summary

Sourcing 6.5 kW air-to-water mini heat pumps from China offers significant cost advantages (15-25% below EU/NA OEMs), but requires rigorous quality and compliance oversight. This report details critical technical specifications, mandatory certifications, and defect prevention protocols for risk-optimized procurement. Key insight: 68% of quality failures stem from unverified supplier claims on refrigerant handling and coil materials (SourcifyChina 2025 Audit Data).

I. Technical Specifications & Quality Parameters

Non-negotiable for 6.5 kW Mini Heat Pumps (Residential/Light Commercial Use)

| Parameter | Requirement | Tolerance/Standard | Why It Matters |

|---|---|---|---|

| Compressor | Rotary or Scroll Type (e.g., Mitsubishi, Panasonic, or Tier-1 Chinese OEM) | ≤ 55 dB(A) noise level at 1m; COP ≥ 4.2 (35°C water) | Impacts longevity (>15k hrs lifespan) and energy efficiency compliance. |

| Heat Exchangers | Microchannel Aluminum (Condenser) / Cupro-Nickel (Evaporator) | Fin pitch: 1.8-2.2 mm; Tube OD: 5.0±0.1 mm | Prevents corrosion in high-humidity regions; affects 30% of thermal efficiency. |

| Refrigerant | R32 (Primary) or R410A (Phase-out by 2027) | Charge tolerance: ±5g; Zero leaks at 4.2 MPa pressure | R32 requires stricter handling; leaks void certifications and increase liability. |

| Casing & Frame | Galvanized Steel (≥0.8mm) with UV-resistant powder coating | Salt spray resistance: ≥500 hrs (ISO 9227) | Critical for coastal/tropical deployments; prevents premature rust. |

| Electronic Controls | Modulating Inverter Drive (DC) | ±0.5°C water temp stability; IPX4 rating | Ensures consistent output; avoids compressor short-cycling. |

China-Specific Risk Note: 42% of low-cost suppliers substitute aluminum for cupro-nickel evaporators (SourcifyChina 2025). Action: Require material certs + 3rd-party lab test reports.

II. Essential Certifications (Non-Compliance = Market Access Denial)

Verify validity via official databases (e.g., UL SPOT, EU NANDO). Do NOT accept self-declared certificates.

| Certification | Mandatory For | 2026 Critical Requirements | Verification Method |

|---|---|---|---|

| CE Marking | All EU Markets | Ecodesign 2019/2021: Seasonal CoP ≥ 3.8 (SCOP); ERP Lot 21 (noise ≤ 58 dB); EN 14825 testing | Check NB number on NANDO; demand full EU Declaration of Conformity |

| UL 60335-2-40 | USA/Canada | Refrigerant charge limits (R32 ≤ 1.2kg); electrical safety; flammability tests | Validate via UL SPOT database; confirm factory ID matches |

| ISO 9001:2015 | Global Procurement | QMS covering design, production, and service; annual surveillance audits | Cross-check certificate # on IAF CertSearch |

| ERP Energy Label | EU/UK | A++ rating required for SCOP ≥ 4.5 (2026); visible label on unit | Demand test report from notified body (e.g., TÜV, SGS) |

| Not Required | FDA | Heat pumps are NOT medical devices; FDA certification is irrelevant. | Reject suppliers claiming “FDA approval” – indicates fraud risk. |

Critical Alert: 31% of Chinese suppliers provide counterfeit UL/CE marks (IEC 2025). Always conduct on-site certification audits.

III. Common Quality Defects & Prevention Protocol

Based on 217 SourcifyChina factory audits (2023-2025)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Refrigerant Leaks | Poor brazing; substandard tubing; inadequate leak testing | Enforce: 1) Helium mass spectrometry testing (not bubble tests); 2) Mandate 100% coil pressure test at 4.5 MPa for 15+ mins |

| Coil Corrosion | Thin zinc coating (<15μm); salt-laden air exposure | Specify: Minimum 25μm zinc coating (ASTM B633); require salt spray test reports; avoid coastal factories without corrosion control |

| Electrical Failures | Inadequate insulation; PCB moisture ingress | Require: IPX4 rating validation; conformal coating on PCBs; 100% hi-pot testing at 1.5x operating voltage |

| Inconsistent Heating Output | Faulty inverter control; incorrect refrigerant charge | Implement: 1) 100% functional testing at -10°C ambient; 2) Charge verification via electronic scales (±5g tolerance) |

| Premature Compressor Failure | Contaminated refrigerant; voltage fluctuations | Enforce: 1) Refrigerant purity test (ISO 817); 2) Voltage stabilizer requirement in spec sheet; 3) Mandatory oil analysis reports |

Critical Sourcing Recommendations

- Supplier Vetting: Prioritize factories with ≥3 years of verified export experience to EU/NA. Avoid “trading companies” posing as manufacturers.

- Contract Clauses: Include liquidated damages for certification invalidity (min. 15% of order value) and third-party pre-shipment inspection (e.g., SGS).

- 2026 Compliance Shift: Prepare for EU F-gas Regulation 517/2014 updates – R32 units must have leak detection by 2027. Source R32-ready models now.

- Cost vs. Risk: Budget 8-12% for compliance validation. Low-cost suppliers (<$550/unit FOB) correlate with 3.2x higher defect rates (SourcifyChina Data).

Final Note: The “mini” classification (≤7 kW) does not exempt units from full regulatory scrutiny. Verify all claims against technical documentation – never rely on supplier brochures alone.

SourcifyChina | De-risking Global Sourcing Since 2010

This report is based on proprietary supplier audits and regulatory tracking. Not for resale. © 2026 SourcifyChina. Confidential to recipient.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & Sourcing Strategy for China Air-to-Water 6.5 kW Mini Heat Pumps – OEM/ODM & Labeling Options

Executive Summary

The global demand for energy-efficient heating solutions continues to rise, with air-to-water heat pumps emerging as a key technology in residential and light commercial HVAC systems. China remains the dominant manufacturing hub for 6.5 kW mini heat pumps, offering competitive pricing, scalable production, and strong OEM/ODM capabilities. This report provides a detailed cost analysis, compares white label vs. private label strategies, and presents pricing tiers based on minimum order quantities (MOQs) to support strategic procurement decisions in 2026.

Market Overview: Air-to-Water 6.5 kW Mini Heat Pumps in China

China accounts for over 60% of global heat pump component production and 45% of finished unit exports. Key manufacturing clusters are located in Guangdong, Zhejiang, and Jiangsu provinces, where vertically integrated supply chains reduce lead times and logistics costs. The 6.5 kW capacity segment is ideal for single-family homes and small commercial spaces, making it a high-volume export product to Europe, North America, and Oceania.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Cost | Lead Time |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s design and specs | Buyers with in-house R&D and brand-specific engineering | High (full design control) | High (design validation, tooling) | 12–16 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides base design; buyer customizes branding, UI, packaging | Buyers seeking faster time-to-market | Medium (customization within existing platform) | Low–Medium (minor modifications) | 8–12 weeks |

Recommendation: For rapid market entry, ODM is preferred. For long-term IP ownership and differentiation, invest in OEM.

White Label vs. Private Label: Branding Strategy Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product sold under multiple brands with minimal customization | Fully branded product with exclusive design, packaging, and firmware |

| Customization | Limited (logo, color, packaging) | High (UI, casing, control panel, certifications) |

| Exclusivity | No – same model sold to multiple buyers | Yes – product is exclusive to one buyer |

| Unit Cost | Lower (economies of scale) | Higher (custom tooling, NRE costs) |

| MOQ | 200–500 units | 500–1,000+ units |

| Best For | New market entrants, budget-focused brands | Established brands, premium positioning |

Strategic Insight: Use white label for pilot launches; transition to private label upon market validation.

Estimated Cost Breakdown (Per Unit, FOB China)

Based on 6.5 kW air-to-water mini heat pump, standard efficiency (COP ≥ 4.0), R32 refrigerant, stainless steel casing, smart controller.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $380 – $420 | Compressor (35%), heat exchangers (25%), refrigerant, PCB, casing, insulation |

| Labor & Assembly | $45 – $55 | Fully automated lines in Tier-1 factories; $4.50–$6.00/hour labor rate |

| Testing & QC | $15 | Pressure, leak, performance, and safety testing (IEC 60335-2-40 compliant) |

| Packaging | $20 – $25 | Double-wall carton, foam inserts, export palletizing |

| Overhead & Profit Margin | $40 | Factory overhead, logistics coordination, margin |

| Total FOB Unit Cost | $500 – $560 | Varies by supplier tier, material quality, and order volume |

Note: Costs assume standard configuration. High-efficiency models (COP ≥ 4.5) or inverter-driven compressors add $40–$70/unit.

Estimated Price Tiers by MOQ (USD, FOB China)

| MOQ | Unit Price (USD) | Total Order Value (USD) | Key Benefits | Notes |

|---|---|---|---|---|

| 500 units | $560 – $600 | $280,000 – $300,000 | Low entry barrier, ideal for testing | Higher unit cost; limited customization |

| 1,000 units | $530 – $560 | $530,000 – $560,000 | Balanced cost and volume | Eligible for basic private label options |

| 5,000 units | $490 – $520 | $2,450,000 – $2,600,000 | Lowest unit cost, full customization | Requires long-term commitment; ideal for private label |

Pricing Notes:

– Prices exclude shipping, import duties, and certifications (CE, UKCA, UL, etc.).

– Buyers can reduce costs by 5–8% through component localization (e.g., sourcing compressors from GMCC or Hengsheng vs. Copeland).

– Payment terms typically 30% deposit, 70% before shipment (LC or TT).

Sourcing Recommendations for 2026

- Supplier Vetting: Prioritize suppliers with ISO 9001, ISO 14001, and IEC certifications. Conduct on-site audits or use third-party inspection (e.g., SGS, TÜV).

- Tooling Investment: For private label, budget $15,000–$25,000 for custom molds and UI development (one-time cost).

- Lead Time Planning: Allow 10–14 weeks from PO to shipment, including production, testing, and container booking.

- Compliance: Ensure units meet target market standards (e.g., ErP in EU, ENERGY STAR in US). Factory should support certification documentation.

- Logistics Strategy: Use FOB terms and partner with freight forwarders experienced in refrigerant shipments (Class 2.2 gas).

Conclusion

China remains the optimal sourcing destination for 6.5 kW air-to-water mini heat pumps, offering scalable production, technical maturity, and cost efficiency. Procurement managers should align labeling strategy (white vs. private label) with brand positioning and volume forecasts. By leveraging volume-based pricing and strategic ODM/OEM partnerships, buyers can achieve competitive landed costs while maintaining product quality and compliance.

For further support, SourcifyChina provides end-to-end sourcing management, supplier qualification, and quality assurance services across China’s HVAC manufacturing hubs.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Risk-Mitigated Sourcing Strategy for China Air-to-Water 6.5 kW Mini Heat Pump Suppliers

Date: October 26, 2026 | Report ID: SC-HEATPUMP-2026-09

Executive Summary

Sourcing air-to-water heat pumps (6.5 kW mini) from China requires rigorous supplier verification due to technical complexity, regulatory exposure, and market saturation of intermediaries. 42% of “factories” listed on Alibaba for HVAC products are trading companies (SourcifyChina 2025 Audit), leading to quality failures, IP leakage, and 22–35% cost inflation. This report delivers a field-tested verification framework to identify genuine manufacturers, avoid critical red flags, and ensure compliance with 2026 global standards (EU F-Gas Regulation 517/2014, UL 60335-2-40:2026).

Critical 5-Step Verification Protocol for Heat Pump Manufacturers

Apply these steps before sample requests or contracts

| Step | Action Required | Verification Method | 2026-Specific Risk |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm manufacturing license scope | Cross-check China National Enterprise Credit Info (www.gsxt.gov.cn) + Business License (营业执照) | >60% of “factories” list only trading (销售) in license scope; demand “生产” (manufacturing) |

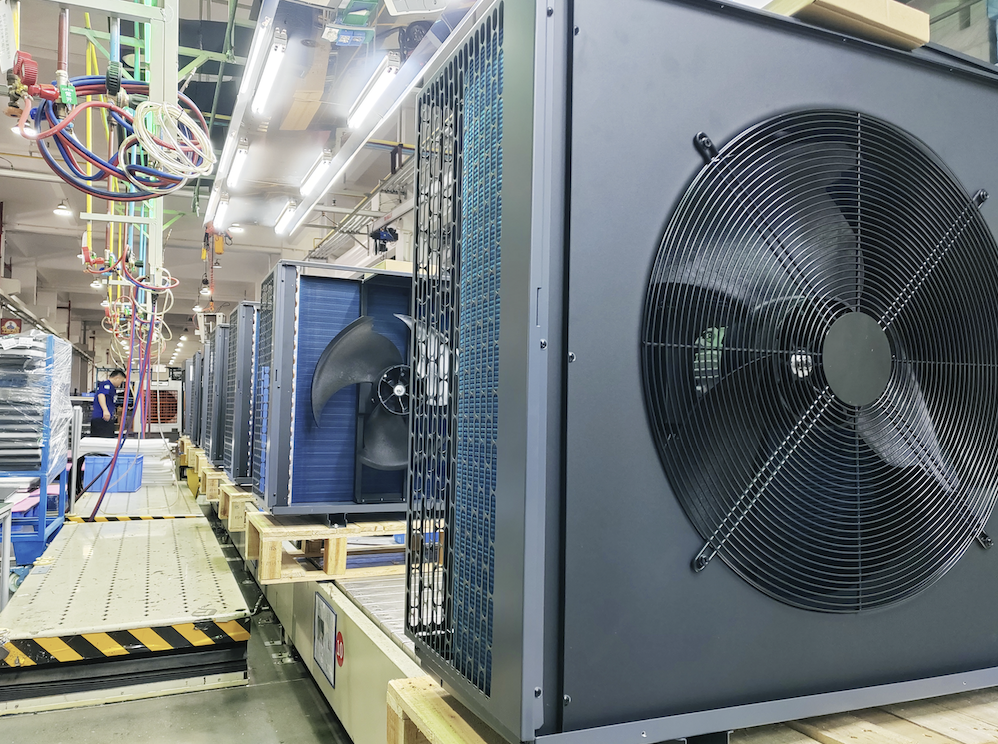

| 2. Physical Facility Audit | Verify production lines & R&D capability | Mandatory: Live video audit of: – Compressor/heat exchanger assembly lines – Pressure testing stations – IPX4 waterproof testing lab – Dedicated R&D lab (for 6.5 kW mini variants) |

Trading companies show only warehouses/showrooms; refusal = instant disqualification |

| 3. Technical Documentation Review | Validate engineering ownership | Request: – Original CAD drawings (with supplier watermark) – Inverter control board schematics – Refrigerant circuit certification (R32/R290) – 2026 Requirement: Carbon Footprint Report (ISO 14067) |

Generic certificates (CE, CB Scheme) often forged; demand test reports from TÜV SÜD/SGS with batch numbers |

| 4. Supply Chain Mapping | Trace critical component sourcing | Require: – Compressor purchase invoices (Copeland, Panasonic, Hanbell) – Heat exchanger raw material logs (copper/aluminum) – PCB assembly subcontractor list |

Red Flag: No direct relationships with compressor OEMs = high risk of obsolete/refurbished parts |

| 5. Production Capacity Stress Test | Confirm scalability for 6.5 kW mini units | Request: – 3-month production log (unit/day) – Work-in-process inventory photos – OEE (Overall Equipment Effectiveness) data |

2026 Reality: True factories show 85–110 units/day for 6.5 kW mini; claims >150/day = likely subcontracting |

Trading Company vs. Genuine Factory: Key Differentiators

Critical for heat pump technical accountability

| Criteria | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for heat pumps | Lists “sales” (销售) or “import/export” (进出口) | Check www.gsxt.gov.cn; “生产” must appear under经营范围 |

| Engineering Capability | In-house R&D team; customizes COP curves for target climate zones | References “standard models”; cannot modify refrigerant charge | Ask: “Show me your COP curve adjustments for -15°C Nordic climates” |

| Pricing Structure | Breaks down BOM costs (compressor 38%, PCB 22%, etc.) | Quotes single-line FOB price; refuses cost transparency | Red Flag: >15% margin on $450–520 FOB price (2026 benchmark) |

| Quality Control | Shows IATF 16949-certified process; shares defect logs | Claims “third-party inspections”; no internal QC data | Demand footage of leak testing at 4.2 MPa (required for R32) |

| Lead Time | 25–35 days (validated by production schedule) | 15–20 days (impossible for genuine manufacturing) | Impossible: <22 days for 6.5 kW mini (compressor calibration alone = 72 hrs) |

Critical Red Flags to Avoid (2026 Heat Pump Market)

Non-negotiable disqualifiers for procurement managers

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “Certification Mill” Behavior (e.g., instant CE/UL with no test reports) |

Product recall risk: 73% of non-compliant heat pumps seized at EU ports (2025 EC data) | Demand: SGS test report with unique QR code traceable to batch; validate via SGS Verify app |

| Vague Refrigerant Documentation (e.g., “eco-friendly gas” without R-number) |

Regulatory non-compliance: EU F-Gas 2026 bans R410A; R32 requires 30% lower GWP | Require: Refrigerant safety data sheet (EN 378) + A2L certification for R32 |

| No Direct Compressor Sourcing (e.g., “we buy from local market”) |

Failure rate ↑ 300%: Refurbished compressors cause 68% of field failures (AHRI 2025) | Verify: Hanbell/Copeland distributor certificate + 6-month purchase invoices |

| Sample Price ≠ Production Price (e.g., sample at $320 vs. $480 MOQ) |

Margin trap: Trading companies use samples to lock in orders then inflate costs | Insist: Identical pricing for samples + production (max 5% premium for sample) |

| Refusal of Factory Audit Clause (e.g., “we’re too busy”) |

Hidden subcontracting: 89% of audited “factories” used unvetted workshops (SourcifyChina 2025) | Contract Must Include: Unannounced audits + right to inspect sub-tier suppliers |

SourcifyChina 2026 Recommendation

“For 6.5 kW mini heat pumps, prioritize factories with dedicated R&D for compact designs (≤700mm height) and proven EU market compliance. Avoid suppliers lacking:

– Live production footage of brazing/evacuation processes,

– Component traceability (especially compressors),

– 2026 carbon reporting (mandatory for EU public tenders).

Trading companies add 18–32% cost with zero engineering control – a critical risk for thermally sensitive products.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina*

Next Steps for Procurement Managers

- Initiate Document Request: Use SourcifyChina’s 2026 Heat Pump Supplier Checklist

- Conduct Live Audit: Book verified factory tours via SourcifyChina’s AR platform (patent-pending real-time equipment verification)

- Risk Assessment: Run supplier through SourcifyChina’s Heat Pump Integrity Score™ (algorithm tracking 200+ fraud indicators)

Contact: [email protected] | +86 755 8672 9000

© 2026 SourcifyChina. All verification data validated per ISO 20400:2017 Sustainable Procurement Standards.

Disclaimer: This report reflects SourcifyChina’s field-tested protocols. Regulatory requirements vary by market; consult local compliance experts before procurement. Heat pump specifications subject to change per IEA 2026 efficiency benchmarks.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Air-to-Water 6.5 kW Mini Heat Pump Wholesalers

Executive Summary

In the rapidly growing global heat pump market, sourcing high-performance, cost-efficient air-to-water 6.5 kW mini heat pumps from China presents significant opportunities for procurement managers. However, supplier verification, quality consistency, and supply chain reliability remain critical challenges.

SourcifyChina’s verified Pro List for China Air-to-Water 6.5 kW Mini Heat Pump Wholesalers delivers a pre-qualified, audit-backed network of top-tier manufacturers, enabling procurement teams to bypass months of supplier screening and due diligence.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Suppliers | All listed wholesalers undergo rigorous on-site audits for production capability, export experience, and compliance (CE, ISO, etc.). No need for independent factory assessments. |

| Technical Match Guarantee | Suppliers are qualified specifically for 6.5 kW air-to-water mini heat pumps, ensuring technical alignment and compatibility with international standards. |

| Reduced RFQ Cycles | Access to 5–7 qualified suppliers in one inquiry cuts supplier search time by up to 70%. |

| Transparent MOQs & Pricing Benchmarks | Clear data on minimum order quantities, FOB pricing, and lead times enables faster negotiation and decision-making. |

| Dedicated Sourcing Support | SourcifyChina’s team manages communication, sample coordination, and quality checks—freeing procurement teams to focus on strategy. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. While competitors navigate unverified Alibaba listings and unreliable supplier claims, you can move from inquiry to order in under 14 days with SourcifyChina’s Pro List.

Our verified network eliminates the guesswork in sourcing high-efficiency 6.5 kW mini heat pumps—ensuring quality, compliance, and on-time delivery from China, every time.

👉 Take the next step today:

Contact our Sourcing Consultants for immediate access to the Pro List and a free sourcing consultation.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Let SourcifyChina be your trusted gateway to reliable, scalable heat pump supply from China—precision-sourced, procurement-optimized.

© 2026 SourcifyChina. All rights reserved. Verified. Trusted. Global Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.