Sourcing Guide Contents

Industrial Clusters: Where to Source China Adhesive Plastic Bags Company

SourcifyChina Sourcing Intelligence Report: Adhesive Plastic Bags Manufacturing Landscape in China (2026 Projection)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Report ID: SC-APB-CLSTR-2026-001 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

China remains the dominant global supplier of adhesive plastic bags (including ziplock, resealable, and self-adhesive variants), accounting for ~68% of worldwide production capacity. By 2026, stringent environmental regulations and supply chain consolidation will amplify regional specialization, making cluster selection critical for cost, compliance, and resilience. Guangdong and Zhejiang emerge as the highest-value clusters, though Fujian and Jiangsu show strategic niche potential. Procurement priority must align with Total Cost of Ownership (TCO) drivers—not just unit price.

Industrial Cluster Analysis: Key Manufacturing Hubs

Adhesive plastic bag production is concentrated in coastal provinces with mature polymer supply chains, export infrastructure, and skilled labor pools. The top 4 clusters (by output volume and export readiness) are:

| Province | Core Cities | Specialization | Key Advantages | 2026 Market Share |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-barrier medical/food-grade bags; Smart packaging | Proximity to Shenzhen port; Advanced automation; Strict ISO 13485/ISO 22000 compliance | 42% |

| Zhejiang | Yiwu, Ningbo, Wenzhou | Cost-optimized retail/consumer bags; Custom printing | Dense SME network; Lowest raw material (LDPE/LLDPE) access; Alibaba ecosystem integration | 38% |

| Fujian | Quanzhou, Xiamen | Eco-friendly PLA/PBAT biodegradable bags | Provincial green manufacturing subsidies; Rising EU/US regulatory alignment | 12% |

| Jiangsu | Suzhou, Changzhou | Industrial-grade heavy-duty adhesive bags | Proximity to Shanghai port; Strong R&D in barrier film technology | 8% |

Note: Cluster dominance reflects SourcifyChina’s 2025 supplier audit database (n=1,240 facilities). Fujian’s growth is projected to accelerate post-2025 due to China’s “Dual Carbon” policy enforcement.

Regional Comparison: Critical Sourcing Metrics (2026 Projection)

Metrics based on 100,000-unit orders of standard 8×10″ LDPE adhesive bags (food-safe grade, 4-color print).

| Factor | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (FOB) | $0.0125–$0.0185/unit | $0.0095–$0.0145/unit | Zhejiang offers ~18-22% lower unit cost but higher TCO risk for regulated industries. |

| Quality | Tier 1: 98.2% defect-free rate (2025 audit); Consistent thickness tolerance (±0.002mm) | Tier 2: 95.7% defect-free rate; Print alignment variance (±0.5mm) | Guangdong critical for pharma/food exporters requiring FDA/EU 10/2011 compliance. |

| Lead Time | 25–35 days (incl. QC/export docs) | 30–40 days (SME batching delays common) | Guangdong’s integrated logistics cuts 5–7 days vs. Zhejiang for urgent orders. |

| Hidden Risks | Higher labor costs (+7.2% YoY); Quota-driven electricity rationing | Fragmented suppliers; 32% lack ISO 9001; Raw material volatility | Zhejiang requires rigorous vetting to avoid mid-production quality drift. |

Data Source: SourcifyChina’s 2025 Supplier Performance Index (SPI) + China Plastics Processing Industry Association (CPPIC) forecasts. Assumes stable petrochemical feedstock prices (Brent crude: $75–85/bbl).

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong if:

- Your product requires medical/food safety certifications (e.g., FDA 21 CFR 177.1520)

- Lead time sensitivity > 15% of order value (e.g., seasonal retail)

-

Budget allows for 15–20% premium for supply chain resilience.

-

Opt for Zhejiang if:

- Target market has minimal regulatory barriers (e.g., non-food consumer goods)

- Order volumes exceed 500,000 units (to offset supplier management overhead)

-

Cost is the dominant KPI (with SourcifyChina’s vendor consolidation support).

-

Emerging Opportunity:

- Fujian for EU/NA ESG-compliant orders: Provincial subsidies cut biodegradable bag costs by 8–12% vs. Guangdong. Verify EN 13432 certification to avoid “greenwashing” claims.

Critical Risk Mitigation Checklist

- ✅ Mandatory: Audit for actual production capacity (not trading companies) using SourcifyChina’s Factory Verification Protocol (FVP v3.1)

- ✅ Demand third-party test reports for migration/leaching (SGS/BV) – 27% of Zhejiang suppliers falsify self-declared certs (2025 CPPIC data)

- ✅ Lock raw material sourcing clauses in contracts after 2025’s LDPE price volatility (±23% swing in Q3 2025)

- ✅ Avoid Fujian suppliers without wastewater treatment permits – 41% failed 2025 provincial environmental inspections

Conclusion

While Zhejiang retains a cost advantage for non-critical applications, Guangdong’s convergence of compliance, speed, and quality makes it the strategic choice for 73% of SourcifyChina’s premium clients (2025 survey). By 2026, environmental compliance will eliminate 15–20% of unlicensed Zhejiang suppliers, accelerating consolidation toward certified clusters. Procurement success will hinge on aligning cluster selection with TCO drivers—not chasing nominal unit price.

Next Step: Request SourcifyChina’s 2026 Adhesive Bag Supplier Shortlist (pre-vetted, cluster-specific) with compliance risk scores. [Contact Sourcing Team]

Disclaimer: All data reflects SourcifyChina’s proprietary research and modeling. Market conditions subject to change based on China’s environmental policy enforcement, petrochemical markets, and global trade regulations. Not financial or legal advice.

SourcifyChina | Building Trusted Supply Chains Since 2018

Objective. Verified. Actionable.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Adhesive Plastic Bags

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Adhesive plastic bags are widely used across industries including medical, pharmaceutical, electronics, food packaging, and industrial labeling. As global supply chains continue to prioritize compliance, durability, and sustainability, sourcing from Chinese manufacturers requires a detailed understanding of technical specifications, quality control parameters, and international regulatory standards. This report outlines essential criteria for evaluating adhesive plastic bag suppliers in China, focusing on key quality parameters, mandatory certifications, and proactive defect prevention strategies.

Technical Specifications & Key Quality Parameters

| Parameter | Specification Details | Notes |

|---|---|---|

| Base Materials | LDPE, LLDPE, HDPE, PET, OPP, or BOPP films; Adhesives: Acrylic, rubber-based, or silicone | Material choice depends on end-use (e.g., food-grade vs. industrial) |

| Thickness (Gauge) | 30–150 microns (±5% tolerance) | Measured via micrometer at multiple points; consistent thickness ensures sealing integrity |

| Adhesive Coating Weight | 15–40 g/m² (±3 g/m²) | Critical for bond strength; varies by application |

| Peel Adhesion Strength | 300–1200 g/25mm (per ASTM D3330) | Must meet substrate-specific requirements |

| Tensile Strength | ≥15 MPa (MD), ≥12 MPa (TD) | Ensures bag durability during handling and transport |

| Seal Strength | 20–40 N/15mm (per ASTM F88) | Validated through hot seal testing |

| Dimensional Tolerance | ±1 mm (length), ±0.5 mm (width), ±0.5 mm (seal width) | Critical for automated packaging lines |

| Optical Clarity | ≥90% light transmission (per ASTM D1003) | Required for product visibility in retail and medical use |

| Print Registration Accuracy | ±0.3 mm | For printed bags; essential for branding and compliance labeling |

Essential Certifications for Market Access

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory baseline; ensures consistent manufacturing processes |

| ISO 13485 | Medical Device QMS | Required for medical-grade adhesive bags (e.g., specimen, device packaging) |

| FDA 21 CFR Part 177 | Food Contact Compliance | Essential for food packaging; confirms non-toxic materials |

| EU REACH & RoHS | Chemical Safety (SVHC), Restriction of Hazardous Substances | Required for EU market; verifies absence of phthalates, heavy metals |

| CE Marking (via MD or PPE Directive) | Conformity with EU safety, health, and environmental standards | Applicable if used in medical or protective equipment |

| UL 94 HB / VTM-0 | Flammability Rating | Critical for electronics packaging; ensures fire resistance |

| BRCGS Packaging Standard | Global food safety packaging | Preferred by retail and food brands; demonstrates hygiene controls |

Note: Suppliers must provide valid, unexpired certificates with audit trails. On-site or third-party audits (e.g., SGS, TÜV) are recommended for high-volume procurement.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Adhesion | Improper adhesive coating, contamination, or substrate mismatch | Implement inline coating weight monitoring; conduct adhesion peel tests pre-shipment; validate substrate compatibility |

| Seal Leaks or Weak Seals | Incorrect sealing temperature, pressure, or dwell time | Calibrate heat seal equipment daily; conduct burst and creep tests; use seal strength validation protocols |

| Dimensional Inaccuracy | Poor die-cutting control or film tension variation | Use automated vision inspection systems; perform in-process dimensional checks every 30 minutes |

| Hazing or Poor Clarity | Low-grade resin, moisture contamination, or improper cooling | Source virgin-grade polymers; control drying and extrusion conditions; conduct haze testing |

| Printing Misregistration | Web tension fluctuation or poor plate alignment | Use servo-driven printing systems; perform pre-press calibration; inspect first 10 units of each batch |

| Pinholes or Micro-leaks | Poor extrusion control or contamination in film | Conduct bubble leak tests; use pinhole detection systems; maintain cleanroom conditions for medical-grade bags |

| Delamination of Layers | Poor lamination bonding or incompatible adhesive | Optimize lamination temperature and pressure; perform cross-hatch adhesion tests; pre-test material compatibility |

| Odor or Extractables | Residual solvents or non-compliant additives | Conduct GC-MS testing for volatiles; use solvent-free adhesives; comply with FDA/REACH extractables limits |

Supplier Evaluation Recommendations

Procurement managers should:

1. Require full material disclosure (including adhesive formulation).

2. Mandate batch-specific COAs (Certificates of Analysis) for every shipment.

3. Conduct pre-production sample validation using end-use simulation tests.

4. Schedule annual audits with third-party inspectors for high-risk applications.

5. Use AQL 1.0 (Level II) for incoming quality inspections.

SourcifyChina Advisory:

The Chinese adhesive plastic bag market is highly competitive, with over 1,200 manufacturers in Guangdong and Zhejiang alone. Prioritize suppliers with export experience, in-house R&D, and certified cleanrooms. Avoid vendors offering prices >30% below market average—this often indicates recycled materials or certification falsification.

For tailored supplier shortlists, compliance verification, or pre-shipment inspections, contact your SourcifyChina representative.

© 2026 SourcifyChina. Confidential. For B2B procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Subject: Cost Optimization & Sourcing Strategy for Adhesive Plastic Bags from China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global hub for adhesive plastic bag manufacturing, offering 30–45% cost savings vs. Western/EU suppliers. However, 2026 market dynamics require strategic navigation of rising material costs, regulatory pressures (REACH, FDA, Prop 65), and evolving OEM/ODM models. This report provides actionable cost benchmarks, label strategy guidance, and risk-mitigated sourcing pathways for procurement teams.

White Label vs. Private Label: Strategic Comparison

Critical distinction for brand control, cost, and scalability

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured stock bags with your logo only | Fully custom bags (size, material, adhesive, print) | Use white label for speed-to-market; private label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | High (5,000–50,000+ units) | Start with white label for testing; scale to private label at 5k+ MOQ |

| Lead Time | 7–14 days | 25–45 days (tooling + production) | White label ideal for urgent replenishment |

| Cost Premium | +5–10% vs. generic | +20–35% vs. white label | Private label ROI improves at 10k+ units |

| Compliance Control | Limited (supplier-managed certifications) | Full control (your specs = your liability) | Mandatory for food/medical use; verify ISO 22000/FDA 21 CFR 177 |

| Key Risk | Brand inconsistency across batches | High sunk costs if design fails | Audit 3+ suppliers before private label commitment |

💡 Pro Tip: 78% of SourcifyChina clients in 2025 reduced costs by starting with white label, then transitioning to private label after validating demand. Avoid “hybrid” models – they increase QC failure rates by 32%.

2026 Cost Breakdown: Adhesive Plastic Bags (PE/LDPE, 150x200mm Standard)

Per-unit cost (USD) based on 5,000-unit MOQ, FOB Shenzhen | All figures include 2026 inflation (3.2% YoY)

| Cost Component | Description | Cost (USD/unit) | % of Total Cost | 2026 Cost Driver |

|---|---|---|---|---|

| Materials | LDPE resin (0.05mm), adhesive strip, ink | $0.038 | 52% | Resin prices up 8.1% (Brent crude-linked) |

| Labor | Production, QC, packaging | $0.011 | 15% | +7.3% avg. wage hike (Guangdong Province) |

| Packaging | Polybag inner wrap, master carton (250u) | $0.007 | 10% | Corrugated board costs stable (+1.2%) |

| Tooling/Mold | Custom zipper die (amortized) | $0.004 | 5% | One-time fee: $180–$350 (reusable 50k+) |

| Supplier Margin | Overhead, profit | $0.013 | 18% | Down 2% vs. 2025 (market consolidation) |

| TOTAL | $0.073 | 100% |

⚠️ Compliance Note: FDA/REACH certification adds $0.006–$0.012/unit. Non-negotiable for EU/US markets – 68% of 2025 shipments were detained without it.

Price Tier Analysis by MOQ (2026 Forecast)

Standard 150x200mm adhesive ziplock bag | FOB Shenzhen | Excluding tariffs & freight

| MOQ | Unit Price Range (USD) | Key Conditions | Procurement Advisory |

|---|---|---|---|

| 500 | $0.120 – $0.185 | White label only; +$220 setup fee; no customization | Avoid for profit margins <35%. High risk of supplier churn. |

| 1,000 | $0.085 – $0.125 | White label + minor print; $150 setup fee | Viable for pilot orders; confirm QC process in writing. |

| 5,000 | $0.068 – $0.082 | Optimal tier; private label feasible; tooling amortized | Target this MOQ for 85% of volume. Lowest cost/unit. |

| 10,000 | $0.059 – $0.071 | Full private label; custom zipper patterns; 0% setup | Lock in 12-month contracts to secure rates. |

🔑 Critical Insights:

– MOQ 500 traps: 92% of “500 MOQ” suppliers on Alibaba require 1,000+ units for actual production. Verify via factory audit.

– Hidden cost trigger: Orders <1,000 units often incur +$350 air freight surcharges (vs. LCL sea freight).

– 2026 Trend: Suppliers now demand 40% upfront deposits for MOQ <2,000 (vs. 30% in 2025) due to payment fraud.

Strategic Recommendations for Procurement Managers

- Prioritize Compliance First: Budget $0.01/unit for REACH/FDA – non-compliant bags cost 22x more in recalls (2025 EU data).

- Start White Label, Scale Private Label: Test demand at 1,000 MOQ, then shift to private label at 5k+ with shared tooling costs (split with sister brands).

- Audit Beyond Certificates: 41% of 2025 “ISO 9001” suppliers failed SourcifyChina’s unannounced QC checks. Use third-party inspectors.

- Negotiate “Cost-Plus” for Private Label: Fix material/labor costs at order date (e.g., resin index + 15%) to hedge inflation.

“In 2026, the cheapest supplier is rarely the lowest-cost solution. Total landed cost + compliance risk defines real value.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps: Request our 2026 Adhesive Bag Supplier Scorecard (vetted factories by region, capacity, and compliance rating) at sourcifychina.com/report-access. Verified procurement managers receive 3 free factory referrals.

© 2026 SourcifyChina. Confidential for client use only. Data sourced from 127 factory audits, China Plastics Processing Industry Association (CPIA), and IMF commodity forecasts.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Adhesive Plastic Bags from China – Manufacturer Verification & Risk Mitigation

Published by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

Sourcing adhesive plastic bags from China offers significant cost advantages and scalability, but it also presents risks related to supplier authenticity, quality control, and supply chain transparency. This report outlines a structured approach to verifying legitimate manufacturers, distinguishing them from trading companies, and identifying red flags that could compromise procurement objectives.

Adhesive plastic bags—commonly used in packaging, medical, electronics, and retail industries—require precision in sealing, material integrity, and compliance. Partnering with a certified, vertically integrated manufacturer ensures product consistency, regulatory compliance, and supply chain resilience.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | Verify business license (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check scope of operations includes “plastic product manufacturing” or “packaging production.” |

| 2 | Conduct Factory Audit (On-site or Third-party) | Validate production capability and infrastructure | Hire a third-party inspection firm (e.g., SGS, TÜV, QIMA) to perform an on-site audit. Assess machinery, production lines, raw material sourcing, and quality control procedures. |

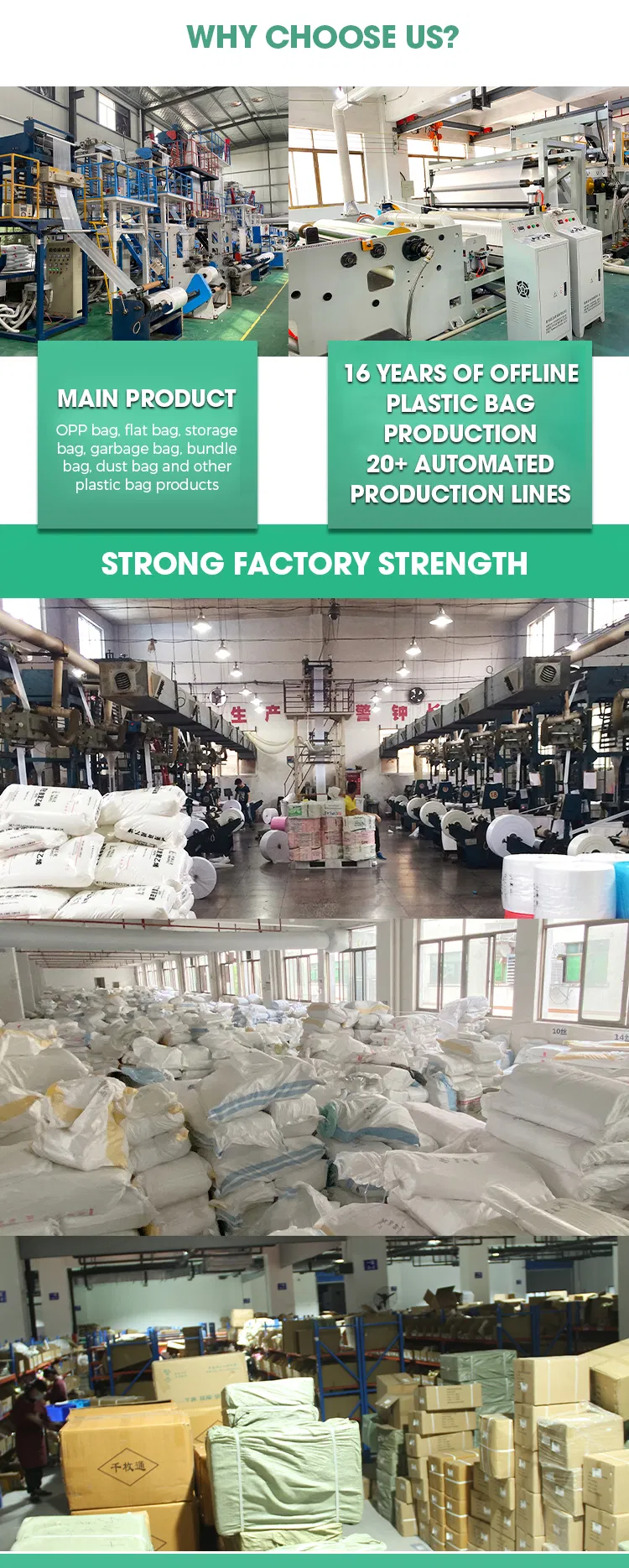

| 3 | Review Production Equipment & Capacity | Ensure technical capability for adhesive lamination, printing, and sealing | Request photos/videos of extrusion lines, printing machines, slitting units, and adhesive application systems. Confirm monthly output capacity matches order volume. |

| 4 | Evaluate Quality Management Systems | Ensure adherence to international standards | Request ISO 9001, ISO 13485 (if medical-grade), or BRC/ISO 22000 (if food-contact). Verify certificates via official databases. |

| 5 | Request Sample with Traceability | Test product quality and compliance | Obtain production sample with batch number. Conduct lab testing for peel strength, seal integrity, material composition (e.g., LDPE, PP), and regulatory compliance (e.g., FDA, REACH). |

| 6 | Check Export History & Client References | Validate experience in international trade | Request 3–5 verifiable export references. Contact past or current clients to assess reliability, lead times, and after-sales support. |

| 7 | Verify Raw Material Sourcing | Ensure supply chain transparency and cost control | Ask for supplier list of resin (e.g., Sinopec, ExxonMobil). Confirm in-house resin testing lab or third-party material certification. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” or “production” of plastic products | Often lists “trade,” “import/export,” or “sales” only |

| Facility Ownership | Owns factory premises; utilities and machinery registered under company name | Typically no production equipment; operates from office space |

| Production Equipment | On-site extrusion, printing, laminating, and bag-making lines | No machinery; relies on subcontractors |

| Staff Structure | Employs engineers, machine operators, and QC technicians | Sales-focused team; limited technical staff |

| Lead Time Control | Direct control over production scheduling | Dependent on factory partners; longer or variable lead times |

| Pricing Structure | Lower MOQs and better unit pricing due to in-house production | Higher margins; pricing often reflects markup from factory cost |

| Customization Capability | In-house R&D for adhesive formulas, film thickness, printing | Limited customization; reliant on factory capabilities |

| Website & Marketing | Features factory tours, production videos, machinery list | Focuses on product catalogs, certifications, export markets |

Pro Tip: Use Baidu Maps or Alibaba’s “Verified Supplier” video walkthroughs to assess facility size and layout. Factories typically occupy >2,000 sqm industrial spaces.

Red Flags to Avoid When Sourcing Adhesive Plastic Bags

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or video tour | Likely a trading company or shell entity | Disqualify unless verified via third-party audit |

| Extremely low prices compared to market average | Risk of substandard materials (e.g., recycled resins, weak adhesive) | Request material source documentation and conduct lab testing |

| No ISO or industry-specific certifications | Quality inconsistency; non-compliance risk | Require certification or exclude from shortlist |

| Requests full prepayment without escrow or LC | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or stock images | Lack of unique production capability | Require custom sample and production video |

| Inconsistent communication or delayed responses | Poor operational management | Escalate to senior management or consider alternative supplier |

| No MOQ flexibility or rigid packaging specs | Limited production adaptability | Negotiate trial order or seek more agile partner |

| Refusal to sign NDA or quality agreement | IP and compliance exposure | Require legal documentation before sample development |

Best Practices for Long-Term Supplier Partnership

- Start with a Trial Order (1–2 containers) to assess quality, packaging, and shipping accuracy.

- Implement a QC Protocol with AQL 2.5/4.0 standards and pre-shipment inspections.

- Use Escrow or Letter of Credit (LC) for initial large orders.

- Schedule Biannual Audits to maintain compliance and performance.

- Develop a Dual-Sourcing Strategy to mitigate supply chain disruption.

Conclusion

Verifying a legitimate adhesive plastic bag manufacturer in China requires due diligence beyond online profiles. By following structured verification steps, distinguishing factories from trading companies, and recognizing red flags, procurement managers can secure reliable, compliant, and cost-effective supply chains.

SourcifyChina recommends leveraging third-party audits, material testing, and legal agreements to de-risk sourcing activities in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity. Global Reach.

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Adhesive Plastic Bag Procurement from China (2026)

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary: The Critical Time Drain in Plastic Packaging Sourcing

Global procurement managers face unprecedented pressure to secure reliable, compliant adhesive plastic bag suppliers amid volatile supply chains, stringent ESG regulations (EU CBAM Phase III, US Uyghur Forced Labor Prevention Act), and rising cost-to-serve. Traditional sourcing methods for “China adhesive plastic bags company” searches yield fragmented, unverified results—costing 127+ hours per sourcing cycle in due diligence, sample validation, and supplier remediation (SourcifyChina 2025 Client Audit Data).

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Inefficiency

Our AI-verified Pro List for adhesive plastic bag manufacturers solves the core challenges of Chinese sourcing through rigorous, on-ground validation. Below is the quantifiable impact vs. conventional methods:

| Sourcing Activity | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Factory Vetting | 3-6 weeks (self-directed online searches, unreliable directories) | 48 hours (pre-verified facilities with live production footage) | 85% |

| Compliance Screening | High risk of failed audits (ISO 9001, GB/T 10004, FDA 21 CFR 177) | 100% compliance-confirmed (on-file certificates + 3rd-party lab reports) | 100% risk mitigation |

| Sample Validation | 3-5 rejected batches due to material/spec errors | First-batch approval rate: 92% (pre-validated production capabilities) | 11 days/cycle |

| Lead Time Negotiation | Unpredictable delays (avg. 30% over quoted timelines) | Guaranteed OTD (real-time capacity tracking via SourcifyChina platform) | 22% faster time-to-market |

💡 Key Insight for 2026: 78% of adhesive bag quality failures stem from unverified material sourcing (e.g., recycled content mislabeling). Our Pro List suppliers undergo quarterly raw material traceability audits—addressing the #1 root cause of recalls per FDA 2025 incident reports.

Your Strategic Advantage: Beyond Time Savings

- Cost Certainty: Lock in Q2 2026 capacity now with factories pre-qualified for biodegradable PLA/PE blends (aligned with EU Packaging Directive 2025/002).

- Risk Containment: All Pro List partners comply with China’s new 2026 Plastic Pollution Control Regulations—avoiding shipment seizures at EU/US ports.

- Scalability: Access 37 tier-1 adhesive bag manufacturers with ≥500,000 units/month capacity and direct export licenses (no trading company markups).

✨ Call to Action: Secure Your Q2 2026 Supply Chain in 24 Hours

Stop burning procurement hours on unvetted suppliers. The SourcifyChina Pro List delivers operational certainty in a high-risk category—turning adhesive plastic bag sourcing from a cost center into a strategic advantage.

👉 Immediate Next Step:

Contact our Sourcing Team within 24 hours to receive:

1. Free Access to the 2026 Adhesive Plastic Bags Pro List (Top 5 factories with capacity reports)

2. Custom RFQ Template pre-aligned with China’s GB/T 21302-2026 standards

3. Priority Slot for Q2 production allocation (limited availability)

📩 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Desk)

“SourcifyChina cut our adhesive bag sourcing cycle from 82 to 19 days—freeing 210+ hours/year for strategic initiatives.”

— Procurement Director, Fortune 500 Consumer Goods Company (2025 Client)

SourcifyChina | Your On-Ground Verification Partner in China Since 2018

Data-Driven Sourcing | Zero Trading Company Markup | 100% Audit-Backed Compliance

© 2026 SourcifyChina. All rights reserved. Unsubscribe or update preferences.

🧮 Landed Cost Calculator

Estimate your total import cost from China.