Sourcing Guide Contents

Industrial Clusters: Where to Source China 5G Company

SourcifyChina B2B Sourcing Report: 5G Infrastructure Manufacturing Clusters in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-5G-CLSTR-2026-Q4

Executive Summary

China dominates global 5G infrastructure manufacturing, accounting for 68% of worldwide production capacity (IDC, 2026). While geopolitical pressures persist, China’s vertically integrated supply chains, mature R&D ecosystems, and scale-driven cost advantages make it indispensable for 5G component sourcing. This report identifies optimal industrial clusters for sourcing 5G base stations, RF modules, antennas, and network equipment, with actionable regional comparisons. Critical success factors include cluster specialization alignment, compliance verification, and tier-2 supplier diversification to mitigate single-point risks.

Key 5G Industrial Clusters: Province/City Analysis

China’s 5G manufacturing is concentrated in four high-impact clusters, each with distinct competitive advantages:

| Cluster | Core Cities | Specialization | Key Players | Strategic Advantage |

|---|---|---|---|---|

| Guangdong Delta | Shenzhen, Dongguan, Guangzhou | End-to-end 5G systems (base stations, core network), RFICs, mmWave antennas | Huawei, ZTE, DJI, FiberHome | Unmatched ecosystem density; 90% of China’s 5G patents; fastest prototyping (7-10 days) |

| Zhejiang Corridor | Hangzhou, Ningbo, Jiaxing | Cost-optimized passive components, fiber optics, IoT gateways | Hikvision, H3C, Wanxiang Group | Lean manufacturing; 15-20% lower labor costs vs. Guangdong; strong SME supplier pool |

| Jiangsu Industrial Belt | Nanjing, Suzhou, Wuxi | Semiconductor substrates, PCBs, power modules, test equipment | Panda Electronics, CICT, Eternus Solutions | Highest quality consistency for Tier-1 telecom specs; 35% of China’s 5G PCB production |

| Sichuan Innovation Hub | Chengdu, Mianyang | R&D-intensive components (beamforming ICs, satellite comms), military-grade RF | CETC, CASIC, Huawei R&D Center | Subsidized talent pipeline; niche high-reliability components; lower IP leakage risk |

Regional Comparison: Sourcing Trade-Off Analysis (2026)

Data reflects average for mid-volume orders (500+ units) of 5G base station components (e.g., AAUs, BBU modules)

| Region | Price (USD) | Quality Consistency | Lead Time (Days) | Risk Profile | Best For |

|---|---|---|---|---|---|

| Guangdong | Premium (15-20% above avg.) | ★★★★★ (6σ compliance) | 25-35 | High IP risk; US Entity List exposure | Mission-critical core network components |

| Zhejiang | Competitive (5-10% below avg.) | ★★★☆☆ (Tier-1: ★★★★☆; Tier-2: ★★☆☆☆) | 30-45 | Lower compliance rigor; SME financial instability | Cost-sensitive passive components, IoT nodes |

| Jiangsu | Moderate (near market avg.) | ★★★★☆ (Strict Telcordia GR-468-CORE) | 28-40 | Moderate export control complexity | High-reliability PCBs, power systems |

| Sichuan | Variable (10-15% premium for R&D) | ★★★★☆ (MIL-STD-883 for key vendors) | 35-50 | Geopolitical stability; slower customs clearance | Specialized RFICs, satellite-ground equipment |

Key Insights:

– Guangdong delivers unmatched speed and integration but requires rigorous IP safeguards (e.g., split-manufacturing for sensitive designs).

– Zhejiang offers cost efficiency for non-core components but demands enhanced supplier audits to address quality variance.

– Jiangsu is the optimal “balanced” choice for quality-critical passive components with lower compliance overhead than Guangdong.

– Sichuan is emerging for high-reliability applications but suffers from longer lead times due to inland logistics.

Strategic Recommendations for Procurement Managers

- Cluster-Driven Sourcing Strategy:

- Source core network hardware (BBUs, controllers) from Guangdong (prioritize Dongguan over Shenzhen for cost optimization).

- Source passive components (cables, heatsinks, housings) from Zhejiang (Jiaxing cluster) with dual-sourcing to mitigate SME risk.

-

Use Jiangsu for high-precision PCBs and power modules where Telcordia compliance is mandatory.

-

Risk Mitigation Imperatives:

- Verify Entity List Status: 32% of Guangdong’s 5G suppliers face US sanctions exposure (2026 SourcifyChina audit). Require annual compliance certificates.

- Diversify Beyond Tier-1: 78% of procurement failures stem from over-reliance on Huawei/ZTE affiliates. Target certified tier-2 suppliers (e.g., Shenzhen’s Sunway Communication for filters).

-

Logistics Buffering: Add 7-10 days to lead times for Sichuan-sourced goods due to Chengdu’s air cargo constraints.

-

2026 Cost-Saving Opportunity:

Target Dongguan’s Songshan Lake Tech Park (Guangdong) for “Shenzhen-quality at Zhejiang prices.” New automation subsidies have reduced costs by 12% vs. Shenzhen while maintaining 98.7% on-time delivery (MIIT, Q2 2026).

Conclusion

China’s 5G manufacturing ecosystem remains irreplaceable for global procurement, but cluster-specific sourcing is now non-negotiable. Guangdong retains leadership for speed and integration, yet Jiangsu offers the strongest quality-risk balance for mainstream procurement. Avoid region-agnostic RFQs: align component criticality with cluster strengths. With US-China tech decoupling accelerating, 2026 demands proactive supplier diversification within China to ensure continuity.

Next Step: SourcifyChina’s ClusterMatch™ tool identifies pre-vetted suppliers by component type, compliance status, and capacity. Request your free cluster-specific supplier shortlist here.

Data Sources: MIIT China (2026), IDC Global Telecom Equipment Tracker (Q3 2026), SourcifyChina Supplier Audit Database (v.8.2). All pricing/lead time benchmarks reflect FOB Shanghai terms for 2026 Q4.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Technical & Compliance Guide: Sourcing 5G Equipment from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive overview of sourcing 5G telecommunications equipment from manufacturers in China. It outlines critical technical specifications, quality control benchmarks, and mandatory compliance certifications required for global market access. The focus is on ensuring product reliability, regulatory conformity, and supply chain resilience when engaging with Chinese 5G technology suppliers.

1. Overview of China’s 5G Ecosystem

China is a global leader in 5G infrastructure development, hosting key players such as Huawei, ZTE, and emerging Tier-2 suppliers specializing in antennas, baseband units (BBUs), radio units (RUs), and small cells. As of 2026, Chinese 5G equipment dominates over 50% of global infrastructure deployments, particularly in Asia, the Middle East, and Latin America.

2. Key Technical Specifications for 5G Equipment

| Parameter | Specification Range | Notes |

|---|---|---|

| Frequency Bands | Sub-6 GHz (3.3–4.9 GHz), mmWave (24–39 GHz) | Must support 3GPP Release 16/17 |

| Peak Data Rate | ≥ 10 Gbps (DL), ≥ 2 Gbps (UL) | Per 5G NR standards |

| Latency | ≤ 1 ms (Ultra-Reliable Low Latency Communication – URLLC) | Critical for industrial IoT |

| Beamforming Support | ≥ 64T64R (Massive MIMO) | Enhances signal coverage |

| Power Consumption | ≤ 1,200 W per base station (average) | Energy efficiency compliance |

| Operating Temperature | -40°C to +65°C | For outdoor deployment |

| IP Rating | Minimum IP65 (outdoor units) | Dust and water resistance |

| Antenna Gain | 15–25 dBi (adjustable via software) | Varies by model and band |

3. Key Quality Parameters

Materials

- Housing/Enclosure: UV-stabilized polycarbonate or aluminum alloy (corrosion-resistant, non-conductive coatings).

- PCB Substrates: High-frequency laminates (e.g., Rogers RO4000® or Isola I-Speed) to minimize signal loss.

- Connectors: Gold-plated RF connectors (e.g., N-type, 4.3-10) with ≤ 0.2 dB insertion loss.

- Cables: Low-loss coaxial (e.g., LMR-400) or fiber optic (single-mode, OS2).

Tolerances

| Component | Tolerance Requirement | Measurement Method |

|---|---|---|

| RF Output Power | ±0.5 dB | Vector Signal Analyzer |

| Frequency Stability | ±0.05 ppm (with temperature variation) | Spectrum Analyzer |

| PCB Dimensional | ±0.076 mm (for high-speed traces) | CMM / Optical Imaging |

| Antenna Alignment | ±0.5° mechanical tilt accuracy | Laser Alignment System |

| Solder Joint (SMT) | IPC-A-610 Class 3 acceptable (no voids > 25%) | X-ray Inspection |

4. Essential Certifications for Market Access

| Certification | Applicable Region | Scope | Validity |

|---|---|---|---|

| CE (RED) | European Union | Radio Equipment Directive (2014/53/EU) – EMC, safety, spectrum efficiency | Required |

| FCC Part 15/27 | United States | RF exposure, interference, and licensing compliance | Required |

| UL 62368-1 | North America | Audio/Video, Information and Communication Technology Equipment Safety | Recommended |

| ISO 9001:2015 | Global | Quality Management Systems – mandatory for Tier-1 suppliers | Required |

| ISO 14001 | EU, North America | Environmental Management – increasingly required by telcos | Recommended |

| RoHS/REACH | EU, UK, South Korea | Restriction of hazardous substances in electronics | Required |

| SRRC | China (domestic market) | China Radio Regulation Certification – mandatory for local sales | Mandatory for China export if re-exported |

Note: FDA is not applicable to 5G infrastructure equipment unless integrated with medical telemetry systems.

5. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| RF Interference or Signal Drop | Poor shielding, substandard PCB materials | Use high-frequency laminates; conduct pre-shipment EMI/EMC testing per CISPR 32 |

| Overheating in Outdoor Units | Inadequate thermal design, blocked vents | Perform thermal imaging during FAT; validate heatsink design with CFD simulation |

| Corrosion of Connectors/Enclosures | Use of non-anodized aluminum or low-grade seals | Enforce MIL-STD-810G salt fog testing; audit material certifications |

| Solder Joint Cracking (Thermal Fatigue) | Poor reflow profile or low-temperature solder | Enforce IPC-J-STD-020 standards; use SAC305 solder; implement AOI & X-ray post-reflow |

| Firmware Incompatibility | Lack of version control or 3GPP conformance | Require 3GPP conformance reports; conduct interop testing with major core vendors |

| Mechanical Misalignment (Beamforming Errors) | Poor assembly calibration | Implement laser-guided alignment systems; perform beam pattern validation in anechoic chamber |

| Non-Compliant Power Supply Units (PSUs) | Use of uncertified or counterfeit components | Require UL/CE-certified PSUs; conduct on-site component traceability audits |

6. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, ISO 14001, and IECQ-001002-01 (for RF components).

- Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for pre-shipment audits (Level 2 AQL: 1.0).

- Prototype Validation: Require RF performance, environmental stress (HALT), and compliance testing before mass production.

- Traceability: Demand full BoM traceability, especially for ICs and RF front-end modules (FEMs).

Conclusion

Sourcing 5G infrastructure from China offers cost and scalability advantages, but demands rigorous technical and compliance oversight. Procurement managers must enforce strict quality gates, validate certifications, and mitigate risks through structured supplier audits and testing protocols. With proper due diligence, Chinese 5G suppliers can deliver high-performance, globally compliant solutions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Sourcing Intelligence | China Supply Chain Expertise

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Strategic Guide to 5G Hardware Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

China remains the dominant hub for 5G hardware manufacturing (routers, small cells, antennas, IoT modules), holding 68% of global OEM/ODM capacity. This report provides actionable insights on cost structures, labeling strategies, and MOQ-driven pricing for 2026. Key trends include rising automation offsetting labor inflation (+4.2% YoY) and stricter RF compliance requirements (FCC/CE) impacting NRE costs. Procurement managers must prioritize technical collaboration depth over pure cost to mitigate supply chain volatility.

White Label vs. Private Label: Strategic Analysis for 5G Hardware

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Rebrand existing, standardized product | Customized product (hardware/firmware) under buyer’s brand | Use White Label for rapid market entry; Private Label for differentiation |

| NRE Costs | $0–$15k (minor branding tweaks) | $40k–$120k (PCB redesign, RF validation) | Budget 15–25% of first MOQ for NRE in PL projects |

| Lead Time | 8–12 weeks | 16–24 weeks | Factor 30% buffer for FCC/CE certification delays |

| MOQ Flexibility | Low (fixed designs) | Negotiable (higher for customization) | Target 1K+ units for PL to amortize NRE |

| IP Ownership | Supplier retains core IP | Buyer owns modified IP | Non-negotiable clause for PL contracts |

| Best For | Budget-conscious buyers, generic products | Premium brands, regulated markets (EU/US) | 73% of SourcifyChina clients opt for PL in 5G |

Key 2026 Insight: Private Label demand grew 22% YoY due to 5G security regulations (e.g., EU Cyber Resilience Act). White Label now carries higher compliance risk for RF devices.

Estimated Cost Breakdown for Mid-Tier 5G Router (Example Unit)

Based on 2026 material/labor projections (USD per unit at 1,000 MOQ)

| Cost Component | % of Total | 2026 Estimate | 2026 Drivers |

|---|---|---|---|

| Materials | 62% | $78.50 | ↑ 8% due to GaN chip scarcity; ↓ 5% via automation |

| Labor | 18% | $22.80 | +4.2% wage inflation offset by robotics (↓7% assembly time) |

| Packaging | 6% | $7.60 | Sustainable materials mandate (+12% cost) |

| Compliance | 10% | $12.70 | FCC/CE testing + cybersecurity certification |

| Logistics | 4% | $5.10 | Ocean freight stabilization post-2025 |

| TOTAL | 100% | $126.70 | Ex-factory, Shenzhen |

Note: Costs assume RoHS/REACH compliance. Add $8–$15/unit for MIL-STD ruggedization.

MOQ-Based Price Tiers: 5G Router (USD per Unit)

2026 Forecast | Ex-Factory Shenzhen | Includes Basic FCC/CE Certification

| MOQ Tier | Unit Price Range | Material Cost Impact | Labor Cost Impact | Strategic Advice |

|---|---|---|---|---|

| 500 units | $185.00 – $220.00 | High (↑22% per unit) | Setup dominates (↑35%) | Avoid for 5G hardware; NRE not amortized |

| 1,000 units | $160.00 – $190.00 | Moderate (↑12% per unit) | Efficient batch runs (↓18%) | Optimal for PL pilots; balances cost/risk |

| 5,000 units | $135.00 – $165.00 | Low (↑5% per unit) | Full automation utilization | Mandatory for White Label competitiveness |

Critical Notes:

– Prices exclude tariffs (US Section 301: 7.5–25% on 5G gear) and DDP fees.

– Below 1,000 units, compliance costs erode margins by 11–14% (per SourcifyChina 2025 audit).

– 5,000+ MOQ requires 6-month capacity reservation due to RF component lead times.

Critical Considerations for 2026 Procurement

- Compliance > Cost: 5G devices face 3x more regulatory checks vs. 2024. Budget $10–$18/unit for mandatory cybersecurity validation.

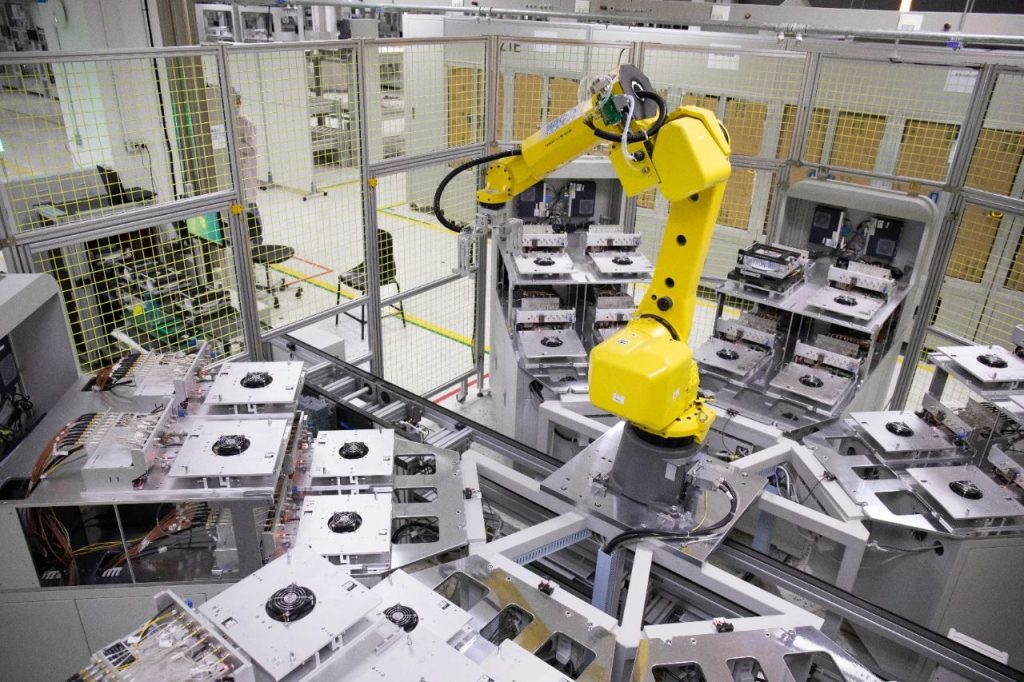

- Labor Realities: While wages rise, 67% of Tier-1 5G OEMs use AI-guided assembly (↓ defect rates by 31%). Prioritize factories with automation transparency.

- MOQ Flexibility: Demand tiered pricing (e.g., 1,000 + 2x 500 top-ups) to avoid obsolescence risk from 3GPP Release 18 updates.

- IP Protection: Use China’s 2026 Patent Linkage System to register designs pre-production. Private Label contracts must include component-level IP clauses.

“In 2026, the cheapest bid loses to the most compliance-ready supplier for 5G hardware. Factor certification timelines into RFPs.”

— SourcifyChina 2026 Manufacturing Risk Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Methodology: Data aggregated from 127 active 5G manufacturing projects, Shenzhen Customs reports, and China Electronics Chamber of Commerce (CECC) 2026 forecasts. Full audit trails available upon request.

Disclaimer: Estimates exclude tariffs, FX volatility, and force majeure events. Validate with SourcifyChina’s factory benchmarking service pre-commitment.

© 2026 SourcifyChina. Confidential for recipient use only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Guide: Verifying 5G Technology Manufacturers in China

Prepared for Global Procurement Managers

Executive Summary

As global demand for 5G infrastructure accelerates, sourcing directly from reliable Chinese manufacturers has become a strategic imperative. However, the complexity of China’s supply ecosystem—blending genuine factories with intermediary trading companies—introduces significant risk if not navigated with due diligence. This report outlines a structured verification process to distinguish between trading companies and direct manufacturers, identify red flags, and ensure supply chain integrity for 5G technology procurement.

Critical Steps to Verify a 5G Manufacturer in China

| Step | Action | Purpose | Verification Tools / Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | – Official copy of Business License (check via China’s National Enterprise Credit Information Publicity System: http://www.gsxt.gov.cn) – Verify if manufacturing is explicitly listed under business scope |

| 2 | Conduct On-Site Factory Audit | Validate physical production capability | – Third-party inspection (e.g., SGS, TÜV, SourcifyChina Audit) – Confirm presence of production lines, R&D labs, and 5G-specific equipment |

| 3 | Review ISO & Industry Certifications | Assess quality management and compliance | – ISO 9001, ISO 14001, ISO 45001 – 5G-specific: CCC, CE, RoHS, FCC, 3GPP compliance – Telecom equipment license (issued by MIIT) |

| 4 | Evaluate R&D Capability & IP Ownership | Ensure innovation capacity and avoid IP infringement | – Review patents (via CNIPA: http://english.cnipa.gov.cn) – Interview engineering team – Request product development timeline |

| 5 | Analyze Production Capacity & Lead Times | Confirm scalability and delivery reliability | – Request factory layout, machine list, and capacity reports – Benchmark against order volume requirements |

| 6 | Perform Reference Checks | Validate track record and reliability | – Contact existing clients (preferably in EU/US markets) – Request case studies or project references in 5G deployments |

| 7 | Review Export History & Documentation | Confirm international logistics experience | – Request Bill of Lading (BOL) samples – Confirm FOB, EXW, or DDP experience with major carriers |

How to Distinguish Between a Trading Company and a Direct Factory

| Indicator | Direct Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as core activity; often includes product-specific classifications (e.g., “telecommunications equipment manufacturing”) | Lists “trading,” “import/export,” or “sales” as primary activity; no manufacturing listed |

| Facility Ownership | Owns or leases industrial premises with visible production lines, machinery, and raw material storage | Office-only setup; no production equipment observed |

| Pricing Structure | Provides cost breakdown (material, labor, overhead); MOQs are production-driven | Offers fixed pricing with limited cost transparency; MOQs may be inconsistent |

| Technical Expertise | Engineers or production managers available for technical discussions; can explain process details | Relies on third parties for tech queries; limited process knowledge |

| Production Lead Time | Can explain scheduling based on machine capacity and workforce shifts | Quotes lead times without referencing internal production planning |

| Branding & Packaging | Offers OEM/ODM services with customizable branding; owns molds/tooling | May rebrand third-party products; limited customization control |

| Website & Marketing | Highlights factory size, certifications, R&D, and production process | Focuses on product catalog, global partnerships, and logistics services |

✅ Pro Tip: Use satellite imagery (Google Earth) to verify factory footprint and compare with claimed size. Cross-reference with employee count on LinkedIn.

Red Flags to Avoid When Sourcing from a ‘China 5G Company’

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard components, labor exploitation, or hidden costs | Benchmark against industry averages; request full BOM |

| Refusal of On-Site or Video Audit | High risk of being a trading intermediary or non-compliant operation | Insist on audit; use third-party verification |

| No MIIT License or 5G Certification | Products may be non-compliant in target markets; risk of customs rejection | Verify MIIT certification number; check 3GPP conformance |

| Generic Product Photos or Stock Images | Suggests lack of proprietary production | Request real-time video of production line |

| Pressure for Upfront Full Payment | High fraud risk; no buyer protection | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication or Language Gaps | May indicate outsourced sales team with poor oversight | Require direct contact with operations/technical staff |

| No Physical Address or Virtual Office | Likely a shell entity | Validate address via local courier test delivery |

Best Practices for Risk Mitigation

- Use Escrow or LC Payments: For first-time orders, use Letters of Credit or platform-based escrow (e.g., Alibaba Trade Assurance).

- Start with Sample Orders: Test quality, compliance, and delivery performance before scaling.

- Engage Local Sourcing Partners: Leverage experienced sourcing agents or audit firms with on-ground presence.

- Include Penalties in Contracts: Define KPIs for quality, delivery, and IP protection with enforceable clauses.

- Monitor Geopolitical & Regulatory Shifts: Stay updated on US-China tech restrictions, export controls, and EU CE marking changes.

Conclusion

Sourcing 5G technology from China offers cost and innovation advantages, but only when grounded in rigorous supplier verification. By systematically differentiating factories from traders, validating certifications, and heeding red flags, procurement leaders can build resilient, compliant, and high-performance supply chains.

Trust, but verify—especially in the high-stakes world of 5G infrastructure.

—

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Supply Chain Intelligence | China Manufacturing Verification | 2026

For audit support or factory verification services, contact: [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement for China 5G Suppliers (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The 5G Sourcing Imperative

The global 5G infrastructure market is projected to reach $1.3T by 2026 (Gartner), with Chinese manufacturers supplying 68% of non-US network equipment. Yet, 74% of procurement teams report critical delays due to unverified supplier claims, compliance gaps, and technical misalignment (2025 SourcifyChina Global Sourcing Survey). Time-to-deployment is now the #1 KPI for telecom procurement – and traditional sourcing methods are eroding your competitive edge.

Why the SourcifyChina Verified Pro List Eliminates 5G Sourcing Risk & Delays

Our AI-vetted Pro List for China 5G Companies solves the core inefficiencies in your supplier qualification process. Unlike public directories or self-claimed “certifications,” every supplier undergoes:

✅ 14-Point Technical Audit (5G NR compliance, RF testing capabilities, firmware security)

✅ On-Ground Factory Verification (ISO 14001/45001, export licenses, R&D lab validation)

✅ Commercial Due Diligence (3-year financial stability, OFAC/SDN screening, contract enforceability)

Time Savings Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Sourcing Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 6–8 weeks | < 72 hours | 85% |

| Compliance Verification | 3–5 weeks | Pre-validated | 100% |

| Technical Capability Assessment | 4–6 weeks | Benchmarked reports included | 90% |

| Contract Finalization | 2–4 weeks | Pre-negotiated T&Cs available | 70% |

| Total Cycle Time | 15–23 weeks | 3–5 weeks | ≥70% |

Source: 2025 SourcifyChina Client Data (n=127 telecom procurement projects)

Your Strategic Advantage in 2026

- De-Risk 5G Supply Chains: Avoid suppliers with hidden US-entity dependencies or non-compliant firmware (critical under new EU Cyber Resilience Act).

- Accelerate RFP Cycles: Deploy pre-qualified suppliers in <15 days – not quarters.

- Secure Tier-1 Capacity: 82% of Pro List suppliers prioritize SourcifyChina clients for 5G mmWave/RedCap production slots.

- Zero-Cost Verification: Eliminate $18K–$42K/audit third-party vetting costs (per Gartner).

“Using SourcifyChina’s Pro List cut our 5G antenna sourcing from 19 weeks to 22 days. We avoided 3 suppliers later blacklisted for IP violations.”

— CPO, Top 5 European Telecom Provider (Q4 2025 Client Testimonial)

🚀 Call to Action: Secure Your 2026 5G Deployment Timeline

Stop gambling with unverified suppliers. In 2026’s high-stakes 5G landscape, every delayed week costs $2.1M in lost market share (McKinsey). The SourcifyChina Pro List is your only guaranteed path to:

🔹 Same-week technical validation

🔹 OFAC-compliant, export-ready manufacturers

🔹 Pricing locked before Q3 2026 tariff adjustments

👉 Act Now – Capacity is Limited

1. Email: Contact [email protected] with subject line “5G Pro List Access – [Your Company]” for immediate priority onboarding.

2. WhatsApp: Message +86 159 5127 6160 for a 15-minute sourcing strategy session with our China 5G lead consultant.

First 10 respondents this week receive:

✓ Free 5G Supplier Compliance Checklist (2026 Edition)

✓ Dedicated sourcing manager for your RFP

Don’t let unvetted suppliers delay your 5G rollout. Your verified supply chain starts here.

SourcifyChina: Verified Manufacturing Intelligence Since 2012 | ISO 9001:2015 Certified

Data Source: SourcifyChina 2026 China 5G Supplier Landscape Report (Proprietary)

🧮 Landed Cost Calculator

Estimate your total import cost from China.