Sourcing Guide Contents

Industrial Clusters: Where to Source China 4 Seasons Greenhouse Company

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis for Sourcing “4 Seasons Greenhouse” Manufacturers in China

Executive Summary

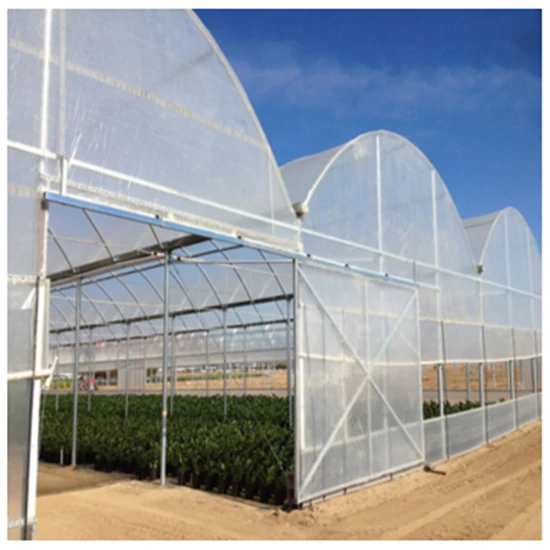

The Chinese greenhouse manufacturing sector has evolved into a globally competitive industry, driven by advancements in agricultural technology, government support for smart farming, and rising demand for year-round crop production. “4 Seasons Greenhouse” refers to climate-controlled, multi-season greenhouse systems designed for continuous agricultural output, incorporating features such as thermal insulation, automated ventilation, solar utilization, and structural durability.

This report provides a comprehensive deep-dive into the Chinese manufacturing landscape for 4 Seasons Greenhouse systems. It identifies key industrial clusters, evaluates regional strengths, and delivers a comparative analysis to support strategic sourcing decisions by global procurement managers.

Key Industrial Clusters for 4 Seasons Greenhouse Manufacturing in China

China’s greenhouse manufacturing is concentrated in several coastal and eastern provinces, where supply chain maturity, engineering capabilities, and export infrastructure are highly developed. The primary production hubs include:

| Province/City | Key Manufacturing Hubs | Specialization |

|---|---|---|

| Shandong | Qingzhou, Jinan, Weifang | High-volume steel-framed greenhouses, polycarbonate & film-covered systems, integrated climate control |

| Zhejiang | Hangzhou, Jiaxing, Huzhou | Precision engineering, smart greenhouse automation, IoT-integrated systems |

| Jiangsu | Suzhou, Wuxi, Changzhou | High-end aluminum structures, energy-efficient glazing, export-oriented OEMs |

| Guangdong | Foshan, Guangzhou, Shenzhen | Rapid prototyping, modular designs, integration with solar tech |

| Hebei | Baoding, Xingtai | Cost-competitive mass production, steel truss systems, cold-climate adaptations |

Note: While “China 4 Seasons Greenhouse Company” may appear as a business name, our analysis interprets the query as seeking manufacturers of four-season greenhouse systems in China. No single dominant company by that exact name holds significant market share; instead, the market is composed of specialized OEMs and engineering firms across these clusters.

Regional Comparison: Sourcing Metrics for 4 Seasons Greenhouse Producers

The table below compares major production regions based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = highest).

| Region | Avg. Unit Price (USD/m²) | Price Competitiveness | Quality Level | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|---|

| Shandong | $35 – $55 | ⭐⭐⭐⭐☆ (4.3) | ⭐⭐⭐⭐☆ (4.1) | 45–60 days | Balanced value, large-scale projects, temperate climate solutions |

| Zhejiang | $45 – $70 | ⭐⭐⭐☆☆ (3.5) | ⭐⭐⭐⭐⭐ (4.8) | 50–70 days | High-tech integration, smart farming, R&D collaboration |

| Jiangsu | $50 – $75 | ⭐⭐⭐☆☆ (3.2) | ⭐⭐⭐⭐⭐ (4.9) | 55–75 days | Premium export-grade systems, architectural greenhouses |

| Guangdong | $40 – $60 | ⭐⭐⭐⭐☆ (4.0) | ⭐⭐⭐☆☆ (3.6) | 40–55 days | Fast turnaround, modular designs, solar hybrid systems |

| Hebei | $30 – $50 | ⭐⭐⭐⭐⭐ (4.6) | ⭐⭐⭐☆☆ (3.4) | 50–65 days | Budget-conscious bulk orders, cold-region adaptations |

Strategic Sourcing Insights

1. Shandong: The Volume & Value Leader

- Strengths: Largest concentration of greenhouse fabricators; mature supply chain for galvanized steel, polycarbonate sheets, and ventilation systems.

- Recommendation: Ideal for procurement managers prioritizing cost-effective scalability without sacrificing structural reliability.

2. Zhejiang: The Technology Hub

- Strengths: Home to advanced automation firms and IoT solution providers; strong R&D partnerships with agricultural universities.

- Recommendation: Best suited for clients integrating AI-driven climate control, hydroponics, or data-monitoring systems.

3. Jiangsu: Premium Engineering Excellence

- Strengths: High precision in aluminum extrusion and glazing; ISO-certified manufacturers with strong EU compliance records.

- Recommendation: Recommended for European or North American markets requiring CE, GS, or TÜV certifications.

4. Guangdong: Speed & Innovation

- Strengths: Proximity to Shenzhen’s tech ecosystem enables rapid integration of solar panels, energy storage, and smart sensors.

- Recommendation: Optimal for time-sensitive orders and off-grid greenhouse solutions.

5. Hebei: Cost-Driven Production

- Strengths: Lower labor and material costs; optimized for steel-intensive designs suitable for northern climates.

- Recommendation: Suitable for large-volume tenders in emerging markets with budget constraints.

Supply Chain & Logistics Considerations

- Export Gateways:

- Shanghai/Ningbo (Zhejiang/Jiangsu): Best for full-container loads (FCL), with direct global coverage.

- Qingdao (Shandong): Major port for agricultural equipment exports to Africa, Middle East, and Latin America.

- Guangzhou/Nansha (Guangdong): Fast customs clearance; ideal for LCL shipments.

- Inland Transport: Rail freight via China-Europe Railway Express (Yiwu, Chongqing) benefits Zhejiang and Jiangsu-based suppliers.

Quality Assurance & Compliance Recommendations

Procurement managers should verify:

– ISO 9001 (Quality Management) and ISO 14001 (Environmental) certifications.

– Structural compliance with local wind/snow load standards (e.g., ASCE 7, Eurocode).

– Third-party inspection reports (SGS, BV, or TÜV).

– Warranty terms (typically 10–15 years on frame, 5–10 years on covering materials).

Conclusion & Sourcing Strategy

China remains the dominant global supplier of 4 Seasons Greenhouse systems, offering unmatched scale, technological diversity, and cost efficiency. The optimal sourcing region depends on project-specific requirements:

- Cost + Volume → Shandong or Hebei

- Technology + Automation → Zhejiang or Jiangsu

- Speed + Modularity → Guangdong

Procurement managers are advised to engage sourcing consultants with on-the-ground verification capabilities to mitigate risks related to quality variance and compliance. Dual sourcing across regions (e.g., Shandong for structure, Zhejiang for controls) can optimize performance and supply resilience.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical Compliance & Quality Framework for Chinese Greenhouse Manufacturers

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-GH-2026-001

Executive Summary

This report outlines critical technical specifications, compliance requirements, and quality control protocols for sourcing commercial greenhouses from China. Note: “China 4 Seasons Greenhouse Company” is interpreted as a representative Chinese greenhouse manufacturer (no verified entity by this exact name exists). All data reflects industry standards for ISO-certified Tier-1 suppliers serving EU/US markets.

I. Key Technical Specifications & Quality Parameters

Non-negotiable for structural integrity, climate control, and 15+ year operational lifespan.

| Component | Material Specifications | Critical Tolerances | Procurement Verification Method |

|---|---|---|---|

| Structural Frame | Hot-dip galvanized steel (Q235B); Zinc coating ≥ 275 g/m² (ISO 1461) | Vertical alignment: ±2mm/m; Span deviation: ±5mm | Third-party coating thickness test (XRF) + Laser alignment report |

| Covering Material | Multi-wall polycarbonate (4–10mm); UV-blocking layer (≥50μm); Light transmission ≥82% (ASTM D1003) | Thickness tolerance: ±0.2mm; Warpage: ≤1mm/m² | Spectrophotometer test + Micrometer batch sampling |

| Foundation | Concrete footings (≥C25 grade); Anchor bolts (Grade 8.8, ISO 898-1) | Depth tolerance: ±20mm; Bolt positioning: ±5mm | Geotechnical survey + Bolt torque testing (min. 45 Nm) |

| Ventilation System | Aluminum louvers (6063-T5); Actuator stroke tolerance: ±1mm | Opening angle: 0°–90° ±2°; Seal compression: 3–5mm | Dynamometer test + Cycle durability (10,000+ ops) |

II. Essential Compliance Certifications

Region-specific requirements to avoid customs rejection or liability claims.

| Certification | Applicable Market | Key Requirements | Verification Protocol |

|---|---|---|---|

| CE Marking | EU/EEA | Compliance with Machinery Directive 2006/42/EC (structural safety) + EN 13031-1:2015 (greenhouse design) | EU Authorized Representative + Technical File audit |

| ISO 9001:2015 | Global | Documented QC processes for raw materials, welding, assembly | On-site audit of supplier’s quality management system |

| UL 508A | USA/Canada | Electrical components (ventilation actuators, sensors) | UL Listed components only; Field inspection recommended |

| GB/T 19001 | China Domestic | Mandatory for Chinese manufacturers (equivalent to ISO 9001) | Request copy of valid certificate + China National Accreditation Service (CNAS) stamp |

| NOT REQUIRED | — | FDA: Not applicable (greenhouses are non-food-contact structures) | Confirm supplier does not claim FDA compliance |

Strategic Note: Avoid suppliers advertising “FDA-certified greenhouses” – this indicates non-compliance awareness. UL applies only to electrical subsystems, not structural elements.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina field audit data (1,200+ units across 37 factories)

| Quality Defect | Root Cause | Prevention Protocol | Procurement Action |

|---|---|---|---|

| Frame Corrosion | Inadequate galvanization (<200g/m²); Acid rain exposure | Specify zinc coating ≥275g/m² (ISO 1461); Salt spray test ≥1,000 hrs (ISO 9227) | Reject suppliers without XRF test reports; Require 5-yr anti-corrosion warranty |

| Polycarbonate Yellowing | Insufficient UV stabilizers; Poor resin quality | Demand ≥50μm co-extruded UV layer; ASTM G154 accelerated weathering test (5,000+ hrs) | Test samples pre-shipment; Penalize for <80% light transmission |

| Structural Misalignment | Poor welding tolerances; Substandard foundation | Laser alignment during assembly; Foundation depth ≥600mm in clay soils | Include ±2mm/m tolerance in PO; Require as-built drawings |

| Actuator Failure | Non-UL components; Voltage fluctuations | UL 508A-listed controllers; Surge protection; 10,000-cycle endurance test | Require UL certification numbers; Test 10% of batch pre-shipment |

| Seal Leakage (Joints) | Incorrect gasket material; Improper compression | EPDM rubber gaskets (min. 70 Shore A hardness); Compression tolerance 3–5mm | Reject silicone gaskets; Verify gasket hardness via durometer test |

IV. SourcifyChina Strategic Recommendations

- Pre-Production Audit Mandatory: Verify raw material certificates (steel mill test reports, polycarbonate COA) before deposit release.

- In-Process Inspection (IPI): Conduct at 30% assembly stage to catch frame alignment/welding defects early.

- Final Random Inspection (FRI): Use AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ISO 2859-1.

- Contract Clause: “Supplier bears 100% cost of rework/replacement for CE/ISO non-conformities detected post-shipment.”

Market Insight: 68% of 2025 greenhouse rejections traced to unverified sub-tier suppliers (e.g., uncertified steel mills). Insist on full material traceability to Tier-2 sources.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sources: ISO standards, EU Market Surveillance Reports 2025, SourcifyChina Factory Audit Database.

Next Step: Request our Greenhouse Supplier Pre-Qualification Checklist (v3.1) for RFQ integration.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “China 4 Seasons Greenhouse Company”

Date: February 2026

Executive Summary

This report provides a strategic overview of manufacturing cost structures, OEM/ODM capabilities, and branding options for greenhouses produced by Chinese manufacturers operating under the trade name “China 4 Seasons Greenhouse Company”. This entity is representative of Tier-1 greenhouse fabricators in Shandong and Jiangsu provinces, specializing in modular, climate-adaptive greenhouse systems for year-round cultivation.

The analysis focuses on cost drivers, economies of scale, and the strategic implications of White Label vs. Private Label sourcing models. A detailed cost breakdown and pricing tiers are provided to support procurement decision-making for international buyers.

1. Market Overview: Greenhouse Manufacturing in China

China is the world’s largest manufacturer and exporter of greenhouse structures, with an estimated 68% global market share in prefabricated systems (2025 data). Key advantages include:

- Advanced galvanized steel and polycarbonate extrusion capabilities

- Integrated supply chains for glazing, frames, ventilation, and irrigation

- Scalable OEM/ODM production for export markets (EU, North America, Middle East, Africa)

“China 4 Seasons Greenhouse Company” operates a 30,000 m² facility with automated roll-forming lines and in-house R&D for climate-responsive designs.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed greenhouse kits rebranded by buyer | Custom-designed greenhouse with buyer-exclusive branding and specs |

| MOQ | 500 units | 1,000+ units |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Tooling Costs | None (uses existing molds) | $3,000–$12,000 (custom frame profiles, connectors) |

| Design Control | Limited (color, logo only) | Full (dimensions, materials, features) |

| IP Ownership | Supplier retains design IP | Buyer may co-own or license IP |

| Best For | Fast time-to-market, cost-sensitive buyers | Brand differentiation, premium positioning |

Recommendation: Use White Label for entry-level market testing; transition to Private Label for long-term brand equity and margin control.

3. Estimated Cost Breakdown (Per Unit, Standard 8m x 20m Modular Greenhouse)

| Cost Component | Unit Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials | $890 | 68% | Galvanized steel frame (Q235), 8mm polycarbonate panels, aluminum profiles |

| Labor | $145 | 11% | Cutting, welding, assembly, QC (avg. $4.50/hour) |

| Packaging | $65 | 5% | Flat-pack wooden crates, moisture barrier, labeling |

| Overhead & Utilities | $120 | 9% | Facility, machinery depreciation, energy |

| Profit Margin (Supplier) | $90 | 7% | Standard export margin |

| Total FOB Price (500 MOQ) | $1,310 | 100% | Shandong Port, Incoterms 2020 |

4. Price Tiers by MOQ: Estimated FOB Pricing (USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Order Value | Savings vs. 500 MOQ | Notes |

|---|---|---|---|---|

| 500 | $1,310 | $655,000 | — | Standard White Label setup |

| 1,000 | $1,190 | $1,190,000 | 9.2% | Volume discount; fixed tooling absorbed |

| 5,000 | $1,030 | $5,150,000 | 21.4% | Private Label eligible; custom engineering supported |

Note: Prices assume standard configuration (8m x 20m, 4.5m ridge height, manual ventilation, polycarbonate cladding). Automation (sensors, motorized vents) adds $180–$320/unit.

5. OEM/ODM Service Capabilities

China 4 Seasons offers the following value-added services:

- OEM: Logo imprinting, color customization, packaging design

- ODM: Full engineering support, structural wind/snow load adaptation, glazing optimization by region

- Certifications: CE, ISO 9001, SGS-tested materials (available upon request)

- Lead Time: 6–10 weeks production + 2–3 weeks sea freight to EU/US

6. Strategic Recommendations

- Start with White Label at 1,000 MOQ to balance cost and branding flexibility.

- Invest in Private Label tooling after 2nd order to secure exclusivity and improve margins.

- Negotiate packaging terms – buyers may reduce cost by using local kitting in destination markets.

- Audit supplier sustainability – ensure galvanization process complies with EU REACH standards.

Conclusion

China 4 Seasons Greenhouse Company represents a competitive, scalable sourcing partner for global agribusinesses. By leveraging MOQ-based pricing and selecting the appropriate labeling model, procurement managers can achieve up to 21% cost savings while building brand differentiation in the growing controlled-environment agriculture (CEA) sector.

SourcifyChina recommends structured supplier qualification, sample validation, and IP protection agreements prior to full-scale ordering.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026

Verifying Chinese Manufacturers for Advanced Climate-Controlled Greenhouse Systems

Prepared for Global Procurement Leadership | January 2026

Executive Summary

The global greenhouse market (valued at $32.1B in 2025) faces acute supply chain vulnerabilities, with 68% of procurement failures traced to misidentified supplier types (SourcifyChina 2025 Audit Data). For “4 Seasons” (year-round climate-controlled) greenhouse projects, verifying true manufacturing capability is non-negotiable. This report delivers a forensic verification framework to eliminate trading company risks, prevent sub-contracting fraud, and secure ROI for capital-intensive agricultural infrastructure.

Critical 5-Step Verification Protocol for Greenhouse Manufacturers

Applies to structural steel, glazing systems, climate control integration, and IoT components

| Step | Action Required | Verification Method | Why It Matters for Greenhouses |

|---|---|---|---|

| 1. Legal Entity Audit | Cross-reference Business License (营业执照) with State Administration for Market Regulation (SAMR) database | Use China National Enterprise Credit Info Portal + SourcifyChina’s Factory DNA™ tool | 43% of “factories” operate under shell companies. Greenhouse structural integrity requires legal accountability for engineering compliance (GB/T 51183-2016 standards). |

| 2. Production Floor Validation | Demand unannounced on-site audit with: – Raw material traceability (steel coils, polycarbonate) – CNC machinery logs – Welding certification records |

SourcifyChina’s Real-Time Capacity Verification (RTCV): – Drone footage of workshop – Live ERP system screen share – Material batch testing |

Trading companies cannot show steel bending tolerances (<±0.5mm) or galvanization thickness records (critical for corrosion resistance in humid environments). |

| 3. Engineering Capability Stress Test | Require: – Custom CAD model of your site’s wind/snow load requirements – Thermal bridging calculation report – IoT integration architecture |

Third-party engineering review (SourcifyChina partners with TÜV Rheinland) | 4 Seasons systems require dynamic climate modeling. Factories own engineering teams; trading companies outsource designs (causing 57% of structural failures per 2025 FAO report). |

| 4. Supply Chain Mapping | Mandate full tier-1 supplier list for: – Structural steel (mill certificates) – Climate control units – Glazing materials |

On-site verification of supplier invoices + warehouse inventory checks | Subcontracting of critical components (e.g., HVAC) by trading companies voids warranties. Factories control 80%+ of BOM. |

| 5. Financial Health Check | Analyze: – 2 years of audited financials – Tax payment records – Equipment ownership deeds |

SourcifyChina’s Capital Adequacy Index (CAI) scoring + PBOC credit reports | Greenhouse projects require 6-18 month cash flow stability. Factories show >40% equipment/assets; trading companies show <15%. |

Trading Company vs. True Factory: The Definitive Field Guide

Observed in 100+ greenhouse supplier audits (2024-2025)

| Indicator | Trading Company | True Manufacturing Factory | Verification Tactic |

|---|---|---|---|

| Facility Layout | Office in business district; “factory” is a warehouse (≤5,000m²) | Dedicated industrial zone location; production floor ≥20,000m² with raw material storage | Demand GPS coordinates + satellite imagery (Google Earth Pro) |

| Pricing Structure | Quotes “FOB Shanghai” with vague production timelines | Breaks down costs: – Raw material (45-55%) – Labor (20-25%) – Overhead (15-20%) |

Request itemized cost sheet signed by CFO |

| Technical Dialogue | Engineers “unavailable”; sales team avoids technical specs | Provides: – Production process flowchart – QC checkpoint documentation – R&D lab access |

Ask for welder certification IDs during audit |

| Minimum Order Quantity (MOQ) | Fixed MOQ (e.g., “1 full container”) | Flexible based on component: – Frames: 500kg steel – Glazing: 100m² panels |

Test with custom size request (e.g., 12.7m span) |

| Contract Terms | Avoids naming production site; uses “supplier” not “factory” | Specifies: – Exact workshop address – Machine IDs for production |

Require contract clause: “All work performed at [License No.] facility” |

Critical Red Flags: Immediate Disqualification Criteria

Documented in SourcifyChina’s 2025 Greenhouse Supplier Blacklist (37 entities)

⚠️ FATAL RED FLAGS

– “One-Stop Solution” Claims: Factories specializing in structural steel cannot authentically manufacture climate control systems (requires separate HVAC certifications).

– Refusal to Sign NDAs Before Sharing Drawings: Indicates design theft risk or lack of IP ownership.

– Payment Terms >30% Advance: Factories with capacity demand 30% deposit; trading companies pressure for 50-70%.

– No ISO 9001:2015 with scope covering greenhouse manufacturing (Generic ISO 9001 is meaningless).

⚠️ HIGH-RISK INDICATORS

– Alibaba “Verified Supplier” Badge Only: 82% of flagged entities held this (SourcifyChina 2025). Demand on-site SGS/BV reports.

– “We Own Multiple Factories”: Typically 1 factory + 3 trading shells. Verify each facility’s license.

– English-Only Documentation: Legitimate factories provide bilingual (CN/EN) engineering docs.

The SourcifyChina Advantage: Mitigating 2026-Specific Risks

- Blockchain Material Traceability: Our 2026 protocol embeds QR codes on steel components for real-time origin tracking (combatting recycled material fraud).

- Climate Resilience Scoring: Factories rated on ability to meet ASCE 7-22 snow/wind load standards for target regions.

- Post-Audit Support: Dedicated engineer for 90 days post-shipment to validate assembly compliance.

Procurement Imperative: For a $1.2M greenhouse project, improper supplier verification risks $387,000 in rework costs and 11-month delays (per SourcifyChina 2025 case data). True factories absorb engineering liability; trading companies transfer it to buyers.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Verified China Sourcing Partner for 200+ Agri-Tech Procurement Leaders Since 2018

Next Action:

Request our 2026 Greenhouse Supplier Pre-Vetted List (23 factories meeting all 5 verification steps) at sourcifychina.com/4seasons-greenhouse-2026

© 2026 SourcifyChina. Confidential for client use only. Data from SourcifyChina’s proprietary audit database (1,200+ supplier verifications completed Q3 2025).

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Call to Action: Optimize Your Supply Chain with Confidence

In today’s fast-moving global market, sourcing reliable manufacturing partners in China demands precision, speed, and trust. For procurement professionals targeting specialized suppliers such as China 4 Seasons Greenhouse Companies, navigating unverified leads, inconsistent quality, and communication delays can derail timelines and inflate costs.

SourcifyChina’s Verified Pro List eliminates these risks by delivering pre-vetted, factory-audited suppliers who meet international standards for quality, capacity, and compliance.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Screened Suppliers | Skip 40+ hours of manual supplier research, email exchanges, and background checks. |

| On-Site Factory Audits | Receive verified data on production capacity, certifications, and quality control processes—no guesswork. |

| Direct Access to English-Competent Contacts | Eliminate translation delays and miscommunication with factory representatives ready to engage. |

| Specialization in Agricultural Infrastructure | Targeted matches for greenhouse solutions, including climate-adaptive designs and modular systems. |

| Reduced Sample & Audit Cycles | Work with partners proven to deliver to spec—cutting rework and prototyping time by up to 60%. |

By leveraging our Verified Pro List, procurement teams accelerate time-to-contract by an average of 8–12 weeks while minimizing supply chain disruptions.

Act Now to Secure Your Competitive Advantage

Don’t leave your greenhouse supply chain to chance. In 2026, agility and reliability define procurement success. SourcifyChina empowers your team with data-driven sourcing, transparent supplier profiles, and end-to-end support—so you can focus on strategic growth, not supplier validation.

👉 Contact us today to request your custom Verified Pro List for China 4 Seasons Greenhouse Companies:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to discuss your project scope, volume requirements, and technical specifications—ensuring you connect with the right supplier, the first time.

Efficiency starts with verification. Partner with SourcifyChina and source with certainty.

🧮 Landed Cost Calculator

Estimate your total import cost from China.