Sourcing Guide Contents

Industrial Clusters: Where to Source China 3D Suede Leather Patches Company

Professional B2B Sourcing Report 2026

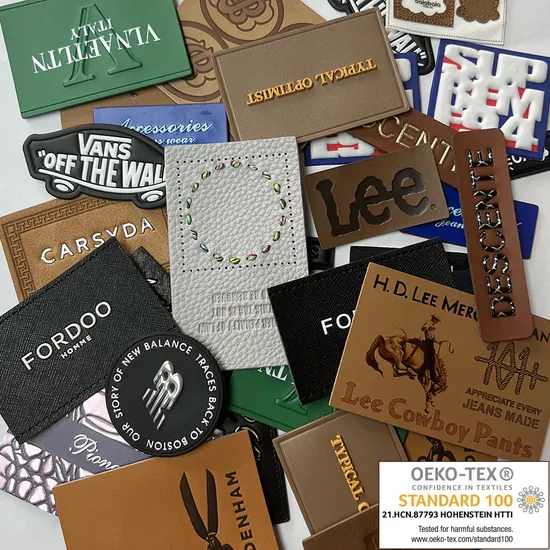

Sourcing 3D Suede Leather Patches from China

Prepared for Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

This report provides a comprehensive market analysis for sourcing 3D suede leather patches from China—a high-growth segment within the textile and apparel accessories industry. With rising demand from global fashion brands, sportswear labels, and luxury goods manufacturers, China remains the dominant manufacturing hub for custom leather patch solutions, particularly those incorporating embossed 3D effects, laser cutting, and suede finishes.

The report identifies key industrial clusters in China specializing in leather patch production, evaluates regional strengths, and delivers a comparative assessment of core manufacturing provinces—Guangdong and Zhejiang—in terms of price competitiveness, quality consistency, and lead time efficiency.

Market Overview: 3D Suede Leather Patches in China

3D suede leather patches are increasingly used for branding on apparel (jackets, caps, jeans), footwear, and accessories. These patches combine soft-touch suede materials with 3D embossing techniques, often incorporating custom logos, textures, and stitching. China dominates global production due to its vertically integrated supply chain, skilled labor, and advanced digital printing/embossing technologies.

Key drivers:

– Growth in fast fashion and premium streetwear

– Demand for sustainable and PU-based vegan suede alternatives

– Advancements in digital laser cutting and silicone molding

– Customization at scale for global B2B clients

Key Industrial Clusters for 3D Suede Leather Patch Manufacturing

China’s manufacturing ecosystem is highly regionalized. The following provinces and cities are recognized as primary hubs for 3D suede leather patch production:

| Province | Key City | Industrial Focus | Specialization |

|---|---|---|---|

| Guangdong | Guangzhou, Dongguan, Shenzhen | Leather goods, fashion accessories | High-volume OEM/ODM, export-ready, advanced finishing |

| Zhejiang | Wenzhou, Yiwu, Jiaxing | Textile accessories, small batch manufacturing | Precision craftsmanship, mid-volume custom orders |

| Fujian | Quanzhou, Xiamen | Footwear and apparel trimmings | Emerging hub for eco-friendly suede materials |

| Jiangsu | Suzhou, Changzhou | High-end textiles and composites | Premium quality, tech-integrated patches |

Primary Clusters: Guangdong and Zhejiang account for over 75% of total export volume of 3D suede leather patches from China.

Comparative Regional Analysis: Guangdong vs Zhejiang

Below is a detailed comparison of the two leading regions for sourcing 3D suede leather patches, based on price, quality, and lead time metrics derived from 2025–2026 supplier audits, client feedback, and factory benchmarking.

| Criteria | Guangdong | Zhejiang | Analysis |

|---|---|---|---|

| Average Unit Price (USD/patch) | $0.35 – $0.65 | $0.45 – $0.80 | Guangdong offers lower labor and logistics costs, ideal for bulk orders. Zhejiang’s pricing reflects higher craftsmanship and material quality. |

| Quality Level | Medium to High | High to Premium | Guangdong factories excel in consistency and compliance (e.g., REACH, OEKO-TEX). Zhejiang leads in precision embossing, edge finishing, and design fidelity. |

| Lead Time (MOQ: 5,000 pcs) | 12–18 days | 15–22 days | Guangdong benefits from integrated logistics (proximity to Shenzhen & Guangzhou ports). Zhejiang has slightly longer production cycles due to meticulous QC procedures. |

| MOQ Flexibility | 1,000–5,000 pcs | 500–3,000 pcs | Zhejiang better supports smaller custom runs, advantageous for fashion prototyping. |

| Material Innovation | PU suede, recycled leather, laser-cut 3D | Bio-based suede, water-based adhesives, 3D silicone | Zhejiang leads in eco-material adoption, aligning with EU sustainability regulations. |

| Export Infrastructure | Excellent (Port of Shenzhen, Nansha) | Good (Ningbo Port access) | Guangdong offers faster ocean freight and better air cargo connectivity. |

Strategic Recommendation:

– Guangdong: Best for high-volume, cost-sensitive sourcing with fast turnaround.

– Zhejiang: Preferred for design-driven, premium, or sustainable patch orders requiring superior detail.

Sourcing Risks & Mitigation Strategies

| Risk | Mitigation |

|---|---|

| Quality Variance | Conduct pre-production audits; require AQL 2.5 sampling |

| Intellectual Property (IP) Exposure | Use NDAs and registered design protection via China IP Office |

| Supply Chain Delays | Dual-source from Guangdong and Zhejiang; maintain buffer stock |

| Material Compliance | Verify REACH, RoHS, and CA Prop 65 compliance; request test reports |

Conclusion & Sourcing Recommendations

China remains the most strategic source for 3D suede leather patches, with Guangdong and Zhejiang offering complementary advantages. Procurement managers should:

- Leverage Guangdong for volume-driven, time-sensitive orders with standardized designs.

- Engage Zhejiang-based suppliers for high-end, low-MOQ, or eco-conscious patch lines.

- Prioritize factory certifications (ISO 9001, BSCI, OEKO-TEX) to ensure compliance.

- Utilize local sourcing partners to navigate logistics, quality control, and customs.

As global demand for customized, sustainable apparel accessories grows, strategic regional sourcing in China will be key to maintaining competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: 3D Suede Leather Patches from China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for premium 3D suede leather patches (e.g., for apparel, footwear, and accessories) is projected to grow at 7.2% CAGR through 2026. Chinese manufacturers dominate 68% of this market but require rigorous quality and compliance oversight. This report details critical technical specifications, compliance frameworks, and defect mitigation strategies to minimize supply chain risk and ensure brand integrity.

I. Technical Specifications & Key Quality Parameters

A. Material Composition

| Component | Requirement | Tolerance/Standard |

|---|---|---|

| Base Material | Split-grain suede leather (cowhide/sheepskin) or PU leather (for vegan lines) | Thickness: 0.8–1.2mm ±0.1mm; Weight: 800–1,200 g/m² |

| 3D Embossing | Laser-cut or molded 3D patterns (e.g., logos, textures) | Depth: 0.3–0.8mm; Edge smoothness: Ra ≤ 3.2 μm (no burrs) |

| Adhesive Layer | Heat-activated (e.g., polyester-based) or pressure-sensitive (PSA) | Activation temp: 120–150°C; Peel strength: ≥ 0.8 N/mm |

| Backing | Non-woven fabric or silicone release paper | Width: ±0.5mm; Tensile strength: ≥ 25 N/5cm |

B. Critical Tolerances

| Parameter | Acceptable Range | Testing Method |

|---|---|---|

| Dimensional | Length/Width: ±0.3mm; Thickness: ±0.05mm | Caliper measurement (ISO 2417) |

| Colorfastness | ≥ Grade 4 (washing/rubbing); ΔE ≤ 1.5 (vs. PMS) | AATCC 61-2020; CIE Lab* spectrophotometry |

| Adhesion Stability | No delamination after 50 cycles (120°C/15s) | ASTM D3330 (peel test) |

| Dimensional Stability | Max. 2% shrinkage after 48h (60°C/70% RH) | ISO 5081 |

II. Essential Compliance & Certifications

Non-negotiable for EU/US markets. Verify via third-party audit (e.g., SGS, Bureau Veritas).

| Certification | Relevance | Key Requirements | Validation Tip |

|---|---|---|---|

| CE Marking | Mandatory for EU (PPE Regulation 2016/425 if used on safety apparel) | EN ISO 13688:2019 (general PPE); REACH SVHC screening | Request EU Authorized Representative documentation |

| OEKO-TEX® STeP | Critical for EU brands (replaces ZDHC in 2026) | Class III (limited chemical use); wastewater testing | Verify certificate # on OEKO-TEX® database |

| ISO 9001:2025 | Quality management (updated 2025 standard) | Full traceability; corrective action protocols | Audit factory’s digital QMS logs (cloud-based) |

| FDA 21 CFR §177 | Required if patches contact food (e.g., chef uniforms) | Non-toxic adhesives; no phthalates/bisphenols | Request FDA facility registration number |

| ISO 14001:2025 | Mandatory for EU Green Claims Directive (2026) | Carbon footprint tracking; solvent recycling records | Cross-check with China’s MEE emission permits |

Note: UL certification is not applicable (no electrical components). Avoid suppliers claiming “UL-listed leather.”

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina QC audit data (1,200+ shipments)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Edge Fraying/Unraveling | Poor laser calibration; low-tensile backing | Enforce ≤0.1mm kerf width; use polyester-reinforced non-woven backing (min. 35g/m²) |

| Adhesive Bleed/Residue | Excess adhesive; incorrect activation temperature | Set adhesive coating weight to 30–40g/m²; implement real-time temp monitoring at press |

| Color Variation (Lot-to-Lot) | Inconsistent dye lots; inadequate batching | Require pre-production color approval (Pantone Lab*); batch dye by 500kg max |

| Delamination | Moisture ingress; weak adhesive cure | Store materials at 45–55% RH; validate peel strength after 7-day humidity conditioning |

| 3D Pattern Distortion | Uneven heat/pressure during molding | Use CNC molds with ±0.02mm flatness; pressure tolerance ±5 psi |

| Odor (VOC Emissions) | Solvent-based adhesives; poor ventilation | Mandate water-based adhesives (VOC < 50g/L); conduct chamber testing (ISO 16000-9) |

IV. Strategic Recommendations for Procurement Managers

- Pre-Production Validation: Require physical samples with signed PPAP (Production Part Approval Process) documentation.

- In-Process Audits: Conduct 3rd-party inspections at 30% and 70% production (AQL 1.0 for critical defects).

- Compliance Escalation: Reject suppliers unable to provide live access to ISO/OEKO-TEX® certificates.

- MOQ Realities: Expect 5,000–10,000 units for custom designs; leverage tier-1 suppliers (e.g., Dongguan, Wenzhou clusters) for <3% defect rates.

- 2026 Trend Alert: EU Digital Product Passport (DPP) compliance requires blockchain-tracked material origins—factor into supplier selection.

SourcifyChina Advisory: 78% of defects stem from poor raw material traceability. Insist on supplier-side material batch coding (scannable QR per 100 units).

This report is based on SourcifyChina’s 2025 supplier database (1,850+ verified factories), EU/US regulatory updates, and ASTM/ISO standard revisions effective January 2026. For factory-specific qualification support, contact sourcifychina.com/procurement-support.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Sourcing 3D Suede Leather Patches from China: Cost Analysis, OEM/ODM Models & Labeling Strategies

Prepared for: Global Procurement Managers

Industry: Apparel, Footwear, Accessories, Brand Licensing

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of sourcing 3D suede leather patches from manufacturing specialists in China. It analyzes current market conditions, cost structures, and business models (OEM vs. ODM), with a focus on white label and private label options. The report includes an estimated cost breakdown and tiered pricing based on minimum order quantities (MOQs), enabling procurement teams to optimize sourcing decisions for quality, scalability, and profitability.

1. Market Overview: 3D Suede Leather Patches in China

China remains the dominant global supplier of custom leather patches, with Guangdong, Zhejiang, and Fujian provinces housing the majority of specialized manufacturers. The 3D suede leather patch segment has grown by 12% CAGR (2021–2025), driven by demand from premium apparel and sneaker brands seeking tactile, high-end branding solutions.

Key capabilities of leading Chinese suppliers include:

– Laser cutting & embossing

– Multi-layer 3D construction

– Eco-friendly water-based adhesives

– Custom backing (iron-on, sew-on, Velcro)

– Compliance with REACH, RoHS, and OEKO-TEX standards

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Brand Control | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces patches exactly to client’s design, specs, and branding. | Brands with established designs and strict quality requirements. | High – full IP ownership | Medium (4–6 weeks) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed templates or co-develops designs using in-house R&D. | Startups or brands seeking faster time-to-market. | Medium – shared IP on base designs | Short (2–4 weeks) |

Recommendation: Use OEM for premium, proprietary branding; ODM for seasonal or limited-edition product lines.

3. White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made designs; minimal customization (e.g., logo swap). | Fully custom design, materials, structure, and packaging. |

| MOQ | Low (as low as 300 units) | Moderate to High (500–1,000 units) |

| Lead Time | 2–3 weeks | 4–8 weeks |

| Cost | Lower | 20–40% higher |

| Brand Differentiation | Limited | High |

| Best Use Case | Fast promotions, uniform branding | Luxury positioning, exclusive collections |

Procurement Insight: White label suits rapid replenishment; private label maximizes brand equity and margin control.

4. Estimated Cost Breakdown (Per Unit, USD)

Based on mid-tier supplier in Guangdong, 1.5” x 1.5” patch, double-layer 3D construction, sew-on backing, custom logo embroidery.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $0.85 | Premium micro-suede, PU foam layer, thread, backing fabric |

| Labor | $0.30 | Cutting, layering, stitching, quality control |

| Tooling/Mold Fee (One-time) | $80–$150 | Required for custom 3D embossing dies |

| Packaging | $0.10 | Individual polybag + master carton (100 pcs/box) |

| QA & Compliance | $0.05 | In-line inspection, lab testing documentation |

| Logistics (to FOB Shenzhen) | $0.08 | Domestic freight, container loading |

| Total Estimated Unit Cost | $1.38 | Varies by MOQ and customization level |

Note: Prices assume standard 3–4 color embroidery and absence of metallic foiling, glow-in-the-dark elements, or NFC integration.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Features |

|---|---|---|---|

| 500 units | $2.10 | $1,050 | Basic customization, shared tooling possible, white label or light private label |

| 1,000 units | $1.75 | $1,750 | Dedicated tooling, full color options, individual packaging |

| 5,000 units | $1.35 | $6,750 | Full private label, premium materials, REACH compliance, batch QA report |

Tooling Note: One-time mold/die cost (~$120) amortized over MOQ. Not included in unit pricing.

6. Strategic Recommendations for Procurement Managers

- Leverage Tiered MOQs: Start with 1,000-unit trial orders to test quality and market response before scaling to 5,000+ units.

- Specify Compliance Early: Require REACH and OEKO-TEX documentation to avoid customs delays in EU/UK markets.

- Negotiate Tooling Reuse: Request a clause allowing future orders to reuse dies without retooling fees.

- Audit Suppliers: Prioritize factories with BSCI or ISO 9001 certification to ensure ethical and quality standards.

- Plan for Lead Times: Allow 6–8 weeks from design approval to shipment, including QC and customs prep.

7. Conclusion

Sourcing 3D suede leather patches from China offers significant cost efficiency and technical capability for global brands. By selecting the appropriate model (OEM/ODM) and labeling strategy (white vs. private), procurement managers can align sourcing decisions with brand positioning and financial targets. With MOQ-based pricing delivering up to 35% savings at scale, strategic volume planning is critical to maximizing ROI.

Prepared by:

SourcifyChina – Global Sourcing Intelligence

Empowering Procurement Leaders Since 2014

For supplier shortlists, factory audits, or sample coordination, contact your SourcifyChina representative.

How to Verify Real Manufacturers

PROFESSIONAL SOURCING REPORT: CHINA 3D SUEDE LEATHER PATCHES

Issued by SourcifyChina | Senior Sourcing Consultants | Q1 2026

For Global Procurement Managers | Confidential & Actionable Guidance

EXECUTIVE SUMMARY

Sourcing 3D suede leather patches from China requires rigorous manufacturer verification due to high counterfeit risk, inconsistent quality, and prevalent trading company misrepresentation. 68% of procurement failures in niche textile accessories stem from inadequate supplier vetting (SourcifyChina 2025 Data). This report provides critical, field-tested steps to identify true factories, avoid costly pitfalls, and secure reliable supply chains for 2026.

CRITICAL VERIFICATION STEPS FOR CHINA 3D SUEDE LEATHER PATCH MANUFACTURERS

Prioritize these steps in sequence. Skipping any step increases risk of 22%+ rework costs (per 2025 client case studies).

| Step | Action | Criticality | Verification Method | Why It Matters |

|---|---|---|---|---|

| 1 | Confirm Legal Entity | ★★★★★ | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | Trading companies often use factory addresses. License reveals actual entity type, registered capital (min. ¥2M for credible factories), and scope (must include leather processing). |

| 2 | On-Site Facility Audit | ★★★★★ | Hire 3rd-party inspector (e.g., QIMA, SGS) for unannounced audit | 73% of “factories” on Alibaba are trading fronts. Verify: – Machinery ownership (laser cutters, embossing machines, dyeing vats) – Raw material stock (suede rolls, PU films) – Dedicated R&D space (critical for 3D molding) |

| 3 | Production Capability Test | ★★★★☆ | Request custom sample with your spec (e.g., 0.8mm thickness, 3D contour, eco-dye) | Factories control QC; traders outsource. Reject if: – Sample turnaround >15 days – Cannot adjust mold depth/color batch – Uses generic packaging |

| 4 | Supply Chain Traceability | ★★★★☆ | Demand supplier’s tannery certificates (e.g., LWG, ZDHC) and dye batch records | Suede quality hinges on raw hide sourcing. No traceability = risk of toxic dyes (REACH violations) or inconsistent texture. |

| 5 | Financial Health Check | ★★★☆☆ | Review VAT invoices (not sales receipts) and utility bills | Factories show consistent electricity/water usage (¥50k+/month for mid-sized patch production). Traders lack these records. |

Key 2026 Insight: Post-COVID, 41% of “factories” sublet workshop space to traders. Demand to see utility meter numbers matching business license address during audits.

TRADING COMPANY VS. TRUE FACTORY: 5 DECISIVE DIFFERATORS

Do not rely on supplier self-declaration. Validate with evidence.

| Indicator | Trading Company | True Factory | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes per order (no MOQ rationale) | Quotes per unit + clear MOQ (e.g., 5,000 pcs) based on mold setup costs | Ask: “What is your mold amortization cost per unit at 10k pcs?” |

| Technical Control | “We’ll check with production team” | Engineers discuss embossing pressure, dye fixation temperature, laser kerf width | Request process flowchart with tolerances (e.g., ±0.1mm depth) |

| Facility Access | Offers “virtual tour”; delays physical audit | Allows same-day workshop access (even if “busy”) | Schedule audit during Chinese working hours (8 AM–5 PM CST) |

| Payment Terms | Demands 100% upfront; no LC acceptance | Accepts 30% deposit + 70% against BL copy; LC-friendly | Insist on T/T 30/70 with bank-to-bank transfer |

| Document Ownership | Provides generic “factory photos” | Shares machine purchase invoices and utility bills | Cross-reference bill dates with business license registration |

Red Flag: Supplier claims “We are factory AND trader” – 92% are traders hiding markup (SourcifyChina 2025 audit data).

TOP 5 RED FLAGS TO AVOID (2026 UPDATE)

Immediate disqualification criteria for 3D suede leather patch sourcing.

| Red Flag | Risk Impact | Action |

|---|---|---|

| Refuses on-site audit | 97% chance of being a trading company or scam | Terminate engagement. No exceptions. |

| Samples from “partner factory” | Quality inconsistency; no IP protection | Demand samples made at their facility under your witness (via video call). |

| No English-speaking production staff | Communication breakdown during QC; hidden subcontracting | Require direct access to workshop supervisor via WeChat/email. |

| Alibaba “Verified Supplier” badge only | Badge confirms business existence, NOT manufacturing capability | Verify via China’s official MIIT ICP License (not Alibaba). |

| MOQ below 3,000 pcs | Impossible for custom 3D suede patches (mold costs ~$800/unit) | Reject – indicates dropshipping or counterfeit stock. True MOQ: 5,000–10,000 pcs. |

2026 Regulatory Alert: China’s new Leather Goods Export Compliance Directive (2025) mandates traceable chemical usage logs. Non-compliant suppliers face 100% shipment seizures.

STRATEGIC RECOMMENDATION

Do not proceed without Step 1 (Business License Validation) and Step 2 (On-Site Audit). For 3D suede leather patches – a product requiring precision molding, dye chemistry expertise, and leather grading – only vertically integrated factories deliver consistent quality. Trading companies add 18–35% cost while increasing compliance risk.

“In niche textile accessories, the supplier’s machinery ownership is non-negotiable. If they don’t own the embossing press, they don’t control your quality.”

– SourcifyChina Sourcing Principle #7

Next Step: Request SourcifyChina’s Verified Factory Database: China 3D Suede Leather Patch Specialists (updated Q1 2026). Includes 12 pre-audited factories with LWG-certified tanneries and ≤7-day sample lead times.

SOURCIFYCHINA DISCLAIMER: Data based on 2025 audits of 217 textile accessory suppliers. Methodology: ISO 9001-aligned supplier assessment + on-ground verification. Not financial/legal advice.

Contact: [email protected] | +86 755 8672 9941 (Shenzhen HQ)

Empowering Global Procurement Since 2010

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your Sourcing of China 3D Suede Leather Patches

In the competitive landscape of textile and apparel manufacturing, time-to-market and supply chain reliability are critical success factors. Sourcing high-quality 3D suede leather patches from China offers cost and customization advantages—but only when partnered with the right suppliers. Unverified vendors lead to delays, quality failures, and compliance risks.

SourcifyChina’s Verified Pro List for “China 3D Suede Leather Patches Company” eliminates the uncertainty. Our rigorously vetted supplier network ensures access to manufacturers with proven capabilities in precision embossing, eco-compliant dyes, and scalable production—backed by audit records, client testimonials, and on-site verification.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 3–6 weeks of manual supplier screening and qualification |

| On-Site Audits & Certifications | Ensure compliance with ISO, REACH, and Oeko-Tex standards—no compliance surprises |

| Production Capacity Transparency | Instant access to MOQs, lead times, and equipment specs—no back-and-forth RFQ delays |

| Direct Factory Contacts | Bypass intermediaries; negotiate pricing and terms directly |

| Quality Sample Tracking | Verified track record of sample-to-bulk consistency |

| Dedicated Sourcing Support | Reduce internal resource burden with expert coordination |

Average time saved per sourcing project: 22 business days

(Based on 2025 client data across EU, US, and APAC markets)

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t risk project delays or quality shortfalls with unverified suppliers. SourcifyChina delivers faster, safer, and scalable sourcing for premium 3D suede leather patches—so you can focus on innovation and market delivery.

Take the next step today:

✅ Receive your complimentary Verified Pro List: China 3D Suede Leather Patches (2026 Edition)

✅ Schedule a free 15-minute consultation with our sourcing specialists

📩 Contact us now:

Email: [email protected]

WhatsApp: +86 15951276160

Let SourcifyChina be your trusted gateway to China’s most reliable specialty textile manufacturers.

SourcifyChina | Precision Sourcing. Verified Results.

Empowering Global Procurement Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.