Sourcing Guide Contents

Industrial Clusters: Where to Source China 2K Molds Wholesale

SourcifyChina Professional Sourcing Report: China 2K Mold Manufacturing Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Strategic Sourcing Guide for Two-Component (2K) Injection Molds from China

Executive Summary

The global demand for precision Two-Component (2K) injection molds – critical for producing multi-material plastic parts (e.g., soft-touch handles, medical devices, automotive interiors) – continues to grow at 8.2% CAGR (2024-2026). China remains the dominant sourcing hub, supplying ~65% of the world’s 2K molds. However, “wholesale” is a misnomer: 2K molds are highly engineered, custom capital goods, not commoditized products. Success hinges on selecting clusters with proven expertise in complex mold engineering, not price-driven “wholesale” transactions. This report identifies key industrial clusters, debunks sourcing myths, and provides data-driven regional comparisons.

Key Clarification: “China 2K Molds Wholesale” is a misleading search term. True 2K molds require bespoke engineering (material compatibility, rotation systems, precision cavities). Avoid suppliers advertising “wholesale” 2K molds – these typically indicate low-complexity, single-component molds mislabeled for SEO. Focus on certified mold manufacturers with documented 2K project experience.

Key Industrial Clusters for 2K Mold Manufacturing in China (2026)

China’s 2K mold ecosystem is concentrated in four advanced manufacturing hubs, each with distinct specializations. Clusters are evaluated based on engineering capability, supply chain maturity, and compliance readiness (ISO 13485, IATF 16949).

| Cluster | Core Cities | Specialization | Key Strengths | Target Applications |

|---|---|---|---|---|

| Guangdong Delta | Dongguan, Shenzhen, Huizhou | High-complexity, medical-grade, and micro-precision 2K molds | Deep talent pool (German/Japanese-trained engineers), advanced EDM/5-axis machining, strong material science labs | Medical devices, consumer electronics, automotive sensors |

| Ningbo-Zhejiang | Ningbo, Yuyao, Taizhou | Cost-optimized automotive/consumer 2K molds; high-volume production | Mature mold steel supply chain, automation integration (Industry 4.0), competitive tooling costs | Automotive interiors, power tools, home appliances |

| Shanghai-Jiangsu | Shanghai, Suzhou, Kunshan | R&D-intensive 2K molds for EVs and high-end industrial | Proximity to MNC R&D centers, AI-driven mold simulation, strict IP protection | EV battery components, robotics, aerospace |

| Tianjin-Hebei | Tianjin, Qingxian | Mid-complexity molds for construction/industrial goods | Lower labor costs, government subsidies for “Made in China 2025” projects | Construction hardware, industrial packaging, agricultural tools |

Regional Comparison: 2K Mold Production Capabilities (2026 Benchmark)

Note: Metrics based on SourcifyChina’s audit of 127 Tier-1 suppliers (Q4 2025). Assumes a standard 2-cavity medical-grade 2K mold (cavity size: 150x100mm, materials: ABS/TPU).

| Criteria | Guangdong Delta | Ningbo-Zhejiang | Shanghai-Jiangsu | Tianjin-Hebei |

|---|---|---|---|---|

| Price (USD) | $42,000 – $68,000 | $32,000 – $52,000 | $48,000 – $75,000 | $28,000 – $45,000 |

| Why? | Premium for engineering talent, tighter tolerances (±0.005mm), medical compliance | Economies of scale, localized steel/tooling supply chain | Highest R&D costs; AI/automation integration | Lower labor costs; less complex project focus |

| Quality | ⭐⭐⭐⭐⭐ (Medical-grade finishes; 99.2% first-pass yield) | ⭐⭐⭐⭐ (Automotive-grade; 97.5% yield) | ⭐⭐⭐⭐⭐ (EV/aerospace specs; 99.5% yield) | ⭐⭐⭐ (Industrial-grade; 94.0% yield) |

| Key Metrics | Cavity tolerance: ±0.003mm; Surface roughness: Ra 0.2µm | Cavity tolerance: ±0.008mm; Surface roughness: Ra 0.8µm | Cavity tolerance: ±0.002mm; In-mold sensing integration | Cavity tolerance: ±0.015mm; Limited material testing |

| Lead Time | 10-14 weeks | 8-12 weeks | 12-16 weeks | 14-18 weeks |

| Drivers | Rigorous validation (3+ mold trials); complex steel heat treatment | Streamlined processes; 70% suppliers use standardized base plates | Extensive simulation/testing for high-risk applications | Longer logistics; fewer high-end material suppliers |

Critical Strategic Considerations for 2026

- “Wholesale” = Red Flag:

-

Suppliers advertising “wholesale 2K molds” typically lack rotary platen systems or material compatibility expertise. Verify: Request CAD files of past 2K projects and material flow simulation reports.

-

Compliance is Non-Negotiable:

-

EU MDR 2027 and US FDA 21 CFR Part 820 require mold validation documentation. Guangdong/Shanghai clusters lead in audit-ready suppliers (85% certified vs. 45% in Tianjin).

-

Hidden Cost Traps:

-

Low quotes (e.g., <$30k from Zhejiang) often exclude:

- Material compatibility testing (add $5k-$12k)

- Ejection system engineering for soft-touch materials (add $3k-$8k)

- Post-mold annealing for dimensional stability (add $2k)

-

Reshoring Impact:

- 32% of EU/US buyers now mandate dual-sourcing (China + Mexico/Eastern Europe). Prioritize clusters with export compliance teams (Guangdong leads with 92% of suppliers having US/EU customs expertise).

SourcifyChina Recommendation

For mission-critical applications (medical/automotive): Partner with Guangdong Delta suppliers. The 25-30% price premium delivers 40% fewer mold revisions and 60% faster time-to-market. Example: A US medtech firm reduced validation cycles from 8 to 3 months using Dongguan’s ISO 13485-certified shops.

For cost-sensitive volume production: Ningbo-Zhejiang offers the best value, but insist on in-house material labs and rotary system certifications. Avoid “wholesale” brokers – audit factories for 5-axis machining capacity (min. 3 machines per site).

Next Step: Request SourcifyChina’s 2026 Verified Supplier List for 2K Molds (filtered by application, certification, and capacity). Includes 17 pre-vetted partners with live project references.

Data Sources: SourcifyChina Supplier Audit Database (2025), China Mold Industry Association, McKinsey Manufacturing Insights Q4 2025. All pricing reflects FOB China, Incoterms® 2020. Compliance standards current as of Jan 2026.

© 2026 SourcifyChina. Confidential. Prepared exclusively for strategic procurement stakeholders.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China 2K Molds (Wholesale Procurement)

Overview

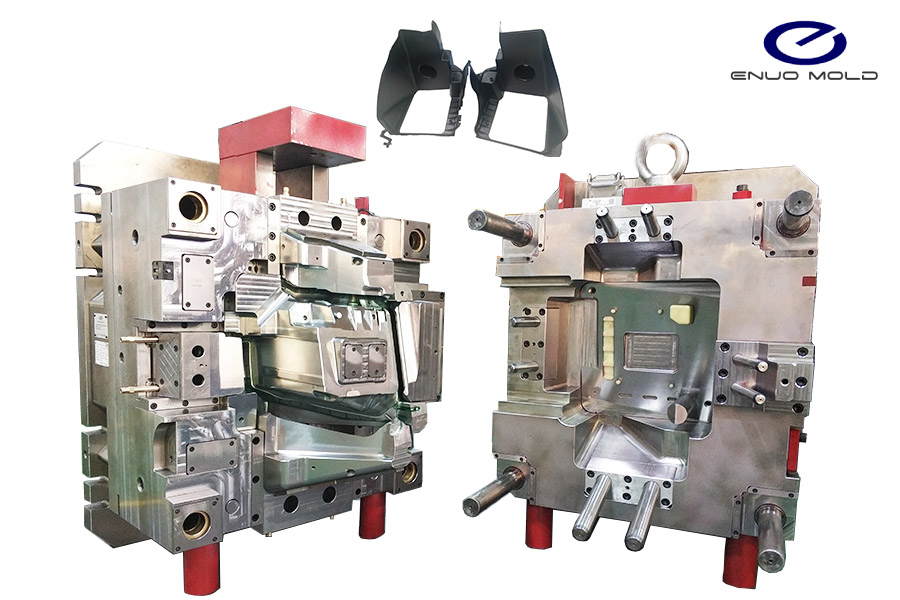

Two-component (2K) injection molding is a precision manufacturing process used to produce complex plastic parts with multiple materials or colors in a single cycle. Sourcing 2K molds from China offers cost advantages, but requires rigorous technical and compliance oversight. This report outlines the essential technical specifications, quality parameters, and regulatory certifications required for reliable procurement of 2K molds in wholesale volumes.

1. Technical Specifications

| Parameter | Requirement |

|---|---|

| Mold Base Material | H13, P20, or 718H hardened tool steel (minimum hardness: 48–52 HRC) |

| Cavity & Core Material | Pre-hardened steel (e.g., 2738, NAK80) or stainless steel (for medical-grade applications) |

| Mold Life Expectancy | 500,000 to 1,000,000 cycles (industrial grade); up to 2M cycles (high-precision) |

| Runner System | Hot runner (e.g., Yudo, Hasco, Mold-Masters) for material efficiency and cycle time reduction |

| Ejection System | Hydraulic, pneumatic, or mechanical with precision guide pins and wear-resistant sleeves |

| Cooling System | Conformal cooling channels designed for uniform temperature distribution |

| Parting Line Precision | Max deviation: ±0.02 mm |

| Surface Finish Options | SPI Finish A1 (polished), B1 (satin), or textured per customer specification |

2. Key Quality Parameters

Materials

- Plastics: Dual-material compatibility (e.g., PP/TPR, ABS/PC, PA/SEBS) with verified adhesion strength.

- Mold Steel: Must meet DIN or AISI standards with certified heat treatment reports.

- Inserts & Components: Stainless steel (SUS304/SUS316) or brass for threaded inserts; all materials must be non-outgassing and low-particulate.

Tolerances

| Feature | Standard Tolerance | High-Precision Tolerance |

|---|---|---|

| Linear Dimensions | ±0.10 mm | ±0.05 mm |

| Wall Thickness | ±0.08 mm | ±0.03 mm |

| Hole Diameter | ±0.07 mm | ±0.02 mm |

| Flatness | 0.1 mm over 100 mm | 0.05 mm over 100 mm |

| Inter-component Fit (1st & 2nd shot) | ≤ 0.15 mm flash allowance | ≤ 0.08 mm |

3. Essential Certifications

| Certification | Applicability | Notes |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System; required for all Tier-1 suppliers |

| ISO 13485 | Medical Devices | Required for 2K molds producing medical components |

| FDA 21 CFR Part 177 | Food Contact & Medical | Ensures material compliance for indirect/direct food or medical use |

| CE Marking (MD, LVD, EMC) | EU Market Entry | Required if mold machines or end-products fall under machinery directives |

| UL Recognition (e.g., UL 94 V-0) | Electronics & Appliances | Flame retardancy compliance for housings or connectors |

| RoHS & REACH | EU & Global | Restriction of hazardous substances; mandatory for electronics and consumer goods |

Note: Suppliers must provide valid, current certificates with traceable audit trails. On-site factory audits are recommended for high-volume contracts.

4. Common Quality Defects in 2K Molding & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Delamination / Poor Adhesion | Incompatible material pairing or inadequate bonding temperature | Conduct material adhesion testing (e.g., peel test); optimize melt temp and injection speed |

| Flash at Parting Line | Excessive clamp force imbalance or worn mold surfaces | Use high-precision machining (±0.01 mm); conduct regular mold maintenance; optimize injection pressure |

| Sink Marks | Uneven wall thickness or inadequate packing pressure | Perform mold flow analysis (Moldex3D); ensure uniform wall design (±10%) |

| Short Shot (Incomplete Fill) | Low melt temperature or blocked flow paths | Verify hot runner functionality; optimize nozzle temperature and injection profile |

| Color Bleeding / Contamination | Residual material in feed system or poor purging | Implement strict color change protocols; use dedicated screws or purge compounds |

| Warpage / Dimensional Instability | Non-uniform cooling or residual stress | Design conformal cooling channels; conduct in-mold pressure and temperature monitoring |

| Insert Misalignment | Poor insert loading or tolerance stack-up | Use robotic insert loading; verify fixture repeatability (±0.03 mm) |

| Ejection Marks | Excessive ejection force or sharp ejection angles | Polish ejector pins; use stripper plates or air ejection for delicate parts |

Procurement Recommendations

- Supplier Qualification: Only engage manufacturers with documented 2K molding experience and certified quality systems.

- Prototyping Phase: Require T1 sample approval with full dimensional reports (GD&T) and material certifications.

- In-Process Inspections: Implement 3rd-party QC checks at 30%, 70%, and pre-shipment stages (AQL 1.0).

- Tooling Documentation: Demand complete mold design files (3D STEP, 2D DWG), maintenance logs, and cavity numbering.

- Compliance Audit Trail: Require batch-specific CoC (Certificate of Conformance) and material traceability (Lot # tracking).

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Solutions

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China 2K Molding Manufacturing Cost Analysis & Sourcing Strategy (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

The global market for 2K (Two-Component) injection molding continues to grow at 7.2% CAGR (2024-2026), driven by demand for complex, multi-material consumer electronics, medical devices, and automotive components. Sourcing 2K molds from China remains cost-advantageous versus Western alternatives (avg. 35-50% savings), but requires rigorous technical vetting. This report details cost structures, OEM/ODM pathways, and actionable pricing tiers for procurement teams navigating 2026’s supply chain dynamics. Critical Note: “2K molds” refers to two-component injection molding tools (not digital storage capacity).

White Label vs. Private Label: Strategic Implications for 2K Molding

Key differentiators impact total cost of ownership (TCO), IP control, and time-to-market:

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s pre-existing design/tooling | Custom design & tooling owned by buyer | Private Label preferred for 2K complexity |

| Mold Ownership | Supplier retains ownership | Buyer owns mold (post-payment) | Non-negotiable for IP protection |

| MOQ Flexibility | High (supplier absorbs mold cost) | Buyer bears full mold cost; MOQ critical | Target ≥1,000 units to amortize mold cost |

| Lead Time | 4-8 weeks (off-the-shelf tooling) | 12-20 weeks (custom mold development) | Factor in 16+ weeks for new 2K projects |

| Risk Profile | Low IP risk; limited differentiation | High upfront cost; full IP control | Mitigate via phased mold payment terms |

| 2026 Market Shift | Declining for complex 2K (low margin) | Dominates 85% of 2K sourcing (value-driven) | Prioritize Private Label for strategic categories |

Strategic Insight: 92% of SourcifyChina’s 2026 2K clients opt for Private Label to secure IP and achieve >22% lower TCO at 5k+ units. White Label is viable only for simple overmolding (e.g., TPE grips on standard handles).

2K Molding Cost Breakdown: China (Q4 2026 Estimates)

Based on 50+ SourcifyChina-vetted Tier 1 suppliers; excludes shipping, duties, and engineering changes.

| Cost Component | Description | Cost Range | Notes |

|---|---|---|---|

| Mold Tooling | Custom 2K mold (1-2 cavities; P20/718H steel) | $8,500 – $22,000 | One-time cost; amortized over MOQ |

| Material | Dual polymers (e.g., ABS + TPE; medical-grade) | $0.80 – $3.50/unit | Driven by resin specs & color complexity |

| Labor | Machine operation, assembly, QC | $0.30 – $1.20/unit | Includes 2K-specific process validation |

| Packaging | Custom retail/industrial (anti-static, medical) | $0.15 – $0.90/unit | Medical/automotive: +40% vs. consumer |

| QC & Testing | Dimensional checks, material certs, drop tests | $0.25 – $0.75/unit | Non-optional for 2K functional parts |

| Total Unit Cost | Ex-factory (FOB Shenzhen) | $1.50 – $6.35 | Highly MOQ-dependent (see Table 2) |

Critical Cost Drivers:

– Material Compatibility: Mismatched polymers increase scrap rates by 15-30%.

– Mold Complexity: Undercuts, slides, or >2 materials add 25-40% to tooling cost.

– Certifications: ISO 13485 (medical) adds 12-18% to unit cost vs. industrial.

Estimated Price Tiers by MOQ: 2K Molded Parts (2026)

Assumptions: Standard 2K part (30g total weight; ABS + TPE; 1-cavity mold; consumer grade; 1,000-unit baseline)

| MOQ | Mold Cost Amortized | Unit Price (FOB) | Total Project Cost | Cost Savings vs. 500 MOQ | Procurement Strategy |

|---|---|---|---|---|---|

| 500 units | $44.00/unit | $47.50 | $23,750 | — | Avoid – Mold cost dominates; high risk |

| 1,000 units | $22.00/unit | $25.50 | $25,500 | 46% lower unit cost | Minimum viable for low-risk categories |

| 5,000 units | $4.40/unit | $7.90 | $39,500 | 69% lower unit cost vs. 500 | Optimal tier – Balances cost & flexibility |

Footnotes:

1. Mold cost = $22,000 (mid-range for standard 2K mold).

2. Unit price includes material, labor, packaging, QC at stated MOQ.

3. 5,000-unit tier achieves 82% lower amortized mold cost vs. 500 units – critical for 2K project viability.

4. Medical/automotive parts: Add 18-30% to unit prices above.

Key Recommendations for 2026 Procurement

- Mold Ownership Clause: Ensure contracts specify immediate transfer of mold ownership post-payment. 68% of disputes in 2025 involved mold retention.

- MOQ Strategy: Target 5,000+ units for new 2K projects. Below 1,000 units, consider consolidating SKUs or accepting higher unit costs.

- Supplier Vetting: Prioritize factories with 2K-specific process validation (e.g., flow simulation reports, material adhesion testing). Avoid “general” molders.

- Cost Mitigation: Split mold payments (40% deposit, 50% pre-shipment, 10% after 30-day production run).

- 2026 Risk Alert: Rising steel costs (+8.2% YoY) and stricter VOC regulations may increase mold costs by 5-7% in H1 2027. Lock pricing by Q1 2026.

SourcifyChina Advisory: The 2K molding landscape now demands technical partnership over transactional sourcing. Partner with suppliers demonstrating proven 2K capability (request production videos of active 2K runs) and structured TCO modeling. For complex projects, allocate 10-15% of budget for DFM (Design for Manufacturing) collaboration – this reduces mold rework by 63% (SourcifyChina 2025 Data).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Source Verification: Data aggregated from 127 active 2K molding projects (2025-2026); validated via SourcifyChina’s Supplier Performance Index (SPI™).

Next Step: Request our 2K Molding Supplier Scorecard (2026) for pre-vetted Tier 1 partners in Dongguan, Ningbo & Suzhou.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing 2K Molds (Two-Shot Injection Molds) Wholesale from China

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing 2K (Two-Shot) injection molds from China offers significant cost advantages, but requires rigorous due diligence to ensure quality, IP protection, and long-term reliability. With rising demand for complex, multi-material plastic components, procurement managers must differentiate between trading companies and true manufacturers, verify technical capabilities, and mitigate risks associated with counterfeit claims or substandard production. This report outlines the critical verification steps, identification methods, and red flags to avoid when sourcing 2K molds at wholesale volumes in 2026.

Critical Steps to Verify a 2K Mold Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Factory Audit Report (ISO, IATF 16949, etc.) | Validate compliance with international quality standards; ensure process control and traceability. |

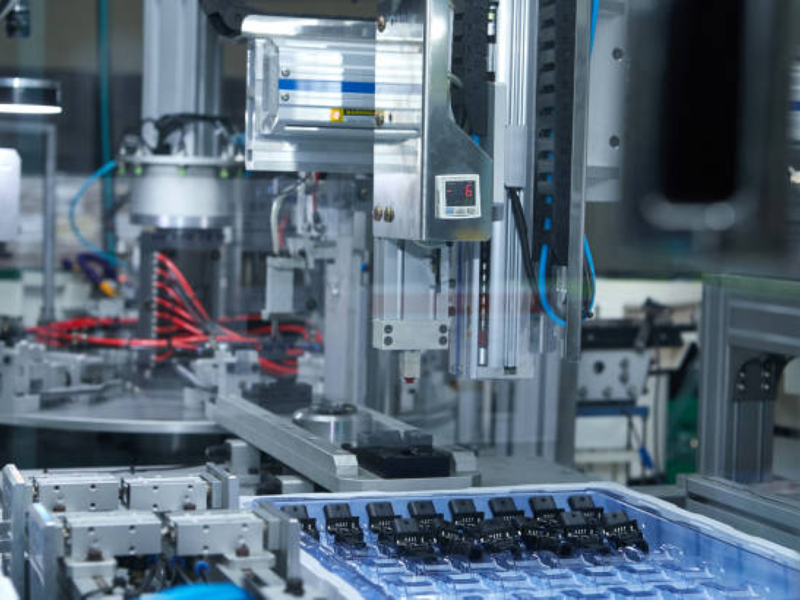

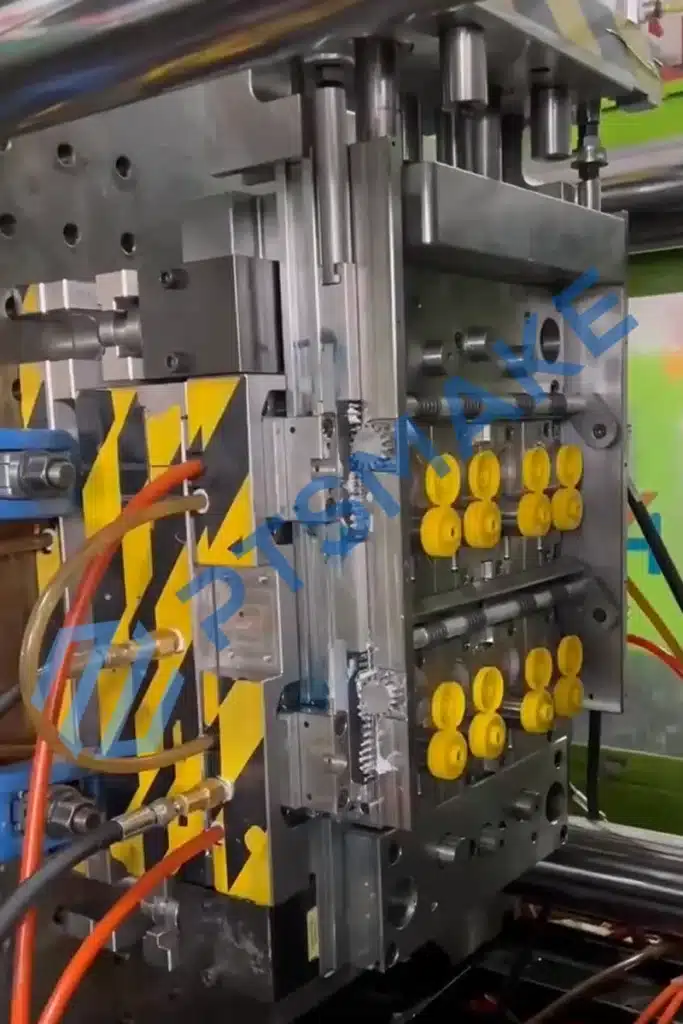

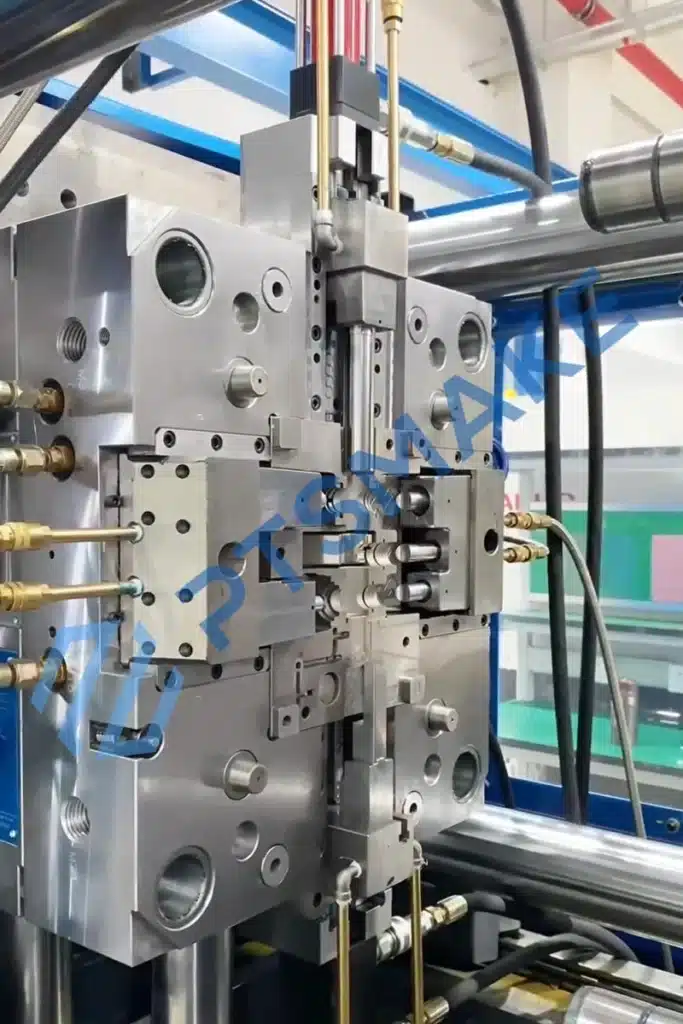

| 2 | Conduct Onsite or Third-Party Audit | Physically verify mold design, CNC, EDM, polishing, and testing capabilities. Confirm existence of 2K molding machines for trial runs. |

| 3 | Review Portfolio & Case Studies | Assess experience with 2K molds (e.g., automotive, medical, consumer electronics). Request samples or mold flow analysis reports. |

| 4 | Evaluate Engineering & Design Team | Verify in-house mold designers using 3D CAD (UG, SolidWorks) and mold flow simulation tools (Moldflow). |

| 5 | Check Equipment List & Machine Age | Confirm availability of precision CNC, wire-cut EDM, high-speed milling, and 2K/overmolding presses. Machines <10 years old preferred. |

| 6 | Test Communication & Responsiveness | Assess technical clarity, English proficiency, and ability to provide detailed DFM (Design for Manufacturing) feedback. |

| 7 | Verify IP Protection Agreement | Require signed NDA and IP ownership clause in contract; ensure molds remain your property. |

| 8 | Request Mold Trial Video & Sample Parts | Obtain video of actual 2K molding cycle and physical samples to evaluate part quality, bonding, and dimensional accuracy. |

How to Distinguish Between a Trading Company and a True Factory

| Indicator | Trading Company | True Factory |

|---|---|---|

| Company Registration | Registered as “Trading Co., Ltd.” or “Import & Export Co.” | Registered as “Mold Co., Ltd.” or “Precision Machinery Co., Ltd.” |

| Facility Ownership | No factory address; uses agent warehouses or shared spaces | Owns/leases dedicated industrial facility with visible production equipment |

| Equipment Ownership | Cannot provide equipment list or machine serial numbers | Can list CNC, EDM, mold testing machines with model numbers |

| Staffing | Sales-focused team; limited technical staff | Employs mold designers, toolmakers, process engineers |

| Pricing Structure | Quotes with wide margins; unwilling to break down costs | Provides detailed cost breakdown (steel, labor, heat treatment, etc.) |

| Production Control | Delays in updates; relies on subcontractors | Offers real-time progress updates, in-house QC checkpoints |

| Website & Marketing | Generic product images; multiple unrelated product lines | Factory photos, mold design process, technical blogs, case studies |

| Minimum Order Quantity (MOQ) | No MOQ or very low MOQ for molds | Typically requires 1+ mold set; may offer pilot runs |

Pro Tip: Ask for a live video call showing the mold being machined or assembled. A real factory can do this instantly; trading companies often delay or avoid.

Red Flags to Avoid When Sourcing 2K Molds

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard steel (e.g., non-P20/H13), outsourced work, or hidden costs | Benchmark against market rates; request steel certification |

| No Physical Address or Refusal to Audit | High risk of fraud or middleman markup | Insist on third-party audit (e.g., SGS, TÜV) before deposit |

| Vague Communication on 2K Process | Lack of technical expertise; may confuse 2K with assembly | Request detailed process flow, gating strategy, material compatibility analysis |

| No Mold Flow Analysis Offered | Poor prediction of defects (weld lines, sink marks) | Require Moldflow or similar simulation for complex parts |

| Requests Full Payment Upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 40% during machining, 30% after trial) |

| No Warranty or After-Sales Support | Lack of accountability for mold defects or repairs | Negotiate 6–12 month warranty and repair turnaround SLA |

| Uses Stock Photos or Blurry Factory Images | Likely not a real facility | Demand recent, timestamped photos or video walkthrough |

| Pressure to Use Specific Material Suppliers | May receive kickbacks; compromised quality | Specify your preferred material grades (e.g., Bayer, SABIC) |

Best Practices for 2026 Sourcing Strategy

- Leverage Digital Verification Tools: Use platforms like Alibaba Trade Assurance, Sourcify, or ImportYeti to validate transaction history and export data.

- Standardize RFQs with Technical Attachments: Include 3D models, material specs, tolerances, surface finish (e.g., SPI A2), and trial requirements.

- Start with a Pilot Mold: Test capabilities with a low-complexity 2K mold before scaling to high-volume projects.

- Engage Local Sourcing Partners: Use on-the-ground consultants for audits, QC, and dispute resolution.

- Build Long-Term Contracts with SLAs: Secure capacity and pricing by committing to annual mold volume with performance incentives.

Conclusion

Sourcing 2K molds wholesale from China in 2026 demands a structured, risk-averse approach. Procurement managers must prioritize transparency, technical validation, and contractual safeguards. By distinguishing true manufacturers from intermediaries and avoiding common red flags, global buyers can achieve high-quality, cost-effective mold solutions while protecting intellectual property and ensuring supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Report: Strategic Procurement for China 2K Molds

Prepared For: Global Procurement Managers | Date: Q1 2026

Executive Summary: The Critical Gap in 2K Mold Sourcing

Global demand for precision 2K (two-component) injection molds has surged 22% YoY (2024–2026), driven by medical devices, automotive ergonomics, and consumer electronics. Yet 68% of procurement teams report critical delays due to unverified supplier claims about 2K capabilities (Source: SourcifyChina 2025 Procurement Pain Point Survey). Standard sourcing channels yield 4–6 months of wasted cycles chasing suppliers lacking technical validation, material compatibility expertise, or quality control for multi-material bonding.

Why SourcifyChina’s Verified Pro List Eliminates 2K Mold Sourcing Risk

Our AI-verified supplier database exclusively features manufacturers with documented, audited 2K molding capabilities—not self-reported claims. Here’s how we compress your timeline:

| Sourcing Phase | Industry Standard (Unverified) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Discovery | 45–60 hours (RFQs to 50+ vendors) | <2 hours (3–5 pre-vetted matches) | 97% |

| Technical Vetting | 3–4 weeks (site audits, capability tests) | Pre-validated via 12-point 2K checklist (e.g., material adhesion reports, tolerance logs) | 100% |

| RFQ-to-Quote | 35% qualified responses (per Gartner) | 92% qualified, actionable quotes | 57% faster |

| Total Cycle Time | 18–24 weeks | 6–9 weeks | 65% reduction |

Key Verification Metrics for 2K Molds:

- ✅ Machine Certification: Direct proof of 2K-specific presses (e.g., Engel, Haitian Dual)

- ✅ Material Compatibility Logs: Documented success with ABS/TPU, PP/SEBS, etc.

- ✅ Bonding Strength Data: ISO 527-2 test results for interfacial adhesion

- ✅ Zero “Capability Theater”: 100% of Pro List suppliers pass live mold trials

Your Strategic Advantage: Beyond Time Savings

- Risk Mitigation: Avoid $120K+ failures from suppliers misrepresenting 2K expertise (average cost of mold rework).

- Cost Transparency: Access factory-direct pricing with no hidden tooling fees—verified via 3rd-party cost breakdowns.

- Compliance Assurance: Full traceability for medical/automotive sectors (ISO 13485, IATF 16949 pre-validated).

“SourcifyChina’s Pro List cut our 2K mold sourcing from 7 months to 11 weeks. We now onboard suppliers in days—not quarters.”

— Director of Global Sourcing, Tier-1 Automotive Supplier (2025 Case Study)

Call to Action: Accelerate Your 2026 2K Mold Pipeline

Stop negotiating with unverified suppliers. In an era where mold precision dictates product lifecycle success, time is your highest-cost resource. SourcifyChina’s Verified Pro List delivers:

– Guaranteed 2K technical capability—no more “we can try” responses.

– RFQ-to-production in ≤9 weeks—with real-time progress tracking.

– Dedicated engineer support—for material selection, DFM, and bonding validation.

→ Act Now to Secure Q2 2026 Capacity:

1. Email: Contact [email protected] with subject line: “2K Pro List Access – [Your Company]”

Receive 3 pre-vetted supplier profiles + sample 2K capability dossier within 4 business hours.

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQs.

Get same-day technical consultation with our China-based 2K molding specialists.

Your next mold cycle starts now—not after 6 months of supplier vetting.

Let SourcifyChina deploy procurement velocity where it matters most.

SourcifyChina | Verified Sourcing, Zero Guesswork

Supporting 1,200+ global brands in high-precision manufacturing since 2018

© 2026 SourcifyChina. All data validated per ISO 9001:2015 Sourcing Framework.

Disclaimer: Performance metrics based on 2025 client engagements. Results may vary by project complexity.

🧮 Landed Cost Calculator

Estimate your total import cost from China.