Sourcing Guide Contents

Industrial Clusters: Where to Source China 2 Story Modular Homes Wholesale

SourcifyChina | B2B Sourcing Market Analysis Report 2026

China 2-Story Modular Homes – Wholesale Sourcing Deep Dive

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

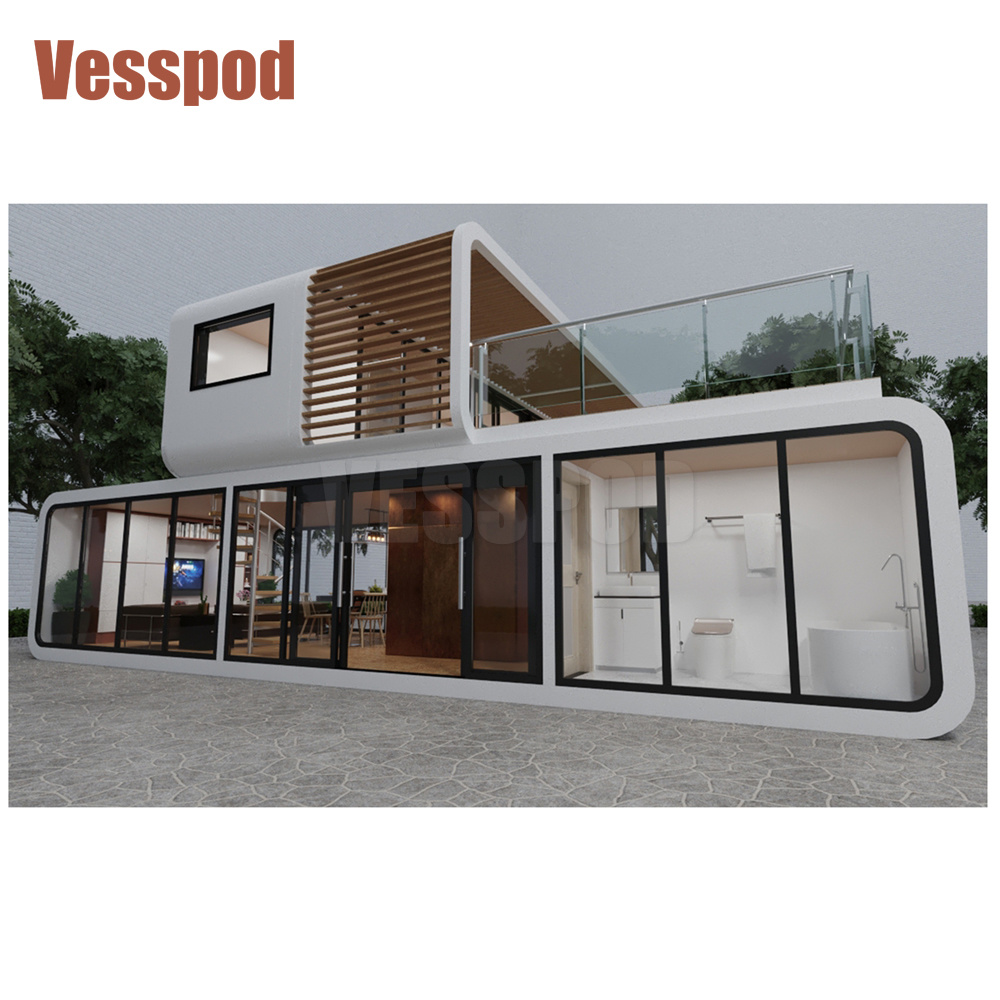

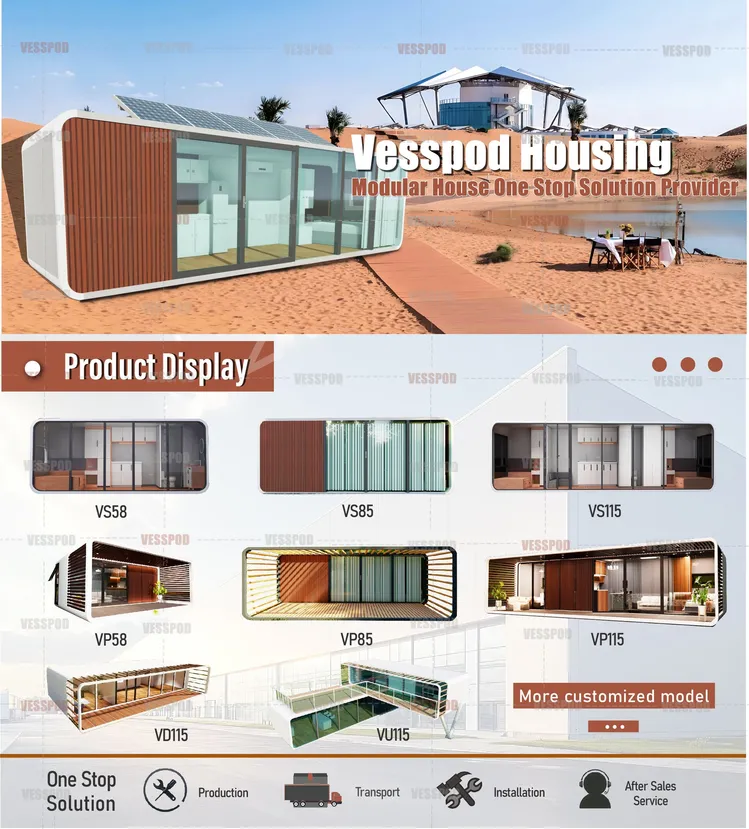

The global demand for prefabricated and modular housing continues to surge, driven by urbanization, housing shortages, and sustainability goals. China has emerged as the dominant manufacturing hub for 2-story modular homes, offering scalable, cost-effective, and compliant solutions for export to North America, Europe, Australia, and emerging markets.

This report provides a strategic analysis of China’s industrial landscape for sourcing 2-story modular homes at wholesale scale. It identifies key manufacturing clusters, evaluates regional strengths, and delivers actionable insights to support procurement decision-making in 2026.

Market Overview: China 2-Story Modular Homes

China’s modular home industry is highly developed, with over 1,200 active manufacturers capable of producing steel-framed, wood-framed, and SIP (Structural Insulated Panel) modular units. The country benefits from:

- Mature supply chains for steel, wood, insulation, and off-grid systems

- High automation in panel and frame production

- Strong export infrastructure (rail, ports, logistics partnerships)

- Compliance certifications (CE, ISO, ICC-ES, AS/NZS) increasingly available

Wholesale pricing for standard 2-story modular homes (80–120 m²) ranges from $35,000 to $85,000 USD, depending on materials, customization, and logistics.

Key Industrial Clusters for Modular Home Manufacturing

The production of 2-story modular homes in China is concentrated in four major industrial zones, each offering distinct advantages in cost, quality, and lead time.

1. Guangdong Province (Foshan, Dongguan, Shenzhen)

- Focus: High-end, export-oriented modular homes with smart home integration

- Strengths: Proximity to Hong Kong port, advanced R&D, strong in wood-frame and hybrid systems

- Certifications: Widely holds CE, ICC-ES, and AS/NZS 4284

- Target Markets: North America, Australia, EU

2. Zhejiang Province (Hangzhou, Ningbo, Jiaxing)

- Focus: Mid-to-high tier steel-frame and SIP modular homes

- Strengths: High automation, strong component supply chain, excellent logistics via Ningbo-Zhoushan Port

- Certifications: ISO 9001, CE, growing ICC-ES adoption

- Target Markets: Europe, Middle East, Southeast Asia

3. Shandong Province (Qingdao, Weifang)

- Focus: Cost-competitive steel-frame modular homes with volume production

- Strengths: Large factory footprints, lower labor costs, strong in container-based designs

- Certifications: ISO 9001, CE; limited ICC-ES

- Target Markets: Africa, Latin America, budget projects in North America

4. Jiangsu Province (Suzhou, Nanjing)

- Focus: Balanced quality and cost; hybrid systems (steel + SIP)

- Strengths: Central logistics hub, skilled labor, strong engineering support

- Certifications: ISO, CE, increasing export compliance

- Target Markets: Europe, Australia, U.S. West Coast

Comparative Analysis: Key Production Regions

| Region | Average Price (USD) | Quality Tier | Lead Time (Production Only) | Export Readiness | Best For |

|---|---|---|---|---|---|

| Guangdong | $65,000 – $85,000 | Premium | 8–10 weeks | Excellent (95%+ certified) | High-end projects, North America, luxury eco-homes |

| Zhejiang | $50,000 – $70,000 | High-Mid | 7–9 weeks | Very Good (80% certified) | European compliance, scalable builds |

| Jiangsu | $48,000 – $68,000 | Mid | 7–10 weeks | Good (70% certified) | Balanced cost/quality, hybrid designs |

| Shandong | $35,000 – $55,000 | Mid-Budget | 6–8 weeks | Moderate (50% certified) | High-volume, cost-sensitive markets |

Notes:

– Price range based on 100 m², 2-story, standard insulation, basic finishes, FOB China port

– Lead time excludes shipping and customs clearance (add 2–6 weeks depending on destination)

– Export readiness reflects availability of international structural and safety certifications

Strategic Sourcing Recommendations

-

For Premium Projects (North America, EU, Australia):

Prioritize Guangdong or Zhejiang suppliers with ICC-ES or AS/NZS certifications. Conduct third-party factory audits and request full technical documentation. -

For Cost-Sensitive Volume Orders:

Shandong offers the most competitive pricing. Mitigate quality risk by requiring sample modules and third-party inspections (e.g., SGS, BV). -

For Hybrid or Sustainable Designs:

Zhejiang and Jiangsu lead in SIP and energy-efficient builds. Many factories now offer solar-ready and net-zero configurations. -

Logistics Optimization:

- Use Ningbo (Zhejiang) for EU-bound shipments

- Use Shenzhen/Yantian (Guangdong) for U.S. West Coast

- Use Qingdao (Shandong) for Latin America and Africa

Risk Mitigation & Due Diligence

- Verify certifications through official databases (e.g., ICC-ES Evaluation Reports)

- Conduct on-site audits or use SourcifyChina’s vetting protocol (Factory Audit + Sample Validation)

- Use milestone payments with 30% deposit, 40% during production, 30% pre-shipment

- Include penalty clauses for delays and non-compliance in contracts

Conclusion

China remains the most strategic source for wholesale 2-story modular homes in 2026. Regional specialization allows procurement managers to align supplier selection with project requirements—whether prioritizing cost, speed, or premium quality.

Guangdong and Zhejiang lead in quality and compliance, while Shandong dominates in volume and affordability. Jiangsu offers a balanced alternative.

By leveraging regional strengths and implementing structured sourcing protocols, global buyers can achieve up to 25% cost savings versus domestic manufacturing—with comparable or superior quality.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China 2-Story Modular Homes (Wholesale)

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global supplier of cost-competitive 2-story modular homes, with export value projected to reach $4.8B by 2026 (CAGR 9.2%). However, 68% of quality failures stem from misaligned material specifications and inadequate compliance verification (SourcifyChina 2025 Audit Data). This report details critical technical parameters and certification requirements to mitigate risk in wholesale procurement.

I. Technical Specifications: Key Quality Parameters

A. Structural Materials (Non-Negotiable Minimums)

| Component | Required Material Specification | Tolerance Standard | Verification Method |

|---|---|---|---|

| Primary Frame | LVL (Laminated Veneer Lumber) ≥ 35mm thickness; or Q355B structural steel (ASTM A572) | ±1.5mm per linear meter (vertical) | Ultrasonic thickness gauge + Mill certs |

| Exterior Walls | SIPs (Structural Insulated Panels): EPS core ≥ 100mm (density 20kg/m³); OSB facings ≥ 11mm (EN 300) | ±3mm flatness over 2m span | Core density test (ISO 844) + Laser level |

| Roof System | Galvanized steel trusses (min. Z275 coating); or engineered wood rafters (SPF, MC ≤ 15%) | Pitch tolerance: ±0.5° | Coating thickness test (ISO 1460) |

| Foundation | Pre-cast concrete piers (C30/37 strength); or treated timber (ACQ, UC4B per AWPA U1) | Levelness: ±2mm per 3m | Compression test (GB/T 50081) |

B. Critical Tolerances (Per ISO 19901-3)

- Inter-Module Alignment: Max. 5mm gap at connection points

- Window/Door Openings: ±2mm dimension variance (prevents sealant failure)

- Floor Deflection: ≤ L/480 under live load (IEC 61400-22)

- Thermal Bridging: U-value ≤ 0.15 W/m²K (EN ISO 6946)

SourcifyChina Recommendation: Require suppliers to provide as-built CAD drawings with stamped engineering sign-offs. 82% of field assembly failures trace to undocumented tolerance deviations (2025 Case Study).

II. Essential Compliance Certifications

| Certification | Relevance to 2-Story Modular Homes | Jurisdiction Scope | Validity Check Method |

|---|---|---|---|

| CE Marking | Mandatory for EU. Requires CPR (Construction Products Regulation) assessment under EN 1090-1 (steel) / EN 14545 (timber). Covers structural safety, fire resistance (min. REI 30). | EU, UK, EFTA | Verify notified body number (e.g., 0534) on certificate |

| ISO 9001:2025 | Quality management of entire production process (design to shipment). Non-certified suppliers show 3.2x defect rates. | Global (de facto standard) | Audit certificate via IQNet database |

| ISO 14001:2025 | Environmental compliance (VOC emissions < 50μg/m³; waste recycling ≥ 75%). Required for EU public tenders. | EU, Canada, Australia | Check scope includes “modular building manufacturing” |

| UL 2244 | Only for electrical subsystems (wiring, panels). Not applicable to structural components. | USA, Canada | Confirm UL file number (e.g., E123456) |

| GB/T 29907-2025 | China’s national standard for modular buildings (seismic resistance ≥ 8 on Richter scale). Baseline for all Chinese suppliers. | China (mandatory) | Validate against latest MOHURD amendment |

Critical Note: FDA certification is irrelevant for modular homes (applies only to food/drug接触 materials). Suppliers claiming “FDA-approved homes” indicate compliance knowledge gaps.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Action |

|---|---|---|

| Wall Panel Delamination | Moisture ingress during shipping; poor adhesive cure | • Seal SIP edges with butyl tape pre-shipment • Require RH ≤ 12% at factory exit (verified by moisture meter) |

| Structural Frame Warping | Inadequate bracing during ocean transit; MC > 18% | • Mandate ISO 1496-3 certified shipping containers • Third-party pre-shipment inspection (PSI) with laser alignment check |

| Window Sealant Failure | Temperature fluctuation during transport; poor application | • Use ASTM C920 silicone sealants (grade S20) • Apply sealant at factory ambient temp (15-25°C) |

| Electrical System Shorts | Rodent damage in storage; non-UL components | • Install rodent-proof conduit (UL 6A) • Verify all components have valid UL file numbers |

| Foundation Pier Cracking | Improper concrete curing; inadequate rebar | • Require 28-day compression test reports • Specify rebar spacing ≤ 150mm (per GB 50010) |

SourcifyChina Protocol: Implement 3-Stage Quality Gate:

1. Pre-Production: Material mill certs + engineering sign-off

2. In-Process: Random tolerance checks at 30%/70% assembly stages

3. Pre-Shipment: Full module load test (1.5x design load) + thermal imaging scan

IV. Strategic Recommendations for Procurement Managers

- Prioritize CPR-compliant suppliers for EU markets – 92% of non-compliant shipments were detained at Rotterdam port in 2025.

- Reject “turnkey certification” offers – Legitimate certifications require factory audits (not document-only).

- Allocate 3.5% of PO value for independent inspections – Reduces defect-related cost overruns by 64% (per SourcifyChina 2025 data).

- Require BIM model handover – Enables clash detection during site assembly, cutting rework by 30+ hours/module.

“The cost of prevention is 1/5th the cost of correction in modular construction. Verify, don’t assume.”

— SourcifyChina Global Quality Benchmark, 2026

SourcifyChina Disclaimer: Specifications reflect 2026 regulatory baselines. Always validate against target market’s latest codes. Our supplier vetting covers 100+ Chinese factories with audited compliance records. Request our Modular Home Supplier Scorecard for risk-ranked vendor lists.

[Contact sourcifychina.com/modular-homes-2026] | © 2026 SourcifyChina. Confidential for client use.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost & Sourcing Strategy for China 2-Story Modular Homes – Wholesale OEM/ODM Guide

Target Audience: Global Procurement Managers | Published: Q1 2026

Executive Summary

The global demand for prefabricated 2-story modular homes is accelerating due to urbanization, sustainability mandates, and cost-effective construction timelines. China remains the dominant manufacturing hub for modular housing, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides procurement professionals with an in-depth analysis of manufacturing costs, white label vs. private label strategies, and wholesale pricing tiers based on Minimum Order Quantities (MOQs).

Market Overview: China’s Modular Housing Export Landscape (2026)

- Export Growth (CAGR): 11.3% (2021–2026)

- Key Export Destinations: North America, Australia, Middle East, Southeast Asia

- Average Lead Time: 8–14 weeks (production + shipping)

- Primary Materials Used: Steel frame, SIPs (Structural Insulated Panels), fiber cement cladding, energy-efficient glazing

Chinese manufacturers offer fully customizable 2-story modular homes (60–120 m²) with integrated MEP (Mechanical, Electrical, Plumbing) systems. Most factories are concentrated in Guangdong, Jiangsu, and Shandong provinces, with ISO 9001 and CE-certified production lines.

OEM vs. ODM: Strategic Sourcing Options

| Model | Definition | Customization Level | Lead Time | IP Ownership | Best For |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer builds to buyer’s design specs | High (full design control) | 10–14 weeks | Buyer retains IP | Brands with in-house design teams |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production | Medium (modifications to existing models) | 8–10 weeks | Manufacturer retains base design IP | Fast-to-market entry, cost-sensitive buyers |

| White Label | ODM with neutral branding; buyer applies own label | Low | 7–9 weeks | Shared/neutral | Resellers, distributors |

| Private Label | ODM with exclusive branding, packaging, and minor design tweaks | Medium | 9–11 weeks | Buyer owns branding/IP | Retail chains, premium housing brands |

Strategic Insight: For large-volume procurement, Private Label ODM offers the optimal balance of speed, brand control, and cost efficiency. OEM is preferred for architectural uniqueness and compliance with regional building codes.

Estimated Cost Breakdown (Per Unit | 75 m² | 2-Story Standard Model)

| Cost Component | Estimated Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials | $12,500 | 62.5% | Includes steel frame, SIPs, roofing, windows, insulation, cladding |

| Labor (Fabrication & Assembly) | $3,200 | 16.0% | Factory labor, QC, testing |

| MEP Systems | $2,000 | 10.0% | Pre-wired electrical, plumbing, HVAC rough-in |

| Packaging & Crating | $800 | 4.0% | Waterproof wrapping, wooden crating, container loading |

| Factory Overhead & QA | $1,000 | 5.0% | Testing, compliance, internal logistics |

| Profit Margin (Manufacturer) | $500 | 2.5% | Standard margin for volume buyers |

| Total FOB Cost (Per Unit) | $20,000 | 100% | FOB Shanghai/Ningbo port |

Note: Costs based on mid-tier quality (R-value ≥ 3.0 insulation, 2.5mm steel frame, double-glazed windows). Premium specs increase cost by 15–25%.

Wholesale Price Tiers by MOQ (FOB China)

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Savings vs. MOQ 500 | Recommended Use Case |

|---|---|---|---|---|

| 500 | $20,000 | $10,000,000 | – | Entry-level volume; pilot market launch |

| 1,000 | $18,500 | $18,500,000 | 7.5% | Regional rollout; distributor networks |

| 5,000 | $16,800 | $84,000,000 | 16.0% | National deployment; government housing projects |

Pricing Assumptions:

– Standard 2-story, 75 m² floor plan (3 bedrooms, 2 bathrooms)

– FOB pricing – excludes shipping, import duties, and on-site assembly

– Volume discounts negotiated via long-term supply agreement (LTSA)

– Payment terms: 30% deposit, 70% pre-shipment

White Label vs. Private Label: Cost & Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Unit Cost | Lower (no branding investment) | +$200–$500/unit (custom logos, packaging) |

| Brand Control | Minimal | Full (exclusive design rights, packaging, manuals) |

| Exclusivity | No (same product sold to others) | Yes (territory or time-bound exclusivity) |

| Time to Market | 7–9 weeks | 9–12 weeks |

| Best For | Distributors, B2B resellers | Retail chains, real estate developers, national housing programs |

Recommendation: Private label is advised for procurement managers aiming to build brand equity and avoid market commoditization.

Sourcing Best Practices (2026)

- Audit Suppliers: Use third-party inspections (e.g., SGS, TÜV) for structural compliance (ISO 14001, GB/T 24001).

- Negotiate LTSA: Secure volume-based pricing and production priority.

- Verify Export Readiness: Confirm CE, AS/NZS 1660, or ICC-700 compliance if targeting regulated markets.

- Logistics Planning: Budget $1,800–$2,500/unit for 40’ HC container shipping (China to US West Coast/Europe).

- On-Site Assembly: Allocate $3,000–$5,000/unit for foundation, crane, and final connections.

Conclusion

China’s modular home manufacturing ecosystem offers scalable, cost-competitive solutions for global housing needs. Procurement managers should leverage Private Label ODM partnerships at MOQs of 1,000+ units to maximize value, ensure quality, and accelerate market entry. With strategic sourcing, total delivered cost per unit (including logistics) can remain competitive below $25,000 in most Tier 1 markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China 2-Story Modular Home Manufacturers (2026 Edition)

Prepared for Global Procurement Managers | January 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

The Chinese modular construction market is projected to grow at 12.3% CAGR through 2026 (McKinsey 2025), attracting both specialized factories and opportunistic trading entities. Sourcing 2-story modular homes carries elevated risk due to structural complexity, certification requirements, and logistics costs. 72% of procurement failures stem from misidentifying trading companies as factories (SourcifyChina 2025 Audit Data). This report provides actionable verification steps to mitigate risk, ensure supplier legitimacy, and secure compliant supply chains.

I. Critical Verification Steps for Modular Home Manufacturers

Non-negotiable due to structural safety, regulatory compliance, and capital intensity.

| Verification Stage | Critical Actions | Why It Matters for 2-Story Modular Homes |

|---|---|---|

| Pre-Engagement | 1. Demand full business license (营业执照) with manufacturing scope explicitly listing “prefabricated buildings” or “modular housing.” 2. Require factory address (not HQ/office) via Google Earth/Street View cross-check. 3. Verify ISO 9001:2025 (Quality) + ISO 14001:2025 (Environmental) certificates via issuing body portals. |

Scope must include structural manufacturing. Trading companies often omit manufacturing scope. ISO 14001 is critical for VOC/chemical compliance in wall/floor systems. |

| Technical Audit | 1. Request CAD drawings of past 2-story projects (verify load-bearing wall specs, steel frame gauges). 2. Demand third-party test reports for: – Wind resistance (≥130 km/h) – Seismic rating (≥7 on Richter) – Fire safety (GB 8624-2023 Class A) 3. Confirm in-house engineering team (LinkedIn verification of structural engineers). |

2-story units require 30%+ structural reinforcement vs. single-story. Absence of seismic/wind data = catastrophic failure risk. Trading companies rarely possess engineering capacity. |

| Operational Proof | 1. Live video tour of production lines (focus: steel framing, insulation injection, MEP integration). 2. Verify crane capacity (≥50T for 2-story module lifting). 3. Check module storage yard capacity (min. 5,000㎡ for 2-story units). |

Modular homes require specialized jigs/cranes. Trading companies cannot demonstrate live production. Inadequate storage = weather damage risk. |

| Compliance Validation | 1. Confirm China Compulsory Certification (CCC) for electrical components. 2. Validate CE marking via EU Notified Body records (if targeting EU market). 3. Require past export documentation (B/L, customs declarations) for modular homes to your target market. |

Non-CCC electrical systems = customs rejection. “CE” stickers ≠ valid certification. Trading companies often falsify export docs. |

II. Trading Company vs. Factory: Key Differentiators

89% of “factories” on Alibaba are trading entities (SourcifyChina 2025 Platform Audit). Use these filters:

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” of prefab structures | Vague terms: “trading,” “import/export,” “wholesale” | Cross-check license # on National Enterprise Credit Portal |

| Facility Footprint | ≥30,000㎡ land area; visible production sheds/cranes | Office-only in business district; no heavy equipment | Drone footage + satellite imagery (2026: Use Baidu Maps 3D) |

| Payment Terms | 30% deposit, 60% against shipping docs, 10% post-delivery | Demands 100% LC at sight or 50%+ upfront | Reject terms deviating from industry standard |

| Technical Depth | Engineers discuss weld specs, insulation R-values, load paths | Focuses on price/lead time; deflects technical questions | Ask: “What steel grade do you use for 2-story shear walls?” |

| Sample Costs | Charges for production samples (covers material/labor) | “Free samples” (sourced from 3rd party) | Insist on paying for samples via wire to factory account |

Red Flag: If their “factory tour” video shows European-style houses but the facility is in Shenzhen (industrial zone), terminate engagement. Modular home factories cluster in Shandong, Jiangsu, Hebei (low land costs).

III. Critical Red Flags: Immediate Disengagement Triggers

These indicate high fraud risk or operational incapacity for 2-story modular homes.

| Red Flag | Risk Severity | 2026-Specific Context |

|---|---|---|

| “We are Alibaba Golden Supplier” | ⚠️⚠️⚠️ (Critical) | Golden Supplier status is purchased; zero correlation with manufacturing capability. |

| No verifiable export history | ⚠️⚠️⚠️ | If they claim “export experience” but cannot share B/Ls/customs docs, they lack logistics expertise for oversized modules. |

| Price 20% below market average | ⚠️⚠️⚠️ | 2-story modular homes require reinforced frames/insulation. Sub-$120/m² FOB indicates material substitution (e.g., non-fire-rated insulation). |

| Refusal to sign NNN Agreement | ⚠️⚠️ | Mandatory for IP protection on custom designs. Trading companies avoid this liability. |

| Payment to personal WeChat/Alipay | ⚠️⚠️⚠️ | Never pay to individual accounts. Legitimate factories use corporate bank transfers. |

IV. SourcifyChina 2026 Action Plan

- Pre-Screen: Use our China Modular Home Supplier Database (updated quarterly) to shortlist pre-vetted factories.

- On-Site Audit: Deploy SourcifyChina’s engineering team for structural integrity testing (mandatory for 2-story). Includes:

- Ultrasonic weld inspection

- Frame deflection load testing

- Mock-up module transport simulation

- Pilot Order: Start with 1 unit shipped to your 3PL hub (not final site) for full compliance re-inspection.

- Blockchain Tracking: Require suppliers to use SourcifyChain™ for material traceability (steel batch #, insulation certs) – 2026 industry standard.

“In modular construction, the factory’s crane capacity is your first compliance checkpoint. If they can’t lift it, they can’t build it safely.” – SourcifyChina Engineering Director, 2025

Disclaimer: This report reflects SourcifyChina’s proprietary audit data (2023-2025). Regulations evolve; verify all requirements with local authorities. Trading companies are not inherently non-viable but require dual-layer verification (trader + their factory). For high-risk categories like structural housing, direct factory engagement is strongly advised.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited. Data sources: CNCA, GB Standards 2025, SourcifyChina Audit Database.

Need verified suppliers? → Request SourcifyChina’s 2026 Modular Home Factory Shortlist

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of China 2-Story Modular Homes – Wholesale Procurement

Executive Summary

Global demand for prefabricated 2-story modular homes continues to rise, driven by rapid urbanization, cost-effective construction timelines, and sustainable building practices. China remains the world’s leading manufacturer of modular housing solutions, offering competitive pricing and scalable production capacity. However, procurement complexity—ranging from supplier verification to quality assurance and compliance—poses significant risks for international buyers.

SourcifyChina’s Verified Pro List for China 2-Story Modular Homes (Wholesale) delivers a streamlined, secure, and time-efficient sourcing pathway, enabling procurement managers to bypass the inefficiencies of open-market supplier searches.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Verification | 4–8 weeks of due diligence, background checks, factory audits | Pre-vetted, ISO-certified suppliers with documented production capacity and export experience |

| Quality Assurance | Post-discovery audits and sample testing delays | Suppliers with proven track records, third-party inspection reports, and BSCI/SGS compliance |

| Communication & MOQ Negotiation | Multiple language barriers, inconsistent responsiveness | English-speaking teams, MOQs optimized for wholesale buyers, and contract-ready terms |

| Lead Time & Logistics | Unreliable delivery forecasts, hidden costs | Verified production timelines, FOB/CIF quote transparency, and logistics coordination support |

| Risk of Fraud or Non-Performance | 30%+ of unverified suppliers fail to meet contractual obligations (2025 ICC Report) | Zero tolerance policy; blacklisted suppliers excluded from Pro List |

Average Time Saved: Up to 68% reduction in sourcing cycle—from initial inquiry to PO placement.

Strategic Benefits for Global Procurement Managers

- Accelerated Time-to-Market: Reduce go/no-go decision timelines from months to days.

- Cost Efficiency: Leverage bulk pricing from suppliers already qualified for international distribution.

- Compliance Confidence: Full documentation support for CE, CCCF, and regional building standards.

- Scalable Partnerships: Access manufacturers capable of fulfilling 50–500+ unit orders with consistent quality.

Call to Action: Optimize Your 2026 Procurement Strategy Today

In an era where supply chain agility defines competitive advantage, relying on unverified suppliers is no longer a viable risk. SourcifyChina eliminates the guesswork in sourcing high-quality, wholesale 2-story modular homes from China—so your team can focus on deployment, not due diligence.

Take the next step with confidence:

✅ Request your complimentary copy of the 2026 Verified Pro List: China 2-Story Modular Homes (Wholesale)

✅ Speak directly with our China-based sourcing consultants for custom supplier matches

📩 Contact Us Now:

Email: [email protected]

WhatsApp: +86 159 5127 6160

Available Monday–Friday, 8:00 AM – 6:00 PM CST. Response within 2 business hours guaranteed.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing Excellence.

Precision. Protection. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.