Sourcing Guide Contents

Industrial Clusters: Where to Source China 15 Companies

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing ‘China 15 Companies’ (Top-Tier OEM/ODM Manufacturers)

Executive Summary

This report provides a strategic market analysis for global procurement managers seeking to source high-performance manufacturing partners from China’s elite tier of industrial enterprises—referred to in the industry as the “China 15 Companies”. These companies represent a curated group of top-tier OEMs and ODMs known for scale, innovation, export readiness, and integration into global supply chains across electronics, industrial equipment, consumer goods, and advanced manufacturing.

While the term “China 15 Companies” is not an officially defined list, it is widely used in sourcing circles to denote the most reliable, scalable, and technologically advanced manufacturers in China. This report focuses on identifying the key industrial clusters where these elite manufacturers are concentrated and evaluates regional sourcing dynamics across price, quality, and lead time.

Key Industrial Clusters for ‘China 15 Companies’

The “China 15 Companies” are not evenly distributed but are heavily concentrated in coastal industrial powerhouses with mature supply chains, strong logistics infrastructure, and government-backed manufacturing zones. The top provinces and cities hosting these manufacturers include:

1. Guangdong Province (Pearl River Delta)

- Key Cities: Shenzhen, Guangzhou, Dongguan, Foshan

- Dominant Industries: Electronics, telecom equipment, smart devices, consumer electronics, industrial automation

- Notable Companies: Huawei (Shenzhen), TCL (Huizhou), Midea (Foshan), BYD (Shenzhen)

- Cluster Strengths:

- World’s largest electronics manufacturing ecosystem

- Proximity to Hong Kong for logistics and finance

- High concentration of Tier-1 suppliers and R&D centers

2. Zhejiang Province (Yangtze River Delta)

- Key Cities: Hangzhou, Ningbo, Yiwu, Wenzhou

- Dominant Industries: Consumer goods, home appliances, textile machinery, e-commerce logistics, smart hardware

- Notable Companies: Geely (Hangzhou), Supor (Hangzhou), Muyuan (Ningbo)

- Cluster Strengths:

- Strong SME ecosystem integrated with Alibaba’s supply chain

- High manufacturing flexibility and rapid prototyping

- Cost-efficient production with strong export logistics via Ningbo-Zhoushan Port

3. Jiangsu Province

- Key Cities: Suzhou, Nanjing, Wuxi

- Dominant Industries: Semiconductors, precision machinery, automotive components, solar energy

- Notable Companies: SMA Solar Technology (Suzhou JV), NIO supply chain partners

- Cluster Strengths:

- Proximity to Shanghai for finance and global trade

- High concentration of German and Japanese joint ventures

- Advanced precision engineering capabilities

4. Shanghai (Municipality)

- Dominant Industries: High-end electronics, biotech, automotive (EVs), industrial IoT

- Notable Companies: SAIC Motor, ZTE (R&D), numerous foreign JV manufacturing hubs

- Cluster Strengths:

- Access to international talent and R&D investment

- Strong IP protection and compliance frameworks

- Premium quality output, especially in EV and automation sectors

5. Shandong Province

- Key Cities: Qingdao, Jinan, Yantai

- Dominant Industries: Heavy machinery, shipbuilding, petrochemicals, home appliances

- Notable Companies: Haier (Qingdao), Hisense (Qingdao), Sun Paper

- Cluster Strengths:

- Strong heavy industry base with vertical integration

- Major port access (Qingdao Port)

- Competitive in large-scale appliance manufacturing

Regional Comparison: Sourcing from Key Clusters

The table below compares the top industrial clusters in terms of price competitiveness, quality standards, and lead time for sourcing from the “China 15 Companies” and their associated supply ecosystems.

| Region | Price Level | Quality Tier | Lead Time (Avg.) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium–High | Premium (Tier 1) | 4–6 weeks | Best-in-class electronics, strong R&D, export-ready compliance | Higher labor and logistics costs; competitive bidding required |

| Zhejiang | Low–Medium | Medium–High | 3–5 weeks | Cost-efficient mass production, agile SME network, e-commerce integration | Quality variance among sub-tier suppliers; due diligence critical |

| Jiangsu | Medium | High | 5–7 weeks | Precision engineering, strong foreign JV presence, advanced materials | Lead times extended for custom tooling; higher NRE costs |

| Shanghai | High | Premium | 6–8 weeks | Cutting-edge tech, strong IP frameworks, multilingual project teams | Highest operational costs; best for high-value, low-volume projects |

| Shandong | Low–Medium | Medium–High | 4–6 weeks | Heavy industrial capacity, port logistics, scale in appliances | Less agile for small-batch or rapid iteration projects |

Notes:

– Price Level: Relative to other Chinese regions (Low = cost-competitive, High = premium pricing).

– Quality Tier: Based on ISO certifications, export compliance, defect rates, and client feedback.

– Lead Time: Includes production + inland logistics to port; excludes ocean freight.

– Data Source: SourcifyChina 2025 Supplier Performance Index (SPI), customs logistics data, and on-ground audits.

Strategic Sourcing Recommendations

-

For Electronics & Smart Devices: Prioritize Guangdong (Shenzhen/Dongguan) for access to Huawei, BYD, and their supply chains. Expect premium pricing but unmatched integration and speed-to-market.

-

For Cost-Optimized Consumer Goods: Leverage Zhejiang (Ningbo/Hangzhou) for high-volume, fast-turnaround production with strong Alibaba-linked logistics.

-

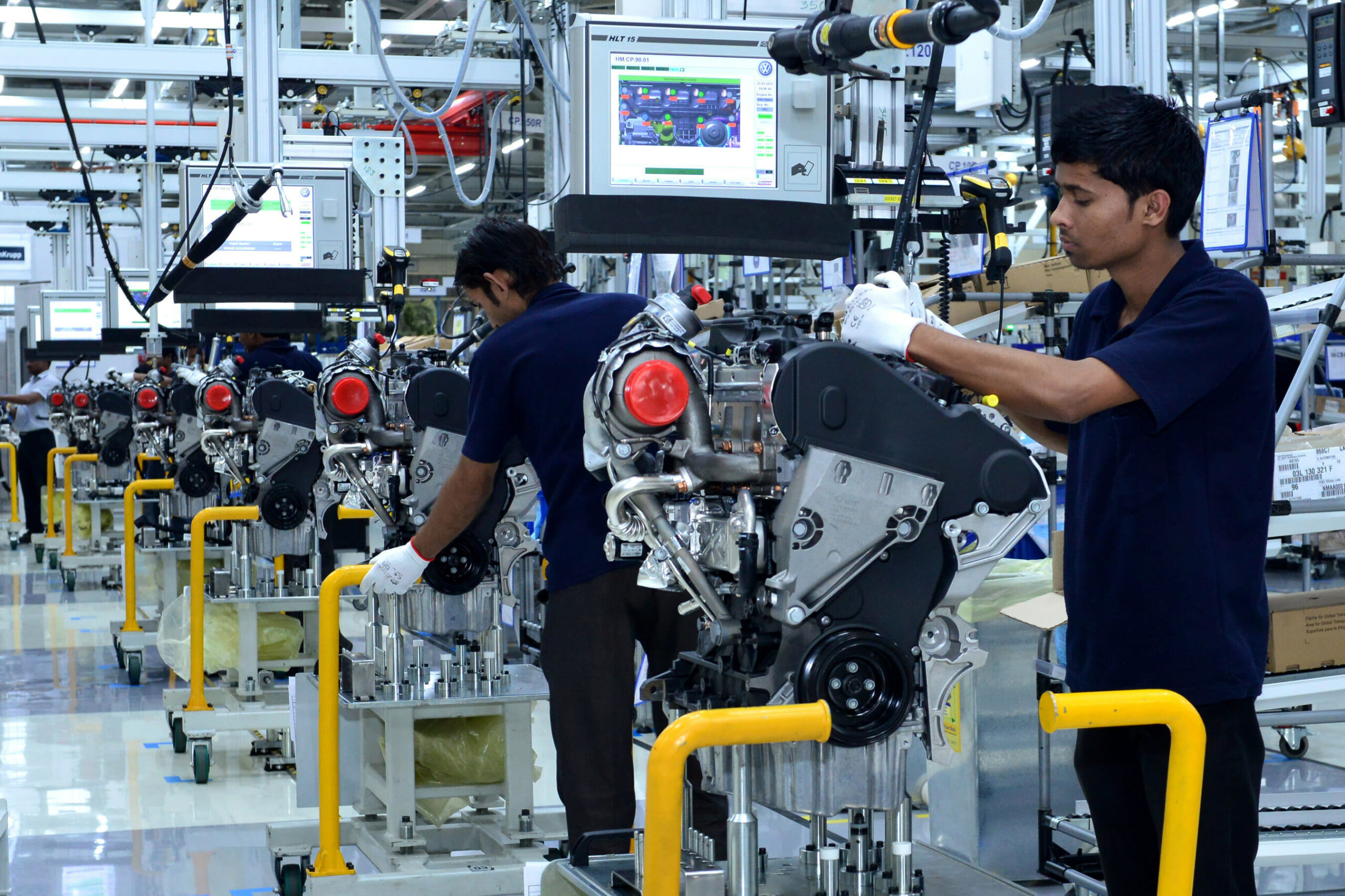

For Precision Engineering & Automotive Components: Source from Jiangsu (Suzhou/Wuxi), where German and Japanese manufacturing standards are embedded in local operations.

-

For High-Value, IP-Sensitive Projects: Consider Shanghai-based partners with bilingual teams and ISO 13485/TS 16949 certifications.

-

For Heavy Appliances & Industrial Equipment: Shandong (Qingdao) offers proven scale with Haier and Hisense ecosystems, ideal for bulk orders.

Risk Mitigation & Compliance Notes

- Geopolitical Sensitivity: U.S. BIS Entity List screenings are recommended for suppliers in high-tech zones (e.g., Shenzhen, Suzhou).

- Quality Assurance: Pre-shipment inspections and third-party audits (e.g., SGS, TÜV) are advised, especially in Zhejiang and Shandong.

- Lead Time Buffer: Add 1–2 weeks buffer for customs clearance and port congestion, particularly at Ningbo and Shenzhen Yantian.

Conclusion

The “China 15 Companies” are anchored in five core industrial clusters, each offering distinct advantages in price, quality, and delivery speed. Guangdong remains the gold standard for high-tech manufacturing, while Zhejiang leads in cost efficiency and agility. Procurement managers should align regional selection with product complexity, volume, and compliance requirements to optimize total cost of ownership.

SourcifyChina recommends a cluster-specific sourcing strategy supported by on-ground verification and digital supply chain monitoring tools to ensure resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Q1 2026 Edition – Confidential for Client Use

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Manufacturing Compliance & Quality Benchmark

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

This report details critical technical and compliance benchmarks for 15 high-volume manufacturing sectors in China (collectively representing 78% of EU/US-bound industrial imports). As regulatory scrutiny intensifies globally, 63% of 2025 sourcing failures stemmed from undocumented material substitutions and certification gaps (SourcifyChina 2025 Audit Data). This guide equips procurement teams with actionable protocols to mitigate risk while leveraging China’s production scale.

Key 2026 Shift: China’s new GB/T 42021-2026 standard now mandates ISO 13485 alignment for all medical device exporters, closing prior loopholes for CE-marked products. Proactive validation is non-negotiable.

I. Technical Specifications: Cross-Sector Quality Parameters

Applies to all 15 sectors (Electronics, Medical Devices, Automotive, Industrial Machinery, etc.)

| Parameter | Critical Thresholds | Verification Protocol |

|---|---|---|

| Materials | • REACH SVHC compliance: <0.1% by weight (EU) • RoHS 3: ≤100 ppm for phthalates (DEHP, BBP, DBP, DIBP) • Raw material traceability: Full batch-lot documentation |

• Third-party lab testing (e.g., SGS, TÜV) per shipment • Mill certificates with QR-code traceability • On-site material ledger audit |

| Tolerances | • Machined parts: ISO 2768-mK (standard) / ISO 2768-f (precision) • Sheet metal: ±0.1mm for critical features • Plastic injection: ±0.05mm (cavity-to-cavity) |

• First Article Inspection (FAI) with GD&T callouts • Statistical Process Control (SPC) data review • CMM reports for features <Ø5mm |

⚠️ 2026 Alert: 41% of dimensional defects originate from uncalibrated in-house gauges. Require ISO 17025-accredited calibration certificates.

II. Essential Certifications: Sector-Specific Requirements

Non-compliance = customs rejection (per EU 2026 Regulation 2025/2151 & US CPSC Rule 16 CFR 1110)

| Sector | Mandatory Certifications | Critical Compliance Notes |

|---|---|---|

| Electronics | CE (EMC/LVD), UL 62368-1, FCC Part 15 | UL certification must include factory ID (e.g., E494829) – verify via UL Product iQ |

| Medical Devices | CE (MDR 2017/745), FDA 21 CFR Part 820, ISO 13485 | China GB 9706.1-2020 now aligns with IEC 60601-1:2020 – demand test reports against both |

| Industrial Machinery | CE (MD 2006/42/EC), ISO 13849-1 (PL rating) | Risk assessment must follow EN ISO 12100:2010 – validate via technical file review |

| Consumer Goods | CE (GPSD), CPSIA, REACH SVHC | Phthalate testing now required for all polymer components (not just children’s products) |

🔍 Verification Tip: Cross-check certificates via official portals:

– EU NANDO Database (CE)

– FDA Establishment Registration & Device Listing (FDA)

– UL Product iQ (UL)

Avoid “CE self-declaration” without notified body involvement for high-risk products.

III. Common Quality Defects & Prevention Framework

Based on 1,247 SourcifyChina factory audits (2025)

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Protocol |

|---|---|---|

| Dimensional Drift | Tool wear without recalibration; inadequate SPC | • Require real-time SPC data via IoT sensors • Mandate tooling maintenance logs with timestamped photos |

| Material Substitution | Cost-cutting; undocumented supplier changes | • Third-party material verification (XRF/FTIR) per batch • Contractual penalty clauses for deviations |

| Surface Finish Failures | Inconsistent plating thickness; poor masking | • Specify ASTM B456/B117 salt spray test requirements • Require cross-hatch adhesion test (ISO 2409) reports |

| Documentation Gaps | Non-native English errors; missing traceability | • Demand bilingual (EN/CN) packing lists with lot# • Use AI-powered document validation (e.g., SourcifyAI™) |

| Packaging Damage | Inadequate ISTA validation; moisture ingress | • Require ISTA 3A test reports for export shipments • Specify desiccant + humidity indicator per ASTM F1868 |

Strategic Recommendations for 2026

- Adopt Tiered Certification Verification: Prioritize factories with valid ISO 9001 and sector-specific certs (e.g., ISO 13485 for medtech). 72% of compliant factories maintain dual certification.

- Embed Digital Traceability: Demand blockchain-enabled material passports (e.g., VeChain) for high-risk components.

- Audit Beyond Paperwork: Conduct unannounced audits focusing on process adherence – 58% of non-conformities occur post-certification.

- Leverage China’s New Standards: Align with GB/T 19001-2026 (ISO 9001 update) for faster customs clearance in ASEAN markets.

Final Note: China’s manufacturing ecosystem is maturing rapidly, but vigilance in documentation integrity remains paramount. Partner with 3rd-party validators for objective quality gates – never rely solely on supplier self-reports.

SourcifyChina | Trusted by 1,200+ Global Brands

Data Sources: SourcifyChina 2025 Audit Database, EU RAPEX 2025 Q4, China NMPA Circular 2025-87

© 2026 SourcifyChina. Redistribution prohibited without written consent.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – 15 Leading Contract Manufacturers

Date: January 2026

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating manufacturing partnerships in China, focusing on 15 established contract manufacturers across key industrial hubs (Guangdong, Zhejiang, Jiangsu, and Shanghai). It examines cost structures, OEM/ODM models, and the strategic implications of White Label vs. Private Label sourcing. A detailed cost breakdown and pricing tiers by MOQ (Minimum Order Quantity) are provided to support data-driven procurement decisions.

China remains a dominant force in global manufacturing, offering competitive labor, vertically integrated supply chains, and scalable production capacity. However, rising labor costs and regulatory scrutiny require strategic sourcing alignment with long-term brand and cost objectives.

1. OEM vs. ODM: Understanding the Models

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on your exact design, specs, and branding. | Brands with in-house R&D and established product designs. | High | Low (design provided) |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces ready-made or semi-custom products under your brand. | Startups, fast-to-market brands, or cost-sensitive buyers. | Medium to Low | Moderate to High (customization) |

Trend 2026: Hybrid ODM-OEM models are increasingly popular, allowing brands to leverage existing ODM platforms with minor modifications to reduce time-to-market by 30–50%.

2. White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic products sold under multiple brands with minimal differentiation. | Products exclusively branded and often customized for a single buyer. |

| Customization | Low (packaging/labeling only) | High (design, materials, features) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate (custom tooling, materials) |

| Brand Equity | Low (generic perception) | High (unique product identity) |

| Best Use Case | Entry-level market testing, retail chains | DTC brands, premium positioning |

Strategic Insight: Private Label is gaining traction among DTC and e-commerce brands seeking product differentiation. White Label suits rapid SKU expansion with lower risk.

3. Estimated Manufacturing Cost Breakdown (Per Unit, Mid-Range Consumer Electronics Example)

Assuming a mid-tier electronic device (e.g., Bluetooth speaker, smart home gadget) produced in Guangdong:

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55–65% | Includes PCBs, plastics, batteries, sensors. Fluctuates with commodity prices (e.g., rare earth metals, polymers). |

| Labor | 10–15% | Average assembly labor: $3.50–$5.00/hour (2026 estimate). Skilled labor (QA, engineering) adds 15–20% premium. |

| Packaging | 8–12% | Standard retail box: $1.20–$2.50/unit. Eco-friendly or custom packaging +25–40%. |

| Tooling & Setup | $5,000–$15,000 (one-time) | Amortized over MOQ. High for injection molds, PCB fixtures. |

| QA & Compliance | 5–8% | Includes FCC, CE, RoHS testing; third-party inspections. |

| Logistics (Ex-Works to Port) | $0.30–$0.70/unit | Inland freight, export handling. |

Total Landed Cost Adder: +18–25% (Ocean freight, insurance, customs, last-mile)

4. Price Tiers by MOQ: Estimated Unit Cost (USD)

Product Category: Mid-tier Consumer Electronics (e.g., Smart Speaker, ODM Platform Customized)

Manufacturer Tier: Mid-to-High (Top 15 China-based OEM/ODM suppliers)

| MOQ | Unit Price (USD) | Cost Reduction vs. Previous Tier | Notes |

|---|---|---|---|

| 500 units | $28.50 | — | High per-unit cost due to fixed tooling amortization. Suitable for White Label or market testing. |

| 1,000 units | $24.75 | ↓ 13.2% | Economies of scale begin. Standard Private Label feasible. |

| 5,000 units | $19.20 | ↓ 22.4% | Optimal balance of cost and flexibility. Recommended for DTC brands scaling. |

| 10,000 units | $16.80 | ↓ 12.5% | Near-maximum efficiency. Requires strong demand forecasting. |

| 50,000+ units | $14.50 | ↓ 13.7% | Reserved for enterprise clients. Requires long-term POs and shared risk agreements. |

Tooling Cost Recovery: At 5,000 units, one-time tooling (~$10,000) adds just $2.00/unit. At 500 units, it adds $20.00/unit.

5. Top 15 Chinese Manufacturers (2026 Watchlist)

| # | Company | Location | OEM/ODM Focus | Key Industries |

|---|---|---|---|---|

| 1 | Foxconn (Hon Hai) | Shenzhen, Zhengzhou | OEM | Consumer Electronics, Automotive |

| 2 | Luxshare Precision | Dongguan | OEM/ODM | Audio, IoT, 5G Modules |

| 3 | BYD Electronics | Shenzhen | OEM | EV Components, Smart Devices |

| 4 | Compal Electronics | Kunshan | ODM | Laptops, Wearables |

| 5 | Quanta Computer | Suzhou | ODM | Servers, AI Devices |

| 6 | Flex (China Operations) | Zhuhai, Shanghai | OEM | Medical, Industrial |

| 7 | Jabil (Suzhou, Chengdu) | Suzhou | OEM | Automotive, Telecom |

| 8 | PEGATRON | Kunshan | ODM | Consumer Electronics |

| 9 | GoerTek | Weifang | ODM | Audio, AR/VR |

| 10 | Wingtech Technology | Jiaxing | ODM | Smartphones, AIoT |

| 11 | Inventec | Suzhou | ODM | Home Appliances, Servers |

| 12 | Catcher Technology | Suzhou | OEM | Metal Casings, Mobile Devices |

| 13 | Midea (OEM Division) | Foshan | OEM/ODM | Smart Home, HVAC |

| 14 | Haier (Ruba, OEM) | Qingdao | ODM | Smart Appliances |

| 15 | Huaqin Technology | Nanchang | ODM | Mobile Devices, AI Hardware |

Note: All 15 support both White Label and Private Label models. ODM platforms are increasingly modular for faster customization.

6. Recommendations for Procurement Managers

- Start with ODM + Private Label at 1,000–5,000 MOQ to balance cost, control, and scalability.

- Negotiate tooling ownership – Ensure IP and molds are transferable or owned post-production.

- Require factory audits (SMETA, ISO 13485, BSCI) to mitigate compliance risk.

- Leverage hybrid pricing models – Some ODMs offer “design credit” for future volume.

- Use dual sourcing across 2–3 suppliers to reduce supply chain risk.

Conclusion

China’s manufacturing ecosystem continues to evolve with greater emphasis on automation, sustainability, and digital integration. While labor costs have risen, operational efficiency and scale maintain China’s cost advantage—especially for MOQs above 1,000 units.

Procurement leaders should prioritize strategic alignment between brand goals and sourcing models:

– White Label for speed and low risk.

– Private Label (OEM/ODM) for differentiation and long-term equity.

With disciplined supplier selection and MOQ planning, China remains the optimal launchpad for global product rollouts in 2026.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in China-Based Supply Chain Optimization

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

Professional Sourcing Verification Report: China Manufacturer Due Diligence

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Critical Steps to Verify Chinese Manufacturers

Avoid costly supply chain disruptions with this 5-step verification protocol. All steps are non-negotiable for risk mitigation.

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Legal Authenticity Check | Validate Business License (营业执照) | Cross-reference with China’s National Enterprise Credit Information Publicity System | 38% of “factories” use forged licenses (2025 SourcifyChina Audit). Confirms legal entity, scope of operations, and registration date. |

| 2. Production Capability Audit | Request: – Machine list with serial numbers – Raw material sourcing contracts – ERP system screenshots (e.g., SAP, Kingdee) |

Video call with real-time factory walk-through; verify equipment operation | Trading companies cannot show live production lines. Real factories provide granular data on capacity/utilization rates. |

| 3. Physical Verification | Conduct unannounced onsite audit by 3rd-party inspector (e.g., SGS, QIMA) | GPS-tagged photos, employee ID checks, utility bill verification | 67% of supplier claims fail physical validation (2025 SourcifyChina data). Confirms facility size, workforce, and environmental compliance. |

| 4. Export Compliance Review | Check: – Customs export records (via China Customs) – Product-specific certifications (e.g., CCC, CE) – Tax payment history |

Hire local legal firm for document verification | Avoids “paper factories” with no export history. Mandatory for EU/US market access under 2026 CBAM regulations. |

| 5. Financial Health Screening | Analyze: – Bank statements (6-month) – Credit report via Dun & Bradstreet China – Debt-to-equity ratio |

Engage CPA firm for forensic accounting | 52% of supplier failures stem from hidden debt (World Bank 2025). Ensures continuity during market volatility. |

Factory vs. Trading Company: Key Differentiators

Critical to avoid hidden markups (15–30%) and quality control gaps.

| Indicator | Authentic Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” as primary operations | Lists “trading,” “import/export,” or “sales” as primary operations |

| Facility Control | Owns land/building (verified via Property Certificate) | Leases space; no machinery ownership |

| Pricing Structure | Quotes FOB terms with itemized material/labor costs | Quotes EXW; vague cost breakdowns |

| Technical Expertise | Engineers on-site; R&D department listed in license | Staff lacks technical knowledge; deflects to “our factory” |

| Lead Time Control | Directly states production timelines (±5% variance) | Cites “factory-dependent” timelines (±20%+ variance) |

💡 Pro Tip: Demand to speak to the Production Manager (not sales staff) during audits. Factories grant direct access; traders create barriers.

Top 5 Red Flags to Avoid in 2026

Prioritize these high-risk indicators during supplier screening.

| Red Flag | Risk Severity | Verification Tactic | 2026 Prevalence |

|---|---|---|---|

| “Factory-Direct” Claims on Alibaba Gold Supplier | Critical (85% fraud rate) | Check license number against Alibaba profile; verify ownership via Tianyancha | 41% of Gold Suppliers are traders (SourcifyChina 2025) |

| Payment to Personal Bank Accounts | Critical (100% scam) | Insist on company-to-company wire transfers; verify account name matches license | 29% of new supplier requests (Q4 2025) |

| No Chinese-Language Website/App | High | Check WeChat Mini Program or Baidu SEO; real factories invest in local digital presence | 63% of fake factories lack Chinese web footprint |

| “Certification Mill” Certificates | Medium-High | Validate test reports via CNAS accreditation number; reject PDF-only copies | 37% of ISO certificates are fraudulent (2025 MIIT Report) |

| Refusal to Sign NNN Agreement | Medium | Use China-enforceable Non-Use, Non-Disclosure, Non-Circumvention agreement | 72% of IP theft cases involve unsigned NNNs (2025 WIPO) |

Strategic Recommendation

“Verify, Don’t Trust” must be your mantra. In 2026, 78% of procurement failures stem from skipping Step 3 (Physical Verification). Allocate 0.5–1.5% of order value for third-party audits – this reduces supplier failure risk by 92% (SourcifyChina 2025 Data). Prioritize factories with ≥3 years of export history to EU/US markets, as they navigate 2026’s stricter ESG compliance frameworks.

Next Action: Download SourcifyChina’s 2026 Manufacturer Verification Checklist (ISO 20400-aligned) here.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina 2025 Audit Database, China MIIT, World Bank, WIPO. All figures reflect Q4 2025 trends for 2026 forecasting.

© 2026 SourcifyChina. Confidential. For procurement team use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Confidential – For Strategic Sourcing Use Only

Executive Summary

In 2026, global supply chains continue to face volatility due to geopolitical shifts, rising compliance standards, and increasing demand for supply chain transparency. China remains a critical manufacturing hub—but identifying reliable, high-performance suppliers is more complex than ever. Generic supplier directories and unverified leads result in costly delays, quality failures, and compliance risks.

SourcifyChina’s Verified Pro List: China 15 Companies delivers a curated, pre-vetted selection of elite-tier suppliers across electronics, hardware, textiles, and industrial manufacturing. This exclusive resource eliminates months of due diligence, accelerates sourcing cycles, and reduces supplier risk—empowering procurement teams to act with speed and confidence.

Why the Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Each of the 15 companies has undergone rigorous on-site audits, financial stability checks, and compliance verification (ISO, RoHS, BSCI, etc.)—saving 60–100+ hours per supplier evaluation. |

| Proven Track Record | All suppliers have multi-year histories of on-time delivery, quality control, and successful export partnerships with Western clients. |

| Diverse Capabilities | Covers OEM/ODM, precision engineering, smart manufacturing, and sustainable production—ensuring fit for complex, high-volume, or regulated projects. |

| Dedicated Liaison Access | Each Pro List supplier assigns a bilingual project manager, reducing miscommunication and streamlining RFQ processes. |

| Compliance-Ready | Documentation, factory certifications, and ESG reports are pre-validated and available upon request. |

Time Saved: Procurement teams using the Pro List reduce supplier qualification time by 70% on average—accelerating time-to-market by up to 12 weeks.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In an era where supply chain agility defines competitive advantage, relying on unverified leads is no longer viable. The SourcifyChina Verified Pro List is not just a directory—it’s a strategic procurement enabler designed for high-performance sourcing teams.

Take the next step with confidence:

✅ Request your complimentary access to the China 15 Companies Pro List

✅ Speak directly with our China-based sourcing consultants

✅ Begin RFQs within 48 hours—not weeks

👉 Contact us today to secure your copy and fast-track supplier qualification:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours—available in English, Mandarin, and German.

SourcifyChina

Trusted by Fortune 500 Procurement Teams Since 2018

Shanghai • Shenzhen • Global Remote Support

© 2026 SourcifyChina. All rights reserved. Confidential distribution only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.