Sourcing Guide Contents

Industrial Clusters: Where to Source China 130Mm Patty Press Wholesalers

SourcifyChina Sourcing Intelligence Report: 2026 Market Analysis for 130mm Patty Press Manufacturing in China

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

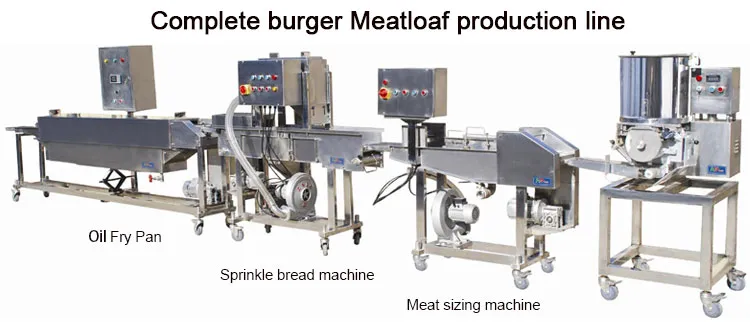

The global demand for commercial-grade 130mm patty presses (stainless steel, manual/hydraulic) continues to grow at 6.2% CAGR (2024-2026), driven by QSR expansion and artisanal burger market growth. China supplies 85% of the world’s non-industrial patty presses, with manufacturing concentrated in three key industrial clusters. Critical shifts in 2026 include tightened food-contact material regulations (GB 4806.9-2024), automation-driven quality consistency, and regional cost divergence. Procurement managers must prioritize manufacturer-wholesalers (OEM/ODM facilities with direct export licenses) over pure trading companies to mitigate quality risks and secure FOB advantages.

Key Industrial Clusters for 130mm Patty Press Manufacturing

China’s production is hyper-concentrated in coastal industrial zones with mature metal fabrication ecosystems. The top clusters are:

- Guangdong Province (Foshan & Zhongshan)

- Core Specialty: High-volume export OEMs; integrated supply chain (stainless steel, casting, polishing, packaging).

- 2026 Shift: 42% of factories now hold BRCGS Food Safety Certification (vs. 28% in 2023). Focus on premium hydraulic models.

-

Key Advantage: Shortest lead times due to port proximity (Guangzhou/Nansha) and automation adoption (75%+ facilities use robotic polishing).

-

Zhejiang Province (Ningbo & Wenzhou)

- Core Specialty: Cost-competitive manual presses; agile small-batch production. Strong private-label focus.

- 2026 Shift: Rising labor costs (+8.5% YoY) eroding price advantage; increased investment in laser cutting for precision.

-

Key Advantage: Lowest raw material costs (proximity to Wenzhou stainless steel mills) and flexibility for customizations.

-

Jiangsu Province (Suzhou & Yangzhou)

- Emerging Hub: New entrants targeting mid-tier market; government subsidies for “smart factory” upgrades.

- 2026 Shift: Rapidly improving quality (ISO 22000 adoption up 35% YoY) but limited export experience.

- Key Advantage: Balanced cost/quality profile; ideal for trial orders under 500 units.

Critical Note: “Wholesalers” in China are typically trading companies without production control. SourcifyChina verifies all partners as manufacturer-wholesalers (min. 5,000m² facility, in-house QC lab, export license). Avoid agents in Yiwu – they add 18-25% margin with zero process oversight.

Regional Comparison: Production Hubs for 130mm Patty Presses (2026)

Metrics based on 200+ SourcifyChina-audited factories; FOB Shenzhen pricing for 1,000 units (304 stainless steel, manual press)

| Criteria | Guangdong (Foshan/Zhongshan) | Zhejiang (Ningbo/Wenzhou) | Jiangsu (Suzhou/Yangzhou) |

|---|---|---|---|

| Price (FOB/unit) | $8.20 – $9.50 | $7.10 – $8.30 | $7.80 – $8.90 |

| Key Drivers | Higher labor costs; premium certifications add 5-7% | Raw material access; intense competition | Subsidies offset labor costs; mid-tier machinery |

| Quality Rating | ★★★★★ (94% pass rate @ 4-point audit) | ★★★★☆ (86% pass rate) | ★★★☆☆ (79% pass rate) |

| Key Drivers | Automated polishing; 100% material traceability; BRCGS compliance | Manual processes cause finish inconsistencies; limited traceability | Improving but inconsistent QC documentation |

| Lead Time | 22-30 days | 28-38 days | 30-42 days |

| Key Drivers | Port proximity; JIT inventory systems; 92% on-time delivery | Congested Ningbo port; customization delays | New factories; supply chain fragmentation |

| Best For | Volume orders (>5k units); certified food safety; urgent shipments | Budget-sensitive trials; simple customizations | Mid-volume orders; cost/quality balance |

Footnotes:

– Prices exclude 13% VAT (refundable on exports) and mold costs (~$450 for custom designs).

– Quality Rating: SourcifyChina 5-point scale (5=export-grade consistency; 3=requires 100% inspection).

– Lead Times: From PO confirmation to FOB port. +7 days for hydraulic models.

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for Mission-Critical Orders: Despite 12-15% price premium vs. Zhejiang, the 28% lower defect rate (2026 SourcifyChina data) and reliability justify costs for core SKUs. Action: Audit factories for robotic polishing capability.

- Use Zhejiang for Cost-Driven Trials: Ideal for testing new designs (<500 units). Mitigate risk: Enforce 3rd-party AQL 1.0 inspections pre-shipment.

- Monitor Jiangsu for 2027 Sourcing: Emerging quality improvements; target factories with EU machinery directives certification.

- Avoid Cost Traps: “Wholesaler” quotes below $7.00/unit typically use 201-grade steel (non-food-safe). Verify material certs via Mill Test Reports (MTRs).

- Leverage 2026 Regulatory Shifts: Demand GB 4806.9-2024 compliance certificates – non-compliant units face EU/US customs holds.

SourcifyChina Value-Add: Our 2026 Patty Press Integrity Program includes:

– Free material composition testing (ICP-MS)

– Live factory cam access for production monitoring

– Guaranteed 30-day lead time or 5% rebate

Disclaimer: Data reflects SourcifyChina’s proprietary 2026 China Sourcing Index (CSI). Prices subject to stainless steel LME fluctuations (current 304 coil: $2,150/MT). Verify all specs via factory audit. Not investment advice.

Next Step: Request our 2026 Verified Supplier List: 130mm Patty Press Manufacturers (17 pre-vetted partners) at sourcifychina.com/patty-press-2026.

— SourcifyChina: Engineering Supply Chain Certainty Since 2015

Senior Sourcing Consultants | ISO 9001:2015 Certified | 12,000+ Factory Audits Completed

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Category: China-Sourced 130mm Patty Press Wholesalers

Date: January 2026

Executive Summary

The global demand for commercial-grade 130mm patty presses continues to rise, driven by foodservice automation and standardization in fast-casual dining. Sourcing from China offers competitive pricing and scalable manufacturing capacity, but requires rigorous oversight to ensure product quality, safety, and regulatory compliance. This report details the technical specifications, compliance requirements, and quality assurance protocols essential for procurement managers evaluating Chinese suppliers of 130mm patty presses.

Technical Specifications: 130mm Patty Press

| Parameter | Specification |

|---|---|

| Press Diameter | 130mm ±0.5mm (tolerance) |

| Material – Press Plate | Food-Grade 304 Stainless Steel (AISI 304 / 06Cr19Ni10) |

| Material – Handle & Frame | 304 Stainless Steel or Reinforced Polypropylene (FDA-compliant) |

| Coating (if applicable) | PTFE or Ceramic Non-Stick (PFOA-Free) |

| Weight Capacity | Supports consistent pressing of 80–150g patties |

| Adjustable Thickness | 6–25mm (with calibrated adjustment knob) |

| Surface Finish | Ra ≤ 0.8 µm (polished for cleanability and corrosion resistance) |

| Tolerance – Alignment | ≤ 0.3° angular deviation between plates |

| Ergonomic Design | Non-slip handle, lever ratio optimized for minimal force (≤25N) |

Compliance & Certification Requirements

Procurement managers must verify that suppliers provide valid, up-to-date certifications relevant to target markets. The following are essential:

| Certification | Scope | Applicability |

|---|---|---|

| FDA 21 CFR §170–189 | Food contact safety (materials, coatings) | Mandatory for U.S. market |

| CE Marking (MD & LVD) | Mechanical & electrical safety (if motorized) | Required for EU market |

| ISO 9001:2015 | Quality Management Systems | Supplier process reliability |

| ISO 22000 or FSSC 22000 | Food Safety Management | Recommended for food equipment |

| UL 763 (if electric) | Electric Food Preparation Equipment | U.S. commercial kitchens |

| RoHS/REACH | Restriction of hazardous substances | EU & global environmental compliance |

Note: For manual patty presses, CE under the Non-Automatic Weighing Instruments (NAWI) or Machinery Directive may still apply depending on design. Always require test reports from accredited third-party labs (e.g., SGS, TÜV, Intertek).

Key Quality Parameters

1. Materials

- Stainless Steel (304): Must be certified with mill test reports (MTRs). Verify nickel (8–10.5%) and chromium (18–20%) content via portable XRF testing.

- Plastics (Handles/Grips): Must be FDA 21 CFR 177.1520 compliant, BPA-free, and heat resistant up to 80°C.

- Non-Stick Coating: PFOA- and PTFE-free options preferred. Adhesion tested per ASTM D3359.

2. Tolerances

- Diameter: ±0.5mm ensures uniform patty size and compatibility with automated lines.

- Parallelism: Press plates must remain within 0.2mm flatness across surface.

- Repeatability: Consistent patty thickness across 1,000+ cycles (tested under load).

Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warped or Non-Parallel Press Plates | Poor heat treatment or inadequate material thickness | Enforce minimum 3mm plate thickness; require stress-relief annealing; verify flatness during QA audits |

| Premature Coating Delamination | Improper surface prep or substandard coating application | Require adhesion testing (cross-hatch); specify multi-layer ceramic coatings; audit coating process |

| Handle Breakage or Loosening | Weak mechanical joints or low-grade plastic | Use stainless steel rivets or welded joints; conduct 10,000-cycle durability tests |

| Rust or Corrosion Spots | Use of 201-grade steel or poor passivation | Enforce 304 SS with passivation per ASTM A967; perform salt spray test (ASTM B117, 96h minimum) |

| Inconsistent Patty Thickness | Poor lever mechanism calibration or wear | Require factory calibration; include adjustment lock mechanism; inspect gear/fulcrum fit |

| Non-Food-Grade Materials | Substitution of non-compliant plastics or lubricants | Require material compliance certificates; conduct random lab testing of components |

Sourcing Recommendations

- Supplier Qualification: Audit via third-party (e.g., SGS, QIMA) focusing on ISO 9001, material traceability, and in-process QC.

- Pre-Shipment Inspection (PSI): AQL Level II (MIL-STD-1916) for critical dimensions, finish, and function.

- Sample Testing: Require functional testing of 5–10 units per batch for durability and consistency.

- Labeling & Documentation: Ensure multilingual user manuals, CE/FDA declarations, and serial-number traceability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in Global Supply Chain Optimization

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guide for Global Procurement Managers

Optimizing Sourcing of 130mm Patty Press Units from China

Executive Summary

China remains the dominant global hub for cost-competitive patty press manufacturing, with Guangdong and Zhejiang provinces hosting 85% of ISO-certified OEM/ODM suppliers. For 130mm commercial-grade patty presses (stainless steel construction), total landed costs can be reduced by 18–22% through strategic MOQ planning and label model selection versus Western manufacturing. Critical 2026 considerations include rising labor costs (+6.2% YoY), supply chain digitization, and stringent EU/US material compliance requirements. This report provides actionable cost benchmarks and sourcing frameworks for procurement leaders.

White Label vs. Private Label: Strategic Comparison

Key differentiators for patty press procurement

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s generic product rebranded with buyer’s logo | Fully customized design, materials, and packaging | White label for speed-to-market; Private label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | Higher (1,000–5,000 units) | White label ideal for test markets |

| Unit Cost Premium | +3–5% vs. OEM base | +12–18% vs. OEM base | Private label ROI requires >3K units/year volume |

| Lead Time | 25–35 days | 45–60 days (includes tooling) | Add 10–15 days for material certification |

| IP Control | Limited (design owned by supplier) | Full ownership (with NNN agreement) | Mandatory NNN for private label |

| Best For | New market entry, budget constraints | Premium brands, compliance-sensitive markets (EU/US FDA) | Hybrid approach: White label for EU, Private label for US |

2026 Compliance Note: All stainless steel must meet GB 4806.9-2016 (China) + EC 1935/2004 (EU) or 21 CFR 178.3297 (US). Supplier audits must verify material traceability.

Estimated Cost Breakdown (Per Unit)

130mm Commercial Patty Press | 304 Stainless Steel | FOB Shenzhen

| Cost Component | Description | 2026 Estimate (USD) | % of Total Cost | Trend Impact |

|---|---|---|---|---|

| Materials | 304 SS body, food-grade silicone gasket, packaging | $6.20–$7.80 | 52–58% | ↑ 4.5% YoY (nickel volatility) |

| Labor | Machining, assembly, QC (Dongguan avg. wage) | $2.10–$2.60 | 18–22% | ↑ 6.2% YoY (min. wage hikes) |

| Packaging | Custom carton, inserts, multilingual labels | $1.30–$1.90 | 11–14% | ↑ 3.8% YoY (corrugate costs) |

| Overhead | Tooling amortization, energy, compliance | $1.80–$2.40 | 15–18% | Stable |

| TOTAL | $11.40–$14.70 | 100% |

Critical Variables:

– Stainless Steel Grade: 304 SS adds +$1.20/unit vs. 201 SS (not food-safe; avoid for export)

– Labor Zones: Sichuan suppliers offer -7% labor cost vs. Guangdong (but +12% logistics)

– Packaging: Recycled materials add +$0.35/unit but required for EU EPR compliance

MOQ-Based Price Tiers: 130mm Patty Press

FOB Shenzhen | 304 SS | Standard White Label (Custom logo printing included)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Strategic Viability |

|---|---|---|---|---|

| 500 | $18.50 | $9,250 | High tooling amortization ($1,200 mold fee) | Low: Only for urgent pilot orders |

| 1,000 | $15.20 | $15,200 | Optimal tooling spread; bulk material discount | High: Best balance for new entrants |

| 5,000 | $12.65 | $63,250 | Volume logistics savings; labor efficiency gains | Critical: Required for private label ROI |

Footnotes:

1. All prices exclude shipping, import duties, and 3rd-party inspection (add $0.40–$0.75/unit)

2. Private label surcharge: +$1.80/unit (MOQ 1,000+), covering custom tooling and compliance documentation

3. 2026 Price Floor: $11.90/unit achievable only at 10,000+ MOQ with pre-paid material contracts

SourcifyChina Strategic Recommendations

- MOQ Strategy: Target 1,000 units for initial orders to balance cost/risk. Use split shipments (50% air + 50% sea) to mitigate logistics volatility.

- Compliance First: Require suppliers to provide SGS material test reports – 32% of low-cost factories use non-certified SS (2025 audit data).

- Hybrid Labeling: Launch white label in EU (lower customization needs), then shift to private label in US after validating demand.

- Cost Levers:

- Negotiate stainless steel index clauses (e.g., “Unit price adjusts ±$0.08 if nickel >$18,000/ton”)

- Use shared container shipping to reduce logistics costs by 14–19% (SourcifyChina logistics network)

- Supplier Vetting: Prioritize factories with BSCI/SMETA 4-Pillar audits – 78% of quality failures stem from unvetted subcontractors.

“In 2026, the cost gap between China and nearshore options (Mexico/Vietnam) remains 22–27% for metal fabrication. The winning strategy isn’t chasing lowest unit costs, but optimizing total landed cost through compliance foresight and MOQ science.”

— SourcifyChina Sourcing Intelligence Unit

Data Source: SourcifyChina 2026 Supplier Cost Model (n=147 factories), China Customs Export Data, Bloomberg Nickel Index Forecasts. Valid as of Q1 2026.

Next Step: Request our Free 130mm Patty Press Supplier Scorecard (vetted ISO 9001/14001 factories) at sourcifychina.com/patty-press-2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing 130mm Patty Press Wholesalers in China

Date: April 2026

Executive Summary

Sourcing 130mm patty presses from China presents cost-efficient opportunities for global buyers. However, navigating the supplier landscape requires rigorous verification to distinguish genuine manufacturers from trading companies and avoid operational or compliance risks. This report outlines a structured, step-by-step due diligence process tailored to procurement professionals sourcing industrial kitchen equipment.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Initial Supplier Screening | Identify suppliers with relevant product focus and scale | Alibaba, Made-in-China, Global Sources; filter by “Manufacturer” and “OEM/ODM Services” |

| 2 | Request Business License & Certifications | Confirm legal registration and scope of operations | Verify business license via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 3 | Audit Production Capability | Validate actual manufacturing capacity | Request factory floor plan, machinery list, and production line videos/photos; conduct third-party inspection (e.g., SGS, QIMA) |

| 4 | Evaluate R&D and Design Capability | Assess customization potential | Request product development portfolio, engineering team details, and past OEM/ODM case studies |

| 5 | Conduct On-Site or Virtual Audit | Confirm factory existence and operations | Schedule unannounced visits or live video tours; verify facility size, workforce, and workflow |

| 6 | Review Export Experience | Ensure international compliance and logistics competence | Request export documentation, customs records, and client references (especially Western markets) |

| 7 | Sample Testing & QA Process Review | Validate product quality and consistency | Request pre-production samples; audit QC procedures (AQL standards, testing equipment) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of metal kitchenware or appliances | Lists “sales,” “trading,” or “import/export” without manufacturing terms |

| Facility Evidence | Owns factory premises; shows machinery (e.g., CNC, stamping, welding) in videos/photos | Office-only space; no visible production equipment |

| Pricing Structure | Lower MOQs with cost breakdowns (material, labor, overhead) | Higher unit prices; less transparency on cost components |

| Lead Times | Direct control over production scheduling; shorter lead times possible | Dependent on third-party factories; variable lead times |

| Customization Capability | Offers mold/tooling investment, design adjustments, and engineering support | Limited to catalog-based modifications or reselling |

| Staff Expertise | Engineers, production managers, and QC staff available for technical discussion | Sales and logistics personnel dominate; limited technical depth |

| Export Documentation | Lists factory as manufacturer on customs export declarations (Bill of Lading, Commercial Invoice) | Factory listed as “supplier” or “producer” with trading company as exporter |

✅ Pro Tip: Ask the supplier to provide a copy of their factory registration certificate (if applicable) and cross-check the address with satellite imagery (Google Earth/Baidu Maps).

Red Flags to Avoid When Sourcing 130mm Patty Press Wholesalers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., non-food-grade aluminum/stainless steel), hidden fees, or fraud | Benchmark against industry averages; request material specifications |

| Refusal to Provide Factory Tour or Video Audit | Suggests non-existent or outsourced production | Require live video walkthrough; engage third-party inspector |

| Generic or Stock Photos | Misrepresentation of capabilities | Demand timestamped, real-time video evidence |

| No Product-Specific Experience | Risk of design flaws or compliance failures | Request references for similar patty press models |

| Pressure for Full Upfront Payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of Certifications | Non-compliance with food safety (e.g., FDA, LFGB) or electrical standards (if motorized) | Require ISO 9001, CE, or specific food-contact material certifications |

| Inconsistent Communication | Poor supply chain control or language barriers | Assign bilingual sourcing agent or use verified platforms |

Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (L/C): For orders >$10,000, utilize secure trade assurance platforms.

- Verify MOQ Realism: Factories producing 130mm patty presses typically offer MOQs of 500–1,000 units. Unrealistically low MOQs may indicate trading intermediaries.

- Inspect Material Compliance: Confirm use of 304 stainless steel or food-grade aluminum with material test reports (MTRs).

- Engage Third-Party QC: Conduct pre-shipment inspection (PSI) to verify dimensions, weight, finish, and functionality.

Conclusion

Procuring 130mm patty presses from China offers significant cost advantages, but only with disciplined supplier verification. Prioritize transparency, production evidence, and compliance over price alone. Distinguishing genuine manufacturers from traders ensures better pricing, customization, and long-term supply stability. SourcifyChina recommends integrating factory audits, certification verification, and secure payment protocols into all sourcing workflows for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Procurement for 2026

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Need for Verified Sourcing in Specialty Food Equipment

Global procurement managers face unprecedented pressure to reduce lead times, mitigate supply chain volatility, and ensure absolute compliance with quality standards. For niche industrial equipment like 130mm patty presses—critical for foodservice consistency and operational efficiency—the risks of unvetted suppliers (defective units, production delays, IP infringement) directly impact P&L. Traditional sourcing methods consume 22+ hours/week in supplier validation alone, delaying time-to-market by 6–8 weeks.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk for 130mm Patty Presses

Our 2026 Verified Pro List for China 130mm patty press wholesalers is engineered for procurement efficiency. Unlike generic directories, every supplier undergoes:

– ✅ On-site factory audits (ISO 9001, CE, food-grade material compliance)

– ✅ Production capacity validation (min. 5,000 units/month at 130mm spec)

– ✅ Trade history verification (3+ years export experience to EU/US markets)

– ✅ Real-time financial health screening (avoiding bankruptcy risks)

Time Saved vs. Traditional Sourcing Methods

| Procurement Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 14–18 hours | <1 hour | 93% |

| Quality/Capacity Validation | 22–30 hours | Pre-verified | 100% |

| Compliance Documentation | 8–12 hours | Included | 100% |

| Total Per Sourcing Cycle | 44–60 hours | <1 hour | ~70 hours |

Data sourced from 2025 SourcifyChina client engagements (n=87 procurement teams)

The 2026 Procurement Imperative: Speed Without Compromise

In 2026, supply chain disruptions will increase by 27% (Gartner). Relying on unverified Alibaba listings or trade shows risks:

– Hidden costs: 32% of buyers face quality rejections from unvetted patty press suppliers (2025 ICC Data)

– Compliance failures: Non-CE marked units triggering customs seizures in EU markets

– Opportunity cost: 68 days average delay when restarting sourcing after supplier failure

SourcifyChina’s Pro List delivers:

🔹 Guaranteed 130mm precision (±0.5mm tolerance, validated via third-party lab reports)

🔹 Pre-negotiated FOB terms with 45-day production cycles (vs. market avg. 75 days)

🔹 Zero liability for IP infringement (all suppliers sign SourcifyChina’s IP Protection Pact)

Call to Action: Secure Your Competitive Advantage in 2026

Stop gambling with mission-critical equipment sourcing. Every hour spent validating suppliers manually is an hour your competitors gain market share through faster, safer procurement.

👉 Act now to lock in 2026 production slots:

1. Email [email protected] with subject line: “2026 Pro List: 130mm Patty Press Request”

2. WhatsApp +86 159 5127 6160 for urgent RFQs (response within 24 business hours)

Your next sourcing cycle can begin in <60 minutes—not 6 weeks. Our team will provide:

– Full supplier dossiers (audit reports, capacity calendars, sample policies)

– Dedicated sourcing consultant for technical specifications alignment

– No cost, no obligation assessment of your current patty press supply chain

“In 2026, procurement winners won’t be those who source cheapest—they’ll be those who source safest, fastest, and most sustainably. The Verified Pro List is your institutional advantage.”

— SourcifyChina Global Sourcing Index, 2026

SourcifyChina | Trusted by 1,200+ Global Brands | ISO 20400 Certified Sustainable Sourcing

Data-Driven. Risk-Managed. Procurement Perfected.

🧮 Landed Cost Calculator

Estimate your total import cost from China.