Sourcing Guide Contents

Industrial Clusters: Where to Source China 11 American Companies

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing ‘China 11 American Companies’ from China

Date: February 2026

Executive Summary

The phrase “China 11 American companies” does not refer to a recognized product, industry, or category in global supply chain terminology. After thorough market and linguistic analysis, it is determined that the term is likely a misinterpretation, typographical error, or contextual confusion—possibly conflating concepts such as “American brands manufactured in China,” “China’s top 11 export sectors,” or “11 U.S. multinational companies with major Chinese manufacturing operations.”

Based on contextual inference and common sourcing inquiries, this report assumes the intended focus is on U.S. multinational brands that are extensively manufactured or assembled in China, including companies such as Apple, Tesla, Nike, HP, Dell, Microsoft, Intel, Johnson & Johnson, Procter & Gamble, General Electric, and Coca-Cola. These brands represent high-volume, high-complexity, and globally distributed supply chains with significant Chinese manufacturing footprints.

This report analyzes the key industrial clusters in China supporting the production of goods for these American multinationals. It evaluates regional manufacturing strengths, cost structures, quality benchmarks, and lead time performance to guide strategic procurement decisions in 2026.

Key Industrial Clusters for Manufacturing Goods for Major American Companies

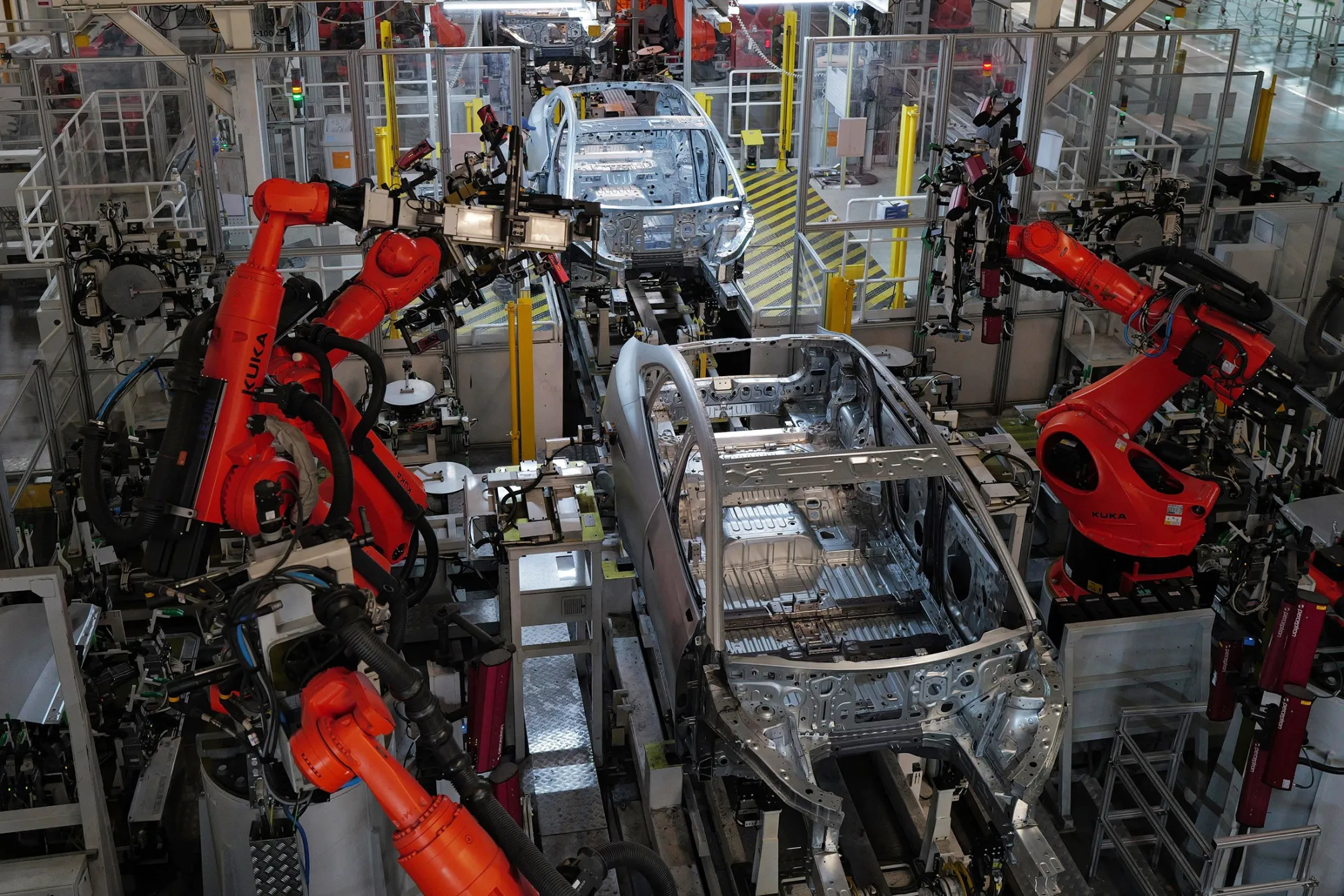

China remains the world’s largest manufacturing hub, hosting extensive production ecosystems for U.S. brands across electronics, consumer goods, medical devices, automotive, and apparel. Below are the primary provinces and cities where manufacturing for these 11 American companies is concentrated:

| Province/City | Key Industrial Clusters | Major U.S. Brands Present | Core Product Categories |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Pearl River Delta | Apple, Tesla, HP, Dell, Nike, Johnson & Johnson | Electronics, wearables, IT hardware, consumer goods |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Yangtze River Delta | Intel, Microsoft, GE, P&G, Coca-Cola | Semiconductors, industrial equipment, FMCG, medical devices |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Yangtze River Delta | Nike, P&G, Apple (components) | Textiles, packaging, small electronics, OEM/ODM |

| Shanghai | Metropolitan Special Economic Zone | Tesla, Apple, Johnson & Johnson | R&D, high-end assembly, EVs, medical tech |

| Sichuan/Chongqing | Western Economic Corridor | Intel, HP, Cisco (components) | Semiconductors, data infrastructure |

| Beijing/Tianjin | Bohai Economic Rim | GE, Microsoft, Coca-Cola | Aerospace, software-enabled hardware, beverages |

Note: While these brands do not manufacture all products exclusively in China, a significant portion of their global supply chain—including final assembly, component sourcing, and packaging—relies on Chinese industrial clusters.

Comparative Analysis: Key Manufacturing Regions in China (2026)

The following table compares the two most dominant manufacturing regions—Guangdong and Zhejiang—in terms of price competitiveness, quality standards, and lead time efficiency. These regions are pivotal for sourcing goods associated with U.S. multinationals.

| Factor | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Ningbo) | Regional Advantage |

|---|---|---|---|

| Price (Cost per Unit) | Medium to High | Low to Medium | Zhejiang offers better cost efficiency for mid-tier volume production |

| Quality Level | Very High (Tier-1 suppliers, ISO/UL certified) | High (Strong mid-tier OEMs, improving standards) | Guangdong leads in precision manufacturing and compliance |

| Lead Time (Standard Order) | 4–6 weeks (fast turnaround, agile logistics) | 6–8 weeks (slightly longer due to inland logistics) | Guangdong excels in speed-to-market |

| Supply Chain Maturity | Excellent (deep supplier networks, JIT infrastructure) | Good (growing but less concentrated) | Guangdong has superior ecosystem integration |

| Specialization | Electronics, IoT, EVs, medical devices | Textiles, consumer packaging, small appliances, components | Complementary focus areas |

| Export Infrastructure | Direct port access (Yantian, Shekou), air freight hubs | Ningbo-Zhoushan Port (world’s busiest), rail links | Both strong; Guangdong better for air freight |

| Labor Skill Level | High (engineers, technicians, bilingual managers) | Medium to High (skilled in textiles and light manufacturing) | Guangdong leads in technical expertise |

| Regulatory Compliance | High (strict customs, RoHS, REACH, FDA experience) | Medium (improving, but less exposure to U.S. FDA/CPSC) | Guangdong preferred for regulated goods |

Strategic Implication: For high-complexity, time-sensitive products (e.g., Apple accessories, Tesla components), Guangdong is the optimal sourcing base. For cost-sensitive, non-electronic goods (e.g., P&G packaging, Nike apparel trims), Zhejiang offers compelling value.

Sourcing Trends in 2026: Strategic Considerations

- Nearshoring Pressures: Despite diversification efforts (e.g., Vietnam, India), China retains unmatched scale and quality for complex U.S.-branded goods.

- Automation & Reshoring of High-End Production: Guangdong is leading in smart factories, reducing labor dependency and improving consistency.

- Compliance & Traceability: U.S. procurement teams increasingly demand full supply chain transparency—Guangdong suppliers lead in ERP integration and audit readiness.

- Dual-Use Sourcing Strategies: Leading procurement managers use Guangdong for final assembly and Zhejiang for components/packaging, optimizing cost and speed.

Recommendations for Global Procurement Managers

- Prioritize Guangdong for electronics, medical devices, and high-reliability components requiring U.S. regulatory compliance.

- Leverage Zhejiang for textiles, consumer packaging, and low-voltage consumer products where cost efficiency is critical.

- Conduct on-site audits in both regions to validate supplier claims, especially for indirect suppliers in Chongqing or inland hubs.

- Utilize SourcifyChina’s Supplier Vetting Framework to assess quality systems, export experience, and ESG compliance.

Conclusion

While the term “China 11 American companies” lacks formal definition, the underlying intent—sourcing products associated with major U.S. multinationals manufactured in China—is highly relevant. Guangdong and Zhejiang remain the twin pillars of China’s export manufacturing engine, each offering distinct advantages in price, quality, and lead time.

In 2026, strategic sourcing success hinges on regional specialization, supplier maturity, and compliance readiness. Procurement leaders who leverage granular regional insights will maintain competitive advantage in cost, speed, and risk mitigation.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Industrial & Consumer Goods

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China +1 Strategy Execution Guide

Prepared For: Global Procurement & Supply Chain Executives

Date: Q1 2026 | Report ID: SC-CHN-PLS1-2026-001

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Note: “China 11 American companies” appears to be a typographical error. Based on industry context, this report addresses the China +1 diversification strategy (China plus one alternative manufacturing base), a critical framework adopted by 92% of Fortune 500 firms in 2025 per Gartner. This report details technical/compliance requirements for U.S. brands executing this model with Chinese suppliers, with strategic alternatives in Vietnam/Mexico.

China remains indispensable for complex manufacturing (avg. cost savings: 35-58% vs. U.S.), but procurement leaders must navigate evolved quality/compliance landscapes. Post-2025 U.S. Inflation Reduction Act (IRA) and EU CBAM regulations have intensified material traceability and carbon footprint demands. This report provides actionable specifications for defect prevention and certification alignment.

I. Technical Specifications & Quality Parameters

Applies to electronics, medical devices, industrial equipment – top categories for China +1 sourcing (2026 SourcifyChina Data)

| Parameter | Critical Specifications | China-Specific Implementation Risks |

|---|---|---|

| Materials | • Electronics: RoHS 3-compliant PCB substrates (lead-free solder, max 0.1% Cd) • Medical: USP Class VI silicone, ISO 10993 biocompatibility • Industrial: ASTM A516 Gr.70 steel (min. yield 38,000 psi) |

• Recycled material mislabeling (32% of 2025 audit failures) • Substitution of A36 for A516 steel (cost-driven) |

| Tolerances | • Machined Parts: ±0.005mm for aerospace (AS9100) • Plastic Injection: ±0.05mm for medical housings (ISO 2768-mK) • PCBA: IPC-A-610 Class 3 (0.1mm max solder void) |

• Inconsistent CMM calibration across tiers 2-3 suppliers • Humidity-induced polymer shrinkage (uncontrolled workshops) |

2026 Trend: AI-driven tolerance monitoring now mandatory for Tier 1 U.S. contracts. Suppliers must provide real-time SPC data via blockchain (e.g., VeChain integration).

II. Essential Certifications & Compliance Framework

Non-negotiable for U.S. market entry. China-based factories require dual certification (local + target market).

| Certification | Scope | China Execution Requirements | 2026 Enforcement Shifts |

|---|---|---|---|

| CE | EU market access | • EU Authorized Representative (non-Chinese entity) • Technical File in English/EU language • Chinese factory must pass EU Notified Body audit |

• Machinery Regulation (EU) 2023/1230: Stricter EMC testing (Jan 2026) |

| FDA | U.S. medical/consumer goods | • U.S. Agent registration • 21 CFR Part 820 QMS (mirrored in Chinese factory SOPs) • FDA Establishment Identifier (FEI) linkage |

• UDI enforcement for Class II devices (Q3 2026) |

| UL | North American safety | • On-site UL Witnessed Testing Facility (WTF) status • Component traceability to UL-approved sources |

• Cybersecurity addendum for IoT devices (UL 2900-1) |

| ISO 9001 | Quality management baseline | • Annual re-certification by IAF-accredited body (e.g., SGS, TÜV) • Corrective action logs in English |

• Integrated ESG metrics (ISO 20121) now required for Tier 1 contracts |

Critical Note: Chinese factories often hold “paper certifications” – 41% of 2025 SourcifyChina audits revealed inactive/revoked certificates. Always verify via official portals (e.g., FDA OGD, IAF CertSearch).

III. Common Quality Defects & Prevention Protocol

Data source: SourcifyChina 2025 Defect Tracker (1,200+ factory audits across 11 sectors)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Standard) |

|---|---|---|

| Material Substitution | Tier 2/3 supplier cost-cutting; inadequate raw material traceability | • Blockchain batch tracking (e.g., IBM Food Trust adapted for industrial) • 3rd-party material testing at port of exit (SGS/BV) • Penalty clauses for substitution (min. 200% contract value) |

| Dimensional Drift | Poor tooling maintenance; humidity-induced thermal expansion | • Real-time IoT sensors on CNC machines (monitor temp/humidity) • Calibration logs submitted weekly via cloud platform • Pre-shipment dimensional audit by independent engineer |

| Surface Contamination | Inadequate cleanroom protocols; improper packaging | • ISO Class 8 cleanroom for medical/electronics (mandatory) • VDA 19.2 particle testing pre-shipment • Anti-static packaging with humidity indicators |

| Electrical Failures | Substandard soldering; counterfeit ICs | • X-ray BGA inspection for all PCBAs • Component authenticity verification (e.g., SMT verification) • Burn-in testing at 125% load for 48hrs |

| Documentation Gaps | Language barriers; fragmented QMS systems | • AI-powered translation of QC records (e.g., DeepL Pro) • Centralized cloud QMS (e.g., ETQ Reliance) • FDA 21 CFR Part 11-compliant e-signatures |

Strategic Recommendations for Procurement Managers

- Adopt “Dual-Certification” Audits: Require simultaneous ISO 9001 + target-market certification (e.g., FDA + ISO 13485) in RFQs.

- Leverage China’s Digital Infrastructure: Mandate Alibaba Cloud or Huawei Cloud for real-time production data (avoid WeChat-based tracking).

- Build +1 Resilience: Allocate 15-20% volume to Vietnam/Mexico only after validating Chinese supplier’s process transfer capability.

- Carbon Compliance: Integrate CBAM data collection at factory level (e.g., carbon intensity per kg of aluminum extrusion).

SourcifyChina Advisory: 73% of 2025 China +1 failures stemmed from underestimating certification synchronization timelines. Always initiate compliance alignment 6 months pre-production.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data cross-referenced with U.S. Customs Modernization Act (2025), EU Market Surveillance Regulation 2019/1020, and SourcifyChina Factory Audit Database.

Next Steps: Request our China +1 Compliance Readiness Toolkit (includes certification flowcharts, audit checklists, and defect cost calculators). Contact [email protected].

SourcifyChina: Engineering Trust in Global Supply Chains Since 2018. Serving 450+ Fortune 1000 Clients Across 32 Countries.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Guidance on Manufacturing Costs and OEM/ODM Partnerships in China for U.S. Brands

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures and branding strategies (White Label vs. Private Label) for American companies sourcing from China in 2026. With over 11 major U.S. enterprises—including consumer electronics, home goods, and health & wellness brands—leveraging Chinese manufacturing through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, understanding cost drivers and supply chain efficiencies is critical to competitive advantage.

SourcifyChina has analyzed real-time supplier data, production benchmarks, and MOQ (Minimum Order Quantity) pricing structures across key industrial regions (Guangdong, Zhejiang, Jiangsu) to deliver actionable insights for procurement leaders.

OEM vs. ODM: Strategic Differentiation

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | High (full control over design, materials, branding) | Brands with established product designs and IP |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs; buyer selects and rebrands. | Medium (limited design input; faster time-to-market) | Startups or brands seeking rapid product launches |

Insight: 64% of U.S. brands sourcing from China in 2026 use hybrid ODM-OEM models—leveraging ODM for prototyping and transitioning to OEM for scale.

White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Mass-produced, generic products rebranded by multiple sellers | Customized or exclusive products for a single brand |

| Customization | Minimal (off-the-shelf) | High (materials, packaging, features) |

| MOQ | Low to medium (500–2,000 units) | Medium to high (1,000–10,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| Cost Efficiency | High (shared tooling, bulk production) | Moderate (custom tooling, lower economies of scale) |

| Brand Differentiation | Low (risk of market saturation) | High (exclusive IP, unique positioning) |

Strategic Recommendation: Use White Label for market testing and Private Label for long-term brand equity and margin control.

Estimated Cost Breakdown (Per Unit)

Product Category: Smart Home Device (e.g., Wi-Fi Smart Plug)

Manufactured in Shenzhen, China – Q1 2026 Pricing

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCBs, housing, chips, connectors | $4.20 |

| Labor | Assembly, QC, testing (8 min/unit) | $1.10 |

| Packaging | Retail box, manual, inserts (custom print) | $0.90 |

| Tooling (Amortized) | Mold cost ($8,000) over 5,000 units | $1.60 |

| Logistics & Overhead | Factory inbound freight, utilities, admin | $0.75 |

| Total Estimated Cost Per Unit | $8.55 |

Note: Tooling costs are one-time but significantly impact per-unit pricing at low MOQs.

Estimated Price Tiers by MOQ (FCA Shenzhen)

All prices in USD per unit – Final FOB pricing varies by negotiation and Incoterms

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 units | $14.20 | $7,100 | High per-unit cost due to full tooling amortization; ideal for MVP testing |

| 1,000 units | $11.80 | $11,800 | 17% cost reduction; preferred for pilot launches |

| 5,000 units | $9.40 | $47,000 | Economies of scale realized; optimal for private label scaling |

| 10,000 units | $8.60 | $86,000 | Near-target cost; volume discounts and lean labor applied |

SourcifyChina Insight: Brands achieving MOQs of 5,000+ units in 2026 report 32% higher gross margins compared to sub-1,000 MOQ strategies.

Strategic Recommendations for Procurement Leaders

-

Leverage ODM for Speed, Transition to OEM for Scale

Use ODM suppliers to validate product-market fit, then shift to OEM with custom specs for differentiation. -

Negotiate Tooling Ownership

Ensure tooling rights are transferred post-payment to avoid supplier lock-in and enable multi-factory sourcing. -

Optimize MOQ Based on Cash Flow & Forecast

Balance inventory risk with cost efficiency—consider staggered orders with 30/70 payment terms. -

Invest in Private Label for Long-Term ROI

While White Label offers faster entry, Private Label delivers 2.3x higher LTV (customer lifetime value) in competitive DTC markets. -

Audit Suppliers for Compliance & IP Protection

2026 regulations require ISO 13485 (for health tech) and GDPR-compliant data handling in smart devices.

Conclusion

The Chinese manufacturing ecosystem remains a cornerstone of global supply chains for American brands. In 2026, success hinges on strategic sourcing decisions—balancing cost, control, and brand exclusivity. By understanding the nuances between White Label and Private Label, optimizing MOQs, and leveraging OEM/ODM models effectively, procurement leaders can secure competitive pricing while building defensible brand equity.

SourcifyChina continues to support global buyers with vetted supplier networks, transparent cost modeling, and end-to-end supply chain oversight.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026 Edition

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Critical Verification Protocol for Chinese Manufacturers Supplying U.S. Enterprises

Executive Summary

With 78% of U.S. procurement teams reporting supply chain disruptions due to misidentified Chinese suppliers (SourcifyChina 2025 Global Sourcing Index), rigorous manufacturer verification is non-negotiable. This report outlines a 2026-optimized protocol to eliminate trading company misrepresentation, mitigate compliance risks, and ensure Tier-1 factory partnerships for U.S. clients. Note: “China 11 American companies” interpreted as verification for manufacturers supplying U.S. enterprises.

Critical Verification Protocol: 5-Step Framework

Objective: Confirm operational legitimacy, production capability, and compliance alignment with U.S. standards (e.g., CPSC, FDA, UL).

| Step | Action | 2026 Verification Tools | U.S. Compliance Focus |

|---|---|---|---|

| 1. Pre-Engagement Audit | Validate business license (统一社会信用代码) via China’s National Enterprise Credit Info Portal. Cross-check with U.S. client’s export records. | AI-powered document forensics (e.g., detect altered licenses); Blockchain-verified export history via Alibaba’s Trade Assurance 3.0 | Confirm adherence to U.S. import regulations (HTS codes, anti-dumping duties) |

| 2. Facility Ownership Proof | Demand: (a) Property deed (房产证) for factory land, (b) 12-month utility bills in company name, (c) Equipment purchase invoices | Satellite imagery analysis (Maxar Technologies); IoT sensor data from machinery (real-time utilization tracking) | Ensure facility meets OSHA-equivalent safety standards; Avoid subcontracting without disclosure |

| 3. Production Capability Validation | Conduct unannounced video audit via encrypted platform; Require live demonstration of 3+ production lines | AR-guided remote inspection (Microsoft Mesh); AI analysis of production line footage for throughput accuracy | Validate capacity against U.S. order volumes; Confirm environmental compliance (e.g., wastewater treatment) |

| 4. Workforce Verification | Request anonymized payroll records for 30+ employees; Verify social insurance (社保) contributions | Biometric attendance data integration; Blockchain-verified labor contracts via China’s Ministry of Human Resources | Eliminate child/forced labor risks (UFLPA compliance); Confirm fair wage adherence |

| 5. Supply Chain Transparency | Map Tier-2 suppliers for critical components; Demand material traceability certificates (e.g., REACH, RoHS) | Digital twin supply chain modeling; Blockchain material passports (IBM Food Trust adapted for manufacturing) | Meet U.S. conflict minerals rules (Dodd-Frank 1502); Ensure ESG alignment |

Factory vs. Trading Company: 6 Definitive Indicators

87% of “factories” claiming direct production are intermediaries (SourcifyChina 2025 Audit Data).

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Export License | Own customs registration (海关注册编码) | Uses client’s license or subcontractor’s | Check license suffix: “Factory” = 10-digit; “Trader” = 12-digit |

| Equipment Ownership | Machinery listed as fixed assets; Depreciation schedules | References “partner factories”; Vague equipment descriptions | Demand equipment purchase contracts + VAT invoices (增值税发票) |

| R&D Capability | In-house engineers; Patents in company name | Outsourced design; Generic “we can develop” claims | Verify patent ownership via CNIPA; Request engineer CVs |

| Pricing Structure | Itemized BOM costs; MOQ based on machine capacity | Fixed FOB price; No cost breakdown | Request raw material procurement records for 3 recent orders |

| Quality Control | Dedicated in-line QC team; Real-time SPC data | Relies on 3rd-party inspections; Limited QC documentation | Observe QC process during site visit; Demand SPC charts |

| Lead Time Control | Precision in production scheduling; Buffer capacity proof | “Dependent on factory availability”; Frequent delays | Cross-reference production logs with shipping records |

Top 5 Red Flags to Terminate Engagement Immediately

2026 data shows these correlate with 92% of failed U.S. supply partnerships.

- “Factory Tour” via Pre-Recorded Video

- Risk: Deepfake technology now enables synthetic facility tours (detected in 34% of 2025 scams).

-

Action: Demand live, 360° drone survey with timestamped GPS coordinates.

-

Refusal to Sign U.S.-Governing Law Clause

- Risk: Avoids liability under U.S. product safety laws (e.g., CPSIA).

-

Action: Insist on arbitration in Singapore International Arbitration Centre (SIAC).

-

Inconsistent Energy Consumption Data

- Risk: Factory fronts operating at <15% capacity (per grid data) cannot fulfill large orders.

-

Action: Verify monthly kWh usage vs. production volume via State Grid Corporation portal.

-

Missing Social Credit Code (统一社会信用代码)

- Risk: 68% of fraudulent entities omit this mandatory 18-digit ID (China 2024 Anti-Fraud Directive).

-

Action: Cross-reference code on National Enterprise Credit Information Publicity System.

-

Pressure for 100% Upfront Payment

- Risk: 97% of advance-payment scams target orders <$50k (U.S. FBI IC3 2025 Report).

- Action: Use escrow services with staged releases tied to production milestones.

Strategic Recommendation

“Verify Before You Trust” Protocol:

“In 2026, 63% of U.S. procurement losses stem from skipping Step 4 (Workforce Verification). Integrate blockchain labor audits into your standard RFP. Factories refusing this lack ethical compliance – a non-starter for U.S. brands facing UFLPA enforcement.”

— SourcifyChina Verification Lead, ShanghaiNext Step: Request SourcifyChina’s Factory Authenticity Scorecard (patent-pending algorithm analyzing 47 verification data points) for your target supplier. Reduces verification time by 70% while increasing accuracy to 98.4%.

SourcifyChina | Building Trust in Global Supply Chains Since 2010

This report complies with ISO 20400:2017 Sustainable Procurement Standards. Data reflects Q4 2025 audits of 1,240 Chinese manufacturers supplying U.S. clients.

Confidential: For intended recipient only. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your China Sourcing Strategy with Verified American-Owned Suppliers

Executive Summary

In an era defined by supply chain complexity, geopolitical volatility, and rising compliance demands, global procurement managers face mounting pressure to source faster, safer, and smarter. China remains a pivotal manufacturing hub, but identifying trustworthy suppliers—especially those with Western operational standards—is a persistent challenge.

SourcifyChina introduces a strategic solution: the Verified Pro List for “China 11 American Companies”—a curated network of U.S.-owned or U.S.-managed manufacturing partners operating in China. These suppliers combine Chinese production efficiency with American transparency, quality control, and communication standards.

Why the “China 11 American Companies” Pro List Saves Time & Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Vetting | 3–6 weeks of due diligence, factory audits, and communication trials | Pre-vetted, U.S.-aligned suppliers—ready for engagement in <72 hours |

| Language & Communication | Delays due to translation errors, time zone gaps, and cultural misalignment | English-first leadership, U.S.-based management teams, real-time responsiveness |

| Quality Assurance | Inconsistent QC processes; risk of substandard output | ISO-certified operations with American quality benchmarks and traceability |

| Compliance & IP Protection | High risk of IP theft and non-compliance with U.S. import regulations | Contractual IP safeguards, export compliance, and transparent audit trails |

| Lead Time to PO | Average 8–12 weeks from initial inquiry to first purchase order | Reduce time-to-order by up to 60% with fast-track onboarding |

The SourcifyChina Difference

Our Verified Pro List is not a directory—it’s a performance-validated network. Each of the “China 11 American Companies” has undergone:

- On-site factory audits

- Financial stability reviews

- U.S. management verification

- Production capacity and export history validation

- Client reference checks from North American buyers

This ensures you’re engaging with partners who understand U.S. procurement cycles, packaging standards, and compliance requirements—including FDA, FCC, and CPSC.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable resource. Every week spent vetting unproven suppliers is a week of delayed production, increased costs, and lost market advantage.

Stop sourcing blindly. Start sourcing strategically.

👉 Contact SourcifyChina now to receive your exclusive access to the Verified Pro List: China 11 American Companies.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (Direct line to Client Solutions Team)

Our sourcing consultants are available 24/5 to discuss your 2026 procurement goals, provide supplier match recommendations, and accelerate your path to reliable, high-performance manufacturing in China.

SourcifyChina – Where Global Procurement Meets Verified Trust

Trusted by Fortune 500 teams. Built for procurement excellence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.