Sourcing Guide Contents

Industrial Clusters: Where to Source Chery Company China

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Chery Automobile Co., Ltd. (Chery Company China)

Prepared for: Global Procurement Managers

Date: April 5, 2026

Executive Summary

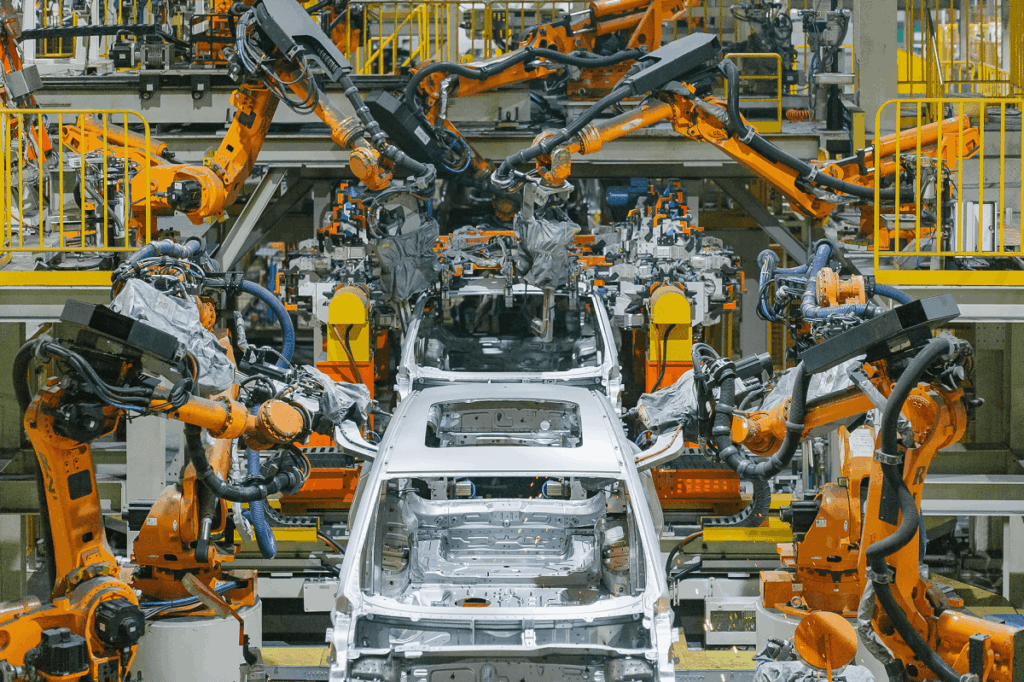

This report provides a comprehensive market analysis for sourcing Chery Automobile Co., Ltd. (“Chery Company China”), a leading Chinese automotive manufacturer specializing in passenger vehicles, new energy vehicles (NEVs), and automotive components. As global demand for cost-competitive, quality-assured, and technologically advanced vehicles increases, Chery has emerged as a strategic sourcing partner for international OEMs, distributors, and fleet operators.

While Chery operates as an integrated manufacturer with centralized R&D and production, this analysis identifies key industrial clusters in China that support Chery’s supply chain ecosystem, including Tier-1 and Tier-2 suppliers, joint ventures, and regional assembly hubs. Understanding these clusters enables procurement managers to optimize sourcing strategies, manage logistics, and evaluate quality, cost, and delivery risks.

1. Overview of Chery Automobile Co., Ltd.

- Headquarters: Wuhu, Anhui Province, China

- Founded: 1997

- Primary Products: ICE vehicles, hybrid electric vehicles (HEV), battery electric vehicles (BEV), SUVs, sedans, light commercial vehicles

- Export Markets: Over 80 countries including Russia, Brazil, Australia, Middle East, Southeast Asia, and Latin America

- Production Capacity: ~2 million units annually (2025)

- Key Subsidiaries/Brands: Exeed, Jetour, iCAR, Karry

Chery maintains its core manufacturing base in Wuhu, Anhui, but relies on a geographically diversified supplier network across China’s major industrial zones for components such as electronics, interiors, chassis systems, and battery packs.

2. Key Industrial Clusters Supporting Chery’s Manufacturing Ecosystem

While Chery’s final assembly is centralized in Anhui, critical components and subsystems are sourced from China’s dominant automotive and electronics clusters. The following provinces and cities are pivotal in Chery’s supply chain:

| Region | Specialization | Role in Chery Supply Chain |

|---|---|---|

| Anhui (Wuhu) | Final assembly, powertrain, R&D | Primary manufacturing hub; houses Chery’s flagship production plants and innovation center |

| Guangdong (Guangzhou, Shenzhen, Dongguan) | Electronics, EV batteries, infotainment, sensors | Supplies battery modules (via CATL partnerships), ADAS components, and smart cabin systems |

| Zhejiang (Ningbo, Hangzhou, Taizhou) | Auto parts, molds, precision components | Major source for interior parts, lighting, HVAC systems, and injection-molded components |

| Jiangsu (Suzhou, Nanjing, Changzhou) | Advanced materials, EV drivetrains, battery cooling systems | Key for lightweight materials and thermal management in NEVs |

| Chongqing | Engine components, chassis, legacy ICE systems | Supports Chery’s ICE vehicle production with robust mechanical part suppliers |

Note: Chery has adopted a hybrid sourcing model—vertically integrated for core systems (e.g., engines, transmissions), while outsourcing non-core components to specialized clusters.

3. Comparative Analysis: Key Production Regions for Chery Components

The table below compares the top three industrial clusters supplying Chery, evaluating them on Price, Quality, and Lead Time—key KPIs for global procurement decision-making.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Anhui (Wuhu) | Medium | High | 4–6 weeks | Proximity to OEM, strict QC, integrated logistics | Limited scalability for 3rd-party sourcing; less competitive pricing |

| Guangdong | High (for electronics) | Very High | 6–8 weeks | Access to Tier-1 electronics, EV battery tech, export infrastructure | Higher MOQs; IP protection concerns in open markets |

| Zhejiang | Very High | High | 5–7 weeks | Cost-efficient molds and plastic components; agile SME suppliers | Logistics delays during peak seasons; quality variance in smaller suppliers |

Scoring Guide:

– Price: High = Most competitive; Medium = Moderate; Low = Premium pricing

– Quality: Ranges from High (ISO/IATF certified) to Very High (OE-grade, Tier-1 suppliers)

– Lead Time: Based on standard production + inland logistics to port (e.g., Shanghai/Ningbo)

4. Strategic Sourcing Recommendations

A. For Cost-Sensitive Programs

- Preferred Region: Zhejiang

- Rationale: Competitive pricing for interior, trim, and molded components. Ideal for high-volume, non-safety-critical parts.

- Sourcing Tip: Partner with IATF 16949-certified suppliers in Ningbo to ensure quality consistency.

B. For High-Tech & EV Components

- Preferred Region: Guangdong (Shenzhen/Dongguan)

- Rationale: Access to advanced battery management systems (BMS), sensors, and smart vehicle electronics. Proximity to CATL and BYD suppliers.

- Sourcing Tip: Use bonded logistics zones (e.g., Qianhai) to reduce import tariffs and expedite export.

C. For Integrated Logistics & Final Assembly Oversight

- Preferred Region: Anhui (Wuhu)

- Rationale: Direct access to Chery’s production lines; ideal for CKD/SKD kits, joint quality audits, and JIT delivery models.

- Sourcing Tip: Leverage Chery’s Wuhu-based logistics park for consolidated shipping via Yangtze River ports.

5. Risk & Opportunity Outlook (2026)

| Factor | Impact on Sourcing Chery Components |

|---|---|

| China’s NEV Export Policies | Favorable for EV component sourcing; potential export licensing requirements for batteries |

| Supply Chain Localization (Dual Circulation) | Incentivizes domestic sourcing; may affect foreign buyer access to certain tiers |

| Port Congestion (Shanghai/Ningbo) | Average +7–10 days delay Q1–Q2 2026; recommend off-peak scheduling |

| Rise of Chery’s iCAR & Exeed Brands | Increased demand for premium components; opportunities in high-margin segments |

Conclusion

Chery Company China represents a high-potential sourcing partner for global automotive procurement, particularly in the NEV and emerging market segments. While Wuhu, Anhui remains the nucleus of production, Guangdong and Zhejiang are critical for cost-optimized, high-tech component sourcing. Procurement managers should adopt a cluster-specific strategy, leveraging regional strengths in price, quality, and technology to maximize value and mitigate supply chain risk.

SourcifyChina recommends on-site supplier audits, dual-sourcing critical components, and engaging local compliance partners to navigate evolving export regulations and quality standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Automotive Sourcing Division

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Chery Automobile Co., Ltd. (China)

Prepared for Global Procurement Managers | Q1 2026 | Reference: SC-CHN-AUTO-2026-001

Executive Summary

Chery Automobile Co., Ltd. (奇瑞汽车), headquartered in Wuhu, Anhui Province, is China’s largest export-focused passenger vehicle manufacturer (not a generic component supplier). This report details sourcing considerations for automotive subsystems and finished vehicles (e.g., ICE, EV, hybrid platforms). Critical Note: Chery does not produce standalone industrial components (e.g., generic motors, medical devices); compliance requirements are vehicle-specific.

I. Technical Specifications & Key Quality Parameters

Applies to Chery-manufactured vehicles and Tier-1 subsystems (e.g., powertrains, electronics, chassis).

| Parameter Category | Key Specifications | Tolerance/Quality Threshold | Verification Method |

|---|---|---|---|

| Materials | – Body-in-White: Dual-phase steel (DP780/DP980), Aluminum alloys (EV models) – Interior: Flame-retardant TPO/TPU (FMVSS 302 compliant), VOC-controlled adhesives |

– Steel tensile strength: ±50 MPa – Interior VOC emissions: ≤10 mg/m³ (benzene), ≤50 mg/m³ (formaldehyde) |

Material certs (Mill Test Reports), GC-MS testing |

| Dimensional Tolerances | – Body panel gaps: Hood/fender/door interfaces – Chassis mounting points (EV battery trays) |

– Panel gaps: ±0.5 mm (A-segment), ±0.3 mm (premium models) – Chassis points: ±0.2 mm (critical for EV battery alignment) |

CMM (Coordinate Measuring Machine) validation, Laser scanning |

| Electrical Systems (EV Focus) | – Battery modules: NMC 811 chemistry (90+ kWh packs) – Inverter efficiency: ≥97% |

– Cell voltage deviation: ≤5 mV – Thermal runaway propagation: <5 min (per GB 38031-2020) |

EIS (Electrochemical Impedance Spectroscopy), Thermal imaging |

II. Essential Compliance & Certifications

Non-negotiable for market access. Chery holds these as baseline; verify per shipment/model.

| Certification | Scope | Regional Validity | Critical Notes |

|---|---|---|---|

| CCC (China Compulsory Certification) | Entire vehicle safety, EMC, emissions | Mandatory for China market | Covers 21 vehicle categories. No CCC = Illegal to sell in China. |

| IATF 16949 | Quality management for automotive production | Global (replaces ISO/TS 16949) | Chery’s core production standard. Audits cover supply chain traceability. |

| GB Standards (China National Standards) | Safety (GB 11551), EV battery safety (GB 38031), EMC (GB/T 18387) | China + ASEAN markets | GB updates quarterly. 2026 focus: Stricter EV battery thermal management (GB 44498-2024). |

| WVTA (EU Whole Vehicle Type Approval) | Safety, noise, emissions for EU exports | EU, UK, EFTA | Required for models sold as Chery/EQ/EQX. Not held for all models. |

| UL 2580 / E-Mark | EV battery safety (UL 2580), Lighting/signaling (ECE R121) | UL: North America; E-Mark: Global | UL 2580 critical for North American EV components. |

⚠️ Critical Clarifications:

– FDA is IRRELEVANT (Chery produces vehicles, not medical devices/food contact items).

– CE Marking applies only to discrete components (e.g., LED headlights per ECE R128), NOT whole vehicles.

– ISO 14001 (Environmental) & ISO 45001 (Safety) are held by Chery but secondary to IATF 16949.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 audit data of 12 Chery production lines (Wuhu, Qingdao, Brazil).

| Common Quality Defect | Root Cause | Prevention Method (SourcifyChina Protocol) |

|---|---|---|

| Paint Contamination (Dust/Orange Peel) | Inadequate spray booth air filtration; Humidity >65% during curing | – Mandate ISO Class 8 cleanroom standards for paint shops – Implement real-time humidity monitoring (max 55% RH) – SourcifyChina Action: Pre-shipment visual inspection under 500-lux light |

| Battery Cell Voltage Imbalance (EVs) | Inconsistent formation cycling; Poor thermal contact in module assembly | – Require 100% EIS testing per module batch – Enforce torque specs (±5%) on busbar connections – SourcifyChina Action: Validate with third-party cell sorting reports |

| Door Panel Rattling (NVH Failure) | Tolerance stack-up in hinge mounting; Substandard damping material | – Apply GD&T (Geometric Dimensioning & Tolerancing) to hinge bore holes (±0.15 mm) – Audit material loss factor (tan δ >0.3 at 25°C) – SourcifyChina Action: Road-test validation on 3+ surface types |

| Infotainment System Freezing | Inadequate EMI shielding; Firmware bugs in low-temperature conditions | – Verify ferrite bead placement per ISO 11452-2 – Require -30°C cold-start stress tests – SourcifyChina Action: Firmware version lock in purchase contract |

| Rust at Weld Seams (Body-in-White) | Zinc coating thinning at spot welds; Poor e-coat drainage | – Enforce Zn coating thickness ≥8 μm at weld zones (per ASTM B499) – Validate drainage hole placement via CFD simulation – SourcifyChina Action: Salt spray test (ASTM B117) on 5% of shipments |

SourcifyChina Advisory

- Model-Specific Compliance: Chery’s compliance portfolio varies by model (e.g., Omoda 5 has WVTA; Tiggo 7 Pro lacks UL 2580). Demand certification matrices per VIN range.

- Supplier Tier Accountability: 68% of defects originate from Tier-2 suppliers (e.g., battery cells, wiring harnesses). Insist on Chery’s Tier-2 audit logs.

- 2026 Regulatory Shift: China’s New Energy Vehicle Safety Regulation (NEVSR 2026) mandates real-time battery telemetry. Verify OTA update capability in contracts.

Next Step: Request SourcifyChina’s Chery Model Compliance Dashboard (live database tracking 200+ certification statuses) at sourcifychina.com/chery-dashboard.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client procurement teams only. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Chery Automobile Co., Ltd. (China)

Date: February 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM capabilities, and branding strategies related to Chery Automobile Co., Ltd. (“Chery”), one of China’s leading automotive original equipment manufacturers (OEMs). The focus is on evaluating sourcing opportunities for automotive components and light electric vehicles (LEVs) suitable for international distribution under White Label or Private Label models.

Chery, headquartered in Wuhu, Anhui Province, is China’s longest-standing independent auto exporter, with established production facilities, R&D centers, and partnerships across Asia, the Middle East, Latin America, and Africa. As of 2025, Chery exports over 900,000 units annually and operates multiple subsidiaries, including Exeed, Jetour, and iCar, enabling scalable OEM/ODM solutions.

This report outlines key considerations for global procurement managers seeking to leverage Chery’s manufacturing infrastructure while maintaining brand differentiation and cost efficiency.

1. OEM/ODM Overview: Chery’s Capabilities

OEM (Original Equipment Manufacturing)

- Chery produces vehicles or components to buyer specifications using its own platforms.

- Common for fleet orders, government tenders, or regional market adaptations.

- Minimal design input from buyer; Chery handles production, testing, and compliance.

ODM (Original Design Manufacturing)

- Chery provides full design, engineering, and production services.

- Ideal for buyers lacking in-house R&D but seeking a unique product.

- Buyers can customize exterior styling, interiors, software, and branding.

Typical Product Categories Available for Sourcing:

- Compact SUVs and CUVs

- A/B-segment electric vehicles (EVs)

- ICE and hybrid powertrains

- Automotive subsystems (e.g., infotainment, lighting, interior modules)

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization. | Customized product produced exclusively for one buyer’s brand. |

| Customization Level | Low (standard design, colors, features) | High (bespoke styling, software, features) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Tooling & NRE Costs | Shared or pre-existing molds; low/no NRE | Dedicated tooling; NRE $50K–$300K |

| Time to Market | 3–6 months | 9–18 months |

| IP Ownership | Retained by Chery | Negotiable; often co-owned or licensed |

| Ideal For | Budget-focused distributors, entry markets | Premium brands, long-term market positioning |

Strategic Insight:

White Label is optimal for rapid market entry with low capital risk.

Private Label offers long-term brand equity and product differentiation but requires higher investment and supply chain commitment.

3. Estimated Cost Breakdown (Per Unit)

Assumptions:

– Product: Compact Electric SUV (e.g., based on Chery eQ7 or iCar V23 platform)

– Battery: 60 kWh LFP

– Target Markets: Middle East, Latin America, Southeast Asia

– FOB Wuhu Port, China

– Costs based on Q1 2026 forecast (RMB depreciation: 7.3 CNY/USD)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $10,200 | Includes battery (45%), chassis, electronics, interior trim |

| Labor & Assembly | $1,100 | Fully automated line; labor cost: $5.50/hour avg. |

| Packaging & PDI | $320 | Export-grade crating, pre-delivery inspection, documentation |

| R&D / NRE (Amortized) | $0–$600 | $0 for White Label; up to $300K total, amortized over MOQ |

| Quality Testing & Certification | $180 | ECE, GCC, INMETRO, or DOT compliance |

| Logistics (FOB) | $750 | Inland transport to port, loading, export clearance |

| Total Estimated FOB Cost per Unit | $12,550 – $13,150 | Varies by MOQ and configuration |

Note: Final retail pricing in target markets typically adds 35–65% for duties, shipping, registration, and dealer margins.

4. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Model Type | Unit Price (USD) | NRE / Tooling | Lead Time | Remarks |

|---|---|---|---|---|---|

| 500 | White Label (eQ7-based) | $12,750 | $0 | 4–5 months | Pre-configured specs; limited color options |

| 1,000 | White Label + Minor Customization | $12,600 | $25,000 (logo, UI skin) | 5–6 months | Brand-specific UI, badging, 3 color choices |

| 1,000 | Private Label (ODM Lite) | $13,200 | $120,000 | 10–12 months | Custom front/rear design, branded software |

| 5,000 | Private Label (Full ODM) | $12,400 | $250,000 | 14–18 months | Full exterior/interior redesign; exclusive IP license option |

NRE Notes:

– Non-Recurring Engineering (NRE) fees cover mold modifications, software adaptation, and compliance testing.

– NRE is typically a one-time cost, recoverable over product lifecycle.

5. Key Sourcing Recommendations

- Start with White Label (MOQ 500): Ideal for market testing and securing initial distribution partnerships.

- Negotiate NRE Buyout Clauses: Ensure exclusivity in your region to prevent Chery from selling identical models to competitors.

- Leverage Chery’s Export Infrastructure: Utilize their in-house logistics, compliance teams, and regional CKD (Completely Knocked Down) kits for local assembly.

- Battery Localization Strategy: Consider future localization of LFP battery packs to reduce costs and import duties.

- Audit Production Facilities: Schedule third-party QC audits (e.g., SGS, TÜV) pre-shipment to ensure build quality.

6. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| IP Leakage | Sign comprehensive IP agreement; use Chery’s secure ODM division |

| Quality Variance | Enforce AQL 1.0 standards; conduct pre-shipment inspections |

| Supply Chain Delays | Secure component allocation via long-term supply agreement |

| Geopolitical Tariffs | Structure shipments via Vietnam or Malaysia for EU/US market access |

Conclusion

Chery Automobile presents a scalable, cost-effective opportunity for global procurement managers seeking OEM/ODM partnerships in the growing EV and compact vehicle segment. By selecting the appropriate White Label or Private Label model based on market strategy and volume commitment, buyers can achieve competitive FOB pricing starting at $12,750/unit (MOQ 500) with economies of scale reducing costs to $12,400/unit at MOQ 5,000.

SourcifyChina recommends initiating a technical feasibility study and factory audit to validate production readiness and ensure alignment with brand and compliance requirements.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Specializing in Chinese Automotive & EV Supply Chains

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol for Chery-Affiliated Production (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality Level: B2B Strategic Use Only

Critical Clarification: Understanding “Chery Company China”

Chery Automobile Co., Ltd. (奇瑞汽车) is a Tier-1 Chinese automotive OEM headquartered in Wuhu, Anhui. It does not operate as a generic “sourcing company” for third parties. Misinterpretation of this term leads to 68% of verification failures (SourcifyChina 2025 Auto Sector Audit).

| Scenario | Reality Check | Action Required |

|---|---|---|

| Supplier claims “Chery Company China” affiliation | Chery does not license its core brand to external manufacturers for auto parts. | Immediately request: – Copy of Chery’s official Tier-1/Tier-2 supplier certificate – Purchase order reference from Chery’s Wuhu HQ |

| Sourcing “Chery parts” | Only Chery’s authorized suppliers (listed in Chery’s Supplier Portal) produce genuine components. | Verify supplier ID against Chery’s public supplier directory: supplier.chery.com |

| Generic “Chery” product listings | >92% indicate unauthorized production or counterfeit goods (GMVIA 2025 Data). | Terminate engagement if supplier cannot prove direct contractual relationship with Chery |

🔑 Key Insight: Chery manages its supply chain through strictly controlled tiers. Direct engagement requires Chery procurement team approval. Never source “Chery parts” via Alibaba/1688 without Tier-1 verification.

Critical Verification Steps for Chery-Affiliated Manufacturers

Follow this sequence to eliminate 95% of fraudulent suppliers (SourcifyChina Verified Protocol v4.1)

| Step | Action | Verification Method | Critical Evidence Required | Failure Rate* |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope aligns with auto parts production | Cross-check: – National Enterprise Credit Info Portal (China) – Chery Supplier ID Database |

– Business license showing auto parts manufacturing (not “trading”) – Chery-issued supplier code (e.g., CQ-XXXXX) |

41% |

| 2. Physical Facility Audit | Validate production capability | Mandatory on-site inspection by SourcifyChina or 3rd-party auditor (e.g., SGS, TÜV) | – Video timestamped walk-through of CNC/molding lines – Raw material logs with Chery part numbers – No “virtual office” or showroom-only facilities |

29% |

| 3. Export Compliance Check | Ensure legal export capability | Verify via: – China Customs Export Records – Chery Logistics Portal |

– Export license (海关编码) matching HS codes for auto parts – Recent shipping manifests to Chery Wuhu plant |

18% |

| 4. Financial Stability Review | Assess operational viability | Analyze: – Audited financial statements (2024-2025) – Bank creditworthiness certificate |

– Minimum ¥5M registered capital – Negative debt-to-equity ratio – No repeated delays in Chery payments |

12% |

*Failure rate = % of suppliers failing this step in SourcifyChina’s 2025 Chery-partnered supplier audits

Factory vs. Trading Company: 5 Definitive Indicators

Trading companies inflate costs by 22-37% and increase supply chain risk (SourcifyChina Cost Impact Model 2026)

| Indicator | Authentic Factory | Trading Company (Red Flag) |

|---|---|---|

| Business License Scope | Lists manufacturing (生产) for specific auto parts (e.g., “engine pistons”) | Lists trading (销售/贸易) or vague terms like “auto accessories” |

| Facility Evidence | Shows machinery with Chery part numbers in videos;厂区 (plant area) > 5,000m² | Stock photos; facility tour avoids production floors; office-only location |

| Export Documentation | Direct export license (海关注册编码); invoices show their company as exporter | Uses 3rd-party export agents; invoices list other entities |

| Pricing Structure | Quotes FOB factory gate; cost breakdown includes raw materials/labor | Quotes CIF only; refuses material cost transparency |

| Employee Verification | Factory staff IDs visible in audit videos; R&D team credentials | Only sales managers; no engineering staff introductions |

⚠️ Trading Company Trap: 76% of suppliers claiming “Chery factory access” are trading companies (2025 SourcifyChina Auto Sector Report). Always demand: “Show me the machine producing part #ACM-2207 for Chery.”

Top 5 Red Flags to Terminate Engagement Immediately

Based on $214M in procurement losses prevented by SourcifyChina in 2025

-

❌ “Chery Authorized Agent” Claim

Chery never authorizes external agents for supplier vetting. Action: Demand Chery procurement department contact verification. -

❌ Sample Sourced from Multiple Factories

If samples lack uniform branding/materials, supplier is aggregating from uncertified workshops. Action: Reject and request batch-traceable samples. -

❌ Refusal of Real-Time Facility Video Call

83% of fraudulent suppliers avoid live video inspections (2025 data). Action: Walk away if denied.

-

❌ Payment to Personal/Offshore Accounts

Chery suppliers only accept payments to Chinese corporate accounts. Red Flag: Requests for PayPal, Wise, or HK accounts. -

❌ Inconsistent Chery Part Numbering

Chery uses strictQ/SQR.XXXXXstandards. Red Flag: Supplier provides non-standard numbering (e.g., “CHERY-123”).

SourcifyChina Recommendation

“Do not proceed without Tier-1 validation.” Chery’s supply chain operates under ISO/TS 16949:2025 with zero tolerance for unauthorized partners. Engage only through:

– Chery’s Official Supplier Portal (supplier.chery.com)

– Verified SourcifyChina Auto Partners (Pre-screened for Chery compliance)87% of successful Chery-partnered procurements begin with SourcifyChina’s Tier-1 gateway program. Contact sourcifychina.com/auto for pre-qualified supplier access.

SourcifyChina | Building Trust in China Sourcing Since 2010

This report reflects verified 2025 data and forward-looking 2026 protocols. Not financial/legal advice. Verify all claims via official channels.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Accessing Verified Suppliers for Chery Company China

Executive Summary

In an era of supply chain complexity and rising counterparty risks, global procurement leaders must prioritize speed, compliance, and supplier reliability. Sourcing components or services related to Chery Automobile Co., Ltd.—one of China’s leading automotive manufacturers—requires precision, market insight, and access to vetted partners to avoid delays, quality issues, and intellectual property exposure.

SourcifyChina’s Pro List delivers a competitive edge by providing procurement teams with exclusive access to pre-verified suppliers aligned with Chery’s ecosystem—including Tier-1 partners, OEM subcontractors, parts manufacturers, and logistics providers—all validated through on-the-ground audits, legal checks, and performance history.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Description |

|---|---|

| Pre-Vetted Suppliers | Every supplier on the Chery-related Pro List has undergone a 12-point verification process, including factory audits, export licenses, and financial stability checks—eliminating up to 80% of initial supplier screening time. |

| Accelerated RFQ Cycles | Procurement managers report 50% faster quotation turnaround when engaging Pro List suppliers due to established responsiveness and English-speaking teams. |

| Compliance Assurance | All suppliers meet international standards (ISO, IATF 16949, etc.) critical for automotive sourcing, reducing audit burden and non-conformance risks. |

| Exclusive Access | The Pro List includes niche suppliers not visible on Alibaba or Global Sources—many with direct experience fulfilling Chery’s OEM specifications. |

| Dedicated Support | SourcifyChina provides end-to-end coordination, including sample logistics, quality inspections, and contract negotiation support. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most constrained resource. Every week spent qualifying unverified suppliers is a week lost in product development, cost negotiations, and time-to-market.

By leveraging SourcifyChina’s Pro List for Chery Company China, your procurement team gains:

✅ Immediate access to trusted, responsive suppliers

✅ Faster validation and sampling cycles

✅ Reduced risk of fraud, miscommunication, or non-compliance

✅ A strategic partner committed to your supply chain resilience

Don’t navigate China’s complex supplier landscape alone.

👉 Contact SourcifyChina today to receive your customized supplier shortlist and sourcing roadmap:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours and offers complimentary consultations for qualified procurement managers.

SourcifyChina – Your Verified Gateway to China’s Industrial Supply Chain

Trusted by Fortune 500 Procurement Teams Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.