The global chelated iron fertilizer market is experiencing robust growth, driven by rising awareness of micronutrient deficiencies in soils and the increasing demand for high-yield, sustainable agriculture. According to a report by Mordor Intelligence, the global micronutrient fertilizers market—which includes chelated forms such as iron EDTA, DTPA, and EDDHA—was valued at USD 4.8 billion in 2023 and is projected to grow at a CAGR of over 8.5% from 2024 to 2029. Chelated iron, in particular, has gained prominence due to its superior bioavailability and effectiveness in alkaline and calcareous soils, where iron deficiency is a persistent challenge. With expanding adoption of precision farming and government initiatives promoting balanced fertilization, manufacturers are scaling production and innovating formulations to meet regional crop demands. This growing momentum has positioned chelated iron as a critical input in modern agriculture, fueling competition among key players worldwide. Here, we spotlight the top 7 chelated iron fertilizer manufacturers leading this transformation through product quality, innovation, and global reach.

Top 7 Chelated Iron Fertilizer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Shijiazhuang Hanhao Trade Co., Ltd.

Domain Est. 2014

Website: hhfertilizer.com

Key Highlights: EDDHA Fe 6% Organic Chelated Iron Fertilizer is a highly soluble, microgranular formulation designed to address iron deficiency in plants. The ……

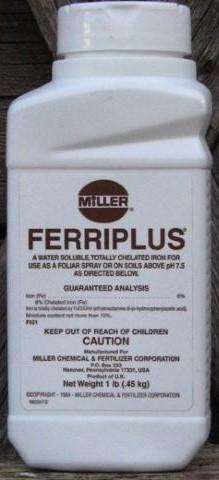

#2 Ferriplus®

Domain Est. 1998

Website: millerchemical.com

Key Highlights: Ferriplus® is a water-soluble, EDDHA-chelated iron (6%) fertilizer formulated for use on soils above pH 7.5. It is derived from iron (Fe) EDDHA ……

#3 Chelated Iron

Domain Est. 1998

Website: jrpeters.com

Key Highlights: For adding a soluble form of Iron to your fertility program. Useful for correcting or preventing iron deficiencies in sensitive plants….

#4 Chelated Iron Fertilizer for Horticulture

Domain Est. 2001

Website: royalbrinkman.com

Key Highlights: Iron chelates are organic trace elements that bind iron like a claw. Discover our wide range of chelated iron fertilizers now at Royal Brinkman!…

#5 Chelated Iron EDTA Fertilizer

Domain Est. 2010

#6 Haifa Micro™ Chelated Iron Fertilizer

Domain Est. 2011

Website: haifa-group.com

Key Highlights: A range of Iron fertilizers, Fe-EDDHA (6% Fe), containing O-O chelates. Prevents and cures plant iron deficiencies. EDDHA chelate – for maximum efficiency….

#7 About Us

Domain Est. 2018

Website: sash-co.com

Key Highlights: In the same year, the production of Chelated Iron fertilizer marked the emergence of a new generation of fertilizers under the brand name Khazra. In the ……

Expert Sourcing Insights for Chelated Iron Fertilizer

H2: 2026 Market Trends for Chelated Iron Fertilizer

The global chelated iron fertilizer market is projected to experience steady growth by 2026, driven by increasing awareness of micronutrient deficiencies in crops, rising demand for high-yield and sustainable agriculture, and advancements in precision farming technologies. Chelated iron fertilizers, which offer enhanced bioavailability and reduced soil fixation compared to non-chelated forms, are becoming essential tools in modern agricultural practices.

Key trends shaping the 2026 market landscape include:

-

Growing Focus on Soil Health and Nutrient Management: With expanding areas of calcareous and alkaline soils—where iron deficiency is prevalent—farmers are increasingly adopting chelated iron to prevent chlorosis and improve crop productivity. Governments and agricultural bodies are promoting balanced fertilization programs, further boosting demand.

-

Expansion of Specialty Agriculture: The rise in greenhouse farming, hydroponics, and high-value crop cultivation (e.g., fruits, vegetables, and vineyards) is fueling demand for efficient micronutrient delivery systems. Chelated iron is favored in these systems due to its solubility and compatibility with drip irrigation and foliar application methods.

-

Sustainability and Environmental Regulations: As environmental regulations tighten, especially in North America and Europe, there is a shift toward eco-friendly fertilizers that minimize nutrient leaching and soil degradation. Chelated iron formulations, particularly those using biodegradable chelating agents like EDDHA and IDHA, are gaining preference over traditional synthetics like EDTA due to lower environmental persistence.

-

Innovation in Chelating Agents: Market players are investing in R&D to develop next-generation chelates with improved stability, cost-efficiency, and environmental profiles. For example, IDHA (Iminodisuccinic acid), a biodegradable chelator, is emerging as a sustainable alternative, supported by regulatory incentives in the EU.

-

Regional Market Dynamics:

- Asia-Pacific, led by India and China, is expected to dominate market growth due to large agricultural bases, government subsidies on micronutrient fertilizers, and increasing farmer education.

- Latin America and Africa present high growth potential due to expanding cultivated areas and rising awareness of micronutrient deficiencies.

-

Europe remains a mature but innovative market, with strong regulatory support for sustainable inputs.

-

Consolidation and Strategic Partnerships: Major agrochemical companies are engaging in mergers, acquisitions, and collaborations with biotech firms to expand their chelated micronutrient portfolios. This trend is expected to intensify by 2026, improving product accessibility and distribution networks.

In conclusion, the 2026 chelated iron fertilizer market is characterized by technological advancement, regulatory influence, and a growing emphasis on sustainable intensification of agriculture. As global food demand rises and arable land quality declines, chelated iron will play a critical role in ensuring crop nutrition and yield stability.

Common Pitfalls in Sourcing Chelated Iron Fertilizer (Quality & Intellectual Property)

Sourcing high-quality chelated iron fertilizer is critical for effective plant nutrition, especially in high-pH soils where iron availability is limited. However, buyers face significant challenges related to both product quality and intellectual property (IP) protection. Being aware of these pitfalls is essential for making informed procurement decisions.

Quality-Related Pitfalls

Inadequate Chelate Stability

One of the most critical quality issues is insufficient stability of the iron-chelate complex under field conditions. Different chelating agents (EDTA, DTPA, EDDHA, HEEDTA, etc.) offer varying stability across pH ranges. Sourcing fertilizers with chelates unsuitable for the target soil pH (e.g., using Fe-EDTA in alkaline soils) results in rapid iron precipitation and poor nutrient uptake. Buyers must match the chelate type to their specific soil conditions.

Low Iron Content or Mislabeling

Some suppliers may exaggerate the iron concentration on product labels. Chelated iron products vary in actual iron content depending on the chelating agent used. For example, Fe-EDDHA typically contains around 6% iron, while Fe-EDTA contains about 13%. Sourcing without independent verification can lead to under-application and ineffective treatment of iron deficiency.

Use of Inferior or Non-Standard Chelating Agents

Not all chelates perform equally. Some manufacturers may use cheaper, less effective, or non-standard chelating agents that offer poor protection of iron ions. These may break down quickly in soil, rendering the iron unavailable. Buyers should verify the specific chelating agent used and ensure it complies with recognized standards (e.g., ISO, CEN, or national fertilizer regulations).

Impurities and Contaminants

Low-quality chelated iron may contain harmful impurities such as heavy metals (arsenic, cadmium, lead) or unreacted raw materials. These can damage crops or pose environmental and regulatory risks. Reputable suppliers provide certificates of analysis (CoA) detailing purity and contaminants.

Inconsistent Product Formulation

Batch-to-batch variability in chelate-to-iron ratio, particle size, or solubility affects performance. Poor manufacturing controls can result in inconsistent dissolution rates or clogging in irrigation systems (especially in fertigation). Buyers should require consistency data and conduct pilot testing.

Intellectual Property (IP) Pitfalls

Sourcing from IP-Infringing Manufacturers

A major risk is unknowingly purchasing chelated iron fertilizers produced using patented chelation technologies without proper licensing. Some generic manufacturers replicate branded formulations (e.g., mimicking specific EDDHA isomers or proprietary blends) that are protected by patents. Buyers risk legal liability, supply chain disruptions, or reputational damage if they distribute infringing products.

Lack of Transparency in Formulation Origin

Suppliers may not disclose whether their chelation process or formulation is protected by IP. Without clear documentation or licensing agreements, buyers assume the risk of IP violations. It is crucial to request proof of freedom to operate (FTO) or licensing from the supplier.

Counterfeit or Misbranded Products

In some markets, counterfeit versions of branded chelated iron (e.g., fake Sequestrene® or Sprint® products) are sold. These often lack the correct chelate structure or isomeric purity, leading to poor performance. Buyers may pay a premium for a trusted brand but receive an ineffective imitation.

Use of Expired or Invalidated Patents

While some chelate technologies (e.g., basic Fe-EDTA) are off-patent, newer, more effective formulations (such as specific ortho-ortho EDDHA isomers) may still be protected. Assuming all chelated iron products are freely available can lead to infringement if the supplier is using a patented process without authorization.

Inadequate Due Diligence

Failing to conduct IP due diligence—such as checking patent databases (e.g., WIPO, USPTO, EPO) or consulting legal experts—leaves buyers exposed. This is especially critical when sourcing from low-cost regions where IP enforcement may be weak, but international sales could still trigger legal action.

Conclusion

To avoid these pitfalls, buyers should:

– Verify product specifications with third-party lab testing.

– Match chelate type to soil pH and crop requirements.

– Demand transparency on formulation and sourcing.

– Conduct IP risk assessments and require FTO documentation.

– Prefer suppliers with strong quality certifications and clear IP compliance.

Proactive due diligence ensures both the agronomic effectiveness and legal safety of chelated iron fertilizer sourcing.

Logistics & Compliance Guide for Chelated Iron Fertilizer

Overview of Chelated Iron Fertilizer

Chelated Iron Fertilizer is a specialized micronutrient product used in agriculture to correct and prevent iron deficiency in plants, particularly in high-pH soils where iron becomes less available. The chelating agent (commonly EDTA, EDDHA, DTPA, or HEEDTA) binds to iron ions, enhancing their stability and uptake by plant roots. Due to its chemical composition and agricultural application, proper logistics and regulatory compliance are essential for safe, legal, and effective distribution.

Classification and Regulatory Status

Chelated Iron Fertilizer is typically classified as a specialty agricultural input rather than a hazardous chemical, but classification may vary by jurisdiction. Key considerations include:

- Not Generally Hazardous: Most chelated iron formulations are non-flammable, non-explosive, and non-toxic under normal handling conditions. However, they may be subject to agricultural chemical regulations.

- GHS/SDS Compliance: A Safety Data Sheet (SDS) in accordance with the Globally Harmonized System (GHS) must be provided. While not classified as hazardous under GHS in many cases, SDSs must still detail handling, storage, and environmental precautions.

- Fertilizer Registration: Required in many countries (e.g., U.S. EPA state-level registration, EU Fertilising Products Regulation (EU) 2019/1009). Products must be registered with relevant national or regional agricultural authorities.

- Organic Certification: If marketed for organic use, certification under standards such as USDA NOP or EU Organic Regulation is required. Note: Not all chelates (e.g., EDTA) are permitted in organic agriculture.

Packaging and Labeling Requirements

Proper packaging and labeling ensure product integrity, safety, and regulatory compliance.

- Packaging Materials:

- Use moisture-resistant, UV-protected containers (e.g., HDPE bags, lined woven polypropylene sacks, or plastic drums).

- Avoid metal containers that may react with chelates over time.

-

Ensure seals are tight to prevent caking or degradation.

-

Labeling:

- Product name and active ingredient (e.g., Fe-EDDHA, 6% chelated iron).

- Total iron content and percentage in chelated form.

- Net weight/volume.

- Manufacturer/distributor name and contact information.

- Batch/lot number and expiration date.

- Usage instructions, crop recommendations, and application rates.

- Precautionary statements (e.g., avoid inhalation of dust, wear gloves).

- Regulatory compliance marks (e.g., EPA registration number, EU CE mark if applicable).

- Storage instructions (e.g., store in a cool, dry place away from direct sunlight).

Transport and Shipping

Transport regulations depend on formulation (powder, liquid, granular) and mode of transport.

- International Shipping (IMDG, IATA, ADR):

- Chelated iron fertilizers are generally not classified as dangerous goods under IMDG (sea), IATA (air), or ADR (road) when in solid, non-dusty form and below specified concentration thresholds.

- Liquid formulations may require assessment for corrosivity or environmental hazards.

-

Always verify with current regulatory editions and SDS classification.

-

Domestic Transport (e.g., U.S. DOT, EU ADR):

- Typically transported as a non-hazardous agricultural commodity.

- Use covered trucks or containers to prevent moisture exposure and contamination.

-

Segregate from food, feed, and incompatible chemicals (e.g., strong oxidizers, acids).

-

Documentation:

- Bill of Lading (BOL)

- Commercial Invoice

- Certificate of Analysis (CoA)

- SDS (mandatory for all shipments)

- Phytosanitary Certificate (if required by importing country)

Storage Guidelines

Proper storage maintains product efficacy and safety.

- Environmental Conditions:

- Store in a dry, well-ventilated area with temperatures between 10°C and 30°C (50°F–86°F).

- Protect from direct sunlight, moisture, and extreme temperatures.

-

Avoid freezing for liquid formulations.

-

Segregation:

- Store separately from acids, alkalis, and oxidizing agents.

-

Keep away from food, animal feed, and seed products.

-

Shelf Life:

- Typically 2–3 years when stored properly.

- Monitor for caking, discoloration, or clumping, which may indicate degradation.

Customs and Import/Export Compliance

Cross-border movement requires adherence to international and national regulations.

- HS Code Classification:

- Common HS codes include 3105.60 (mineral or chemical fertilizers containing two or three of nitrogen, phosphorus, and potassium; other) or 3824.99 (prepared binders for foundry molds; chemical products and preparations).

-

Verify with national customs authorities, as classification varies (e.g., U.S. HTSUS, EU TARIC).

-

Import Requirements:

- Proof of fertilizer registration in the destination country.

- Import permit or license (e.g., from APHIS in the U.S. or DG AGRI in the EU).

-

Compliance with maximum residue levels (MRLs) for chelating agents (e.g., EDTA limits in EU surface waters).

-

Export Controls:

- No major export restrictions apply, but verify destination-specific bans (e.g., certain chelates restricted in organic farming in the EU).

Environmental and Safety Considerations

- Environmental Impact:

- Chelates like EDTA are persistent and can mobilize heavy metals in soil and water. Use site-specific formulations (e.g., EDDHA in alkaline soils).

-

Follow local regulations on application near water bodies.

-

Worker Safety:

- Use PPE (gloves, dust mask) when handling powders to avoid irritation.

- Wash hands after handling.

-

Avoid prolonged inhalation of dust.

-

Spill Management:

- Sweep up solid spills; collect in a sealed container.

- Avoid runoff into drains or waterways.

- Refer to SDS for specific cleanup procedures.

Recordkeeping and Traceability

Maintain documentation for compliance audits and quality control:

– Batch production records

– SDS and CoA archives

– Shipping and delivery logs

– Regulatory registration documents

– Customer certifications (e.g., organic, sustainable farming)

Conclusion

Chelated Iron Fertilizer requires careful attention to classification, packaging, transport, and regulatory compliance across its supply chain. While generally non-hazardous, adherence to agricultural input regulations, accurate labeling, and proper handling ensures product efficacy, environmental safety, and legal conformity. Always consult local and international authorities for up-to-date requirements, especially when shipping across borders.

In conclusion, sourcing chelated iron fertilizer is a strategic and effective solution for addressing iron deficiency in crops, particularly in high-pH or calcareous soils where iron availability is limited. Chelated iron, through its protective molecular structure, enhances nutrient uptake by preventing iron from becoming insoluble and inaccessible to plants. When sourcing this fertilizer, it is essential to consider factors such as the type of chelating agent (e.g., EDTA, DTPA, EDDHA, or lignosulfates), soil conditions, crop requirements, cost-effectiveness, and environmental impact. Selecting a reputable supplier that provides high-quality, properly formulated chelated iron products ensures better crop performance, improved yields, and sustainable agricultural practices. Ultimately, investing in the right chelated iron fertilizer—tailored to specific soil and crop needs—leads to long-term plant health and optimal agricultural productivity.