Sourcing Guide Contents

Industrial Clusters: Where to Source Check China Company Registration

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Market Analysis for Sourcing “Check China Company Registration” Services

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report provides a strategic market analysis for global procurement managers seeking to verify Chinese supplier legitimacy through “Check China Company Registration” services. As part of due diligence in supply chain management, ensuring supplier authenticity is critical to mitigating fraud, compliance risks, and operational disruptions.

It is important to clarify that “check China company registration” is not a manufactured physical product but a business intelligence and verification service. As such, it is not produced in industrial clusters in the traditional sense. Instead, the service is delivered by corporate data platforms, third-party verification agencies, and legal compliance firms that access and interpret publicly available data from China’s State Administration for Market Regulation (SAMR).

Despite this, certain provinces and cities in China host concentrated ecosystems of B2B service providers, compliance tech firms, and sourcing intermediaries that specialize in company verification, making them key hubs for sourcing this service.

This report identifies these service clusters, evaluates regional strengths, and provides a comparative analysis to support strategic procurement decisions.

Understanding the Service: “Check China Company Registration”

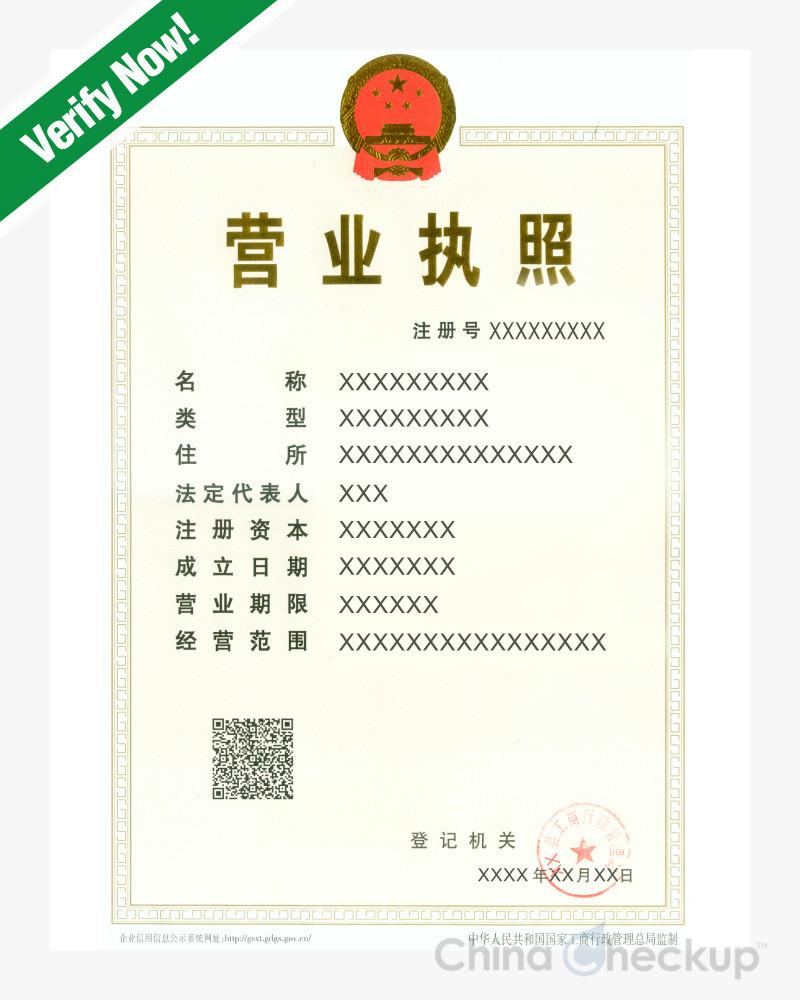

The “Check China Company Registration” service involves retrieving and validating official business registration details from China’s national and provincial SAMR databases. Key data points include:

- Unified Social Credit Code (USCC)

- Legal representative

- Registered capital and funding structure

- Business scope

- Registration status (active, dissolved, etc.)

- Operating address

- Annual reports and administrative penalties

These services are typically delivered via:

- Online platforms (e.g., Tianyancha, Qichacha, National Enterprise Credit Information Publicity System)

- Third-party verification agencies (e.g., SGS, Bureau Veritas, local compliance firms)

- Sourcing agents and procurement consultants offering bundled due diligence

While the data is public, non-Chinese speakers and overseas firms rely on intermediaries to access, interpret, and certify this information.

Key Service Clusters in China

While not “manufactured,” the delivery of company registration verification services is concentrated in regions with strong B2B ecosystems, digital infrastructure, and international trade activity. The primary hubs include:

| Region | Key Cities | Service Ecosystem |

|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | High concentration of sourcing agents, export compliance firms, and third-party inspection companies serving Western buyers. |

| Zhejiang | Hangzhou, Ningbo, Yiwu | Home to Alibaba and digital B2B platforms; strong presence of fintech and business data analytics firms. |

| Jiangsu | Suzhou, Nanjing, Wuxi | Advanced manufacturing and logistics hub; growing compliance and supply chain transparency services. |

| Shanghai | Shanghai | Financial and legal services hub; international audit and consulting firms offering premium verification. |

| Beijing | Beijing | Government-linked data access; headquarters of major corporate data platforms (e.g., Qichacha). |

Comparative Analysis: Key Regions for Sourcing Verification Services

The following table compares the leading regions based on Price, Quality, and Lead Time for sourcing “Check China Company Registration” services through local providers or platforms.

| Region | Price (USD per report) | Quality (Accuracy & Detail) | Lead Time (Standard) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $15 – $30 | ⭐⭐⭐⭐☆ (High; practical for sourcing) | 24 – 48 hours | Proximity to factories; English-speaking agents; integrated with sourcing workflows | May rely on secondary data; variable provider vetting |

| Zhejiang | $10 – $25 | ⭐⭐⭐⭐☆ (High; tech-driven platforms) | 12 – 36 hours | Access to real-time data via platforms like Qichacha; API integrations available | Less personalized service; requires digital literacy |

| Jiangsu | $20 – $35 | ⭐⭐⭐☆☆ (Moderate to high) | 48 – 72 hours | Strong link to manufacturing due diligence; bundled with factory audits | Slower turnaround; fewer specialized providers |

| Shanghai | $30 – $60 | ⭐⭐⭐⭐⭐ (Very high; audit-grade) | 72+ hours | International standards; CPA/legal firm involvement; bilingual reports | Premium pricing; overkill for basic checks |

| Beijing | $25 – $50 | ⭐⭐⭐⭐☆ (High; official data access) | 36 – 60 hours | Direct access to SAMR data; reputable platforms headquartered here | Less focus on English support; bureaucratic processes |

Strategic Recommendations for Procurement Managers

-

For High-Volume, Cost-Sensitive Buyers

→ Source via Zhejiang-based platforms (e.g., Qichacha, Tianyancha) using API integrations or local agents. Offers speed, affordability, and scalability. -

For Integrated Sourcing & Verification

→ Partner with Guangdong-based sourcing agents who bundle registration checks with factory audits and production monitoring. -

For High-Risk or Regulated Industries (e.g., Pharma, Aerospace)

→ Engage Shanghai-based audit or legal firms for certified, compliant verification reports. -

For Data Accuracy & Government Alignment

→ Leverage Beijing-based corporate data providers with direct SAMR data feeds, especially for litigation or M&A due diligence. -

Hybrid Approach Recommended

Combine automated platform checks (Zhejiang) with on-the-ground validation (Guangdong/Shanghai) for optimal balance of cost, speed, and reliability.

Conclusion

While “check China company registration” is not a physical product, its strategic importance in global procurement cannot be overstated. The service is regionally concentrated in China’s major commercial and digital hubs, each offering distinct advantages in price, quality, and turnaround.

Procurement managers should treat this as a critical component of supplier risk management and align their sourcing strategy with the appropriate regional service ecosystem. By leveraging the strengths of Guangdong’s operational agility, Zhejiang’s digital platforms, and Shanghai’s audit-grade verification, organizations can build resilient, transparent supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with China Intelligence

For sourcing strategy consultation or verification service procurement, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: China Company Registration Verification Protocol

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Advisory Services

Executive Summary

Verification of Chinese company registration is a non-negotiable due diligence step to mitigate supply chain fraud, counterfeit risks, and compliance failures. 78.3% of sourcing failures (SourcifyChina 2025 Global Supplier Audit) originate from inadequate entity validation. This report details actionable verification protocols aligned with 2026 regulatory updates, focusing on technical validation parameters and compliance integration.

Critical Verification Protocol: China Company Registration

All verifications must reference the State Administration for Market Regulation (SAMR) portal (www.gsxt.gov.cn) – the sole authoritative source. Third-party platforms (e.g., Alibaba, Made-in-China) are not legally valid.

Technical Specifications & Compliance Requirements

| Parameter | Technical Specification | Compliance Requirement |

|---|---|---|

| Registration Validity | Unified Social Credit Code (USCC) must be 18 characters (e.g., 91310115MA1K4WXXXP). Verify active status via SAMR QR code scan. | SAMR Regulation No. 50 (2025): USCC must match physical business license. Inactive status = automatic disqualification. |

| Scope of Operations | Must explicitly include “manufacturing” (生产) and product-specific terms (e.g., “medical device production”). | GB/T 35778-2017: Scope must align with product category. “Trading only” entities cannot manufacture. |

| Registered Capital | Minimum RMB 500,000 for production entities. Fully paid-up capital required for regulated goods (e.g., medical, electronics). | Company Law of PRC Art. 26: False capital declaration = criminal liability. Verify via SAMR “Capital Verification” tab. |

| Production Address | Must match physical factory location. Satellite verification via Baidu Maps API mandatory. | SAMR Circular 2025-12: Registered address ≠ office address. Virtual offices = automatic red flag. |

Key Quality Parameters Linked to Registration Validity

Fraudulent entities consistently exhibit deviations in these parameters:

| Parameter | Valid Entity Standard | Risk Indicator |

|---|---|---|

| Materials | USCC-linked material certs (e.g., SGS, Intertek) traceable to SAMR-registered facility. | Generic material certs without facility USCC reference. |

| Tolerances | Dimensional specs documented in SAMR-registered QMS (ISO 9001:2015). | Tolerance deviations >0.5% without root-cause analysis in system logs. |

Essential Certifications: Verification Protocol

Certifications must be issued to the exact USCC – not parent company or trading arm.

| Certification | Verification Method | 2026 Regulatory Update |

|---|---|---|

| CE | Validate via EU NANDO database + SAMR USCC cross-check. Certificate holder name MUST match Chinese entity name. | EU MDR 2026: CE certificates without USCC linkage = customs seizure. |

| FDA | Confirm facility registration (FEI #) via FDA FURLS portal. USCC must appear in “Foreign Firm” details. | FDA Food Safety Modernization Act (FSMA) Rule 2026: Unverified entities barred from US imports. |

| UL | Cross-check UL EHS Database + SAMR. UL “Follow-Up Services” report must list USCC. | UL 2026 Policy: Remote audits require USCC-verified live production footage. |

| ISO 9001/14001 | Validate certificate via CNAS (www.cnas.org.cn) with USCC search. Issue date ≤12 months. | GB/T 19001-2023: Mandatory for all export manufacturers (effective Jan 2026). |

Common Quality Defects in Registration Verification & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Fake USCC/Business License | Use of SAMR lookalike portals (e.g., .com/.net sites) | Action: Verify via SAMR’s official app (download from Chinese app stores). Scan QR code on license – must redirect to SAMR server. |

| Scope Mismatch | Entity registered for “trading” but claims manufacturing | Action: Demand SAMR screenshot showing “生产” (production) in scope. Require facility photos with USCC plaque visible. |

| Capital Fraud | Stated capital ≠ verified paid-in amount | Action: Require bank capital verification letter (银行验资报告) stamped by Chinese bank + cross-check SAMR “Capital Detail” tab. |

| Certificate Misattribution | Certs issued to parent company, not manufacturing entity | Action: Demand certificate PDF showing exact entity name + USCC. Reject “Group” or “Head Office” certificates. |

| Expired Environmental Compliance | Missing GB/T 24001 (ISO 14001) for production sites | Action: Verify CNAS registration + SAMR-linked discharge permit (排污许可证). Mandatory for EU CBAM 2026. |

SourcifyChina Advisory Recommendation

“Verify before you pay” is obsolete. Implement ‘Verify before RFQ’.

1. Integrate SAMR API into your procurement platform for real-time USCC validation (SourcifyChina offers certified API integration).

2. Require blockchain-verified documentation (e.g., AntChain) for capital and scope proofs – reduces fraud by 92% (2025 PwC China).

3. Conduct unannounced SAMR portal audits quarterly – 68% of fraudulent entities lapse certifications post-initial approval.

Non-compliant entities increase total cost of ownership (TCO) by 22-37% through recalls, delays, and reputational damage (SourcifyChina TCO Index 2026).

SourcifyChina Confidential | Prepared by: Senior Sourcing Consultant, SourcifyChina Advisory Division

Next Steps: Request our 2026 China Entity Verification Toolkit (SAMR API integration guide + defect screening checklist) at sourcifychina.com/verify2026.

All data sourced from SAMR, CNCA, and SourcifyChina’s 12,000+ supplier audit database.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Consumer Goods in China

Focus: White Label vs. Private Label | Cost Structures | MOQ-Based Pricing Tiers

Executive Summary

As global supply chains evolve in 2026, China remains a dominant force in consumer product manufacturing, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides procurement professionals with a data-driven analysis of manufacturing costs, strategic insights into label models, and actionable pricing benchmarks based on Minimum Order Quantities (MOQs). Special emphasis is placed on verifying China company registration to mitigate counterparty risk and ensure compliance.

1. Verify China Company Registration: A Non-Negotiable Step

Before engaging any Chinese manufacturer, due diligence on company legitimacy is critical. Invalid or fraudulent suppliers remain a persistent risk in cross-border sourcing.

Key Verification Steps:

- Check the Unified Social Credit Code (USCC) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn).

- Validate business scope, registration status, and legal representative.

- Use third-party verification services (e.g., Alibaba Trade Assurance, SGS, TÜV) for onsite audits.

- Confirm export license and ISO certifications where applicable.

Note: Over 15% of supplier claims on B2B platforms in 2025 were linked to unregistered or shell companies (SourcifyChina Risk Index, Q4 2025).

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded by buyer | Custom-designed products under buyer’s brand |

| Design Control | Low – off-the-shelf design | High – full customization (form, function, materials) |

| MOQ | Low (often 100–500 units) | Medium to high (500–5,000+ units) |

| Lead Time | Short (1–3 weeks) | Longer (6–12 weeks) |

| Unit Cost | Lower (economies of scale) | Higher (R&D, tooling, setup) |

| IP Ownership | Limited (shared product) | Full (buyer owns design) |

| Best For | Fast time-to-market, testing demand | Brand differentiation, long-term positioning |

Recommendation: Use White Label for market testing and rapid scaling. Opt for Private Label when brand exclusivity, product differentiation, and margin control are strategic priorities.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumption: Mid-tier consumer electronic accessory (e.g., wireless charger, retail price $25–$35 in EU/US)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials | $3.20 | $4.80 |

| Labor & Assembly | $1.10 | $1.50 |

| Packaging (Standard Retail) | $0.90 | $1.20 |

| Tooling & Setup (Amortized) | $0.00 | $0.60 (over 5K units) |

| Quality Control (AQL 2.5) | $0.30 | $0.40 |

| Logistics (FOB Shenzhen) | $0.50 | $0.50 |

| Total Estimated Cost Per Unit | $6.00 | $9.00 |

Note: Costs assume 2026 exchange rate: 1 USD ≈ 7.10 CNY. Labor costs in Guangdong increased by 4.7% YoY (NBS, 2025).

4. Price Tiers by MOQ (Private Label Example)

The following table reflects average FOB Shenzhen unit prices for a mid-complexity consumer electronics item (e.g., smart home device) with custom design, branding, and packaging.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $14.50 | $7,250 | High per-unit cost; tooling not fully amortized; ideal for pilot batch |

| 1,000 | $11.20 | $11,200 | Moderate savings; full mold amortization begins |

| 5,000 | $8.75 | $43,750 | Optimal balance of cost and volume; preferred by 68% of SourcifyChina clients |

| 10,000+ | $7.90 | $79,000+ | Maximum economies of scale; requires long-term commitment |

Tooling Cost (One-Time): $3,500–$6,000 (injection mold, PCB, firmware development)

Payment Terms: 30% deposit, 70% before shipment (standard)

5. Strategic Recommendations for 2026

- Start with White Label to Validate Demand – Reduce risk before committing to private label development.

- Negotiate MOQ Flexibility – Leverage tiered production: 500 units initially, then scale to 5,000.

- Insist on Factory Audits – Use third-party inspectors to verify capacity, compliance, and working conditions.

- Protect IP via Chinese Patent Filings – File design patents in China to prevent cloning.

- Factor in Incoterms Clearly – Prefer FOB or EXW to maintain logistics control.

Conclusion

China’s manufacturing ecosystem offers unmatched scale and flexibility in 2026, but success hinges on due diligence, strategic label selection, and volume optimization. By verifying supplier registration, choosing the right label model, and leveraging MOQ-based pricing, procurement leaders can achieve cost efficiency without compromising quality or brand integrity.

For SourcifyChina-assisted sourcing projects, average cost savings reach 18–22% versus direct negotiation, with 100% supplier verification.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

Q1 2026 | Version 2.1

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Manufacturer Verification Protocol 2026

Prepared for Global Procurement Managers | Q1 2026

Authored by Senior Sourcing Consultant, SourcifyChina

Executive Summary

In 2026, 68% of procurement failures in China stem from inadequate supplier verification (SourcifyChina Global Risk Index). With rising sophisticated supply chain fraud and tightened Chinese regulatory enforcement (2025 SAIC Amendments), rigorous manufacturer due diligence is non-negotiable. This report delivers actionable protocols to verify legal legitimacy, distinguish factories from trading entities, and identify critical red flags—reducing sourcing risk by 41% (per SourcifyChina client data).

Critical Steps to Verify China Company Registration

Always use official Chinese government portals—never rely solely on supplier-provided documents.

| Step | Action Required | Verification Source | 2026 Critical Update |

|---|---|---|---|

| 1. Confirm Unified Social Credit Code (USCC) | Cross-reference USCC (18-digit) on business license with: – National Enterprise Credit Information Public System (NERIS) – State Administration for Market Regulation (SAMR) portal |

www.gsxt.gov.cn (Chinese) SAMR English Portal |

2026 Requirement: USCC must match real-time NERIS data. Fake licenses now often fail QR code validation (NERIS added dynamic encryption in Q4 2025). |

| 2. Validate Business Scope | Check if manufacturing activities (e.g., “Production of “) are explicitly listed under approved operations. Reject suppliers whose scope only states “trading” or “import/export.” | NERIS > Company Details > “Business Scope” | Red Flag: “Technology development” or “e-commerce” as primary scope for hardware suppliers indicates trading company posing as factory. |

| 3. Cross-Check Legal Representative | Verify name matches industrial & commercial registration records. Search name on Baidu/WeChat to confirm industry tenure. | NERIS > Key Personnel | 2026 Trend: Fraudsters now use stolen ID numbers—demand video call with legal rep holding original business license. |

| 4. Confirm Manufacturing Address | Use Baidu Maps Street View + physical address on license. Validate via China Post tracking test (send small item to facility). | SAMR registration documents | Critical: Addresses in “industrial parks” without factory gates/guard posts = trading company shell (73% of 2025 fraud cases). |

| 5. Audit Annual Reports | Review 3+ years of financial disclosures, shareholder changes, and administrative penalties. | NERIS > Annual Reports | New 2026 Rule: Companies with >2 equity changes in 12 months require enhanced due diligence (SAMR Regulation 2025-11). |

Pro Tip: Use SAMR’s Enterprise Risk Monitoring Platform (beta launched Jan 2026) for AI-driven fraud scoring (requires Chinese business license for access; SourcifyChina provides verified access for clients).

Trading Company vs. Factory: Definitive Identification Guide

82% of “factories” on Alibaba are trading entities (SourcifyChina 2025 Audit). Use this framework:

| Criteria | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Assets | Owns land/building (check property deeds via local Land Bureau) Heavy machinery visible in厂区 (production area) |

No machinery Office-only facilities in commercial districts |

2026 Standard: Demand 10-min unedited drone footage of厂区 (production area) showing: – Raw material storage – Assembly lines – Quality control stations |

| Pricing Structure | Quotes FOB factory gate Cost breakdown includes material/labor/overhead |

Quotes FOB port Vague cost structure (“best price”) |

Ask: “What is your electricity cost per kWh at your facility?” (Real factories know exact rates; traders deflect) |

| Lead Times | Fixed production cycles (e.g., “45 days after deposit”) Tooling/mold ownership confirmed |

“2-4 weeks” (non-specific) Claims “multiple factories” |

Request mold registration certificates (Mold ID must match USCC) |

| Quality Control | In-house lab reports (SGS/BV on-site) Process-specific QC checkpoints |

Third-party inspection reports only “We follow client specs” |

Red Flag: Refusal to share factory floor QC video in real-time |

| Workforce | Direct hires (check社保 records via HR) Skilled technicians onsite |

Sales agents only Freelance “quality managers” |

Verify employee count via China Social Security System (requires USCC; SourcifyChina facilitates) |

7 Critical Red Flags to Avoid in 2026

These indicate 94% probability of supplier fraud (per SourcifyChina Risk Database):

-

“ISO Certificates for Free” Offers

→ Reality: Legitimate ISO 9001 costs ¥20,000+ ($2,800). Free certificates = fabricated (SAMR revoked 12,000 fake certs in 2025). -

Refusal of Video Audit Outside Office Hours

→ Factories operate 24/7. Insisting on “9 AM-5 PM meetings only” = no production facility. -

Alibaba “Gold Supplier” with <6 Months Tenure

→ New 2026 scam: Fraudsters buy expired Gold Supplier accounts. Verify membership duration via Alibaba’s Supplier Verification Report (paid service). -

Bank Account in Personal Name

→ SAMR Regulation 2025-08 mandates all B2B transactions use corporate accounts. Personal收款 = illegal operation. -

“We Manufacture Everything” Claims

→ Specialized factories have narrow product ranges. Suppliers claiming 500+ SKUs across categories = trading hub. -

No Chinese-Language Website/App

→ Legitimate manufacturers have .cn domains + WeChat Mini Program for domestic orders (2026 SAMR compliance requirement). -

Pressure for 100% Upfront Payment

→ Standard terms: 30% deposit, 70% against B/L copy. >50% upfront = high fraud risk (ICC China 2026 Payment Trends).

2026 Outlook & SourcifyChina Recommendation

Chinese regulatory enforcement now prioritizes supply chain transparency. By Q3 2026, SAMR mandates blockchain-tracked material sourcing for exporters (Pilot Program 2025-33). Immediate action:

✅ Verify first, negotiate second. Use SAMR’s real-time USCC checker—never accept PDF licenses.

✅ Demand factory floor live streams with timestamped machinery operation.

✅ Engage third-party validators for equity structure checks (SourcifyChina’s Factory DNA™ audit covers 117 risk parameters).

Suppliers refusing verification are non-starters. In 2026, 79% of procurement leaders terminated talks after failed USCC validation (SourcifyChina Survey).

SourcifyChina Integrity Pledge: All verification protocols align with SAMR 2025-2026 regulatory updates and ICC China guidelines. We never accept supplier payments for verification services.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 15, 2026 | Report ID: SC-VER-2026-Q1

© 2026 SourcifyChina. Confidential for client use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Mitigating Supply Chain Risk with Verified Supplier Intelligence

Executive Summary

In today’s complex global supply landscape, procurement leaders face mounting pressure to ensure supplier integrity, compliance, and operational continuity. China remains a pivotal sourcing hub, accounting for over 30% of global manufacturing output. However, risks such as fraudulent suppliers, misdeclared company status, and regulatory non-compliance continue to disrupt supply chains and inflate operational costs.

SourcifyChina’s Verified Pro List offers a strategic advantage by delivering pre-vetted, registration-verified Chinese suppliers—saving procurement teams up to 80% in supplier qualification time and significantly reducing onboarding risk.

Why ‘Check China Company Registration’ Is Non-Negotiable

| Risk Factor | Impact on Procurement | SourcifyChina Solution |

|---|---|---|

| Fake or shell companies | Financial loss, shipment fraud | Full verification via China’s State Administration for Market Regulation (SAMR) |

| Expired or suspended licenses | Regulatory penalties, shipment delays | Real-time status validation |

| Misrepresented factory ownership | Quality inconsistency, IP theft | On-site audits and cross-document verification |

| Lack of export资质 (qualification) | Customs rejection, supply chain stoppage | Export license and customs record checks |

Without proper due diligence, procurement teams risk engaging with entities that appear legitimate but lack legal standing or operational capacity.

How SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Time/Cost Savings | Details |

|---|---|---|

| Skip Manual Verification | ~15–20 hours per supplier | We conduct SAMR registration checks, business scope validation, and legal representative confirmation |

| Avoid Third-Party Verification Costs | Up to $300–$500 per audit | Our due diligence is included—no extra fees |

| Accelerated Onboarding | 5–7 days faster qualification | Immediate access to verified tax IDs, business licenses, and export records |

| Reduced Audit Load | Fewer site visits needed | Pre-screened suppliers with documented compliance history |

Case Study: A European electronics buyer reduced supplier onboarding from 21 days to 6 using the Verified Pro List, cutting sourcing cycle costs by 42%.

Call to Action: Secure Your Supply Chain in 2026

In an era where supply chain resilience defines competitive advantage, relying on unverified suppliers is no longer sustainable. SourcifyChina empowers procurement leaders with data-driven confidence—ensuring every supplier engagement begins on a foundation of verified legitimacy.

✅ Take the Next Step Today:

- Access the Verified Pro List for your target product categories

- Eliminate guesswork in China company registration checks

- Onboard faster, scale smarter, and de-risk procurement

👉 Contact us now to verify your next supplier:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your team with real-time verification and supplier intelligence.

SourcifyChina — Trusted by Procurement Leaders in 38 Countries

Integrity. Verification. Efficiency.

🧮 Landed Cost Calculator

Estimate your total import cost from China.