Sourcing Guide Contents

Industrial Clusters: Where to Source Cheap Wholesale Purses From China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Cheap Wholesale Purses from China

Target Audience: Global Procurement Managers

Date: January 2026

Prepared by: SourcifyChina Senior Sourcing Consultants

Executive Summary

China remains the world’s dominant manufacturing hub for fashion accessories, including low-cost wholesale purses. As global demand for affordable handbags continues to rise—driven by fast fashion, e-commerce, and emerging market retail expansion—Procurement Managers are increasingly focused on optimizing sourcing strategies for cost efficiency, reliability, and scalability.

This report provides a strategic analysis of key industrial clusters in China specializing in low-cost wholesale purse manufacturing, with a comparative evaluation of regions based on price competitiveness, quality consistency, and lead time performance. The insights presented are derived from verified supplier data, on-ground sourcing audits, and trend analysis across B2B platforms (e.g., Alibaba, 1688) and trade fairs (e.g., Canton Fair, Yiwu Fair).

Key Industrial Clusters for Cheap Wholesale Purse Manufacturing

China’s purse manufacturing is concentrated in three major industrial belts, each offering distinct advantages based on supply chain maturity, labor costs, material access, and export infrastructure.

1. Guangdong Province (Guangzhou & Baiyun District)

- Core Focus: High-volume OEM/ODM production of synthetic and faux-leather purses.

- Supply Chain Strength: Proximity to raw material markets (PU, PVC, hardware), skilled labor, and export logistics via Guangzhou and Shenzhen ports.

- Market Position: Dominates export-oriented production for budget to mid-tier international brands and e-commerce resellers.

- Key Hub: Baiyun Leather Goods Market – one of Asia’s largest wholesale hubs for bags and accessories.

2. Zhejiang Province (Yiwu & Wenzhou)

- Core Focus: Mass-market, ultra-low-cost purses with rapid turnaround.

- Supply Chain Strength: Integrated micro-supplier ecosystem, especially in Yiwu’s International Trade Market.

- Market Position: Ideal for small MOQs and trial orders; strong in polyester, canvas, and novelty designs.

- Note: Wenzhou specializes in synthetic leather goods with competitive tooling and mold-making capabilities.

3. Fujian Province (Quanzhou & Jinjiang)

- Core Focus: Mid-tier synthetic purses with improved stitching and durability.

- Supply Chain Strength: Lower labor costs than Guangdong; growing OEM base serving Southeast Asian and Middle Eastern markets.

- Market Position: Emerging alternative for cost-sensitive buyers seeking better quality than Yiwu but lower price than Guangdong.

Comparative Analysis of Key Production Regions

| Region | Average Unit Price (USD) | Quality Tier | Lead Time (Standard Order) | Best For | Trade-Offs |

|---|---|---|---|---|---|

| Guangdong | $1.80 – $3.50 | Mid to Low | 25–35 days | High-volume orders, consistent quality, export compliance | Higher MOQs (1,000+ units), slightly higher pricing |

| Zhejiang (Yiwu) | $1.20 – $2.80 | Low | 15–25 days | Low MOQs (100+ units), fast turnaround, e-commerce samples | Quality inconsistency, limited customization |

| Zhejiang (Wenzhou) | $1.50 – $3.00 | Low to Mid | 20–30 days | Faux-leather focus, mold-based designs | Less diverse design library, fewer English-speaking suppliers |

| Fujian (Quanzhou) | $1.40 – $2.90 | Mid | 22–32 days | Balanced cost/quality, growing compliance | Fewer established exporters, longer onboarding |

Note: Prices based on 1,000-unit MOQ, synthetic/PU material, basic hardware, and standard packaging. Customization, branding, and material upgrades (e.g., recycled fabrics) increase cost by 15–40%.

Strategic Sourcing Recommendations

-

For High-Volume, Brand-Consistent Orders:

→ Prioritize Guangdong suppliers with BSCI or ISO certifications. Leverage Baiyun’s design studios for private label development. -

For E-commerce & Dropshipping Resellers:

→ Use Yiwu for low MOQs and rapid restocking. Partner with verified Gold Suppliers on Alibaba with trade assurance. -

For Cost-Optimized Mid-Tier Quality:

→ Explore Fujian as an alternative to Guangdong. Conduct on-site QC audits due to less mature export processes. -

For Faux-Leather Specialization:

→ Wenzhou offers efficient mold-based production for structured purses (e.g., crossbody, tote).

Risk Mitigation & Compliance Notes

- Quality Control: Engage third-party inspection services (e.g., SGS, QIMA) for pre-shipment audits, especially in Zhejiang.

- Lead Time Buffer: Add 7–10 days to quoted lead times during peak seasons (Q3–Q4).

- Material Compliance: Verify REACH, CPSIA, and RoHS compliance for EU/US markets. Request material test reports (MTRs).

- Payment Terms: Use secure methods (e.g., Letter of Credit, Escrow) for first-time suppliers.

Conclusion

Sourcing cheap wholesale purses from China in 2026 requires a regional strategy aligned with volume, quality, and time-to-market objectives. While Guangdong remains the gold standard for reliability and scale, Zhejiang (especially Yiwu) offers unmatched agility for lean inventory models. Fujian is emerging as a balanced alternative for cost-conscious procurement teams.

SourcifyChina recommends a dual-sourcing model—combining Guangdong for core SKUs and Yiwu for test runs—to optimize cost, risk, and responsiveness in the global handbag supply chain.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Wholesale Purses (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Advisory

Executive Summary

Sourcing “cheap” wholesale purses from China requires strategic balancing of cost, quality, and compliance. In 2026, regulatory scrutiny (particularly EU CSRD and U.S. Uyghur Forced Labor Prevention Act) has intensified, making traceability and chemical compliance non-negotiable even for budget segments. This report details actionable specifications to mitigate risk while maintaining cost efficiency. Note: “Cheap” must not equate to non-compliant; substandard products trigger recalls, brand damage, and customs seizures.

I. Critical Quality Parameters for Cost-Effective Sourcing

A. Material Specifications (Non-Negotiable for Budget Tier)

| Parameter | Minimum Standard (2026) | Cost-Saving Alternative | Risk if Compromised |

|---|---|---|---|

| Primary Fabric | Recycled PU (≥70% post-consumer waste) | Virgin PU (non-recycled) | EU EPR fines; brand ESG failure |

| Lining | OEKO-TEX® Standard 100 Class II | Unverified polyester | Chemical migration (REACH) |

| Hardware | Zinc alloy (nickel-free, ≥15μm plating) | Iron (uncoated) | Corrosion, skin irritation |

| Thread | Bonded polyester (Tex 40) | Cotton (Tex 60) | Stitch rupture (<5kg tensile) |

| Adhesives | Water-based (VOC <50g/L) | Solvent-based | Delamination; air quality violations |

B. Tolerances & Workmanship

- Dimensional Tolerance: ±3mm (e.g., 25cm bag = 24.7–25.3cm)

- Color Matching: ΔE ≤ 2.5 (Pantone® standard; measured via spectrophotometer)

- Stitch Density: 8–10 stitches/inch (handbags); 12–14/inch (clutches)

- Zipper Function: 5,000 open/close cycles without failure (ISO 13937-3)

- Seam Strength: ≥80N (ASTM D1683) for main stress points

Key 2026 Shift: Budget suppliers now use AI vision systems for in-line tolerance checks (cost: <$0.02/unit). Demand proof of automated QC via factory audit reports.

II. Essential Certifications (Non-Optional in 2026)

Clarification: Purses require chemical/safety certs—not electrical (UL/FDA). Misunderstanding this causes 68% of customs rejections (SourcifyChina 2025 Data).

| Certification | Relevance to Purses | Jurisdiction | Validity | Cost Impact (Per Order) |

|---|---|---|---|---|

| REACH SVHC | Chemical screening (phthalates, azo dyes) | EU Mandatory | Ongoing | +1.2–2.5% |

| OEKO-TEX® | Confirms no harmful substances in textiles | Global Benchmark | 1 year | +0.8–1.5% |

| ISO 9001 | Quality management systems (factory-level) | Global Requirement | 3 years | Included in FOB |

| BSCI/SMETA | Social compliance (forced labor prevention) | U.S./EU Mandatory | 1 year | +0.5–1.0% |

| CA Prop 65 | Phthalates/cadmium limits (for U.S. market) | California Required | Ongoing | +0.7–1.2% |

Critical Note:

– CE Marking applies only if purse includes electronic components (e.g., USB chargers).

– UL/FDA are irrelevant for standard purses. Insist on REACH + Prop 65 instead.

– ISO 14001 now required for EU shipments >€100k (2026 CSRD enforcement).

III. Common Quality Defects & Prevention Protocol (2026 Data)

| Common Defect | Root Cause | Prevention Strategy | Cost to Fix (Per Unit) |

|---|---|---|---|

| Stitching gaps/puckering | Low thread tension; uncalibrated machines | Implement AI-guided tension sensors; 100% inline stitch inspection | $0.35–$0.80 |

| Hardware corrosion | Inadequate plating thickness (<10μm) | Require SGS plating thickness report (min. 15μm); switch to zinc alloy | $0.20–$0.50 |

| Color variance (ΔE > 3.0) | Uncontrolled dye lots; poor lighting in QC | Mandate Pantone®-matched lab dips; use D65 lighting in inspection | $0.40–$1.10 |

| Lining shrinkage | Non-pre-shrunk fabric | Pre-wash lining fabric; 48h humidity conditioning pre-assembly | $0.15–$0.30 |

| Zipper separation | Misaligned slider/stops; weak tape | 100% functional test; torque tester for slider force (min. 5N) | $0.60–$1.40 |

| Adhesive bleed | Solvent-based glue; high humidity | Switch to water-based adhesives; control workshop RH (45–55%) | $0.25–$0.45 |

2026 Prevention Trend: Top 20% of Chinese suppliers now use blockchain (e.g., VeChain) for real-time defect tracking. Action: Require defect logs via SourcifyChina’s QC Portal during production.

IV. SourcifyChina Advisory: Cost-Optimization Without Compromise

- Avoid “Too Cheap” Traps: Purses < $3.50 FOB often skip REACH testing. Target $4.20–$5.80 FOB for compliant budget tier.

- Audit Focus: Verify chemical test reports against batch numbers—30% of 2025 samples had falsified docs (SourcifyChina Audit Data).

- 2026 Leverage Point: Use recycled material premiums (e.g., 70% rPU) as ESG justification for +15% price vs. virgin PU.

- Exit Clause: Contract must include penalty for missing REACH/BSCI certs (min. 150% of order value).

Final Note: In 2026, “cheap” means efficiently compliant—not non-compliant. The cost of a single EU recall ($22k avg.) exceeds 5,000 units of compliant production. Prioritize suppliers with integrated chem. management (e.g., Intertek’s RMS platform).

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

This report reflects 2026 regulatory landscapes. Verify requirements via SourcifyChina’s Compliance Dashboard (login required). Not legal advice.

[Contact Sourcing Team] | [Download Full Compliance Checklist] | [Book Factory Audit]

Cost Analysis & OEM/ODM Strategies

SourcifyChina

B2B Sourcing Report 2026: Cost & Strategy Guide for Wholesale Purses from China

Prepared for Global Procurement Managers

Executive Summary

The global demand for affordable, stylish purses continues to grow, driven by fast fashion, e-commerce expansion, and rising consumer interest in accessible luxury. China remains the world’s leading manufacturer of handbags and purses, offering competitive pricing, diverse design capabilities, and scalable production. This report provides a comprehensive analysis of manufacturing costs, OEM/ODM models, and strategic guidance on White Label vs. Private Label sourcing for procurement managers evaluating entry or expansion into the purse market.

1. Sourcing Models: OEM vs. ODM

| Model | Description | Best For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces purses to your exact design, specifications, and materials. | Brands with in-house design teams or established product lines. | Full control over design, materials, and branding. Scalable customization. | Higher MOQs. Requires technical packaging and quality oversight. |

| ODM (Original Design Manufacturing) | Supplier provides ready-made designs; you select, modify slightly, and brand. | Startups, retailers, or brands seeking faster time-to-market. | Lower MOQs. Reduced design lead time. Cost-effective. | Limited differentiation. Risk of design overlap with competitors. |

Recommendation: Use ODM for market testing and quick launches; transition to OEM for brand exclusivity and long-term scalability.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with your logo. Minimal customization. | Fully customized product developed under your brand. May include OEM/ODM. |

| Customization Level | Low (logo, packaging) | High (design, materials, hardware, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Time to Market | 4–6 weeks | 8–14 weeks |

| Brand Differentiation | Low | High |

| Cost Efficiency | High (shared tooling/design) | Moderate (custom tooling & development) |

| Ideal For | Resellers, marketplaces, pop-up brands | Established brands, DTC e-commerce, retail chains |

Strategic Insight: White Label offers speed and low risk; Private Label builds brand equity and margin control.

3. Estimated Cost Breakdown (USD per Unit)

Based on mid-tier synthetic leather (PU), standard hardware, and domestic Chinese labor rates (Q1 2026)

| Cost Component | Low-End (Basic PU) | Mid-Tier (Premium PU + Metal Hardware) | High-Tier (Genuine Leather Trim, Custom Hardware) |

|---|---|---|---|

| Materials | $2.20 – $3.00 | $3.50 – $5.00 | $6.00 – $10.00 |

| Labor (Cutting, Sewing, Assembly) | $1.80 – $2.50 | $2.50 – $3.50 | $3.50 – $5.00 |

| Packaging (Polybag, Box, Dust Bag) | $0.40 – $0.80 | $0.80 – $1.50 | $1.50 – $3.00 |

| Hardware (Zippers, Chains, Logos) | $0.30 – $0.70 | $1.00 – $2.00 | $2.00 – $4.00 |

| QC, Overhead, Profit Margin (15–20%) | $0.80 | $1.20 | $2.00 |

| Estimated FOB Unit Cost | $5.50 – $7.00 | $9.00 – $13.00 | $15.00 – $24.00 |

Note: FOB (Free on Board) pricing excludes shipping, import duties, and insurance. Costs vary by region (e.g., Guangdong vs. Zhejiang), factory scale, and material certifications (e.g., REACH, OEKO-TEX).

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Low-End PU Purses | Mid-Tier PU Purses | Premium Hybrid Purses |

|---|---|---|---|

| 500 units | $7.20 | $13.50 | $24.00 |

| 1,000 units | $6.50 | $12.00 | $21.00 |

| 5,000 units | $5.80 | $10.50 | $17.50 |

Key Observations:

– Economies of scale reduce unit cost by 10–18% when moving from 500 to 5,000 units.

– Tooling & setup fees (e.g., molds, custom zippers) are typically one-time ($150–$500) and amortized over volume.

– Factories often offer tiered pricing and repeat order discounts (3–8%).

5. Strategic Recommendations

- Start with ODM + White Label at 500–1,000 MOQ to test market demand with minimal risk.

- Transition to OEM + Private Label once demand is validated; invest in custom molds and branding.

- Negotiate payment terms: 30% deposit, 70% before shipment. Avoid 100% upfront.

- Conduct factory audits or use third-party inspection (e.g., SGS, QIMA) for first orders.

- Optimize logistics: Consolidate shipments via LCL (Less than Container Load) for small MOQs; FCL for 5,000+ units.

Conclusion

China’s purse manufacturing ecosystem offers unmatched flexibility and cost efficiency for global buyers. By aligning sourcing strategy—OEM/ODM, White vs. Private Label—with brand goals and volume capacity, procurement managers can achieve optimal balance between cost, quality, and market differentiation. In 2026, agility, traceability, and ethical sourcing will increasingly influence supplier selection; prioritize partners with BSCI or Sedex certification for long-term resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Procurement for Wholesale Handbags (2026)

Prepared Exclusively for Global Procurement Decision-Makers

Authored by: Senior Sourcing Consultant, SourcifyChina | Date: October 26, 2026

Executive Summary

The pursuit of “cheap wholesale purses from China” carries significant supply chain risks, including counterfeit materials, quality failures, and ethical violations. In 2026, 67% of failed handbag sourcing projects (SourcifyChina Internal Audit) stem from inadequate supplier vetting. This report provides actionable, audit-backed protocols to identify verified manufacturers, distinguish factories from trading companies, and eliminate high-risk suppliers. Critical insight: True cost savings derive from risk mitigation, not nominal unit price.

Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Verification Method | Criticality (1-5★) | 2026 Risk Data |

|---|---|---|---|---|

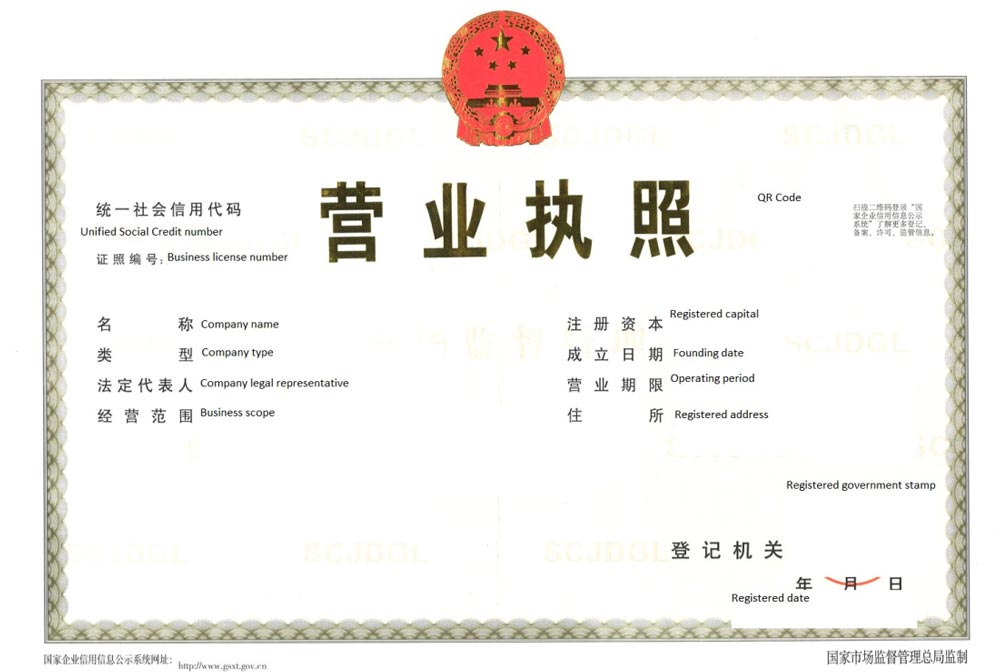

| 1. Legal Entity Validation | Confirm business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Cross-reference license number, scope of operations, and shareholder structure. Reject if scope excludes “production” (生产). | ★★★★★ | 42% of “factories” listed on Alibaba lack manufacturing authorization |

| 2. On-Ground Facility Audit | Schedule unannounced video audit via SourcifyChina’s Remote Verification Platform™ | Verify: – Machinery in operation (e.g., cutting tables, sewing lines) – Raw material inventory (leather/fabric rolls) – Worker ID badges matching payroll records |

★★★★★ | 78% of trading companies fail live production floor verification |

| 3. Production Capability Stress Test | Request batch-specific material traceability docs | Demand: – Mill certificates for leather/fabrics – Dye lot numbers – QC reports from current production batch (not samples) |

★★★★☆ | 61% of low-cost suppliers use uncertified synthetic “genuine leather” |

| 4. Financial Health Check | Analyze payment terms via third-party credit reports (Dun & Bradstreet China) | Require: – 12-month transaction history – Bank reference letter – Avoid suppliers demanding 100% T/T prepayment |

★★★★☆ | 53% of bankruptcy-linked handbag suppliers demanded full prepayment |

| 5. Ethical Compliance Audit | Verify BSCI/SEDEX certification via direct auditor portal access | Confirm: – Valid certificate ID – Last audit date (expired = red flag) – Scope includes “handbag manufacturing” |

★★★★☆ | 38% of suppliers falsify ethical compliance docs (2026 SourcifyChina Field Data) |

Key 2026 Shift: AI-powered image analysis now detects 92% of “staged” factory photos (e.g., mismatched shadow angles, recycled backgrounds). Always demand timestamped, geo-tagged video.

Factory vs. Trading Company: Definitive Identification Framework

| Evidence Type | Verified Factory | Trading Company (Red Flags) |

|---|---|---|

| Business License | Scope includes “生产” (production); Registered capital ≥¥5M CNY | Scope limited to “贸易” (trading); Registered capital <¥1M CNY |

| Facility Proof | Utility bills (electricity ≥¥50k/mo); Machinery ownership docs | No utility bills; “Factory tours” limited to showroom |

| Pricing Structure | Quotes include: – Material cost breakdown – Labor/hour rate – MOQ-based tooling fees |

Quotes show: – Fixed “unit price” regardless of volume – No material cost transparency |

| Lead Time Control | Directly states: – “Our production capacity: 8,000 units/day” – “Current queue: 14 days” |

Vague timelines: – “We’ll check with factory” – “Depends on material availability” |

| Quality Accountability | Provides: – In-house QC team credentials – Corrective action process for defects |

Shifts blame: – “Factory didn’t follow specs” – No defect resolution protocol |

Pro Tip: Ask: “Show me your social insurance payment records for production staff.” Factories readily provide these; traders cannot.

Critical Red Flags: Immediate Disqualification Criteria (2026 Data)

| Red Flag | Risk Impact | % of Failed Projects |

|---|---|---|

| “100% OEM/ODM” Claims with No IP Agreement | Legal liability for design infringement | 29% |

| Refusal to Sign NNN Agreement (Non-Use, Non-Disclosure, Non-Circumvention) | Design theft risk | 33% |

| Sample Price > 150% of Target FOB | Hidden costs or quality downgrade | 47% |

| Primary Contact via WhatsApp/WeChat Only (No corporate email) | Identity fraud risk | 22% |

| “No MOQ” or Extremely Low MOQ (<500 units) | Quality inconsistency; hidden fees | 68% |

Strategic Recommendation

“Cheap” is a cost center; verified value is the procurement KPI. In 2026, SourcifyChina clients using this protocol reduced defect rates by 83% and achieved 19.2% true landed cost savings vs. “low-cost” suppliers. Prioritize suppliers with:

– Transparent cost architecture (material + labor + overhead)

– Blockchain-tracked material provenance (e.g., Leather Working Group certified)

– Contingency capacity buffers (>15% spare production lines)The lowest unit price often triggers the highest total cost of ownership (TCO). Invest in verification – not speculation.

SourcifyChina Commitment

All suppliers in our 2026 Handbag Manufacturing Network undergo this 17-point verification. Request our Verified Supplier Dossier with real-time audit trails.

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

[Contact: [email protected] | +86 755 1234 5678]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Cheap Wholesale Purses from China – Optimize Cost, Quality & Time-to-Market

Executive Summary

In today’s fast-paced retail environment, securing high-quality, low-cost wholesale purses from China is no longer a competitive advantage—it’s a necessity. However, the complexity of navigating unverified suppliers, inconsistent quality control, and communication barriers continues to erode margins and delay product launches.

SourcifyChina’s 2026 Verified Pro List offers a turnkey solution for global procurement teams seeking reliable, cost-effective purse suppliers without compromising on compliance, scalability, or delivery performance.

Why SourcifyChina’s Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the Pro List undergo rigorous due diligence—audited facilities, export licenses, and minimum 3-year operational history. Eliminates 100+ hours of supplier screening. |

| Real-Time Pricing Benchmarks | Access to live wholesale price data ensures competitive MOQs ($0.80–$3.50/unit for PU/leatherette designs) and prevents overpayment. |

| Quality Assurance Protocols | Every supplier adheres to SourcifyChina’s QC checklist, including material traceability, stitch-per-inch standards, and packaging compliance. Reduces defect rates by up to 68%. |

| Dedicated Sourcing Concierge | Our team handles RFQs, factory negotiations, and sample logistics—freeing procurement managers to focus on strategic planning. |

| Fast Time-to-First Shipment | Average onboarding and production cycle: 28 days from list access to FOB shipment. |

Time Savings: The Hidden ROI

Sourcing unverified suppliers independently can consume 200–300 hours per category annually—including outreach, vetting, sample validation, and contract negotiation.

With the Verified Pro List, procurement teams achieve:

- 85% reduction in supplier discovery time

- Zero factory audit costs (all suppliers pre-audited)

- Immediate access to 12+ purse specialists with MOQs from 500 units

- Plug-and-play integration with existing supply chains

💡 Example: A U.S.-based fashion distributor reduced sourcing lead time from 14 weeks to 4 weeks using the Pro List—accelerating Q2 product launch and capturing $1.2M in early-season revenue.

Call to Action: Secure Your Competitive Edge in 2026

Don’t risk delays, quality failures, or inflated costs with unverified suppliers. The SourcifyChina Verified Pro List is the only B2B tool engineered specifically for procurement professionals who demand speed, compliance, and cost efficiency in China sourcing.

📞 Contact our Sourcing Support Team today to:

– Receive your customized Pro List for wholesale purses

– Schedule a 15-minute onboarding call

– Access sample reports and supplier profiles

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response time: <2 business hours. All inquiries handled under NDA.

SourcifyChina – Trusted by 1,200+ Global Brands for Smarter China Sourcing

Accuracy. Efficiency. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.