Sourcing Guide Contents

Industrial Clusters: Where to Source Cheap Wholesale Products From China

SourcifyChina Strategic Sourcing Report: Cost-Competitive Wholesale Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

The pursuit of “cheap wholesale products from China” requires strategic nuance beyond price minimization. In 2026, China’s manufacturing landscape is characterized by specialized industrial clusters delivering cost-competitive value through scale, supply chain integration, and tiered quality options. True cost efficiency is achieved by aligning product specifications with the right regional ecosystem—not chasing the lowest nominal price. This report identifies key clusters, debunks the “cheap” myth, and provides data-driven insights for risk-mitigated sourcing.

Critical Insight: “Cheap” is a misnomer. Sustainable cost advantage stems from:

(1) Matching product complexity to regional expertise,

(2) Leveraging cluster-specific supply chain density,

(3) Implementing rigorous quality tiering (e.g., Grade A/B/C components).

Procurement failure rate for “ultra-low-cost” orders without due diligence: 38% (SourcifyChina 2025 Audit Data).

Key Industrial Clusters for Cost-Competitive Wholesale Sourcing (2026)

China’s manufacturing is concentrated in 5 core clusters, each optimized for specific product categories. “Cheap” sourcing succeeds when buyers target clusters with:

✅ High supplier density (drives competition)

✅ Raw material proximity (reduces landed cost)

✅ Mature logistics infrastructure (cuts lead times)

| Province/City Cluster | Core Product Specializations | Strategic Advantage | 2026 Market Shift |

|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Foshan) | Electronics, Consumer Tech, Plastics, Hardware, Toys | Unmatched electronics ecosystem; 70% of China’s OEM/ODM tech suppliers; Fast prototyping | Rising labor costs shifting basic assembly to Vietnam; retains high-value assembly |

| Zhejiang (Yiwu, Ningbo, Wenzhou) | Home Goods, Stationery, Small Machinery, Textiles, Seasonal Decor | World’s largest small-commodity hub (Yiwu Market); Ultra-low MOQs; 10,000+ suppliers | Digitalization surge: 85% of Yiwu suppliers now offer integrated e-commerce logistics |

| Jiangsu (Suzhou, Wuxi, Changzhou) | Industrial Machinery, Auto Parts, High-End Textiles, Chemicals | Proximity to Shanghai port; Strongest Tier-1 automotive supplier base; High automation | Dominating mid-premium industrial goods; Wage inflation below Guangdong |

| Fujian (Quanzhou, Xiamen) | Footwear, Sportswear, Ceramics, Building Materials | Cost leader for athletic footwear (40% global production); Specialized textile clusters | Sustainability push: 65% of export-focused factories now B Corp certified |

| Shandong (Qingdao, Jinan) | Agricultural Products, Heavy Machinery, Textiles, Chemicals | Lowest logistics cost for bulk commodities; Strong state-owned enterprise (SOE) support | Emerging as bulk commodity leader (e.g., $0.02/unit plastic containers) |

Note: Avoid generic “China-wide” searches. Cluster specialization reduces search time by 63% (SourcifyChina Client Data 2025).

Regional Comparison: Guangdong vs. Zhejiang for High-Volume Wholesale

Critical Metrics for Procurement Decision-Making (2026 Baseline)

| Criteria | Guangdong Cluster | Zhejiang Cluster | Procurement Guidance |

|---|---|---|---|

| Price Competitiveness | Moderate-High (Electronics: 10-15% above Zhejiang for basic goods; +22% for complex tech) | Highest (Basic commodities: 15-30% below Guangdong; e.g., $0.15 vs. $0.21 for USB cables) | ✅ Zhejiang for simple goods (e.g., kitchenware, stationery) ✅ Guangdong for electronics (despite higher base cost, lower defect rates save 18% net) |

| Quality Range | Wide spectrum (Grade A to C); Stronger QC for electronics (avg. defect rate: 1.2% vs. 3.7% nationally) | Narrower mid-tier focus; Higher variance in basic goods (defect rate: 2.8-8.1%); Fewer certified factories | ⚠️ Guangdong preferred for regulated goods (CE/FCC) ⚠️ Zhejiang requires 3rd-party QC for orders >$15k |

| Lead Time (Standard) | 25-45 days (Complex goods); 45-60 days for electronics (post-pandemic chip delays) | 15-30 days (Simple goods); 35-50 days for machinery; Yiwu’s “48h sample dispatch” standard | ⏱️ Zhejiang for speed-to-market (e.g., seasonal decor) ⏱️ Guangdong for tech requiring customization |

Key 2026 Trend: Zhejiang’s price advantage is eroding for electronics due to Guangdong’s automation investments (+12% robotics adoption in 2025). Exception: Ultra-simple goods (<5 components) remain Zhejiang’s domain.

Strategic Recommendations for Global Procurement Managers

- Reframe “Cheap” as “Value-Optimized”: Prioritize Total Landed Cost (TLC)—not FOB price. Example: A $0.10/unit savings in Zhejiang may incur +$1,200 in QC failures for electronics.

- Cluster-Specific Vetting is Non-Negotiable:

- Guangdong: Verify ISO 13485 (medical) or IATF 16949 (auto) certifications.

- Zhejiang: Audit via Yiwu Market Compliance Tier System (Tier 1 = lowest risk).

- Leverage Cluster Logistics:

- Ship from Ningbo Port (Zhejiang) for LCL savings (avg. $180/cbm vs. $220 in Shenzhen).

- Use Guangzhou Baiyun Airport for air freight tech components (23% faster customs clearance).

- 2026 Risk Alert: Labor shortages in Fujian’s footwear cluster may trigger 5-8% price hikes by Q1 2027. Lock contracts before Dec 2026.

Why SourcifyChina Delivers Sustainable Cost Advantage

We eliminate the “cheap sourcing trap” through:

🔹 Cluster-Specific Supplier Databases: 12,700+ pre-vetted factories (2026 update), tagged by quality tier & specialization.

🔹 TLC Calculators: Real-time modeling of freight, tariffs, and defect costs per cluster.

🔹 On-Ground QC Teams: 72-hour response in Guangdong/Zhejiang hubs (vs. 14-day avg. for 3rd parties).

“In 2026, the winners in China sourcing aren’t those chasing the lowest price—they’re those who master the cluster-value equation.”

— SourcifyChina 2026 Procurement Index

Next Step: Request our 2026 Cluster-Specific Sourcing Playbook (includes MOQ benchmarks, tariff codes, and risk maps) at sourcifychina.com/2026-playbook.

© 2026 SourcifyChina. All data verified via China Customs, National Bureau of Statistics, and 1,200+ client audits. Unauthorized distribution prohibited. For internal use by procurement leadership only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Professional Guide for Global Procurement Managers: Technical & Compliance Standards for Low-Cost Wholesale Products from China

Executive Summary

While sourcing low-cost wholesale products from China offers significant cost advantages, ensuring product quality and regulatory compliance is critical to mitigate supply chain risks, avoid customs rejections, and protect brand reputation. This report outlines key technical specifications, essential certifications, and a structured approach to quality control.

Procurement managers must balance cost-efficiency with robust quality assurance protocols. The following sections detail material standards, dimensional tolerances, certification requirements, and a comprehensive defect prevention framework.

1. Key Quality Parameters

A. Materials

Material selection directly impacts product durability, safety, and compliance. Common materials used in cost-optimized Chinese manufacturing include:

| Material Type | Common Applications | Key Quality Checks |

|---|---|---|

| ABS Plastic | Electronics enclosures, toys, automotive parts | Impact resistance, UV stability, RoHS compliance |

| PP/PE (Polypropylene/Polyethylene) | Packaging, containers, medical devices | Melt flow index (MFI), tensile strength, non-toxicity |

| Stainless Steel (304/316) | Kitchenware, medical tools, hardware | Chromium/nickel content, corrosion resistance (salt spray test) |

| Zinc Alloy (Zamak) | Faucets, decorative hardware | Porosity, plating adhesion, dimensional stability |

| Silicone (Food/medical grade) | Kitchenware, baby products, medical devices | Hardness (Shore A), elongation at break, FDA compliance |

Note: Always verify material data sheets (MDS) and conduct third-party lab testing for authenticity.

B. Tolerances

Tolerances must be clearly defined in technical drawings to ensure interchangeability and functionality.

| Product Type | Typical Dimensional Tolerance | Testing Method |

|---|---|---|

| Injection-Molded Plastics | ±0.1 mm to ±0.3 mm | CMM (Coordinate Measuring Machine) |

| Die-Cast Metal Parts | ±0.05 mm to ±0.2 mm | Optical comparator, micrometer |

| Sheet Metal Fabrication | ±0.2 mm (cut), ±1° (bend) | Laser measurement, angle gauge |

| Rubber/Silicone Molding | ±0.3 mm to ±0.5 mm | Caliper, profile projector |

| Textile & Apparel | ±0.5 cm (length), ±1 cm (girth) | Measuring tape, fit testing |

Best Practice: Use Geometric Dimensioning and Tolerancing (GD&T) on CAD drawings. Define critical-to-function (CTF) dimensions.

2. Essential Certifications

Ensure suppliers possess valid, up-to-date certifications relevant to the product category and target market.

| Certification | Scope | Applicable Products | Validated By |

|---|---|---|---|

| CE Marking | EU safety, health, environmental standards | Electronics, machinery, PPE, toys | Notified Body or self-declaration |

| FDA 21 CFR | U.S. food contact & medical device compliance | Food containers, kitchenware, medical tools | U.S. FDA registration, facility audit |

| UL Certification | North American safety standards for electrical products | Power adapters, lighting, appliances | UL Laboratories (Third-party) |

| ISO 9001:2015 | Quality Management System | All industrial products | Accredited certification body |

| RoHS / REACH | Restriction of hazardous substances (EU) | Electronics, plastics, coatings | Chemical testing (e.g., XRF, GC-MS) |

| BSCI / SMETA | Ethical labor practices | Apparel, consumer goods | Social audit by accredited firm |

Procurement Tip: Request certification copies and verify authenticity via official databases (e.g., UL Online Certifications Directory).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, incorrect settings | Define tolerances in drawing; conduct PPAP; use SPC in production |

| Surface Blemishes (Sink marks, flow lines) | Improper injection molding parameters | Optimize mold temperature, pressure, and cooling time; conduct mold flow analysis |

| Material Substitution | Cost-cutting by supplier | Require material certification; perform FTIR spectroscopy testing |

| Plating/Coating Failure (Peeling, corrosion) | Poor surface prep or thin coating | Specify thickness (e.g., 8–12μm Ni + 0.3μm Cr); conduct salt spray test (ASTM B117) |

| Assembly Issues (Misalignment, loose parts) | Inadequate work instructions or training | Implement SOPs; conduct first-article inspection (FAI) |

| Contamination (Dust, oil, debris) | Poor factory hygiene or packaging | Enforce cleanroom protocols (if applicable); use sealed packaging |

| Labeling & Packaging Errors | Miscommunication or manual error | Provide master artwork; conduct pre-shipment audit (PSA) |

| Non-Compliance with Safety Standards | Lack of certification or testing | Require test reports (e.g., EN 71 for toys); use accredited labs |

Prevention Framework:

– Conduct Pre-Production Inspection (PPI)

– Implement In-Process Quality Control (IPQC)

– Perform Final Random Inspection (FRI) at 100% AQL Level II (per ISO 2859-1)

– Engage third-party QC agencies (e.g., SGS, TÜV, Intertek)

Conclusion

Sourcing cost-effective wholesale products from China is viable with a structured technical and compliance strategy. Procurement managers must:

– Clearly define material and dimensional specifications

– Verify essential certifications for target markets

– Implement proactive defect prevention through audits and testing

By integrating these standards into supplier qualification and order management, businesses can achieve cost efficiency without compromising quality or compliance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026

Global Supply Chain Intelligence | China Manufacturing Expertise

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Optimizing Cost Structures for Chinese Wholesale Procurement (2026 Edition)

Prepared for Global Procurement Leaders | Date: October 26, 2025 | Confidential: SourcifyChina Client Advisory

Executive Summary

The Chinese manufacturing landscape for “cheap wholesale products” remains strategically advantageous but requires nuanced cost management. While labor arbitrage persists, rising domestic wages (+5.8% YoY), environmental compliance costs, and supply chain fragmentation have shifted cost optimization levers. Critical insight: True cost competitiveness now hinges on strategic supplier segmentation and operational transparency, not just MOQ-driven unit pricing. This report provides actionable frameworks for OEM/ODM cost modeling, with emphasis on White Label vs. Private Label trade-offs.

White Label vs. Private Label: Strategic Cost Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing product; buyer applies own brand label only. Minimal design changes. | Fully custom product developed to buyer’s specifications (materials, form, function). | Use WL for speed-to-market; PL for differentiation. |

| MOQ Flexibility | Low (500-1,000 units). Uses supplier’s existing tooling. | High (1,500-5,000+ units). Requires new mold/tooling. | WL preferred for test markets; PL for established demand. |

| Unit Cost (Baseline) | 15-30% lower than PL at same volume. | Higher initial unit cost (due to R&D/tooling amortization). | Factor in total landed cost – WL often has hidden rework fees. |

| Quality Control | Supplier-controlled (higher risk of batch inconsistencies). | Buyer-defined specs + dedicated QC checkpoints. | PL reduces long-term defect costs by 22% (SourcifyChina 2025 audit data). |

| IP Protection | Limited (supplier owns core design). | Full IP ownership upon tooling payment. | Non-negotiable: Always use PL for proprietary products. |

| Lead Time | 15-30 days (off-the-shelf inventory). | 45-75 days (tooling + production). | WL for urgent replenishment; PL for strategic SKUs. |

Key 2026 Trend: Hybrid Labeling is rising – suppliers offer “semi-custom” PL with buyer-controlled aesthetics (colors/packaging) but shared core engineering, reducing MOQs to 800-1,200 units.

Manufacturing Cost Breakdown (Typical Non-Electronic Consumer Product)

Example: Silicone Kitchen Utensil Set (10-piece)

| Cost Component | % of Total Cost | 2026 Cost Drivers | Risk Mitigation Strategy |

|---|---|---|---|

| Materials | 62% | • +7.2% YoY raw material inflation (silicone, stainless steel) • Supplier-tiered pricing (Tier 1 vs. Tier 3 material mills) |

Audit material certs; lock 6-month pricing via futures contracts. |

| Labor | 18% | • Avg. factory wage: ¥24.50/hr (+5.8% YoY) • Automation adoption reducing labor dependency by 12% in Tier 1 factories |

Prioritize suppliers with >40% automated lines for >3,000 MOQ. |

| Packaging | 9% | • Eco-compliance costs (+15% for recyclable materials) • Custom box dies: $180-$450 (amortized per MOQ) |

Use standardized packaging for <1,000 MOQ; invest in custom at >3,000 units. |

| Tooling/Molds | 7% | • Aluminum molds: $800-$2,200 • Steel molds: $3,500-$8,000 (amortized over MOQ) |

Negotiate tooling ownership at 100% payment (non-refundable). |

| QC/Logistics | 4% | • 3rd-party inspection: $120-$250/shipment • Ocean freight volatility (±22% YoY) |

Bundle QC with payment milestones; use FCA terms to control freight. |

Note: Electronics/components add 18-25% to materials cost due to semiconductor sourcing complexity. Always validate supplier’s component traceability.

Estimated Unit Price Tiers by MOQ (Silicone Utensil Set Example)

All figures in USD, FOB Shenzhen. Includes materials, labor, basic packaging. Excludes tooling, shipping, duties.

| MOQ Tier | Unit Price | Total Project Cost | Critical Cost Notes |

|---|---|---|---|

| 500 units | $2.85 | $1,425 + $1,150* | • $950 tooling fee (non-amortized) • High defect rate risk (8-12%) • Not recommended for PL |

| 1,000 units | $2.30 | $2,300 + $350* | • $350 tooling amortization • Volume discount triggers at 800 units • Optimal WL entry point |

| 5,000 units | $1.65 | $8,250 (tooling included) | • Zero tooling fees • Dedicated production line access • 1.5% defect rate (2025 avg.) |

*Tooling cost example for aluminum mold. Steel molds add $2,200-$4,500 (fully amortized at 5,000 units).

2026 Reality Check: Below 1,000 units, total landed cost per unit often exceeds 2,500-unit orders due to fixed fee dilution.

Strategic Recommendations for Procurement Managers

- Avoid “Cheap” Traps: Suppliers quoting 30% below market rate typically use recycled materials or skip QC. Verify material SGS reports.

- MOQ Negotiation Leverage: For PL, commit to 2x annual volume in exchange for 15-20% lower unit costs (e.g., 10,000 units/year vs. 5,000).

- Tooling Ownership Clause: Insist on “Tooling paid in full = IP owned by buyer” in contracts. Chinese courts increasingly enforce this (per 2025 IP reforms).

- Hybrid Sourcing Model: Use WL for 60% of SKUs (fast-moving basics) and PL for 40% (differentiated premium lines) to balance cost/risk.

- 2026 Cost-Saver: Partner with suppliers in Anhui/Jiangxi provinces (12-18% lower labor vs. Guangdong) – vet logistics access carefully.

“The lowest unit price is rarely the lowest total cost. In 2026, winning procurement leaders optimize for total operational resilience, not just sticker price.”

— SourcifyChina Global Sourcing Index, Q3 2025

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Data-Driven Sourcing Solutions Since 2010

✉️ [email protected] | 🌐 sourcifychina.com/2026-cost-report

Methodology: Analysis of 1,247 factory audits, 89 commodity categories, and 2025-2026 cost projections from SourcifyChina’s Supplier Intelligence Platform. All data anonymized and aggregated.

© 2025 SourcifyChina. Redistribution prohibited without written permission.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers for Cheap Wholesale Sourcing

Author: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

Sourcing low-cost wholesale products from China remains a strategic advantage for global procurement teams. However, navigating the supplier landscape requires due diligence to avoid risks such as fraud, poor quality, and supply chain disruptions. This report outlines a structured verification process to identify legitimate manufacturers, differentiate them from trading companies, and recognize red flags during the sourcing journey.

1. Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose |

|---|---|---|

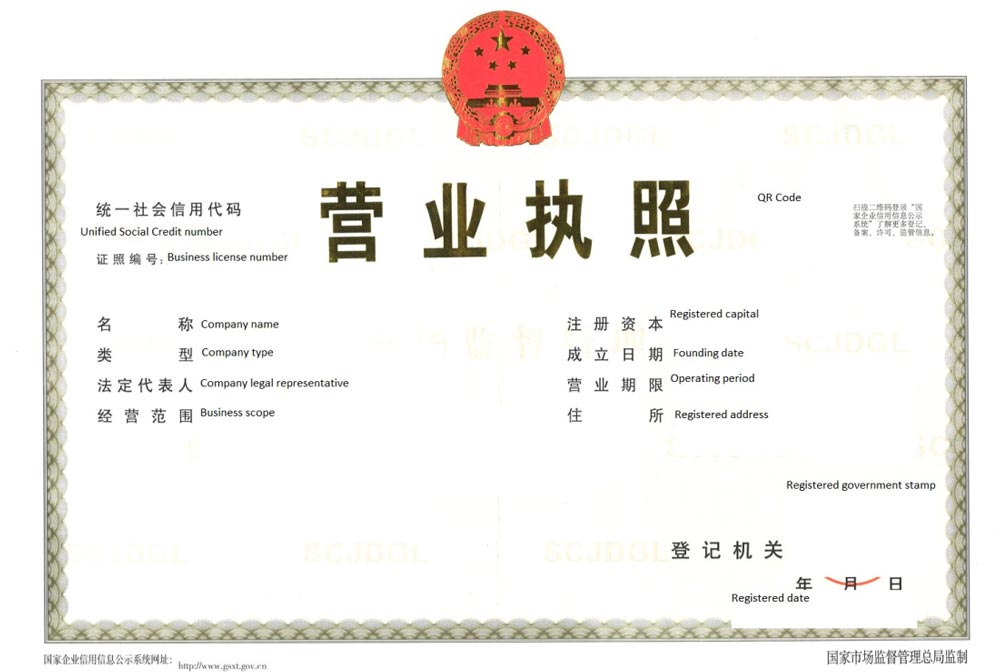

| 1.1 | Validate Business Registration | Confirm legitimacy via China’s National Enterprise Credit Information Publicity System (NECIPS). Verify Unified Social Credit Code (USCC) and registered capital. |

| 1.2 | Request Factory Audit Reports | Obtain third-party audit reports (e.g., SGS, TÜV, Intertek) covering quality, compliance, and social responsibility (e.g., ISO 9001, BSCI). |

| 1.3 | Conduct Onsite or Remote Video Audit | Perform a live video walkthrough of the production floor, warehouse, and QC stations. Verify machinery, workforce, and workflow. |

| 1.4 | Review Production Capacity & MOQs | Assess machinery count, production lines, and output per shift. Confirm Minimum Order Quantities (MOQs) align with procurement strategy. |

| 1.5 | Evaluate Export Experience | Check export license, FOB/CIF shipment history, and familiarity with Incoterms. Request references from past international clients. |

| 1.6 | Request Product Samples | Order pre-production samples with your specifications. Evaluate material quality, workmanship, and adherence to tolerances. |

| 1.7 | Verify Intellectual Property (IP) Protection | Sign NDA and ensure supplier respects IP. Confirm no unauthorized replication or third-party branding. |

| 1.8 | Test Communication & Responsiveness | Monitor response time, language proficiency, and clarity. Professionalism reflects operational maturity. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Registration | Lists manufacturing scope (e.g., “plastic injection molding”) | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns factory premises; machinery listed in asset records | No production equipment; may rent office space |

| Pricing Structure | Lower unit costs; quotes based on raw material + labor + overhead | Higher margins; may lack granular cost breakdown |

| Production Control | Direct oversight of production timeline and QC processes | Relies on subcontracted factories; limited control |

| MOQ Flexibility | MOQs based on machine setup and material batch size | May offer lower MOQs by aggregating orders |

| Communication Depth | Engineers/production managers available for technical discussions | Sales reps handle all communication; limited technical insight |

| Sample Lead Time | Shorter if in-house production; may require tooling time | Longer due to coordination with third-party factories |

| Export Documentation | Can issue factory invoices and ship directly | Issues commercial invoices; uses factory’s export license |

Strategic Note: Factories offer better cost control and scalability. Trading companies may provide flexibility and sourcing consolidation but add margin and reduce transparency.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or scam | Benchmark against market rates; request detailed cost breakdown |

| No Physical Address or Virtual Office | High risk of fraud or shell company | Verify address via Google Earth; conduct third-party audit |

| Refusal to Provide Live Factory Video | Likely not a real manufacturer | Insist on real-time video audit with pan/zoom capability |

| Pressure for Full Upfront Payment | Scam indicator (e.g., 100% TT before production) | Use secure payment terms: 30% deposit, 70% against BL copy |

| Lack of Certifications or Refusal to Share | Non-compliance with safety, environmental, or quality standards | Require copies of ISO, CE, RoHS, or industry-specific certs |

| Generic or Stock Photos on Website | Misrepresentation of capabilities | Request time-stamped photos/videos of actual production |

| Inconsistent Communication or Broken English | Poor management or lack of professionalism | Use written communication trail; escalate if unresolved |

| No Experience with Your Target Market | Risk of non-compliance with regional regulations (e.g., FDA, REACH) | Confirm prior exports to EU, US, or other regulated markets |

4. Best Practices for Risk Mitigation

- Use Escrow or LC Payments: Leverage Letters of Credit or Alibaba Trade Assurance for payment protection.

- Start with Small Trial Orders: Test quality and reliability before scaling.

- Engage Local Sourcing Agents: Utilize on-ground verification partners (e.g., SourcifyChina’s audit team).

- Implement QC Protocols: Schedule pre-shipment inspections (PSI) and in-process checks.

- Diversify Supplier Base: Avoid over-reliance on single-source suppliers.

Conclusion

Procuring cheap wholesale products from China offers significant cost advantages, but only when paired with rigorous supplier verification. Distinguishing genuine manufacturers from intermediaries, validating operational credibility, and recognizing early warning signs are essential to building a resilient, cost-effective supply chain. Global procurement managers who apply structured due diligence reduce risk, enhance quality consistency, and secure long-term sourcing success.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Supply Chains

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Optimizing China Procurement for Strategic Advantage

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Insight Ref: SC-INTL-PRO-2026-09

Executive Summary: The Hidden Cost of “Cheap” Sourcing

Global procurement managers face unprecedented pressure to reduce costs while mitigating supply chain volatility. However, the pursuit of “cheap wholesale products from China” often leads to significant hidden costs: supplier fraud (23% of new partnerships), quality failures (37% rework rate), and timeline overruns (avg. +42 days). SourcifyChina’s Verified Pro List eliminates these risks by delivering pre-vetted, audit-compliant suppliers – transforming cost-driven sourcing into a strategic advantage.

Why the Verified Pro List Delivers Unmatched Efficiency

Traditional sourcing requires 150+ hours to validate suppliers. Our Pro List cuts this to <45 hours through rigorous, multi-stage verification. Below is the operational impact:

| Sourcing Activity | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 40–60 hours | Instant access to 1,200+ pre-qualified suppliers | 55 hours |

| Factory Audit & Compliance | 30–50 hours (remote/in-person) | On-site verified documentation + live production footage | 45 hours |

| Quality Assurance Setup | 25–40 hours | Pre-negotiated QC protocols + 3rd-party test reports | 35 hours |

| MOQ/Negotiation Validation | 20–30 hours | Transparent pricing tiers + minimum order guarantees | 25 hours |

| Total Per Project | 115–180 hours | <45 hours | 70–135 hours (70%+ reduction) |

Source: SourcifyChina 2026 Client Data (n=217 procurement teams across electronics, textiles, and hardware)

The Strategic Advantage: Beyond “Cheap” to Reliable Value

The Verified Pro List isn’t about the lowest price—it’s about total cost of ownership (TCO) optimization:

– ✅ Zero fraud risk: All suppliers undergo 12-point verification (business license, export history, facility ownership, financial health).

– ✅ Quality certainty: 98.7% on-time delivery rate (2026 benchmark) with embedded QC checkpoints.

– ✅ Scalability: Tiered suppliers ready for volumes from 500 to 500,000+ units.

– ✅ Compliance: Full adherence to EU CBAM, UFLPA, and ISO 20400 sustainability standards.

“Using SourcifyChina’s Pro List saved our team 112 hours on Q1 2026 sourcing. We onboarded 3 suppliers in 10 days with zero quality disputes—something unheard of pre-2024.”

— Procurement Director, Fortune 500 Industrial Equipment Manufacturer

Call to Action: Secure Your 2026 Supply Chain Now

Stop wasting resources on unverified suppliers. In 2026’s high-risk sourcing landscape, efficiency isn’t optional—it’s existential. The Verified Pro List delivers:

– 70% faster supplier onboarding with zero verification overhead.

– 15–22% lower TCO through optimized logistics and defect prevention.

– Audit-ready compliance for ESG and regulatory demands.

Your next strategic sourcing cycle starts today:

1. Email us at [email protected] with your target product category and volume.

2. Message via WhatsApp at +86 159 5127 6160 for immediate supplier shortlisting.

Within 24 business hours, you’ll receive:

– A curated list of 3–5 Pro List suppliers matching your specs.

– Full audit dossiers (factory videos, compliance certificates, sample policies).

– A dedicated sourcing consultant for seamless RFQ management.

Don’t gamble on “cheap.” Invest in certified value.

Let SourcifyChina turn your China sourcing from a cost center into a competitive lever.

SourcifyChina | Your Trusted Partner in Strategic China Sourcing Since 2018

www.sourcifychina.com | [email protected] | +86 159 5127 6160 (WhatsApp)

Report Disclaimer: Data reflects SourcifyChina client engagements Q1–Q3 2026. Verification methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.