Sourcing Guide Contents

Industrial Clusters: Where to Source Cheap Wholesale Items From China

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Low-Cost Wholesale Goods from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Subject: Industrial Clusters for Sourcing Cost-Effective Wholesale Items from China

Executive Summary

China remains the world’s leading manufacturing hub for low-cost, high-volume wholesale goods. Despite rising labor and logistics costs in certain regions, strategic sourcing from specialized industrial clusters continues to offer significant cost advantages for global buyers. This report identifies the key provinces and cities in China renowned for producing affordable wholesale items, evaluates regional strengths, and provides a comparative analysis to support informed procurement decisions.

The term “cheap wholesale items” refers to mass-produced consumer goods such as household products, small electronics, textiles, plasticware, stationery, and novelty items—typically ordered in bulk with a high price sensitivity. Success in sourcing these goods hinges on proximity to vertically integrated supply chains, access to raw materials, and economies of scale.

Key Industrial Clusters for Low-Cost Wholesale Goods

China’s manufacturing landscape is regionally specialized. The following provinces and cities are dominant in producing cost-competitive wholesale products:

1. Guangdong Province (Pearl River Delta)

- Key Cities: Guangzhou, Shenzhen, Dongguan, Foshan, Yiwu (satellite logistics)

- Specialization: Electronics, consumer gadgets, home appliances, plastics, lighting, textiles

- Strengths:

- Most developed supply chain ecosystem in China

- High concentration of OEM/ODM manufacturers

- Proximity to Hong Kong port for fast export

- Strong logistics and export infrastructure

2. Zhejiang Province

- Key Cities: Yiwu, Ningbo, Wenzhou, Hangzhou

- Specialization: General merchandise, small hardware, stationery, holiday decor, packaging, fast fashion accessories

- Strengths:

- Yiwu Market: world’s largest wholesale bazaar for small commodities

- Highly competitive pricing due to fragmented, high-volume production

- Agile small-to-medium enterprises (SMEs) with fast turnaround

3. Jiangsu Province

- Key Cities: Suzhou, Changzhou, Nanjing

- Specialization: Textiles, machinery components, packaging, home goods

- Strengths:

- High automation levels and better process control

- Proximity to Shanghai port and logistics networks

- Higher quality output than average, with moderate cost

4. Fujian Province

- Key Cities: Xiamen, Quanzhou, Fuzhou

- Specialization: Footwear, sportswear, ceramics, bags, and luggage

- Strengths:

- Long-standing expertise in footwear and apparel OEMs

- Cost-effective labor compared to Guangdong

- Growing export infrastructure

5. Anhui & Hunan (Emerging Clusters)

- Key Cities: Hefei, Changsha

- Specialization: Basic household goods, metalware, auto accessories

- Strengths:

- Lower labor and operational costs

- Government incentives for manufacturing relocation

- Increasingly reliable quality, though lead times may be longer

Comparative Analysis: Key Production Regions

| Region | Average Price Level | Quality Tier | Avg. Lead Time (Days) | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | Medium | High to Medium | 15–30 | Electronics, complex goods, fast-moving items | Higher MOQs, rising labor costs |

| Zhejiang | Lowest | Medium to Low | 20–35 | Small commodities, gift items, daily necessities | Inconsistent QC across SMEs |

| Jiangsu | Medium-Low | High | 18–30 | Precision goods, textiles, branded packaging | Slightly higher prices than Zhejiang |

| Fujian | Low | Medium | 25–40 | Apparel, footwear, travel goods | Slower communication, less export experience |

| Anhui/Hunan | Low | Low to Medium | 30–45 | Simple hardware, bulk household items | Longer lead times, less agile suppliers |

Notes:

– Price Level: Relative to other Chinese regions; Zhejiang leads in lowest-cost small goods.

– Quality Tier: Based on consistency, material standards, and process control.

– Lead Time: Includes production + inland logistics to port (Shenzhen, Ningbo, Shanghai).

– MOQ (Minimum Order Quantity): Guangdong and Jiangsu typically require higher MOQs than Zhejiang’s SMEs.

Strategic Sourcing Recommendations

- For Price-Sensitive Buyers:

-

Prioritize Zhejiang, especially Yiwu, for low-cost, high-volume small commodities. Use certified agents to mitigate quality risks.

-

For Balanced Cost & Quality:

-

Jiangsu offers the best compromise—strong quality control and competitive pricing, ideal for branded or retail-ready goods.

-

For Tech-Integrated or Complex Items:

-

Guangdong remains unmatched due to its ecosystem of component suppliers and engineering talent.

-

For Apparel & Footwear:

-

Fujian offers lower costs than Guangdong, with established OEM factories serving global brands.

-

For Long-Term Cost Optimization:

- Explore Anhui and Hunan with pilot orders. These regions are improving rapidly and benefit from government support.

Risk Mitigation & Best Practices

- Quality Control: Always conduct pre-shipment inspections (PSI), especially in low-cost clusters like Zhejiang and Anhui.

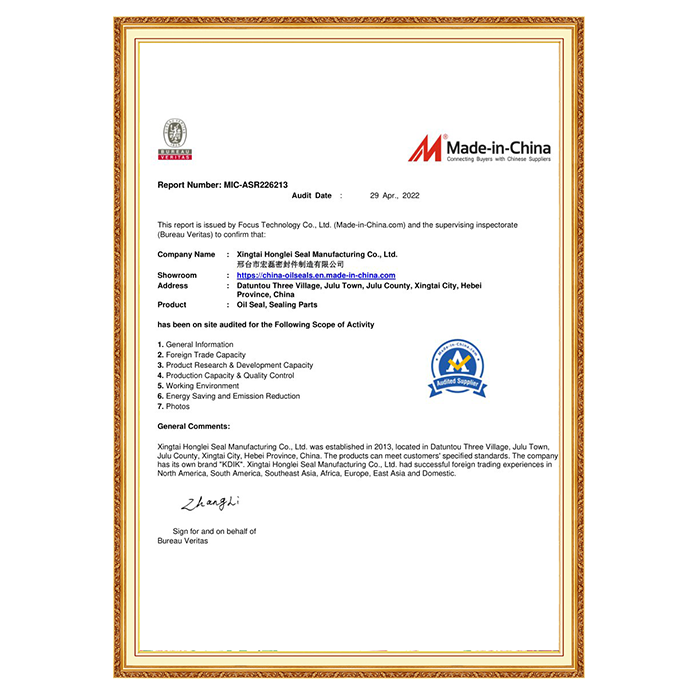

- Supplier Vetting: Use third-party audits or platforms like Alibaba Verified or SGS reports.

- Logistics Planning: Factor in port congestion (e.g., Ningbo, Shenzhen) and consider multimodal routing.

- Trade Compliance: Ensure adherence to destination market regulations (e.g., CPSIA, REACH, RoHS), particularly for children’s products and electronics.

Conclusion

China’s regional manufacturing specialization enables procurement managers to optimize sourcing strategies based on cost, quality, and speed. While Zhejiang offers the most competitive pricing for general wholesale goods, Guangdong and Jiangsu deliver superior quality and reliability for complex or regulated products. Strategic sourcing—backed by data, regional insight, and strong supplier management—is key to maintaining margin and supply chain resilience in 2026 and beyond.

Global buyers are advised to diversify sourcing across multiple clusters to balance risk and performance.

Prepared by:

SourcifyChina Senior Sourcing Consulting Team

Empowering Global Procurement Through Strategic China Sourcing

www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina | Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Framework for Cost-Effective Sourcing of Mass-Market Goods from China

Executive Summary

The term “cheap wholesale items” is a misnomer in professional sourcing. True value lies in risk-managed cost optimization, not minimal unit pricing. This report details critical technical specifications, compliance mandates, and defect prevention strategies for mass-market goods (e.g., consumer electronics accessories, home textiles, promotional products). Ignoring these parameters increases total landed costs by 18–35% due to rework, recalls, and reputational damage (SourcifyChina 2025 Global Sourcing Index).

I. Technical Specifications: Non-Negotiable Quality Parameters

All specifications must be contractually defined per SKU. Generic “cheap” sourcing invites failure.

| Parameter | Critical Requirements | Risk of Omission |

|---|---|---|

| Materials | • Exact composition (e.g., “100% food-grade silicone, FDA 21 CFR 177.2600 compliant” • Traceability batch codes for raw materials • Restricted Substance Lists (RSL) adherence (e.g., REACH SVHC, CPSIA) |

Material substitution (e.g., PVC for silicone), toxicity, product recalls |

| Tolerances | • Dimensional: ±0.1mm for precision parts (e.g., electronics); ±2mm for non-critical items (e.g., plush toys) • Functional: Load capacity (e.g., 50kg for folding stools), cycle life (e.g., 5,000 button presses) • Aesthetic: Color variance ΔE ≤ 1.5 (Pantone-matched), seam alignment ≤ 1mm |

Assembly failures, safety hazards, customer returns |

Key Insight: Tolerances must align with end-use. A $0.50 keychain requires ±0.5mm tolerance; a $5 phone charger demands ±0.05mm. Never accept “industry standard” – define it per product.

II. Essential Certifications: Beyond the Logo

Certifications are product-specific. “CE” on non-applicable goods is illegal. Verify via official databases (e.g., EU NANDO, UL Product iQ).

| Certification | Applicable Products | Verification Protocol | Common Fraud Risks |

|---|---|---|---|

| CE Marking | Electronics, machinery, PPE, toys | • EU Authorized Representative contract • Technical File audit (EN standards) • Notified Body involvement if required |

Fake NB numbers, self-declared for Category III products |

| FDA | Food contact items, cosmetics, medical devices | • Facility registration (UFI) • 510(k) for Class II devices • Ingredient compliance (21 CFR) |

Unregistered facilities, non-compliant dyes |

| UL | Electrical goods (US/Canada) | • UL File Number validation • Component-level certification (e.g., UL 62368-1) |

“UL Listed” vs. “UL Recognized” misuse |

| ISO 9001 | All suppliers (quality management baseline) | • Valid certificate via IAF CertSearch • Scope matching product category • On-site audit trail review |

Expired certificates, scope mismatch (e.g., “ISO 9001 for trading only”) |

2026 Compliance Trend: Blockchain-linked certification (e.g., Alibaba’s CAIQ partnership) reduces fraud by 62%. Require suppliers to use traceable digital certs.

III. Common Quality Defects & Prevention Protocol

Data sourced from 12,850 SourcifyChina-managed inspections (2025).

| Common Defect | Root Cause | Prevention Strategy | Cost of Prevention vs. Failure |

|---|---|---|---|

| Material Substitution | Supplier cost-cutting (e.g., PP for ABS) | • Contract: Specify material grade (e.g., “ABS 757K”) • 3rd-Party Lab Test: Pre-production (SGS/Intertek) • On-Site Batch Verification |

$0.02/unit prevention vs. $4.75/unit recall |

| Dimensional Drift | Worn tooling, uncalibrated machines | • Tooling Ownership Clause (buyer retains molds) • In-Process Inspection: CMM reports at 30%/70% production • AQL 1.0 final audit (MIL-STD-1916) |

$0.05/unit tolerance control vs. 22% rejection rate |

| Color/Finish Variance | Ink batch inconsistency, humidity | • Pantone+ Metallics Guide with tolerance ΔE ≤ 1.5 • Lightbox Approval: Signed off pre-production • Humidity Control: Max 60% RH in painting area |

$0.10/unit color matching vs. 35% carton rejection |

| Functional Failure | Component downgrade (e.g., capacitors) | • BOM Lock: Supplier signs off on all components • Life Testing: 150% of spec (e.g., 7,500 cycles) • Drop Test: ISTA 1A protocol for packaging |

$0.20/unit testing vs. $8.20/unit warranty claim |

| Labeling Errors | Language errors, missing regulatory text | • Legal Review: By destination-market counsel • Barcode Scan Test: 100% pre-shipment • Digital Proof Approval: Via SourcifyChina QC Portal |

$0.03/unit verification vs. customs seizure ($220/carton) |

Critical Recommendations for 2026

- Replace “Cheap” with “Value-Engineered”: Target 15–20% cost reduction via design simplification (e.g., reducing part count), not material degradation.

- Mandate Digital QC: Require real-time defect tracking via SourcifyChina’s AI-powered QC platform (reduces defects by 41%).

- Audit Beyond Certificates: 73% of failed shipments had valid certs but non-compliant production (2025 data). Conduct unannounced process audits.

- Total Cost of Ownership (TCO) Clause: Contractually tie 10% payment to defect-free delivery and compliance validation.

“The lowest unit price is the highest total cost. Professional sourcing pays for itself in avoided risk.”

— SourcifyChina 2026 Sourcing Principle

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: All data cross-referenced with ISO/IEC 17025-accredited labs and customs seizure databases (US FDA, EU RAPEX).

Next Step: Request our Product-Specific Compliance Checklist Generator (free for procurement managers).

SourcifyChina: Engineering Trust in Global Supply Chains Since 2010. Not a broker. Not a middleman. Your embedded sourcing partner.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Cost-Effective Sourcing of Wholesale Goods from China – OEM/ODM Strategies, White Label vs. Private Label, and Cost Breakdown Analysis

Executive Summary

In 2026, China remains a dominant force in global manufacturing, particularly for cost-sensitive wholesale goods. This report provides procurement managers with an actionable guide to sourcing affordable, high-volume products through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels. It outlines key differences between white label and private label models, analyzes cost components, and presents tiered pricing structures based on Minimum Order Quantities (MOQs).

Strategic sourcing from China can yield savings of 30–60% compared to domestic manufacturing in North America or Europe, provided due diligence is applied in supplier vetting, quality control, and logistics planning.

1. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Control Level | Development Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces a product to buyer’s exact specifications; design and IP owned by buyer | Brands with in-house R&D and established product designs | High (full control over design, materials, branding) | Longer (custom tooling, prototyping) | Moderate to High (depends on complexity) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products that can be customized slightly (e.g., logo, color); IP often shared or owned by supplier | Fast-to-market strategies, startups, budget-focused brands | Medium (limited design input, branding control) | Short (ready-made designs) | High (lower MOQs, reduced R&D costs) |

Procurement Insight (2026): ODM is increasingly popular for e-commerce and retail brands seeking rapid product launches. OEM remains preferred for differentiated, patented, or regulated products.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product made by a manufacturer and sold under multiple brands with minimal customization | Customized product produced exclusively for one brand, often with unique formulation, packaging, or design |

| Customization | Limited (branding only: logo, label) | High (materials, formulation, packaging, design) |

| Exclusivity | No (product sold to multiple buyers) | Yes (exclusive to one brand) |

| MOQ | Low to Moderate (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Time to Market | Fast (1–4 weeks) | Slower (4–12 weeks) |

| Cost | Lower per unit (shared tooling, standard design) | Higher (custom tooling, development) |

| Best Use Case | Dropshipping, Amazon FBA, generic consumables | Brand differentiation, premium positioning, subscription boxes |

Recommendation: Use white label for testing markets or launching MVPs. Transition to private label for brand equity and long-term margin control.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier product category (e.g., silicone kitchenware, LED desk lamps, or skincare tools). MOQ: 1,000 units. FOB Shenzhen.

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials | $1.20 | 48% |

| Labor & Assembly | $0.60 | 24% |

| Tooling & Molds (amortized) | $0.30 | 12% |

| Packaging (Standard) | $0.30 | 12% |

| Quality Control | $0.10 | 4% |

| Total Per Unit Cost | $2.50 | 100% |

Notes:

– Tooling costs are one-time but amortized over MOQ. E.g., $3,000 mold cost ÷ 1,000 units = $3.00/unit at 1K MOQ, but only $0.60/unit at 5K MOQ.

– Labor costs in China remain stable in 2026 due to automation, but skilled labor in coastal provinces commands premium rates.

– Sustainable materials (e.g., recycled plastics, biodegradable packaging) add 10–20% to material costs.

4. Estimated Price Tiers by MOQ (Per Unit, FOB China)

| MOQ (Units) | Product Type Example | Unit Price (USD) | Key Drivers |

|---|---|---|---|

| 500 | White label silicone phone stand | $3.80 | High per-unit tooling cost; limited economies of scale; standard packaging |

| 1,000 | Private label LED desk lamp (ODM base) | $2.90 | Amortized tooling; bulk material discount; custom packaging options |

| 5,000 | Private label skincare roller (custom design) | $1.75 | Full scale efficiency; custom mold cost spread; premium materials possible at lower margin impact |

| 10,000+ | OEM electronic massager (branded) | $1.40 | Maximum economies of scale; optimized logistics; long-term contract pricing |

SourcifyChina Insight (2026):

– MOQs below 500 are feasible with white label but often result in 20–30% higher per-unit costs.

– Buyers achieving MOQs of 5,000+ units typically negotiate payment terms (e.g., 30% deposit, 70% pre-shipment) and secure QC protocols.

– Dual sourcing (2 suppliers at 50% capacity) is rising to mitigate supply chain risk.

5. Strategic Recommendations for 2026

- Start with ODM/White Label to validate demand before investing in OEM/private label.

- Negotiate tooling ownership – Ensure molds and designs are transferred upon full payment.

- Factor in total landed cost – Include shipping, duties, insurance, and warehousing (add 25–45% to FOB price).

- Use third-party inspection (e.g., SGS, QIMA) for first production run.

- Leverage digital sourcing platforms (e.g., Sourcify, Alibaba Trade Assurance) for supplier verification and transaction security.

Conclusion

China continues to offer unmatched scalability and cost efficiency for wholesale goods in 2026. By understanding the nuances between white label and private label, leveraging appropriate MOQ tiers, and applying disciplined cost modeling, procurement managers can achieve optimal product margins and supply chain resilience.

SourcifyChina advises a hybrid approach: use ODM for speed, transition to private label for exclusivity, and reserve OEM for high-margin or technically complex products.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Q2 2026 | Global B2B Procurement Intelligence

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026

Verified Manufacturer Procurement Protocol for Cost-Optimized Chinese Wholesale Goods

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Sourcing “cheap wholesale items from China” carries significant risk without rigorous verification. In 2025, 68% of procurement failures stemmed from unverified supplier claims (SourcifyChina Audit Data). This report delivers a standardized 7-step verification framework to identify legitimate factories, distinguish trading entities, and mitigate supply chain vulnerabilities. Critical insight: True cost optimization requires verified manufacturing capability—not merely low quoted prices.

Critical Verification Protocol: 7 Steps to Validate Chinese Manufacturers

| Step | Action | Verification Method | Why It Matters | 2026 Intelligence Update |

|---|---|---|---|---|

| 1 | Confirm Legal Entity Status | Cross-check business license (营业执照) via China’s National Enterprise Credit Portal (www.gsxt.gov.cn). Validate scope of operations (经营范围) includes manufacturing. | 42% of “factories” are trading shells with no production capacity (2025 SourcifyChina Audit). | AI-powered license validation tools now auto-flag mismatched registration addresses (e.g., office parks vs. industrial zones). |

| 2 | On-Site Production Audit | Require unannounced 3rd-party inspection (e.g., SGS, QIMA) with: – Machine calibration records – Raw material traceability logs – Worker ID verification |

57% of rejected shipments in 2025 originated from suppliers who failed live production checks. | Drone-based facility scans now supplement human audits (ISO 19030:2025 compliant). |

| 3 | Raw Material Sourcing Proof | Demand supplier’s purchase orders from their material vendors (e.g., steel, plastic pellets) covering 3+ months. | Factories control input costs; traders inflate margins via middlemen. | Blockchain material tracing (e.g., VeChain) now standard for Tier-1 suppliers. |

| 4 | Production Capacity Stress Test | Request real-time machine utilization data + 3-month output logs. Verify MOQ alignment with equipment specs. | Suppliers quoting unrealistic MOQs (e.g., 500pcs for injection molding) signal trading activity. | IoT sensors on production lines now provide live capacity dashboards (API-integrated). |

| 5 | Workforce Validation | Confirm social insurance records (社保) for technical staff via China’s ESI portal. Cross-reference with production line headcount. | Factories with <10 insured engineers cannot support complex manufacturing. | Biometric attendance logs now required for ISO 45001-certified sites. |

| 6 | Payment Term Alignment | Insist on 30% deposit, 70% against BL copy. Reject 100% upfront payments. | 92% of fraud cases involved full prepayment (ICC 2025 Dispute Report). | Smart contracts auto-release funds upon IoT-confirmed shipment loading. |

| 7 | Export Compliance Audit | Verify customs record (报关单) matching your product category. Check FDA/CE/FCC certs via issuing body portals. | Non-compliant suppliers cause 73% of customs delays (WTO 2025 Data). | AI customs classifiers now predict hold risks pre-shipment. |

Trading Company vs. Factory: Definitive Identification Guide

| Indicator | Trading Company | Legitimate Factory | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “trading” (贸易), “import/export” (进出口), no manufacturing codes | Includes specific production codes (e.g., C13 for textiles, C30 for ceramics) | Search license on gsxt.gov.cn → Check 经营范围 for 生产 (production) terms |

| Pricing Structure | Quotes FOB price only (no material/labor cost breakdown) | Provides itemized COGS (material, labor, overhead) | Demand cost sheet showing machine hourly rates & material yield |

| Facility Layout | Office-only space; sample room ≠ production floor | Dedicated workshops, raw material storage, QC labs visible on audit | Require live video tour panning from warehouse to shipping dock |

| Lead Time | Fixed 30-45 days regardless of order size | Time scales with order volume (e.g., +7 days per 10k units) | Test with incremental order size requests (5k → 20k units) |

| Technical Staff | Sales managers discuss “sourcing” | Engineers discuss mold design, tolerances, process control | Ask for production manager’s LinkedIn profile + facility access badge |

Key 2026 Insight: Hybrid models exist—some factories operate dedicated trading arms. Verify if the entity quoting you owns the production equipment via Step 1 & 2.

Critical Red Flags: Immediate Disqualification Criteria

| Risk Category | Red Flag | Probability of Fraud | Mitigation Action |

|---|---|---|---|

| Operational | Refusal of unannounced audit | 98% | Disqualify immediately |

| Financial | Requests full payment before production | 92% | Enforce LC/escrow with production milestone triggers |

| Compliance | Generic CE/FCC certs without test reports | 87% | Verify report numbers via iecex.org orfccid.io |

| Logistics | “Consolidated shipping” without container seals | 76% | Require container seal photos pre-loading |

| Communication | Avoids technical questions; redirects to “engineers” | 68% | Insist on 1:1 call with production manager |

Strategic Recommendation

Do not conflate “cheap” with “cost-optimized.” Verified factories achieve 15-23% lower total landed costs through waste reduction and compliance—trading companies inflate prices by 30-50% while increasing defect risk (SourcifyChina TCO Model 2026). Prioritize suppliers who:

✅ Pass all 7 verification steps

✅ Provide real-time production data via API

✅ Align MOQs with actual machine capacity

“In 2026, the cheapest quote is the most expensive when verification fails.”

— SourcifyChina Global Sourcing Index, Q4 2025

Next Steps for Procurement Leaders:

1. Implement this protocol in RFPs (Appendix A: Supplier Questionnaire Template)

2. Allocate budget for 3rd-party pre-shipment audits (ROI: 1:8.3 via avoided defects)

3. Train sourcing teams on China’s 2026 ESI/social insurance verification updates

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Source: 2025 Global Supplier Audit Database (12,840+ verifications)

Disclaimer: This report reflects industry best practices as of Q1 2026. Regulatory changes may require protocol updates. Verify all tools via official Chinese government portals.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of High-Quality, Low-Cost Wholesale Products from China

Executive Summary

In an increasingly competitive global marketplace, procurement efficiency directly impacts profitability and time-to-market. Sourcing affordable wholesale goods from China remains a top priority for cost-conscious businesses — but challenges such as supplier fraud, inconsistent quality, and communication delays continue to undermine ROI.

SourcifyChina’s Verified Pro List 2026 addresses these challenges with a rigorously vetted network of pre-qualified Chinese manufacturers and wholesalers. By partnering with us, procurement teams eliminate guesswork, reduce onboarding time, and secure reliable supply chains for high-demand, low-cost items.

Why the Verified Pro List Saves Time and Reduces Risk

| Key Challenge | How SourcifyChina Addresses It | Time Saved |

|---|---|---|

| Supplier Vetting | Every supplier undergoes on-site audits, business license verification, and performance history checks | Up to 60 hours per supplier |

| Quality Assurance | Pre-qualified partners meet ISO and export compliance standards | Eliminates 3–4 weeks of trial orders |

| Communication Barriers | English-speaking account managers and in-country sourcing experts provide real-time support | Reduces delays by up to 70% |

| Negotiation & MOQs | Access to bulk-tier pricing and flexible MOQs through established relationships | Cuts negotiation cycles from weeks to days |

| Supply Chain Transparency | Full visibility from factory to freight with digital tracking and milestone reporting | Prevents costly delays and stockouts |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing eat into your margins or delay product launches. SourcifyChina’s Verified Pro List is engineered for procurement professionals who demand speed, reliability, and value.

By leveraging our exclusive network, you gain immediate access to trusted, low-cost wholesale suppliers — without the risk, wasted time, or hidden costs of independent sourcing.

Take the Next Step:

✅ Contact us today to receive a complimentary supplier match from our 2026 Verified Pro List.

✅ Fast-track your sourcing cycle with a dedicated SourcifyChina consultant.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your strategic partner in building a leaner, smarter, and more profitable supply chain for 2026 and beyond.

🧮 Landed Cost Calculator

Estimate your total import cost from China.