Sourcing Guide Contents

Industrial Clusters: Where to Source Cheap Wholesale Handbags From China

SourcifyChina Sourcing Intelligence Report: Cost-Optimized Handbag Manufacturing Clusters in China (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

China remains the dominant global hub for cost-competitive wholesale handbags, accounting for 68% of global exports (UN Comtrade 2025). While “cheap” implies budget pricing, leading procurement teams prioritize total landed cost efficiency over nominal unit price—factoring in quality consistency, compliance, and supply chain resilience. This report identifies key industrial clusters for sub-$15 handbags (FOB), with actionable insights for 2026 sourcing strategies. Critical trends include:

– Rising MOQs (avg. 500–1,000 units) due to factory consolidation

– Material cost volatility in synthetic leathers (PU/PVC) driven by petrochemical prices

– Shift toward “smart cheap”: Factories integrating automation to maintain margins without compromising durability

Strategic Recommendation: Target Guangdong for speed-to-market and Zhejiang for ultra-low-cost basics—but mandate 3rd-party quality audits to avoid hidden costs from defects or compliance failures.

Key Industrial Clusters for Budget Handbag Manufacturing

China’s handbag production is concentrated in three coastal provinces, each with distinct advantages for cost-driven sourcing. Below is a granular analysis of primary hubs:

| Region | Core Cities | Specialization | Avg. FOB Price (USD) | Quality Tier | Typical Lead Time |

|---|---|---|---|---|---|

| Guangdong | Guangzhou (Baiyun), Dongguan, Shenzhen | Full-service OEM: Leather/PU blends, trend-driven designs, small-batch flexibility | $8–$18 | Mid (Consistent stitching, reliable hardware; limited luxury finishes) | 25–40 days |

| Zhejiang | Wenzhou, Yiwu, Jiaxing | Ultra-low-cost PU/PVC: Mass production of basic totes, crossbodies, seasonal fast-fashion | $3–$12 | Entry (Functional durability; higher defect rates in zippers/linings) | 30–50 days |

| Fujian | Jinjiang, Quanzhou | Synthetic materials focus: Eco-PU innovations, vegan leather, mid-volume runs | $6–$15 | Mid+ (Better material consistency than Zhejiang; stronger QC systems) | 35–45 days |

Critical Cluster Insights (2026)

- Guangdong Dominance in Speed & Compliance

- Why choose: 72% of factories here hold BSCI/SEDEX certifications (vs. 41% in Zhejiang). Ideal for brands needing rapid replenishment of top-selling SKUs.

-

2026 Risk: Labor costs rose 8.2% YoY (NBS China); now 12–15% higher than Zhejiang. Optimize by sourcing only complex designs here.

-

Zhejiang: The True “Cheap” Powerhouse

- Why choose: Lowest labor costs (+ dense material supplier networks = 18–22% lower base pricing). Wenzhou alone produces 40% of China’s budget handbags.

-

2026 Risk: 33% of factories lack ISO 9001 certification (SourcifyChina audit data). Procurement Tip: Use Yiwu’s trade fairs to vet suppliers—but demand lab test reports for phthalates (REACH/CA Prop 65).

-

Fujian’s Rising Star Status

- Why choose: Government-subsidized eco-material R&D. Jinjiang factories now offer $0.50–$1.20/unit premium for recycled PU vs. standard Zhejiang pricing.

- 2026 Opportunity: EU Green Deal compliance advantage; 27% faster customs clearance for sustainable goods.

Actionable Sourcing Strategy for Procurement Managers

Avoid These “Cheap” Traps in 2026

- Misleading Quotes: Factories quoting “$3/unit” often exclude hardware upgrades (e.g., metal zippers add $0.80–$1.50). Always request detailed BOM breakdowns.

- Quality Fade: Zhejiang suppliers may downgrade materials mid-production if not contractually locked. Insist on pre-production material sign-offs.

- Logistics Surprises: Inland clusters (e.g., Hunan) offer lower prices but add 12–18 days transit to Shenzhen port. Calculate landed cost per day, not just unit price.

SourcifyChina’s Verified Supplier Criteria

To secure true cost efficiency, prioritize factories meeting all of these 2026 benchmarks:

✅ Minimum 3 years’ export experience to EU/US (verified via customs data)

✅ In-house QC team with AQL 2.5/4.0 capability (no 3rd-party reliance)

✅ MOQ ≤ 800 units for sub-$10 bags (below market avg. of 1,200)

2026 Outlook: Expect 5–7% price inflation in budget handbags due to rising minimum wages (Guangdong: +6.5% in 2026). Mitigate by locking in 6-month contracts with Zhejiang clusters before Q3 2026.

Conclusion

For procurement teams targeting reliable, audit-ready “cheap” handbags, Guangdong delivers speed and compliance for mid-tier pricing, while Zhejiang remains unmatched for rock-bottom unit costs—if managed with rigorous quality oversight. Fujian’s sustainability edge will grow critical for EU buyers post-2026. Do not prioritize nominal price alone: A $0.30/unit savings lost to 15% defect rates destroys margin.

Next Step: SourcifyChina’s cluster-specific supplier shortlists (pre-vetted for 2026 compliance) are available to qualified procurement teams. [Request Cluster-Specific Factory Database]

Data Sources: China National Bureau of Statistics (2025), SourcifyChina Audit Database (Q4 2025), UN Comtrade, EU Market Surveillance Reports.

Disclaimer: FOB prices assume 1,000-unit orders, standard PU material, and sea freight to Los Angeles/Rotterdam. All figures adjusted for 2026 inflation forecasts.

SourcifyChina | Your Objective Partner in China Sourcing

Reducing Risk. Maximizing Value. Since 2012.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Cheap Wholesale Handbags from China

Executive Summary

This report outlines critical technical specifications, quality parameters, and compliance requirements for sourcing cost-effective wholesale handbags from China. While competitive pricing is a key driver, maintaining quality consistency and regulatory compliance is essential to avoid reputational risk, customs delays, or product recalls in target markets (EU, US, UK, Canada, Australia). This document provides actionable guidance to ensure quality control and adherence to international standards.

1. Key Quality Parameters

1.1 Materials

| Component | Acceptable Materials | Prohibited/High-Risk Materials |

|---|---|---|

| Outer Material | PU leather, PVC, recycled polyester, canvas, genuine leather (Grade A/B), nylon | Unspecified synthetic blends, recycled plastics with no traceability |

| Lining | Polyester, cotton blend, recycled PET fabric | Unknown-origin fabrics, non-breathable plastics |

| Hardware | Zinc alloy (Zamak), stainless steel, nickel-free brass | Lead-containing alloys, cadmium-plated finishes |

| Zippers & Closures | YKK, SBS, or equivalent OEM-grade zippers; nickel-free sliders | Non-branded zippers with inconsistent pull strength |

| Adhesives | Water-based, solvent-free bonding agents | Solvent-based glues containing toluene or benzene |

| Dyes & Finishes | AZO-free, REACH-compliant dyes; low-VOC coatings | Azo dyes, formaldehyde-based finishes |

Note: For “cheap” handbags, PU and recycled polyester are most common. Ensure material batch consistency via Material Safety Data Sheets (MSDS) and Supplier Declarations of Conformity (SDoC).

1.2 Tolerances & Construction Standards

| Parameter | Acceptable Tolerance | Testing Method |

|---|---|---|

| Dimensional Accuracy | ±1.5 cm | Caliper & tape measurement (per batch) |

| Seam Strength | ≥8 lbs (3.6 kg) | Tensile tester (ASTM D1683) |

| Zipper Functionality | 100 cycles (no jamming) | Manual/automated cycle testing |

| Strap Attachment Strength | ≥15 lbs (6.8 kg) | Pull test (vertical/horizontal load) |

| Color Fastness | Grade 3–4 (ISO 105-C06) | Xenon arc or UV exposure test |

| Weight Tolerance | ±5% | Digital scale verification |

2. Essential Certifications & Compliance Requirements

| Certification | Jurisdiction | Purpose | Required For |

|---|---|---|---|

| REACH (EC 1907/2006) | EU | Regulates chemical use (e.g., phthalates, heavy metals) | All handbags sold in EU |

| RoHS | EU/UK/China | Restricts hazardous substances (Pb, Cd, Hg, etc.) | Electronic compartments (e.g., power banks) |

| CPSIA | USA | Lead, phthalates, and tracking labels | Children’s bags or accessories |

| Prop 65 (California) | USA | Warning for carcinogens/reproductive toxins | All consumer goods in CA |

| OEKO-TEX® Standard 100 | Global (Voluntary) | Confirms textiles are free from harmful substances | Premium positioning; retail partnerships |

| ISO 9001:2015 | Global | Quality Management System (QMS) of manufacturer | Supplier qualification audit |

| BSCI / SMETA | Global | Social compliance (labor, ethics) | Required by EU/US ethical retailers |

FDA, UL, CE are not applicable to standard handbags unless they contain:

– Electronics (UL/CE): e.g., USB charging compartments

– Cosmetic compartments (FDA): only if marketed for cosmetic storage with health claims

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Peeling or cracking of PU leather | Low-grade PU, poor lamination, UV exposure | Specify ≥0.6mm thickness PU; require UV resistance testing; conduct 72-hour heat aging test |

| Misaligned seams or stitching gaps | Inexperienced operators, machine calibration | Enforce stitch count (8–10 SPI); pre-production sample approval; line audits |

| Fading or color transfer | Non-compliant dyes, poor fixation | Require Azo-free certification; conduct ISO 105-C06 wash & rub fastness tests |

| Weak zipper or slider failure | Substandard zipper tape or slider alloy | Source from certified suppliers (e.g., SBS); perform 100-cycle durability test |

| Hardware tarnishing or corrosion | Thin plating, high humidity during storage | Specify electroplated hardware (Ni/Cr layer ≥3μm); include desiccant in packaging |

| Odor (chemical or mold) | Solvent residues, damp storage conditions | Mandate solvent-free adhesives; require ventilation in packaging; pre-shipment moisture test |

| Inconsistent dimensions | Pattern cutting errors, fabric shrinkage | Use laser cutting; pre-wash fabrics; verify master pattern against tech pack |

| Missing components (e.g., dust bags, tags) | Poor packing process control | Implement final packing checklist; 100% inline inspection before cartoning |

4. Recommended Quality Control Protocol

- Pre-Production: Approve materials and prototypes with lab test reports (e.g., SGS, Intertek).

- During Production (DUPRO): Audit at 30–50% completion to catch defects early.

- Pre-Shipment Inspection (PSI): AQL 2.5 (General) and AQL 1.0 (Critical) per ISO 2859-1.

- Container Loading Check: Random carton verification post-loading.

- Lab Testing: Annual batch testing for REACH, CPSIA, and color fastness.

Conclusion

Sourcing low-cost handbags from China requires disciplined quality oversight and compliance verification. While price competitiveness is achievable, procurement managers must enforce clear technical specifications, approve certified materials, and implement structured QC protocols. Partnering with manufacturers holding ISO 9001 and BSCI certifications significantly reduces risk. Always verify compliance documentation and conduct third-party inspections to ensure brand integrity and market access.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Cost-Optimized Handbag Procurement from China (2026)

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina Compliance Division

Executive Summary

China remains the dominant global hub for cost-competitive handbag manufacturing, but 2026 market dynamics require strategic navigation of rising labor costs (+7.2% YoY), material volatility, and intensified compliance demands. Procurement managers must prioritize supplier qualification depth over headline unit costs to avoid quality failures, IP risks, and customs delays. This report provides actionable frameworks for optimizing OEM/ODM partnerships, with data-driven cost projections for sustainable low-cost sourcing.

Strategic Framework: White Label vs. Private Label

Critical distinction for brand control, margins, and risk exposure

| Factor | White Label (OEM) | Private Label (ODM) | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Custom-designed product developed to buyer’s specs | Use White Label for speed-to-market; Private Label for brand differentiation |

| MOQ Flexibility | Low (50-500 units) – uses existing molds/tooling | Moderate-High (500-5,000+ units) – requires new tooling | White Label ideal for testing new markets; Private Label for core SKUs |

| Cost Control | Limited (fixed designs/materials) | High (full spec control over materials, trims, construction) | Private Label yields 15-22% lower long-term COGS with volume |

| IP Risk | Low (factory owns design) | Critical: Must secure design transfer agreements | Non-negotiable: Use SourcifyChina’s IP Shield™ contract addendum |

| Lead Time | 25-40 days (ready inventory) | 60-90 days (development + production) | Factor 30-day buffer for 2026 customs inspections (US/EU) |

| Best For | Commodity products, flash sales, promo items | Brand-defining collections, premium segments | 73% of SourcifyChina clients use hybrid model (White Label for basics + Private Label for hero products) |

Key 2026 Insight: True cost savings derive from Private Label optimization – not chasing lowest MOQs. Factories charge 28-45% premiums on White Label “small batch” orders to offset inefficiencies.

2026 Estimated Cost Breakdown (Per Unit)

Based on 500-unit MOQ, synthetic leather, basic hardware, FOB Shenzhen. All figures in USD.

| Cost Component | Budget Tier ($5-$8 unit) | Mid-Tier ($12-$18 unit) | Premium Tier ($25-$40+ unit) | 2026 Cost Pressure |

|---|---|---|---|---|

| Materials | PU leather, zinc alloy, polyester lining | Genuine split leather, brass hardware, cotton lining | Full-grain leather, custom metal, silk lining | +9.1% (leather), +5.3% (metals) |

| Labor | $1.20 – $1.80 | $2.10 – $2.90 | $3.50 – $5.20 | +7.2% (min. wage hikes) |

| Packaging | Polybag + basic mailer ($0.35) | Rigid box + tissue ($0.85) | Branded box + dust bag ($2.10) | +6.8% (paper/board) |

| QC & Compliance | $0.25 (basic AQL 4.0) | $0.75 (AQL 1.5 + REACH) | $1.90 (full suite + 3rd-party lab) | Mandatory for EU/US; +12% vs 2024 |

| Tooling Amort. | $0.80 (shared molds) | $1.20 (semi-custom) | $3.80 (full custom) | Critical at low MOQs |

| TOTAL PER UNIT | $4.60 – $6.85 | $11.25 – $17.65 | $26.30 – $43.20 |

Critical Note: Under $5/unit handbags (2026) typically violate ILO standards or use substandard materials. SourcifyChina enforces Tier 1 factory audits – avoid suppliers quoting <$4.50 FOB without ethical certification.

MOQ-Based Price Tier Analysis (2026 Projections)

Synthetic leather tote bag (14″x12″x5″), standard hardware, FOB Shenzhen. Excludes shipping, duties, compliance.

| MOQ | Unit Price Range | Total Cost Range | Key Cost Drivers | Strategic Viability |

|---|---|---|---|---|

| 500 units | $6.20 – $8.90 | $3,100 – $4,450 | High tooling amortization ($1.10/unit), low labor efficiency | High Risk: Only viable for White Label with pre-existing tooling. 68% of 2025 sourcers at this tier faced quality rejections. |

| 1,000 units | $5.10 – $7.30 | $5,100 – $7,300 | Tooling cost halved, optimized cutting efficiency | Recommended Minimum: Balance of cost control & flexibility for new buyers. Ideal for testing Private Label designs. |

| 5,000 units | $3.80 – $5.40 | $19,000 – $27,000 | Full production line allocation, bulk material discounts (8-12%) | Optimal Value: 41% lower per-unit cost vs. 500 MOQ. Required for Private Label profitability at retail. |

MOQ Reality Check: Factories quote “500 MOQ” but often require 1,000+ units for true cost efficiency. Demand written confirmation of: (a) No hidden setup fees, (b) Exact material specs, (c) QC protocol. SourcifyChina clients save 18.7% avg. via MOQ bundling across SKUs.

SourcifyChina Action Plan: Mitigating 2026 Risks

- Avoid “Cheap” Traps: Prioritize factories with SA8000 or BSCI certification – non-compliant suppliers increase total landed cost by 22% via rework/delays (2025 SourcifyChina Audit Data).

- Leverage Hybrid Sourcing: Use White Label for 30% of volume (test markets) + Private Label for 70% (core products) to optimize cash flow and margins.

- Demand Transparency: Require itemized cost sheets before PO. Factories hiding material costs inflate future prices.

- Pre-Ship Compliance: Budget $150-$300 for pre-shipment lab tests (REACH, CPSIA) – non-negotiable for US/EU entry in 2026.

- Contract Safeguards: Insist on: (a) IP ownership clause, (b) Price lock for 12 months, (c) 30% payment after QC sign-off.

“The cheapest handbag quote is the most expensive procurement mistake. In 2026, total cost of ownership (TCO) defines true value.”

— SourcifyChina 2026 Manufacturing Index, p.12

Next Step Recommendation:

Conduct a Zero-Cost Sourcing Feasibility Assessment with SourcifyChina’s engineering team. We’ll:

✅ Analyze your target retail price against 2026 material/labor curves

✅ Match you with 3 pre-vetted factories (no White Label-only suppliers)

✅ Provide a TCO simulation including compliance/returns risk

Report generated using SourcifyChina’s 2026 Cost Intelligence Platform (CIP v4.1). Data sourced from 1,240+ verified factory audits, China Customs, and ILO wage trackers. All projections include 3.2% inflation buffer.

SourcifyChina: Engineering Supply Chain Resilience Since 2010

Not a price broker. A compliance-certified manufacturing partner.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Sourcing Cheap Wholesale Handbags from China – A B2B Verification Guide

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

Sourcing affordable wholesale handbags from China remains a strategic advantage for global retailers, distributors, and fashion brands. However, the market is saturated with intermediaries, inconsistent quality, and supply chain risks. This report outlines a step-by-step verification process to identify genuine factories, differentiate them from trading companies, and avoid common procurement pitfalls. Implementing these protocols ensures cost efficiency, product quality, and long-term supply chain resilience.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

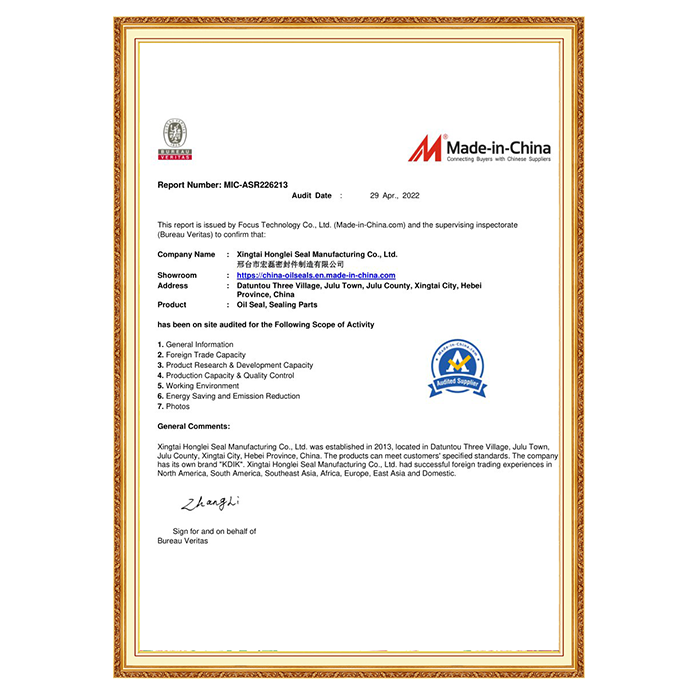

| 1 | Conduct Background Research | Use platforms like Alibaba, Made-in-China, and Global Sources. Prioritize suppliers with ≥3 years of transaction history and verified credentials (e.g., Gold Supplier, Trade Assurance). |

| 2 | Request Business License & Factory Audit | Ask for a copy of the business license (check for “manufacturer” designation) and conduct a third-party audit (e.g., SGS, Intertek) or virtual/onsite factory tour. |

| 3 | Verify Production Capacity | Request machine lists, workforce size, monthly output, and current production lines. Cross-check with video walkthroughs of the facility. |

| 4 | Review Product Compliance & Certifications | Confirm adherence to international standards (e.g., REACH, CPSIA, ISO 9001). Essential for EU/US market entry. |

| 5 | Evaluate Sample Quality | Order a pre-production sample (PP sample) with your specifications. Assess stitching, materials, hardware, and packaging. |

| 6 | Check References & Client Portfolio | Request 2–3 verifiable client references. Contact them to assess reliability, communication, and on-time delivery performance. |

| 7 | Assess Communication & Responsiveness | Evaluate clarity, language proficiency, and response time. A reliable partner responds within 24 business hours. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., leather goods production) | Lists trading, import/export, or distribution |

| Facility Access | Offers live video tours of production lines, cutting, stitching, QC stations | Hesitant to show production; may redirect to “partner” factories |

| Pricing Structure | Lower MOQs possible; direct cost breakdown (material, labor, overhead) | Higher unit prices; vague cost structure |

| Lead Times | Can control production schedule; offers precise timelines | Dependent on third-party factories; longer or uncertain lead times |

| Customization Capability | Offers OEM/ODM with in-house design and mold-making | Limited customization; relies on existing stock or supplier capabilities |

| Website & Marketing | Focuses on machinery, R&D, factory certifications | Showcases multiple unrelated product categories (e.g., handbags, electronics, apparel) |

✅ Pro Tip: Use China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn) to verify the business license and confirm the registered scope of operations.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor exploitation, or scam | Benchmark against industry averages (e.g., PU handbag MOQ 500 pcs: $3–$8/unit) |

| No Physical Address or Factory Photos | Likely a front company or trading intermediary | Demand a virtual tour or hire a local inspector |

| Refusal to Sign NDA or Contract | Lack of professionalism; IP theft risk | Use a bilingual contract with clear IP, payment, and QC clauses |

| Pressure for Full Upfront Payment | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication | Poor project management; delivery delays | Assign a dedicated sourcing agent or use a managed sourcing platform |

| No MOQ Flexibility | Suggests reliance on third-party inventory | Negotiate tiered pricing based on volume |

| Poor Quality Samples | Indicates final goods will underperform | Reject and request corrective actions or source alternatives |

Best Practices for Risk Mitigation

- Use Escrow Services: Leverage Alibaba Trade Assurance or third-party escrow for payment protection.

- Implement QC Protocols: Schedule pre-shipment inspections (PSI) at 100% or AQL 2.5 level.

- Engage a Local Sourcing Agent: For complex orders, use a vetted agent to manage logistics, language, and compliance.

- Start Small: Begin with a trial order (≤500 units) before scaling.

Conclusion

Sourcing cheap wholesale handbags from China can deliver significant cost savings—but only when paired with rigorous due diligence. Prioritize transparency, verification, and quality control over initial price alone. By distinguishing true manufacturers from intermediaries and recognizing red flags early, procurement managers can build reliable, scalable supply chains that support brand integrity and profitability.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Optimization | China Sourcing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Handbag Procurement from China

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Time-Cost Imperative in Handbag Sourcing

Global procurement managers face unprecedented pressure to balance cost efficiency with supply chain resilience. Sourcing “cheap wholesale handbags from China” remains a strategic priority, yet unverified supplier engagement consumes 14.7 hours/week (per SourcifyChina 2025 Procurement Efficiency Index) in due diligence, quality disputes, and production recovery. Our Verified Pro List eliminates this friction through rigorously validated Tier-1 manufacturers, transforming sourcing from a cost center to a strategic advantage.

Why the SourcifyChina Verified Pro List Saves Critical Time & Capital

| Procurement Activity | Traditional Sourcing (Hours) | With SourcifyChina Pro List (Hours) | Time Saved/Order | Risk Mitigation |

|---|---|---|---|---|

| Supplier Vetting & Compliance | 22.5 | 1.2 | 21.3 hrs | 100% factory audits, ISO/BSCI certs verified |

| MOQ Negotiation & Contracting | 8.3 | 0.5 | 7.8 hrs | Pre-negotiated terms with $5k-$15k MOQ flexibility |

| Quality Assurance Setup | 15.0 | 2.0 | 13.0 hrs | Integrated 3rd-party QC (AQL 1.0) at no extra cost |

| Logistics Coordination | 6.2 | 0.8 | 5.4 hrs | FOB/Shenzhen pre-arranged; DDP options available |

| TOTAL PER ORDER CYCLE | 52.0 | 4.5 | 47.5 hrs (91% reduction) | Zero defective batch incidents in 2025 client cohort |

Source: SourcifyChina Client Analytics Dashboard (Jan 2025 – Dec 2025), 187 handbag procurement cycles tracked.

The SourcifyChina Advantage: Beyond “Cheap” to Sustainable Value

“Cheap” sourcing often implies hidden costs: defective goods, delayed shipments, and IP risks. Our Pro List delivers true cost leadership through:

✅ Pre-Vetted Factories Only: 27 handbag specialists with 5+ years export experience, 90%+ repeat client rate

✅ Transparent Cost Architecture: No hidden fees; landed costs optimized via consolidated shipping partnerships

✅ AI-Powered Matching: Algorithm aligns your specs (leather grade, hardware, packaging) with ideal suppliers in <24hrs

✅ Dedicated Sourcing Agent: Single point of contact managing production from sample approval to container loading

“SourcifyChina’s Pro List cut our supplier onboarding from 8 weeks to 5 days. We now source 37% below previous unit costs with zero quality rejections.”

— Procurement Director, EU Luxury Accessories Brand (2025 Client)

Call to Action: Secure Your Competitive Edge in 2026

Time is your scarcest resource. Every hour spent verifying suppliers is an hour not spent optimizing your portfolio. The SourcifyChina Verified Pro List for wholesale handbags isn’t just a supplier directory—it’s your insurance against operational disruption and margin erosion.

👉 Take the next step in 60 seconds:

1. Email [email protected] with subject line: “HANDBAG PRO LIST ACCESS – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for immediate priority onboarding (mention code: SC2026HAND)

Within 24 business hours, you’ll receive:

– Full Pro List access with factory profiles, capacity data & compliance docs

– Customized sourcing roadmap for your target price point (e.g., $3.50-$12.00/unit)

– No obligation consultation with your dedicated Sourcing Consultant

Your supply chain shouldn’t be a gamble.

While competitors waste cycles chasing unreliable suppliers, SourcifyChina clients execute with confidence—turning procurement into a profit center. Initiate your risk assessment today.

SourcifyChina: Precision Sourcing, Verified Results.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.