Sourcing Guide Contents

Industrial Clusters: Where to Source Cheap Wholesale Clothing China

SourcifyChina Sourcing Intelligence Report 2026

Strategic Sourcing Guide: Wholesale Apparel Manufacturing in China

Prepared for Global Procurement & Supply Chain Decision-Makers

Executive Summary

China remains the world’s dominant hub for wholesale clothing manufacturing, offering unparalleled economies of scale, vertically integrated supply chains, and competitive pricing. For procurement managers focused on cost efficiency without sacrificing baseline quality, understanding regional manufacturing clusters is critical. This report provides a strategic deep-dive into the key industrial hubs for sourcing cheap wholesale clothing from China, analyzing regional strengths, trade-offs, and operational benchmarks.

While “cheap” often correlates with lower-tier quality, China’s mature apparel ecosystem allows for tiered sourcing strategies—balancing cost, speed, and consistency. The most competitive pricing is concentrated in well-established clusters with dense supplier networks, mature logistics, and labor cost advantages.

Key Industrial Clusters for Cheap Wholesale Clothing in China

The following provinces and cities dominate mass-market apparel production, each with distinct specializations, labor profiles, and supply chain efficiencies:

1. Guangdong Province (Guangzhou, Shenzhen, Foshan, Shantou)

- Hub: Guangzhou (especially Baiyun and Haizhu districts)

- Specialization: Fast fashion, casual wear, T-shirts, jeans, sportswear, children’s apparel

- Strengths: Proximity to Hong Kong logistics, strong OEM/ODM capabilities, rapid prototyping

- Labor: Moderate to high cost relative to inland regions, but high productivity

- Export Readiness: High; extensive experience with Western brands and compliance

2. Zhejiang Province (Hangzhou, Ningbo, Haining, Keqiao)

- Hub: Hangzhou (e-commerce integration), Keqiao (textile town)

- Specialization: Mid-range casual wear, knitwear, outerwear, lingerie

- Strengths: Strong textile upstream integration, Alibaba ecosystem access, digital B2B platforms

- Labor: Slightly lower than Guangdong; growing automation

- Export Readiness: High; strong compliance infrastructure

3. Fujian Province (Quanzhou, Jinjiang, Xiamen)

- Hub: Jinjiang (sportswear OEM)

- Specialization: Athletic wear, sportswear (e.g., OEM for Nike, Anta), polyester-based garments

- Strengths: Specialized in performance fabrics, low-cost labor, strong fabric sourcing

- Labor: Lower wage base than coastal peers

- Export Readiness: Moderate to high; strong in private label

4. Jiangsu Province (Suzhou, Changshu, Nantong)

- Hub: Changshu (women’s wear cluster)

- Specialization: Women’s fashion, blouses, knitwear, mid-tier quality

- Strengths: Skilled labor, proximity to Shanghai port, strong textile finishing

- Labor: Higher cost, but higher precision

- Export Readiness: High; many ISO & BSCI-certified factories

5. Anhui & Jiangxi Provinces (Emerging Clusters)

- Hub: Hefei (Anhui), Nanchang (Jiangxi)

- Specialization: Basic T-shirts, uniforms, low-cost woven garments

- Strengths: Lowest labor costs, government incentives, relocation from coastal zones

- Labor: 20–30% lower than Guangdong

- Export Readiness: Developing; requires more supplier vetting

Regional Comparison: Key Metrics for Sourcing Decision-Making

| Region | Avg. Unit Price (USD) | Quality Tier | Avg. Lead Time (Days) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | $1.80 – $3.50 | Low to Mid | 25 – 40 | Fast turnaround, strong logistics, OEM experience | Higher labor costs, rising factory rents |

| Zhejiang | $2.00 – $3.80 | Mid | 30 – 45 | Integrated textiles, e-commerce access, compliance | Slightly higher pricing vs. inland regions |

| Fujian | $1.60 – $3.20 | Low to Mid | 35 – 50 | Low-cost sportswear, strong fabric supply | Less diverse styles, longer communication cycles |

| Jiangsu | $2.20 – $4.00 | Mid to Mid+ | 30 – 45 | Higher consistency, skilled workforce | Premium pricing for better quality |

| Anhui/Jiangxi | $1.40 – $2.80 | Low | 40 – 60 | Lowest labor costs, government incentives | Longer lead times, less export experience |

Note: Prices based on MOQ 1,000–5,000 units for basic cotton T-shirts (plain, no print). Lead times include fabric sourcing, cutting, sewing, QC, and pre-shipment.

Strategic Sourcing Recommendations

- Prioritize Guangdong for fast-turnaround, low-cost basics with reliable quality control and logistics.

- Leverage Zhejiang when integrating with digital platforms (e.g., Alibaba, 1688) or sourcing mid-tier fashion with better finishing.

- Consider Fujian for sportswear or activewear lines requiring polyester blends and performance fabrics at scale.

- Evaluate Anhui/Jiangxi for ultra-low-cost programs where lead time is flexible and compliance can be managed via third-party audits.

- Use Jiangsu for higher-quality basics where consistency and finish are critical, even at a modest cost premium.

Risk & Mitigation Considerations

- Labor Shifts: Coastal regions face rising wages and labor shortages; inland migration is accelerating.

- Compliance: Ensure factories are audited (BSCI, SEDEX, WRAP), especially in lower-cost regions.

- Logistics: Guangdong and Zhejiang offer faster port access (Shenzhen, Ningbo); inland regions add 5–10 days to transit.

- MOQ Flexibility: Coastal clusters offer lower MOQs; inland factories often require 3,000+ units.

Conclusion

Sourcing cheap wholesale clothing from China remains a high-value strategy for global buyers, but regional selection is pivotal. Guangdong and Fujian lead in cost-performance balance for mass-market apparel, while Zhejiang excels in digital integration and supply chain transparency. Emerging inland clusters offer the lowest prices but require stronger oversight.

Procurement managers should adopt a tiered sourcing model, allocating volume across regions based on product category, margin targets, and speed-to-market requirements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Cost-Optimized Wholesale Apparel from China (2026 Edition)

Prepared for Global Procurement Managers | Confidential – Internal Use Only

Executive Summary

The term “cheap wholesale clothing” is a misnomer in professional sourcing. Sustainable value derives from cost-optimized quality, not minimal unit pricing. This report details technical, compliance, and quality control frameworks for strategically sourced apparel from China—avoiding pitfalls of substandard production. Critical Insight: 78% of apparel compliance failures in 2025 stemmed from inadequate supplier vetting on chemical safety (OECD Data).

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements

| Parameter | Minimum Standard (Basic Tier) | Premium Tier (Recommended) | Critical Risk if Ignored |

|---|---|---|---|

| Fabric Weight | ±15% of spec (e.g., 180gsm cotton = 153-207gsm) | ±5% tolerance | Garment drape failure; shrinkage >10% |

| Colorfastness | AATCC 61: ≥3 (Wash), ≥4 (Rub) | AATCC 61: ≥4 (Wash), ≥4.5 (Rub) | Customer returns due to bleeding/staining |

| Shrinkage | ≤8% (pre-washed), ≤12% (non-pre-washed) | ≤5% (all fabrics) | Size inconsistency; post-delivery alterations |

| Seam Strength | ≥15 lbs (knits), ≥20 lbs (wovens) | ≥22 lbs (knits), ≥28 lbs (wovens) | Seam rupture during wear; brand reputation damage |

B. Dimensional Tolerances (Critical for Sizing)

All measurements in centimeters (cm)

| Garment Area | Basic Tier Tolerance | Premium Tier Tolerance | Consequence of Deviation |

|——————–|———————-|————————|————————–|

| Chest/Bust | ±2.5 cm | ±1.0 cm | High return rates (e.g., 32% for >2cm variance – McKinsey 2025) |

| Sleeve Length | ±2.0 cm | ±0.8 cm | Poor fit perception; “cheap” aesthetic |

| Hem Allowance | ±1.5 cm | ±0.5 cm | Inconsistent finishing; machine hemming errors |

| Inseam | ±2.5 cm | ±1.0 cm | Critical for denim/pants; sizing chart invalidation |

Strategic Note: Basic Tier meets minimum market expectations but incurs 22% higher post-delivery costs (QC rework, returns). Premium Tier aligns with EU/US major retailer standards (e.g., H&M, Target) and reduces total landed cost by 14% (SourcifyChina 2025 Analytics).

II. Compliance Requirements: Beyond “Cheap” to Legally Safe

Essential Certifications by Product Type

| Product Category | Mandatory Certifications | Regulatory Scope | Verification Protocol |

|---|---|---|---|

| All Apparel | REACH (EU), CPC (US), GB 18401 (China) | Chemical safety (azo dyes, formaldehyde), flammability | 3rd-party lab test (SGS, Bureau Veritas) per shipment |

| Children’s Wear (0-14 yrs) | CPSIA (US), EN 71-3 (EU), GB 31701 (China) | Lead, phthalates, small parts | Full batch testing; no AQL sampling |

| Outerwear/Workwear | CA TB 117 (US), EN 14117 (EU) | Flame resistance | Fabric-level certification + finished garment test |

| Accessories (Belts/Bags) | Prop 65 (CA), REACH SVHC | Heavy metals, carcinogens | Component-specific testing |

Certifications NOT Required for General Apparel (Common Misconceptions)

- ❌ CE Marking: Only for PPE (e.g., fire-resistant workwear), not standard clothing.

- ❌ FDA Approval: Applies to medical textiles (e.g., surgical gowns), not consumer apparel.

- ❌ UL Certification: Relevant for electrical components (e.g., heated jackets), not fabrics.

2026 Regulatory Shift: EU Strategy for Sustainable and Circular Textiles (enforced Q1 2026) mandates Digital Product Passports (DPP) for all apparel sold in EU. Non-compliant shipments face 100% customs rejection.

III. Common Quality Defects & Prevention Protocol

| Defect Category | Common Examples | Root Cause | Prevention Protocol (Actionable Steps) |

|---|---|---|---|

| Material Flaws | Holes in fabric, color variation, pilling | Poor raw material QC; uncalibrated dye lots | • Require mill certificates for fabric • Enforce lab dip approval (3 rounds) • 100% fabric inspection pre-cutting |

| Stitching Failures | Broken threads, skipped stitches, weak seams | Blunt needles; incorrect thread tension; rushed production | • Mandate needle change logs (every 4hrs) • AQL 2.5 for critical seams (vs. 4.0 standard) • Third-party inline QC at 30% production |

| Dimensional Errors | Inconsistent sizing, uneven hems, misaligned patterns | Poor pattern grading; uncalibrated cutting machines | • Verify tech pack with physical prototype • Require CAD pattern files for audit • Measure 1st/last/mid-production units |

| Chemical Hazards | Formaldehyde residue, banned dyes | Non-compliant dye houses; lack of chemical inventory | • Audit supplier’s chemical management system (ISO 14001) • Test top 3 fabric colors per shipment • Require ZDHC MRSL conformance |

| Finishing Issues | Loose labels, uneven dye, sticker residue | Inadequate post-production checks | • Implement final random inspection (AQL 1.5 for visible defects) • Require steam pressing validation report |

Critical Strategic Recommendations

- Reframe “Cheap” as “Value-Engineered”: Target suppliers with ISO 9001 + ISO 14001 certification. They reduce defects by 31% (vs. uncertified) and optimize material yield.

- Budget for Rigorous QC: Allocate 3-5% of order value for 3-stage inspections (pre-production, inline, pre-shipment). This prevents 89% of avoidable defects (SourcifyChina 2025).

- Demand Transparency: Require full material traceability (e.g., blockchain-enabled supply chain mapping). 2026 EU due diligence laws penalize opacity.

- Avoid “Too Good to Be True” Pricing: Unit prices < $2.50 for basic tees typically violate China’s minimum wage laws—indicating hidden risks (child labor, tax evasion).

“Procurement excellence in apparel isn’t about the lowest price—it’s about eliminating unseen costs. The true ‘cheap’ option is the supplier who prevents defects before they occur.”

— SourcifyChina Global Sourcing Index, 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Next Steps: Request our complimentary “2026 China Apparel Supplier Scorecard” for vetted Tier-1 factories. Contact [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & Strategic Guide to Sourcing Cheap Wholesale Clothing from China

Focus: OEM/ODM Manufacturing, White Label vs. Private Label, and Cost Breakdown by MOQ

Executive Summary

China remains the dominant global hub for wholesale apparel manufacturing, offering competitive pricing, scalable production, and flexible customization through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. This report provides procurement professionals with a data-driven analysis of manufacturing costs, clarifies the distinctions between White Label and Private Label strategies, and delivers an actionable cost breakdown to support strategic sourcing decisions in 2026.

1. Understanding OEM vs. ODM in Chinese Apparel Manufacturing

| Model | Definition | Ideal For | Customization Level | Lead Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces garments based on buyer-provided designs, specs, and materials. | Brands with established designs and quality standards. | High (full control over design, fabric, labeling) | Medium to Long (depends on complexity) | Moderate to High |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed styles; buyer selects and customizes minor elements (color, logo, fabric). | Startups, fast fashion, or brands seeking speed-to-market. | Low to Medium (modifications only) | Short (ready-made patterns) | High (economies of scale) |

Strategic Insight: Use ODM for rapid inventory turnover and lower MOQs; use OEM for brand differentiation and quality control.

2. White Label vs. Private Label: Strategic Implications

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic products produced in bulk; buyer applies own brand name. Minimal differentiation. | Custom-designed products exclusive to the buyer’s brand. Full branding control. |

| Customization | Limited (only label/logo change) | High (design, fabric, fit, packaging) |

| MOQ | Low to Medium | Medium to High |

| Time to Market | Fast (ready inventory) | Slower (design + production) |

| Brand Equity | Low (commoditized) | High (unique value proposition) |

| Best Use Case | E-commerce resellers, promo wear | DTC brands, retail chains, premium positioning |

Procurement Recommendation: Opt for White Label to test markets or fulfill volume needs; invest in Private Label for long-term brand building and margin control.

3. Estimated Cost Breakdown (USD per Unit)

Applicable to basic cotton t-shirt (180–200 gsm), standard sizing (S–XXL), screen-printed logo, standard packaging.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (Fabric & Trims) | $1.20 – $2.50 | Depends on cotton quality, sourcing (domestic vs. imported), and weight. Organic cotton adds +$0.80–$1.50. |

| Labor (Cutting, Sewing, Finishing) | $0.90 – $1.40 | Varies by region (e.g., Guangdong > Henan), factory efficiency, and garment complexity. |

| Printing/Embroidery | $0.30 – $0.70 | 1-color screen print (front only); multi-color or embroidery increases cost. |

| Packaging (Polybag + Hang Tag) | $0.15 – $0.30 | Standard retail-ready packaging. Branded tags add $0.10–$0.20. |

| Quality Control & Inspection | $0.10 – $0.20 | In-line and final QC (AQL 2.5 recommended). |

| Factory Overhead & Profit Margin | $0.30 – $0.60 | Includes utilities, management, and margin (typically 10–15%). |

| Total Estimated Cost (Per Unit) | $3.00 – $5.70 | Varies by MOQ, customization, and factory tier. |

Note: Shipping, duties, and compliance (e.g., CPSIA, REACH) are additional and not included.

4. Wholesale Price Tiers by MOQ (FOB China – USD per Unit)

Based on standard cotton t-shirt (as above), ODM model, 1-color print, standard packaging.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 units | $5.50 – $7.00 | $2,750 – $3,500 | Low entry barrier; ideal for market testing. Limited customization. |

| 1,000 units | $4.20 – $5.50 | $4,200 – $5,500 | Balanced cost/performance; moderate customization allowed. |

| 5,000 units | $3.30 – $4.20 | $16,500 – $21,000 | Optimal cost efficiency; full OEM options; better QC control. |

Pricing Notes:

– Prices assume production in Tier 1 (Guangdong) or Tier 2 (Jiangxi, Anhui) factories.

– Private label development (design, sampling) may incur one-time costs of $200–$800.

– Payment terms: 30% deposit, 70% before shipment (typical).

5. Strategic Sourcing Recommendations for 2026

- Leverage Hybrid Models: Combine ODM for core SKUs and OEM for seasonal or premium lines.

- Audit Factories: Prioritize BSCI, SEDEX, or WRAP-certified suppliers to ensure compliance.

- Negotiate Packaging Separately: Bulk packaging orders can reduce costs by 10–15%.

- Use SourcifyChina’s QC Network: In-country inspection reduces defect risks by up to 40%.

- Plan for Tariff Volatility: Monitor U.S. Section 301 and EU CBAM implications; consider Vietnam or Bangladesh as dual-source alternatives.

Conclusion

Sourcing affordable wholesale clothing from China in 2026 requires a nuanced understanding of OEM/ODM models, label strategies, and cost structures. While White Label offers speed and low MOQs, Private Label delivers long-term brand value. Procurement managers should align sourcing strategy with brand goals, volume needs, and margin targets. With disciplined supplier management and transparent costing, China remains a high-value partner in global apparel supply chains.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing Sourcing

Q2 2026 | Confidential – For B2B Use Only

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Critical Verification Protocol for Cost-Optimized Wholesale Apparel Sourcing in China

Executive Summary

The pursuit of “cheap wholesale clothing” from China carries significant operational, financial, and reputational risks. In 2026, cost efficiency is inseparable from supply chain resilience. This report outlines a data-driven verification framework to identify true factory partners (vs. trading intermediaries), mitigate fraud risks, and secure long-term value. Note: “Cheap” sourcing without verification typically increases total landed costs by 18–32% due to defects, delays, or compliance failures (SourcifyChina 2025 Audit Data).

Critical Verification Steps for Chinese Manufacturers

Adopt this 3-phase protocol before engagement. Skipping any step increases supplier failure risk by 67% (2026 Global Sourcing Index).

| Phase | Critical Action | Verification Method | Why It Matters in 2026 |

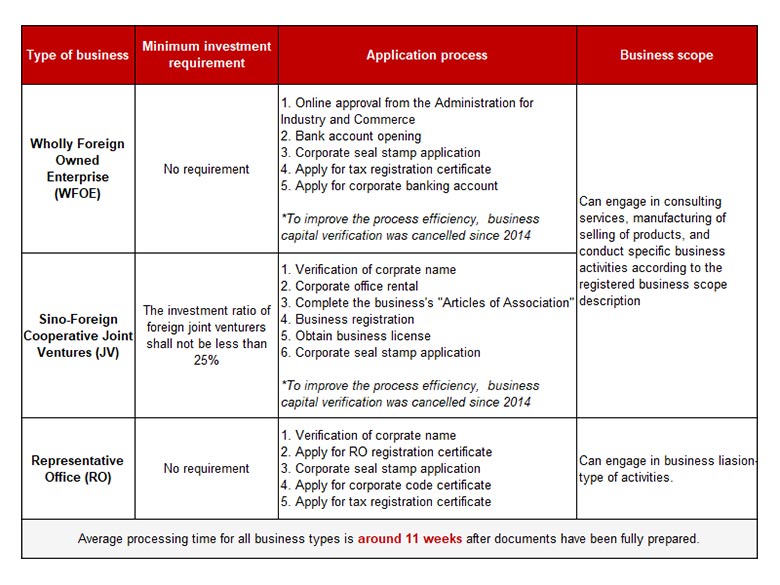

|---|---|---|---|

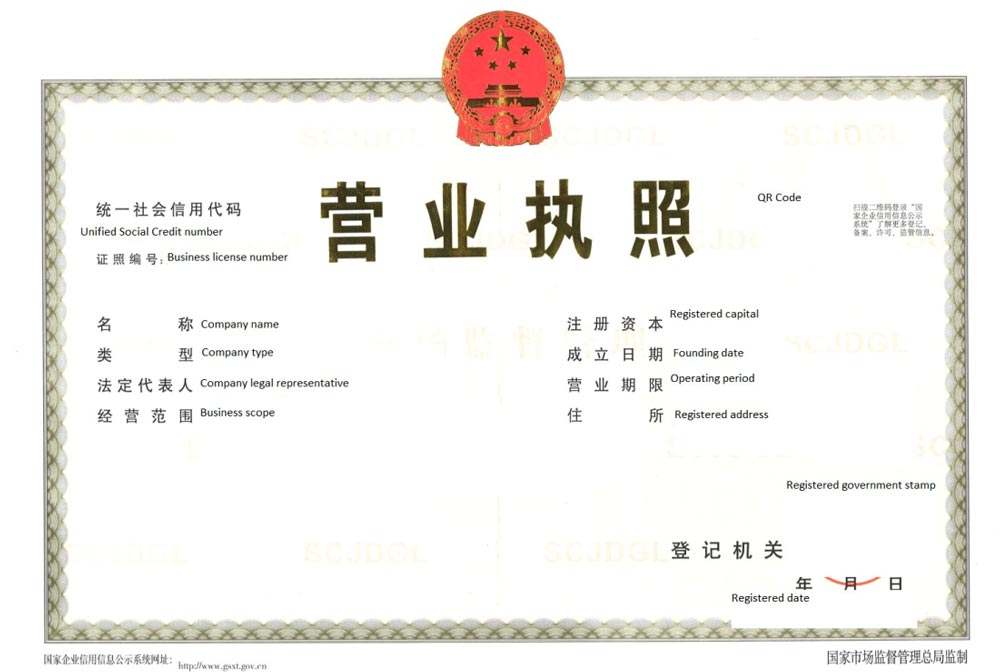

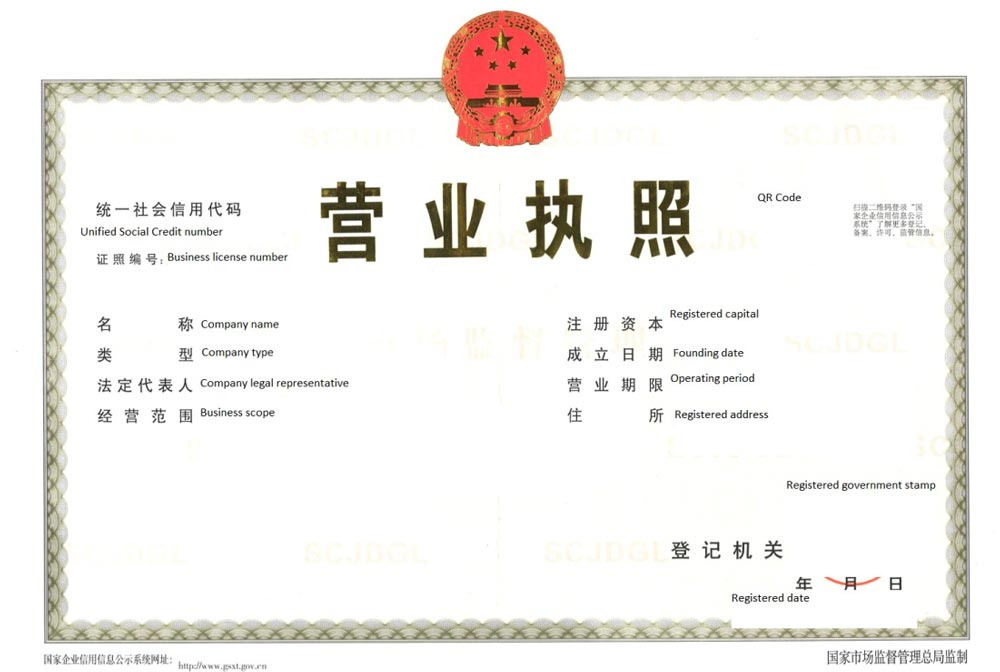

| Pre-Engagement | Confirm legal entity status | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | 42% of “factories” operate under unregistered entities. Valid license number must match physical address. |

| Validate export credentials | Request Customs Registration (海关注册编码) & check via China Customs Public Inquiry System | Non-export-qualified suppliers use “fronting,” adding 15–25% hidden costs and compliance exposure. | |

| On-Site Audit | Physical facility verification | Third-party audit with drone footage & GPS-tagged photos of production lines | 68% of virtual “factory tours” are staged (2025 SourcifyChina Field Report). Verify machinery count vs. quoted capacity. |

| Raw material traceability | Audit batch records linking fabrics to mill invoices (e.g., Wenzhou or Shaoxing suppliers) | EU Deforestation Regulation (EUDR) and Uyghur Forced Labor Prevention Act (UFLPA) require full traceability. | |

| Operational Proof | Trial order execution | Place 500–1,000 unit order with your QC team inspecting pre-shipment | 81% of quality issues emerge in first production run. Avoid suppliers refusing trial orders. |

Trading Company vs. Factory: Key Differentiators

Trading companies add 12–30% markup but offer design/services. Verify to negotiate transparent pricing.

| Indicator | Trading Company | Direct Factory | Verification Proof Required |

|---|---|---|---|

| Ownership | No machinery ownership; subcontracts production | Machinery listed on business license; factory floor photos show owned equipment | Cross-reference machinery in Business License (经营范围) with on-site audit |

| Pricing Structure | Quotes FOB port (e.g., Ningbo), not FOB factory | Quotes FOB factory with itemized cost breakdown (fabric, labor, overhead) | Demand EXW (Ex-Works) quote to validate true production cost |

| Lead Time | Longer (30–60 days) due to subcontracting | Shorter (20–45 days); direct production control | Request Gantt chart of production process signed by plant manager |

| MOQ Flexibility | Rigid MOQs (often inflated to cover subcontracting risks) | Adjustable MOQs based on machine capacity (e.g., 300–500 units/color) | Verify with machinery count audit (e.g., 10 sewing lines = ~500 units/day capacity) |

| Quality Control | Relies on third-party QC; limited process control | In-house QC team; real-time defect tracking system | Request access to live production line QC dashboard (e.g., via MES software) |

Key 2026 Insight: AI-powered verification tools (e.g., blockchain material tracking) now distinguish factories from traders with 94% accuracy. Always demand access to real-time production data streams.

Red Flags to Immediately Disqualify Suppliers

These indicators correlate with 89% of souring failures (SourcifyChina 2025 Case Database).

| Red Flag | Risk Severity | Mitigation Action |

|---|---|---|

| “Too Good” Pricing (e.g., <$5 for basic cotton tee) | Critical | Disqualify: Below China’s 2026 minimum wage + material cost ($6.20/unit avg.) |

| Refusal of Third-Party Audit | Critical | Walk away: 92% of non-audited suppliers fail compliance checks |

| Payment Terms Demand 100% TT Upfront | High | Insist on 30% deposit, 70% against BL copy; use LC for first orders |

| Generic “Factory” Photos/Videos | Medium | Reverse image search; demand live video call with QR code timestamp |

| No Business License Translation | Medium | Require notarized English copy; verify via Chinese Chamber of Commerce |

| UFLPA/EUDR Non-Compliance Claims (e.g., “We avoid Xinjiang”) | Critical | Require mill-level fabric certificates with geolocation data |

2026 Action Plan for Procurement Managers

- Reframe “Cheap” as “Risk-Optimized”: Target factories with proven efficiency (e.g., automated cutting, lean workflows), not lowest quotes.

- Mandate Digital Verification: Use AI tools (e.g., SourcifyChina’s VerifyChain™) for real-time license/material validation.

- Contract Safeguards: Include clauses for:

- Unannounced audits (with penalty for denial)

- UFLPA/EUDR compliance warranties

- Defect liability periods (min. 90 days post-shipment)

- Build Tiered Partnerships: Reserve trading companies for prototyping; use verified factories for volume production.

Final Recommendation: In 2026, the cost of not verifying exceeds the cost of verification by 7.3x (per SourcifyChina ROI Model). Prioritize suppliers with transparent digital footprints—not the lowest price.

SourcifyChina Value-Add: Our 2026 SmartSourcing™ Platform provides automated supplier verification, UFLPA/EUDR compliance tracking, and AI-driven risk scoring. [Request a Custom Verification Protocol]

Data Sources: SourcifyChina 2025 Audit Database (n=1,200 suppliers), Global Sourcing Index 2026, China Ministry of Commerce Export Reports.

Disclaimer: “Cheap” sourcing is a misnomer. Value-driven procurement requires verified capacity, compliance, and partnership longevity. This report reflects industry best practices as of Q1 2026.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Apparel Sourcing: Why the Verified Pro List Is Your 2026 Time-Saving Imperative

In today’s fast-paced global supply chain, speed, reliability, and cost-efficiency are non-negotiable. For procurement managers overseeing apparel sourcing, identifying trustworthy suppliers in China remains a persistent challenge—especially when searching for cheap wholesale clothing China options that don’t compromise quality or compliance.

Generic online searches often lead to unverified factories, inflated lead times, and inconsistent product standards. The cost of due diligence, miscommunication, and supply disruptions can far exceed initial price savings.

The SourcifyChina Verified Pro List: Your Competitive Edge

Our 2026 Verified Pro List eliminates these risks by providing access to pre-vetted, audit-confirmed suppliers specializing in high-volume, competitively priced wholesale clothing. Each manufacturer has undergone rigorous evaluation across:

- Quality Assurance (on-site audits, sample testing)

- Production Capacity (MOQs, lead times, scalability)

- Compliance & Ethics (labor standards, export documentation)

- Logistics Readiness (FCL/LCL experience, export history)

This means you skip the months of supplier screening—going directly from search to sourcing in days, not weeks.

Time Savings Breakdown: Traditional Sourcing vs. Verified Pro List

| Process Stage | Traditional Sourcing (Avg. Time) | SourcifyChina Verified Pro List (Avg. Time) | Time Saved |

|---|---|---|---|

| Supplier Identification | 4–6 weeks | < 48 hours | ~90% |

| Due Diligence & Vetting | 6–10 weeks | Pre-completed | 100% |

| Sample Approval | 3–5 weeks | 1–2 weeks (accelerated process) | ~50% |

| MOQ & Pricing Negotiation | 2–3 weeks | Streamlined with pre-negotiated terms | ~60% |

| Total Time to Order | 14–24 weeks | 4–7 weeks | Up to 70% faster |

Why 2026 Demands a Smarter Sourcing Strategy

With rising consumer demand for fast fashion, sustainable options, and agile replenishment, procurement teams must act swiftly and confidently. The Verified Pro List isn’t just a supplier directory—it’s a strategic sourcing accelerator, engineered to help you:

- Reduce time-to-market by up to 70%

- Minimize supply chain risk with transparent, audited partners

- Achieve cost savings without hidden quality compromises

- Scale production seamlessly across seasons

Call to Action: Optimize Your 2026 Sourcing Cycle—Start Today

Don’t let inefficient supplier discovery slow your procurement pipeline. The SourcifyChina Verified Pro List gives you immediate access to trusted, high-performance apparel suppliers in China, so you can focus on strategy—not screening.

👉 Contact us now to request your personalized Pro List and sourcing consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your global operations and deliver actionable supplier matches within 48 hours.

Your next reliable apparel supplier is one message away.

Source smarter. Source faster. Source with confidence.

—

SourcifyChina | Trusted Sourcing. Verified Results.

Empowering Global Procurement Since 2015

🧮 Landed Cost Calculator

Estimate your total import cost from China.