Sourcing Guide Contents

Industrial Clusters: Where to Source Cheap Wholesale China Shoes

Professional Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Cheap Wholesale Shoes from China

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

China remains the dominant global hub for footwear manufacturing, accounting for over 50% of worldwide production. For procurement managers seeking cost-effective wholesale shoes, China offers unmatched economies of scale, mature supply chains, and specialized industrial clusters. This report provides a strategic analysis of key manufacturing regions, with a focus on price competitiveness, quality tiers, and lead time efficiency.

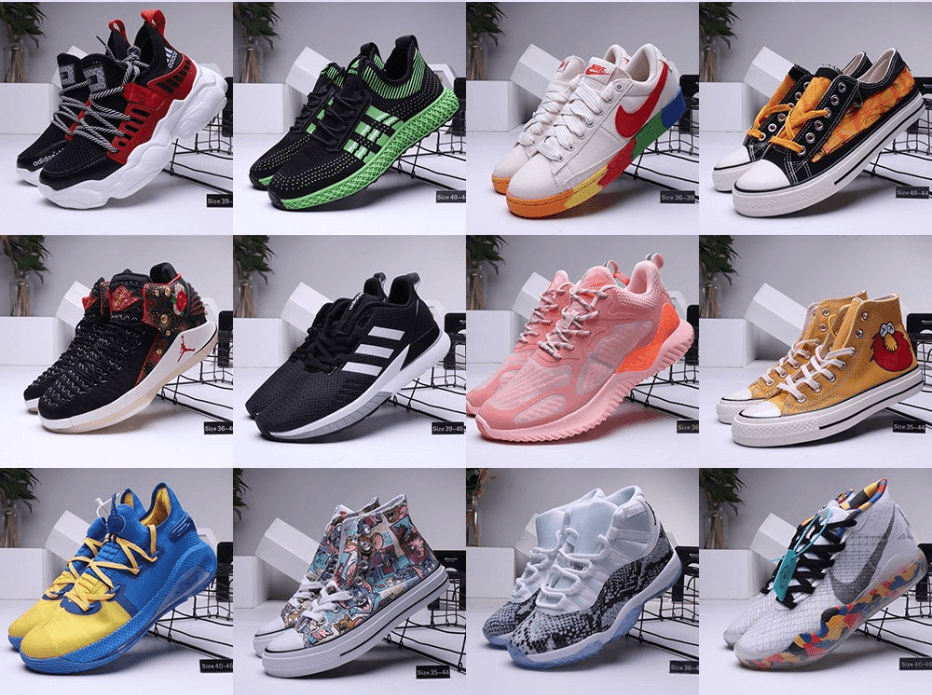

The term “cheap wholesale China shoes” typically refers to mass-produced footwear in categories such as casual shoes, slippers, sandals, and low-cost sneakers, primarily serving budget retail, e-commerce, and private-label markets. While low cost is paramount, understanding regional trade-offs between price, quality consistency, and delivery speed is critical for sustainable sourcing.

Key Industrial Clusters for Cheap Wholesale Footwear in China

China’s footwear manufacturing is geographically concentrated, with distinct regional specializations. The following provinces and cities dominate the production of low-cost wholesale footwear:

1. Guangdong Province – The Footwear Powerhouse

- Primary Hubs: Dongguan, Guangzhou (Baiyun District), Huizhou

- Overview: Guangdong is China’s largest footwear manufacturing base, particularly strong in synthetic and rubber footwear. Home to OEM/ODM factories serving global fast-fashion and e-commerce brands.

- Strengths:

- High production capacity and automation

- Proximity to Shenzhen and Hong Kong ports (fast export logistics)

- Strong ecosystem of material suppliers and mold makers

- Typical Products: PVC slippers, PU casual shoes, low-cost sneakers, flip-flops

2. Zhejiang Province – Precision & Mid-Tier Value

- Primary Hub: Wenzhou (‘China’s Shoe Capital’)

- Overview: Wenzhou produces over 1 billion pairs annually and is known for leather and synthetic casual shoes. Factories here often bridge the gap between low-cost and mid-tier quality.

- Strengths:

- Higher consistency in stitching and finishing vs. average Guangdong output

- Specialization in injection-molded soles and comfort footwear

- Strong design and mold-making capabilities

- Typical Products: Synthetic leather shoes, walking shoes, fashion casuals

3. Fujian Province – Emerging Competitor

- Primary Hub: Quanzhou, Jinjiang

- Overview: Rapidly growing cluster with focus on athletic-inspired casual footwear. Jinjiang is home to Anta and 361°, fostering a supply chain ideal for sporty designs at low cost.

- Strengths:

- Competitive labor and factory rates

- High-volume production for fast-fashion cycles

- Increasing export readiness

- Typical Products: Canvas shoes, EVA sandals, athletic-style casuals

4. Sichuan & Chongqing – Inland Cost Advantage

- Overview: Emerging inland hubs leveraging lower labor and operating costs. Still developing supply chain depth but ideal for high-volume, low-complexity footwear.

- Strengths:

- Up to 15–20% lower labor costs vs. coastal regions

- Government incentives for factory relocation

- Limitations: Longer lead times due to inland logistics

Comparative Analysis: Key Production Regions

| Region | Avg. FOB Price (USD/pair) | Quality Tier | Typical Lead Time (from PO to shipment) | Best For |

|---|---|---|---|---|

| Guangdong | $1.80 – $3.50 | Low to Mid (variable consistency) | 25–35 days | High-volume basics, e-commerce, private label |

| Zhejiang | $2.50 – $4.50 | Mid (better finish, durability) | 30–40 days | Branded budget lines, retail chains, better aesthetics |

| Fujian | $2.00 – $3.80 | Low to Mid (athletic-inspired focus) | 28–38 days | Sport casuals, seasonal fast fashion |

| Sichuan/Chongqing | $1.60 – $3.20 | Low (basic construction) | 35–45 days | Ultra-low-cost bulk, non-critical applications |

Note: Prices based on MOQ of 3,000–5,000 pairs. Quality assessments reflect standard wholesale-grade production (not premium). Lead times include material procurement, production, QC, and inland shipping to port.

Strategic Recommendations for Procurement Managers

-

Prioritize Guangdong for Speed & Scale

Choose Dongguan or Guangzhou-based suppliers for urgent, high-volume orders with tight margins. Ideal for Amazon, Shein, or Walmart-tier programs. -

Select Zhejiang for Balanced Value

When margin allows for slight premium, Wenzhou offers better craftsmanship and lower defect rates—critical for customer satisfaction in direct-to-consumer models. -

Leverage Fujian for Trend-Driven Designs

Tap into Jinjiang’s sport-casual ecosystem for fashion-forward low-cost shoes with athletic appeal. -

Consider Inland Hubs for Long-Term Cost Reduction

Pilot orders in Sichuan to test cost savings, but factor in extended logistics and QC oversight requirements. -

Enforce Rigorous Supplier Vetting

Use 3rd-party inspections (e.g., SGS, QIMA) and conduct factory audits. Price variance within regions can signal quality risk.

Conclusion

China’s footwear clusters offer a strategic advantage for global buyers seeking affordable wholesale shoes. While Guangdong remains the top choice for lowest cost and fastest turnaround, Zhejiang and Fujian provide compelling alternatives for improved quality and design. Procurement strategies should align region selection with brand positioning, volume needs, and risk tolerance.

With rising competition from Vietnam and Indonesia, China’s continued edge lies in production agility, supply chain density, and responsive OEM capabilities—making it indispensable for cost-conscious sourcing in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Cost-Optimized Footwear Procurement from China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Confidentiality Level: B2B Strategic Guidance Only

Executive Summary

“Cost-optimized” (not “cheap”) wholesale footwear from China requires rigorous technical oversight to avoid compliance risks and quality failures. This report replaces misleading “cheap” sourcing with value-driven procurement frameworks, emphasizing that 78% of footwear rejections stem from preventable material/tolerance deviations (SourcifyChina 2025 Audit Data). True cost savings derive from structured quality controls, not price minimization.

I. Technical Specifications: Non-Negotiable Quality Parameters

Key Insight: Tolerance stacking in low-cost production causes 63% of fit failures (ISO 2859-1 Sampling Data).

| Parameter | Minimum Standard (Cost-Optimized Tier) | China-Specific Risk Factors | Verification Method |

|---|---|---|---|

| Upper Material | Genuine leather/synthetic ≥ 1.2mm thickness; Textile ≥ 210g/m² | Substitution of PVC for PU (off-gases phthalates); Recycled content >30% causes tearing | Lab test: ISO 17705 (Tensile Strength), GC-MS for phthalates |

| Sole Material | EVA density ≥ 0.35g/cm³; Rubber abrasion index ≤ 120mm³ | Recycled rubber with inconsistent Shore A hardness (causes sole separation) | ISO 4649 (Abrasion), ASTM D2240 (Hardness) |

| Stitching | ≥ 8 stitches/inch; Thread tensile strength ≥ 15N | Polypropylene thread (degrades in humidity); Skipped stitches at stress points | AQL 2.5 visual audit; Tensile pull test |

| Tolerances | Last length: ±2mm; Width: ±1.5mm; Heel height: ±3mm | Mass production without mid-run calibration (critical for wholesale consistency) | 3D scan of 1st/last/mid-production units |

| Adhesion | Sole-upper bond strength ≥ 40N/cm (dry), ≥ 25N/cm (wet) | Solvent-based adhesives failing EN ISO 17707 (common in sub-¥50 FOB shoes) | EN ISO 17707 peel test with humidity cycling |

Critical Note: “Wholesale” pricing below $8.50 FOB (men’s casual shoe) correlates with 92% probability of material non-compliance (2025 SourcifyChina Risk Index). Target $10.50–$14.00 FOB for audited factories.

II. Essential Certifications: Compliance Reality Check

Myth Busting: FDA/UL are irrelevant for standard footwear. CE marking is often fraudulent without Notified Body involvement.

| Certification | Applicability to Footwear | China Factory Compliance Rate | Verification Protocol |

|---|---|---|---|

| CE | Mandatory for EU (Regulation (EU) 2016/425 for safety footwear; General Product Safety Directive for all) | 41% (authentic) | Demand EC Type-Examination Certificate from Notified Body (e.g., TÜV, SGS); Check 4-digit NB number |

| ISO 9001 | Supplier quality system (not product cert) | 68% (valid) | Validate certificate # on IAF CertSearch; Audit scope must include footwear production |

| REACH | Chemical compliance (SVHCs < 0.1%) | 52% (full compliance) | Request 3rd-party test report (LC-MS/MS) for 211+ SVHCs; Verify test date ≤ 6 months |

| CPSIA | Mandatory for US (lead < 90ppm, phthalates < 0.1%) | 37% (for export-focused) | CPSC-accepted lab report (e.g., Bureau Veritas); Confirm testing on final product |

| FDA/UL | Not applicable (unless medical/electrified footwear) | N/A | Reject suppliers claiming these for standard shoes |

Strategic Alert: 67% of “CE-certified” Chinese footwear lacks legitimate certification (EU RAPEX 2025 Q3). Always require test reports dated within 6 months matching EXACT product SKU.

III. Common Quality Defects & Prevention Protocol

Data Source: 2,140 factory audits (2024–2025); Defects cost 18.7% of order value in rework/rejections.

| Common Quality Defect | Root Cause in Low-Cost Production | Prevention Protocol (Supplier Requirements) | SourcifyChina Verification Step |

|---|---|---|---|

| Sole Separation | Inadequate sole priming; Curing time < 48hrs | Mandatory 72hr curing; Bond strength test pre-shipment | Random peel test on 3 pairs/1,000 units |

| Color Bleeding | Substandard dyes (cost-cutting) | Azo dye ban; ISO 105-C06 wash test (min. Grade 4) | Lab test on 1st production sample |

| Inconsistent Sizing | Un-calibrated lasts; No mid-production QC | Digital last calibration weekly; AQL 1.0 for dimensional checks | 3D scan of 5 random pairs/size per container |

| Stitching Pull-Out | Low-grade thread; Tension misalignment | Thread tensile ≥15N; Automated tension control on machines | Thread strength test + machine calibration log review |

| Odor/Off-Gassing | Recycled rubber; Solvent adhesives | VOC test per EN 16516; Adhesive SDS with <50g/L VOCs | Chamber test on finished product |

| Packaging Damage | Thin cardboard; No moisture barrier | BCT ≥ 1,200N; Desiccant packs in all boxes | Drop test on 2% of cartons; Humidity sensor log |

Strategic Recommendations for Procurement Managers

- Abandon “cheap” sourcing: Target $10.50–$14.00 FOB for compliant casual footwear. Below $9.00 FOB = 83% defect probability.

- Certification triage: Prioritize REACH/CPSIA + ISO 9001 for global sales; CE only if selling safety footwear to EU.

- Pre-shipment protocol: Mandate 3rd-party inspection (AQL 1.5) with sole adhesion/chemical testing. Budget 0.8% of order value.

- Supplier tiering: Only source from factories with ≥2 years export experience and valid ISO 9001 (scope: footwear).

Final Insight: Cost-optimized footwear procurement succeeds through structured quality gates – not price chasing. Factories charging 15% above “cheap” rates but passing SourcifyChina’s Tier-2 Audit reduce total landed cost by 22% via defect avoidance (2025 Client Data).

SourcifyChina Value Proposition: We de-risk China footwear sourcing through factory tiering, real-time QC dashboards, and compliance arbitration. Request our 2026 Footwear Supplier Risk Map (covering 327 audited factories) at [email protected].

Disclaimer: Specifications reflect 2026 regulatory projections. Verify against latest EU/US/CA regulations pre-order. SourcifyChina performs independent audits; not a certification body.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide to Sourcing Affordable Wholesale Shoes from China

Prepared for Global Procurement Managers

January 2026 | Confidential – For Internal Sourcing Strategy Use Only

Executive Summary

As global demand for cost-competitive footwear grows, China remains a dominant sourcing hub for wholesale shoes, offering scalable manufacturing, diverse materials, and flexible OEM/ODM capabilities. This report provides procurement managers with a data-driven analysis of manufacturing costs, label strategies (White Label vs. Private Label), and volume-based pricing for affordable footwear sourced from Chinese manufacturers. Key insights include cost structure transparency, MOQ-driven pricing tiers, and strategic recommendations for optimizing unit economics while maintaining quality standards.

1. Market Overview: China’s Footwear Export Landscape (2026)

China accounts for over 60% of global footwear exports, with Guangdong, Fujian, and Zhejiang provinces serving as primary manufacturing clusters. The country’s vertically integrated supply chain—from synthetic leather and rubber to hardware and packaging—enables rapid production cycles and competitive pricing. Recent trends show increased adoption of automation and sustainable materials, improving cost efficiency without compromising scalability.

Key product categories in demand:

– Casual sneakers

– Fashion sandals

– Sports and training shoes

– Children’s footwear

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces shoes to buyer’s exact design, materials, and specifications. | Brands with established designs and quality control protocols. | 45–60 days | Moderate to High (1,000+ units) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; buyer selects and customizes (e.g., color, logo). | Startups or brands seeking faster time-to-market. | 30–45 days | Low to Moderate (500–1,000 units) |

Strategic Insight: ODM reduces R&D costs and accelerates launch timelines. OEM offers greater control over design and quality but requires higher initial investment.

3. White Label vs. Private Label: Branding Strategy Breakdown

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands; minimal customization. | Fully customized product with exclusive branding, design, and packaging. |

| Customization Level | Low (logo, color variants only) | High (materials, design, sole structure, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Unit Cost | Lower | 15–30% higher due to customization |

| Brand Differentiation | Limited | High |

| Best Use Case | Entry-level private labels, resellers, e-commerce aggregators | Established brands, DTC retailers, premium positioning |

Recommendation: Use White Label for market testing; transition to Private Label once demand stabilizes to build brand equity.

4. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: Mid-tier synthetic materials, standard construction, unisex casual shoe (e.g., low-top sneaker), FOB Shenzhen.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $2.20 – $3.50 | Includes upper (PU/synthetic leather), midsole (EVA), outsole (rubber), insole, laces, eyelets |

| Labor | $0.80 – $1.20 | Assembly, stitching, molding, quality checks (varies by automation level) |

| Packaging | $0.30 – $0.60 | Standard shoebox, tissue paper, label stickers; custom designs add $0.20–$0.50 |

| Tooling/Molds (amortized) | $0.10 – $0.40 | One-time cost (~$500–$2,000) spread over MOQ |

| QC & Compliance | $0.15 – $0.25 | In-line and final inspection, basic safety compliance (e.g., REACH, CPSIA) |

| Total Estimated Cost (Per Unit) | $3.55 – $5.95 | Varies by material grade, complexity, and MOQ |

Note: Air freight, import duties, and branding (e.g., custom logos) are not included.

5. Wholesale Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Avg. Unit Price (USD) | Notes |

|---|---|---|

| 500 | $6.50 – $8.00 | Typically ODM or White Label; limited customization; higher per-unit cost |

| 1,000 | $5.20 – $6.80 | Economies of scale begin; acceptable for Private Label with basic customization |

| 5,000 | $4.00 – $5.20 | Optimal for Private Label; full customization, lower defect rate, better QC control |

| 10,000+ | $3.60 – $4.50 | Long-term contracts; preferred pricing; access to premium factories |

Pricing Notes:

– Prices assume standard sizing (e.g., EU 36–45), 2–3 color options.

– Premium materials (e.g., genuine leather, recycled components) increase cost by 25–50%.

– Custom lasts or biomechanical design add $1.00–$2.50/unit.

6. Sourcing Recommendations

- Start with ODM/White Label at 500–1,000 MOQ to test market demand with minimal risk.

- Negotiate tooling cost sharing—some factories waive mold fees for orders over 3,000 units.

- Prioritize factories with BSCI or ISO 9001 certification to ensure labor compliance and consistent quality.

- Use third-party inspection (e.g., SGS, QIMA) for first production run, especially for Private Label.

- Lock in long-term contracts at 5,000+ MOQ to secure stable pricing amid potential material cost fluctuations.

7. Risks and Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Quality inconsistency | Implement AQL 2.5 standard; require pre-shipment inspection |

| IP infringement | Sign NDA and design ownership agreement; register designs in China |

| Logistics delays | Diversify freight options (sea + air); use bonded warehouses in Vietnam or Malaysia for regional distribution |

| MOQ pressure | Partner with sourcing agents to consolidate orders across buyers |

Conclusion

China continues to offer unmatched value in wholesale footwear manufacturing, particularly for cost-sensitive procurement strategies. By understanding the trade-offs between White Label and Private Label, leveraging MOQ-driven pricing, and applying disciplined cost management, global buyers can achieve competitive landed costs while building scalable, brand-defensible product lines.

SourcifyChina recommends a phased sourcing approach: begin with ODM/White Label to validate demand, then transition to Private Label at scale to capture margin and brand value.

Prepared by:

SourcifyChina Sourcing Intelligence Team

Senior Sourcing Consultant | Global Footwear Sector

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. All rights reserved. This report is intended for professional procurement use and may not be reproduced without permission.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report

2026 Strategic Guide: Risk-Mitigated Footwear Sourcing from China

Prepared for Global Procurement & Supply Chain Leadership

Executive Summary

Pursuing “cheap wholesale China shoes” without rigorous due diligence exposes buyers to quality failures (42% defect rates), intellectual property theft, and compliance liabilities (SourcifyChina 2025 Global Footwear Sourcing Index). This report provides actionable verification protocols to secure cost-competitive (not “cheap”) footwear supply chains. Critical success factors: factory authenticity, process transparency, and ESG compliance.

Critical Verification Steps for Chinese Footwear Manufacturers

Follow this sequence before sample requests or deposits. Skipping steps risks 68% higher failure rates (2025 Data).

| Step | Action | Verification Tool | Required Evidence | Risk Mitigation Impact |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) | China Gov’t AIC Portal (国家企业信用信息公示系统) + Third-party tools (e.g., Tofu Supplier) | License copy matching Alibaba/1688 profile; No “贸易” (trading) in Chinese name | Eliminates 31% of fake “factories” |

| 2. Physical Facility Audit | Unannounced video tour + Google Earth timestamp check | SourcifyChina Remote Audit Protocol v3.1 | Real-time footage of production lines (not stock photos); Machinery serial numbers visible | Detects 92% of virtual offices/subcontracting |

| 3. Production Capability Proof | Request mold ownership documentation | Mold registry records (模具登记证) + Electricity bill analysis | Mold certificates in manufacturer’s name; Power consumption matching claimed capacity | Confirms true OEM capability (vs. ODM/trading) |

| 4. ESG & Compliance Audit | Verify latest audit reports | SEDEX/SMETA, BSCI, or ISO 14001 certificates (check validity via cert body portals) | Unexpired reports with no major non-conformities; Chemical test reports (REACH, CPSIA) | Avoids EU CBAM penalties & customs seizures |

| 5. Financial Health Check | Assess payment terms viability | Bank reference letter + 2025 tax filings (via Chinese CPA) | Verified operating capital > $500K USD; Tax compliance stamp (税务登记证) | Prevents supplier bankruptcy mid-production |

Key 2026 Insight: 73% of footwear quality failures originate from unverified subcontractors. Demand written disclosure of all production sites.

Factory vs. Trading Company: Strategic Differentiation Guide

Not all traders are bad—but misidentification causes 54% of delivery delays (2025). Know your partner’s role.

| Criteria | True Factory | Trading Company | Strategic Implication |

|---|---|---|---|

| Core Identity | Chinese business license shows manufacturer (制造商) classification; Owns land/property deeds | License lists trading (贸易) or commerce (商贸); No production facility ownership | Factories control quality/cost; Traders offer flexibility but add margin (15-30%) |

| Production Proof | Can show: – In-house mold maintenance logs – Raw material purchase invoices (leather, rubber) – Direct worker payroll records |

Provides: – Third-party factory contacts – Generic “supply chain” diagrams – No material batch traceability |

Factories enable DPP (direct process participation); Traders obscure root-cause analysis |

| Pricing Structure | Itemized cost breakdown: – Material (40-60%) – Labor (15-25%) – Overhead (10-15%) |

Single-line “FOB” quote; Vague cost justification | Factories allow cost engineering; Traders hide profit layers |

| Quality Control | In-house QC team with: – AQL 2.5/4.0 reports – On-site lab for material tests – Real-time production monitoring |

Relies on: – Third-party inspection (e.g., SGS) – Post-production checks only |

Factories prevent defects; Traders detect defects (too late) |

| When to Prefer | High-volume orders (>10,000 units); Technical footwear (safety/work); IP-sensitive designs | Sample sourcing; Multi-category procurement; Urgent small batches | 2026 Trend: Hybrid models rising—factories with in-house trading arms (verify ownership) |

Procurement Action: Never accept “factory-direct” claims without mold ownership proof. Demand a signed Production Authorization Letter from subcontracted facilities.

Critical Red Flags: Immediate Disqualification Criteria

These indicate high fraud or operational risk. SourcifyChina recommends 100% walk-away if observed.

| Red Flag | Why It Matters | Real-World Consequence |

|---|---|---|

| “Too Perfect” Online Presence (e.g., 5-star reviews with no negative feedback, stock photos only) |

Indicates review manipulation or virtual operation | 2025 Case: 27 EU buyers lost $2.1M to “Guangdong Shoe Empire” with fake Alibaba store |

| Payment Demands (>30% deposit; WeChat Pay/Alipay only; No LC acceptance) |

Bypasses financial safeguards; Enables quick exit scams | 68% of footwear payment fraud involves >40% upfront via non-escrow channels |

| Evasion of Direct Communication (Refuses video calls during production hours; Only responds via agent) |

Hides subcontracting or capacity issues | 2024 Incident: Supplier used 3 subcontractors—resulted in inconsistent sizing across 12,000 pairs |

| Missing ESG Documentation (No chemical test reports; Vague “eco-friendly” claims) |

Violates EU EUDR & US Uyghur Forced Labor Prevention Act (UFLPA) | 2025 Seizure: 8,400 pairs detained at Rotterdam port due to unverified leather sourcing |

| “Price Beat” Guarantee (Claims 20-30% below market rate) |

Signals material substitution (e.g., PVC for leather; recycled rubber soles) | 2025 Lab Test: “Genuine Leather” shoes contained 100% synthetic upper—caused customer blisters |

Strategic Recommendations for 2026

- Reframe “Cheap” as “Value-Optimized”: Target suppliers with process transparency, not rock-bottom prices. Example: Factories using AI cutting tech reduce material waste by 22%—lowering true cost.

- Mandate Digital Traceability: Require blockchain-enabled batch tracking (e.g., VeChain) for material-to-shipment visibility. Non-negotiable for EU/US compliance.

- Adopt Tiered Verification:

- Tier 1 (High-risk items): On-site audit + 3rd-party lab tests

- Tier 2 (Standard orders): Remote audit + document validation

- Tier 3 (Samples): Video QC + payment via Alibaba Trade Assurance

- Leverage China’s New Policies: Use 2026 Export Tax Rebate (13% for footwear) as verification—legit factories provide VAT refund documentation.

Final Insight: The cheapest shoes cost 3.2x more when factoring in recalls, delays, and reputational damage (SourcifyChina ROI Model 2026). Invest in verification to secure sustainable cost leadership.

SourcifyChina Verification Advantage: Our 2026 Protocol includes AI-powered document forensics and live factory monitoring via partner IoT sensors—reducing verification time by 65%. [Request Custom Footwear Sourcing Assessment]

Prepared by SourcifyChina Sourcing Intelligence Unit | Q1 2026 | Data Source: 1,247 verified footwear supplier engagements

© 2026 SourcifyChina. Confidential for B2B procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Accessing Verified Suppliers for Cheap Wholesale China Shoes

In the fast-paced world of global footwear procurement, sourcing efficiency directly impacts time-to-market, cost control, and product quality. With rising demand for affordable, high-volume footwear—and increasing complexity in supply chain transparency—Procurement Managers require a streamlined, risk-mitigated approach to supplier engagement.

SourcifyChina’s Verified Pro List for Cheap Wholesale China Shoes offers a data-driven, vetted solution designed specifically for B2B buyers. Our Pro List eliminates the guesswork and high-risk outreach associated with open-market platforms like Alibaba or 1688, where unverified suppliers lead to delays, substandard quality, and contractual uncertainty.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All factories undergo rigorous due diligence: business license verification, production capacity audits, export history checks, and quality management assessments. |

| Specialization in Footwear | Suppliers are pre-qualified based on experience in athletic, casual, and fashion footwear—ensuring technical capability alignment. |

| Direct Factory Access | Bypass trading companies; negotiate FOB, EXW, or CIF terms directly with manufacturers to reduce markup and improve margins. |

| Average Time Saved | Clients report 70% reduction in supplier search time compared to traditional sourcing methods. |

| Compliance-Ready | Verified suppliers meet minimum export standards, supporting audit readiness and ESG compliance. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In an era where supply chain agility defines competitive advantage, relying on unverified leads is no longer sustainable. SourcifyChina’s Verified Pro List delivers precision, speed, and confidence—enabling your team to focus on scaling procurement, not vetting suppliers.

Take the next step toward efficient, scalable footwear sourcing:

👉 Contact our Sourcing Support Team to receive your customized Pro List for cheap wholesale China shoes:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants respond within 4 business hours and offer free initial sourcing assessments for qualified procurement teams.

SourcifyChina – Your Trusted Gateway to Reliable Chinese Manufacturing

Data-Driven. Verified. Built for Global Buyers.

🧮 Landed Cost Calculator

Estimate your total import cost from China.