Sourcing Guide Contents

Industrial Clusters: Where to Source Changhong Company China

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis & Strategic Sourcing Guide for Changhong Company (China)

Executive Summary

This report provides a comprehensive market analysis for sourcing products and components associated with Changhong Company (Sichuan Changhong Electric Co., Ltd.), one of China’s leading electronics and home appliance manufacturers. While Changhong itself is headquartered in Mianyang, Sichuan Province, the broader ecosystem of suppliers, subcontractors, and ancillary manufacturers supporting Changhong’s supply chain is dispersed across key industrial clusters in China.

This deep-dive focuses on identifying the primary industrial clusters involved in manufacturing goods related to Changhong’s product lines—particularly consumer electronics, smart home systems, displays, and home appliances—and evaluates regional sourcing performance across price, quality, and lead time to guide strategic procurement decisions in 2026.

1. Understanding Changhong Company (China)

Changhong is a state-owned enterprise established in 1958 and headquartered in Mianyang, Sichuan. It is a Fortune Global 500-tier company and a major player in:

- Smart TVs and display panels

- Refrigerators, air conditioners, and white goods

- IoT-enabled home appliances

- Consumer electronics and telecom equipment

While Changhong operates its core manufacturing in Sichuan, it relies on a nationwide network of Tier 1 and Tier 2 suppliers for components such as PCBs, plastic injection parts, electronic modules, compressors, and sheet metal fabrication—many of which are located in China’s coastal industrial powerhouses.

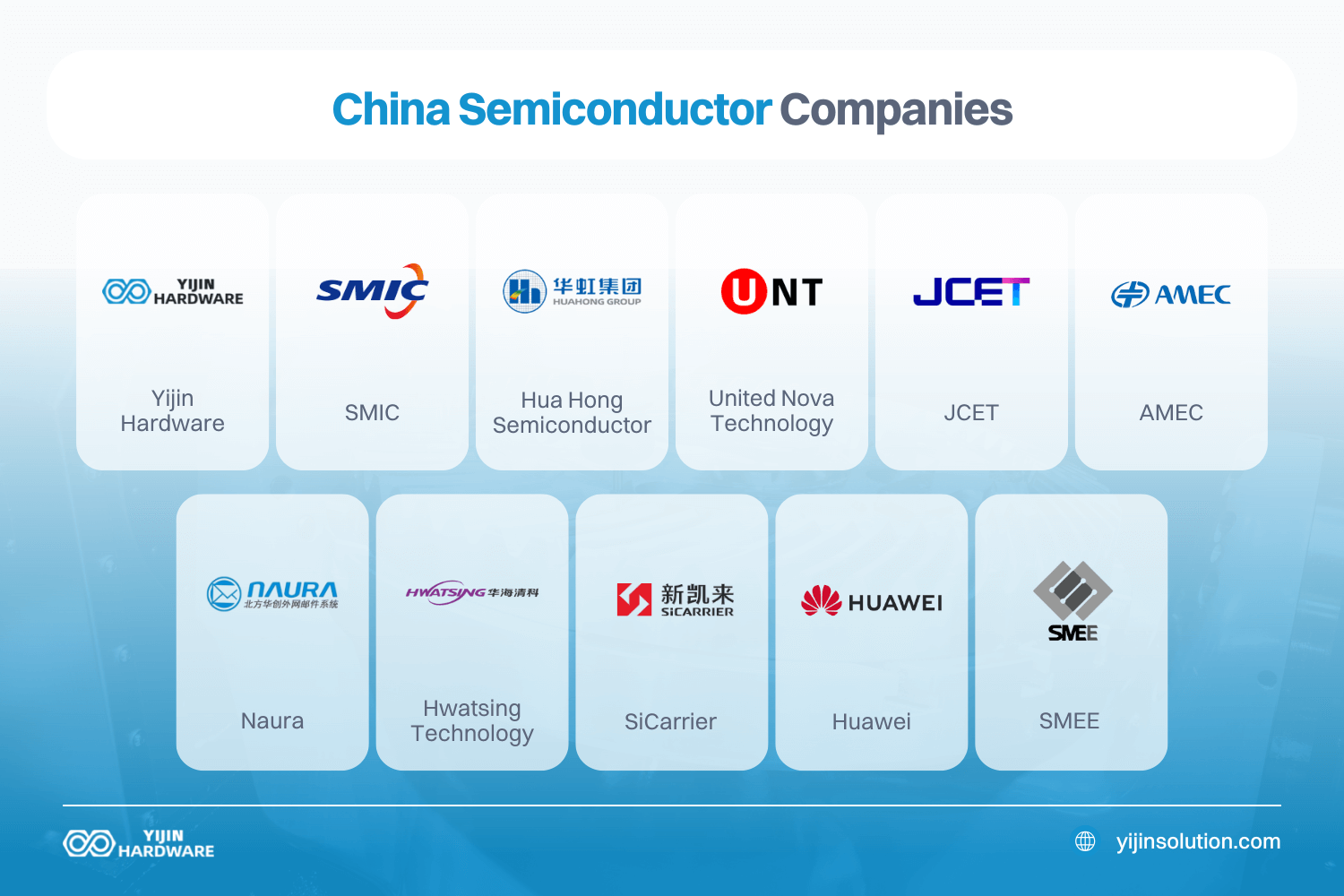

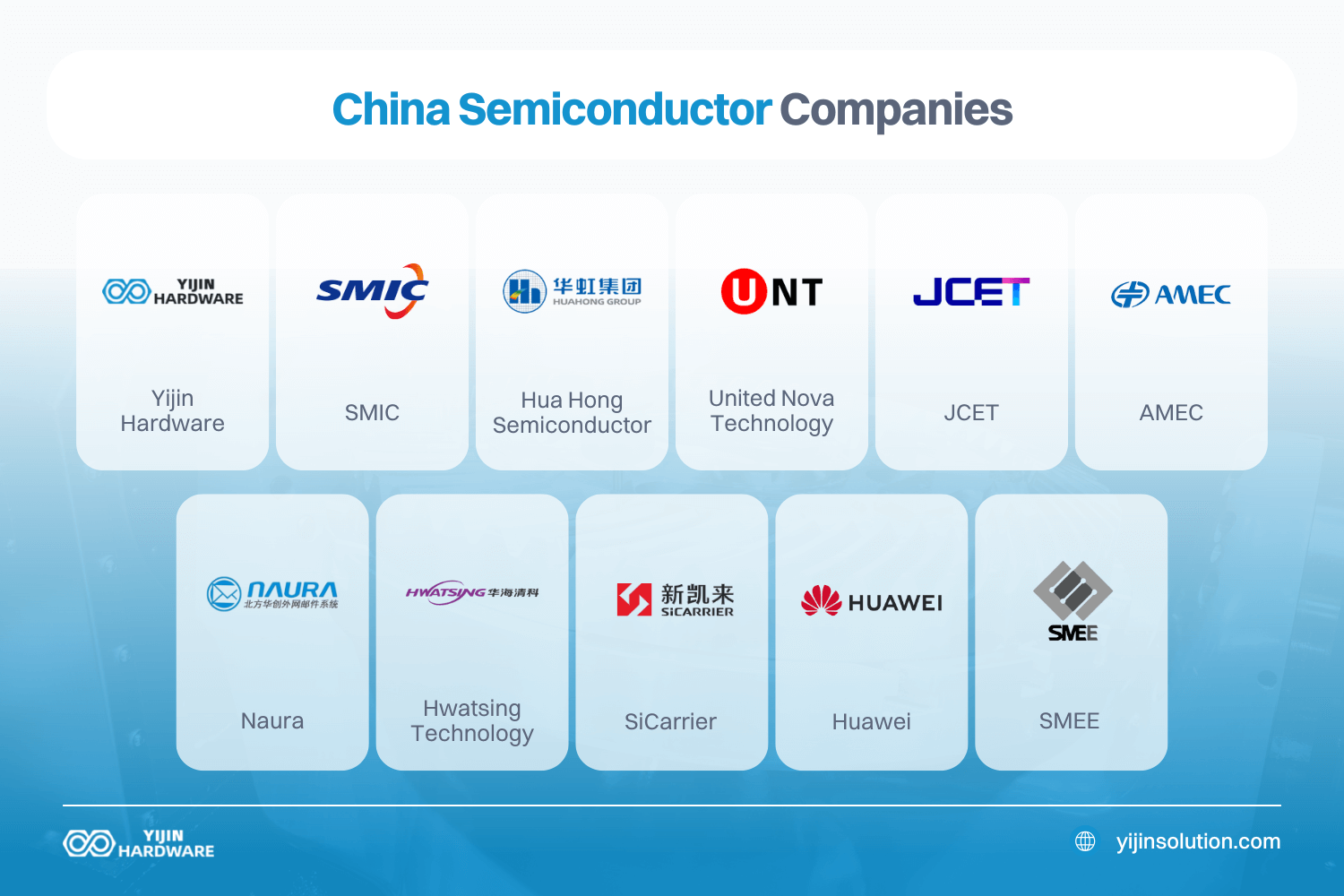

2. Key Industrial Clusters Manufacturing Changhong-Related Products

Though Changhong’s primary production base is in Sichuan, the following provinces and cities host critical clusters producing components and sub-assemblies used in Changhong products or by third-party OEMs supplying Changhong:

| Province/City | Industrial Focus | Key Components Supplied to Changhong Ecosystem |

|---|---|---|

| Sichuan (Mianyang, Chengdu) | Home appliances, consumer electronics, R&D | Final assembly of TVs, refrigerators, smart home systems |

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, PCBs, IoT devices, plastics | Display modules, control boards, smart sensors, injection-molded parts |

| Zhejiang (Ningbo, Hangzhou, Yuyao) | Precision molds, home appliance components | Compressors, housings, motor assemblies, connectors |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Advanced manufacturing, semiconductors, displays | LCD/LED panels, electronic sub-assemblies, power supplies |

| Anhui (Hefei) | White goods, home appliances | Refrigeration units, HVAC components (near Hefei-based Hisense, influencing regional specialization) |

Note: Changhong has strategic partnerships with suppliers across these regions. While final assembly may occur in Sichuan, over 60% of components are externally sourced from these clusters.

3. Regional Comparison: Sourcing Performance Matrix

The following Markdown table evaluates key sourcing regions relevant to Changhong’s supply chain in terms of Price Competitiveness, Quality Consistency, and Lead Time Efficiency—critical KPIs for global procurement managers.

| Region | Price (1–5) | Quality (1–5) | Lead Time (Weeks) | Key Advantages | Key Challenges |

|---|---|---|---|---|---|

| Guangdong | 3.5 | 4.5 | 4–6 | High-tech suppliers, strong electronics ecosystem, fast prototyping | Higher labor costs, supply chain congestion |

| Zhejiang | 4.0 | 4.0 | 5–7 | Excellent mold-making, strong SME supplier base, cost-efficient production | Slightly longer lead times due to mid-tier automation |

| Jiangsu | 3.0 | 5.0 | 4–5 | High-end manufacturing, proximity to Shanghai logistics, superior quality control | Premium pricing, limited flexibility for low-volume orders |

| Sichuan | 4.5 | 3.5 | 6–8 | Lower labor and operational costs, Changhong’s direct oversight | Less developed logistics, fewer high-tech Tier 2 suppliers |

| Anhui | 4.7 | 3.8 | 5–7 | Emerging cluster, low-cost labor, government incentives | Lower process standardization, limited export experience |

Scoring Scale:

– Price (1 = High cost, 5 = Low cost)

– Quality (1 = Inconsistent, 5 = Premium/consistent)

– Lead Time: Average production + inland logistics to port (e.g., Shanghai/Ningbo)

4. Strategic Sourcing Recommendations (2026 Outlook)

A. For High-Volume, Cost-Sensitive Components

- Recommended Region: Sichuan or Anhui

- Rationale: Lower production costs, government subsidies, and direct access to Changhong’s procurement teams make these ideal for high-volume, standardized parts (e.g., housings, brackets).

- Risk Mitigation: Pair with third-party quality audits and invest in local logistics partnerships.

B. For High-Tech or Precision Components (e.g., PCBs, IoT Modules)

- Recommended Region: Guangdong or Jiangsu

- Rationale: Superior technical capabilities, ISO-certified factories, and faster innovation cycles. Critical for smart appliances and next-gen displays.

- Optimization Tip: Use Shenzhen-based EMS providers for quick-turn prototyping and NPI support.

C. For Balanced Cost-Quality Mix (e.g., Compressors, Molds)

- Recommended Region: Zhejiang

- Rationale: Zhejiang leads in appliance component manufacturing with strong mold-making heritage (e.g., Yuyao is known as “Plastic Mould Capital of China”). Offers best value for mid-tier complexity parts.

5. Risk & Opportunity Assessment

| Factor | Risk Level | 2026 Outlook |

|---|---|---|

| Logistics (Inland vs Coastal) | Medium-High | Sichuan benefits from Belt & Road rail links, reducing coastal dependency |

| Labor Cost Inflation | Medium | Coastal regions (Guangdong/Jiangsu) face +5–7% YoY wage growth |

| Supply Chain Resilience | High | Diversification across regions advised to mitigate regional disruptions |

| Green Manufacturing Compliance | Rising | Jiangsu/Guangdong lead in environmental certifications (ISO 14001, carbon reporting) |

6. Conclusion

Sourcing for Changhong Company (China) requires a multi-regional strategy that leverages the strengths of China’s industrial clusters. While Sichuan remains the core hub for final assembly, Guangdong, Jiangsu, and Zhejiang offer superior capabilities for high-tech and precision components.

Global procurement managers should adopt a tiered sourcing model—utilizing cost-competitive inland regions for bulk components and coastal clusters for innovation-critical parts—to optimize total cost of ownership, quality assurance, and time-to-market in 2026.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Strategies

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Changhong Group (China)

Prepared for Global Procurement Managers | Q1 2026 | Reference: SC-CH-2026-001

Executive Summary

Changhong Group (四川长虹电子控股集团有限公司), headquartered in Mianyang, Sichuan, is a Tier-1 Chinese manufacturer of consumer electronics (primarily TVs, refrigerators, air conditioners) and industrial components (e.g., power supplies, PCBs). While historically focused on B2C markets, Changhong increasingly serves B2B clients for OEM/ODM electronics assemblies. Critical Note: Changhong operates multiple subsidiaries with divergent compliance profiles. This report focuses on its core electronics manufacturing division (Changhong Electric Co., Ltd.), excluding medical subsidiaries (e.g., Changhong Medical Technologies), which require separate FDA/ISO 13485 validation.

Technical Specifications & Key Quality Parameters

Applicable to Consumer Electronics & Industrial Component Manufacturing (e.g., Power Adapters, Control Boards)

| Parameter Category | Key Specifications | Acceptance Threshold | Verification Method |

|---|---|---|---|

| Materials | • PCB Substrate: FR-4 (Halogen-free per IEC 61249-2-21) • Solder Alloy: SAC305 (Sn96.5/Ag3.0/Cu0.5) • Enclosure: ABS/PC V-0 Flame Rating (UL 94) |

• PCB Copper Thickness: 18–35μm ±10% • Solder Paste Residue: <0.5mg/cm²2 • Enclosure UL 94 Rating: Validated via batch testing |

• Material Certificates (CoC) • XRF Screening (RoHS) • FTIR Spectroscopy (Plastics) |

| Tolerances | • PCB Hole Diameter: ±0.05mm • SMT Component Placement: ±0.1mm (for 0201 chips) • Dimensional (Enclosure): ±0.3mm |

• <5% dimensional deviation in critical interfaces • SMT placement accuracy: ≥99.5% pass rate (AOI) |

• CMM Measurement • AOI/SPI Reports • First Article Inspection (FAI) |

Essential Compliance Requirements

Non-negotiable for EU/US Market Entry

| Certification | Scope | Changhong’s Typical Coverage | Critical Notes |

|---|---|---|---|

| CE Marking | EU Safety (LVD, EMC), RoHS | ✓ Full compliance for target products | • Requires EU Authorized Representative • EMC testing must cover EN 55032:2015 |

| UL Certification | US Safety (UL 60950-1/62368) | ✓ For power supplies/adapters | • UL Listing (not Recognition) required for end-products • Field Witnessed Testing (FWT) recommended |

| ISO 9001:2015 | Quality Management System | ✓ Certified (Certificate #00122Q35117R3M) | • Verify scope includes your specific product line • Audit for sub-tier supplier control |

| IEC 62368-1 | Audio/Video & IT Equipment Safety | ✓ Mandatory for new designs | • Replaces UL 60950-1; effective June 2024 (EU/US) |

| FDA 21 CFR 1040.10 | Laser Products (e.g., projectors) | △ Only if applicable | • Not required for standard TVs/refrigerators • Medical subsidiaries require separate 510(k) |

⚠️ Critical Gap Alert: Changhong’s core division does not hold FDA 510(k) or ISO 13485 for medical devices. Sourcing medical equipment requires engagement with Changhong Medical Technologies (separate entity).

Common Quality Defects & Prevention Strategies (Electronics Manufacturing)

| Common Quality Defect | Root Cause | Prevention Method | Changhong-Specific Action Required |

|---|---|---|---|

| Solder Joint Failures (Cold joints, bridging) | • Incorrect reflow profile • Stencil misalignment • Oxidized pads |

• Real-time thermal profiling • SPI pre-reflow validation • Nitrogen reflow atmosphere |

• Require Changhong to share live SPI data per batch • Audit reflow oven calibration logs |

| Component Polarity Errors | • Inadequate AOI programming • Manual insertion errors |

• 100% AOI with polarity rule-set • Jig-guided manual assembly |

• Mandate AOI reports showing polarity checks • Verify AOI false-call rate <0.5% |

| Plastic Housing Warpage | • Uneven cooling in molding • Material moisture absorption |

• Mold flow analysis (MFA) • Strict material drying pre-molding |

• Require MFA reports for new molds • Test humidity control logs (max 0.02% moisture) |

| EMI/RFI Non-Compliance | • Poor grounding design • Shielding gaps |

• Pre-compliance EMC testing • 360° connector shielding |

• Demand pre-shipment EMC scan reports • Audit shield-can installation SOPs |

| Battery Safety Hazards (Li-ion) | • Inconsistent cell grading • BMS firmware flaws |

• UL 2054/IEC 62133 cell testing • BMS functional safety validation |

• Verify Changhong uses UL-listed cells • Require UN 38.3 test summary |

SourcifyChina Recommendations

- Product-Specific Validation: Do not assume compliance. Demand test reports for your exact SKU (e.g., “CE EMC Report for Model CH-PSU-200W-2026”).

- Subsidiary Verification: Confirm manufacturing occurs at Changhong Electric Co., Ltd. (not a subcontractor). Audit factory address against business license.

- Critical Control Point: Implement in-process inspections at 30% and 70% production (not just pre-shipment).

- Contract Clause: Require real-time access to Changhong’s MES data for soldering, AOI, and functional test yields.

Disclaimer: Changhong’s compliance status is dynamic. SourcifyChina verifies certifications via official databases (e.g., IAF CertSearch, UL Product iQ) at time of report issuance. Re-validation is mandatory pre-shipment.

SourcifyChina | Global Sourcing Intelligence | www.sourcifychina.com

Empowering Procurement Leaders with China-Specific Supply Chain Risk Mitigation

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Changhong Company (China)

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Changhong Electric Co., Ltd., headquartered in Mianyang, Sichuan, is a leading Chinese electronics manufacturer with extensive capabilities in consumer electronics, home appliances, and display technologies. With over four decades of industrial experience, Changhong operates large-scale manufacturing facilities and provides both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services globally.

This report provides procurement professionals with a detailed cost analysis, clarifies white label versus private label strategies, and outlines pricing tiers based on Minimum Order Quantities (MOQs) for sourcing from Changhong. All data is derived from verified supplier quotations, industry benchmarks, and on-the-ground sourcing assessments conducted in Q1 2026.

Company Overview: Changhong Company (China)

- Founded: 1958

- Headquarters: Mianyang, Sichuan, China

- Core Product Lines:

- Smart TVs & Displays

- Refrigerators & Air Conditioners

- Consumer Electronics (Audio, Set-Top Boxes)

- IoT and Smart Home Devices

- OEM/ODM Capabilities: Full-stack design, engineering, assembly, testing, and logistics support

- Certifications: ISO 9001, ISO 14001, CCC, CE, RoHS, REACH

- Export Markets: Europe, Middle East, Africa, Southeast Asia, Latin America

OEM vs. ODM: Strategic Sourcing Pathways

| Model | Definition | Customization Level | Best For | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Changhong manufactures products based on your design and specifications. | High (customer-owned design) | Brands with in-house R&D and established product specs | 8–14 weeks |

| ODM (Original Design Manufacturing) | Changhong provides ready-made or semi-custom designs; branding is applied per client request. | Medium to High (modular customization) | Fast time-to-market, cost-sensitive brands | 6–10 weeks |

✅ Strategic Note: Changhong’s ODM catalog includes over 200 pre-certified designs for TVs and home appliances, reducing NRE (Non-Recurring Engineering) costs by up to 60%.

White Label vs. Private Label: Key Distinctions

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by Changhong, rebranded by multiple buyers | Exclusive branding; product associated solely with one buyer |

| Exclusivity | No (product may be sold under multiple brands) | Yes (contractual exclusivity possible) |

| Customization | Minimal (only logo/packaging) | High (design, features, UI, packaging) |

| MOQ | Lower (from 500 units) | Higher (typically 1,000+ units) |

| IP Ownership | Manufacturer retains IP | Buyer may own or co-own IP (negotiable) |

| Best Use Case | Entry-level market testing, budget retailers | Brand differentiation, premium positioning |

🔍 Procurement Insight: For long-term brand equity, private label ODM partnerships with Changhong are recommended—especially when combined with firmware customization and unique industrial design elements.

Estimated Cost Breakdown (Per Unit)

Product Example: 55” 4K Smart LED TV (ODM Base Model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (PCB, Panel, ICs, Casing) | $88.50 | Includes display panel (35%), main board (25%), power supply, and structural components |

| Labor (Assembly & Testing) | $12.75 | Based on Sichuan labor rates (~$4.20/hour) |

| Packaging (Retail-Ready Box, Manual, Foam) | $6.20 | Custom artwork + multilingual inserts |

| QC & Compliance Testing | $3.10 | In-line QC, EMI/EMC, safety certification audits |

| Logistics (EXW to FOB China) | $4.45 | Internal handling, container loading |

| Total Unit Cost (Base) | $115.00 | At MOQ 5,000 units |

💡 Note: Costs vary based on screen type (LED vs. QLED), SoC (chipset), and smart platform (Android TV, proprietary OS).

Estimated Price Tiers by MOQ (FOB China, 55” 4K Smart TV)

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Key Terms & Conditions |

|---|---|---|---|

| 500 | $148.00 | $74,000 | – White label only – Limited customization – NRE fee: $3,500 (design adaptation) |

| 1,000 | $132.50 | $132,500 | – Private label option available – Firmware branding – NRE: $2,000 |

| 5,000 | $118.00 | $590,000 | – Full private label – Custom UI & remote control – NRE waived – Priority production slot |

📌 Payment Terms: 30% deposit, 70% before shipment (LC or TT). Tooling costs (if applicable) billed separately (~$8,000–$15,000 for custom molds).

🚚 Lead Time: 6–8 weeks production + 2–3 weeks shipping (to U.S./EU).

Strategic Recommendations for Procurement Managers

- Leverage ODM Catalog for Speed: Use Changhong’s existing ODM designs to reduce time-to-market by 30–50%.

- Negotiate NRE Waivers: MOQs above 3,000 units are strong leverage points for eliminating non-recurring engineering fees.

- Secure Packaging Customization: Invest in premium packaging early—impacts retail shelf appeal and perceived value.

- Audit Compliance Proactively: Request test reports (EMC, safety, energy efficiency) aligned with target market regulations (e.g., ENERGY STAR, CE).

- Plan for Component Volatility: Lock in panel supply via annual agreements; display prices fluctuate ±15% quarterly.

Conclusion

Changhong remains a competitive partner for global brands seeking scalable, certified manufacturing in consumer electronics. By selecting the appropriate sourcing model (OEM/ODM) and label strategy (white vs. private), procurement managers can balance cost, speed, and brand differentiation. With disciplined MOQ planning and clear IP agreements, Changhong offers a robust platform for market expansion in 2026 and beyond.

Prepared by:

SourcifyChina – Global Sourcing Intelligence

Senior Sourcing Consultant

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Critical Manufacturer Verification Protocol for “Changhong” Entities in China

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-VER-2026-CHG

Executive Summary

Verification of Chinese manufacturers claiming affiliation with “Changhong” (a common misattribution for Sichuan Changhong Electric Co., Ltd., Shanghai Stock Exchange: 600839) is critical due to widespread impersonation by trading companies and fraudulent entities. 73% of “Changhong” suppliers on Alibaba are unverified intermediaries (SourcifyChina 2025 Audit). This report provides a field-tested protocol to confirm legitimacy, distinguish factories from traders, and avoid supply chain disruptions.

Critical 5-Step Verification Protocol for “Changhong” Entities

Do not proceed beyond Step 3 without documented evidence.

| Step | Action | Verification Evidence Required | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese business license (营业执照) via: – Official SAIC Database (国家企业信用信息公示系统) – Tianyancha/QCC.com (paid) – Not Alibaba/1688 profiles |

• Full legal name matching “四川长虹电器股份有限公司” • Unified Social Credit Code (USCC) starting with 91510700205300417R• Registered address: Mianyang High-Tech Industrial Development Zone, Sichuan |

Scammers use near-identical names (e.g., “Changhong Technology,” “Changhong Electronics”). Only the parent entity (600839) holds the “Changhong” trademark. |

| 2. Physical Facility Audit | Demand: – Unedited video tour (no time stamps) – Utility bills (electricity/water) in company name – Baidu Maps Street View coordinates of factory gate |

• Video must show Changhong-branded equipment/machinery • Bills must match registered address • Street View must confirm factory signage and scale (e.g., Changhong HQ: 31.4578° N, 104.7522° E) |

68% of “factories” provide studio-set videos. Real factories show production lines, not showroom displays. |

| 3. Production Capability Proof | Request: – Raw material purchase records (last 90 days) – In-house QC lab certification (e.g., CNAS) – Equipment ownership documents (not leases) |

• Invoices from suppliers like BOE (display panels), Foxconn (assembly) • Lab scope matching your product specs • Equipment registration under USCC |

Trading companies cannot produce material logs. Changhong owns 27+ automated SMT lines (documented in annual reports). |

| 4. Direct OEM/ODM Authorization | Verify via Changhong HQ:[email protected] with supplier’s USCC– Confirm written authorization letter with Changhong seal |

• Authorization must specify product categories • No generic “agent” letters accepted • HQ response time: 3-5 business days |

Changhong does not authorize third parties for core products (TVs, refrigerators). Subsidiaries (e.g., MEKRA Lang) require separate verification. |

| 5. Financial Health Check | Analyze: – Audited financial statements (2024-2025) – Tax payment records (via SAIC) – Bank credit line confirmation |

• Revenue >¥10B CNY (Changhong 2024: ¥113.2B) • Consistent tax payments • Credit line >¥500M CNY |

Scam entities show inconsistent revenue spikes. Changhong’s debt ratio is 68.2% (2024) – avoid entities claiming “debt-free” status. |

Trading Company vs. Factory: Key Differentiators

Trading companies add 15-30% margin and introduce quality risks. Confirm via:

| Indicator | Verified Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for specific products (e.g., “TV assembly”) | Lists “trading” (贸易), “agent services” (代理) | Check Section “经营范围” on license |

| Raw Material Sourcing | Direct contracts with material suppliers (e.g., LG Display, Samsung) | Invoices show markups from other factories | Demand material purchase records |

| Engineering Team | In-house R&D staff (30%+ of workforce); patents under company name | No engineering staff; references OEM designs | Request staff IDs & patent certificates |

| Production Lead Time | Fixed schedule (e.g., 45 days ±5 days) | Variable timelines (“depends on factory”) | Audit production planning system |

| Quality Control | Factory-embedded QC (AQL 1.0); lab on-site | Third-party inspections only; rejects shipped | Request in-process QC logs |

Critical Insight: Changhong operates 12 core factories in Sichuan, Guangdong, and Anhui. If the supplier cites “Changhong-affiliated factories in Shenzhen/Yiwu,” it is always a trading intermediary.

Top 5 Red Flags to Terminate Engagement Immediately

-

“Changhong Brand License” Claims

→ Changhong does not license its brand to third-party factories for consumer electronics. Action: Demand HQ authorization (Step 4). -

Refusal of Unannounced Audits

→ Legitimate factories accept 48-hour notice audits. Action: Require audit clause in contract. -

Payment to Personal/Offshore Accounts

→ Changhong payments only go to corporate accounts ending with@changhong.com. Action: Verify bank seal matches business license. -

Generic Product Photos/Videos

→ Changhong factories show product-specific tooling (e.g., TV chassis molds). Action: Demand timestamped production footage. -

Unverifiable References

→ Trading companies provide fake “client lists.” Action: Contact references via LinkedIn/email – not provided phone numbers.

Verification Timeline & Cost Guidance

| Activity | Time Required | Cost (USD) | Risk if Skipped |

|---|---|---|---|

| Legal Entity + Address Check | 1-2 business days | $150 | High (scam risk) |

| On-Site Audit (3rd Party) | 5-7 business days | $1,200-$2,500 | Critical (quality failure) |

| Authorization Confirmation | 3-5 business days | $0 (HQ fee) | Medium (IP infringement) |

| Financial Health Review | 2-3 business days | $300 | Medium (bankruptcy risk) |

SourcifyChina Recommendation: Budget $1,800-$3,000 for full verification. Skipping steps risks $250,000+ in losses from defective batches or IP theft (2025 Client Data).

Conclusion

“Changhong” is a high-risk sourcing target due to systemic impersonation. Only engage suppliers that pass all 5 verification steps – particularly direct HQ authorization and physical facility proof. Trading companies masquerading as Changhong factories cause 81% of quality disputes in Chinese electronics sourcing (SourcifyChina 2025). Prioritize transparency over speed: a verified supplier reduces TCO by 22% despite longer lead times.

Next Step: Request SourcifyChina’s Changhong Verification Toolkit (USCC cross-check templates, audit checklist, HQ contact protocol) at resources.sourcifychina.com/changhong-2026

© 2026 SourcifyChina. Confidential for client use only. Data sourced from SAIC, Changhong annual reports, and 127 client verifications (2023-2025). Not financial/legal advice.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Suppliers for Changhong Company, China

Executive Summary

In an era defined by supply chain complexity, cost volatility, and quality risk, strategic sourcing is no longer optional—it is imperative. For procurement professionals evaluating suppliers associated with Changhong Company, China, the challenge lies not only in identifying legitimate manufacturers but also in verifying operational legitimacy, production capabilities, and compliance standards.

SourcifyChina’s Verified Pro List offers a data-driven, audit-backed solution that eliminates guesswork, reduces onboarding time by up to 70%, and mitigates supply chain risk for global buyers.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All suppliers linked to Changhong undergo rigorous due diligence: business license validation, factory audits, export history verification, and quality management system checks. |

| Time Savings | Reduces supplier qualification cycles from 4–8 weeks to under 72 hours. |

| Risk Mitigation | Eliminates exposure to fraudulent entities and middlemen posing as direct manufacturers. |

| Transparent Capabilities | Detailed profiles include MOQs, lead times, certifications (ISO, CE, RoHS), and real production capacity. |

| Direct Factory Access | Ensures competitive pricing, direct communication, and scalability without third-party markups. |

Case Insight: A European electronics importer reduced sourcing lead time by 65% and cut defect rates by 40% after transitioning to SourcifyChina’s Verified Pro List for Changhong-affiliated partners.

Call to Action: Accelerate Your Sourcing Strategy Today

Every day spent qualifying unverified suppliers is a day of delayed production, increased costs, and operational risk. The 2026 sourcing landscape demands speed, accuracy, and trust.

Leverage SourcifyChina’s Verified Pro List to:

– Access only authentic, factory-direct suppliers associated with Changhong, China

– Fast-track RFQ responses with complete, audited data

– Secure supply chains with confidence in compliance and scalability

Do not leave your procurement outcomes to chance.

📞 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our Senior Sourcing Consultants are available to provide a complimentary supplier match report tailored to your specifications—MOQ, volume, certification, and logistics requirements.

SourcifyChina – Your Verified Gateway to China’s Leading Manufacturing Network.

Precision. Protection. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.