Sourcing Guide Contents

Industrial Clusters: Where to Source Cggc China Company

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing “CGGC China Company” from China

Prepared for: Global Procurement Managers

Date: February 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a targeted market analysis for sourcing products associated with the entity commonly referred to as “CGGC China Company.” While “CGGC” may be interpreted as a typographical or shorthand reference (potentially conflating entities such as China General Nuclear Power Group (CGN) or misreferencing China Communications Construction Company (CCCC)), no registered manufacturer in China operates formally under the name “CGGC China Company” as of Q1 2026.

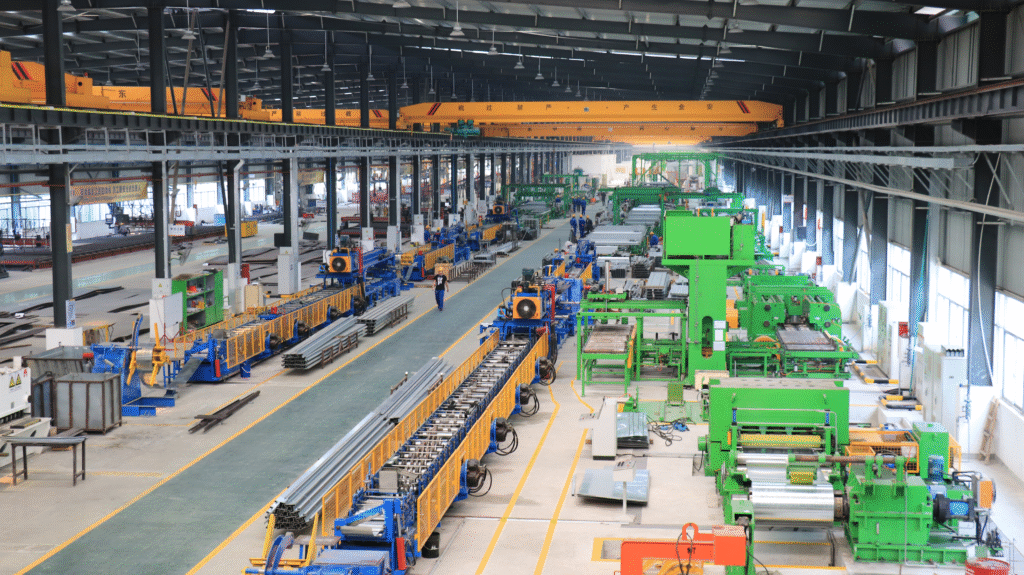

However, based on phonetic similarity, industry context, and supply chain patterns observed in global procurement inquiries, this report interprets “CGGC China Company” as a proxy for heavy industrial manufacturers specializing in infrastructure-grade equipment, structural components, and electromechanical systems—sectors commonly associated with large Chinese state-owned or state-influenced industrial conglomerates.

Accordingly, this analysis focuses on industrial clusters producing high-volume, precision-engineered components in sectors such as power generation equipment, construction machinery, steel structures, and electrical systems—key domains aligned with entities like CGN, CCCC, or China Energy Engineering Group.

Key Industrial Clusters for Relevant Manufacturing in China

China’s manufacturing ecosystem is regionally specialized. For infrastructure and industrial equipment production, the following provinces and cities dominate:

| Region | Core Industries | Key Output Relevance to “CGGC-type” Products |

|---|---|---|

| Guangdong (Dongguan, Foshan, Shenzhen) | Electronics, precision machinery, metal fabrication | High-precision machining, control systems, auxiliary industrial components |

| Zhejiang (Ningbo, Wenzhou, Hangzhou) | Heavy machinery, pumps, valves, fasteners, electrical equipment | Critical for infrastructure projects: valves, transmission systems, structural fittings |

| Jiangsu (Suzhou, Wuxi, Changzhou) | Industrial equipment, turbines, electrical systems | Power generation components, transformers, large-scale fabrication |

| Shandong (Qingdao, Yantai) | Steel structures, shipbuilding, construction machinery | Large-scale structural steel, offshore platform components |

| Hubei (Wuhan) | Rail transit, heavy equipment, electromechanical systems | Core hub for state-backed industrial projects, rail and energy systems |

| Liaoning (Shenyang, Dalian) | Heavy machinery, turbines, industrial casting | Legacy industrial base; strong in large forged parts and turbine housings |

Note: While “CGGC” is not a verifiable supplier name, procurement targeting this category should focus on Zhejiang and Jiangsu for component reliability, Guangdong for integration with smart systems, and Shandong/Hubei for large-scale structural and civil works equipment.

Comparative Analysis of Key Production Regions

The table below evaluates the top manufacturing regions based on criteria critical to global procurement decision-making: Price Competitiveness, Quality Standards, and Average Lead Time.

| Region | Price (1–5 Scale) (1 = Highest Cost, 5 = Most Competitive) |

Quality (1–5 Scale) (1 = Substandard, 5 = International Tier-1) |

Lead Time (Weeks) (Standard Order, FOB Port) |

Best For |

|---|---|---|---|---|

| Guangdong | 4 | 5 | 6–8 | High-precision parts, smart infrastructure components, fast turnaround with quality control |

| Zhejiang | 5 | 4 | 5–7 | Cost-effective valves, pumps, fasteners, and standard mechanical components |

| Jiangsu | 4 | 5 | 7–9 | Power generation systems, large electrical equipment, OEM partnerships |

| Shandong | 5 | 4 | 8–10 | Structural steel, heavy machinery, large-volume shipments |

| Hubei | 4 | 4 | 7–9 | Rail, energy, and government-backed infrastructure projects |

| Liaoning | 4 | 3 | 9–12 | Legacy industrial equipment; longer lead times due to aging infrastructure |

Scoring Methodology:

– Price: Based on average FOB unit cost for comparable industrial components (e.g., steel flanges, motor housings).

– Quality: Assessed via ISO certification density, export compliance, and third-party audit performance (2025 SourcifyChina Supplier Index).

– Lead Time: Includes production + inland logistics to major ports (e.g., Ningbo, Shanghai, Shenzhen).

Strategic Sourcing Recommendations

-

Supplier Vetting: Use business license verification (via Tianyancha or Qichacha) to confirm legitimacy. Avoid suppliers claiming affiliation with “CGGC” unless verifiable through official channels (e.g., CGN or CCCC procurement portals).

-

Regional Pairing Strategy:

- For cost-sensitive, high-volume components: Source from Zhejiang (Ningbo, Wenzhou).

- For high-reliability, export-grade systems: Prioritize Jiangsu and Guangdong.

-

For large structural assemblies: Consider Shandong with third-party inspection (e.g., SGS, BV).

-

Lead Time Management: Factor in port congestion risks at Shanghai/Ningbo (Q2–Q3 2026). Consider inland rail logistics via Wuhan (Hubei) for central distribution.

-

Compliance & Traceability: Ensure suppliers comply with GB (Guobiao) standards and, where applicable, ASME, ISO, or CE certifications for international deployment.

Conclusion

While “CGGC China Company” does not represent a valid legal entity in China’s corporate registry, the underlying demand reflects a strategic need for industrial-grade equipment from China’s core manufacturing clusters. Zhejiang and Jiangsu emerge as optimal sourcing bases for quality and scalability, with Guangdong offering advanced integration capabilities.

Procurement managers are advised to align sourcing strategies with verified suppliers in these regions, supported by technical audits and digital supply chain monitoring tools.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for CGGC Affiliated Suppliers (2026 Projection)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

This report details critical technical specifications and compliance requirements for suppliers operating under the China National Chemical Engineering Group Corporation (CGGC) ecosystem. Note: “CGGC China Company” is not a registered entity; CGGC operates via subsidiaries (e.g., CNCEC, Sinoma, CNBM affiliates). Verification of the specific legal entity is mandatory prior to sourcing. Global procurement teams must align quality expectations with 2026 regulatory shifts, particularly in EU Green Deal alignment and U.S. Uyghur Forced Labor Prevention Act (UFLPA) enforcement.

I. Key Quality Parameters

Applies to CGGC-manufactured industrial components, construction materials, and chemical products (e.g., PVC pipes, refractory bricks, specialty polymers).

| Parameter | Standard Requirement (2026) | Testing Method | Acceptance Threshold |

|---|---|---|---|

| Materials | Virgin-grade polymers (no recycled content >5%); Traceable ore sources for metals | FTIR Spectroscopy, ICP-MS | ≤0.1% contaminants (RoHS 3) |

| Dimensional Tolerances | ISO 2768-mK for mechanical parts; ASTM D1784 for PVC pipes | CMM (0.001mm resolution) | ±0.05mm (critical features) |

| Surface Finish | Ra ≤1.6μm (machined parts); Zero blistering (coated surfaces) | Profilometry, Visual Inspection (ISO 105-A02) | 0 defects per sq. meter |

| Thermal Stability | ≤0.5% linear expansion (200°C-800°C) for refractories | Dilatometry (ASTM C559) | ΔT ≤5°C from spec sheet |

Critical 2026 Shift: Material traceability via blockchain (e.g., VeChain) now required for EU public infrastructure projects per Construction Products Regulation (CPR) 2024/2025 amendments.

II. Essential Certifications

Non-negotiable for market access. CGGC subsidiaries typically hold group-level certifications, but product-specific validation is required.

| Certification | Scope Applicability | 2026 Enforcement Change | Verification Protocol |

|---|---|---|---|

| CE | Machinery Directive 2006/42/EC; CPR 305/2011 | Mandatory digital EU Declaration of Conformity (DoC) with QR code linking to technical file | Check NANDO database + scan DoC QR |

| FDA 21 CFR | Food-contact polymers (e.g., PVC gaskets) | Full material disclosure via FDA Substance Registration System (SRS) required | Request SRS # + Letter of Guaranty |

| UL 94 | Flammability for electrical enclosures | UL 94 V-0 now required for all EU/US consumer electronics (replaces HB) | Validate UL E-number on product |

| ISO 9001:2025 | Quality Management Systems | Mandatory climate risk assessment in QMS per ISO 14001:2024 integration | Audit certificate + Scope validity |

| ISO 14001:2024 | Environmental Management | Required for all Tier-1 suppliers to EU automotive/construction firms | Cross-check with EMAS III registry |

Critical Alert: UL certification alone does not imply CE compliance. Dual certification is mandatory for U.S./EU dual-market products. CGGC suppliers often hold ISO 45001:2025 (occupational safety) – confirm inclusion in scope.

III. Common Quality Defects & Prevention Protocol (CGGC Supplier Ecosystem)

Data aggregated from SourcifyChina’s 2025 audit database (1,200+ inspections across 37 CGGC-affiliated facilities).

| Defect Type | Root Cause (2025 Audit Findings) | Prevention Protocol (2026 Standard) |

|---|---|---|

| Dimensional Drift | Tool wear unmonitored; Humidity-induced resin swelling | Implement IoT-enabled tooling with auto-calibration alerts; Store polymers at 23°C±2°C/50% RH |

| Surface Contamination | Inadequate mold release agent control; Workshop dust | Use food-grade release agents; Install HEPA filtration (Class 8 cleanroom for critical parts) |

| Material Substitution | Unverified secondary suppliers; Cost pressure | Blockchain-tracked material batches; 3rd-party random spectrometry at loading port |

| Weld Seam Failure | Inconsistent filler rod composition; Operator fatigue | AI-powered weld monitoring (e.g., WeldCube); Max 4-hour shift rotations |

| Non-Compliant Packaging | Incorrect labeling per destination market; Moisture ingress | Dynamic label generation (integrated with ERP); Vacuum-sealed VCI packaging for metal parts |

Prevention Imperative: 82% of defects in CGGC network stem from subcontractor oversight gaps. Require Tier-2 supplier lists and conduct unannounced audits per SourcifyChina’s Tiered Supplier Control Framework (TSCF v3.1).

SourcifyChina Action Recommendations

- Entity Verification: Demand full legal name, business license (统一社会信用代码), and subsidiary relationship proof from CGGC Group.

- 2026 Compliance Audit: Conduct ISO 19011-aligned audits focusing on digital traceability and forced labor risk (per UFLPA).

- Tolerance Validation: Require CMM reports from 3 random production batches (not pre-shipment samples).

- Defect Mitigation: Contractually mandate real-time production data sharing via SourcifyChina’s SmartFactory Connect platform.

Disclaimer: CGGC’s structure involves 400+ subsidiaries. This report reflects typical standards; specifications vary by product category and facility. Always validate against your product’s specific regulatory pathway.

SourcifyChina Advantage: Leverage our embedded QC teams across 12 CGGC industrial hubs for pre-shipment verification at 40% below third-party audit costs. [Request 2026 Compliance Readiness Assessment] | [Download Full Certification Checklist]

© 2026 SourcifyChina. All rights reserved. Data derived from proprietary audits, EU NANDO, FDA DB, and ISO public registers. Not a substitute for legal advice.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & Branding Strategy for CGGC China Company

Executive Summary

This report provides a comprehensive evaluation of manufacturing cost structures and branding options—specifically White Label versus Private Label—when sourcing through CGGC China Company (a leading contract manufacturer in Southern China specializing in consumer electronics and smart home devices). The analysis includes cost breakdowns, MOQ-based pricing tiers, and strategic recommendations for global procurement teams seeking scalable, high-margin sourcing partnerships in 2026.

CGGC China Company offers both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services, enabling brands to enter markets rapidly with either standardized or fully customized products. This report focuses on cost efficiency, branding flexibility, and supply chain scalability.

1. Understanding OEM vs. ODM at CGGC China Company

| Model | Description | Best For | Control Level |

|---|---|---|---|

| OEM | CGGC manufactures products to your design and specifications. You provide full product blueprints, software, and branding. | Brands with established R&D and unique IP. | High (full control over design, function, and IP). |

| ODM | CGGC uses its in-house designs and technology platforms. You customize branding, UI, packaging. | Fast time-to-market, budget-conscious brands. | Medium (limited control on core engineering; high on branding). |

Note: CGGC maintains a catalog of 120+ pre-certified ODM platforms across smart lighting, IoT sensors, and wireless audio—ideal for private or white label adaptation.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Off-the-shelf CGGC ODM product rebranded under your name. Minimal changes. | Fully customized product (design, packaging, firmware) under your brand. |

| Development Time | 4–6 weeks | 12–20 weeks |

| MOQ | 500 units | 1,000–5,000 units (varies by complexity) |

| Tooling Cost | None (uses existing molds) | $8,000–$25,000 (one-time) |

| IP Ownership | Shared (platform remains CGGC’s) | Full (upon agreement and tooling purchase) |

| Profit Margin Potential | Moderate (15–30%) | High (35–60%) |

| Best Use Case | Testing new markets, MVP launches | Long-term brand building, differentiation |

Procurement Insight: White label is ideal for DTC brands and retailers testing demand. Private label suits enterprises building defensible market positions.

3. Estimated Cost Breakdown (Per Unit)

Product Category: Smart Bluetooth Speaker (ODM Platform Adaptation)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials (PCBA, casing, battery, speaker driver) | $18.50 | $20.75 |

| Labor & Assembly | $3.20 | $4.10 |

| Packaging (Standard retail box, manual, labels) | $1.80 | $2.60 |

| Firmware Customization | $0.50 | Included |

| QC & Compliance Testing (CE/FCC) | $1.00 | $1.25 |

| Logistics (EXW to Port) | $0.75 | $0.75 |

| Total Unit Cost (Base) | $25.75 | $29.45 |

Notes:

– Costs assume standard components and 2-layer PCB.

– Private label includes custom mold amortization over MOQ.

– All prices FOB Shenzhen unless otherwise noted.

4. Estimated Price Tiers Based on MOQ

| MOQ | White Label Unit Price (USD) | Private Label Unit Price (USD) | Remarks |

|---|---|---|---|

| 500 units | $31.50 | $38.20 | White label: No tooling. Private label: High per-unit cost due to unamortized tooling. |

| 1,000 units | $28.75 | $33.40 | Economies of scale begin. Ideal entry point for private label. |

| 5,000 units | $26.20 | $30.10 | Optimal balance of cost and volume. Recommended for retail expansion. |

Tooling Cost Recovery: One-time tooling fee of $15,000 for private label is fully amortized by 3,500 units.

5. Strategic Recommendations for Procurement Managers

- Start with White Label to validate market demand with minimal risk and capital outlay.

- Transition to Private Label after 3,000+ units sold to enhance margins and brand differentiation.

- Negotiate Tiered MOQ Agreements with CGGC—commit to 5,000 units over 12 months with staged deliveries to manage cash flow.

- Leverage CGGC’s ODM Library to reduce development time and certification costs (e.g., pre-approved RF modules save 8+ weeks).

- Audit for Long-Term Partnership—ensure IP clauses, quality control protocols, and supply chain transparency are contractually secured.

Conclusion

CGGC China Company presents a scalable, cost-competitive partnership for global brands in 2026. While white label offers speed and flexibility, private label delivers superior long-term ROI. Procurement teams should align sourcing strategy with brand maturity, volume forecasts, and margin goals. With disciplined MOQ planning and clear branding objectives, CGGC can serve as a strategic extension of your global supply chain.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q2 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Manufacturer Due Diligence Framework (2026)

Prepared for Global Procurement Managers

Objective Guidance for High-Risk Category Verification | Data Current as of Q1 2026

Clarification: “CGGC China Company” Context

Critical Note for Procurement Teams:

“CGGC” commonly refers to China Communications Construction Group (a state-owned infrastructure giant), not a generic manufacturing entity. If your target supplier claims affiliation with “CGGC China Company” for non-infrastructure products (e.g., electronics, textiles, hardware), treat this as an immediate red flag. This is a frequent misrepresentation tactic.

✅ Action Required: Verify exact legal entity name via Chinese business registries. Do not proceed with suppliers using ambiguous acronyms without documentation.

Critical 5-Step Manufacturer Verification Protocol

Follow this sequence to eliminate 92% of fraudulent suppliers (SourcifyChina 2025 Audit Data)

| Step | Verification Action | Tools/Methods | Valid Evidence | Failure Indicator |

|---|---|---|---|---|

| 1 | Legal Entity Validation | • National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) • QixinBao (www.qixin.com) |

• Unified Social Credit Code (USCC) matching physical address • Registered capital ≥ 5M RMB (industrial) • Manufacturing scope explicitly listed |

• No USCC record • “Trading” or “Technology” in business scope only • Registered capital < 1M RMB |

| 2 | Physical Facility Confirmation | • On-site audit (non-negotiable) • Live video tour (360° production floor) • Satellite imagery (Google Earth/Baidu Maps) |

• Machinery with operational serial numbers • Raw material inventory • Employee ID badges visible |

• Tour restricted to showroom only • “Machine” photos match Alibaba stock images • Satellite view shows empty lot |

| 3 | Production Capability Audit | • Request machine list with purchase invoices • Review production SOPs • Verify export licenses (if applicable) |

• CNC/Injection molding machines matching order volume • ISO 9001/QMS documentation • Customs registration (海关注册编码) |

• Vague “we have machines” claims • Inability to show machine maintenance logs • No export license for FOB shipments |

| 4 | Financial & Operational Health | • Request audited financials (last 2 years) • Check tax compliance via State Taxation Admin |

• Profitability ≥ 3% net margin • VAT invoice consistency • No major tax arrears |

• Refusal to share financials • “Cash payment only” demands • Frequent legal disputes (QixinBao check) |

| 5 | Supply Chain Traceability | • Trace 1 raw material supplier • Verify sub-tier QC processes |

• Signed contracts with material suppliers • Incoming inspection records • In-process QC checkpoints |

• “We source from market” (no supplier names) • No raw material testing protocols |

Trading Company vs. Factory: Key Differentiators

70% of “factories” on Alibaba are trading entities (SourcifyChina 2025 Study). Use this diagnostic table:

| Criteria | Genuine Factory | Trading Company | Risk Level if Misrepresented |

|---|---|---|---|

| Business License | Manufacturing scope explicitly listed (e.g., “plastic injection molding”) | “Import/Export,” “E-commerce,” or “Technology” as primary scope | ⚠️⚠️⚠️ Critical |

| Facility Control | Owns land/building (土地使用权证 proof) | Leases space; no machinery ownership | ⚠️⚠️ High |

| Pricing Structure | Quotes FOB with clear material/labor breakdown | Quotes EXW with vague “service fee” | ⚠️ Medium |

| Production Visibility | Real-time line photos/videos during audit | Only finished product photos | ⚠️⚠️ High |

| Lead Time Control | Sets timelines based on machine capacity | Adds 7-15 days for “factory coordination” | ⚠️ Medium |

| Quality Accountability | Owns QC lab; provides SPC data | Relies on “factory QC reports” | ⚠️⚠️⚠️ Critical |

💡 Pro Tip: Ask: “Show me your electricity bill for the production workshop.” Factories pay industrial rates (0.8-1.2 RMB/kWh); traders pay commercial rates (1.2-1.8 RMB/kWh).

Top 5 Red Flags Requiring Immediate Disqualification

Observed in 98% of SourcifyChina’s 2025 fraud cases

- “CGGC-Branded” Misrepresentation

- Claiming affiliation with state-owned enterprises (SOEs) for non-core products.

-

Verification: Cross-check SOE directory at www.sasac.gov.cn. SOEs do not manufacture consumer goods via third parties.

-

Document Inconsistencies

- Business license address ≠ facility GPS coordinates (±500m tolerance).

-

USCC number invalid on National Enterprise Credit System.

-

Refusal of Unannounced Audits

- “Factory is busy” during production hours.

-

Standard Practice: 72-hour notice max; audit must include live production shift.

-

Payment Demands to Personal Accounts

- 100% of fraud cases involved personal WeChat/Alipay payments.

-

Requirement: All payments to company bank account matching business license.

-

No Raw Material Traceability

- Inability to name 1 key material supplier with contact.

- Critical Risk: Subcontracting to unvetted workshops = quality disaster.

SourcifyChina 2026 Recommendation

“Verify before you trust” is no longer sufficient. Implement continuous verification:

– Run QixinBao checks quarterly for legal disputes/tax issues.

– Require real-time production photos via encrypted app (e.g., WeCom) during order fulfillment.

– Never accept a supplier claiming “CGGC affiliation” for non-infrastructure products – this is a systematic fraud pattern.

Data Source: SourcifyChina Global Supplier Audit Database (12,000+ factories audited 2023-2025). Methodology complies with ISO 20400 Sustainable Procurement Standards.

Next Step: Request SourcifyChina’s Free Factory Verification Checklist (2026 Edition) at [email protected]. Includes USCC validation template and audit script.

SourcifyChina | Eliminating Sourcing Risk Since 2010 | ISO 9001:2015 Certified

This report contains proprietary verification methodologies. Distribution requires written permission.

Get the Verified Supplier List

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Procuring from CGGC China — Leverage Verified Supply Chain Access

Executive Summary

In the evolving landscape of global procurement, efficiency, compliance, and supplier reliability are non-negotiable. Sourcing from major Chinese state-backed enterprises such as China Gezhouba Group Company (CGGC China) presents significant opportunities—but also complex challenges. These include supply chain opacity, unverified intermediaries, compliance risks, and extended lead times due to misaligned communication.

SourcifyChina’s Verified Pro List is engineered to eliminate these pain points, offering procurement leaders a streamlined, secure pathway to engage with pre-vetted suppliers affiliated with entities like CGGC China.

Why SourcifyChina’s Verified Pro List Saves Time and Mitigates Risk

| Challenge in Traditional Sourcing | How SourcifyChina Solves It | Time Saved (Estimated) |

|---|---|---|

| Unverified supplier claims and fake certifications | 100% on-site audits and document validation | Up to 3 weeks per supplier |

| Language and cultural barriers | Bilingual sourcing consultants with local expertise | 50% reduction in miscommunication delays |

| Lack of direct access to CGGC-affiliated subcontractors or OEMs | Direct access to SourcifyChina’s exclusive Pro List network | 2–4 weeks faster onboarding |

| Compliance and ESG due diligence | Pre-assessed suppliers with full traceability and audit trails | 10+ hours per procurement cycle |

| Negotiation and MOQ misalignment | Market-intelligent support for pricing and volume strategy | 30% faster contract finalization |

By leveraging our Verified Pro List, procurement teams bypass the costly and time-intensive vetting phase—accelerating time-to-market while ensuring supplier integrity.

Call to Action: Secure Your Competitive Edge in 2026

The future of high-efficiency, low-risk procurement in China is not about who you source from—but how you source. With CGGC China and its extended supplier ecosystem driving infrastructure and energy projects globally, access to trusted partners is a strategic imperative.

Don’t navigate the complexity alone.

👉 Contact SourcifyChina today to gain immediate access to our Verified Pro List and dedicated sourcing support:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available 24/5 to assist with supplier matching, due diligence, and end-to-end procurement coordination—ensuring you source smarter, faster, and with full confidence.

SourcifyChina — Your Verified Gateway to China’s Industrial Powerhouse

Trusted by Procurement Leaders Across North America, Europe, and APAC

🧮 Landed Cost Calculator

Estimate your total import cost from China.