The global ceramic sanitary ware market is undergoing significant expansion, driven by rising urbanization, increasing residential and commercial construction, and growing consumer preference for durable, hygienic, and aesthetically pleasing bathroom fixtures. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 75.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2028, reaching an estimated USD 106.4 billion by the end of the forecast period. This growth is further supported by technological advancements in manufacturing processes and a surge in demand from emerging economies in Asia-Pacific and Latin America. As sustainability becomes a priority, leading manufacturers are also investing in water-saving designs and eco-friendly production methods, reshaping competitive dynamics across the sector. In this evolving landscape, ten key players have emerged as dominant forces in innovation, scale, and global market reach.

Top 10 Ceramic Sanitary Ware Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Saudi Ceramic Company

Domain Est. 1996

Website: saudiceramics.com

Key Highlights: We are the leading national provider of world-class manufacturing solutions including Ceramics, Sanitary ware, Water Heaters, Red Bricks, and Desert Mines….

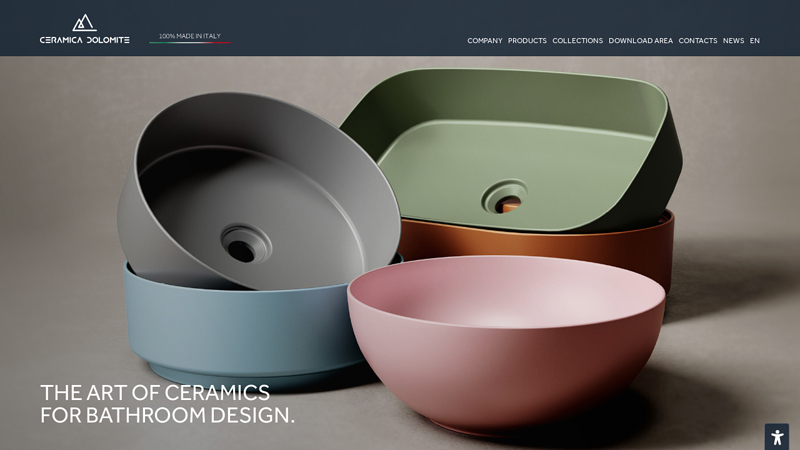

#2 the art of ceramics for bathroom design.

Domain Est. 1997

Website: ceramicadolomite.it

Key Highlights: All Ceramica Dolomite products have been carefully designed to simplify cleaning to ensure your sanitary ware is perfectly hygienic. Upgrade without any ……

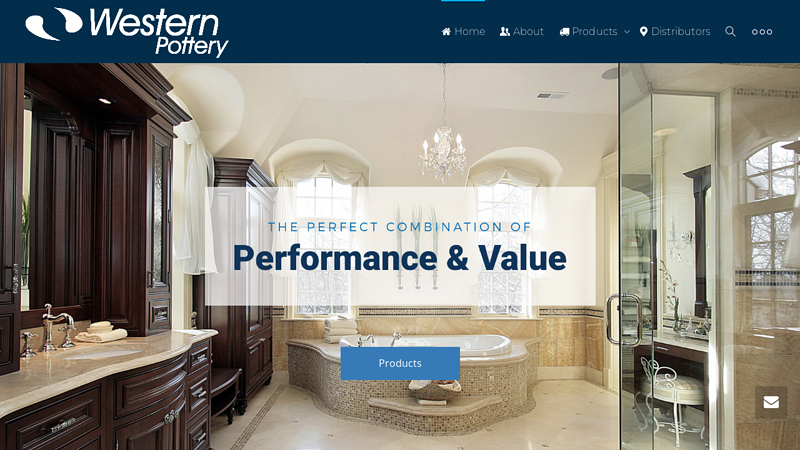

#3 Western pottery

Domain Est. 2004

Website: westernpottery.com

Key Highlights: Leading Developer and Provider of Ceramic Sanitary Ware Based in Southern California, Western Pottery has a 70-year history of providing North America with the ……

#4 Galassia

Domain Est. 2005

Website: ceramicagalassia.com

Key Highlights: Galassia has always been synonymous with quality, design, and reliability in the world of bathroom furnishings. The experience gained over time and a solid ……

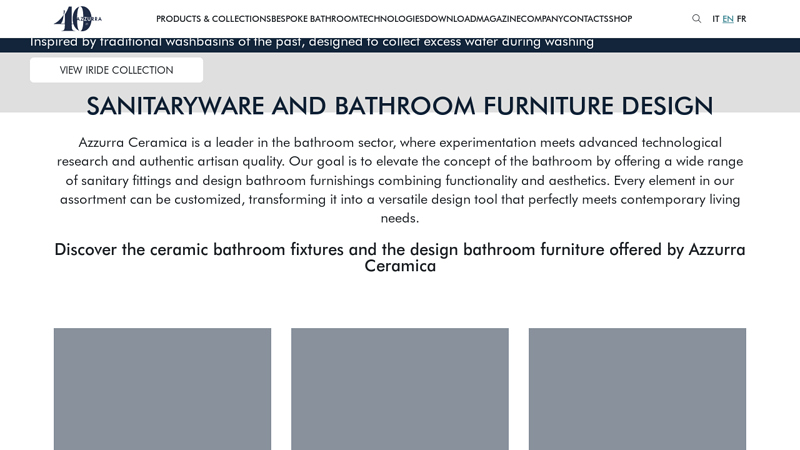

#5 Azzurra Ceramica

Domain Est. 2006

Website: azzurraceramica.com

Key Highlights: Azzurra Ceramica is a leader in the bathroom sector, where experimentation meets advanced technological research and authentic artisan quality….

#6 About Us

Domain Est. 2006

Website: sbordoniceramica.com

Key Highlights: In Sbordoni is the origin of these beautiful, timeless designs and our sanitary fittings are marked with the original brand, hot-stamped on the china surface….

#7 SIMAS

Domain Est. 2015

Website: simasusa.com

Key Highlights: Simas fine ceramic sinks, toilets and bidets are offered in a variety of glossy or matte colors. Also offered are farmhouse sinks and bathroom furniture….

#8 ARROW

Domain Est. 2019

Website: en.arrow-home.cn

Key Highlights: Engineering cases. ARROW Home provides engineering customers around the world with perfect solutions to space with smart sanitary wares, ceramic tiles, ……

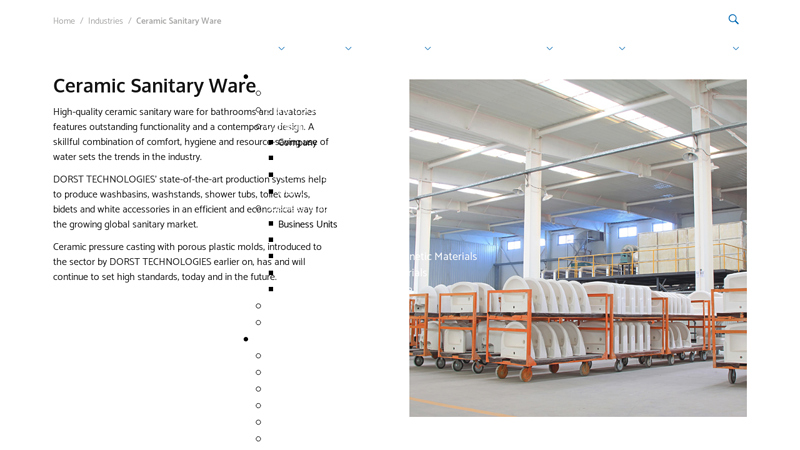

#9 Ceramic Sanitary Ware

Domain Est. 2020

Website: dorst-technologies.com

Key Highlights: High-quality ceramic sanitary ware for bathrooms and lavatories features outstanding functionality and a contemporary design….

#10 Ceramic Sanitary Ware

Domain Est. 2024

Website: dpsanitaryware.com

Key Highlights: We are a comprehensive integrated bathroom brand that encompasses design, R&D, production, sales, and service. Our product range covers six major categories….

Expert Sourcing Insights for Ceramic Sanitary Ware

H2: Market Analysis of Ceramic Sanitary Ware in 2026

The global ceramic sanitary ware market in 2026 is poised for steady growth, driven by urbanization, rising disposable incomes, and increasing focus on hygiene and home improvement. However, the sector faces significant headwinds from economic volatility, supply chain pressures, and evolving consumer preferences. Here’s a comprehensive analysis of key trends shaping the market:

1. Moderate Global Growth with Regional Divergence

- Overall CAGR: The market is projected to grow at a CAGR of 4.5–5.5% from 2022 to 2026, reaching an estimated value of USD 85–90 billion by 2026 (source: Statista, Grand View Research).

- Asia-Pacific Dominance: China, India, and Southeast Asia remain the largest and fastest-growing markets due to rapid urbanization, infrastructure development, and expanding middle-class populations.

- Developed Markets Maturity: North America and Western Europe show stable but slower growth, driven primarily by renovation cycles and premium product demand rather than new construction.

- Emerging Opportunities: Africa and Latin America present long-term potential, though growth is tempered by economic instability and infrastructure gaps.

2. Sustainability and Eco-Innovation as Key Drivers

- Water Efficiency: Water-saving technologies (e.g., dual-flush toilets, low-flow faucets) are becoming standard, driven by regulations (e.g., EPA WaterSense in the U.S.) and consumer environmental awareness.

- Green Manufacturing: Producers are investing in energy-efficient kilns, recycled materials (e.g., post-consumer ceramic waste), and reduced carbon footprints to meet ESG goals and regulatory demands.

- Certifications: Demand for products with eco-labels (e.g., LEED, GreenPro) is rising, especially in commercial and high-end residential projects.

3. Smart and Connected Sanitary Ware Gaining Traction

- Smart Toilets & Fixtures: Integration of IoT features—such as touchless flushing, self-cleaning capabilities, health monitoring, and app connectivity—will expand, particularly in North America, Japan, and premium European markets.

- Design & Technology Fusion: Manufacturers like TOTO, Kohler, and Duravit are leading innovation, blending aesthetics with functionality to appeal to tech-savvy consumers.

- Market Penetration: While still a niche segment (estimated at 8–12% of the market), smart sanitary ware is expected to grow at over 10% CAGR through 2026.

4. Design Trends: Minimalism, Wellness, and Customization

- Wellness-Oriented Bathrooms: Bathrooms are evolving into wellness spaces, driving demand for freestanding baths, rainfall showers, and spa-like fixtures.

- Minimalist Aesthetics: Sleek, wall-hung toilets, concealed cisterns, and seamless designs continue to dominate modern interiors.

- Customization and Personalization: Consumers seek unique finishes (e.g., matte black, textured glazes), color options, and bespoke configurations, pushing manufacturers toward modular and customizable product lines.

5. Supply Chain and Cost Challenges

- Raw Material Volatility: Fluctuations in clay, feldspar, and energy prices—exacerbated by geopolitical tensions—continue to pressure profit margins.

- Logistics & Labor Costs: High freight costs and labor shortages in key manufacturing regions (e.g., China, Italy) may limit supply flexibility.

- Reshoring and Diversification: Some brands are exploring nearshoring or diversifying production to Southeast Asia and Eastern Europe to mitigate risks.

6. Digital Transformation in Sales and Distribution

- E-Commerce Growth: Online sales of sanitary ware are rising, supported by 3D visualization tools, AR/VR try-ons, and B2B platforms for contractors and designers.

- Direct-to-Consumer (DTC) Models: Leading brands are investing in DTC channels to capture higher margins and improve customer data insights.

- BIM and Digital Integration: Building Information Modeling (BIM) compatibility is becoming essential for large-scale and commercial projects.

7. Competitive Landscape: Consolidation and Innovation

- Market Leaders: Companies like LIXIL (INAX, GROHE), Kohler, TOTO, and Roca maintain strong global presence through innovation and acquisitions.

- Regional Players Rising: Chinese (e.g., HUIDA, Dongpeng) and Indian (e.g., Jaquar, Parryware) manufacturers are expanding internationally with cost-competitive, design-forward products.

- M&A Activity: Expected consolidation will help companies scale, enter new markets, and integrate smart technologies.

Conclusion

By 2026, the ceramic sanitary ware market will be characterized by a balance between tradition and innovation. While the core product remains rooted in ceramic craftsmanship, success will depend on adaptability—embracing sustainability, digital integration, and smart technology. Companies that invest in eco-friendly production, respond to regional demand nuances, and leverage digital tools for design and distribution will be best positioned to lead in this evolving landscape.

Common Pitfalls Sourcing Ceramic Sanitary Ware (Quality, IP)

Sourcing ceramic sanitary ware, such as toilets, sinks, and bathtubs, involves navigating several critical challenges, particularly concerning product quality and intellectual property (IP) rights. Overlooking these aspects can lead to significant financial losses, reputational damage, and legal complications.

Quality-Related Pitfalls

Inconsistent Manufacturing Standards

Different suppliers, especially across regions, may adhere to varying quality benchmarks. Without strict oversight, inconsistencies in glazing, structural integrity, and dimensional accuracy can occur, leading to high rejection rates upon delivery.

Poor Material Composition

Low-cost suppliers might use substandard clay or recycled materials, compromising durability and resistance to cracking or staining. This results in shorter product lifespans and increased warranty claims.

Inadequate Glaze Application

A poorly applied or thin glaze can lead to surface pitting, discoloration, and bacterial buildup. Ensuring a uniform, high-gloss, and scratch-resistant finish requires rigorous process control, which some manufacturers may lack.

Insufficient Quality Control Processes

Suppliers without robust quality assurance systems may fail to detect defects such as hairline cracks, warping, or incorrect dimensions. Relying solely on pre-shipment inspections without in-process checks increases risk.

Non-Compliance with International Standards

Products may not meet regulatory requirements (e.g., ASME A112.19.2 in the U.S. or EN 997 in Europe), resulting in customs rejections or legal liabilities. Certification documentation should be verified thoroughly.

Intellectual Property (IP) Risks

Unauthorized Use of Designs

Suppliers may replicate patented or copyrighted designs (e.g., specific toilet bowl shapes or faucet integrations) without authorization. Sourcing such products exposes buyers to infringement claims, even if unintentional.

Counterfeit or “Knock-Off” Products

Some manufacturers produce near-identical copies of branded sanitary ware. Purchasing these items can lead to legal action from original brand owners and damage to your brand’s reputation.

Lack of IP Clauses in Contracts

Failure to include clear IP ownership and indemnification clauses in supply agreements leaves buyers vulnerable. Suppliers should warrant that products do not infringe third-party rights.

Design Theft During Prototyping

Sharing custom designs with suppliers without non-disclosure agreements (NDAs) risks the supplier reproducing and selling the design to competitors.

Grey Market Distribution

Suppliers may divert branded products into unauthorized markets, violating distribution agreements and potentially implicating the buyer in IP violations.

Mitigating these pitfalls requires due diligence, including factory audits, third-party testing, legal review of designs, and strong contractual protections.

Logistics & Compliance Guide for Ceramic Sanitary Ware

Overview of Ceramic Sanitary Ware in Global Trade

Ceramic sanitary ware—including items such as toilets, sinks, bathtubs, and urinals—is a significant segment in the global construction and home improvement market. Due to its fragile nature, heavy weight, and regulatory requirements, proper logistics and compliance planning are essential for successful international trade.

Packaging and Handling Requirements

Proper packaging is critical to prevent breakage during transit. Ceramic sanitary ware must be packed in sturdy, multi-layered corrugated cardboard boxes with internal foam or polystyrene supports. Corner protectors and edge boards are recommended for added protection. Each item should be individually wrapped and secured within the container to minimize movement. Palletization must follow weight distribution guidelines, and stretch-wrapping is essential to stabilize unit loads.

Transportation and Freight Considerations

Due to the weight and fragility of ceramic sanitary ware, sea freight is the most common and cost-effective mode of transportation for international shipments. Containers should be loaded carefully using forklifts with appropriate padding to avoid impact damage. Air freight may be used for urgent or high-value orders but is generally cost-prohibitive due to weight. Overland transport within regions must use shock-absorbing suspension systems and secure cargo tie-downs.

Storage and Warehousing Guidelines

Warehouses storing ceramic sanitary ware should be dry, temperature-controlled, and free from moisture to prevent mold or glaze damage. Items must be stored vertically when possible and never stacked beyond manufacturer-recommended limits. Pallets should be placed on wooden or plastic pallets off the floor to avoid water damage. Inventory rotation (FIFO – First In, First Out) is advised to reduce the risk of long-term storage damage.

Import and Export Documentation

Standard documentation includes the commercial invoice, packing list, bill of lading (or air waybill), certificate of origin, and export declaration. Some markets may require additional documents such as a test report, certificate of conformity, or energy efficiency certification. Accurate Harmonized System (HS) code classification—typically under HS 6910 for ceramic sanitary ware—is essential for customs clearance.

Regulatory and Compliance Standards

Ceramic sanitary ware must comply with the technical and safety regulations of the destination country. Key standards include:

– USA: UPC (Uniform Plumbing Code), CSA B45 in Canada

– EU: EN standards (e.g., EN 997, EN 14688), CE marking under the Construction Products Regulation (CPR)

– Australia/New Zealand: AS/NZS 3634

– GCC Countries: G-Mark certification

Manufacturers must ensure products meet water efficiency, structural strength, and chemical resistance requirements.

Product Certification and Testing

Third-party testing is often required to verify compliance. Common tests include:

– Water absorption and porosity

– Load-bearing capacity (for toilets and basins)

– Thermal shock resistance

– Glaze durability and lead/cadmium leaching (for health safety)

Certificates from accredited laboratories (e.g., SGS, Intertek, TÜV) enhance market acceptance and expedite customs clearance.

Labeling and Marking Requirements

Products should carry permanent markings including:

– Manufacturer name and trademark

– Model number and size

– Country of origin

– Compliance marks (e.g., CE, UPC, WaterSense)

– Installation and handling instructions (in local language, when required)

Environmental and Sustainability Regulations

Increasingly, markets require compliance with environmental standards. This includes restrictions on hazardous substances (e.g., REACH in the EU), use of sustainable manufacturing processes, and recyclability of packaging. Some regions offer incentives for water-saving fixtures (e.g., EPA WaterSense in the U.S.).

Customs Clearance and Duties

Customs authorities may inspect shipments for compliance with safety and labeling rules. Delays can occur if documentation is incomplete or products fail visual inspection. Import duties vary by country and trade agreements—consult the latest tariff schedules. Anti-dumping duties may apply in certain jurisdictions if goods are sold below fair market value.

Risk Management and Insurance

Given the fragility of ceramic products, comprehensive cargo insurance covering breakage, theft, and transit delays is strongly recommended. Shippers should declare the full insured value and specify coverage terms (e.g., Institute Cargo Clauses A). Conducting pre-shipment inspections helps identify defects before dispatch.

Conclusion

Successful logistics and compliance for ceramic sanitary ware require attention to packaging, regulatory standards, documentation, and risk mitigation. Proactive planning ensures timely delivery, reduces the risk of rejection at borders, and supports long-term market access. Engaging with experienced freight forwarders and compliance consultants is advisable for new market entries.

In conclusion, sourcing ceramic sanitary ware requires a strategic approach that balances quality, cost, sustainability, and reliability. It is essential to partner with reputable manufacturers or suppliers who adhere to international standards for material quality, craftsmanship, and environmental practices. Factors such as product durability, design versatility, production capacity, and compliance with regulatory requirements should be carefully evaluated during the selection process. Additionally, considering logistical aspects like lead times, shipping costs, and after-sales support contributes to a successful sourcing outcome. By conducting thorough due diligence and maintaining strong supplier relationships, businesses can secure high-performing ceramic sanitary ware that meets market demands, ensures customer satisfaction, and supports long-term growth in a competitive industry.