The global ceramic gasket market is experiencing robust growth, driven by increasing demand for high-performance sealing solutions in extreme temperature and corrosive environments. According to a 2023 report by Mordor Intelligence, the global gasket market is projected to grow at a CAGR of over 5.8% from 2023 to 2028, with ceramic gaskets gaining traction due to their superior thermal stability, electrical insulation, and mechanical strength. Industries such as aerospace, semiconductor manufacturing, and energy are accelerating adoption, particularly in applications involving high-vacuum and high-temperature systems. Grand View Research further highlights that the expanding semiconductor sector—expected to grow at a CAGR of 10.9% from 2023 to 2030—is a key driver for advanced ceramic components, including gaskets used in chemical vapor deposition (CVD) and etching equipment. With rising investments in clean energy and next-gen electronics, the demand for reliable, precision-engineered ceramic gaskets continues to climb—making it critical to identify the leading manufacturers at the forefront of innovation and quality.

Top 10 Ceramic Gasket Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

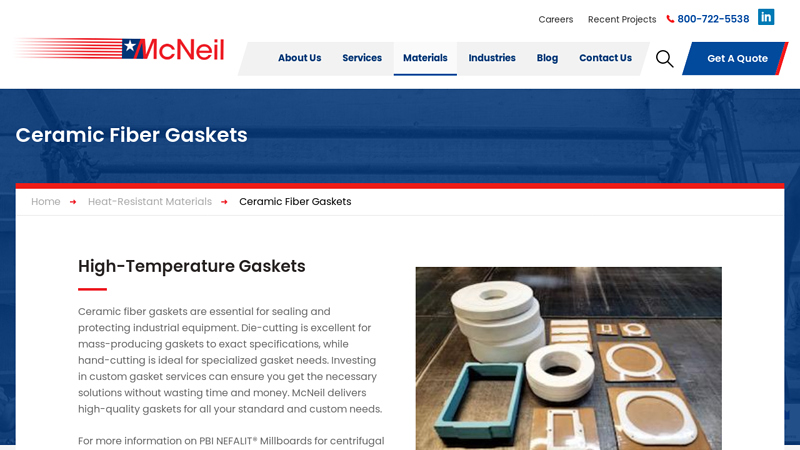

#1 Ceramic-Fiber Gaskets

Domain Est. 1999

Website: mcneilusa.com

Key Highlights: Are you looking for high-temperature, ceramic fiber gaskets? At McNeilUSA, we can handle your custom gasket needs. Contact us today at 800-722-5528….

#2 Lamons

Domain Est. 2002

Website: lamons.com

Key Highlights: Lamons is one of the largest custom gasket, bolt, & seal manufacturers globally, committed to providing industry leading sealing solutions. Call us today!…

#3 Ceramic Gaskets

Domain Est. 2011

Website: nobelengineers.com

Key Highlights: We are engaged in manufacturing and supplying a quality range of Ceramic Gasket. A ceramic fiber gasket is manufactured by applying a mixture including ceramic ……

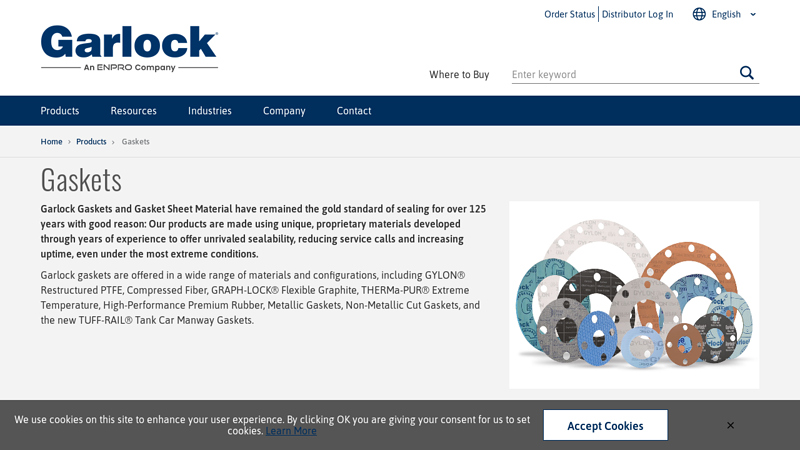

#4 Gaskets

Domain Est. 1995

Website: garlock.com

Key Highlights: The gold standard of sealing for over 125 years. Our Gasket Sheet Materials, Metallic, and Non-Metallic Gaskets are made using unique, proprietary materials ……

#5 Hennig Gasket & Seals

Domain Est. 1999

Website: henniggasket.com

Key Highlights: Hennig Gasket & Seals manufactures custom gaskets and custom seals in virtually any size, shape or configuration that your application requires….

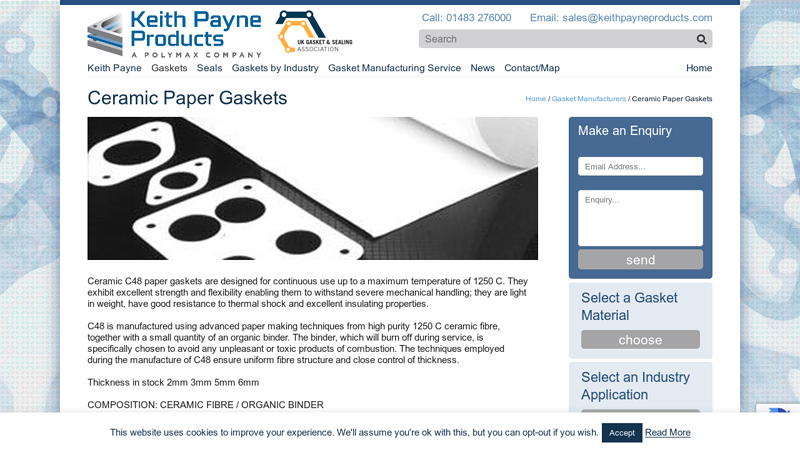

#6 Ceramic Paper Gaskets

Domain Est. 2000

Website: keithpayneproducts.com

Key Highlights: Ceramic C48 paper gaskets are designed for continuous use up to a maximum temperature of 1250 C. They exhibit excellent strength and flexibility….

#7 Ceramic Fiber Gaskets

Domain Est. 2002

Website: mercergasket.com

Key Highlights: We offer a full line of material options and capabilities for forming custom ceramic fiber gaskets to fit your specific needs….

#8 High Temperature Ceramic Fiber Gasket Material

Domain Est. 2004

Website: hannarubbercompany.com

Key Highlights: High Temperature Ceramic Fiber Gasket Material. Download….

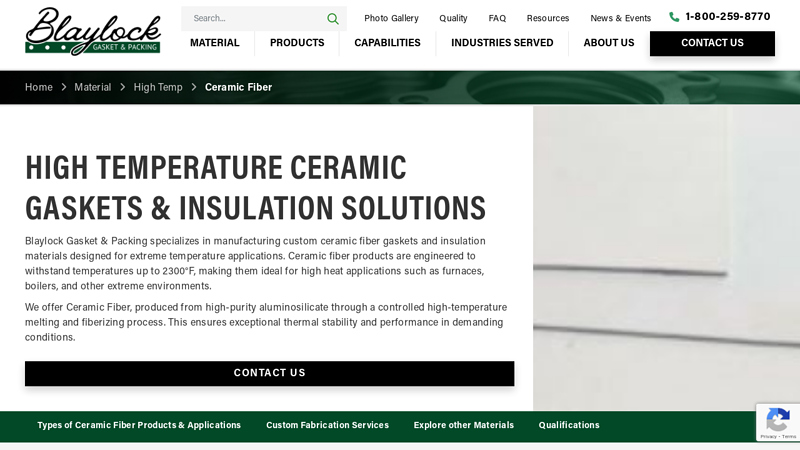

#9 High Temperature Ceramic Gaskets & Insulation Solutions

Domain Est. 2013

Website: blaylock-gasket.com

Key Highlights: Blaylock Gasket & Packing specializes in manufacturing custom ceramic fiber gaskets and insulation materials designed for extreme temperature applications….

#10 CCEWOOL Ceramic Fiber Gasket

Domain Est. 2014

Website: ceceramicfiber.com

Key Highlights: CCEWOOL Ceramic Fiber Gasket is a high-performance insulation material produced from high-purity ceramic fibers and a minimal binder via an advanced nine-stage ……

Expert Sourcing Insights for Ceramic Gasket

H2: Market Trends Shaping the Ceramic Gasket Industry in 2026

The ceramic gasket market is poised for significant transformation by 2026, driven by escalating demands for high-performance materials across critical industries. Key trends emerging in H2 2024 are expected to solidify and accelerate over the next two years, shaping the market landscape significantly.

1. Surging Demand from High-Temperature & High-Pressure Applications (Especially Energy & Aerospace):

* Energy Transition Focus: The global push towards cleaner energy is a major catalyst. Ceramic gaskets are essential in solid oxide fuel cells (SOFCs), concentrated solar power (CSP) plants, and next-generation nuclear reactors (e.g., small modular reactors – SMRs) due to their exceptional stability at temperatures exceeding 800°C. By 2026, increased deployment of these technologies will drive substantial demand.

* Aerospace & Defense Advancements: Development and production ramp-up of hypersonic vehicles, advanced jet engines, and space propulsion systems require materials that withstand extreme thermal cycling and oxidative environments. Ceramic gaskets (e.g., based on alumina, zirconia, silicon nitride) are critical for sealing combustors, afterburners, and exhaust systems. H2 2024 R&D acceleration will translate into commercial demand by 2026.

* Industrial Processing: Growth in high-efficiency industrial furnaces, chemical processing under severe conditions, and waste incineration continues to rely on ceramic gaskets for reliability and longevity.

2. Material Science Innovation Driving Performance and Cost-Effectiveness:

* Advanced Composites & Graded Materials: Research into ceramic matrix composites (CMCs) and functionally graded materials (FGMs) is intensifying. These offer improved fracture toughness, thermal shock resistance, and better compatibility with mating metal components, directly addressing traditional ceramic brittleness. By 2026, these advanced materials will move beyond niche applications into broader industrial use.

* Nano-Engineered Ceramics: Incorporation of nanoparticles (e.g., SiC, CNTs) within the ceramic matrix enhances mechanical properties and thermal conductivity. This trend, gaining momentum in H2 2024, will lead to stronger, more reliable gaskets capable of handling even harsher conditions by 2026.

* Focus on Sintering & Processing: Innovations in sintering techniques (e.g., spark plasma sintering, microwave sintering) aim to reduce manufacturing temperatures and times, improving microstructure and potentially lowering costs – a crucial factor for wider adoption.

3. Electrification and EV Powertrain Evolution:

* Beyond Traditional ICE: While ceramic gaskets are established in traditional internal combustion engines (ICE) for exhaust manifolds and turbochargers, the focus is shifting.

* Power Electronics & Battery Systems: The critical trend emerging in H2 2024 is the application of specialized ceramic gaskets (often based on high-thermal-conductivity ceramics like aluminum nitride or boron nitride) in high-power electric vehicle (EV) inverters, battery management systems (BMS), and charging infrastructure. These gaskets provide essential electrical insulation while efficiently dissipating heat from power semiconductors (SiC, GaN). By 2026, this segment is expected to be a major growth driver, fueled by increasing EV adoption and demands for higher power density and efficiency.

4. Supply Chain Resilience and Regionalization:

* Geopolitical Pressures: Ongoing geopolitical tensions and past supply chain disruptions are pushing OEMs and gasket manufacturers to diversify sourcing and build regional resilience. This trend, evident in H2 2024 sourcing strategies, will lead to increased investment in manufacturing capacity outside traditional hubs (e.g., growth in North America and Europe) by 2026.

* Vertical Integration: Key players may pursue vertical integration, securing access to critical raw materials (e.g., high-purity alumina, zirconia) or acquiring downstream processing capabilities to ensure supply stability and control quality.

5. Sustainability and Lifecycle Considerations:

* Longevity & Reduced Waste: The inherent durability and extended service life of ceramic gaskets compared to metallic or elastomeric alternatives contribute significantly to sustainability by reducing maintenance downtime, part replacement frequency, and waste generation. This lifecycle advantage is becoming a more prominent selling point.

* Manufacturing Efficiency: Efforts to reduce the energy intensity of ceramic processing (sintering) and improve yield rates are ongoing, aligning with broader industrial sustainability goals. Adoption of greener manufacturing processes will be a competitive differentiator by 2026.

Conclusion for 2026 Outlook:

The ceramic gasket market in 2026 will be characterized by robust growth, primarily fueled by the energy transition (fuel cells, nuclear, solar thermal) and the electrification of transportation (EV power electronics). Success will depend on continuous material innovation to overcome brittleness and cost barriers, coupled with strategies to ensure supply chain resilience. Companies that master advanced ceramics manufacturing, develop solutions for next-generation EVs and clean energy systems, and build reliable regional supply chains are best positioned to capture significant market share in this high-performance niche.

Common Pitfalls in Sourcing Ceramic Gaskets: Quality and Intellectual Property Risks

Sourcing ceramic gaskets presents unique challenges due to the material’s specialized properties and manufacturing complexity. Overlooking key quality and intellectual property (IP) aspects can lead to significant operational, financial, and legal repercussions.

Quality-Related Pitfalls

Inadequate Material Specification and Verification

Ceramic gaskets require precise composition (e.g., alumina, zirconia, silicon nitride) and microstructural properties to perform under high temperatures, pressure, and corrosive environments. A common pitfall is accepting gaskets without rigorous material certification or independent verification. Suppliers may provide substandard materials that compromise thermal stability or mechanical strength, resulting in premature failure.

Insufficient Dimensional and Surface Finish Tolerances

Ceramic components are often brittle and difficult to machine post-firing. Poor control over dimensional tolerances or surface roughness can lead to sealing failures, leaks, or difficulty in assembly. Relying solely on supplier-provided drawings without clear, enforceable specifications increases the risk of receiving non-conforming parts.

Lack of Process Control and Traceability

High-quality ceramic gaskets require tightly controlled sintering, grinding, and quality assurance processes. Sourcing from suppliers without documented process controls (e.g., ISO 9001, AS9100) or batch traceability increases the risk of inconsistent quality and complicates root cause analysis during failures.

Inadequate Testing and Qualification Protocols

Assuming ceramic gaskets are “plug-and-play” without proper in-house or third-party testing—such as leak testing, thermal cycling, or mechanical strength validation—can result in field failures. Skipping qualification under actual operating conditions is a critical oversight.

Intellectual Property-Related Pitfalls

Unprotected Design and Specifications

Sharing detailed gasket designs, material formulations, or performance requirements without proper Non-Disclosure Agreements (NDAs) or IP assignment clauses exposes proprietary information. Suppliers may use the designs to serve competitors or replicate the product independently.

Ambiguous Ownership of Tooling and Molds

Custom tooling used in manufacturing ceramic gaskets is often expensive. Failing to clarify ownership rights in the supply agreement allows suppliers to retain control, potentially restricting future sourcing options or demanding additional fees for continued production.

Supplier Reverse Engineering and Market Duplication

A major IP risk arises when suppliers reverse engineer ceramic gasket designs or performance data to develop competing products. This is especially prevalent in regions with weaker IP enforcement. Without robust contractual safeguards, original equipment manufacturers (OEMs) may lose market advantage.

Compliance with International IP Regulations

Sourcing from international suppliers introduces risks related to varying IP laws and enforcement mechanisms. Suppliers in certain jurisdictions may not respect patents or trademarks, leading to unauthorized production or export of infringing components.

Mitigation Strategies

To mitigate these pitfalls, establish clear technical specifications, conduct supplier audits, require material certifications, and implement comprehensive IP protection measures—including NDAs, IP assignment clauses, and monitoring of tooling and design usage. Regular quality audits and batch testing further ensure long-term reliability and protect proprietary innovations.

Logistics & Compliance Guide for Ceramic Gasket

Product Overview

Ceramic gaskets are high-performance sealing components designed to withstand extreme temperatures, corrosive environments, and high pressures. Made from advanced ceramic materials such as alumina, zirconia, or silicon carbide, these gaskets are commonly used in aerospace, automotive, semiconductor manufacturing, and industrial processing applications. Due to their brittle nature and specialized use, proper handling, packaging, and regulatory compliance are critical during logistics operations.

Classification and HS Code

The Harmonized System (HS) code for ceramic gaskets typically falls under:

– HS Code: 6909.19 – Ceramic wares for laboratory, chemical, or other technical uses, other than of porcelain or china.

Note: Final classification may vary based on composition, end use, and country-specific regulations. Verify with local customs authorities or a licensed customs broker.

Packaging Requirements

- Material: Use rigid, shock-absorbent packaging (e.g., double-wall corrugated cardboard boxes with foam or molded inserts).

- Protection: Individually wrap each gasket in bubble wrap or static-dissipative film to prevent chipping or cracking.

- Labeling: Clearly label packages as “Fragile,” “Handle with Care,” and “This Side Up.”

- Moisture Control: Include desiccant packs if transporting through humid environments to prevent contamination or degradation.

Transportation Guidelines

- Mode of Transport: Suitable for air, sea, and ground freight. Air freight is recommended for time-sensitive shipments.

- Temperature Control: Avoid exposure to extreme temperature fluctuations during transit.

- Stacking: Limit stack height to prevent crushing; use pallets for bulk shipments and secure with stretch wrap.

- Documentation: Include packing list, commercial invoice, and material safety data sheet (MSDS/SDS) if applicable.

Regulatory Compliance

- Export Controls: Ceramic components may be subject to export control regulations (e.g., EAR in the U.S. under Commerce Control List 1C990) if used in strategic or military applications.

- REACH & RoHS: Confirm compliance with EU regulations regarding restricted substances. Most ceramic gaskets are inherently compliant but verify additives or coatings.

- Customs Documentation: Provide accurate product descriptions, value, country of origin, and end-use declarations.

- Import Restrictions: Check destination country requirements—some may require product certification (e.g., CE marking, ISO standards).

Safety and Handling

- PPE: Recommend gloves and eye protection when handling to avoid injury from sharp edges.

- Storage: Store in a dry, temperature-controlled environment away from vibration or mechanical stress.

- Static Sensitivity: While ceramics are generally non-conductive, packaging should prevent static buildup in sensitive industrial environments.

Documentation Checklist

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Origin (if required)

- Material Composition Statement

- Export License (if applicable)

- SDS (if coatings or binders are present)

Special Considerations

- Sample Shipments: Mark as “Commercial Sample – No Commercial Value” if applicable to reduce customs scrutiny.

- Warranty & Traceability: Include batch/lot numbers on packaging and documentation for quality tracking.

- Insurance: Declare full replacement value due to high-performance nature and potential fragility.

Adhering to this guide ensures safe, compliant, and efficient global shipment of ceramic gaskets while minimizing risk of damage or customs delays.

Conclusion: Sourcing Ceramic Gaskets

In conclusion, sourcing ceramic gaskets requires a strategic approach that balances material performance, supplier reliability, cost efficiency, and application-specific requirements. Ceramic gaskets offer exceptional thermal stability, electrical insulation, and resistance to corrosion and wear, making them ideal for high-temperature and high-performance environments such as aerospace, automotive, and industrial manufacturing sectors.

When selecting a supplier, it is essential to prioritize those with proven expertise in advanced ceramics, stringent quality control processes, and certifications relevant to the industry (e.g., ISO 9001, AS9100). Customization capabilities, lead times, and technical support are also critical factors that influence the overall value and suitability of the sourcing decision.

By conducting thorough due diligence, evaluating multiple suppliers, and aligning material specifications with operational demands, organizations can ensure reliable performance, reduce downtime, and enhance the longevity of their systems. Ultimately, effective sourcing of ceramic gaskets contributes to improved product quality, operational efficiency, and competitive advantage in demanding applications.