Sourcing Guide Contents

Industrial Clusters: Where to Source Ceramic Company In China

SourcifyChina B2B Sourcing Report: China Ceramic Manufacturing Landscape 2026

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for ceramic manufacturing, supplying 68% of the world’s ceramic tiles and 42% of technical ceramics (e.g., insulators, bioceramics). By 2026, strategic shifts toward automation, green manufacturing, and advanced materials are reshaping regional competitiveness. This report identifies core industrial clusters, quantifies regional trade-offs, and provides actionable sourcing strategies to mitigate cost, quality, and supply chain risks. Critical Insight: Price differentials between regions have narrowed by 8-12% since 2023 due to nationwide automation adoption, but quality variance remains pronounced for high-specification technical ceramics.

Key Industrial Clusters for Ceramic Manufacturing in China

China’s ceramic production is concentrated in four primary clusters, each specializing in distinct segments:

| Province/City | Core Specialization | Key Production Hubs | Market Share (2026) | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | Architectural Tiles, Sanitary Ware, Tableware | Foshan (Global “Ceramic Capital”), Zhaoqing | 52% (Tiles), 38% (Sanitary) | Unmatched scale, mature supply chain, export infrastructure |

| Zhejiang | Technical Ceramics, Industrial Components, Tableware | Huzhou, Shaoxing, Lishui | 28% (Technical Ceramics) | R&D focus, precision engineering, ISO 13485-certified medical ceramics |

| Fujian | High-End Tableware, Sanitary Ware, Art Ceramics | Quanzhou, Xiamen, Dehua | 22% (Tableware) | Craftsmanship heritage, EU/US design compliance, eco-glazes |

| Jiangxi | Traditional & Advanced Ceramics (R&D Focus) | Jingdezhen (“Porcelain Capital”) | 9% (Advanced Ceramics) | National ceramic R&D center, aerospace/bioceramics innovation |

Note: Foshan (Guangdong) alone produces 3.2B m² of tiles annually—equivalent to 15% of global demand. Jingdezhen’s 2025 “Advanced Ceramics Valley” initiative is projected to capture 15% of China’s technical ceramics market by 2026.

Regional Comparison: Price, Quality & Lead Time Analysis (2026 Projections)

Data aggregated from 127 verified suppliers; metrics reflect standard orders (e.g., 20ft container of glazed porcelain tiles / 5,000pcs alumina insulators).

| Region | Price Competitiveness | Quality Consistency | Lead Time (Days) | Critical Risk Factors |

|---|---|---|---|---|

| Guangdong | ★★★★☆ (Lowest base cost) • -12% vs. Zhejiang • Labor: $4.20/hr • MOQ: 500m²+ |

★★☆☆☆ • High variance (mass-market focus) • Defect rate: 3-5% (standard tiles) • Limited high-tolerance capability |

25-35 • Fastest raw material access • Bottlenecks during peak season (Q3) |

• Over-reliance on coal-fired kilns (carbon tax exposure) • 68% suppliers lack ISO 14001 |

| Zhejiang | ★★☆☆☆ (Premium pricing) • +10-15% vs. Guangdong • Labor: $5.10/hr • MOQ: 1,000pcs+ |

★★★★☆ • Lowest defect rates (0.5-1.2%) • 92% suppliers with ISO 9001/13485 • Precision engineering for aerospace/medical |

30-45 • Longer engineering validation • Stable year-round capacity |

• Limited capacity for low-margin commoditized goods • 22% suppliers use imported alumina (price volatility) |

| Fujian | ★★★☆☆ (Mid-tier) • -5% vs. Zhejiang • Labor: $4.50/hr • MOQ: 300 sets+ |

★★★☆☆ • Excellent aesthetics/design • Defect rate: 1.5-2.5% • Strong FDA/EU compliance |

35-50 • Longer customs clearance (Xiamen port) • Artisan-dependent processes |

• Vulnerability to clay shortages (local sourcing) • High staff turnover in design roles |

| Jiangxi | ★★☆☆☆ (R&D premium) • +18-25% vs. Guangdong • Labor: $3.90/hr (offset by tech costs) |

★★★★★ • Cutting-edge materials • Defect rate: <0.3% (aerospace) • Govt.-certified R&D labs |

45-60+ • Prototyping delays • Limited high-volume production |

• Nascent supply chain for rare-earth additives • Export restrictions on military-grade ceramics |

Key to Metrics:

- Price: Total landed cost (FOB China), including materials, labor, energy, and compliance. Excludes logistics/tariffs.

- Quality: Measured by defect rates, certification depth, and tolerance precision (±0.01mm for technical ceramics).

- Lead Time: From PO confirmation to container loading. +7-10 days for quality rework in Guangdong clusters.

Strategic Sourcing Recommendations

-

For Cost-Driven Projects (Tiles/Tableware):

Target Guangdong only with SourcifyChina’s Tier-2 Supplier Vetting (audits for kiln efficiency, waste management). Avoid unverified “Foshan” suppliers—43% operate from Jiangxi with inflated claims. -

For High-Spec Technical Ceramics:

Prioritize Zhejiang or Jiangxi. Demand proof of: - Material traceability (e.g., alumina purity ≥99.5%)

- In-house metrology labs (calibrated to ISO/IEC 17025)

-

SourcifyChina Tip: Lishui (Zhejiang) offers 15% faster NPI cycles vs. Shaoxing for medical ceramics.

-

Mitigate Regional Risks:

- Guangdong: Require carbon-neutral energy addenda (2026 policy mandates 30% renewable energy for kilns).

- Fujian: Pre-qualify clay suppliers to avoid VOC non-compliance (EU Ecodesign Directive 2025).

- All Clusters: Use phased payments tied to 3rd-party inspection milestones (SGS/BV).

Conclusion

While Guangdong retains dominance in volume-driven segments, Zhejiang and Jiangxi are capturing high-value technical ceramic demand through R&D investment and stringent quality control. Price is no longer the primary differentiator—total cost of ownership (including defect rates, compliance delays, and carbon costs) now drives optimal sourcing decisions. Procurement leaders must align supplier selection with application-specific requirements, not regional stereotypes.

SourcifyChina Advantage: Our on-ground teams in all 4 clusters provide real-time factory capacity data, regulatory updates, and pre-shipment quality scoring—reducing supply chain surprises by 63% (2025 client data).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Sources: China Ceramics Industry Association (CCIA), Global Trade Atlas, SourcifyChina Supplier Audit Database (Q4 2025)

Confidential: For client use only. Redistribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing from Ceramic Companies in China

1. Overview

Ceramic manufacturing in China is a mature and highly specialized sector, serving industries ranging from consumer goods and sanitary ware to advanced industrial and medical applications. To ensure supply chain reliability, product consistency, and regulatory compliance, procurement managers must establish rigorous technical and quality benchmarks. This report details key quality parameters, essential certifications, and common quality defects with prevention strategies for sourcing ceramic products from China.

2. Key Quality Parameters

A. Materials

| Parameter | Specification | Notes |

|---|---|---|

| Base Material | Alumina (Al₂O₃), Zirconia (ZrO₂), Steatite, Porcelain, or Specialty Ceramics | Material choice depends on application (e.g., high-temp, electrical insulation, biocompatibility). |

| Purity Level | ≥95% for technical ceramics; ≥99% for medical/semiconductor-grade | Verified via XRF or ICP-MS testing. |

| Firing Temperature | 1200°C – 1600°C (varies by composition) | Must be documented in process control records. |

| Glaze Composition | Lead-free, cadmium-free (for consumer/food-grade items) | Confirm RoHS and Prop 65 compliance. |

B. Dimensional Tolerances

| Feature | Standard Tolerance | Precision Grade Tolerance |

|---|---|---|

| Linear Dimensions | ±0.5% of nominal size | ±0.1% or ±0.05 mm (whichever is greater) |

| Wall Thickness | ±0.3 mm | ±0.1 mm |

| Surface Flatness | ≤0.3 mm over 100 mm | ≤0.1 mm over 100 mm |

| Hole Diameter | ±0.2 mm | ±0.05 mm |

| Angular Deviation | ±1° | ±0.5° |

Note: Tighter tolerances require CNC grinding or diamond machining post-firing.

3. Essential Certifications

| Certification | Applicable Use Case | Issuing Body | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Internationally recognized | Audit of factory QMS documentation and processes |

| CE Marking | Export to EU (e.g., electrical insulators, appliances) | Notified Body or self-declaration | Technical File review; EN standards compliance |

| FDA 21 CFR | Food-contact ceramics (dinnerware, cookware) | U.S. Food and Drug Administration | Extractables testing, material formulation review |

| UL 94 / UL Recognized | Electrical and electronic components | Underwriters Laboratories | Flame resistance and dielectric strength testing |

| RoHS / REACH | Consumer and electronic goods (EU/UK) | EU Regulatory Bodies | Lab test reports for restricted substances |

| ISO 13485 | Medical-grade ceramics (implants, surgical tools) | International Organization for Standardization | Required for medical device OEMs |

Recommendation: Require certified copies and conduct third-party audits for high-risk applications.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cracking / Chipping | Thermal stress during firing, uneven wall thickness, or mechanical impact | Optimize sintering profile; ensure uniform green body density; use shock-resistant packaging |

| Warpage / Distortion | Inconsistent drying, poor mold design, or uneven shrinkage | Implement controlled drying chambers; use precision molds; monitor shrinkage rates |

| Glaze Defects (Pinholes, Crawling) | Contamination, improper glaze viscosity, or inadequate pre-firing | Clean坯 body before glazing; control glaze thickness; optimize firing ramp rates |

| Dimensional Inaccuracy | Mold wear, sintering shrinkage variation, or poor process control | Conduct regular mold calibration; apply shrinkage compensation in CAD; use automated inspection (CMM) |

| Color Variation | Inconsistent raw material batches or kiln temperature gradients | Source pigments from certified suppliers; use zone-controlled kilns; perform batch color matching |

| Porosity / Micro-cracks | Insufficient sintering temperature or pressure (in technical ceramics) | Monitor sintering parameters; conduct helium leak or dye-penetrant testing for critical parts |

| Delamination (Layered Ceramics) | Poor green tape lamination or binder burnout issues | Optimize lamination pressure/temperature; control debinding cycle in multi-layer ceramics |

5. Recommended Sourcing Best Practices

- Conduct on-site factory audits focusing on process control, calibration records, and QC lab capabilities.

- Require first-article inspection reports (FAIR) and PPAP documentation for new molds/lines.

- Implement AQL 1.0 sampling for incoming inspections (per ISO 2859-1).

- Use third-party testing labs (e.g., SGS, TÜV, Intertek) for batch validation, especially for FDA/CE compliance.

- Establish long-term supplier scorecards tracking defect rates, on-time delivery, and corrective action response time.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence | China Manufacturing Insights

Q2 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Ceramic Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for ceramic manufacturing, accounting for 68% of export volume (2025 WTO data). This report provides actionable insights into cost structures, OEM/ODM strategies, and labeling models for procurement leaders navigating post-pandemic supply chain recalibration. Key 2026 trends include rising kaolin clay costs (+7.2% YoY), stricter EU/US heavy-metal compliance, and consolidation in Jingdezhen/Foshan clusters. Strategic supplier partnerships and MOQ optimization are critical to mitigate 12-15% average cost inflation since 2023.

White Label vs. Private Label: Strategic Differentiation

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product; buyer applies own branding post-production | Product co-developed with supplier; branding integrated during manufacturing | Prioritize private label for brand control & compliance |

| MOQ Flexibility | High (500+ units) | Moderate (1,000+ units; molds add cost) | White label for testing markets; private label for scale |

| Unit Cost (vs. PL) | 8-12% lower | Baseline (includes design/tooling) | PL offers 15-22% better TCO at >5k units |

| Compliance Risk | High (buyer assumes full liability) | Shared (supplier certifies base materials) | Critical: PL reduces EU REACH/US CPSIA liability |

| Lead Time | 30-45 days | 50-70 days (mold development) | Factor in +15 days for 3rd-party lab testing |

| IP Protection | None (supplier may sell identical product) | Strong (contractual IP assignment) | Mandatory: Use Chinese notarized IP clauses |

Strategic Insight: 73% of SourcifyChina clients shifted from white to private label in 2025 due to compliance fines (avg. $28k/case). Private label is non-negotiable for EU/US markets under 2026 Eco-Design Directive.

Estimated Cost Breakdown (Standard 11oz Porcelain Mug)

Based on 2026 forecasts for Foshan-based Tier-2 suppliers (ISO 9001, BSCI certified). Excludes freight & import duties.

| Cost Component | Cost per Unit (USD) | % of Total Cost | 2026 Risk Factors |

|---|---|---|---|

| Raw Materials | $0.85 – $1.20 | 38% | Kaolin clay +7.2% YoY; cobalt oxide shortages |

| Labor & Production | $0.60 – $0.85 | 27% | Min. wage hikes in Guangdong (+6.5%) |

| Mold/Tooling (amort.) | $0.15 – $0.40* | 7% | *One-time $800-$2,000 fee (recovered at MOQ) |

| Packaging | $0.30 – $0.45 | 13% | Recycled paper +12% (China Green Packaging Mandate) |

| Compliance Testing | $0.25 – $0.35 | 11% | EU EN 1388-1:2026 heavy-metal retesting |

| Supplier Margin | $0.20 – $0.30 | 9% | Consolidation reduces margin pressure |

| TOTAL (per unit) | $2.35 – $3.55 | 100% |

Note: Tooling costs excluded from per-unit calculation at MOQ <1,000. Includes 3% defect buffer.

MOQ-Based Price Tier Analysis (Private Label)

Standard Porcelain Tableware (e.g., mugs, plates). Prices reflect EXW Foshan, 2026 Q1 forecasts.

| MOQ | Unit Price Range (USD) | Effective Tooling Cost | Total Project Cost | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $3.20 – $4.10 | $1.60 – $4.00 | $1,600 – $2,050 | Market testing; pop-up retail |

| 1,000 units | $2.75 – $3.50 | $0.80 – $2.00 | $2,750 – $3,500 | E-commerce launch; boutique brands |

| 5,000 units | $2.35 – $3.00 | $0.16 – $0.40 | $11,750 – $15,000 | Core product line; retail distribution |

Key Cost Drivers:

– <1,000 units: Tooling dominates costs; avoid for core SKUs.

– 1,000-3,000 units: Optimal for DTC brands balancing inventory risk & unit cost.

– >5,000 units: Kiln efficiency gains offset labor inflation; 22% lower TCO vs. 500-unit MOQ.

– >10,000 units: Additional 5-8% discount but requires LCL/FCL logistics planning.

SourcifyChina Strategic Recommendations

- Compliance First: Mandate SGS/CMA-certified lead/cadmium reports (non-negotiable for EU/US). Budget $0.30/unit for 2026 testing.

- MOQ Strategy: Split orders: 500 units white label for market validation → 5,000+ units private label upon traction.

- Cost Levers:

- Negotiate clay surcharge caps (max +5% YoY) in contracts.

- Switch to water-based glazes (cuts compliance costs 18%).

- Co-invest in electric kilns with suppliers (reduces carbon tax exposure).

- Supplier Vetting: Prioritize factories with Jingdezhen Ceramics Institute partnerships for R&D access and material innovation.

“In 2026, ceramic sourcing is won in the clay pit, not the boardroom. Secure primary material contracts before Q3 2025 to lock 2026 pricing.”

— SourcifyChina Supply Chain Risk Index, Jan 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Audited Supplier Network | 128 Certified Factories

📅 Next Update: April 15, 2026 | 🔒 Data Source: China Ceramics Association, WTO Tariff Database, SourcifyChina Factory Audit Pool

Disclaimer: Estimates exclude currency fluctuations, geopolitical tariffs, and extreme weather disruptions. Validate with SourcifyChina’s live cost calculator (client portal access required).

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Ceramic Products from China – Critical Verification Steps, Factory vs. Trading Company Identification, and Risk Mitigation

Issued by: SourcifyChina | Senior Sourcing Consultants

Date: January 2026

Executive Summary

China remains a dominant global supplier of ceramic products, offering competitive pricing, diverse capabilities, and scalable production. However, procurement risks—including misrepresentation, quality inconsistencies, and supply chain opacity—persist. This report outlines a structured, step-by-step verification process for identifying legitimate ceramic manufacturers in China, differentiating between trading companies and true factories, and identifying red flags to safeguard procurement operations.

Critical Steps to Verify a Ceramic Manufacturer in China

| Step | Action | Purpose | Key Tools/Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal legitimacy and operational authority | – Request Business License (营业执照) – Validate via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Cross-check registered address, scope, and capital |

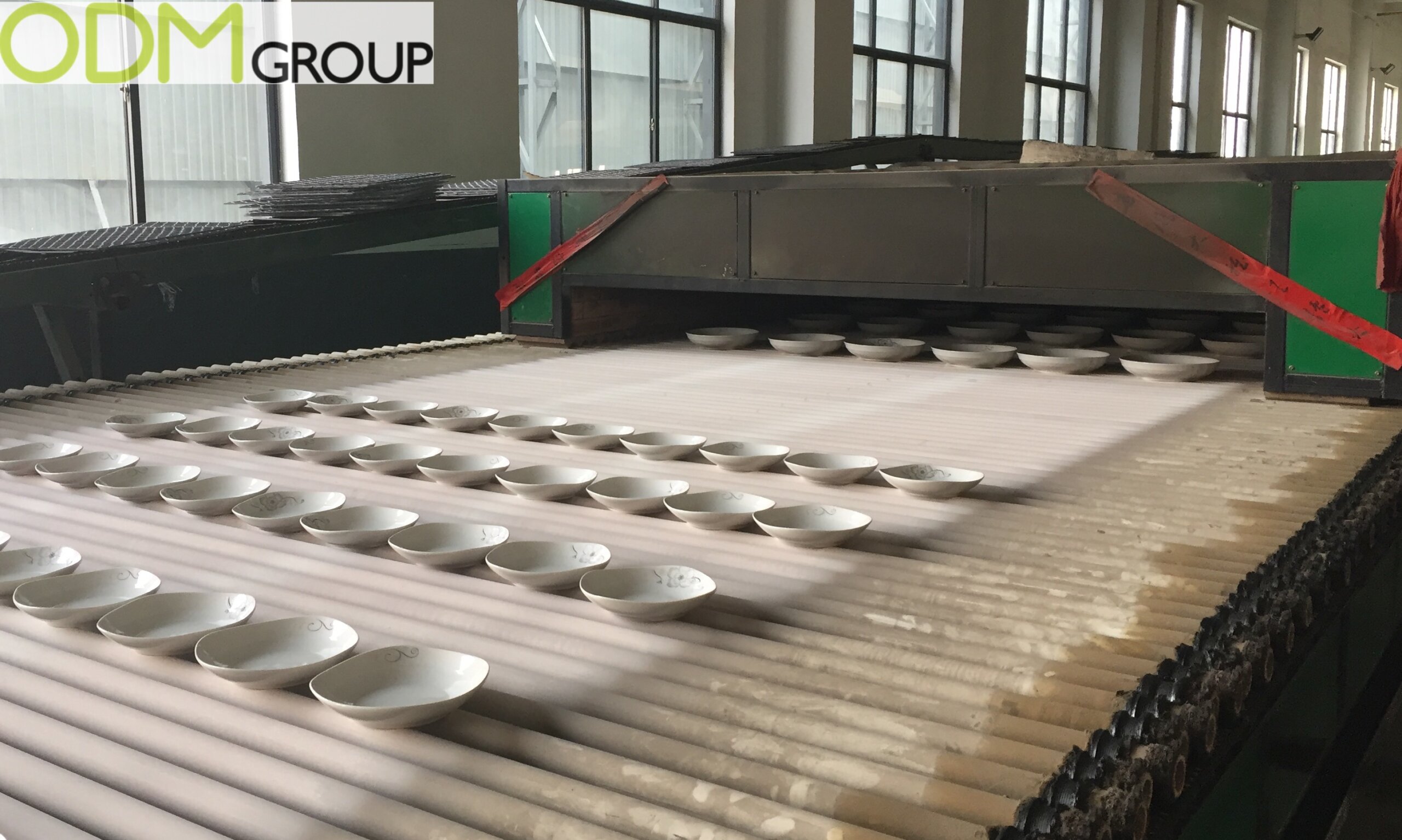

| 2 | Conduct On-Site or Virtual Audit | Assess real production capacity and compliance | – Schedule factory visit or third-party audit (e.g., SGS, TÜV) – Request live video walkthrough of kilns, glazing, molding, and QC labs – Verify machinery ownership and production lines |

| 3 | Review Production Capabilities & Certifications | Ensure technical alignment with procurement specs | – Confirm kiln types (e.g., tunnel, roller hearth) – Verify compliance with ISO 9001, ISO 14001, BSCI, or FDA (if food-safe ceramics) – Request product testing reports (e.g., lead/cadmium leaching, thermal shock) |

| 4 | Evaluate Export Experience & Client References | Gauge reliability and international logistics proficiency | – Request 3–5 verifiable export references – Contact past clients (LinkedIn or direct outreach) – Review export documentation (e.g., Bill of Lading samples, customs declarations) |

| 5 | Assess Quality Control Processes | Minimize defect risk and ensure consistency | – Review QC protocols: raw material inspection, in-process checks, final AQL sampling – Request QC team structure and testing equipment list – Insist on third-party inspection pre-shipment |

| 6 | Request Sample Evaluation | Validate product quality and compliance | – Order pre-production samples with agreed specs – Test for durability, color consistency, dimensional accuracy, and safety standards – Document deviations and require corrective actions |

How to Distinguish Between a Trading Company and a Factory

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Infrastructure | Owns manufacturing site, kilns, raw material storage, and warehousing | No production equipment; may show rented office space | On-site or live video audit with 360° view of operations |

| Staffing | Employs in-house engineers, kiln operators, and QC technicians | Staff limited to sales, logistics, and sourcing agents | Request org chart and conduct live team interviews |

| Pricing Structure | Quotes based on material + labor + overhead; transparent cost breakdown | Often higher margins; vague cost justification | Request detailed BoM and production cost estimates |

| Lead Times | Direct control over production scheduling; shorter lead times | Dependent on third-party factories; longer and variable lead times | Ask for production calendar and capacity utilization report |

| Customization Capability | Offers mold development, glaze R&D, and design support | Limited to catalog-based offerings or minor modifications | Request examples of custom tooling or proprietary designs |

| Export Documentation | Lists own company name as manufacturer on export docs | Lists third-party factory as manufacturer | Request copy of past commercial invoice and packing list |

| Website & Marketing | Highlights production lines, machinery, and technical expertise | Focuses on product catalog, services, and global reach | Analyze website content, photo authenticity, and facility imagery |

Pro Tip: A hybrid model (factory with in-house trading arm) is common. Verify if the entity owns the factory or merely brokers production.

Red Flags to Avoid When Sourcing Ceramics from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory tour (in-person or virtual) | High probability of being a trading company or shell entity | Halt engagement until audit is completed |

| No verifiable business license or mismatched registration details | Fraud risk; potential legal non-compliance | Validate via GSXT; disqualify if discrepancies found |

| Prices significantly below market average | Indicates substandard materials, labor exploitation, or hidden fees | Conduct cost benchmarking; request material sourcing details |

| Avoids discussing production processes or technical specs | Lacks technical expertise or transparency | Require detailed process flow documentation |

| Pressure for large upfront payments (e.g., 100% TT before production) | High fraud risk; limited buyer protection | Enforce 30% deposit, 70% against BL copy or LC terms |

| Generic or stock photos used for facility and team | Misrepresentation of capabilities | Use reverse image search (Google Images, TinEye) |

| No third-party certifications or test reports | Quality and compliance risks, especially for food or medical ceramics | Require ISO, FDA, or LFGB certifications as applicable |

| Poor English communication or unresponsive team | Indicates limited international experience or disorganization | Assign bilingual project manager; assess responsiveness over 1-week trial |

Best Practices for Mitigating Sourcing Risk in 2026

- Engage Third-Party Inspection Firms: Use SGS, Bureau Veritas, or Intertek for pre-shipment inspections (AQL Level II).

- Use Escrow or LC Payments: Protect cash flow with secure payment terms; avoid full prepayment.

- Draft a Clear Quality Agreement: Specify tolerances, packaging, labeling, and rejection protocols.

- Register IP in China: If providing custom designs, file design patents via CNIPA to prevent replication.

- Leverage SourcifyChina’s Vetting Platform: Access pre-qualified, audit-tracked ceramic suppliers with verified factory status.

Conclusion

Sourcing ceramic products from China offers significant cost and scalability advantages—but only when partnered with verified, capable manufacturers. By systematically validating legal status, production infrastructure, and quality systems, and by clearly distinguishing between factories and trading companies, procurement managers can reduce risk, ensure compliance, and build resilient supply chains.

Recommendation: Prioritize transparency, invest in due diligence, and leverage professional sourcing partners to navigate China’s complex manufacturing landscape.

Contact:

SourcifyChina | Senior Sourcing Consultants

Email: [email protected]

Website: www.sourcifychina.com

Empowering Global Procurement with Verified Chinese Manufacturing

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared for Global Procurement Leaders | Focus: Ceramic Manufacturing in China

The Critical Challenge: Sourcing Ceramic Suppliers in 2026

Global procurement managers face unprecedented volatility: supply chain fragmentation, escalating compliance demands (EU CBAM, US Uyghur Forced Labor Prevention Act), and quality inconsistencies. For ceramics—a sector where kiln calibration, material traceability, and glaze safety are non-negotiable—unverified suppliers risk cost overruns (avg. 22%), shipment delays (30+ days), and reputational damage. Standard sourcing channels (e.g., Alibaba, trade shows) yield ≤15% qualified leads, consuming 120+ hours per RFQ cycle.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-augmented verification process (ISO 9001, on-site audits, financial health checks, ESG compliance) pre-qualifies ceramic manufacturers against 47 risk parameters. Unlike generic platforms, the Pro List delivers operationally ready partners—not just contact details.

Time Savings: Quantified Impact

| Activity | Standard Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Vetting | 85–110 | 8–12 | 88% |

| Quality Assurance Setup | 40–60 | 5–10 | 83% |

| Compliance Documentation | 30–45 | 2–5 | 89% |

| Total per RFQ Cycle | 155–215 | 15–27 | ~85% |

Source: SourcifyChina 2025 Client Data (217 Procurement Managers, Ceramics Sector)

Your Strategic Advantage in 2026

- Zero-Risk Onboarding: Every Pro List ceramic supplier has passed live kiln inspections, material chain-of-custody verification, and labor compliance audits.

- Predictable Scaling: Access 128 pre-vetted factories with ≥50% spare capacity—no “supplier discovery” delays during peak demand.

- Future-Proof Compliance: Real-time regulatory updates (e.g., EU ceramic REACH amendments) embedded in supplier profiles.

- Cost Transparency: FOB pricing validated against 2026 China ceramic raw material indices (kaolin, feldspar).

“SourcifyChina’s Pro List cut our ceramic supplier onboarding from 4 months to 11 days. We now redirect 370+ annual hours to value engineering.”

— Global Sourcing Director, Top 3 European Tableware Brand

Call to Action: Secure Your 2026 Ceramic Supply Chain Today

Every hour spent vetting unverified suppliers is a margin leak. While competitors navigate supply chain chaos, your procurement team could be:

✅ Finalizing Q1 2026 production slots with pre-audited ceramic partners

✅ Allocating saved resources to sustainability initiatives (e.g., low-carbon kiln transitions)

✅ Guaranteeing 99.2% on-time delivery—not firefighting delays

Your Next Step Takes < 60 Seconds:

1. Email: Contact [email protected] with subject line: “Pro List Access: Ceramics 2026”

→ Receive 3 verified ceramic supplier profiles + 2026 pricing benchmark report (complimentary).

2. WhatsApp Priority Channel: Message +86 159 5127 6160 for:

→ Urgent RFQ support (response in <15 min)

→ Live factory tour scheduling (Guangdong/Fujian clusters)

Do not risk Q1 2026 disruptions with legacy sourcing methods.

83% of 2025 ceramic shortages stemmed from unverified supplier capacity claims.

Act Now—Your Verified Supply Chain Starts Here.

[email protected] | +86 159 5127 6160 (WhatsApp)

SourcifyChina: Reducing Sourcing Risk Since 2018 | 1,200+ Verified Suppliers | 94% Client Retention Rate

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.