The global sandblasting equipment market is experiencing steady growth, driven by increasing demand from industries such as automotive, aerospace, construction, and shipbuilding for surface preparation and cleaning solutions. According to Grand View Research, the global abrasive blasting equipment market was valued at USD 4.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This growth is fueled by rising industrialization, stricter regulatory standards for surface maintenance, and the need for efficient corrosion prevention methods. As central sandblasting systems—known for their ability to deliver consistent, high-volume abrasive media in centralized operations—gain traction in large-scale facilities, manufacturers are innovating to improve efficiency, durability, and environmental compliance. In this evolving landscape, a select group of manufacturers have emerged as leaders, combining advanced engineering with scalable solutions to meet global demand. Below are the top 5 central sandblasting manufacturers shaping the industry’s future.

Top 5 Central Sandblasting Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

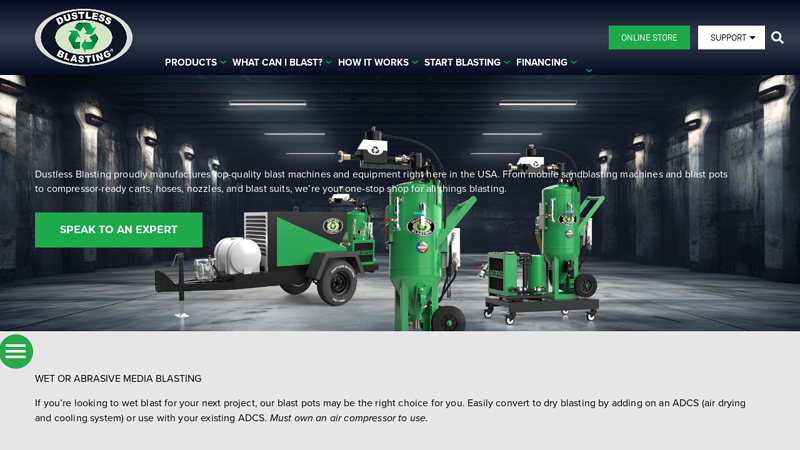

#1 Blast Machines & Equipment

Domain Est. 2011

Website: dustlessblasting.com

Key Highlights: From mobile sandblasting machines and blast pots to compressor-ready carts, hoses, nozzles, and blast suits, we’re your one-stop shop for all things blasting.Missing: central manu…

#2 Sandblasting Water Tanks

Domain Est. 1999

Website: dnrec.delaware.gov

Key Highlights: An air quality permit is required for sandblasting of outdoor water tanks in Delaware. Projects removing lead-containing coatings from water tanks by use of ……

#3 Central Sandblasting Co.

Domain Est. 2002

Website: centralsandblast.com

Key Highlights: Highest quality coating application process. Central Sandblasting is highly specialized in the application of all high-performance coatings….

#4 Central Sandblasting and Speciality Coatings

Domain Est. 2012

Website: centralsandblasting.ca

Key Highlights: Central Sandblasting & Powder Coating has been Manitoba’s leader in corrosion protection for more than 25 years, earning a reputation for quality workmanship ……

#5 Central Blasting

Domain Est. 2021

Website: centralblasting.com

Key Highlights: Dustless Sand Blasting. Perfect for restoring all types of surfaces including wood, metal, bricks, concrete and more….

Expert Sourcing Insights for Central Sandblasting

H2: Market Trends Shaping Central Sandblasting in 2026

As we approach 2026, the central sandblasting industry is undergoing significant transformation driven by technological innovation, regulatory changes, sustainability demands, and evolving industrial needs. Market analysis reveals several key trends that will define the trajectory of central sandblasting systems—integrated abrasive blasting solutions used in large-scale industrial facilities for surface preparation and cleaning.

1. Increased Adoption of Automated and Robotic Sandblasting Systems

By 2026, automation is becoming a cornerstone of efficiency in surface treatment. Central sandblasting systems are increasingly being integrated with robotic arms and AI-driven control systems, especially in automotive, aerospace, and heavy manufacturing sectors. These advancements reduce labor costs, improve precision, and enhance repeatability. Facilities are investing in closed-loop robotic sandblasting cells that minimize human exposure to hazardous environments.

2. Emphasis on Sustainability and Dust-Free Operations

Environmental regulations, particularly in North America and the EU, are pushing companies toward eco-friendly sandblasting solutions. Central systems are transitioning from open blasting to fully enclosed, dust-free operations with advanced filtration and dust collection technologies. The use of recyclable abrasives and wet blasting methods is on the rise to meet emission standards and reduce environmental impact. This trend aligns with ESG (Environmental, Social, Governance) goals, increasingly important for corporate compliance and investor relations.

3. Growth in Modular and Scalable Central Systems

As industries demand flexibility, modular central sandblasting systems are gaining traction. These systems allow companies to scale operations up or down based on production needs. Plug-and-play components, remote monitoring, and IoT-enabled diagnostics make maintenance easier and downtime shorter. This modularity is particularly attractive to job shops and contract manufacturers serving diverse clients.

4. Rising Demand in Renewable Energy and Infrastructure Sectors

The expansion of wind, solar, and green hydrogen infrastructure is creating new opportunities for surface preparation. Turbine blades, steel support structures, and pipelines require rigorous surface cleaning prior to coating. Central sandblasting systems are being customized for these applications, offering high-throughput performance with consistent quality. Government infrastructure initiatives globally are also fueling demand for bridge and structural steel refurbishment.

5. Shift Toward Alternative and Recyclable Abrasives

Traditional silica sand is being phased out due to health hazards (silicosis). By 2026, there is a growing shift toward safer, recyclable abrasives such as steel grit, garnet, crushed glass, and engineered polymer media. Central systems are being optimized to handle these materials efficiently, with closed-loop recycling systems that reduce waste and operational costs.

6. Integration with Industry 4.0 and Predictive Maintenance

Smart sandblasting systems equipped with sensors and cloud connectivity are emerging as a competitive advantage. Real-time monitoring of blast pressure, abrasive flow, nozzle wear, and system health enables predictive maintenance. This reduces unplanned downtime and extends equipment life. Data analytics are also being used to optimize blast parameters for different materials, improving finish consistency.

7. Regional Market Dynamics

While North America and Western Europe lead in adopting advanced central sandblasting technologies, Asia-Pacific is expected to see the fastest growth due to rapid industrialization in India, Vietnam, and Indonesia. China continues to modernize its manufacturing base, driving demand for high-efficiency surface treatment systems.

Conclusion

By 2026, the central sandblasting market will be defined by smarter, cleaner, and more adaptable systems. Companies that invest in automation, sustainability, and digital integration will gain a competitive edge. As industries prioritize efficiency, compliance, and environmental responsibility, central sandblasting is evolving from a utility function to a strategic component of industrial operations.

Common Pitfalls Sourcing Central Sandblasting (Quality, IP)

Sourcing central sandblasting services or equipment involves several critical challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to substandard results, production delays, legal disputes, or compromised proprietary designs. Below are key pitfalls to avoid:

Inadequate Quality Control Standards

Many suppliers lack rigorous quality assurance processes, resulting in inconsistent surface finishes, incomplete cleaning, or substrate damage. Without defined standards (e.g., SSPC-SP 10, ISO 8501), it’s difficult to verify results. Always require documented quality control procedures, third-party certifications, and sample testing before full-scale engagement.

Poor Media Selection and Contamination

Using incorrect abrasive media (e.g., wrong grit size, recycled or contaminated media) can lead to surface pitting, embedded particles, or inadequate profile depth. Suppliers may cut costs by reusing media beyond recommended cycles. Ensure media specifications are contractually defined and regularly audited.

Lack of Environmental and Safety Compliance

Central sandblasting generates hazardous dust and waste. Sourcing from facilities without proper containment, ventilation, or waste disposal systems risks regulatory fines and worker safety issues. Verify OSHA, EPA, or local environmental compliance to avoid liability.

Insufficient Equipment Maintenance

Worn blast nozzles, inconsistent pressure delivery, or poorly maintained recycling systems degrade performance over time. Request maintenance logs and conduct on-site audits to confirm equipment is regularly serviced.

Intellectual Property Exposure

Providing detailed component drawings or proprietary part geometries to third-party blasters increases the risk of IP theft or unauthorized replication. Suppliers may lack secure data handling practices. Mitigate this by using NDAs, limiting design data disclosure, and selecting vendors with certified information security protocols (e.g., ISO 27001).

Inadequate Traceability and Documentation

Without proper batch tracking, blast parameters logging, or inspection records, it’s difficult to trace defects or validate process consistency—especially in regulated industries (aerospace, medical). Require full documentation as part of the service agreement.

Geographic and Logistical Challenges

Long transit times for parts increase handling risks and lead times. Offshore suppliers may offer lower costs but introduce communication barriers and limited oversight. Evaluate total cost of ownership, including shipping, customs, and quality verification efforts.

By proactively addressing these pitfalls—through supplier vetting, clear contracts, and ongoing monitoring—companies can ensure reliable quality and protect their intellectual property when sourcing central sandblasting services.

Logistics & Compliance Guide for Central Sandblasting

This guide outlines the essential logistics procedures and compliance requirements for Central Sandblasting to ensure safe, efficient, and legally compliant operations.

Transportation and Material Handling

All incoming raw materials and outgoing finished products must be transported using approved, well-maintained vehicles equipped with appropriate securing mechanisms. Materials must be labeled clearly with contents, hazard information (if applicable), and handling instructions. Loading and unloading procedures must follow OSHA guidelines, including the use of proper lifting equipment and personal protective equipment (PPE) such as gloves, steel-toed boots, and high-visibility vests.

Storage Protocols

Abrasive media, coatings, and other consumables must be stored in a dry, ventilated, and secure area, segregated by material type to prevent contamination or chemical incompatibility. Flammable materials must be stored in approved safety cabinets away from ignition sources, in compliance with NFPA 30 standards. Inventory must be rotated using the First-In, First-Out (FIFO) method to prevent degradation and ensure quality.

Waste Management and Disposal

Spent abrasive media, dust residues, and paint sludge are classified as industrial waste and must be handled in accordance with EPA and state environmental regulations. Waste must be collected in sealed, labeled containers and stored in a designated hazardous waste area. All waste must be transported and disposed of by licensed waste management contractors with proper documentation, including manifests and disposal certificates. On-site recycling of reusable abrasives is encouraged where feasible and compliant.

Regulatory Compliance

Central Sandblasting must adhere to all applicable federal, state, and local regulations, including but not limited to:

– OSHA 29 CFR 1910 for general industry safety

– EPA Resource Conservation and Recovery Act (RCRA) for waste management

– National Emission Standards for Hazardous Air Pollutants (NESHAP) for particulate emissions

– DOT regulations for the transportation of hazardous materials

All employees must be trained annually on relevant compliance standards, and records must be maintained for audits and inspections.

Equipment and Facility Maintenance

Blasting equipment, ventilation systems (including dust collectors), and safety alarms must undergo routine inspections and maintenance. A documented preventive maintenance schedule must be followed, and any defective equipment must be tagged out of service immediately. Filter changes and system checks must be logged to ensure operational efficiency and regulatory compliance.

Documentation and Recordkeeping

Maintain accurate records of:

– Material Safety Data Sheets (MSDS/SDS) for all chemicals

– Waste disposal manifests and receipts

– Equipment maintenance logs

– Employee training certifications

– Inspection reports from regulatory agencies

All records must be retained for a minimum of five years and be readily accessible for audits.

Emergency Preparedness

An up-to-date emergency response plan must be in place, including procedures for fire, chemical spills, equipment failure, and medical emergencies. Clearly marked exits, eyewash stations, fire extinguishers, and spill kits must be available and inspected monthly. All employees must participate in quarterly emergency drills and be familiar with evacuation routes and reporting protocols.

By adhering to this guide, Central Sandblasting ensures operational integrity, regulatory compliance, and a safe working environment for all personnel.

Conclusion for Sourcing Central Sandblasting

Sourcing central sandblasting services offers significant advantages in terms of efficiency, cost-effectiveness, and quality consistency for industrial operations requiring surface preparation or finishing. Centralized facilities typically provide advanced equipment, strict quality control measures, and experienced personnel, ensuring uniform results across large production volumes. By leveraging economies of scale, businesses can reduce per-unit costs and minimize downtime compared to maintaining in-house sandblasting capabilities.

Additionally, centralized providers often adhere to environmental and safety regulations more rigorously, reducing compliance risks and operational liabilities. When selecting a central sandblasting partner, factors such as capacity, technical capabilities, turnaround time, and location should be carefully evaluated to ensure alignment with project requirements.

In conclusion, outsourcing to a centralized sandblasting service is a strategic decision that enhances operational efficiency, ensures high-quality surface treatment, and supports sustainable manufacturing practices—making it a recommended approach for companies aiming to optimize performance and maintain competitive advantage.