The global insulated metal panel and sheathing market is experiencing steady expansion, driven by rising demand for energy-efficient building solutions in both residential and commercial construction. According to Mordor Intelligence, the global insulation materials market was valued at USD 50.3 billion in 2023 and is projected to grow at a CAGR of over 5.2% through 2029, with rigid foam insulation—such as Celotex’s polyisocyanurate (PIR) boards—representing a significant segment. North America and Europe are leading adopters, fueled by tightening building regulations and sustainability standards. As Celotex, a brand under Recticel Insulation and formerly part of the Dow Chemical portfolio, continues to set benchmarks in high-performance sheathing, a select group of manufacturers have emerged as top producers of Celotex-compatible or equivalent sheathing products. These companies combine advanced manufacturing capabilities, consistent product quality, and broad distribution networks to meet growing demand across key construction markets.

Top 6 Celotex Sheathing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

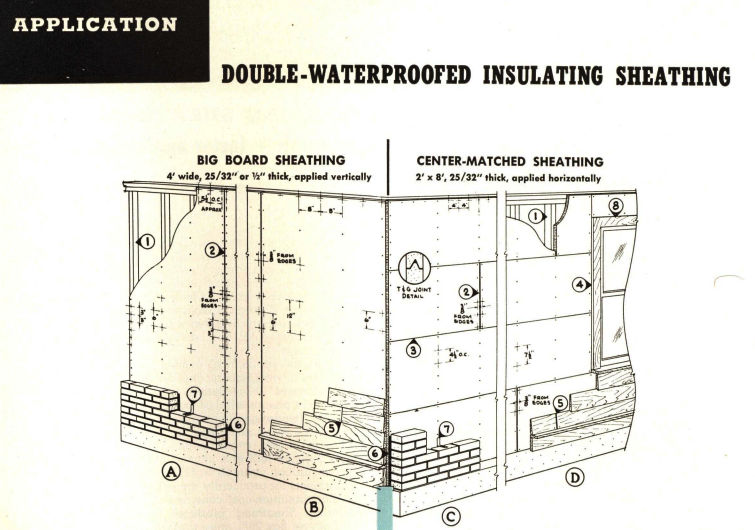

#1 History of Celotex

Domain Est. 1996

Website: westernroofing.net

Key Highlights: Crafted from bagasse, or sugar cane fiber, via a felting process, this product was an exterior sheathing to be used for roof insulation or as a ……

#2 Insulation Boards

Domain Est. 1997

Website: celotex.co.uk

Key Highlights: Insulation Boards manufactured by Celotex. PIR and XPS insulation boards in a range of thicknesses and thermal performances….

#3 CELOTEX CORPORATION

Domain Est. 2008

Website: encyclopediadubuque.org

Key Highlights: Celotex which was headquartered in Tampa, Florida, located in Dubuque in 1953. Production of decorator and acoustical fiber ceilings, insulating sheathing and ……

#4 Celotex Company

Website: mesothelioma.app

Key Highlights: Celotex Company produces insulation, roofing, and building materials. It went bankrupt in 1990. Learn more about its asbestos trust….

#5 Celotex

Domain Est. 1995

Website: asbestos.com

Key Highlights: Celotex used asbestos in insulation products that became the subject of many asbestos lawsuits….

#6 Celotex Corporation

Domain Est. 2013

Website: mesotheliomalawyercenter.org

Key Highlights: The Celotex Corporation made asbestos construction products and operated an asbestos mine, which led to thousands of lawsuits….

Expert Sourcing Insights for Celotex Sheathing

H2: Forecasted 2026 Market Trends for Celotex Sheathing

As we approach 2026, the market for Celotex sheathing—high-performance insulation boards primarily made from polyisocyanurate (PIR)—is expected to evolve in response to shifting construction practices, regulatory changes, and growing emphasis on energy efficiency and sustainability. Several key trends are anticipated to influence demand, innovation, and competitive positioning in the Celotex sheathing segment.

-

Increased Demand Driven by Energy Efficiency Regulations

Governments across Europe, particularly in the UK where Celotex is a market leader, are tightening building regulations to meet net-zero carbon targets by 2050. The Future Homes Standard (UK) and similar EU directives are pushing for higher thermal performance in new and retrofit construction. Celotex sheathing, known for its high thermal resistance (up to 0.75 W/m²K per 100mm), is well-positioned to benefit from this regulatory tailwind. Demand is projected to grow, especially in residential and low-energy building sectors. -

Expansion in Retrofit and Renovation Markets

With an increasing focus on decarbonizing existing building stock, the retrofit market is expected to surge. Celotex sheathing is frequently used in external wall insulation (EWI) and roof upgrades due to its thin profile and high performance. As public and private funding schemes for energy-efficient retrofits expand (e.g., UK’s ECO4 and upcoming Great British Insulation Scheme), Celotex is likely to see stronger adoption in refurbishment projects through 2026. -

Sustainability and Circular Economy Pressures

Environmental concerns are shaping material selection in construction. While Celotex offers strong thermal performance, scrutiny over the lifecycle impacts of PIR foams—particularly in terms of embodied carbon and recyclability—is increasing. In response, Celotex (a brand owned by Saint-Gobain) is expected to accelerate R&D into bio-based raw materials, lower-global warming potential (GWP) blowing agents, and end-of-life recyclability solutions. Transparency in Environmental Product Declarations (EPDs) will become a key differentiator. -

Competition from Alternative Insulation Materials

Celotex faces rising competition from alternative sheathing products such as wood fiberboard, vacuum insulation panels (VIPs), and modified phenolic insulation. These materials offer advantages in breathability, sustainability, or ultra-thinness. However, Celotex’s established distribution network, technical support, and familiarity among specifiers will help maintain market share—provided it innovates to close performance and sustainability gaps. -

Digital Integration and BIM Compatibility

By 2026, digital construction tools like Building Information Modeling (BIM) will be standard in major projects. Celotex is expected to enhance its digital offerings with detailed BIM objects, U-value calculators, and compatibility with energy modeling software. This digital enablement will streamline specification and support architects and contractors in achieving compliance with energy codes. -

Supply Chain Resilience and Cost Volatility

Raw material costs—especially petrochemical derivatives used in PIR production—remain vulnerable to global market fluctuations. Celotex, like other insulation manufacturers, will need to manage supply chain risks through vertical integration, alternative sourcing, and pricing strategies. Regional production capacity in Europe may be expanded to reduce reliance on imports and improve lead times.

Conclusion:

The 2026 outlook for Celotex sheathing is cautiously optimistic. Strong regulatory support for energy-efficient construction will drive demand, particularly in regulated markets like the UK and Western Europe. However, Celotex must navigate sustainability challenges, competitive pressures, and digital transformation to maintain its leadership. Strategic investments in green innovation and digital tools will be critical to capturing market share in the evolving building envelope landscape.

Common Pitfalls Sourcing Celotex Sheathing (Quality, IP)

Inadequate Verification of Product Authenticity

Sourcing Celotex sheathing carries the risk of counterfeit or non-genuine products, especially through unauthorized distributors. Fake materials may lack required fire performance, insulation values, and structural integrity. Always procure through certified suppliers and verify batch numbers and CE/FM markings to ensure authenticity and compliance with building regulations.

Confusion Between Product Lines and Specifications

Celotex offers multiple sheathing and insulation boards (e.g., PL4000, TF/TL4000, XR ranges), each designed for specific applications and performance criteria. Misidentifying the correct product can lead to substandard thermal performance, incorrect load-bearing capacity, or non-compliance with fire safety standards—particularly critical in residential or high-rise construction.

Overlooking Intellectual Property and Brand Licensing

Celotax is a registered trademark of Celotex Limited (part of the CRH Group). Unauthorized use of product names, technical data, or marketing materials may infringe on intellectual property rights. Buyers and specifiers must ensure they reference the correct branded products and avoid reproducing technical documentation without permission.

Insufficient Attention to Fire Performance and Regulatory Compliance

Post-Grenfell, the fire performance of sheathing materials is under intense scrutiny. Celotex RS5000 and similar PIR boards have specific limitations in external wall applications. Sourcing without verifying current UK Building Regulations (e.g., Approved Document B) and ensuring the product is approved for the intended use can result in costly rework, failed inspections, or safety hazards.

Supply Chain Delays and Stock Availability Issues

Celotex products, particularly fire-rated or specialized boards, may face supply constraints due to high demand or production limitations. Relying on last-minute procurement without verifying lead times can disrupt project schedules. Establishing early supply agreements with reputable distributors mitigates this risk.

Misinterpretation of Thermal and Mechanical Data

Assuming uniform performance across all Celotex products can lead to design flaws. Each board has distinct lambda values, compressive strength, and vapor control properties. Failure to consult the latest technical datasheets or to account for long-term performance under load may compromise energy efficiency and structural durability.

Logistics & Compliance Guide for Celotex Sheathing

Product Overview and Handling

Celotex sheathing, typically referring to rigid thermal insulation boards made from polyisocyanurate (PIR), is widely used in roofing, wall, and flooring applications to improve energy efficiency. Proper logistics and compliance procedures are essential to ensure product performance, safety, and regulatory adherence.

Storage Requirements

Store Celotex sheathing in a dry, well-ventilated area, protected from direct exposure to rain, snow, and ground moisture. Boards should remain wrapped in their original packaging until ready for use to prevent moisture absorption and physical damage. Stack horizontally on a flat, level surface using timber bearers to elevate from the ground. Avoid stacking more than 2 meters high to prevent deformation.

Transportation Guidelines

Secure Celotex boards on pallets during transit using straps or shrink wrap to prevent shifting. Use vehicles with weatherproof covers to protect against precipitation. Avoid dragging or dropping packages, which may cause edge damage or delamination. Handle with mechanical aids (e.g., forklifts) when possible to minimize manual strain and product damage.

Health and Safety Compliance

Celotex sheathing is classified as a combustible material. Follow all fire safety regulations during storage and installation. Wear appropriate personal protective equipment (PPE), including gloves and safety glasses, when handling. In poorly ventilated areas, use respiratory protection when cutting boards to minimize inhalation of dust and insulation particles. Refer to the Safety Data Sheet (SDS) for detailed handling and emergency procedures.

Building Regulations and Certifications

Ensure Celotex sheathing products used are compliant with local building regulations, including Part L (Conservation of Fuel and Power) in England and Wales, Section 6 in Scotland, and equivalents in Northern Ireland and the Republic of Ireland. Verify that the specific product variant carries relevant certifications such as BBA (British Board of Agrément) approval, CE marking, and符合 UKCA marking (where applicable post-Brexit). Thermal performance values (U-values) must be calculated in accordance with current standards (e.g., BR 443).

Installation Compliance

Install Celotex sheathing strictly in accordance with manufacturer guidelines and system-specific design details. Avoid thermal bridging by ensuring tight joints and proper sealing. Use compatible adhesives, tapes, and fixings as specified in approved construction systems. Do not modify or cut boards on-site without verifying that performance and fire safety standards remain intact.

Environmental and Sustainability Considerations

Celotex products contribute to energy-efficient building envelopes, aiding compliance with sustainability standards such as BREEAM and Passivhaus. Follow local regulations for waste disposal; off-cuts and packaging should be segregated and recycled where possible. Celotex participates in industry stewardship programs, and product environmental data can be accessed via Environmental Product Declarations (EPDs).

Documentation and Traceability

Maintain records of batch numbers, delivery notes, and product certifications for audit and compliance purposes. Use only Celotex products with full traceability and up-to-date technical literature. Register projects through Celotex’s technical support portal where system warranties or long-term performance guarantees are required.

Fire Performance and Regulatory Compliance

Celotex sheathing must be used in accordance with fire safety regulations, particularly following the Building Safety Act 2022 and Approved Document B (fire safety) in England. Certain high-rise residential or public buildings may have restrictions on combustible materials; always verify suitability for the building type and height. Use fire-rated systems and compatible external finishes (e.g., render, brick slip) where required.

Technical Support and Compliance Verification

For complex applications or compliance queries, contact Celotex Technical Services for system-specific advice, U-value calculations, and compliance documentation. Utilize approved details from Celotex design guides and ensure all work is signed off by qualified professionals in line with local regulatory frameworks.

Conclusion for Sourcing Celotex Sheathing:

Sourcing Celotex sheathing requires careful consideration of project-specific needs, including thermal performance, fire safety regulations, compatibility with other building materials, and regional availability. Celotex offers high-performance insulation solutions known for their excellent thermal conductivity, space efficiency, and durability, making them ideal for a wide range of residential, commercial, and industrial applications. However, due to recent updates in building regulations—particularly following fire safety reviews such as those after the Grenfell Tower tragedy—it is essential to verify that the selected Celotex product complies with current fire safety standards (e.g., achieving the required European Class ratings or UKCA/CE marking).

Procurement should involve collaboration with certified suppliers and manufacturers to ensure authenticity, provide full technical support, and access warranty options. Additionally, sourcing should be planned early in the design phase to accommodate lead times and ensure continuity of supply. By prioritizing certified, compliant, and appropriately specified Celotex sheathing products, construction professionals can achieve energy-efficient, safe, and sustainable building envelopes that meet both regulatory requirements and performance expectations.