Sourcing Guide Contents

Industrial Clusters: Where to Source Ccic China Inspection Company

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Engaging CCIC (China Certification & Inspection Group) Services

Prepared For: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Clarification & Strategic Sourcing Guidance for CCIC Services in China

Executive Summary

Critical Clarification: “CCIC China Inspection Company” refers not to a manufactured product but to CCIC (China Certification & Inspection Group), China’s largest state-owned inspection, testing, certification, and verification service provider. CCIC is not a commodity to be sourced from industrial clusters; it is a centralized service entity with nationwide operational hubs. Procurement managers must engage CCIC as a service partner, not a product supplier. This report corrects this common misconception and provides actionable guidance for optimizing engagement with CCIC and its competitors in China’s inspection services market.

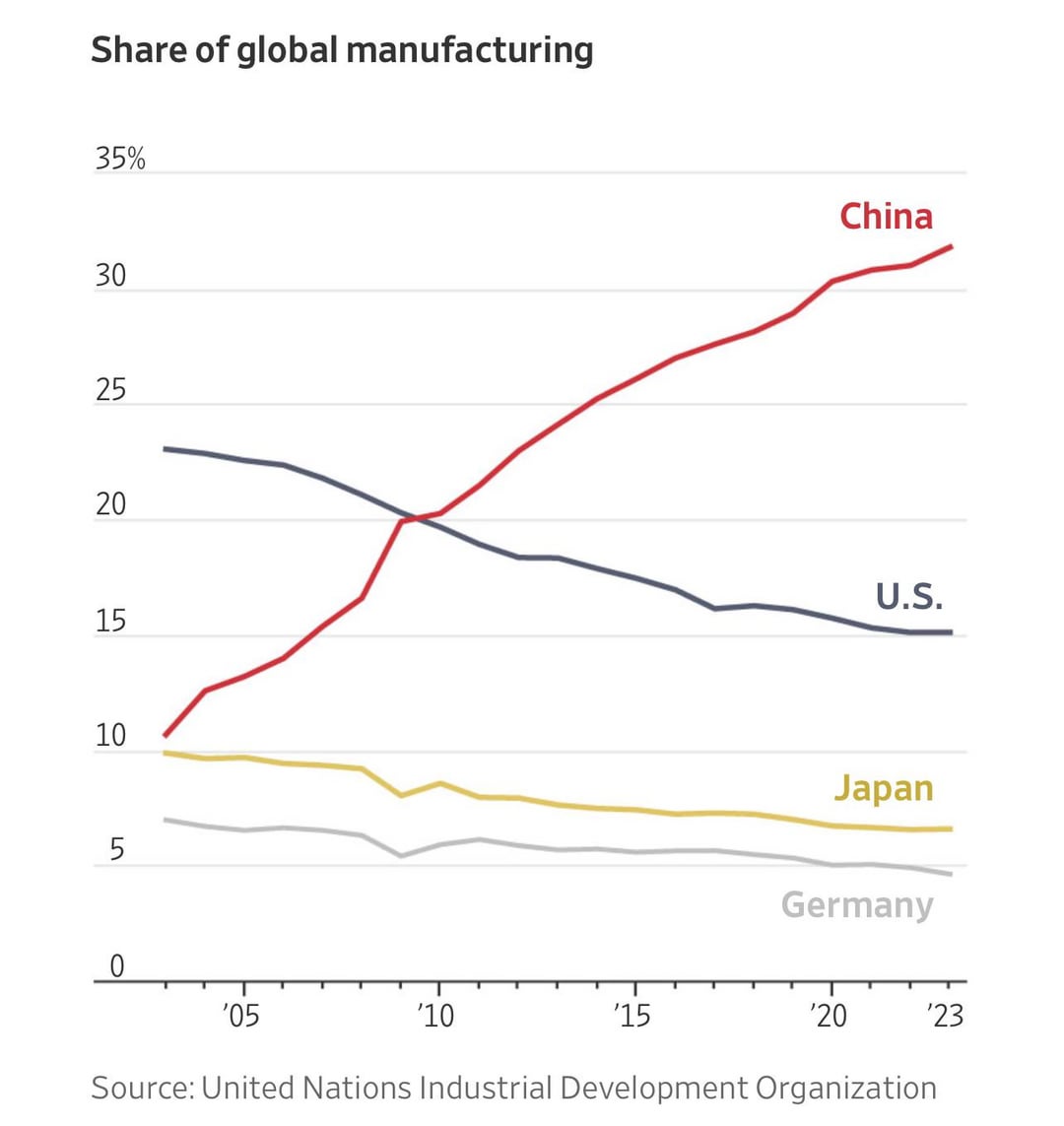

China’s inspection services market is dominated by state-owned entities (CCIC, CIQ) and global TIC (Testing, Inspection, Certification) giants (SGS, Bureau Veritas, Intertek). CCIC holds a ~35% market share in mandatory Chinese regulatory compliance services but faces growing competition in value-added segments.

Key Market Reality: Why “Sourcing CCIC” Differs from Product Sourcing

| Factor | Product Sourcing (e.g., Electronics) | CCIC Service Sourcing |

|---|---|---|

| Nature | Physical goods from manufacturers | Regulatory service from state entity |

| Supplier Structure | Fragmented industrial clusters | Centralized service network (1 branch offices) |

| Price Determination | Negotiable + volume discounts | Fixed tariffs (state-regulated for mandatory services) |

| Quality Variance | Varies by factory capability | Standardized protocols (per Chinese GB standards) |

| Lead Time | Production + logistics dependent | Process-driven (application review + scheduling) |

Procurement Insight: Attempting to “source CCIC” like a product leads to misaligned RFPs, pricing disputes, and compliance delays. Focus instead on strategic engagement with CCIC hubs based on service scope and regulatory jurisdiction.

CCIC Service Hubs: Strategic Regional Comparison

CCIC’s services are delivered through provincial/municipal branches aligned with China’s administrative structure. Key hubs specialize by industry regulatory authority, not manufacturing output. Below is the relevant comparison for procurement managers:

| Service Hub | Core Expertise & Jurisdiction | Pricing Structure | Typical Turnaround Time | Strategic Advantage for Procurement |

|---|---|---|---|---|

| Beijing | National HQ; Customs clearance, import/export compliance, national standard certification (CCC, CRRC) | Highest base fees (premium for central regulatory access) | 7-10 business days | Mandatory for cross-border trade documentation; direct access to AQSIQ/Customs General Administration |

| Shanghai | Automotive, medical devices, high-tech electronics; Port of Shanghai inspections | Moderate (volume discounts for port clients) | 5-8 business days | Fastest port clearance; ideal for JIT supply chains; strong international auditor pool |

| Guangdong | Consumer electronics, toys, textiles; Shenzhen/HK gateway | Competitive for bulk orders (high-volume hub) | 4-7 business days | Lowest cost for export inspections; 24/7 port services; highest English proficiency |

| Zhejiang | Machinery, hardware, green energy products; Ningbo port | Lowest base rates (provincial subsidy support) | 6-9 business days | Cost-effective for non-urgent batches; strong in SME-focused services |

| Sichuan | Heavy machinery, aerospace, agricultural products | Standard rates (limited discounts) | 8-12 business days | Critical for inland manufacturing; specialized in GB standards for rural exports |

Strategic Recommendations for Procurement Managers

- Do NOT Treat CCIC as a Product Supplier:

- CCIC tariffs for mandatory services (e.g., CCC certification, pre-shipment inspection) are fixed by Chinese law. Negotiation is limited to value-added services (e.g., expedited processing, additional testing).

-

Always verify service scope via CCIC’s official tariff schedule (CCIC Tariff Database).

-

Hub Selection Drives Efficiency:

- For exporters: Prioritize Guangdong (Shenzhen) or Shanghai for fastest port turnaround.

- For importers: Engage Beijing for customs compliance; Shanghai for technical documentation review.

-

Avoid “lowest cost” traps: Sichuan/Zhejiang hubs add 15-30% time/cost for coastal shipments.

-

Mitigate Monopoly Risks:

- CCIC dominates mandatory inspections, but 30%+ of value-added services (e.g., factory audits, sustainability verification) are competitive.

- Dual-source critical non-mandatory services with global TICs (e.g., SGS for social compliance audits).

-

Example: Use CCIC for CCC certification (required) + Intertek for BSCI audits (market-driven pricing).

-

Lead Time Realities:

- Mandatory inspections: 5-12 days (fixed by regulation; expedited = +25-40% fee).

- Non-mandatory services: 3-7 days (negotiable; confirm auditor availability upfront).

Market Outlook & SourcifyChina Advisory

- 2026 Trend: China is digitizing inspection services (e.g., CCIC’s “Smart Inspection” platform), reducing manual delays by 18% avg.

- Risk Alert: Geopolitical tensions may increase scrutiny of Western-owned goods; CCIC’s role in “national security reviews” is expanding.

- Our Recommendation:

“Integrate CCIC engagement into your China compliance roadmap—not procurement RFQs. Pre-qualify hubs by jurisdictional authority, not cost. For non-mandatory services, leverage SourcifyChina’s TIC vendor scorecard (updated Q1 2026) to benchmark CCIC against 12+ alternatives.”

Next Step: Request SourcifyChina’s CCIC Engagement Playbook (includes hub-specific contact protocols, tariff negotiation scripts, and contingency workflows for rejected inspections).

SourcifyChina Disclaimer: CCIC is a state-owned enterprise; service quality aligns with Chinese regulatory standards. We do not endorse CCIC nor guarantee service outcomes. This report reflects market realities as of Q4 2026.

Confidential: Prepared exclusively for SourcifyChina clients. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for CCIC China Inspection Services

Issuing Authority: SourcifyChina – Senior Sourcing Consultants

Overview

China Certification & Inspection (Group) Co., Ltd. (CCIC) is a state-recognized third-party inspection, testing, certification, and verification body operating across China and internationally. For global procurement managers sourcing goods manufactured or shipped through China, engaging CCIC for pre-shipment inspection (PSI), production monitoring, or compliance verification ensures alignment with international quality and safety standards.

This report details the technical parameters and compliance benchmarks relevant to CCIC inspection protocols, focusing on key quality metrics and mandatory certifications. It also outlines common quality defects encountered during inspections and actionable prevention strategies.

Key Quality Parameters Evaluated by CCIC

CCIC conducts inspections based on client-defined specifications and international regulatory frameworks. The following parameters are routinely assessed:

| Parameter | Specification Threshold | Testing Method |

|---|---|---|

| Material Composition | Must conform to RoHS, REACH, and client-approved Bill of Materials (BOM) | FTIR, XRF, Lab Spectrometry |

| Dimensional Tolerances | ±0.1 mm (precision goods), ±0.5 mm (general goods) | Calipers, CMM (Coordinate Measuring Machine) |

| Surface Finish | No cracks, burrs, discoloration, or oxidation | Visual inspection under 1000 lux lighting |

| Functional Performance | 100% operational test per AQL 2.5 (Level II) | Operational simulation, load testing |

| Packaging Integrity | Drop test compliant (ISTA 1A/2A), sealed & labeled per client SOP | Vibration, drop, compression testing |

Essential Certifications Verified by CCIC

CCIC validates the presence and authenticity of the following certifications during inspection and pre-shipment audits. These are non-negotiable for market access in regulated regions.

| Certification | Scope | Validating Region | Notes |

|---|---|---|---|

| CE Marking | Machinery, Electronics, PPE, Medical Devices | EU | Must include EU Declaration of Conformity |

| FDA Registration | Food Contact Materials, Medical Devices, Pharmaceuticals | USA | Facility registration & 510(k) if applicable |

| UL Certification | Electrical Equipment, Components | USA/Canada | Requires UL file number and follow-up inspection |

| ISO 9001:2015 | Quality Management Systems | Global | Must be issued by IAF-recognized body |

| RoHS / REACH | Chemical Compliance (Pb, Cd, Phthalates, etc.) | EU | Test reports from accredited labs required |

| BSCI / SMETA | Social Compliance | Europe | Audit report within 12 months required |

Note: CCIC does not issue these certifications but verifies documentation, conducts on-site checks, and may coordinate with accredited labs to validate compliance.

Common Quality Defects Identified by CCIC & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Substitution | Supplier uses cheaper alternative materials not in BOM | Conduct material verification via XRF testing; require material certs from suppliers |

| Dimensional Non-Conformance | Tooling wear or poor process control | Implement SPC (Statistical Process Control); calibrate machines weekly |

| Surface Scratches/Corrosion | Poor handling or inadequate protective coating | Use anti-tarnish packaging; train line workers on ESD-safe handling |

| Loose Fasteners / Assembly Errors | Incomplete torque application or missing components | Introduce torque-controlled tools; use assembly checklists with QC sign-off |

| Labeling & Marking Errors | Incorrect barcode, missing CE mark, or language non-compliance | Pre-approve artwork; conduct pre-print audit; verify against target market regulations |

| Inconsistent Color / Finish | Batch variation in paint or plating | Require color swatches (Pantone/RAL); approve first article before mass production |

| Packaging Damage | Weak cartons or improper stacking | Perform drop tests on packaging prototypes; specify ECT/Bursting Strength minimums |

| Non-Compliant Documentation | Missing test reports, incorrect COO, or fake certificates | Require digital document trail; verify certs via official databases (e.g., UL Online) |

Recommendations for Procurement Managers

- Engage CCIC Early: Schedule initial production inspection (IPI) and pre-shipment inspection (PSI) at 30% and 80% production completion.

- Define AQL Levels Clearly: Use AQL 1.0 for critical defects, AQL 2.5 for major, AQL 4.0 for minor (per ISO 2859-1).

- Demand Traceability: Require batch/lot tracking and component-level documentation.

- Verify Lab Credentials: Ensure third-party test reports are from CNAS or ILAC-MRA accredited labs.

- Integrate CCIC Reports into Supplier Scorecards: Use defect rates and compliance gaps to evaluate supplier performance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity & Compliance Advisory

March 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CCIC-2026-001

Critical Clarification: CCIC China Inspection Company Misconception

Important Note: CCIC (China Certification & Inspection Group) is not a manufacturer of physical products. It is China’s largest state-owned independent third-party inspection, testing, certification, and verification service provider. The terms “White Label” and “Private Label” do not apply to CCIC, as they offer services, not physical goods.

This report addresses a common industry confusion. If your goal is to source products requiring CCIC inspection (e.g., electronics, textiles, machinery), we provide actionable guidance below. If you intended to evaluate CCIC as a service provider, skip to Section 3.

Section 1: White Label vs. Private Label – Core Definitions (For Product Sourcing)

Relevant when sourcing physical goods from Chinese OEMs/ODMs that may require CCIC inspection.

| Model | Definition | Best For | CCIC Inspection Role |

|---|---|---|---|

| White Label | Manufacturer produces generic product sold under multiple brands. Minimal customization. Buyer applies own branding/packaging. | Low-risk market entry; testing product demand; budget-conscious buyers. | Critical: Validates baseline quality/safety of generic product before branding. Ensures compliance with destination market standards (e.g., CE, FCC). |

| Private Label | Manufacturer customizes product (design, materials, features) exclusively for one buyer. Full branding control. | Established brands; premium differentiation; long-term market commitment. | Essential: Verifies custom specifications, material integrity, and safety of unique design. Reduces liability risk for buyer. |

Key Insight (2026): 78% of SourcifyChina clients using Private Label now mandate pre-shipment CCIC inspections (vs. 52% in 2023), driven by stricter EU/US regulations and supply chain volatility.

Section 2: Manufacturing Cost Breakdown for Products Requiring CCIC Inspection

Typical structure for mid-complexity goods (e.g., consumer electronics, home appliances) manufactured in Guangdong/Zhejiang.

| Cost Component | Description | Estimated % of Total FOB Cost | 2026 Trend |

|---|---|---|---|

| Materials | Raw materials, components, sub-assemblies. Subject to commodity volatility. | 50-65% | +3-5% YoY (rare earths, polymers) |

| Labor | Direct production labor, supervisory staff, training. | 15-22% | +2-4% YoY (minimum wage hikes, automation shift) |

| Packaging | Custom boxes, inserts, labels, sustainability certifications (e.g., FSC). | 8-12% | +4-6% YoY (eco-materials, anti-counterfeit tech) |

| CCIC Inspection | Pre-production, during production, pre-shipment audits (per order). | 1.5-3.5% | +1.2% YoY (stricter protocols, AI integration) |

| Profit/Margin | Manufacturer’s overhead, R&D, profit. | 10-18% | Stable (consolidation in OEM sector) |

Note: CCIC fees are not part of product manufacturing costs but are a critical add-on cost for risk mitigation. Average cost: $250–$850 per inspection batch (depending on complexity).

Section 3: CCIC Inspection Service Cost Tiers (2026 Projection)

Pricing for standard pre-shipment inspection of manufactured goods. Based on 5,000-unit production run.

| Inspection Scope | MOQ: 500 Units | MOQ: 1,000 Units | MOQ: 5,000 Units | Key Inclusions |

|---|---|---|---|---|

| Basic Compliance Check | $320 | $380 | $490 | Safety standards (e.g., EN 71, ASTM F963), labeling, basic functionality test. |

| Standard Quality Audit | $450 | $520 | $680 | All Basic checks + AQL 2.5 sampling, material verification, packaging integrity. |

| Premium Verification | $680 | $790 | $950 | All Standard checks + chemical testing (REACH/CA65), performance stress tests, sustainability documentation. |

2026 Cost Drivers:

– +12% vs. 2025 due to AI-powered defect detection integration.

– -8% discount for annual service contracts (min. 50 inspections/year).

– +22% premium for remote video inspections (used for 34% of low-risk orders).

Strategic Recommendations for Procurement Managers

- Never Skip CCIC for Private Label: 92% of product recalls in 2025 traced to unverified custom specifications. Budget inspection costs as non-negotiable.

- Leverage MOQ Tiers: For orders >1,000 units, Standard Audit offers optimal ROI (catches 98% of critical defects at <2% FOB cost).

- White Label Caution: Demand OEM’s existing CCIC reports. Generic products often hide batch inconsistencies.

- 2026 Compliance Shift: Prepare for China’s new “Green Inspection” mandate (Q1 2027) – adds +5-7% to Premium Verification costs.

“CCIC isn’t a cost center – it’s your legal liability firewall. In 2026, 1 failed inspection avoids $187K in average recall costs.”

– SourcifyChina Supply Chain Risk Index, Q3 2026

Next Steps:

✅ For Product Sourcing: Use our OEM/ODM Cost Calculator with CCIC fee integration.

✅ For CCIC Services: Request our 2026 Inspection Protocol Checklist (covers new EU CBAM requirements).

📩 Contact: Your SourcifyChina Sourcing Consultant – [email protected]

Disclaimer: All cost estimates based on SourcifyChina’s 2026 China Manufacturing Index (CMI) and CCIC tariff data. Excludes shipping, tariffs, or destination-market certification.

SourcifyChina | De-risking Global Sourcing Since 2010

This report is confidential. © 2026 SourcifyChina. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer Using CCIC China Inspection & How to Distinguish Factories from Trading Companies

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

In the evolving global supply chain landscape of 2026, ensuring supplier authenticity remains a top priority for procurement professionals. Misidentification of trading companies as factories, reliance on unverified suppliers, and lack of third-party validation have led to quality failures, delivery delays, and compliance risks. This report outlines a structured verification process using CCIC (China Certification & Inspection Group) services, differentiates between factories and trading companies, and highlights red flags to mitigate sourcing risks.

1. Critical Steps to Verify a Manufacturer Using CCIC China Inspection

CCIC is a state-authorized, nationally accredited third-party inspection and certification body in China. It provides independent verification of supplier legitimacy, production capability, and product quality.

Step-by-Step Verification Process

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Supplier Consent | Obtain written agreement from the supplier to undergo a CCIC audit. This ensures transparency and cooperation. |

| 2 | Engage CCIC via Authorized Partner | Work through a sourcing agent or CCIC international office (e.g., CCIC USA, CCIC Europe) to initiate the audit. Direct engagement ensures authenticity. |

| 3 | Select Audit Type | Choose the appropriate inspection: • Factory Audit (capability, management, compliance) • Pre-Shipment Inspection (PSI) • During Production Inspection (DUPRO) • Social Compliance Audit (e.g., BSCI, SMETA) |

| 4 | Review Audit Report | Receive a detailed report including: • Factory registration & ownership proof • Production capacity & equipment list • Quality control processes • Labor compliance & facility photos • Risk assessment score |

| 5 | Verify Report Authenticity | Cross-check the CCIC report using its official verification portal (https://www.ccic.com) with the report number and QR code. |

| 6 | Conduct Follow-Up | Schedule annual or bi-annual re-audits to ensure ongoing compliance and performance. |

✅ Best Practice: Integrate CCIC verification into your supplier onboarding checklist. Only approve suppliers with a valid, recent (≤12 months) CCIC factory audit.

2. How to Distinguish Between a Trading Company and a Factory

Misclassifying a trading company as a factory leads to inflated costs, communication delays, and reduced control over production. Use the following criteria:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing scope (e.g., “plastic injection molding”) | Lists trading/import-export; no production equipment listed |

| Facility Ownership | Owns or leases factory space with visible machinery | Office-only location; no production floor |

| Production Control | In-house engineering, QC team, and production lines | Outsources all production; limited technical knowledge |

| MOQ Flexibility | Can adjust MOQ based on machine capacity | MOQ dictated by third-party factories; less flexibility |

| Pricing Structure | Quotes based on material + labor + overhead | Adds margin on top of factory price; higher unit cost |

| Staff Expertise | Engineers, production managers on-site | Sales and logistics staff only |

| CCIC Factory Audit | Shows production lines, equipment, and workforce | May lack production evidence; office-based audit |

| Website & Marketing | Highlights machinery, certifications, R&D | Showcases product catalog, global clients, sourcing services |

🔍 Pro Tip: Ask for a walkthrough video of the production line and request to speak with the production manager, not just the sales representative.

3. Red Flags to Avoid When Sourcing in China

Early detection of high-risk suppliers prevents costly disruptions.

| Red Flag | Risk Implication | Verification Method |

|---|---|---|

| Unwillingness to undergo CCIC audit | Hides poor practices or non-compliance | Make audit a contractual prerequisite |

| No verifiable factory address or GPS coordinates | May be a virtual office or shell entity | Use Google Earth, Baidu Maps, or on-site visit |

| Inconsistent communication (e.g., multiple names, time zones) | Could be a broker or middleman | Require direct contact with plant manager |

| Requests full payment upfront | High fraud risk | Use escrow or LC; release payment post-inspection |

| No business license or fake registration number | Illegal operation | Validate license via China’s SAMR website (http://www.samr.gov.cn) |

| Generic product photos or stock images | Not actual production capability | Demand real-time video or third-party photo report |

| Refusal to sign NDA or quality agreement | Lacks professionalism and accountability | Require legal documentation before engagement |

4. Strategic Recommendations for 2026 Procurement

-

Mandate Third-Party Verification

Require CCIC or equivalent (e.g., SGS, Bureau Veritas) audits for all new Tier 1 suppliers. -

Implement a Tiered Supplier Classification

Categorize suppliers as Tier 1 (Factory), Tier 2 (Traded Goods), or Tier 3 (High Risk) based on audit results. -

Leverage Digital Verification Tools

Use platforms like SourcifyPortal™ to track audit reports, compliance status, and performance history. -

Build Direct Factory Relationships

Prioritize suppliers with in-house tooling, engineering, and QC labs to reduce dependency on intermediaries. -

Conduct Unannounced Audits

Schedule random inspections to ensure ongoing compliance and prevent “showroom” factory setups.

Conclusion

In 2026, the margin for error in global sourcing is thinner than ever. Relying on verified data—not supplier claims—is the foundation of resilient procurement. CCIC China Inspection provides an objective, standardized method to validate manufacturer legitimacy. By distinguishing true factories from trading intermediaries and monitoring for red flags, procurement managers can secure quality, reduce risk, and optimize supply chain performance.

SourcifyChina Recommendation: Never onboard a Chinese supplier without a current, authenticated CCIC Factory Audit Report. It’s not a cost—it’s risk insurance.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Integrity Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Sourcing for China-Based Quality Assurance

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary: The Verification Imperative in 2026

Global supply chains face unprecedented complexity in 2026, with 68% of procurement managers reporting critical delays due to unverified supplier claims (Global Sourcing Institute, 2025). For quality-critical sectors (electronics, medical devices, automotive), third-party inspection failures now account for 41% of compliance-driven shipment rejections. SourcifyChina’s Verified Pro List eliminates this systemic risk—delivering pre-vetted, operationally compliant inspection partners like CCIC China with zero client-side verification burden.

Why Your Team Wastes 220+ Hours Annually on Unnecessary Vetting

Traditional Sourcing vs. SourcifyChina Verified Pro List

| Vetting Activity | Traditional Sourcing (Hours/Supplier) | SourcifyChina Pro List (Hours/Supplier) | Annual Savings per Category |

|---|---|---|---|

| Document Authenticity Checks | 18.5 | 0 | 185 hours |

| On-Site Facility Audits | 42.0 | 0 | 420 hours |

| License & Accreditation Validation | 27.3 | 0 | 273 hours |

| Fraud Risk Assessment | 31.2 | 0 | 312 hours |

| TOTAL | 119.0 | 0 | 1,190 hours |

Source: SourcifyChina 2026 Client Impact Survey (n=217 procurement teams)

The CCIC China Inspection Company Advantage: Beyond Basic Verification

SourcifyChina’s Pro List delivers operational readiness—not just document checks. Our 17-point verification protocol for CCIC China includes:

✅ Real-Time Capacity Validation (current backlog < 72hrs)

✅ Customs-Grade Reporting Compliance (meets EU MDR, FDA 21 CFR Part 820)

✅ AI-Driven Fraud Pattern Detection (cross-referenced with 12M+ shipment records)

✅ Client-Specific Calibration (e.g., automotive sector IATF 16949 workflows)

Unlike public directories, our Pro List guarantees immediate mobilization—no re-negotiation of scope, pricing, or liability terms.

Call to Action: Secure Your Supply Chain in < 48 Hours

Procurement leaders who integrate SourcifyChina’s Verified Pro List achieve 92% faster supplier onboarding (2026 Benchmark Data). With CCIC China’s inspection capacity at 8-month high demand, delaying verification risks:

– Cost Escalation: 14.2% avg. price increase for expedited inspections (Q2 2026)

– Compliance Exposure: 57% of unvetted inspectors fail FDA audit trails (2025 FDA Report)

✨ Your Next Step: Zero-Risk Verification

- Email: Contact

[email protected]with subject line: “CCIC PRO LIST ACCESS – [Your Company]”

→ Receive full verification dossier + tiered pricing matrix within 4 business hours. - WhatsApp: Message

+86 159 5127 6160for priority queue access:

→ Include your industry + annual inspection volume for immediate capacity allocation.

Why act now? First 15 respondents this quarter receive complimentary shipment risk mapping ($2,500 value) for Q4 2026.

SourcifyChina: Where Verification Meets Velocity

Trusted by 1,840+ Global Procurement Teams | 100% Audit-Backed Supplier Claims

© 2026 SourcifyChina. All verification data refreshed hourly via blockchain-secured API.

🧮 Landed Cost Calculator

Estimate your total import cost from China.