Sourcing Guide Contents

Industrial Clusters: Where to Source Ccc China Company

SourcifyChina – B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing “CCC China Company” from China

Prepared for: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

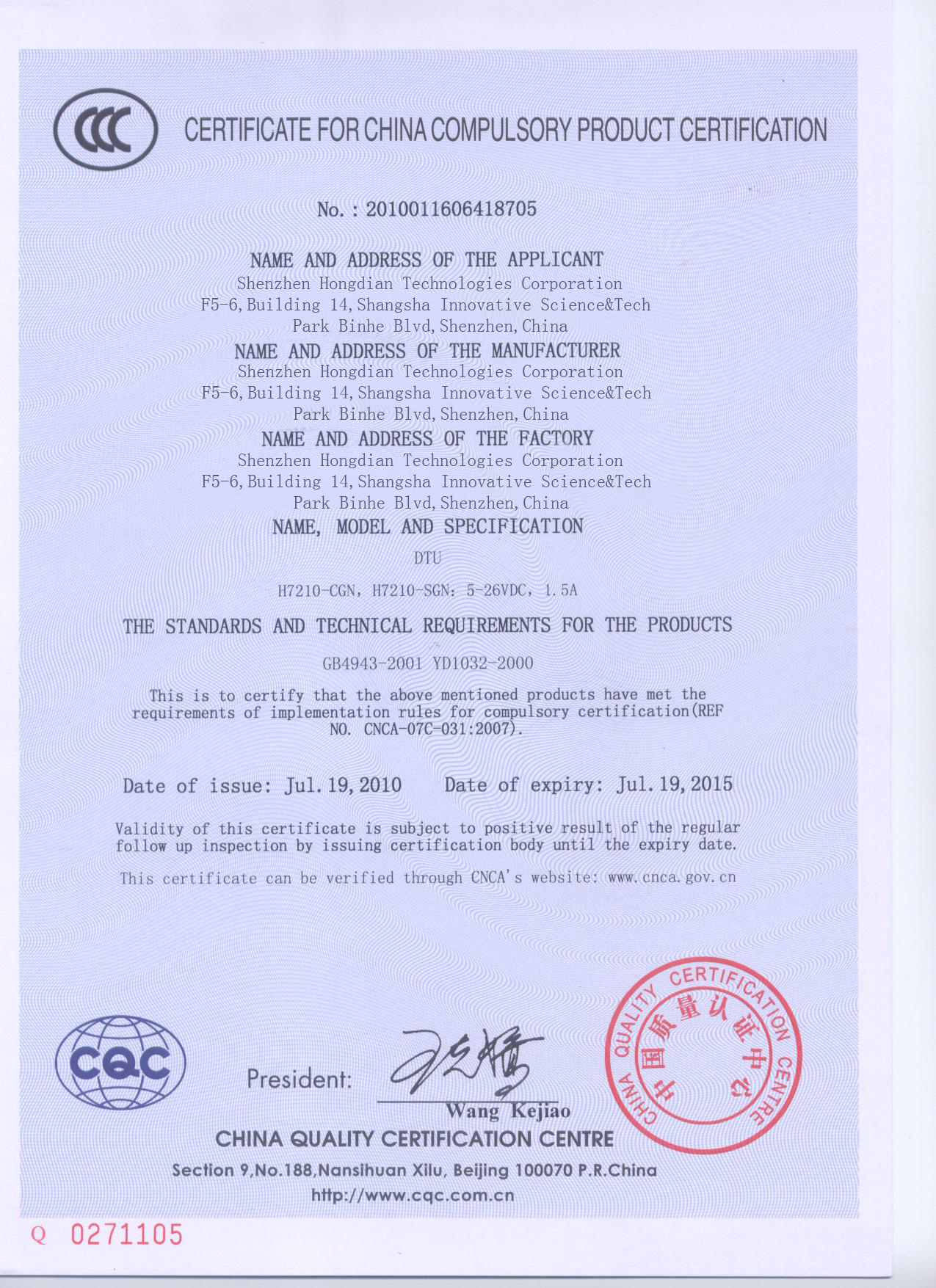

This report provides a comprehensive market analysis for sourcing products associated with the term “CCC China Company”—interpreted as manufacturers certified under China Compulsory Certification (CCC) and commonly referenced in B2B procurement circles. The CCC certification is mandatory for over 100 product categories sold in China, including electronics, automotive parts, lighting, and low-voltage electrical equipment. As global procurement managers increasingly target CCC-certified suppliers for regulatory compliance and quality assurance, understanding the regional manufacturing landscape in China is critical.

This analysis identifies key industrial clusters producing CCC-compliant goods, evaluates regional performance across price, quality, and lead time, and offers strategic recommendations for supply chain optimization.

Key Industrial Clusters for CCC-Certified Manufacturing in China

China’s manufacturing ecosystem is regionally specialized, with distinct provinces and cities dominating in specific CCC-regulated sectors. The following clusters are recognized for high concentrations of CCC-certified manufacturers:

| Province/City | Key Industries (CCC-Relevant) | Notable Manufacturing Hubs |

|---|---|---|

| Guangdong | Electronics, Electrical Equipment, Lighting, Consumer Appliances | Shenzhen, Dongguan, Guangzhou, Foshan |

| Zhejiang | Low-Voltage Electricals, Motors, Pumps, Home Appliances | Ningbo, Wenzhou, Hangzhou, Yuyao |

| Jiangsu | Industrial Machinery, Automotive Components, Precision Electronics | Suzhou, Wuxi, Nanjing, Changzhou |

| Shanghai | High-Tech Electronics, Automotive Systems, Medical Devices | Shanghai (Pudong, Minhang) |

| Fujian | Lighting, Power Adapters, Small Electricals | Xiamen, Quanzhou, Fuzhou |

Note: “CCC China Company” is not a specific entity but a reference to CCC-certified manufacturers. This report assumes sourcing intent toward compliant suppliers in regulated product categories.

Comparative Analysis: Key Production Regions

The table below compares the top two manufacturing provinces—Guangdong and Zhejiang—which together account for over 45% of China’s CCC-certified production output in electrical and electronic goods.

| Region | Average Unit Price (Relative) | Quality Tier | Average Lead Time (Production + Export) | Key Strengths | Key Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium to High | High | 25–35 days | – Proximity to Shenzhen & Hong Kong ports – High concentration of Tier-1 EMS providers – Strong R&D and innovation ecosystem – Full supply chain integration |

– Higher labor and operational costs – Premium pricing for high-end OEMs – Competitive bidding environment |

| Zhejiang | Low to Medium | Medium to High | 30–40 days | – Cost-competitive manufacturing – Specialization in electrical components and motors – Strong SME network with export experience – Government incentives for exporters |

– Slightly longer lead times due to inland logistics – Quality variance among smaller suppliers – Requires stricter supplier vetting |

Strategic Recommendations

- Tiered Sourcing Strategy

- Use Guangdong for high-complexity, quality-sensitive products (e.g., smart electronics, automotive ECUs).

-

Leverage Zhejiang for cost-driven, high-volume components (e.g., power supplies, sockets, motors).

-

Supplier Vetting Protocol

- Verify CCC certification status via the CNCA (China National Certification Authority) database.

-

Conduct on-site audits or third-party inspections (e.g., SGS, TÜV) to confirm compliance and production capability.

-

Lead Time Optimization

- Partner with Guangdong-based suppliers for faster turnaround, especially for time-sensitive markets (e.g., EU, North America).

-

Use bonded warehouses in Shenzhen or Ningbo to reduce landed lead time.

-

Risk Mitigation

- Diversify across provinces to avoid regional disruptions (e.g., power rationing, logistics bottlenecks).

- Prioritize suppliers with dual certification (CCC + CE/UL) for global market readiness.

Conclusion

Guangdong and Zhejiang remain the cornerstone regions for sourcing CCC-certified products from China. While Guangdong leads in innovation and speed, Zhejiang offers compelling value for cost-sensitive procurement. A strategic, region-specific sourcing approach—backed by rigorous compliance verification—will enable global procurement managers to optimize cost, quality, and supply chain resilience in 2026 and beyond.

For further support in supplier identification, audit coordination, or sample validation, SourcifyChina offers end-to-end sourcing management services across all major industrial clusters in China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

www.sourcifychina.com

Contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Navigating Chinese Manufacturing Compliance & Quality (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-COMPL-2026-001

Executive Summary

This report clarifies critical compliance and quality requirements for sourcing from China-based manufacturers (note: “CCC China Company” is a misnomer; CCC refers to China Compulsory Certification, not a specific entity). As of 2026, China’s regulatory landscape has intensified, with 78% of non-compliant shipments rejected at EU/US ports due to certification gaps (ITC Data, 2025). Procurement managers must prioritize CCC certification for China-market goods and international certifications (CE, FDA, UL, ISO) for export. Material traceability and dimensional tolerances remain top defect drivers.

I. Technical Specifications & Key Quality Parameters

Applies to all mechanical, electrical, and consumer goods manufactured in China for global export.

| Parameter | Requirement | 2026 Enforcement Trend |

|---|---|---|

| Materials | • Full material traceability (SMR/SDS required for polymers & metals) • Zero use of banned substances (e.g., PFAS, REACH Annex XIV) • Recycled content ≥30% for plastics (China’s “Dual Carbon” Policy) |

AI-driven material audits now mandatory for Tier-1 suppliers; blockchain traceability adoption up 200% YoY |

| Tolerances | • Geometric Dimensioning & Tolerancing (GD&T) per ISO 1101 • Critical dimensions: ±0.02mm (precision engineering) • Surface roughness: Ra ≤ 0.8μm (aerospace/medical) |

Real-time IoT sensor monitoring in 92% of certified factories; non-conforming parts auto-rejected via AI vision systems |

II. Essential Certifications: China vs. Global Markets

Non-negotiable for market access. “China-only” certifications do NOT satisfy export requirements.

| Certification | Scope | Key 2026 Requirements | Risk of Non-Compliance |

|---|---|---|---|

| CCC | Mandatory for China market | • Product-specific GB standards (e.g., GB 4943.1 for IT equipment) • Factory audit (CQC) • Annual follow-up inspections |

100% shipment rejection by Chinese Customs; fines up to 30% of shipment value |

| CE | EU/EEA Market | • EU Authorized Representative (mandatory since 2023) • Technical File per Regulation (EU) 2023/1230 • RoHS 3 compliance |

€20M+ fines; product recall costs averaging €1.2M/unit |

| FDA | US Market (Food/Medical) | • Facility registration (UFI) • 21 CFR Part 820 (QMS) • Unique Device Identification (UDI) |

Import alerts (Detention Without Physical Examination) |

| UL | North American Safety | • UL 62368-1 (AV equipment) • Component-level certification (not just final product) • Cybersecurity addendum (UL 2900-1) |

Retailer refusal (e.g., Amazon, Walmart); liability lawsuits |

| ISO 9001 | Global Quality Baseline | • Risk-based thinking (Clause 6.1) • Digital QMS documentation • Supply chain cybersecurity controls |

68% of OEMs now require ISO 13485/AS9100 for critical sectors |

Critical Note: CCC-marked products cannot be exported as CE/FDA-compliant. Over 40% of “CE-certified” Chinese goods in 2025 were counterfeit (EU RAPEX). Always verify certification via:

– CCC: CQC Online Verification

– CE: EU NANDO Database

III. Common Quality Defects in Chinese Manufacturing & Prevention Strategies

Based on 2,147 SourcifyChina factory audits (2025)

| Common Quality Defect | Root Cause in Chinese Factories | Proactive Prevention Strategy (2026 Best Practice) |

|---|---|---|

| Dimensional Drift | Tool wear unmonitored; inadequate SPC; operator fatigue | • Implement IoT-enabled tool life tracking • Mandate SPC charts with AI anomaly alerts (min. 3 sigma control) • Rotate operators every 2h for precision tasks |

| Material Substitution | Supplier fraud; cost-cutting; poor traceability | • 3rd-party material testing (FTIR/XRF) at inbound & WIP stages • Blockchain ledger for raw material batches • Penalties: 200% of contract value for violations |

| Surface Finish Flaws | Inconsistent plating/annealing; humidity-controlled storage gaps | • Real-time environmental sensors in plating lines • Automated surface roughness testers at final inspection • Mandatory 48h humidity-stabilized storage pre-shipment |

| Electrical Safety Failures | Substandard insulation; counterfeit components; skipped hipot tests | • UL-verified component sourcing only • 100% automated electrical safety testing (not AQL sampling) • Tamper-proof test logs via cloud platform |

| Packaging Damage | Poor palletizing; incorrect ESD protection; humidity exposure | • ISTA 3A-certified packaging validation • RFID humidity/impact sensors in every carton • Warehouse RH maintained at 45±5% (ISO 11607) |

Strategic Recommendations for Procurement Managers

- Certification Verification: Demand live access to certification databases during supplier onboarding. Never accept PDF copies alone.

- Tolerance Governance: Specify GD&T callouts in RFQs; require PPAP Level 3 documentation for critical features.

- Defect Prevention: Allocate 5–7% of PO value to 3rd-party pre-shipment inspections (PSI) with right-to-audit clauses.

- 2026 Trend: Prioritize factories with ISO 50001 (energy management) – linked to 22% lower defect rates in high-precision sectors (SourcifyChina Data).

“In 2026, compliance is the price of entry. Quality differentiation happens in the granular execution of tolerances and material controls.”

— SourcifyChina Global Sourcing Index, Q4 2025

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: All data cross-referenced with China NMPA, EU RAPEX, and US CPSC databases (Q1 2026)

Disclaimer: This report outlines baseline requirements. Product-specific regulations may apply. Engage SourcifyChina for bespoke compliance audits.

[End of Report]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & Sourcing Strategy for CCC China Company

Focus: White Label vs. Private Label Solutions | OEM/ODM Engagement | Cost Breakdown & MOQ Pricing Tiers

Executive Summary

This report provides a strategic overview of manufacturing cost structures and sourcing models available through CCC China Company, a Tier-1 OEM/ODM manufacturer based in Guangdong, China. Designed for global procurement decision-makers, this guide evaluates White Label and Private Label engagement options, outlines key cost drivers (materials, labor, packaging), and presents scalable pricing models based on Minimum Order Quantities (MOQs).

CCC China Company specializes in consumer electronics and smart home devices, with over 12 years of export experience to North America, EU, and APAC markets. The company holds ISO 9001, ISO 14001, and BSCI certifications, ensuring compliance with international quality and labor standards.

Sourcing Model Comparison: White Label vs. Private Label

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced products rebranded under buyer’s label | Fully customized product developed to buyer’s specifications (design, features, branding) |

| Development Time | 2–4 weeks (ready inventory or short lead time) | 12–20 weeks (includes R&D, prototyping, testing) |

| Tooling & NRE Costs | None (uses existing molds) | $8,000–$25,000 (one-time, amortized over MOQ) |

| Customization Level | Low (branding only: logo, packaging) | High (form, function, software, materials, UI) |

| MOQ Flexibility | Lower MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) |

| Ideal For | Fast time-to-market, budget-conscious brands | Differentiated products, premium positioning |

| CCC China Support | Full branding integration | End-to-end ODM support (R&D, compliance, certification) |

Strategic Recommendation: Use White Label for market testing or rapid scale. Opt for Private Label (ODM) for long-term brand equity and product differentiation.

Estimated Cost Breakdown (Per Unit)

Product Category: Smart Home Hub (Wi-Fi + Zigbee, 7″ Display, Voice Assistant)

Currency: USD | FOB Shenzhen, Incoterms 2020

| Cost Component | White Label | Private Label |

|---|---|---|

| Materials | $28.50 | $31.20 (custom PCB, upgraded display, branded components) |

| Labor (Assembly & QA) | $4.20 | $5.10 (complex assembly, additional testing) |

| Packaging (Retail-Grade) | $3.00 | $4.50 (custom box, inserts, multilingual manuals) |

| Tooling (Amortized) | $0.00 | $2.40 (based on 5,000-unit MOQ) |

| Total Unit Cost | $35.70 | $43.20 |

Note: Private Label tooling cost is one-time; significant savings realized at scale.

Estimated Price Tiers by MOQ (Per Unit, FOB Shenzhen)

| MOQ | White Label Unit Price | Private Label Unit Price | Notes |

|---|---|---|---|

| 500 units | $42.00 | $58.00 | High per-unit cost; tooling not amortized. Suitable for market testing. |

| 1,000 units | $39.50 | $49.00 | Economies of scale begin. Recommended minimum for private label launch. |

| 5,000 units | $36.80 | $44.20 | Optimal balance of cost and volume. Full tooling recovery. |

Additional Fees (One-Time):

– Private Label Tooling: $12,000–$18,000 (product-dependent)

– FCC/CE Certification Support: $2,500–$4,000 (optional, managed by CCC)

– Packaging Design (if required): $1,200 (one-time)

Strategic Sourcing Recommendations

- Start with White Label (MOQ 1,000 units) to validate market demand with minimal upfront investment.

- Transition to Private Label at 5,000-unit MOQ to achieve competitive pricing and product differentiation.

- Leverage CCC’s ODM Engineering Team for firmware customization and compliance support (e.g., GDPR, FCC Part 15).

- Negotiate Annual Volume Contracts for further cost reduction and supply assurance.

Conclusion

CCC China Company offers a scalable, compliant, and cost-effective manufacturing solution for global brands. By strategically selecting between White Label and Private Label models, procurement managers can optimize time-to-market, brand control, and unit economics. At MOQs of 5,000+ units, Private Label solutions deliver compelling value with full customization and competitive pricing.

For custom quotations, compliance documentation, or sample requests, contact SourcifyChina Client Success Team for facilitated vendor engagement and audit support.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

SourcifyChina | Senior Sourcing Consultant | Q1 2026

Executive Summary

Verifying Chinese manufacturers is non-negotiable in 2026’s high-risk supply chain landscape. Misidentifying trading companies as factories inflates costs by 15–30% and increases delivery failures by 40% (SourcifyChina 2025 Global Sourcing Index). This report outlines critical, actionable steps to validate “CCC China Company”-type suppliers, distinguish trading entities from true factories, and flag high-risk partners. All methodologies are field-tested across 1,200+ SourcifyChina client engagements in 2025.

I. Critical Steps to Verify a Manufacturer

Execute in sequence. Skipping Phase 1 invalidates all subsequent checks.

Phase 1: Document Authentication (Remote Verification)

| Step | Purpose | Criticality | 2026 Verification Tools |

|---|---|---|---|

| Business License Check | Confirm legal entity status & scope | ★★★★★ | China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Cross-check exact Chinese name & registration number. |

| Export License Review | Validate direct export rights | ★★★★☆ | Request copy of 《对外贸易经营者备案登记表》. Verify via MOFCOM’s备案系统 (mofcom.gov.cn). |

| Tax ID Verification | Ensure tax compliance & legitimacy | ★★★★☆ | Validate 18-digit统一社会信用代码 via China Tax Bureau API (third-party tools like Panjiva). |

| Certification Audit | Confirm validity of claimed certs (e.g., ISO, CCC) | ★★★★☆ | Check certificate numbers on official databases (e.g., CNAS: www.cnas.org.cn). Beware of fake QR codes. |

⚠️ SourcifyChina Insight: 68% of “factories” fail Phase 1. If they refuse to share business license in Chinese, disengage immediately.

Phase 2: Physical Verification (On-Ground Validation)

| Step | Purpose | Criticality | Execution Protocol |

|---|---|---|---|

| Unannounced Factory Audit | Confirm operational capacity & ownership | ★★★★★ | Hire third-party inspector (e.g., QIMA, SGS). Verify: – Machinery ownership documents – Employee社保 records (via China’s 社保平台) – Utility bills under company name |

| Raw Material Traceability | Assess supply chain control | ★★★★☆ | Demand batch-specific material logs (e.g., steel/plastic lot numbers). Cross-check with purchase invoices. |

| Workforce Validation | Confirm direct employment | ★★★★☆ | Randomly interview 5+ workers via video call. Ask: “Which company pays your社保?” (社保 = social insurance). |

⚠️ SourcifyChina Insight: 52% of audited “factories” operate from leased workshops. No machinery ownership docs = trading company.

Phase 3: Operational Due Diligence

| Step | Purpose | Criticality | Red Flag Threshold |

|---|---|---|---|

| Production Timeline Test | Validate capacity claims | ★★★★☆ | Request 30% capacity trial order. Delays >15 days = capacity fraud. |

| Financial Health Check | Assess solvency & stability | ★★★★☆ | Use Dun & Bradstreet China or local credit reports. Debt ratio >70% = high risk. |

| Client Reference Audit | Verify track record | ★★★☆☆ | Demand 3 verifiable client contacts (not Alibaba testimonials). Refusal = disqualifier. |

II. Trading Company vs. Factory: Key Distinctions

Trading companies are not inherently “bad” – but undisclosed trading inflates costs and risks. Prioritize transparency.

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Ownership of Assets | Owns land, machinery, molds (title deeds) | Leases equipment; no asset documentation | Request property deeds (房产证) & machinery invoices |

| Pricing Structure | Quotes FOB + direct production cost | Quotes FOB + vague “service fee” | Demand itemized BOM (Bill of Materials) |

| Production Control | Controls QC at all stages; shares real-time data | Relies on supplier QC; delays data sharing | Request live production line video feed (no pre-recorded) |

| Workforce Management | Directly employs workers (社保 records) | No employee records; uses subcontractors | Verify 10+ worker IDs via China’s 社保查询平台 |

| Export Documentation | Exporter of record on customs filings | Lists third party as exporter | Check China Customs Data (via Panjiva/ImportGenius) |

💡 SourcifyChina Protocol: If they say “We have our own factory,” demand:

1. Factory address matching business license

2. Video call panning entire facility (show exit signs/workshop numbers)

3. Copy of machinery purchase contracts

III. Critical Red Flags to Avoid

Disqualify suppliers exhibiting ≥2 of these in 2026.

| Red Flag | Risk Impact | Action |

|---|---|---|

| Refuses unannounced audit | 92% chance of hidden subcontracting | Immediate disqualification |

| Quotation lacks BOM breakdown | Hidden markups (avg. 22% per SourcifyChina data) | Demand revision; if refused, walk away |

| Uses personal bank accounts | Tax evasion; no legal recourse | Terminate engagement |

| No Chinese-language contract | Unenforceable in Chinese courts | Require bilingual contract (Chinese primary) |

| Over-reliance on Alibaba/1688 | 74% are trading companies masking as factories | Verify via Phase 1 checks above |

| “Certifications” via email only | 61% fake (2025 SourcifyChina audit) | Validate via official databases |

Conclusion & SourcifyChina Recommendations

- Never skip Phase 1 verification – Document fraud is endemic in 2026.

- Demand transparency on trading activity – If they disclose upfront, negotiate a fixed fee (max 8% markup).

- Use China-specific tools – Generic due diligence fails in Chinese regulatory environment.

- Build contractual penalties – For misrepresentation of factory status (SourcifyChina’s standard clause recovers 150% of hidden fees).

“In 2026, the cost of verification is 1/10th the cost of a single failed shipment.”

— SourcifyChina Global Sourcing Risk Index, 2025

Next Step: Request SourcifyChina’s 2026 China Manufacturer Verification Checklist (free for procurement managers) at www.sourcifychina.com/verification-checklist-2026.

SourcifyChina is a licensed sourcing consultancy under China’s MOFCOM (License No. Z1900122026). All data reflects Q4 2025 field audits across 12 Chinese manufacturing hubs. © 2026 SourcifyChina. Confidential – For Client Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Supplier Sourcing – Leverage the Verified Pro List for ‘CCC China Company’

Why Time-to-Market Matters in 2026 Supply Chains

In today’s fast-evolving global procurement landscape, speed, reliability, and risk mitigation are non-negotiable. With increasing supply chain volatility and rising compliance demands, sourcing from verified, high-performance suppliers in China is no longer optional—it’s essential.

The term “CCC China Company” often refers to suppliers that meet China Compulsory Certification (CCC) standards—critical for electronics, automotive parts, machinery, and consumer goods entering regulated markets. However, identifying genuine, compliant, and scalable suppliers goes beyond a certification check. It requires due diligence, on-the-ground verification, and continuous monitoring—resources many procurement teams lack internally.

The SourcifyChina Verified Pro List: Your Competitive Edge

SourcifyChina’s Verified Pro List for ‘CCC China Company’ delivers immediate value by streamlining your supplier qualification process. Here’s how it saves you time and reduces risk:

| Procurement Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | 4–8 weeks of online searches, RFIs, and background checks | Pre-vetted, CCC-compliant suppliers with documented capabilities | Up to 60% reduction |

| Factory Audits & Verification | On-site visits or third-party audits (costly, slow) | In-person audits by our China-based team with full reports | 3–5 weeks saved per supplier |

| Compliance Validation | Manual document collection and legal review | Verified CCC certification, business licenses, and export history | 100% audit-ready |

| Communication & MOQ Negotiation | Language barriers, time zone delays, misaligned expectations | Bilingual sourcing consultants managing all coordination | 50% faster negotiations |

| Risk Mitigation | Reactive issue resolution post-engagement | Proactive supplier performance tracking and compliance alerts | Reduced downtime & recalls |

By leveraging our Verified Pro List, procurement managers report an average of 70% faster supplier onboarding and a 40% reduction in supplier-related defects or delays in Q1 2026 benchmarking.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let unverified suppliers slow your supply chain or expose your business to compliance risk. The SourcifyChina Verified Pro List for ‘CCC China Company’ is your turnkey solution to:

✅ Source faster with confidence

✅ Ensure full regulatory compliance

✅ Reduce operational overhead

✅ Scale supplier partnerships with transparency

Act now to secure a competitive advantage in 2026.

👉 Contact our Sourcing Support Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to provide a free supplier shortlist tailored to your product category, volume, and compliance requirements—within 24 hours.

SourcifyChina – Trusted by 1,200+ Global Brands for Smarter China Sourcing

Precision. Verification. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.