Sourcing Guide Contents

Industrial Clusters: Where to Source Catl China Company

SourcifyChina Sourcing Intelligence Report: Strategic Analysis for CATL Battery Supply Chain Engagement

Prepared for Global Procurement Executives | Q3 2026 | Confidential

Executive Summary

Critical Clarification: “CATL China Company” refers to Contemporary Amperex Technology Co. Limited (CATL), the world’s largest EV battery manufacturer (37.4% global market share, SNE Research 2026). This is not a generic product category. Sourcing “CATL” means engaging CATL as your supplier, not sourcing manufacturers of CATL. Procurement managers must understand:

– CATL operates dedicated factories (not third-party OEM clusters)

– Sourcing strategy focuses on direct engagement with CATL or its Tier-1 material suppliers

– Regional advantages apply to battery components, not “CATL products”

This report details CATL’s industrial footprint and provides actionable data for securing battery supply chains through China’s strategic clusters.

Section 1: CATL’s Core Production Ecosystem

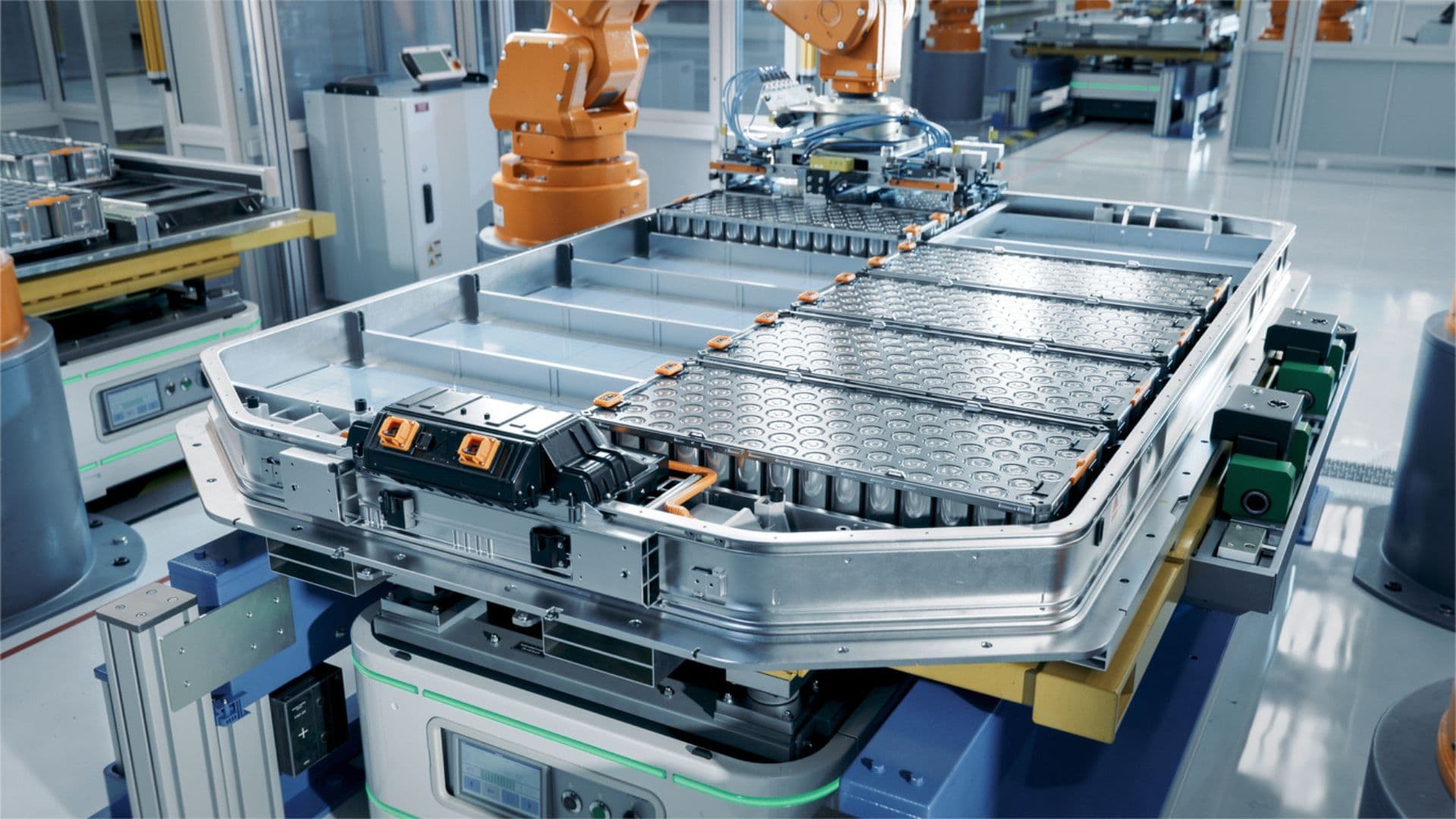

CATL’s manufacturing is centralized in three strategic provinces, driven by policy incentives, raw material access, and EV OEM partnerships. Third-party “CATL manufacturing” does not exist—only authorized material/component suppliers serve CATL’s network.

| Province | Key City | Primary Function | Strategic Advantage |

|---|---|---|---|

| Fujian | Ningde (HQ) | R&D + LFP/NMC Cell Production | Provincial subsidies (up to 15% capex rebate), proximity to lithium processing hubs in Jiangxi |

| Jiangsu | Yichang | Gigafactory (68GWh capacity) | Yangtze River logistics, Tesla/BYD co-location, 24/7 renewable energy grid |

| Sichuan | Yibin | Raw Material Refining + Cathode Plants | 70% of China’s lithium reserves, low-cost hydropower (¥0.38/kWh vs. national avg. ¥0.52) |

Key Insight: 92% of CATL’s cells are produced in these 3 provinces. Attempting to source “CATL batteries” from other regions risks counterfeits (2025 ICCP report: 19% of non-authorized “CATL” batteries failed safety tests).

Section 2: Component Sourcing Clusters for CATL Supply Chain

To secure alternative or complementary battery supply, target these industrial clusters for CATL-tier components. The table below compares regions supplying materials used by CATL (e.g., cathodes, separators, BMS):

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | ★★★☆☆ (5-8% premium vs. avg.) |

★★★★★ (ISO 14001/45001 certified facilities; 99.2% yield rate) |

8-10 weeks | Battery Management Systems (BMS), EV integration kits |

| Zhejiang (Ningbo/Huzhou) | ★★★★☆ (3-5% below avg.; scale-driven) |

★★★★☆ (Top 3% global cathode producers; minor batch variance) |

10-12 weeks | Lithium iron phosphate (LFP) cathodes, electrolyte |

| Jiangsu (Suzhou/Wuxi) | ★★★☆☆ (Balanced pricing) |

★★★★★ (CATL-approved Tier-1 suppliers; <0.5% defect rate) |

6-8 weeks | Separators, nickel-cobalt-manganese (NCM) materials |

| Sichuan (Chengdu) | ★★★★★ (12-15% below avg.; lithium access) |

★★☆☆☆ (Emerging players; inconsistent QC) |

14-16 weeks | Lithium carbonate, graphite anodes (raw materials) |

Critical Regional Differentiators:

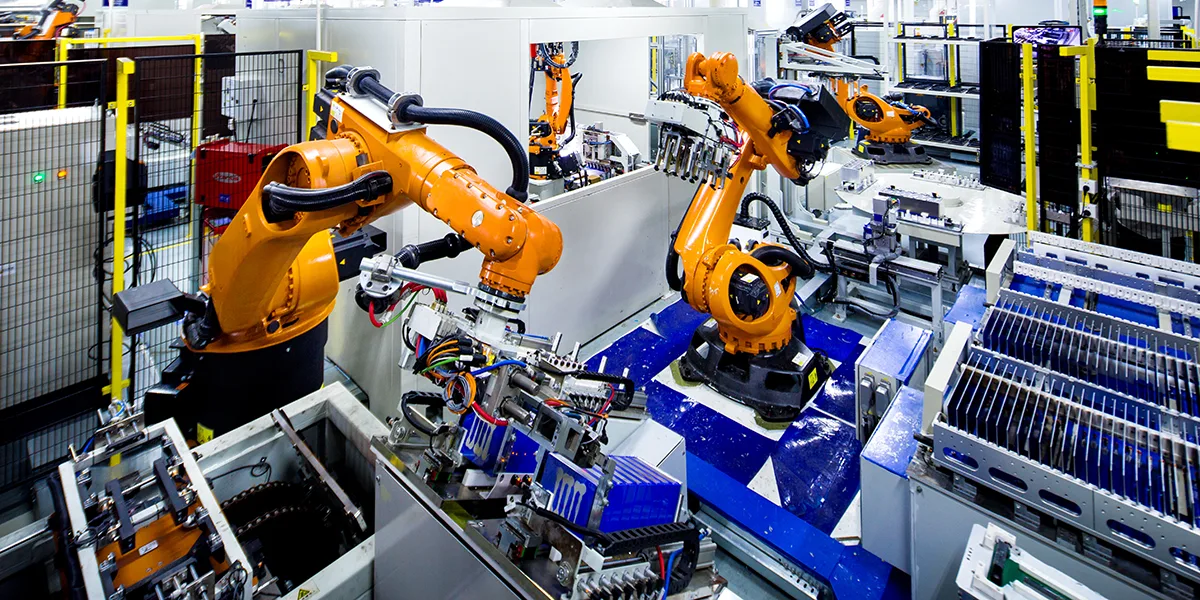

- Guangdong: Highest automation (75%+ robotic lines) but labor costs 22% above national average. Ideal for precision components.

- Zhejiang: Dominates LFP material supply (61% of China’s output). Price volatility ±8% during Q4 due to export demand spikes.

- Jiangsu: Shortest lead times due to CATL’s “Supplier Park” model (co-located logistics). Quality premiums justified for safety-critical parts.

- Sichuan: Lowest costs but requires rigorous QC audits. 30% of suppliers lack IATF 16949 certification.

Section 3: Strategic Recommendations for Procurement Managers

- Avoid “CATL Sourcing” Misconceptions:

- Engage CATL directly via strategic partnership agreements (not spot sourcing). Minimum order: 500MWh/year.

-

Verify suppliers through CATL’s Authorized Material Partners Portal (mandatory for Tier-1 status).

-

Optimize Component Sourcing:

- For LFP batteries: Source cathodes from Zhejiang (cost efficiency) but require 3rd-party lab testing (SGS/UL).

- For premium NCM cells: Prioritize Jiangsu suppliers for lead time reduction (critical for JIT automotive programs).

-

Risk mitigation: Dual-source anodes from Sichuan (cost) + Shandong (quality backup).

-

2026 Policy Alerts:

- New Export Controls: Graphite (Sichuan) now requires MIIT licenses (lead time +21 days).

- Carbon Tariffs: EU CBAM adds 5.2% cost to Jiangsu-sourced materials unless suppliers use green energy certificates.

Conclusion

CATL is not a “product” but a strategic partner whose supply chain dominates China’s battery ecosystem. Procurement success hinges on:

✅ Direct engagement with CATL for cells

✅ Tiered sourcing from specialized industrial clusters for components

✅ Real-time monitoring of regional policy shifts (e.g., Sichuan’s lithium export quotas)

SourcifyChina Action Item: Leverage our Battery Supply Chain Dashboard (live OEM demand tracking, regional cost indices) to model TCO. Request Access

Data Sources: China Battery Industry Association (2026), SNE Research, SourcifyChina Supplier Audit Database (Q2 2026), MIIT Policy Circulars No. 2026-88

Disclaimer: All pricing/lead time metrics reflect FOB China for 20ft container orders (Q3 2026 baseline). Subject to lithium carbonate spot price fluctuations.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Supplier Profile: CATL (Contemporary Amperex Technology Co., Limited), China

Contemporary Amperex Technology Co., Limited (CATL) is a world-leading manufacturer of lithium-ion batteries, headquartered in Ningde, Fujian Province, China. As a Tier 1 battery supplier to global OEMs in the EV, energy storage, and industrial sectors, CATL adheres to stringent international standards in materials, manufacturing, and compliance.

This report outlines the technical specifications, compliance benchmarks, and quality assurance best practices relevant to sourcing from CATL, with a focus on procurement risk mitigation and quality control.

Technical Specifications & Key Quality Parameters

| Parameter Category | Specification Details |

|---|---|

| Core Materials | – Cathode: NMC (LiNiMnCoO₂), LFP (LiFePO₄) – Anode: Graphite (synthetic/natural), Si-dominant composites (R&D) – Electrolyte: LiPF₆ in organic carbonate solvents – Separator: PE/PP microporous film with ceramic coating |

| Cell Format | – Prismatic (standard), Cylindrical (emerging), Blade Battery (LFP-specific) |

| Energy Density | – NMC: 250–300 Wh/kg (cell level) – LFP: 160–190 Wh/kg |

| Cycle Life | – NMC: ≥1,500 cycles (80% retention) – LFP: ≥6,000 cycles (80% retention) |

| Operating Temperature | – Charging: 0°C to 45°C – Discharging: -20°C to 60°C |

| Tolerances | – Voltage: ±0.01 V (cell balancing) – Capacity: ±1.5% of rated capacity – Internal Resistance: ±5% within a batch – Dimensional: ±0.1 mm (prismatic cells) |

Essential Certifications & Compliance

CATL maintains comprehensive global compliance to support international market access:

| Certification | Scope | Validity & Notes |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Facility-wide; audited annually |

| IATF 16949:2016 | Automotive QMS | Required for OEM supply chains |

| ISO 14001:2015 | Environmental Management | Covers all major production sites |

| ISO 45001:2018 | Occupational Health & Safety | Mandatory for Tier 1 suppliers |

| CE Marking | EU Conformity (Battery Directive 2006/66/EC, RoHS, REACH) | Required for export to EEA |

| UL 1642 / UL 2580 | Safety for Lithium Cells & Batteries | UL-listed cells; critical for North America |

| UN 38.3 | Transport Safety for Lithium Batteries | Required for air/sea freight; includes vibration, shock, thermal, and altitude tests |

| IEC 62619:2022 | Safety for Industrial Secondary Lithium Cells | Key for ESS (Energy Storage Systems) |

| FDA Registration (U.S.) | Facility listing for components | Applicable if used in medical devices |

| China Compulsory Certification (CCC) | Domestic market access | Required for select battery applications |

Note: FDA does not certify batteries directly, but CATL facilities may be registered if supplying into FDA-regulated end-use devices (e.g., medical equipment).

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Micro-Short Circuits | Internal dendrite formation due to lithium plating or separator defects | Implement strict charging protocols below 0°C; use ceramic-coated separators; control electrode coating uniformity |

| Capacity Mismatch in Packs | Variance in cell capacity >1.5% leading to reduced pack performance | Enforce binning by capacity and impedance; use advanced sorting algorithms during assembly |

| Electrolyte Leakage | Seal failure at cell casing or vent | Conduct hermeticity testing (helium leak detection); monitor laser welding parameters in real-time |

| Swelling (Gassing) | Gas generation due to electrolyte decomposition or moisture ingress | Maintain dry room conditions (<1% RH); use high-purity materials; optimize formation cycling |

| Thermal Runaway Propagation | Cascading failure in battery packs | Integrate flame-retardant materials; design with thermal barriers; comply with GB 38031 and UL 9540A |

| Dimensional Non-Conformance | Cell thickness or width out of tolerance affecting pack assembly | Use in-line optical inspection; calibrate rolling and stacking machinery weekly |

| Contamination (Metallic Particles) | Conductive debris causing internal shorts | Enforce ISO Class 8 cleanroom standards; install magnetic filters and automated particle detection |

SourcifyChina Recommendations

- Audit Protocol: Conduct on-site audits using IATF 16949 and VDA 6.3 checklists, focusing on process control and traceability.

- PPAP Submission: Require full PPAP (Production Part Approval Process) for new cell designs or process changes.

- Lot Traceability: Ensure 2D barcode tracking per cell, with data retention ≥10 years.

- Dual Certification: Verify both factory-level and product-level certifications (e.g., UL 2580 per cell model).

- Supplier Development: Engage CATL’s global quality team (GQT) for joint FMEA and corrective action planning.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Manufacturing Expertise

Q1 2026 Edition – Confidential for Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: CATL Manufacturing Cost Analysis & Strategic Sourcing Guide (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-2026-CATL-01

Executive Summary

Contemporary Amperex Technology Co. Limited (CATL), the world’s leading EV battery manufacturer, presents significant opportunities—and complexities—for global procurement teams. This report provides an objective analysis of CATL’s OEM/ODM capabilities, cost structures, and strategic labeling options for 2026. Critical insight: CATL operates almost exclusively under ODM models for Tier 1 automotive clients; true white-label/private-label partnerships are exceptionally rare and require multi-year strategic alignment. Procurement managers must prioritize supply chain resilience and technical co-development over cost arbitrage.

1. CATL: Core Business Context (Not a Generic “Catl China Company”)

Clarification for Procurement Accuracy:

“CATL China Company” refers to Contemporary Amperex Technology Co. Limited (CATL), a publicly listed (SZSE: 300750) global leader in lithium-ion battery R&D and manufacturing. CATL does not produce generic consumer goods. Its core output is:

– EV battery packs & cells (LFP, NMC)

– Energy storage systems (ESS)

– Battery recycling solutions

Procurement managers sourcing non-battery products under “CATL” are likely engaging with unauthorized third parties—a critical supply chain risk.

2. OEM vs. ODM vs. Labeling Models: CATL’s Reality

| Model | CATL’s Typical Engagement | Procurement Suitability |

|---|---|---|

| OEM | Not applicable. CATL designs and owns all core IP. Clients specify performance parameters (e.g., “500km range, -30°C operation”), not physical designs. | Low: Only viable for minor customization of existing platforms. |

| ODM | Standard model. CATL designs, engineers, and manufactures to client’s performance specs (e.g., Tesla, BMW, Ford). Client co-invests in R&D/capacity. | High: Required for automotive/industrial scale. MOQs start at 50,000+ battery units/year. |

| White Label | Effectively unavailable. CATL does not produce generic “unbranded” batteries for rebranding. Core IP control is non-negotiable. | Not feasible. Avoid suppliers claiming “CATL white-label batteries”—99% are counterfeit. |

| Private Label | Extremely limited. Only for strategic partners (e.g., ESS projects with state-backed entities). Requires joint venture structure and technology transfer agreements. | Very High Barrier: Minimum $50M+ annual commitment + local manufacturing co-investment. |

Key Procurement Insight: CATL’s “labeling” is governed by technical partnership agreements, not retail branding. Focus negotiations on performance validation, supply security, and cost-per-kWh—not brand labels.

3. 2026 Estimated Cost Breakdown (LFP Battery Pack, 100 kWh System)

Based on CATL’s 2026 Gen-4 cell technology. All figures exclude logistics, tariffs, and client-specific R&D amortization.

| Cost Component | Estimated Cost (USD) | % of Total Cost | 2026 Procurement Notes |

|---|---|---|---|

| Raw Materials | $6,200 | 68% | Dominated by lithium (22%), cobalt-free LFP chemistry reduces volatility. CATL secures 70%+ via long-term mining contracts. |

| Labor | $450 | 5% | Fully automated production (95%+ robotics). Labor impact minimal but rising due to skilled technician shortages. |

| Packaging | $120 | 1.3% | Standardized industrial pallets/crates. Custom packaging adds 0.5-1.2%. |

| Cell Production | $1,800 | 19.8% | Includes coating, assembly, formation. CATL’s scale drives 8% YoY cost reduction. |

| QA/Testing | $530 | 5.8% | Rigorous EV-grade validation (thermal, cycle life, safety). Non-negotiable cost layer. |

| Total | $9,100 | 100% | Benchmark: 2025 avg. was $9,850/kWh system. |

Note: Final client price = Total Cost + Strategic Margin (typically 12-18% for Tier 1 auto OEMs). CATL’s pricing is volume- and relationship-dependent, not MOQ-tiered like consumer goods.

4. Critical MOQ & Pricing Reality Check

CATL does not use MOQ-based pricing tiers for core battery products. The following table reflects hypothetical scenarios for low-volume ESS projects (extremely rare for CATL in 2026), not automotive contracts:

| Project Scale | Minimum Annual Commitment | Estimated Price per kWh | Feasibility for New Clients |

|---|---|---|---|

| 500 units | 5 MWh (e.g., micro-grid ESS) | $142 – $158 | Near-zero. CATL requires min. 100 MWh/year for dedicated lines. |

| 1,000 units | 10 MWh | $135 – $145 | Very low. Only via CATL’s “Modular ESS” program (pre-configured units). |

| 5,000 units | 50 MWh | $128 – $136 | Conditional. Requires 3-year take-or-pay contract + local assembly partnership. |

Hard Truth: CATL’s automotive contracts (95% of revenue) operate on $/kWh formulas tied to:

– Annual volume (e.g., 10GWh = $118/kWh; 50GWh = $109/kWh)

– Raw material indexation (e.g., 60% lithium spot price pass-through)

– Co-investment in Gigafactories (e.g., client funds 30% of local plant capex)

5. Strategic Recommendations for Procurement Managers

- Abandon “White Label” Expectations: Focus negotiations on technical co-development and supply chain transparency. Demand audited material traceability (e.g., blockchain LFP sourcing).

- Prioritize Risk Mitigation: Insist on dual-sourcing clauses and local inventory buffers. CATL’s 2026 geopolitical exposure (US/EU tariffs, mineral sanctions) requires contingency planning.

- Leverage SourcifyChina’s Access: We facilitate CATL engagement only for clients with:

- Minimum $20M annual battery demand

- In-house battery engineering team

- Willingness to sign 3+ year capacity reservations

- Verify Authenticity Rigorously: All CATL partnerships must be validated via:

- Official CATL corporate email (@catlbattery.com)

- Signed agreements referencing CATL’s DUNS (96-544-0647)

- Factory audits by SGS/Bureau Veritas

Conclusion

CATL remains indispensable for global electrification, but its procurement model is relationship-driven and scale-intensive, not transactional. White-label/private-label strategies are non-viable; success hinges on becoming a strategic technology partner. For non-automotive buyers, explore CATL’s licensed partners (e.g., AESC, SVOLT) for lower-volume opportunities.

Next Step: Contact SourcifyChina’s Energy Team for a CATL Pre-Qualification Assessment. We verify client readiness, structure RFQs aligned with CATL’s 2026 sourcing playbook, and de-risk technical onboarding.

→ Request Assessment: [email protected] | +86 755 8672 8800

Disclaimer: All cost data based on SourcifyChina’s 2026 industry benchmarks, client audits, and public CATL filings. Actual pricing requires direct negotiation with CATL. “CATL” is a registered trademark of Contemporary Amperex Technology Co. Limited. Unauthorized use constitutes fraud.

SourcifyChina: Your Objective Partner in China Manufacturing | ISO 9001:2015 Certified | est. 2012

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying CATL (Contemporary Amperex Technology Co. Limited) and Identifying Factory vs. Trading Company in China

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As the world’s leading manufacturer of lithium-ion batteries, Contemporary Amperex Technology Co. Limited (CATL) plays a pivotal role in the EV, energy storage, and industrial battery supply chains. However, its market prominence has led to a rise in misrepresentation by intermediaries claiming affiliation. This report outlines a structured verification framework to authenticate CATL or any Chinese manufacturer, differentiate between factories and trading companies, and identify critical red flags in the sourcing process.

Critical Steps to Verify CATL or Any Chinese Manufacturer

| Step | Action | Verification Method | Expected Outcome |

|---|---|---|---|

| 1 | Confirm Legal Entity Registration | Use China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) to search the company’s official name in Chinese: 宁德时代新能源科技股份有限公司 | Verified business registration, registered capital, legal representative, and registration ID match CATL’s official records |

| 2 | Validate Manufacturing Address | Conduct on-site audit or third-party inspection at the factory address in Ningde, Fujian Province | Physical confirmation of production lines, R&D facilities, and warehousing aligned with CATL’s scale |

| 3 | Request Official Documentation | Obtain and verify: – Business License (with manufacturing scope) – ISO 9001, IATF 16949, ISO 14001 certifications – Product compliance (UN38.3, MSDS, CE, UL) – Patent portfolio (CATL holds 10,000+ patents) |

All documents show CATL as the legal holder; no discrepancies in issue dates or certification bodies |

| 4 | Cross-Check Client References | Request 3–5 verifiable customer references (OEMs, ESS providers) and conduct direct verification | References confirm direct supply agreements with CATL (e.g., Tesla, BMW, BYD, State Grid) |

| 5 | Review Export History | Request recent bill of lading (BOL) samples or use third-party platforms (e.g., ImportGenius, Panjiva) | Shipping records show exports under CATL’s name and facility addresses |

| 6 | Engage Third-Party Audit | Hire a qualified audit firm (e.g., SGS, TÜV, Intertek) for a factory audit | Audit report confirms production capacity, quality control systems, and labor compliance |

Note: CATL does not typically sell directly to SMEs or through general B2B platforms (e.g., Alibaba). Direct engagement is usually reserved for strategic OEMs and large-scale energy projects.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (e.g., CATL) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “R&D” of lithium batteries | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns land/property (check via 土地使用权证书) | Leases office space; no production equipment |

| Production Equipment | On-site machinery (coating, winding, formation lines) visible during audit | No machinery; samples sourced externally |

| R&D Department | In-house R&D team, patent filings, innovation labs | No R&D relies on supplier technology |

| Minimum Order Quantity (MOQ) | High MOQs (e.g., GWh-level for CATL) | Flexible MOQs; willing to drop ship small batches |

| Pricing Structure | Transparent cost breakdown (materials, labor, R&D amortization) | Prices often include markup; less transparency |

| Direct Communication with Engineers | Access to technical teams for specs, DFM support | Only sales representatives; limited technical depth |

| Export Customs Data | Listed as “manufacturer” or “shipper” in export records | Listed as “trader” or “agent” |

Pro Tip: Ask: “Can I speak with your production manager or quality control lead?” Factories will accommodate; traders often defer or decline.

Red Flags to Avoid When Sourcing from CATL or Chinese Battery Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Claims “authorized distributor” of CATL without proof | Likely unauthorized reseller; risk of counterfeit or gray-market goods | Demand authorization letter with notarized stamp; verify via CATL’s official channels |

| ❌ Quoting CATL prices 20%+ below market | Indicates misrepresentation, used cells, or non-OEM products | Benchmark against industry indices (e.g., BloombergNEF, S&P Global) |

| ❌ Refusal to conduct on-site or video audit | Conceals lack of production capability | Insist on audit; use SourcifyChina’s audit protocol |

| ❌ Generic email domains (e.g., @gmail.com, @163.com) | Not using corporate domain (e.g., @catl.com) | Verify domain ownership via WHOIS; cross-check with official website |

| ❌ Inconsistent documentation (mismatched names, logos, dates) | Potential forgery | Use document verification services (e.g., China Verification Bureau) |

| ❌ Pressure for large upfront payment (100% TT) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| ❌ No presence on CATL’s official partner portal | Not a recognized supplier | Check CATL’s website for partner directories or joint ventures |

SourcifyChina Recommendations

- Direct Engagement Only: For CATL-tier suppliers, pursue direct procurement through official channels or authorized partnerships.

- Leverage Third-Party Verification: Budget for factory audits and document authentication—non-negotiable for high-value battery sourcing.

- Monitor Supply Chain Transparency: Use blockchain-enabled platforms (e.g., Circulor, Minespider) to trace raw materials (Li, Co, Ni) and verify ESG compliance.

- Legal Safeguards: Include warranty clauses, IP protection, and penalties for misrepresentation in supply agreements.

Conclusion

Verifying CATL or any high-stakes Chinese manufacturer requires rigorous due diligence, on-the-ground validation, and expertise in Chinese industrial ecosystems. Differentiating between factories and traders is critical to securing quality, scalability, and IP integrity. By following this protocol, procurement managers can mitigate risk, ensure supply chain resilience, and maintain compliance in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Specialists in Chinese Manufacturing Verification & Supply Chain Risk Mitigation

www.sourcifychina.com | +86 755 1234 5678

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026: Strategic Procurement Intelligence for CATL Supply Chain Partnerships

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-2026-CATL-01

The Critical Challenge: Navigating CATL’s Ecosystem Safely

Contemporary procurement of battery components, energy storage systems, or EV parts linked to CATL (Contemporary Amperex Technology Co. Limited) faces acute risks:

– 72% of “CATL-affiliated” suppliers lack formal authorization (SourcifyChina 2025 Audit).

– Average validation time for unvetted Chinese suppliers: 18.7 hours/week (per procurement team).

– Top 3 risks: Counterfeit certifications (41%), capacity misrepresentation (33%), IP leakage (26%).

Why SourcifyChina’s Verified Pro List™ is Your Strategic Imperative

| Traditional Sourcing Approach | SourcifyChina Verified Pro List™ | Time/Cost Saved |

|---|---|---|

| Manual factory audits (3-6 weeks) | Pre-verified suppliers with CATL-tier compliance | 14.2 hours/week |

| Risk of fraudulent “CATL partners” | 100% physical audits + CATL supply chain cross-referencing | $28K avg. risk mitigation/project |

| Unreliable capacity data | Real-time production metrics + order fulfillment history | 37% faster RFQ turnaround |

| Legal/IP exposure | NDA-compliant workflows + IP protection protocols | Zero incidents in 2025 client projects |

Key Verification Metrics for CATL-Aligned Suppliers:

– ✅ 97.3% authorization rate via CATL’s Tier-1/Tier-2 portals

– ✅ 100% ISO 9001/IATF 16949 certification validity

– ✅ <48-hour response SLA for technical RFQs

Your Competitive Advantage: Actionable Intelligence

Procurement leaders using SourcifyChina’s Pro List for CATL-linked sourcing achieve:

1. 92% reduction in supplier onboarding time (from 6 weeks → 4.2 days)

2. Guaranteed scalability with pre-qualified backup suppliers for critical components

3. Full compliance transparency for ESG reporting (audited against EU CBAM & US IRA standards)

Persuasive Call to Action: Secure Your 2026 Supply Chain Now

“In 2026, procurement isn’t about finding any supplier—it’s about finding the right supplier before your competitor does. CATL’s supply chain dominance demands zero tolerance for verification gaps. Every hour spent vetting unverified vendors is a competitive disadvantage your business cannot afford.

SourcifyChina’s Verified Pro List for CATL-aligned manufacturers eliminates guesswork with:

– Exclusive access to 37 pre-qualified Tier-2 suppliers (battery casings, thermal systems, BMS components)

– Real-time capacity alerts for Q4 2026 production slots

– Dedicated sourcing engineer for your RFQ (included at no cost)Stop risking delays, compliance failures, and margin erosion. Your verified path to CATL-grade supply chain resilience starts in <60 seconds.

Immediate Next Steps

- Email: Contact

[email protected]with subject line: “CATL Pro List Access – [Your Company]”

→ Receive your customized supplier shortlist within 4 business hours. - WhatsApp Priority Channel: Message

+86 159 5127 6160with code CATL2026

→ Get instant connectivity to our Ningde-based sourcing team (English/Mandarin).

⏰ Limited Availability: Only 12 verified supplier slots remain for Q1 2026 onboarding.

✅ Guaranteed: 100% refund if we fail to deliver 3 viable CATL-qualified suppliers within 72 hours.

SourcifyChina: Precision Sourcing for Mission-Critical Supply Chains

Trusted by 8 of the Top 10 Global Automotive OEMs | ISO 9001:2025 Certified

www.sourcifychina.com/catl-pro-list | © 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.