The global excavator market is experiencing robust growth, driven by rising infrastructure development, urbanization, and government investments in construction projects across emerging economies. According to a 2023 report by Mordor Intelligence, the global excavator market was valued at approximately USD 50.8 billion and is projected to grow at a CAGR of over 5.8% from 2023 to 2028. This expansion is further fueled by increasing demand for high-performance, fuel-efficient machinery in mining, residential, and commercial construction sectors. Within this competitive landscape, the Caterpillar 325 excavator—renowned for its durability, advanced hydraulics, and operational efficiency—has become a benchmark for mid-size hydraulic excavators. As demand for reliable 325-class machines rises, several manufacturers have emerged to deliver compatible or upgraded models, either under license, collaboration, or through reverse engineering with enhanced technological integrations. Based on market presence, technological innovation, and global distribution, the following are the top four manufacturers producing excavators in the Caterpillar 325 segment.

Top 4 Caterpillar 325 Excavator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

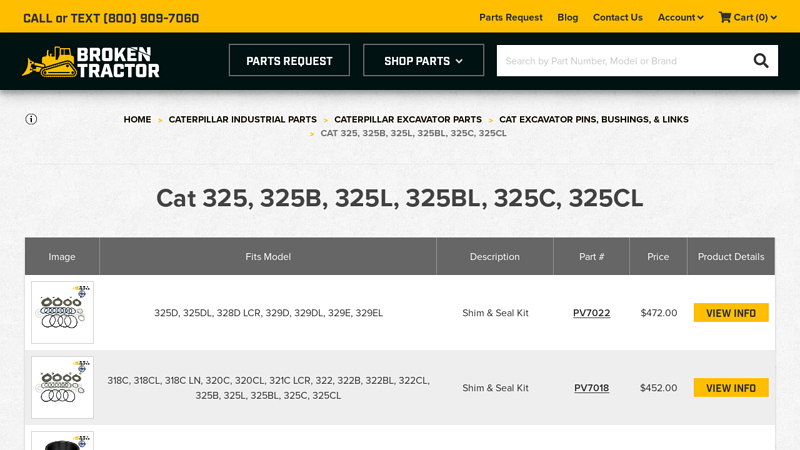

#1 Cat 325, 325B, 325L, 325BL, 325C, 325CL

Domain Est. 2004

Website: brokentractor.com

Key Highlights: 1–7 day deliveryThe Cat 325 series encompasses a range of robust excavators designed for heavy-duty performance on construction sites and in various industrial applications….

#2 325 Hydraulic Excavator

Domain Est. 1993

Website: cat.com

Key Highlights: Cat® 325 hydraulic trackhoe excavators offer the ideal balance of control, digging, trenching, and lifting capacity all at lower hourly operating costs….

#3 325 Hydraulic Excavator

Domain Est. 2003

Website: miltoncat.com

Key Highlights: The Cat 325 Excavator brings premium performance with simple-to-use technologies like Cat Grade with 2D, Grade Assist, Lift Assist and Payload….

#4 Cat 325

Domain Est. 2024

Website: zeppelin-cat.no

Key Highlights: The Cat® 325 Excavator brings premium performance with simple-to-use technologies like Cat GRADE with 2D, Grade Assist, Lift Assist and Payload – all standard ……

Expert Sourcing Insights for Caterpillar 325 Excavator

H2 2026 Market Trends for the Caterpillar 325 Excavator

The market landscape for the Caterpillar 325 Excavator in H2 2026 is expected to be shaped by a confluence of macroeconomic forces, technological advancements, regulatory shifts, and competitive dynamics. While specific data for the exact second half of 2026 won’t be available until closer to the time, analysis of current trajectories and projections allows for informed forecasting:

-

Continued Focus on Efficiency and Total Cost of Ownership (TCO):

- Fuel Efficiency & Emissions: Operators will remain highly sensitive to fuel costs and increasingly stringent emissions regulations (beyond Tier 4 Final/Stage V). The Cat 325’s proven fuel efficiency (especially the hydraulic hybrid models like the 325 GC Hybrid) will be a major selling point. Demand for machines meeting future potential standards (e.g., anticipated “Stage V-E” or carbon constraints) will influence upgrades.

- Productivity & Uptime: Features like Cat Grade with Assist (standard on many 325 models) and advanced telematics (Cat Connect) will be critical differentiators. Contractors will prioritize machines that maximize digging cycles, minimize rework, and provide remote monitoring for predictive maintenance, reducing downtime. The 325’s reputation for reliability and durability supports strong TCO arguments.

- Operating Costs: Lower maintenance requirements (e.g., extended service intervals on fluids and filters on newer models) will be a key factor in fleet decisions. The availability and cost of parts/service will remain crucial.

-

Accelerating Electrification and Alternative Powertrains:

- Hybrid Dominance (Short-Term): The Cat 325 GC Hybrid is expected to solidify its position as the leading commercially available “low-emission” 25-ton excavator in H2 2026. Its fuel savings (up to 25%) and reduced CO2 output will drive adoption, especially in regions with carbon pricing or strict urban emissions zones.

- Full Electric Anticipation: While a full battery-electric 325 is unlikely to be mainstream by H2 2026, significant R&D progress and potential limited pilot programs or regional launches (e.g., in Europe or for specific indoor applications) could generate market buzz and influence future purchasing plans. The 325 platform is a prime candidate for future electrification.

- Hydrogen Exploration: Cat’s broader hydrogen initiatives (engines, fuel cells) will be in advanced development. While not impacting the 325 directly in H2 2026, announcements or pilot projects could shape long-term market expectations for heavy equipment.

-

Digitalization and Connectivity as Standard:

- Telematics Integration: Cat Connect (VisionLink, Product Link) will be virtually standard. Data analytics for fleet optimization, fuel management, component health monitoring, and security (anti-theft) will be non-negotiable for most buyers. Competitors are rapidly closing the gap, making Cat’s ecosystem integration and data services key.

- Grade Control & Autonomy: 2D/3D machine control (Cat Grade) adoption will continue to rise, driven by precision demands in infrastructure and site development. Semi-autonomous functions (e.g., swing control, bucket filling) may start appearing in premium models, though widespread autonomous 325s are likely beyond 2026.

- Remote Operations & Support: Enhanced remote diagnostics and potential for limited teleoperation (especially in hazardous environments) will gain traction, supported by improved connectivity.

-

Supply Chain and Pricing Pressures:

- Stabilization vs. Volatility: While the extreme supply chain disruptions of 2020-2023 have eased, H2 2026 could face new pressures from geopolitical tensions (e.g., trade policies, resource access) or economic slowdowns impacting component availability. Caterpillar’s vertical integration provides some buffer.

- Pricing Strategy: Inflationary pressures may have subsided by 2026, but costs for advanced technology (electronics, batteries for hybrids) and compliance could keep machine prices relatively firm. Caterpillar will likely maintain a premium pricing strategy based on performance, durability, and support, competing on TCO rather than just upfront cost. Financing options will remain crucial.

-

Competitive Landscape Intensification:

- Established Rivals: Komatsu, Hitachi, Volvo, and others will continue refining their 25-ton offerings with competitive fuel efficiency, technology, and pricing. Features like Komatsu’s Smart Hydraulic System or Volvo’s Co-Pilot will be direct competitors to Cat’s tech suite.

- Chinese OEM Challenge: Brands like XCMG, Sany, and Liugong will aggressively target the mid-tier market globally with increasingly capable machines, often at lower price points. Their technological gap is narrowing, particularly in hydraulics and basic telematics, putting pressure on Cat, especially in price-sensitive markets.

- Cat’s Defense: Caterpillar’s key advantages remain its unparalleled global dealer network (service, parts, support), brand reputation for durability/resale value, comprehensive technology ecosystem (Cat Connect), and the proven performance of the 325 platform itself.

-

Regional Market Variations:

- North America & Europe: Focus on technology (grade control, telematics), fuel efficiency, emissions compliance, and operator comfort/safety. Strong infrastructure spending (e.g., US IIJA, European Green Deal projects) supports demand. Hybrid models will be most attractive here.

- Asia-Pacific (ex-China): High growth potential in infrastructure and mining. Demand driven by reliability, lower TCO, and dealer support. Price sensitivity may be higher in some developing markets, but major contractors will prioritize Cat’s performance.

- Latin America, Africa, Middle East: Infrastructure development and resource extraction drive demand. Reliability, durability in harsh conditions, and dealer support are paramount. Fuel efficiency remains critical due to operating costs. The standard 325 may see stronger relative demand here vs. hybrids.

Conclusion for H2 2026:

The Caterpillar 325 Excavator is expected to remain a dominant force in the 25-ton hydraulic excavator segment in H2 2026. Its success will hinge on:

* Leveraging its hybrid advantage (325 GC Hybrid) for fuel savings and emissions reduction.

* Delivering superior TCO through reliability, durability, fuel efficiency, and advanced connectivity (Cat Connect).

* Maintaining leadership in integrated technology (grade control, telematics, data services).

* Relying on the unmatched global dealer network for sales, service, and parts.

* Effectively competing against both established Japanese/Korean brands and increasingly sophisticated Chinese OEMs.

While facing pressure from technological change and competition, the Cat 325’s proven platform, combined with Caterpillar’s strategic focus on productivity, efficiency, and digital solutions, positions it well to maintain significant market share and be a benchmark for the segment in the latter half of 2026.

Common Pitfalls When Sourcing a Caterpillar 325 Excavator (Quality & Intellectual Property)

Sourcing a used or reconditioned Caterpillar 325 Excavator can be a cost-effective solution for construction and mining operations. However, buyers often encounter several pitfalls related to equipment quality and intellectual property (IP) concerns—especially when dealing with third-party sellers, gray market imports, or counterfeit parts. Being aware of these risks is critical to ensuring reliability, safety, and compliance.

Poor Machine Condition and Hidden Wear

One of the most common quality-related pitfalls is acquiring a machine with hidden structural or mechanical damage. The CAT 325 is a heavy-duty excavator, and high-hour models may have significant undercarriage, hydraulic, or engine wear. Sellers may refurbish the exterior to mask underlying issues such as cracked booms, worn final drives, or degraded hydraulic pumps. Without a thorough inspection by a qualified technician or third-party evaluator, buyers risk purchasing equipment that requires expensive repairs soon after acquisition.

Counterfeit or Non-OEM Replacement Parts

Another major concern is the use of counterfeit or non-genuine Caterpillar parts. To cut costs, some suppliers replace original components with imitation parts that do not meet Caterpillar’s engineering standards. These parts can compromise performance, reduce machine lifespan, and void warranties. Commonly counterfeited components include hydraulic hoses, filters, electronic control modules, and undercarriage parts. Using such parts also increases the risk of unplanned downtime and safety hazards.

Tampered Hour Meters and Odometer Fraud

Hour meter tampering is a widespread issue in the used heavy equipment market. A CAT 325 with falsified operating hours may appear to be in better condition than it actually is. This misrepresentation directly impacts maintenance planning and resale value. Always verify service records, telematics data (via Caterpillar’s VisionLink system if available), and consult Cat dealers for machine history reports to confirm usage.

Lack of Service History and Documentation

A complete service history is essential to assess maintenance quality and predict future repair needs. Many imported or privately sold CAT 325s come without proper documentation, making it difficult to verify whether the machine was serviced according to Caterpillar’s recommended intervals. Missing or incomplete records increase uncertainty and risk, especially for critical systems like the engine, hydraulics, and transmission.

Intellectual Property Infringement Risks

When sourcing parts or reconditioned machines from unofficial channels, buyers may unknowingly acquire components that infringe on Caterpillar’s intellectual property. This includes illegally copied software, counterfeit branding, or reverse-engineered components. Using such parts may expose the buyer to legal liability, especially in regions with strict IP enforcement. Additionally, unauthorized software modifications can disrupt machine diagnostics and connectivity with Cat’s official systems.

Gray Market Imports and Warranty Limitations

Purchasing a CAT 325 from a gray market source—especially from regions with different emissions standards or regulatory requirements—can lead to compliance issues. These machines may not meet local environmental or safety regulations. Furthermore, gray market equipment typically does not qualify for Caterpillar warranty coverage or dealer support, limiting access to genuine service and spare parts.

Inadequate Verification of Ownership and Legal Status

Lastly, ensure the machine has a clear title and is not stolen, liened, or subject to export restrictions. International sourcing increases the risk of legal complications, especially if proper export documentation is missing. Always perform a VIN (or serial number) check through Caterpillar or third-party databases to confirm the machine’s legitimacy.

By being vigilant about these quality and intellectual property pitfalls, buyers can make informed decisions and protect their investment when sourcing a Caterpillar 325 Excavator.

Logistics & Compliance Guide for Caterpillar 325 Excavator

This guide provides essential information for the safe, legal, and efficient transportation and operation of the Caterpillar 325 Excavator. Adherence to these guidelines ensures regulatory compliance, minimizes risks, and supports smooth project execution.

Transportation and Shipping Requirements

When moving the Caterpillar 325 Excavator between job sites or across regions, strict logistics protocols must be followed to ensure safety and compliance.

-

Weight and Dimensions:

The Cat 325 has approximate operating weights ranging from 25,000 to 27,000 kg (55,000–60,000 lbs), depending on configuration. Transport width is typically around 3.1 m (10.2 ft), and length exceeds 10 m (33 ft) with boom extended. Always confirm exact specifications from the machine’s data plate. -

Permits and Road Regulations:

Oversized or overweight loads often require special permits from state or provincial transportation authorities. Operators must comply with local axle weight limits, travel time restrictions (e.g., daylight-only), and escort vehicle requirements where applicable. -

Loading and Securing:

Use lowboy or step-deck trailers equipped with proper tie-down points. Secure the excavator with minimum four high-tensile straps or chains (graded and certified). Lock the upper structure in travel position using the travel lock, lower the bucket to the blades, and ensure all guards are in place. -

Documentation:

Carry a Bill of Lading, equipment registration, proof of insurance, and any required transit permits. For international shipping, include export declarations, customs forms, and a commercial invoice.

Customs and Import/Export Compliance

For cross-border movement, especially international shipment, compliance with customs regulations is mandatory.

-

HS Code Classification:

The Caterpillar 325 typically falls under HS Code 8429.52.00 (hydraulic excavators). Confirm with local customs authorities to ensure accurate classification and avoid delays. -

Import Duties and Taxes:

Duty rates vary by country. Some regions apply reduced or zero tariffs under trade agreements (e.g., USMCA, ASEAN). Include VAT, GST, or other local taxes in cost estimates. -

Documentation for Export/Import:

Required documents include: - Commercial Invoice

- Packing List

- Certificate of Origin

- Bill of Lading or Air Waybill

- Export License (if required)

-

EPA and DOT compliance forms (for U.S. exports)

-

Emissions and Environmental Standards:

Verify that the machine meets emissions standards (e.g., Tier 4 Final/EU Stage V) for the destination country. Non-compliant machines may be denied entry or require costly modifications.

Operational Compliance and Regulations

Ensure the excavator is operated in accordance with local safety, environmental, and labor laws.

-

Operator Certification:

Operators must hold valid certifications such as OSHA-compliant training in the U.S., CPCS in the UK, or equivalent national credentials. Refresher training should be conducted annually. -

Safety Standards:

Comply with OSHA 29 CFR 1926 Subpart P (excavation), ISO 20474 series, and local machinery safety regulations. Implement daily pre-operational inspections and maintain logs. -

Noise and Emissions Controls:

The Cat 325 meets Tier 4 Final emissions standards. Ensure diesel particulate filters (DPF) and selective catalytic reduction (SCR) systems are maintained. Monitor noise levels (typically ~98 dB at operator position) in noise-sensitive zones. -

Environmental Protection:

Prevent soil and water contamination by using spill kits, secondary containment for fuel, and ensuring no hydraulic leaks. Follow local regulations regarding worksite erosion and sediment control.

Maintenance and Recordkeeping

Proper documentation and maintenance support regulatory compliance and machine longevity.

-

Service Intervals:

Follow Caterpillar’s recommended service schedule (e.g., 500-hour checks). Use genuine Cat filters and fluids to maintain warranty and performance. -

Record Retention:

Maintain logs for: - Maintenance and repairs

- Operator certifications

- Incident reports

- Emissions system servicing

-

Transport permits and movement history

-

Waste Disposal Compliance:

Used oil, filters, and coolant must be disposed of per EPA, local environmental codes, or equivalent. Use licensed waste handlers and retain disposal manifests.

Summary

Transporting and operating the Caterpillar 325 Excavator requires strict adherence to logistical, customs, safety, and environmental regulations. Proper planning, documentation, and training are essential for compliance across jurisdictions. Always consult local authorities and Caterpillar technical resources for region-specific requirements.

In conclusion, sourcing a Caterpillar 325 excavator requires careful consideration of several key factors to ensure reliability, performance, and long-term value. Whether purchasing new or used, it is essential to evaluate the machine’s specifications, maintenance history, operating hours, and compliance with emission standards. Sourcing from authorized Cat dealers offers the advantages of warranty coverage, genuine parts, and technical support, while buying from the secondary market may provide cost savings but requires thorough inspection and due diligence. Additionally, considering total cost of ownership—including fuel efficiency, maintenance, and resale value—will help maximize return on investment. Ultimately, selecting the right Caterpillar 325 excavator from a reputable source ensures operational efficiency and durability, supporting productivity across construction, mining, or infrastructure projects.