The global mining truck market, driven by rising demand for efficient haulage solutions in large-scale surface mining operations, is projected to grow at a CAGR of 5.8% from 2023 to 2030, according to Grand View Research. With ore production and infrastructure development accelerating across North America, Australia, and Latin America, demand for high-capacity haul trucks like the Caterpillar 797F remains strong. While Cat dominates this segment, a growing number of manufacturers are offering competitive alternatives through remanufactured units, component upgrades, or aftermarket support—creating a dynamic landscape for buyers seeking optimal value. This report identifies the top eight manufacturers and suppliers influencing the Cat 797F ecosystem, evaluated based on pricing transparency, global reach, parts availability, and service integration, providing procurement teams and mining operators with data-backed insights to support strategic sourcing decisions.

Top 8 Cat 797F Price Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

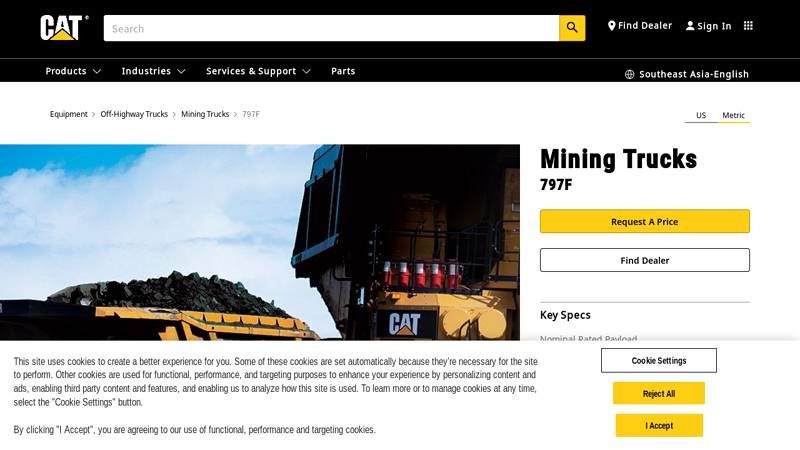

#1 797F Mining Truck

Domain Est. 1993

Website: cat.com

Key Highlights: Overview. Lowest Cost Per Ton in Its Size Class. What makes the Cat® 797F Mining Truck the most productive 363-tonne (400-ton) truck in the market?…

#2 Visitors Center & Museum in Peoria, IL

Domain Est. 1995

Website: caterpillar.com

Key Highlights: This isn’t your average museum! Your visit begins with a virtual ride in the bed of a massive two-and-a-half story Cat 797F Mining Truck….

#3 New Cat 797F Mining Truck For Sale

Domain Est. 1997

Website: empire-cat.com

Key Highlights: It’s fast, fuel efficient and delivers class-leading productivity, making it the industry benchmark for lower cost per ton in its size class….

#4 2025 CATERPILLAR 797F For Sale in

Domain Est. 1997

Website: wyomingcat.com

Key Highlights: CATERPILLAR – 797F – MINING TRUCK LOWEST COST PER TON IN ITS SIZE CLASS What makes the Cat® 797F Mining Truck the most productive 363-tonne (400-ton) truck ……

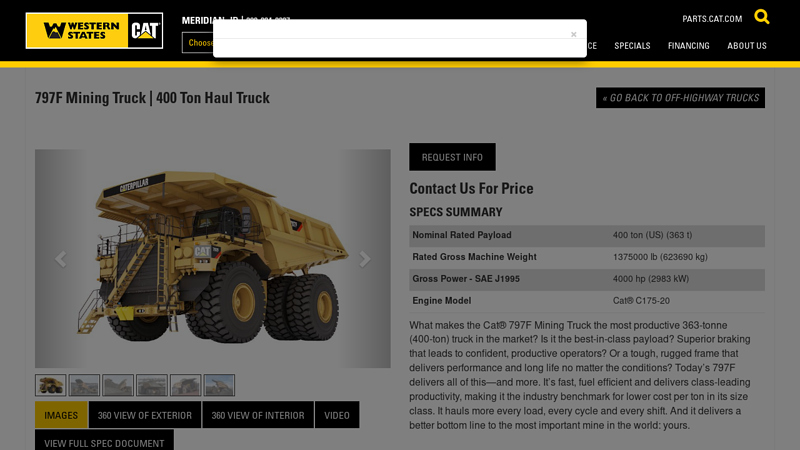

#5 797F Mining Truck

Domain Est. 2005

Website: westernstatescat.com

Key Highlights: It’s fast, fuel efficient and delivers class-leading productivity, making it the industry benchmark for lower cost per ton in its size class….

#6 By Vehicle,CATERPILLAR,BELAZ

Domain Est. 2011

Website: haiangroup.com

Key Highlights: CAT 797F Earth Mover Tires · 59/80R63 Earth Mover Tires Luan Brand for 400 Ton … Notes:The information and graphics in this official website reflect some ……

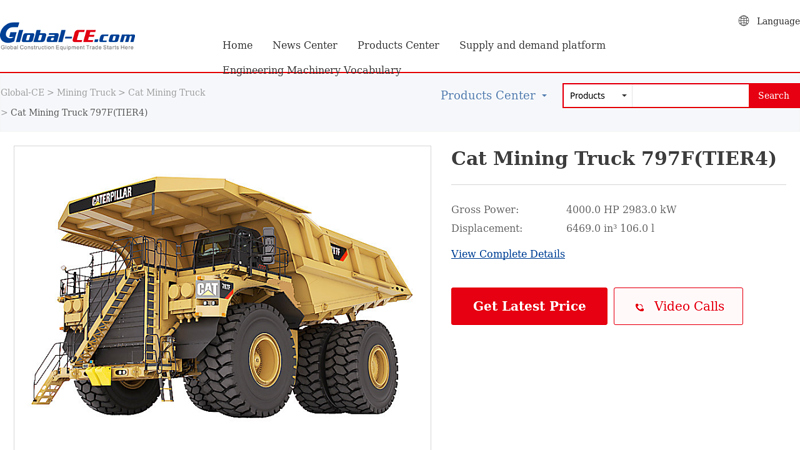

#7 Cat Mining Truck 797F(TIER4)

Domain Est. 2018

Website: product.global-ce.com

Key Highlights: The 797F provides you with the best in class cost per unit of production. Including the improvements in safety, productivity, serviceability and comfort….

#8 Cat 797F

Domain Est. 2024

Website: zeppelin-cat.no

Key Highlights: Today’s 797F is the most productive 363-tonne (400-ton) truck in the market. It’s fast, fuel efficient and delivers class-leading productivity, making it the ……

Expert Sourcing Insights for Cat 797F Price

2026 Market Trends for Cat 797F Pricing

The Caterpillar 797F, one of the largest and most powerful off-highway trucks in the world, operates in a highly specialized segment of the mining equipment market. Its pricing in 2026 will be shaped by a confluence of macroeconomic, industry-specific, and technological factors. While Cat does not typically list public prices for such large machinery—sales are usually negotiated directly—several key trends will influence valuation and total cost of ownership (TCO) by 2026.

Escalating Raw Material and Manufacturing Costs

A primary driver of Cat 797F pricing will be sustained high costs for steel, copper, rare earth elements, and other critical materials. Geopolitical instability, trade policies, and supply chain bottlenecks may continue to pressure input costs through 2026. Additionally, inflationary pressures on labor and logistics are expected to contribute to upward price momentum. As a result, manufacturers like Caterpillar are likely to pass on a portion of these costs through higher list prices or reduced discounting, leading to a net increase in acquisition cost.

Strong Demand in Key Mining Sectors

The 797F is predominantly used in large-scale surface mining operations for commodities such as copper, iron ore, and coal. Demand for copper—essential for electrification, renewable energy infrastructure, and EVs—is projected to surge through the 2020s. This increased mining activity, especially in regions like Chile, Australia, and Africa, will maintain strong demand for high-capacity haul trucks. Higher demand typically supports pricing power, potentially resulting in stable or rising prices for new units in 2026.

Emphasis on Total Cost of Ownership and Fuel Efficiency

While initial purchase price is significant, mining operators increasingly prioritize TCO, including fuel consumption, maintenance, and availability. The 797F’s AC-electric drive system and fuel-efficient Cat C175-20 engine provide long-term savings. Caterpillar may position price increases as justified by performance and durability, particularly as mines face pressure to reduce operational costs and carbon emissions. Features like predictive maintenance via Cat Connect® could enhance resale value and support premium pricing.

Transition Toward Sustainable and Alternative Technologies

Though the 797F is currently diesel-powered, the mining industry is beginning to explore zero-emission haulage solutions. By 2026, emerging battery-electric and hydrogen-powered prototypes from competitors may influence purchasing decisions. Caterpillar is investing in low-carbon technologies, but the 797F is expected to remain a diesel flagship. However, its pricing could reflect added compliance costs with tightening emissions standards (e.g., Tier 4 Final/Stage V equivalents), or include optional efficiency upgrades to remain competitive against future electric models.

Resale and Secondary Market Dynamics

The used market for ultra-class haul trucks like the 797F remains active, especially in developing mining regions. Strong residual values and long service lives (often 15–20 years) support high initial pricing. With many 797Fs still in productive service, the availability of refurbished units may cap price growth for new models. However, limited production volume and long lead times could sustain pricing power for new orders placed in 2026.

Conclusion

In 2026, the Cat 797F is expected to maintain or slightly increase in price due to persistent cost pressures, robust demand in critical mineral mining, and its unmatched performance in ultra-high-capacity applications. While alternative technologies loom on the horizon, the 797F will likely remain the benchmark for large-scale haulage, with pricing reflecting its reliability, efficiency, and integral role in global mining operations. Buyers should anticipate higher upfront costs but strong lifecycle value, particularly in copper and iron ore sectors.

Common Pitfalls When Sourcing Cat 797F Trucks (Quality and Intellectual Property Concerns)

Sourcing a Cat 797F, one of the largest and most sophisticated mining haul trucks in the world, involves significant financial and operational risks. Buyers must be vigilant to avoid common pitfalls related to both quality assurance and intellectual property (IP) protection. Falling into these traps can result in costly downtime, safety hazards, legal liabilities, and compromised operational efficiency.

1. Purchasing Unauthorized or Counterfeit Components

One of the most critical risks when sourcing parts or even entire rebuilt 797F systems is the prevalence of counterfeit or unauthorized components. These parts may appear identical to genuine Cat products but lack the rigorous engineering, materials, and quality control standards.

- Quality Risk: Substandard components—especially in critical systems like hydraulics, braking, or engine controls—can fail prematurely, leading to unplanned maintenance, safety incidents, or total equipment damage.

- IP Risk: Counterfeit parts violate Caterpillar’s intellectual property rights, including trademarks and design patents. Purchasers may unknowingly become complicit in IP infringement, exposing their organization to legal action or reputational damage.

Best Practice: Source exclusively through Caterpillar dealers or authorized remanufacturers. Verify part numbers and use Caterpillar’s official verification tools to confirm authenticity.

2. Acquiring Non-Compliant or Reverse-Engineered Systems

Some third-party suppliers offer “compatible” or “equivalent” systems—such as control modules, software, or powertrains—marketed as lower-cost alternatives to OEM systems.

- Quality Risk: These systems may not meet the environmental, durability, or performance standards required for extreme mining conditions, leading to reduced payload capacity, increased fuel consumption, or system incompatibilities.

- IP Risk: Reverse-engineering Cat’s proprietary software or control systems often infringes on copyrighted code and patented technologies. Using such systems may void warranties and trigger legal disputes from Caterpillar.

Best Practice: Insist on OEM-integrated technology. Avoid any solution that requires bypassing or replacing Cat’s proprietary Cat Electronic Technician (Cat ET) or Product Link systems.

3. Buying Rebuilt or Used Trucks Without Proper Documentation

The 797F is often sold in the secondary market after years of service. Without complete maintenance history and OEM certification, buyers face hidden quality issues.

- Quality Risk: Undisclosed structural fatigue, engine wear, or prior accident damage can lead to catastrophic failures. Non-OEM rebuilds may use inferior welding, subpar paint, or uncalibrated components.

- IP Risk: Unauthorized modifications or cloning of onboard software (e.g., engine tuning or payload monitoring) may breach licensing agreements and expose the buyer to liability.

Best Practice: Require full Cat Certified Rebuild documentation or purchase through Cat Certified Used Equipment channels. Audit service records and perform third-party inspections before acquisition.

4. Falling for Misrepresented “Genuine” Parts from Grey Market Suppliers

Grey market suppliers may claim to sell “genuine Cat” parts at steep discounts, but these components could be stolen, expired, or diverted from legitimate distribution channels.

- Quality Risk: Parts may be damaged, improperly stored, or past their service life, compromising reliability and safety.

- IP Risk: Caterpillar controls the distribution of its IP-protected products. Unauthorized sales violate trademark and distribution agreements, and buyers may lose warranty coverage.

Best Practice: Confirm the supplier’s authorization status through Caterpillar’s dealer locator. Reject offers that seem too good to be true.

5. Overlooking Software Licensing and Digital IP Rights

Modern 797Fs are heavily reliant on proprietary software for engine management, payload optimization, and remote diagnostics.

- Quality Risk: Unauthorized software updates or pirated diagnostic tools can destabilize control systems, leading to operational errors or complete shutdowns.

- IP Risk: Copying, distributing, or using unlicensed Cat software infringes on copyright and licensing agreements. Caterpillar actively protects its digital IP and may pursue legal remedies.

Best Practice: Ensure all software is properly licensed and updated only through authorized Cat service channels. Audit software compliance during procurement.

By understanding and mitigating these quality and intellectual property pitfalls, organizations can protect their investment, maintain operational integrity, and ensure compliance when sourcing Cat 797F trucks or related components.

Logistics & Compliance Guide: Caterpillar 797F Mining Truck

Overview of the Caterpillar 797F

The Caterpillar 797F is one of the largest and most powerful off-highway trucks in the world, designed for heavy-duty mining operations. Due to its size, weight, and specialized use, the logistics and compliance requirements for transporting and operating a 797F are highly complex and must be handled with meticulous planning and adherence to regulations.

Transportation Logistics

Disassembly and Packaging

- The 797F is typically shipped in major components due to its massive size (overall length: ~14.5 m, height: ~7.7 m, width: ~9.8 m).

- Key components include the frame, cab, engine, tires, dump body, and powertrain.

- Each component must be crated or secured on flatbed trailers or heavy-lift containers.

- Use of custom jigs and lifting points is required to avoid structural damage.

Shipping Methods

- Ocean Freight: Most common for international delivery. Components shipped via heavy-lift vessels or roll-on/roll-off (RoRo) ships.

- Land Transport: For regional or domestic delivery, specialized lowboy trailers and pilot/escort vehicles are required.

- Air Freight: Not feasible due to size and weight; only small spare parts may be air-shipped.

Route Planning

- Conduct pre-shipment route surveys for land transport to identify bridge weight limits, road width, turning radius, and overhead clearance.

- Coordinate with local authorities for permits and traffic management plans.

- Avoid peak traffic hours and schedule movement during off-peak times.

Import/Export Compliance

Export Documentation

- Commercial Invoice: Itemized list of components with declared value (price varies by configuration, typically $5.5M–$6.5M USD).

- Packing List: Details dimensions, weight, and handling instructions for each crate.

- Certificate of Origin: Required for customs clearance and tariff determination.

- Export License: May be required depending on destination country (especially for embargoed or high-risk regions).

Import Regulations

- Customs Duties and Taxes: Vary by country; check Harmonized System (HS) code 8704.21 or 8704.22 for off-road dump trucks.

- Environmental and Safety Standards: Must comply with local emissions (if applicable) and workplace safety codes.

- Import Permits: Some countries require special permits for oversized or heavy machinery.

Trade Compliance

- Adhere to U.S. Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR) if applicable.

- Ensure compliance with anti-boycott, sanctions, and restricted party screening (e.g., OFAC, BIS lists).

Regulatory and Safety Compliance

Transportation Regulations

- DOT (U.S.): Oversize/overweight permits required for road transport; adherence to Hours of Service (HOS) for drivers.

- ADR/RID (Europe): If applicable, ensure compliance with dangerous goods regulations—even non-hazardous components may require documentation.

- Road Weight Limits: Confirm axle load limits and distribute weight accordingly.

Onsite Assembly and Operation

- Must comply with MSHA (U.S.) or OHS regulations (e.g., Canada’s OHSA, Australia’s WHS) at the mining site.

- Operators must be certified and trained per Caterpillar standards.

- All safety systems (ROPS/FOPS, fire suppression, proximity detection) must be installed and inspected before operation.

Environmental Compliance

- Ensure proper handling of fluids (hydraulic oil, coolant, diesel) during transport and assembly to prevent spills.

- Follow local environmental regulations for noise, emissions, and waste disposal.

Insurance and Risk Management

Cargo Insurance

- Secure all-risk marine and land cargo insurance covering damage, delay, and theft.

- Include clauses for high-value equipment and specify coverage limits per component.

Liability Coverage

- Ensure transporters carry adequate liability insurance.

- Verify coverage for third-party damage during transit, especially in urban or sensitive areas.

Contingency Planning

- Prepare for delays due to weather, port congestion, or customs inspections.

- Maintain spare parts inventory onsite for rapid reassembly and commissioning.

Final Delivery and Commissioning

Reassembly Oversight

- Use Caterpillar-trained technicians or certified partners for reassembly.

- Follow OEM procedures for alignment, torque specifications, and fluid fills.

Compliance Verification

- Conduct final inspection to ensure all components meet original specifications.

- Validate compliance with local mining and equipment safety regulations.

Documentation Handover

- Provide complete compliance dossier to the end-user, including:

- Bill of Lading

- Customs clearance records

- Inspection certificates

- Warranty and service manuals

Summary

Transporting and deploying a Caterpillar 797F requires coordinated logistics, strict regulatory compliance, and expert handling. Due to the truck’s high value and operational criticality, engaging experienced freight forwarders, compliance officers, and OEM support is essential to ensure a smooth delivery and legal operation.

In conclusion, sourcing the price for a CAT 797F haul truck requires a comprehensive approach due to the fact that Caterpillar does not publicly list official pricing for this large mining vehicle. Accurate pricing typically comes from direct consultation with authorized Caterpillar dealers, who can provide quotations based on customized configurations, regional factors, delivery terms, and additional support packages such as maintenance, training, and warranties. Market conditions, including supply chain dynamics and demand in the mining sector, also influence final costs. Additionally, alternative options such as pre-owned units or fleet upgrades may affect budgeting decisions. Therefore, obtaining a reliable and competitive price for the CAT 797F involves engaging with Caterpillar representatives, evaluating total cost of ownership, and considering long-term operational needs.