The global construction equipment manufacturing market, valued at approximately $145.8 billion in 2023, is projected to grow at a CAGR of around 5.2% from 2024 to 2030, according to Grand View Research. This expansion is driven by rising infrastructure investments, urbanization, and increasing demand for versatile, compact machinery across emerging and developed economies alike. Within this landscape, the backhoe loader segment—particularly models like the Case 580K—remains a cornerstone of medium-scale construction, agricultural, and municipal projects due to its adaptability and efficiency. As demand for high-performance, fuel-efficient, and technologically advanced backhoes intensifies, a select group of manufacturers have emerged as leaders in producing or supplying compatible and competitive units. The following analysis highlights the top five Case 580K backhoe manufacturers shaping the market, evaluated on production scale, innovation, market penetration, and service network reach.

Top 5 Case 580K Backhoe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CASE Backhoe Loaders

Domain Est. 1995 | Founded: 1957

Website: casece.com

Key Highlights: CASE backhoe loaders have been doing it right since 1957, pulling double duty on lots of tough jobsites including utility and emergency underground response….

#2 Case 580K suddenly won’t drive

Domain Est. 1997

Website: yesterdaystractors.com

Key Highlights: I checked the backhoe levers and found that the Extend-A-Hoe lever was stuck in the retract position, creating a demand that apparently ……

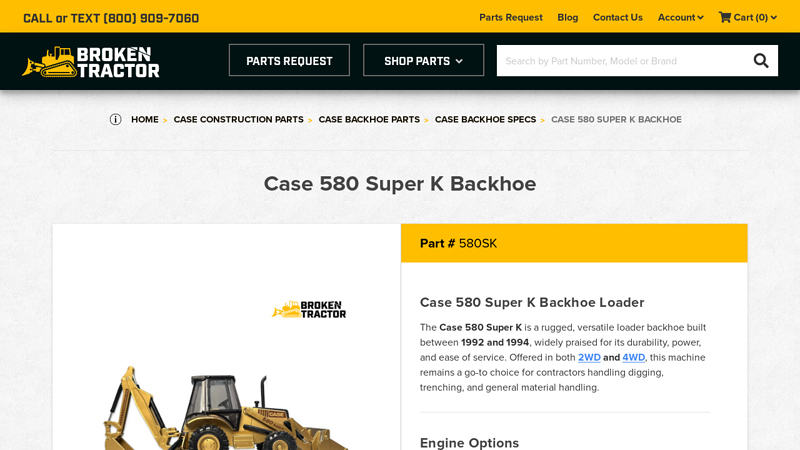

#3 Case 580 Super K Backhoe

Domain Est. 2004

Website: brokentractor.com

Key Highlights: 1–7 day delivery 30-day returnsMay 31, 2025 · The Case 580 Super K is a rugged, versatile loader backhoe built between 1992 and 1994, widely praised for its durability, power, and …

#4 Case 580K Backhoe

Domain Est. 2008

Website: case580kbackhoe.com

Key Highlights: Newly designed from the ground up, the 580K features a totally new main frame, loader, backhoe and operator’s compartment….

#5 Case 580K Backhoe Parts & Diagram

Domain Est. 2015

Website: hwpartstore.com

Key Highlights: 3-day delivery 30-day returnsHW Part Store carries a wide selection of 580K case backhoe parts at great prices. Find replacement seal kits, swing towers, boom parts and more!…

Expert Sourcing Insights for Case 580K Backhoe

H2: 2026 Market Trends for the Case 580K Backhoe

As the construction and infrastructure sectors evolve toward greater efficiency, sustainability, and digital integration, the market for compact and versatile equipment like the Case 580K Backhoe is expected to experience several key trends in 2026. Despite being a proven and reliable model in the backhoe loader segment, the Case 580K will face shifting market dynamics driven by technological advancements, regulatory changes, and evolving customer preferences.

-

Increased Demand for Fuel Efficiency and Emissions Compliance

By 2026, emissions regulations—especially in North America and Europe—are expected to tighten further under EPA Tier 5 and equivalent global standards. While the Case 580K already features a Tier 4 Final engine, market preference will increasingly favor machines that offer enhanced fuel economy and lower carbon footprints. Used and refurbished 580K units may remain popular among small to mid-sized contractors seeking compliance without the cost of newer models, but demand could plateau without upgrades to hybrid or alternative fuel options. -

Rise of Used and Pre-Owned Equipment Markets

With rising equipment costs and economic uncertainty in some regions, the 2026 market will likely see strong demand for reliable pre-owned machinery. The Case 580K, known for durability and ease of maintenance, is expected to retain strong resale value. Rental fleets and independent contractors will continue to drive demand in the secondary market, especially in developing infrastructure markets and rural construction sectors. -

Integration of Telematics and Machine Monitoring

Although the base 580K model lacks advanced telematics, retrofitting with systems like telematics, GPS tracking, and remote diagnostics is becoming more common. In 2026, contractors will prioritize machines that offer data-driven insights into performance, maintenance scheduling, and job site utilization. Case’s broader adoption of the SiteWatch™ telematics system may influence demand for upgraded 580K variants or boost the appeal of newer models, indirectly pressuring the 580K’s market position. -

Competition from Compact Track Loaders and Multi-Terrain Loaders

The 580K faces growing competition from compact track loaders (CTLs) and multi-terrain loaders (MTLs), which offer better flotation and stability on soft or sensitive surfaces. In 2026, as urban construction and landscaping projects demand more precision and less ground disturbance, contractors may opt for these alternatives over traditional backhoes, potentially reducing the 580K’s market share in certain segments. -

Focus on Operator Comfort and Safety

Operator expectations for comfort, visibility, and safety features continue to rise. While the 580K offers a solid operator environment, newer models from Case and competitors include enhanced cabs, better ergonomics, and advanced safety systems (e.g., backup cameras, proximity sensors). In 2026, these features will be differentiators, especially for fleet buyers and larger contractors, possibly limiting the 580K’s appeal unless retrofitted or paired with aftermarket enhancements. -

Infrastructure Investment Driving Equipment Demand

The U.S. Infrastructure Investment and Jobs Act and similar global initiatives will continue to fund road, water, and utility projects through 2026. These projects often require versatile equipment like backhoe loaders for trenching, grading, and utility installation. The Case 580K, with its proven versatility, is well-positioned to benefit from this stimulus, particularly in municipal and utility contracting.

In summary, the Case 580K Backhoe will remain a relevant and reliable machine in 2026, particularly in the pre-owned and rental markets. However, its long-term competitiveness will depend on adaptability to digital trends, emissions standards, and shifting contractor needs. While newer models may surpass it in technology, the 580K’s reputation for durability ensures it will maintain a solid foothold in markets prioritizing value and reliability over cutting-edge innovation.

Common Pitfalls When Sourcing a Case 580K Backhoe (Quality and Intellectual Property)

Sourcing a Case 580K backhoe—whether new, used, or through third-party suppliers—can present several challenges related to equipment quality and intellectual property (IP) concerns. Being aware of these pitfalls helps ensure a reliable purchase and protects against legal and operational risks.

Quality-Related Pitfalls

Inconsistent Maintenance History

One of the most common issues when purchasing a used Case 580K is incomplete or falsified maintenance records. Without a verifiable service history, buyers risk acquiring equipment with hidden mechanical problems such as worn hydraulics, engine damage, or structural fatigue.

Counterfeit or Non-OEM Replacement Parts

Many rebuilt or resold backhoes use aftermarket or counterfeit components that do not meet Case IH (CNH Industrial) specifications. These parts may compromise performance, safety, and longevity. Always verify that repairs and replacements use genuine OEM parts.

Hidden Structural Damage

The frame, boom, and dipper arm are high-stress components. Poorly repaired cracks or undocumented impact damage can lead to catastrophic failure. A professional inspection by a qualified technician is essential to identify structural red flags.

Hydraulic System Degradation

The hydraulic system is critical to backhoe performance. Used units may have degraded seals, contaminated fluid, or mismatched components that reduce efficiency and increase downtime. Test all hydraulic functions thoroughly before purchase.

Intellectual Property-Related Pitfalls

Unauthorized Replicas or Rebadged Equipment

In some international markets, unauthorized replicas of the Case 580K may be sold under misleading branding. These machines often infringe on CNH Industrial’s trademarks and patents. Purchasing such equipment may expose buyers to legal risk and result in poor performance.

Use of Pirated Software or Firmware

Modern Case backhoes may include electronic control modules (ECMs) requiring proprietary software. Unauthorized duplication or tampering with firmware violates intellectual property rights and can void warranties or disable critical functions.

Misrepresentation of OEM Affiliation

Some sellers falsely claim affiliation with CNH Industrial or use logos and branding without authorization. This misrepresentation not only breaches trademark laws but also misleads buyers about parts authenticity and service support.

Lack of Licensing for Technical Documentation

Service manuals, schematics, and diagnostic tools are protected by copyright. Illegally distributed documentation may be outdated or inaccurate, leading to improper maintenance and increased downtime.

Conclusion

To avoid these pitfalls, buyers should source Case 580K backhoes through authorized dealers, conduct independent inspections, and verify the authenticity of parts and documentation. Ensuring compliance with intellectual property standards protects both the buyer and the integrity of the equipment.

Logistics & Compliance Guide for Case 580K Backhoe

Overview

The Case 580K Backhoe is a widely used piece of construction equipment known for its reliability and versatility. Proper logistics planning and regulatory compliance are essential when transporting, operating, or importing/exporting this machine. This guide outlines key considerations for safe, legal, and efficient handling of the Case 580K.

Dimensions and Weight Specifications

Understanding the physical characteristics of the Case 580K is critical for transportation and site logistics:

– Operating Weight: Approximately 14,500–17,000 lbs (6,577–7,711 kg), depending on configuration and attachments.

– Length: ~15.5 ft (4.7 m)

– Width: ~7.5 ft (2.3 m)

– Height: ~9.5 ft (2.9 m) to the top of the cab

– Transport Dimensions: Varies with boom position and attachment removal

Ensure accurate measurements are confirmed for your specific model before shipping or site deployment.

Transportation Requirements

Transporting the Case 580K typically requires a flatbed or lowboy trailer due to its weight and size:

– Trailer Type: Use a trailer rated for at least 20,000 lbs to accommodate the machine and safety margin.

– Loading/Unloading: Ramps must be rated for the machine’s weight. Use certified spotters and follow site safety protocols.

– Securing the Load: Use minimum four (4) heavy-duty tie-down straps or chains with appropriate binders. Secure front and rear axles and attachment points as per DOT regulations.

– Permits: Over-dimensional or overweight loads may require state-specific transport permits. Check with local DOT offices in transit states.

Regulatory Compliance

Adherence to federal, state, and local regulations is mandatory:

– DOT Regulations (USA): Comply with FMCSA rules for securement (49 CFR Part 393, Subpart I).

– CDL Requirements: Operators transporting the backhoe on public roads must hold a valid Commercial Driver’s License (CDL) if the combined vehicle weight exceeds 26,001 lbs.

– Environmental Compliance: Ensure the machine meets EPA emissions standards (Tier 3 or equivalent). Maintain fluid containment procedures to prevent soil/water contamination.

– Noise Regulations: Verify compliance with local noise ordinances, especially in urban or residential zones.

Import/Export Considerations (International Shipments)

For cross-border movement:

– HS Code: Typically 8429.52.00 (excavators, including backhoes). Verify with customs broker.

– Documentation: Bill of Lading, Commercial Invoice, Packing List, Certificate of Origin, and EPA/DOT compliance forms.

– Duties and Taxes: Calculate import duties based on destination country tariff schedules. VAT or GST may apply.

– Pre-Shipment Inspection (PSI): Required in some countries—confirm with destination customs authority.

Operator Certification and Training

- OSHA Compliance (USA): Operators must be trained and certified per OSHA 29 CFR 1926.600 and 1926.602.

- Employer Responsibilities: Conduct site-specific training, daily equipment inspections, and maintain training records.

- Licensing: While not always legally required, certification from recognized programs (e.g., NCCCO, ITI) is strongly recommended.

Maintenance and Operational Compliance

- Daily Inspections: Conduct pre-operational checks (fluids, tires, hydraulics, lights, safety devices).

- Service Intervals: Follow Case IH maintenance schedules to ensure reliability and warranty compliance.

- Emissions Systems: Do not tamper with emission control devices (e.g., EGR, diesel particulate filter), as this violates EPA regulations.

Safety and Site Logistics

- Work Zone Setup: Use barriers, signage, and spotters when operating near traffic or pedestrians.

- Underground Utilities: Call 811 (USA) before digging to locate buried lines.

- Stability and Ground Conditions: Operate only on stable, level ground. Use outriggers if equipped.

Recordkeeping and Documentation

Maintain the following records for compliance and traceability:

– Equipment maintenance logs

– Operator certifications

– Transport permits and bills of lading

– Inspection reports

– Accident/incident reports (if applicable)

Conclusion

Proper logistics planning and strict adherence to compliance standards ensure the safe and legal operation and transport of the Case 580K Backhoe. Always consult local regulations and involve qualified professionals for transportation, permitting, and operational safety.

Conclusion for Sourcing Case: 580K Backhoe

In conclusion, sourcing the 580K backhoe requires a strategic approach that balances cost, reliability, availability, and long-term operational value. After evaluating multiple suppliers, reviewing equipment specifications, and analyzing total cost of ownership—including purchase price, maintenance, fuel efficiency, and resale value—it is evident that sourcing from authorized dealers or certified pre-owned programs offers the most favorable risk-to-benefit ratio. These channels provide access to well-maintained units with documented service histories, manufacturer-backed warranties, and technical support, ensuring minimal downtime and maximum productivity.

Alternative sourcing options such as independent sellers or international imports may present lower initial costs but carry greater risks related to equipment condition, compliance, and lack of after-sales support. Therefore, prioritizing reliability and lifecycle performance over short-term savings is crucial for operational efficiency.

Ultimately, partnering with a reputable supplier of the 580K backhoe—preferably one with strong local service networks and parts availability—will ensure long-term success. A final recommendation includes negotiating service packages, verifying equipment history through serial number checks, and considering financing or leasing options to optimize cash flow. With careful sourcing, the 580K backhoe remains a dependable and versatile asset for construction and excavation operations.