The global carved wood products market has experienced steady expansion, driven by rising demand in furniture, interior décor, and architectural applications. According to Grand View Research, the global wood carving market was valued at USD 17.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030. This growth is fueled by increased consumer preference for sustainable, handcrafted materials and the resurgence of artisanal craftsmanship in residential and commercial design. Additionally, expanding construction activities in emerging economies and rising investments in luxury home furnishings are amplifying demand for high-quality carved wood components. As the industry evolves, manufacturers are enhancing production efficiency while preserving traditional techniques, creating a competitive landscape led by innovation and craftsmanship. In this context, the following list highlights the top 10 carved wood manufacturers excelling in design, scalability, and market reach.

Top 10 Carved Wood Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hand Carved Wooden Crafts Manufacturer

Domain Est. 2016

Website: ewoodarts.com

Key Highlights: Discover unique, high-quality wood carving crafts at Ewoodarts. With over 20 years of experience, we offer OEM and ODM services tailored to your needs….

#2 to Stadtlander Woodcarvings!!!

Domain Est. 2001

Website: stadtlandercarvings.com

Key Highlights: We specialize in items for relief carving and chip carving. We offer a large variety woodcarving knives and woodcarving gouges from several manufacturers….

#3 Wood Carving Tools and Supplies for Everyone. We have over …

Domain Est. 1996

Website: chippingaway.com

Key Highlights: Wood Carving Tools, Knives, Supplies, Power Tools, Accessories and Beginner Kits! We have a huge inventory just waiting for you!…

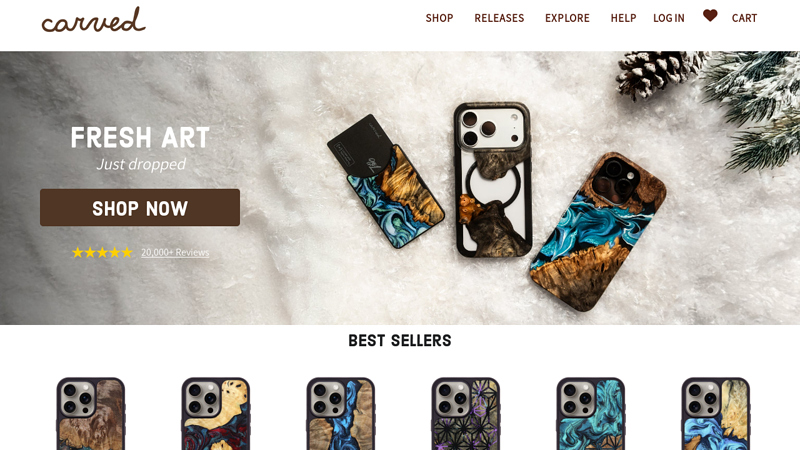

#4 Carved

Domain Est. 1999

Website: carved.com

Key Highlights: We design and make unique, handmade wooden goods that you’ll be proud to carry. Shop for Wood & Resin Phone Cases, Bracelets, Wallets, Wireless Chargers ……

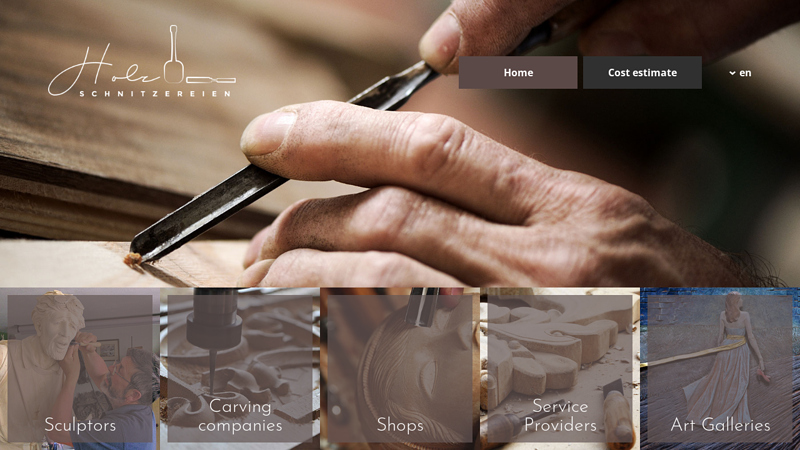

#5 Wood carving companies and sculptors from Italy

Domain Est. 2000

Website: holzschnitzereien.net

Key Highlights: Hand-carved pieces of art – Religious and modern statues and sculptures of sculptors and wood carving companies from Val Gardena in Italy in the Dolomites….

#6 Carvedwood•44

Domain Est. 2000

Website: plygem.com

Key Highlights: Carvedwood•44 is an ideal choice for remodelers because of its optimal thickness and wide selection of designer-inspired colors….

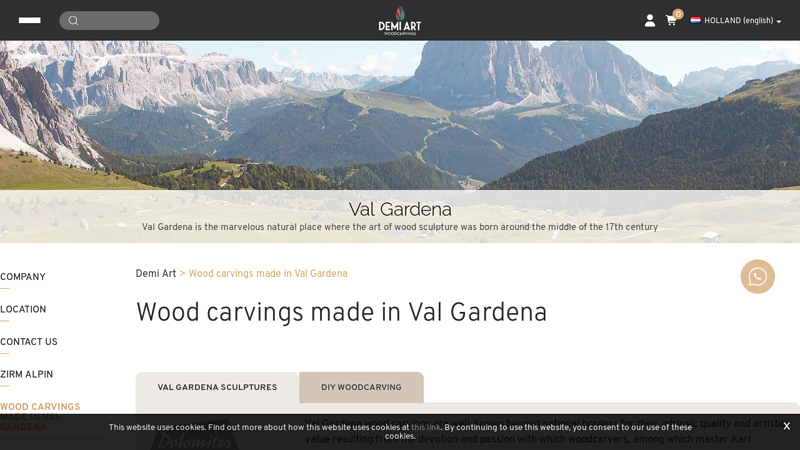

#7 Wood carvings made in Val Gardena

Domain Est. 2006

Website: demi-art.com

Key Highlights: Val Gardena wood carvings are well-known beyond national borders for their intrinsic quality and artistic value resulting from the devotion and passion with ……

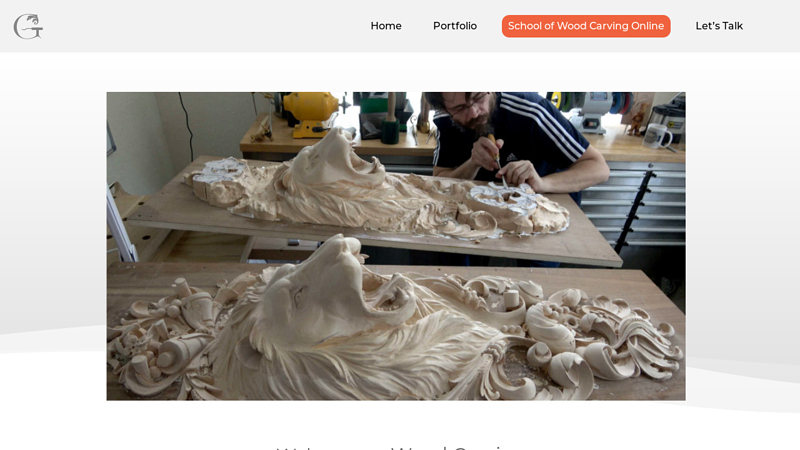

#8 CUSTOM WOOD CARVING BY ALEXANDER GRABOVETSKIY …

Domain Est. 2010

Website: grabovetskiy.com

Key Highlights: Welcome to the website of Master Wood Carver Alexander Grabovetskiy, internationally acclaimed artist and master of decorative and architectural wood carving….

#9 Carved Woodworks: Custom Wood Furniture Design

Domain Est. 2010

Website: carvedwoodworks.com

Key Highlights: Carved Woodworks offers custom design furniture. We specialize in crafting custom wood furniture designs that add personal value and style to your home….

#10 JMS Wood Sculpture

Domain Est. 2016

Website: jmswoodsculpture.com

Key Highlights: Over 24 years experience creating gorgeous works of art. Order your custom wood sculptures today! Located in McCleary, Washington (formerly Gig Harbor, WA)….

Expert Sourcing Insights for Carved Wood

H2: 2026 Market Trends for Carved Wood

The carved wood market in 2026 is poised for dynamic evolution, shaped by shifting consumer values, technological integration, and sustainability imperatives. While rooted in tradition, the sector is adapting to modern demands, creating both opportunities and challenges.

H2: Key Drivers Shaping the 2026 Carved Wood Market

-

Sustainability & Ethical Sourcing as Non-Negotiables: By 2026, consumer and regulatory pressure will make sustainable forestry practices (FSC/PEFC certification) and transparent supply chains paramount. Demand will surge for reclaimed, salvaged, and rapidly renewable woods (like bamboo or responsibly managed fast-growing species). “Greenwashing” will be heavily scrutinized, pushing producers towards verifiable eco-credentials. Urban wood recycling programs will gain traction as a key material source.

-

Artisan Craftsmanship Meets Digital Precision: The tension and synergy between handcrafting and technology will define quality and accessibility. High-end, bespoke pieces will emphasize unique, hand-carved details and artist provenance, commanding premium prices. Conversely, CNC (Computer Numerical Control) routers and advanced 3D carving software will enable small workshops and designers to produce intricate, complex, or customized designs more efficiently and affordably, democratizing intricate patterns and expanding design possibilities for mass-market and mid-tier segments.

-

Customization and Personalization as Standard: Consumers increasingly seek unique, meaningful pieces. The market will see a significant rise in customizable options – from personalized motifs and monograms on furniture and decor to bespoke architectural elements. Online platforms allowing virtual design configurators will become more sophisticated, enabling remote collaboration between customers and artisans.

-

Wellness and Biophilic Design Integration: The continued focus on wellness and connection to nature (biophilia) will drive demand for carved wood elements in homes, workplaces, and healthcare settings. Intricate carvings featuring natural motifs (flora, fauna, organic textures) will be sought after for their calming, grounding aesthetic, moving beyond mere decoration to contribute to psychological well-being.

-

E-Commerce and Direct-to-Consumer (DTC) Dominance: Online marketplaces (specialized craft platforms, Etsy, dedicated brand sites) will be the primary sales channel for most carved wood artisans and smaller brands. High-quality photography, detailed provenance stories, and immersive 360-degree views will be essential for online success. Social media (Instagram, Pinterest) will remain crucial for discovery and marketing, showcasing the artistry and process.

-

Urbanization and Space Constraints Influencing Design: As urban living intensifies, demand will grow for multifunctional, space-saving carved wood pieces. Think intricate carvings on compact furniture, sculptural wall panels that double as room dividers, or decorative elements that maximize visual impact in small areas without sacrificing floor space.

-

Cultural Heritage & Storytelling Premium: Pieces with authentic cultural heritage, traditional techniques (e.g., specific regional styles like Balinese, African, Scandinavian), and clear artist stories will command higher value. Consumers will pay more for the narrative and cultural significance embedded in the carving, supporting artisan communities and preserving traditions. “Heritage revival” styles may see renewed interest.

-

Material Innovation and Hybrids: While solid wood remains core, experimentation with wood composites, laminates incorporating carved veneers, or combining carved wood with other sustainable materials (metals, stone, recycled glass) will increase, offering new textures, durability, and design options, particularly in contemporary and functional design.

H2: Challenges and Outlook for 2026

- Cost Pressures: High-quality wood, skilled labor (especially master carvers), and sustainable practices increase costs. Artisans and manufacturers will need to balance premium pricing for authenticity with market competitiveness, potentially leveraging technology for efficiency.

- Skill Gap & Artisan Preservation: Attracting and training the next generation of skilled carvers remains a challenge. Initiatives supporting craft education and fair compensation will be vital for the sector’s long-term health.

- Market Competition: The market will be crowded, with competition from mass-produced imitations and global producers. Differentiation through genuine craftsmanship, unique design, and strong branding will be critical.

Conclusion: The 2026 carved wood market will thrive at the intersection of tradition and innovation. Success will belong to those who master the balance: honoring heritage craftsmanship while embracing technology for efficiency and customization, prioritizing verifiable sustainability, and effectively telling the compelling story behind each unique piece in an increasingly digital and conscious marketplace. The focus will shift from mere product to experience, meaning, and environmental responsibility.

Common Pitfalls When Sourcing Carved Wood (Quality, IP)

Sourcing carved wood products—whether for furniture, decor, or artisanal goods—can present several challenges, particularly concerning quality consistency and intellectual property (IP) risks. Being aware of these pitfalls helps ensure ethical, legal, and high-standard procurement.

Inconsistent Quality Standards

One of the most frequent issues in sourcing carved wood is the lack of uniform quality. Hand-carved pieces can vary significantly due to differences in craftsmanship, tools, and raw materials. Buyers may receive inconsistent grain patterns, finish quality, or structural integrity across batches, especially when working with multiple artisans or small workshops lacking standardized processes.

Use of Substandard or Non-Sustainable Wood

Suppliers may use lower-grade or improperly dried wood to cut costs, leading to warping, cracking, or pest infestation over time. Additionally, sourcing from regions with weak environmental regulations raises risks of using illegally harvested or non-FSC-certified timber, which can damage brand reputation and lead to compliance issues in regulated markets.

Lack of Skilled Artisanship

Authentic wood carving requires significant skill and experience. Sourcing from regions where traditional craftsmanship is declining may result in poorly executed details, asymmetrical designs, or weak joinery. Mass-produced “hand-carved” items are often partially machine-made, misleading buyers about the product’s true craftsmanship.

Intellectual Property Infringement

Carved wood designs—especially traditional or culturally significant patterns—may be protected under copyright, design patents, or community IP rights. Sourcing replicas of indigenous art, famous sculptures, or branded designs without proper licensing can lead to legal disputes, shipment seizures, or forced recalls.

Cultural Appropriation and Ethical Sourcing Risks

Using designs rooted in specific cultural or ethnic traditions without permission or fair compensation to originating communities constitutes ethical and reputational risk. Buyers may unintentionally commercialize sacred symbols or traditional knowledge, leading to public backlash and accusations of exploitation.

Inadequate Documentation for IP and Provenance

Many suppliers fail to provide documentation verifying the originality of designs or the legal sourcing of materials. Without clear provenance records, companies expose themselves to IP litigation and customs complications, especially in markets with strict import regulations on cultural artifacts.

Poor Communication and Misaligned Expectations

Language barriers, vague product descriptions, or insufficient technical drawings can result in final products that deviate from specifications. Detailed prototypes, clear contracts, and regular quality checks are essential to avoid costly revisions or rejected shipments.

Supply Chain Transparency Gaps

Complex, multi-tiered supply chains make it difficult to trace the origin of both wood and design. Without transparency, companies cannot verify claims of sustainability, fair labor practices, or design authenticity—increasing exposure to regulatory and reputational risks.

Logistics & Compliance Guide for Carved Wood

Product Classification and HS Codes

Identify the correct Harmonized System (HS) code for carved wood products to ensure accurate customs declarations. Common classifications may fall under HS Chapter 44 (Wood and Articles of Wood), such as 4415 (Wooden frames for paintings, photographs, mirrors, etc.) or 4420 (Other articles of wood). The specific code depends on the type of wood, intended use, and level of craftsmanship. Proper classification affects tariffs, import restrictions, and documentation requirements.

CITES Regulations and Protected Species

Verify whether the wood species used in carving are listed under the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES). Species such as Brazilian rosewood (Dalbergia nigra) or African blackwood (Dalbergia melanoxylon) require CITES permits for international trade. Exporters and importers must obtain valid CITES documentation to prove legal sourcing and compliance with environmental protection laws.

Phytosanitary Requirements and ISPM 15

Comply with International Standards for Phytosanitary Measures No. 15 (ISPM 15) if shipping carved wood items that include packaging materials like wooden crates or pallets. These must be heat-treated or fumigated and marked with the official ISPM 15 stamp to prevent the spread of pests. While the carved items themselves may be exempt if fully processed, accompanying wood packaging is strictly regulated.

Country-Specific Import Restrictions

Research import regulations in the destination country, as some nations impose restrictions or bans on certain wood types or require special declarations. For example, the U.S. Lacey Act mandates proof of legal harvest and chain-of-custody documentation, while the EU Timber Regulation (EUTR) prohibits placing illegally harvested wood on the market. Non-compliance can result in shipment rejection, fines, or confiscation.

Packaging and Labeling Standards

Package carved wood items securely to prevent damage during transit, using environmentally friendly and compliant materials. Clearly label packages with contents, wood species (if required), country of origin, and any applicable certifications (e.g., FSC, PEFC). Accurate labeling supports transparency and meets regulatory expectations in consumer protection and sustainability.

Documentation and Export Procedures

Prepare a complete set of shipping documents, including commercial invoice, packing list, certificate of origin, and any required permits (e.g., CITES, phytosanitary certificate). Ensure all documents accurately describe the carved wood products and align with customs requirements. Inaccurate or incomplete paperwork can delay clearance and trigger inspections.

Transportation and Handling Considerations

Choose carriers experienced in handling fragile and high-value artisan goods. Maintain stable temperature and humidity during transport to prevent cracking or warping of wood. For air freight, consider insurance coverage for loss or damage. Proper handling and climate control are essential for preserving the integrity of hand-carved items.

Sustainability and Ethical Sourcing

Source wood from legally and sustainably managed forests. Maintain records of supplier certifications (e.g., FSC, PEFC) to demonstrate responsible sourcing. Many markets and consumers prioritize eco-friendly and ethical practices, and compliance enhances reputation and market access.

Recordkeeping and Audit Readiness

Retain all transaction records, including supplier invoices, permits, and shipping documents, for a minimum of five years. Regulatory bodies may conduct audits to verify compliance with timber trade laws. Organized and accessible records are critical for demonstrating due diligence and avoiding penalties.

Conclusion

Successfully navigating the logistics and compliance landscape for carved wood requires attention to species regulations, international standards, proper documentation, and ethical sourcing. Proactive compliance ensures smooth cross-border trade, supports conservation efforts, and builds trust with global partners and customers.

Conclusion on Sourcing Carved Wood:

Sourcing carved wood requires a thoughtful and responsible approach that balances aesthetic value, cultural respect, sustainability, and ethical considerations. It is essential to prioritize wood from legal, sustainable sources to protect forests and biodiversity. Artisans and suppliers should adhere to fair labor practices, ensuring that the craftspersons behind the intricate carvings are properly compensated and respected. Whenever possible, sourcing directly from local artisans or community cooperatives supports traditional craftsmanship and helps preserve cultural heritage. Additionally, verifying certifications such as FSC (Forest Stewardship Council) or other recognized eco-labels adds credibility to the sourcing process. Ultimately, responsible sourcing of carved wood not only yields high-quality, authentic products but also contributes to environmental conservation and the empowerment of artisan communities worldwide.