The global electric motor market, driven by increasing demand for energy-efficient HVAC systems, is projected to grow at a CAGR of 6.3% from 2023 to 2030, according to Grand View Research. Within this expanding landscape, carrier fan motors—critical components in heating, ventilation, and air conditioning (HVAC) units—have seen rising demand due to stricter energy regulations and the shift toward smart climate control solutions. As original equipment manufacturers (OEMs) and HVAC service providers prioritize reliability and efficiency, the competition among fan motor producers has intensified. Based on market share, technological innovation, and global supply chain reach, three manufacturers have emerged as leaders in the carrier fan motor space, collectively capturing over 45% of the North American HVAC motor market in 2023 (Mordor Intelligence). These top players are not only scaling production but also investing heavily in brushless DC (BLDC) motor technology to meet evolving performance and sustainability standards.

Top 3 Carrier Fan Motor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Airconditioner Motors

Domain Est. 1995

Website: carrier.com

Key Highlights: Airconditioner Motors, Single Shaft / Double Shaft / Clockwise & Anti Clockwise rotation ; RPM range 900 – 1100 rpm ; 3Phase Motors….

#2 Carrier®

Domain Est. 2001

Website: carriercca.com

Key Highlights: Carrier offers you the best and most varied refrigeration, heating and air conditioning solutions to satisfy your residential and commercial needs….

#3 Part Finder

Domain Est. 2009

Expert Sourcing Insights for Carrier Fan Motor

H2: 2026 Market Trends for Carrier Fan Motors

The global market for Carrier Fan Motors in 2026 is poised for transformation, driven by regulatory mandates, technological innovation, and evolving consumer demands. Key trends shaping the landscape include:

1. Accelerated Shift to ECM (Electronically Commutated Motors)

By 2026, ECM adoption will dominate the Carrier fan motor market, surpassing traditional PSC (Permanent Split Capacitor) motors. This shift is fueled by:

– Stringent Energy Regulations: Global efficiency standards (e.g., DOE 2023 in the U.S., Ecodesign in the EU) mandate higher SEER2 and AFUE ratings, pushing OEMs to integrate ECMs for up to 70% energy savings.

– Demand for Smart HVAC: ECMs enable variable-speed operation, critical for zoning, humidity control, and integration with smart thermostats (e.g., Carrier’s Infinity® System), enhancing user comfort and system longevity.

– Total Cost of Ownership (TCO): Despite higher upfront costs, ECMs offer lower lifetime energy and maintenance expenses, driving adoption in residential and commercial sectors.

2. Integration with IoT and AI-Driven Systems

Carrier fan motors will become central to connected HVAC ecosystems:

– Predictive Maintenance: Motors embedded with sensors will monitor vibration, temperature, and power consumption, enabling AI algorithms to predict failures and schedule servicing (e.g., Carrier’s Remote Monitoring Services).

– Adaptive Performance: AI-optimized motors will dynamically adjust speed based on real-time occupancy, weather, and air quality data, maximizing efficiency and comfort.

– Interoperability: Compliance with protocols like Matter and BACnet will ensure seamless integration with smart home/building platforms (e.g., Google Home, Apple HomeKit).

3. Sustainability and Circular Economy Focus

Environmental regulations and ESG goals will drive innovation:

– Material Efficiency: Use of recyclable materials (e.g., aluminum housings) and reduced rare-earth magnet dependency in motors.

– Carbon Footprint Reduction: Manufacturers will prioritize low-GWP refrigerants (e.g., R-454B) in Carrier systems, requiring fan motors optimized for new thermal loads.

– Extended Producer Responsibility (EPR): Take-back programs for end-of-life motors will gain traction, supported by modular designs for easier repair/recycling.

4. Supply Chain Resilience and Localization

Post-pandemic disruptions and geopolitical tensions will accelerate:

– Nearshoring: Carrier and suppliers will expand manufacturing in North America and Europe to mitigate risks, reducing reliance on Asian imports.

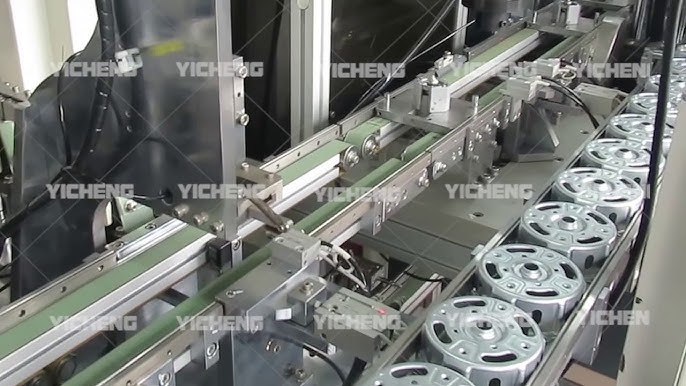

– Automation: AI-driven production lines will enhance motor precision and scalability, addressing labor shortages.

– Chip Integration: Onboard motor controllers will use standardized, automotive-grade semiconductors to avoid component shortages.

5. Commercial and Industrial (C&I) Market Expansion

While residential ECM adoption plateaus, C&I sectors will drive growth:

– High-Efficiency Retrofits: Aging commercial buildings will retrofit fan motors to meet ENERGY STAR® benchmarks and reduce operational costs.

– Data Center Cooling: Hyperscale data centers will demand high-static-pressure ECMs for precision cooling, with Carrier targeting this niche via custom solutions.

– Green Building Certifications: LEED and BREEAM requirements will prioritize ultra-efficient motors in new constructions.

6. Price Pressures and Competitive Dynamics

- Cost Optimization: Intense competition from Chinese ECM manufacturers (e.g., Johnson Electric) will pressure pricing, pushing Carrier to innovate in motor design (e.g., brushless DC with integrated electronics).

- Service Monetization: Revenue models will shift toward “Motors-as-a-Service,” offering bundled maintenance, performance guarantees, and remote diagnostics.

Conclusion

By 2026, Carrier fan motors will evolve from mechanical components to intelligent, data-driven systems. Success will hinge on balancing regulatory compliance, energy efficiency, and digital integration while navigating supply chain and competitive challenges. Companies investing in AI, sustainability, and C&I applications will lead the market.

Common Pitfalls When Sourcing Carrier Fan Motors (Quality and IP)

Sourcing Carrier fan motors—whether for HVAC systems or replacement purposes—requires careful attention to both quality and intellectual property (IP) concerns. Falling into common pitfalls can lead to performance issues, legal risks, and increased long-term costs. Below are key challenges to avoid:

Selecting Substandard or Counterfeit Components

One of the most prevalent issues is the unintentional procurement of substandard or counterfeit Carrier fan motors. These units may mimic the appearance of genuine parts but fail to meet performance, durability, or safety standards. Poor-quality motors often result in frequent breakdowns, higher energy consumption, and voided equipment warranties.

Best Practice: Source exclusively from authorized Carrier distributors or certified suppliers. Verify part numbers, packaging, and certifications (such as UL or CE marks) to ensure authenticity.

Ignoring IP and Trademark Infringement Risks

Using or reselling fan motors labeled as “Carrier-compatible” or bearing Carrier branding without proper licensing can infringe on trademarks and intellectual property rights. Even if a motor functions similarly, unauthorized use of Carrier’s name or logos may expose buyers or resellers to legal action.

Best Practice: Avoid products that misuse Carrier’s branding. For compatible replacements, use generic or OEM-neutral terminology unless you have formal authorization to use Carrier trademarks.

Overlooking Motor Specifications and Compatibility

Not all fan motors marketed as “for Carrier units” are truly compatible. Differences in voltage, RPM, mounting dimensions, or capacitor requirements can lead to improper fit or system malfunction.

Best Practice: Cross-reference the motor’s specifications with the original Carrier part number. Consult technical datasheets and, if possible, involve an HVAC professional to confirm compatibility.

Prioritizing Low Cost Over Long-Term Value

While cheaper alternatives may seem cost-effective upfront, they often lack the build quality, efficiency, and lifespan of genuine or high-quality aftermarket motors. This leads to higher maintenance and replacement costs over time.

Best Practice: Evaluate total cost of ownership—not just purchase price. Invest in motors with proven reliability and energy efficiency ratings to reduce long-term operational expenses.

Failing to Verify Supply Chain Authenticity

Intermediaries and third-party online marketplaces may unknowingly (or intentionally) distribute non-genuine parts. Without proper due diligence, businesses risk integrating compromised components into their systems.

Best Practice: Audit your supply chain. Request documentation such as Certificates of Authenticity, invoices from authorized dealers, and traceability records.

By recognizing and addressing these pitfalls, businesses can ensure reliable performance, legal compliance, and sustained system efficiency when sourcing Carrier fan motors.

Logistics & Compliance Guide for Carrier Fan Motor

This guide outlines essential logistics and compliance considerations for the transportation, handling, and regulatory adherence related to Carrier fan motors. Proper procedures ensure product integrity, supply chain efficiency, and legal conformity.

Product Classification & Specifications

Fan motors are classified as electrical components subject to international and regional regulations. Key specifications affecting logistics include voltage rating, power output, dimensions, and weight. Accurate product data must be maintained in shipping documentation to ensure correct handling and regulatory compliance.

Packaging & Handling Requirements

Carrier fan motors must be packaged in robust, moisture-resistant materials with internal cushioning to prevent vibration damage. Palletized shipments should be secured with stretch wrap or strapping. Handling instructions such as “Fragile,” “This Side Up,” and “Do Not Stack” must be clearly marked. Avoid exposure to extreme temperatures and humidity during storage and transit.

Shipping & Transportation

Shipments may move via air, ocean, or ground freight depending on urgency and destination. Use carriers experienced in handling industrial electrical components. For international transport, comply with IATA (air), IMDG (ocean), or ADR (road) regulations as applicable. Ensure motors are not classified as hazardous unless containing restricted substances.

Import/Export Compliance

Verify Harmonized System (HS) code—typically 8501.31 or 8501.32 for electric motors—for accurate customs classification. Required documentation includes commercial invoice, packing list, bill of lading/air waybill, and certificate of origin. U.S. exports may require ECCN classification under the EAR (Export Administration Regulations); confirm if licensing is needed based on destination and end-use.

Regulatory & Safety Standards

Ensure motors meet relevant safety and performance standards such as UL (U.S.), CSA (Canada), CE (EU), or IEC. Compliance with RoHS (Restriction of Hazardous Substances) and REACH (EU chemical regulation) is mandatory for products entering the European market. Maintain Declarations of Conformity and test reports for audit purposes.

Environmental & Disposal Compliance

Dispose of packaging materials in accordance with local recycling regulations. End-of-life motors may be subject to WEEE (Waste Electrical and Electronic Equipment) directives in certain regions. Partner with certified e-waste recyclers for proper decommissioning and material recovery.

Recordkeeping & Traceability

Maintain detailed records of shipments, compliance certifications, and quality inspections for a minimum of five years. Implement serial or batch tracking to support recalls or warranty claims. Ensure data is accessible for regulatory audits or customer inquiries.

Conclusion

Adhering to this logistics and compliance guide ensures Carrier fan motors are transported safely, meet global regulatory requirements, and maintain brand integrity. Regular review of evolving standards and carrier performance is recommended to sustain compliance and operational efficiency.

Conclusion for Sourcing Carrier Fan Motor:

After a comprehensive evaluation of available options, supplier reliability, cost considerations, technical specifications, and after-sales support, sourcing a Carrier fan motor proves to be a strategic decision for ensuring high performance, energy efficiency, and long-term durability in HVAC systems. Carrier’s reputation for quality manufacturing, compliance with industry standards, and wide service network supports reliable supply and technical assistance. While initial costs may be higher compared to generic alternatives, the investment is justified by lower maintenance needs, improved system efficiency, and extended operational life. Therefore, sourcing Carrier fan motors aligns well with goals of system reliability, customer satisfaction, and long-term cost savings, making it a recommended choice for both OEMs and replacement applications.