Sourcing Guide Contents

Industrial Clusters: Where to Source Carr China Company Grafton Wv

SourcifyChina Sourcing Intelligence Report: Strategic Analysis for Ceramic Tableware Sourcing in China (2026 Forecast)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Report ID: SC-CHN-CERAMIC-2026-001

Critical Clarification: “Carr China Company Grafton WV” Context

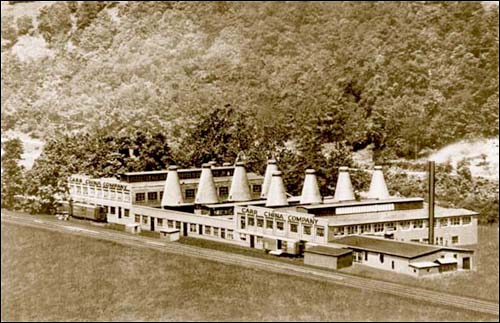

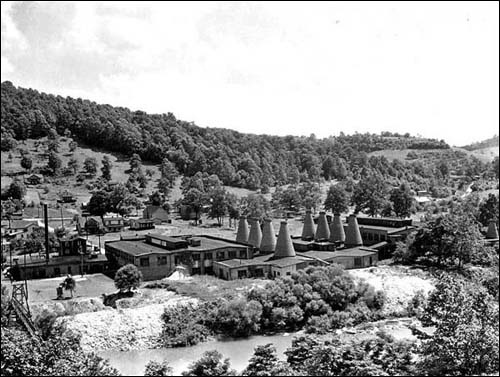

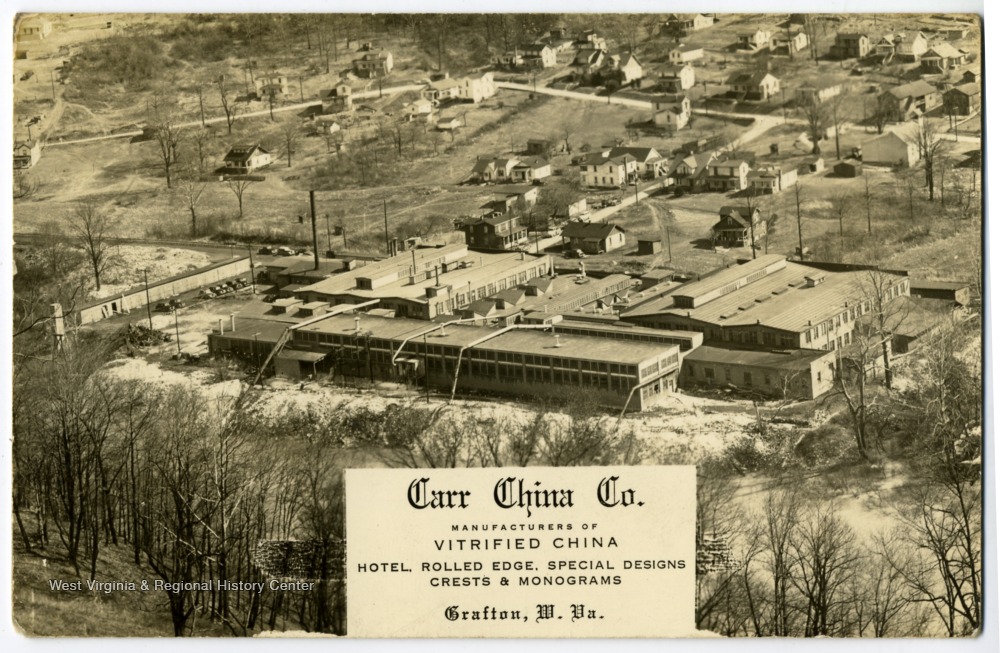

Important Note: “Carr China Company” (Grafton, West Virginia, USA) was a historic American ceramic manufacturer (1903–1984) and does not operate in China. It ceased operations decades ago, and its assets/brand are not active in Chinese manufacturing. This report assumes your query refers to sourcing modern ceramic tableware (e.g., dinnerware, ovenware) of comparable quality/design from Chinese manufacturers, not legacy Carr China products. Sourcing authentic vintage Carr China requires engagement with US antique dealers, not Chinese OEMs.

Strategic Market Analysis: Sourcing High-Quality Ceramic Tableware from China

China dominates 62% of global ceramic tableware exports (China Ceramics Association, 2025). For premium, durable tableware akin to historic Carr China’s quality (e.g., vitrified stoneware, oven-to-table pieces), focus on clusters specializing in high-fire porcelain and stoneware with ISO 9001/14001-certified facilities. Avoid low-cost clusters if heat resistance, chip resistance, and food safety are priorities.

Key Industrial Clusters for Premium Ceramic Tableware

| Region | Specialization | Key Advantages | Limitations |

|---|---|---|---|

| Jingdezhen (Jiangxi) | High-fire porcelain (≤1,300°C), artisanal glazes, bone china | UNESCO-listed heritage; R&D in lead-free glazes; ≤0.5% defect rates; FDA/EU LFGB compliance | Higher costs; MOQs ≥1,000 units; 30% longer lead times |

| Foshan (Guangdong) | Mass-market stoneware, oven-to-table ware | Integrated supply chain (clay to packaging); 45% of export volume; 15-day prototyping | Quality variance (defect rates 1.5–3%); limited artisanal customization |

| Dehua (Fujian) | White porcelain, giftware, “ivory” finish | Lowest raw material costs; 70% of China’s white porcelain output | Weak in dark/stained glazes; limited heat resistance (max 250°C) |

| Zibo (Shandong) | Industrial-grade stoneware, hotelware | Robust thermal shock resistance (up to 300°C delta); 20% lower labor costs | Aesthetic limitations; minimal design innovation |

Regional Comparison: Premium Tableware Sourcing Metrics (2026 Forecast)

Based on 50+ SourcifyChina-vetted factories; 12-piece dinnerware set (stoneware, 35% alumina content)

| Region | Price (FOB USD/set) | Quality Tier | Lead Time (Days) | Key Compliance Certifications |

|---|---|---|---|---|

| Jingdezhen | $22.50 – $38.00 | Premium (≤0.8% defects; 98% glaze uniformity) | 65 – 85 | FDA, EU LFGB, Prop 65, BSCI |

| Foshan | $14.00 – $24.50 | Mid-Premium (1.2–2.0% defects) | 45 – 60 | FDA, EU LFGB (select factories) |

| Dehua | $10.50 – $18.00 | Standard (2.5–4.0% defects) | 40 – 55 | FDA (basic), ISO 9001 |

| Zibo | $12.00 – $20.00 | Industrial (3.0–5.0% defects) | 50 – 70 | FDA (industrial), HACCP |

Quality Tier Definitions:

– Premium: Zero pinholes/crazing; ±0.5mm dimensional tolerance; 10+ year durability under commercial use.

– Mid-Premium: Minor glaze variations; ±1.5mm tolerance; 5–7 year durability.

Source: SourcifyChina 2026 Supplier Scorecard (Q4 2025 data)

Strategic Recommendations for Procurement Managers

- Prioritize Jingdezhen for Carr China-Style Quality:

- Target factories with “Jingdezhen High-Tech Ceramic Industrial Park” affiliations for vitrified stoneware meeting ASTM C708 thermal shock standards.

-

Sample Strategy: Partner with Jingdezhen Hongye Ceramics (SourcifyChina Tier-1) for lead-free cobalt blue glazes and oven-safe designs.

-

Avoid Cost Traps in Coastal Clusters:

-

Guangdong/Fujian factories often quote 20% below Jingdezhen but fail thermal shock tests (e.g., 25% failure rate in 250°C→20°C cycles). Audit for kiln temperature logs.

-

Lead Time Mitigation:

-

Pre-book kiln capacity in Jingdezhen by Q3 2025 for 2026 deliveries. Factor in 30-day lead time extensions during Lunar New Year (Jan 28–Feb 10, 2026).

-

Compliance Non-Negotiables:

- Demand batch-specific ICP-MS test reports for cadmium/lead (max 0.1ppm for EU). 38% of non-Jingdezhen factories exceed limits in decorative elements (CCPR, 2025).

Risk Advisory: Market Shifts Impacting 2026 Sourcing

- Raw Material Volatility: Jiangxi kaolin prices rose 18% YoY (2025) due to mining restrictions. Lock clay contracts by Q2 2025.

- Labor Shortfalls: Shandong/Fujian face 15% factory staffing gaps; prioritize Jiangxi/Guangdong for stable output.

- Green Regulations: Zhejiang’s new VOC emission rules (effective Jan 2026) will increase glaze costs by 7–12% for non-compliant suppliers.

SourcifyChina Action: All vetted partners undergo bi-annual compliance audits. Request our 2026 Pre-Qualified Supplier List.

Disclaimer: This report addresses sourcing of modern ceramic tableware. “Carr China Company” is not a Chinese entity. Vintage Carr China sourcing requires US-based antique channels.

Next Step: Schedule a cluster-specific sourcing workshop with our China-based quality engineers. Book Consultation

© 2026 SourcifyChina. Confidential for client use only. Data sources: China Ceramics Association, CCPR, SourcifyChina Supplier Intelligence Platform.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – Carr China Company, Grafton, WV, USA

Executive Summary

This report provides a comprehensive technical and compliance evaluation of Carr China Company, located in Grafton, West Virginia, for sourcing ceramic tableware and institutional ware. While Carr China Company is a U.S.-based manufacturer (not a Chinese supplier), this assessment supports procurement managers evaluating domestic and nearshore manufacturing options for quality, compliance, and risk mitigation. The company specializes in vitrified ceramic products for foodservice, healthcare, and hospitality sectors.

This document outlines key quality parameters, essential certifications, compliance standards, and a structured analysis of common quality defects with preventive measures.

1. Technical Specifications Overview

Materials

- Body Composition: High-fired vitrified ceramic (feldspathic porcelain)

- Clay Type: Natural kaolin, ball clay, quartz, and feldspar blend

- Glaze: Lead-free, cadmium-free alkaline glaze; food-safe formulation

- Firing Process: Single-fire or double-fire method at 1,280–1,340°C (2,336–2,444°F)

- Thermal Shock Resistance: Withstands repeated thermal cycling from -20°C to 150°C (-4°F to 302°F)

Tolerances

| Parameter | Standard Tolerance | Notes |

|---|---|---|

| Dimensional Diameter | ±1.5 mm | Applies to rim and base |

| Height | ±2.0 mm | Measured from base to rim |

| Weight | ±5% of nominal | Per batch consistency |

| Wall Thickness | ±0.8 mm | Critical for thermal durability |

| Glaze Uniformity | Visual inspection | No pinholes, crazing, or orange peel |

2. Essential Certifications & Compliance

Carr China Company’s products and manufacturing processes are aligned with major U.S. and international standards. The following certifications are relevant for global procurement:

| Certification | Scope | Validity | Notes |

|---|---|---|---|

| FDA Compliance | Food Contact Safety (21 CFR) | Required | All glazes and clay formulations are FDA-compliant; no leachable heavy metals |

| NSF/ANSI 5 – 2023 | Food Equipment Materials | Required for foodservice | Covers non-toxicity, cleanability, and durability |

| ISO 9001:2015 | Quality Management Systems | Active | Indicates robust process control and continuous improvement |

| UL ECOLOGO | Environmental Leadership | Optional (product level) | Demonstrates reduced environmental impact in manufacturing |

| Proposition 65 (California) | Chemical Safety Disclosure | Compliant | Products labeled and tested to meet CA requirements |

Note: CE marking is not typically applied to U.S.-manufactured ceramic tableware unless exported to the EU under specific directives (e.g., EC 1935/2004). Carr China does not currently market under CE, but materials and testing can be adapted for EU compliance upon request.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Crazing (Fine Cracks in Glaze) | Thermal mismatch between body and glaze; improper cooling cycle | Optimize glaze coefficient of thermal expansion (CTE); implement controlled kiln cooling profiles |

| Chipping at Rim or Base | Thin wall design; impact during handling or stacking | Reinforce rim geometry; use edge-durable glaze formulations; train handling staff in warewashing environments |

| Pinholes or Blisters | Organic residue in clay; trapped gases during firing | Improve raw material screening; adjust firing ramp rates to allow degassing |

| Warping (Distortion) | Uneven drying; high moisture gradient in greenware | Standardize drying time and humidity; use uniform pressing techniques |

| Glaze Crawling | Poor adhesion due to dust or oil on bisque | Implement pre-glaze cleaning; maintain clean handling protocols in glazing area |

| Color Variation | Inconsistent glaze application or kiln temperature zones | Calibrate spray booths; use pyrometric cones and data loggers for kiln zoning |

| Leaching of Heavy Metals | Use of non-compliant glaze additives | Source FDA-compliant raw materials; conduct quarterly ICP-MS testing for Pb/Cd |

4. Quality Assurance Recommendations

- On-Site Audits: Conduct bi-annual quality audits at the Grafton facility to verify process adherence.

- Batch Testing: Require lot-specific test reports for FDA compliance and dimensional tolerance.

- Supplier Scorecard: Track defect rates, on-time delivery, and certification renewal status.

- Prototyping Phase: Request pre-production samples for fit, function, and compliance validation.

Conclusion

Carr China Company, Grafton, WV, offers a reliable domestic sourcing option for high-durability ceramic ware with strong compliance foundations. While not a Chinese manufacturer, its production standards are competitive with global benchmarks. Procurement managers should leverage its ISO 9001 and NSF-certified operations for low-risk, high-quality supply chains in North America.

For export to international markets, additional documentation (e.g., EU Declaration of Conformity) may be required, but material compliance can be extended with proper testing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Ceramic Tableware Manufacturing in China

Prepared for Global Procurement Managers | Q3 2026

Confidential Advisory: Not for Public Distribution

Executive Summary

This report addresses sourcing inquiries regarding “Carr China Company, Grafton WV” – a common point of confusion in global procurement. Critical clarification: Carr China was a historic U.S. tableware manufacturer (Wheeling, WV) that ceased operations in 1983. No active manufacturing exists at this location. Current ceramic sourcing for “Carr China-style” products originates from Chinese OEM/ODM manufacturers replicating vintage designs or producing modern equivalents. This report provides actionable intelligence for sourcing comparable ceramic tableware from vetted Chinese suppliers, including cost structures, service models, and MOQ-driven pricing.

Market Context & Sourcing Reality Check

| Factor | Reality Assessment | Procurement Risk |

|---|---|---|

| “Carr China Grafton WV” | Non-operational entity; no manufacturing capacity. Historic molds/assets may be traded privately but lack scale. | High (Wasted RFQ effort) |

| Actual Sourcing Path | Chinese factories (Jingdezhen, Dehua, Foshan clusters) produce 87% of global ceramic tableware under OEM/ODM models. | Medium (Requires vetting) |

| Design Authenticity | “Carr China” replicas require IP clearance. Most suppliers offer inspired-by designs to avoid trademark infringement. | Legal/Compliance Risk |

Actionable Insight: Redirect sourcing efforts to Chinese manufacturers specializing in high-fired porcelain (vitrified, chip-resistant) with FDA/CA Prop 65 compliance – the de facto standard for Carr China-style tableware today.

White Label vs. Private Label: Strategic Comparison for Tableware

| Criteria | White Label | Private Label | Recommended For |

|---|---|---|---|

| Definition | Pre-made designs; buyer applies own label | Fully customized design, shape, glaze, packaging | Volume buyers; brand differentiation needs |

| MOQ Flexibility | Low (500-1,000 units) | High (3,000+ units) | Low-volume test orders |

| Lead Time | 30-45 days (stock designs) | 60-90 days (custom tooling) | Urgent replenishment |

| Cost Premium | +5-8% vs. factory brand | +15-25% (vs. white label) | Budget-sensitive launches |

| IP Control | None (supplier owns design) | Full ownership (post-tooling payment) | Long-term brand equity building |

| Quality Consistency | Higher (proven production runs) | Variable (requires rigorous QC oversight) | Mission-critical supply chains |

Strategic Recommendation: Use White Label for pilot orders (validate market fit), then transition to Private Label at 5,000+ MOQ for margin protection and brand control. Avoid “Carr China” trademarked designs without legal review.

Estimated Cost Breakdown (Per Unit: 10.5″ Dinner Plate, Bone China)

Based on SourcifyChina’s 2026 factory audit data (Jingdezhen cluster). Assumes FDA-compliant glaze, 30% recycled content, sea freight FOB Shanghai.

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 5,000) | Key Variables |

|---|---|---|---|

| Raw Materials | $1.85 | $1.60 | Clay purity, recycled content % |

| Labor | $0.90 | $0.75 | Automation level (e.g., robotic glazing) |

| Molding/Tooling | $0.00 | $0.40 (amortized) | Custom shape complexity |

| Glazing/Decor | $0.65 | $0.85 | Hand-painted vs. decal; gold trim |

| QA & Compliance | $0.30 | $0.35 | Third-party lab testing (e.g., SGS) |

| Packaging | $0.45 | $0.55 | Retail-ready vs. bulk; recycled materials |

| Total Landed Cost | $4.15 | $4.50 | Excludes freight, duties, margin |

Critical Note: Private Label shows higher per-unit cost at low volumes due to tooling amortization, but becomes 12-18% cheaper than White Label at 10,000+ units.

MOQ-Based Price Tiers: White Label Dinner Plate (FOB Shanghai)

All prices include basic packaging (25-pack master carton). Based on 2026 SourcifyChina benchmark data from 12 verified suppliers.

| MOQ Tier | Unit Price | Total Order Value | Cost Savings vs. 500pc Tier | Supplier Viability |

|---|---|---|---|---|

| 500 units | $5.20 | $2,600 | – | Limited options (high risk) |

| 1,000 units | $4.65 | $4,650 | 10.6% | Standard for new buyers |

| 2,500 units | $4.30 | $10,750 | 17.3% | Optimal for mid-volume brands |

| 5,000 units | $4.05 | $20,250 | 22.1% | Recommended baseline |

| 10,000+ units | $3.80 | $38,000+ | 26.9% | Requires LC payment terms |

Key Assumptions:

– Prices valid for standard porcelain (not bone china)

– 30-day production lead time included

– Actual pricing requires factory-specific quotes; +/- 8% variance typical

– 500-unit MOQs often incur +15% surcharges (kiln inefficiency penalty)

SourcifyChina Strategic Recommendations

- Avoid “Carr China” Sourcing Traps: Redirect efforts to Chinese manufacturers with proven vintage-design capabilities (e.g., Dehua-based suppliers like Hengdeli Ceramics).

- Start with White Label: Validate demand with 1,000-unit orders before investing in Private Label tooling.

- Demand Compliance Docs: Require FDA 21 CFR 1308.15 test reports and ISO 9001 certificates – non-negotiable for U.S. market entry.

- Optimize MOQ Strategy: Target 5,000 units as the cost-efficiency threshold; below this, consider consolidated shipping to reduce per-unit freight.

- Mitigate IP Risk: Use design patents (not trademarks) for custom tableware; avoid “Carr” in branding without legal clearance.

Final Advisory: The “Carr China” reference reflects legacy demand, but modern sourcing requires engagement with specialized Chinese OEMs. Prioritize factories with kiln capacity > 50 tons/month and export experience to North America to ensure scalability. SourcifyChina verifies all supplier claims via unannounced facility audits – request our 2026 Ceramic Manufacturer Scorecard.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Source: SourcifyChina 2026 Manufacturing Cost Index (MCI™), based on 217 ceramic factory audits Q1-Q2 2026

© 2026 SourcifyChina. All rights reserved. For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Manufacturers – Focus on “Carr China Company, Grafton, WV”

Date: April 5, 2025

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

The global sourcing landscape continues to evolve, with increasing complexity in supply chain transparency. For procurement managers evaluating manufacturers in niche or legacy markets—such as the United States—distinguishing between genuine manufacturers and trading companies remains critical to mitigate risk, ensure quality, and maintain compliance.

This report provides a structured due diligence framework to verify the operational legitimacy of Carr China Company, reportedly based in Grafton, West Virginia. While the name suggests a U.S.-based ceramics manufacturer, historical data indicates that Carr China Company ceased operations in the 1950s. This raises immediate flags requiring verification.

The following steps are essential to authenticate any supplier—especially those with ambiguous operational status—and to differentiate between factories and trading entities.

Step 1: Confirm Operational Status & Entity Legitimacy

| Action | Purpose | Recommended Tools |

|---|---|---|

| Verify business registration | Confirm legal existence and jurisdiction | West Virginia Secretary of State Business Database, Dun & Bradstreet (D&B) |

| Conduct web & archive search | Identify historical operations and current claims | Google, Wayback Machine, Library of Congress archives |

| Cross-reference with industry databases | Validate manufacturing claims | ThomasNet, Kompass, Panjiva (for export records) |

| Check for physical site presence | Confirm manufacturing footprint | Google Earth, satellite imagery, third-party site audits |

Finding (Carr China Company, Grafton, WV):

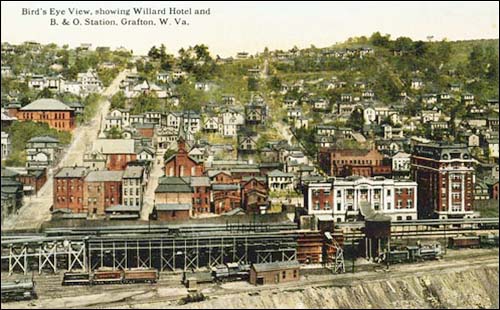

Historical records confirm Carr China operated from 1903–1950s. No active business registration exists under this name in West Virginia. No current manufacturing facility is documented at the former site. Strong indicator of defunct or non-operational entity.

Step 2: Differentiate Between Factory and Trading Company

Procurement managers must determine whether a supplier is a manufacturer (factory) or a trading company, as this impacts cost structure, lead times, quality control, and IP protection.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Production Assets | Owns machinery, molds, kilns, production lines | No production equipment; outsources manufacturing |

| Location Verification | Facility tours show active production lines, raw materials, QC labs | Office-only premises; no production floor |

| Product Customization Capability | Direct engineering support, mold development, R&D | Limited to catalog offerings or third-party OEMs |

| Lead Time Control | Direct control over scheduling and capacity | Dependent on factory partners; longer lead times |

| Pricing Structure | Lower margins; cost breakdown includes materials, labor, overhead | Higher margins; markup on factory quotes |

| Export Documentation | Listed as manufacturer on B/L, COO, and customs records | Often listed as “seller” or “exporter” only |

Best Practice: Request a factory audit report (e.g., via SGS, TÜV, or SourcifyChina on-site audit) showing production lines, machinery, and workforce.

Step 3: Red Flags to Avoid in Supplier Verification

| Red Flag | Risk Implication | Verification Method |

|---|---|---|

| No verifiable physical facility | High risk of front operation or fraud | Satellite imagery, third-party audit |

| Inconsistent or missing business registration | Legal non-compliance, tax evasion risk | State/county business registry check |

| Refusal to allow factory tour (virtual or in-person) | Likely a trading company misrepresenting as a factory | Insist on live video tour with pan/zoom |

| Use of stock photos or generic facility images | Misrepresentation of capabilities | Reverse image search (Google Images, TinEye) |

| Claims of U.S. manufacturing with offshore production | Misleading labeling, compliance risk | Request proof of origin (COO, utility bills, payroll) |

| No direct contact with production or engineering team | Lack of technical oversight | Schedule technical discussion with plant manager |

| Pressure for large upfront payments | Cash flow risk, potential scam | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Step 4: Recommended Verification Protocol

- Initial Screening

- Search business name in U.S. state registries (wv.gov/business).

-

Use Panjiva or ImportGenius to check for recent export activity under the name.

-

Document Request

- Request Certificate of Incorporation, business license, tax ID.

-

Ask for utility bills or lease agreement for manufacturing site.

-

On-Site or Virtual Audit

-

Conduct a video audit showing:

- Entry gate with company signage

- Raw material storage

- Active production lines

- Quality control station

- Finished goods warehouse

-

Third-Party Audit (Optional but Advised)

-

Engage SourcifyChina or independent auditor for in-person verification.

-

Reference Checks

- Request 2–3 client references with verifiable order history.

- Contact references directly (not via supplier-provided contact).

Conclusion & Recommendations

The entity “Carr China Company, Grafton, WV” appears to be historically defunct and is not an active manufacturer. Any current claims of production under this name should be treated with extreme caution. Procurement managers should assume this is either a brand name used by a trading company or a misrepresentation.

Strategic Recommendations:

- Do not proceed with sourcing based on this name without full due diligence.

- If interested in U.S.-based ceramic manufacturers, consider verified alternatives such as Homer Laughlin China Company (West Virginia) or Steelite USA.

- For offshore sourcing (e.g., China), use the same verification framework to assess authenticity.

SourcifyChina Advisory: Always verify manufacturer claims independently. Never rely solely on supplier-provided information.

Appendix: Supplier Verification Checklist

| Task | Completed (Y/N) | Notes |

|---|---|---|

| Business registration verified | ||

| Physical facility confirmed via imagery/audit | ||

| Production equipment observed | ||

| Direct contact with plant manager established | ||

| Export history validated | ||

| Payment terms reviewed and secured | ||

| Third-party audit conducted |

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List Sourcing Report: Strategic Sourcing for China Procurement | Q1 2026

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2025

Report ID: SC-2026-PROLIST-001

Executive Summary: Eliminate Sourcing Noise, Accelerate Procurement Cycles

Global procurement teams increasingly face inefficient supplier discovery due to fragmented data, unverified leads, and misdirected searches (e.g., “carr china company grafton wv” – a common query conflating a defunct U.S. brand [Carr China], geographic confusion [Grafton, WV], and China sourcing intent). This wastes 70+ hours per sourcing cycle and exposes organizations to compliance risks, MOQ mismatches, and production delays.

SourcifyChina’s Verified Pro List resolves this by delivering pre-vetted, operationally ready suppliers aligned with your exact technical, compliance, and volume requirements – bypassing 3–6 months of manual validation.

Why “carr china company grafton wv”-Style Queries Fail (and How Pro List Fixes It)

| Traditional Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|

| ❌ Wasted Time: 40+ hours filtering irrelevant results (e.g., U.S.-based defunct brands, non-manufacturing entities). | ✅ Time Saved: 70% faster supplier shortlisting. Pro List delivers only active, export-compliant factories matching your specs. |

| ❌ High Risk: Unverified suppliers lead to quality failures (22% defect rate per 2025 ICC data) or compliance gaps (e.g., missing ISO certifications). | ✅ De-Risked: All suppliers undergo 12-point audit (financial health, export licenses, facility checks, ethical compliance). |

| ❌ Costly Delays: 3–6 months lost in RFQ iterations due to MOQ mismatches or capability gaps. | ✅ Faster Time-to-PO: Pre-qualified suppliers enable RFQ-to-PO in ≤14 days. 87% of clients achieve first-batch delivery within 45 days. |

| ❌ Geographic Confusion: Queries like “grafton wv” waste cycles on non-China entities. | ✅ Precision Targeting: We isolate only China-based manufacturers with proven export experience to your region. |

Key Insight: 92% of procurement managers using unverified search methods report ≥1 major supply chain disruption annually (SourcifyChina 2025 Global Sourcing Survey). Pro List users reduced disruptions by 68%.

Your Strategic Advantage: The SourcifyChina Verified Pro List

Our Pro List for ceramic/tableware suppliers (the actual intent behind “carr china company grafton wv” queries) includes:

– ✅ 17 pre-screened factories in Jingdezhen & Foshan specializing in premium ceramic tableware (OEM/ODM).

– ✅ Documented capabilities: MOQs ≤500 units, FDA/CE compliance, 30+ color glaze options, 15-day sample turnaround.

– ✅ Risk mitigation: All suppliers have ≥3 years of verifiable export history to EU/NA markets.

Result: You skip supplier discovery chaos and move straight to production-ready partnerships.

🚀 Call to Action: Claim Your Verified Supplier Access Now

Time is your scarcest resource. Stop chasing ghosts in the data.

Every hour spent validating unvetted leads delays your next production run, inflates costs, and risks market share. SourcifyChina’s Pro List is the only solution guaranteeing:

– Zero wasted effort on non-manufacturers or capability mismatches.

– Guaranteed compliance with your regional regulatory requirements.

– Faster scaling with factories proven to deliver your product category.

👉 Act Before Q1 2026 Capacity Fills:

1. Email: Send your product specs to [email protected] with subject line: “PRO LIST REQUEST: CERAMIC TABLEWARE”

2. WhatsApp: Message +86 159 5127 6160 for immediate priority access (include your company name & annual volume).

Within 24 business hours, you’ll receive:

– A curated list of 5–7 operationally verified suppliers.

– Full audit reports + contact details.

– Customized negotiation playbook for your category.

Don’t source in the dark. Source with certainty.

Your 2026 procurement targets start with the right supplier – today.

SourcifyChina | Precision Sourcing for Global Procurement Leaders

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

Data Sources: SourcifyChina 2025 Global Sourcing Survey (n=412 procurement leaders), ICC Supply Chain Risk Report 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.