The global carpet tape market is experiencing steady growth, driven by rising demand in construction, automotive, and home improvement sectors. According to Mordor Intelligence, the adhesive tapes market—which includes carpet tape—is projected to grow at a CAGR of over 4.5% from 2023 to 2028, fueled by increased infrastructure development and consumer preference for DIY installation solutions. Carpet tape, in particular, has gained traction due to its versatility in temporary flooring applications, event setups, and safety compliance in commercial spaces. As demand escalates, manufacturers are advancing product formulations for stronger adhesion, residue-free removal, and eco-friendly materials. In this competitive landscape, nine key players have emerged as leaders, combining innovation, global reach, and high-performance products to capture significant market share.

Top 9 Carpet Tape Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Carpet Tape

Domain Est. 2019

#2 BT

Domain Est. 1997

Website: brontapes.com

Key Highlights: 10-day returnsBT-437 is a premium clean removal double sided carpet tape. Featuring an aggressive natural rubber adhesive, BT-437 provides strong and secure adhesion….

#3 Carpet Tape

Domain Est. 1997

#4 Carpet Tape

Domain Est. 1998

#5 Carpet Tape

Domain Est. 2001

Website: interfloor.com

Key Highlights: Carpet Tape. A highly aggressive double-sided tape, hot melt coated with a paper carrier, for use with carpets other than vinyl backed….

#6 Scotch™ Brand Tapes

Domain Est. 2003

Website: scotchbrand.com

Key Highlights: Scotch™ Anti-Slip Rug Tape SP920-NA, 2 in x 300 in. Scotch™ Anti-Slip Rug Tape · 3M Stock. 7100330367 ; Scotch® Tape Dispenser White, C18. Scotch® Desktop ……

#7 Tapes

Domain Est. 2003

Website: powerhold.com

Key Highlights: Tapes · 110 Professional Grade Carpet Seaming Tape (3 Inch – 9 Beads) · 150 Premium Carpet Seaming Tape (3 Inch – 9 Beads) · 250 Premium Carpet Seaming Tape (3 ……

#8 Double

Domain Est. 2011

Website: ppmindustries.com

Key Highlights: High-performance white double-sided OPP film tape primarily designed to fasten carpets, mats and other flooring materials in a swift way….

#9 Double sided duct tape carpet tape

Domain Est. 2016

Website: yousantape.com

Key Highlights: Double-sided duct tape is double-sided sticky and creates a strong bond between two surfaces. It is made of artificial fiber cloth as the base material….

Expert Sourcing Insights for Carpet Tape

H2 2026 Market Trends for Carpet Tape

As we move into the second half of 2026, the global carpet tape market is experiencing dynamic shifts driven by evolving consumer preferences, technological advancements, and sustainability imperatives. This analysis explores the key trends shaping the carpet tape industry during H2 2026 across various segments including residential, commercial, and industrial applications.

Sustainable and Eco-Friendly Materials Gain Momentum

A defining trend in H2 2026 is the accelerated shift toward environmentally responsible carpet tape solutions. Manufacturers are increasingly adopting biodegradable adhesives, recyclable backings, and low-VOC (volatile organic compound) formulations to meet stringent environmental regulations and heightened consumer awareness. Brands are labeling products with third-party certifications such as GREENGUARD, Cradle to Cradle, and ISO 14001 to appeal to eco-conscious buyers, particularly in North America and Europe.

Growth in DIY and Temporary Installation Solutions

The do-it-yourself (DIY) home improvement sector continues to expand, fueled by online tutorials and e-commerce accessibility. Carpet tape, as a temporary and damage-free flooring solution, has become a go-to product for renters and homeowners seeking easy installation and removal. In H2 2026, demand remains strong for double-sided tapes with repositionable features, especially in urban markets where short-term leases and movable interiors are prevalent.

Commercial and Retail Sector Adoption

Commercial real estate and retail environments are increasingly utilizing carpet tape for modular flooring systems, pop-up stores, and exhibition displays. The flexibility and cost-efficiency of taped-down carpets over permanent adhesives or tack strips make them ideal for high-turnover commercial spaces. Additionally, carpet tape supports quick renovations with minimal downtime—critical for businesses aiming to reduce operational disruption.

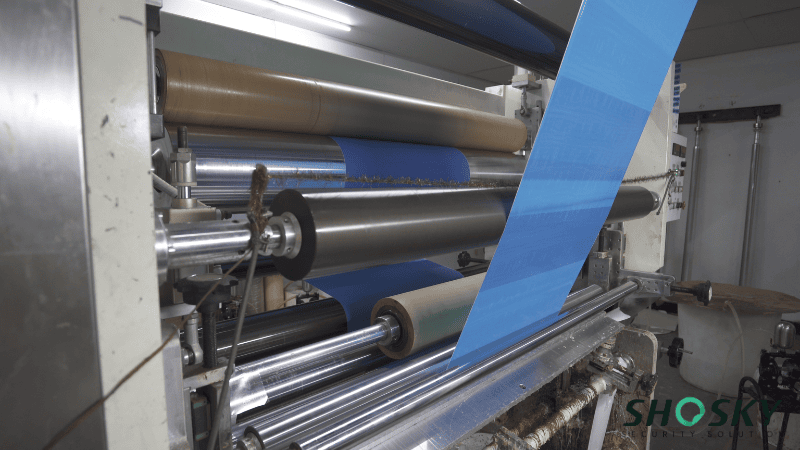

Technological Innovations in Adhesive Performance

Advancements in adhesive chemistry have led to carpet tapes with improved durability, temperature resistance, and bonding strength. In H2 2026, smart formulations that adjust to humidity levels or provide anti-slip properties are gaining traction. Some manufacturers are incorporating nanotechnology to enhance adhesion without residue, addressing longstanding concerns about damage upon removal.

Regional Market Dynamics

- North America: Steady growth driven by residential remodeling and green building standards. The U.S. dominates demand, supported by strong e-commerce platforms and home improvement retail chains.

- Europe: Regulatory pressure and sustainability goals are pushing manufacturers toward circular economy models. Carpet tape with recyclable components is seeing increased adoption, particularly in Germany and Scandinavia.

- Asia-Pacific: Rapid urbanization and expanding construction sectors in countries like India and Vietnam are fueling demand. However, price sensitivity remains a challenge, favoring mid-tier and budget-friendly products.

- Middle East & Africa: Growth is emerging in commercial construction and hospitality sectors, with demand for premium, durable tapes on the rise.

E-Commerce and Direct-to-Consumer Channels

Online retail continues to be a major distribution channel for carpet tape in H2 2026. Platforms like Amazon, Home Depot, and Alibaba offer extensive product ranges, customer reviews, and fast delivery. Brands are investing in digital marketing, augmented reality (AR) tools for product visualization, and subscription models for bulk buyers such as property managers and event planners.

Challenges and Outlook

Despite positive momentum, the market faces challenges including raw material price volatility (especially for acrylic adhesives and synthetic polymers) and competition from alternative flooring methods like interlocking tiles. However, innovation and alignment with sustainability goals position carpet tape for continued growth.

In conclusion, H2 2026 marks a transformative phase for the carpet tape market, characterized by eco-conscious innovation, digital engagement, and expanding applications. Companies that prioritize sustainability, performance, and customer-centric solutions are best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Carpet Tape: Quality and Intellectual Property Risks

Sourcing carpet tape—especially from international or low-cost suppliers—can expose buyers to several critical pitfalls related to product quality and intellectual property (IP) protection. Being aware of these risks can help prevent costly mistakes, project delays, and legal complications.

Inconsistent or Substandard Quality

One of the most frequent issues in carpet tape sourcing is receiving products that fail to meet expected performance standards. This includes tapes with weak adhesive strength, poor durability under foot traffic, or backing materials that degrade quickly. Variability in raw materials and manufacturing processes—especially with unqualified suppliers—can result in batch-to-batch inconsistencies, leading to installation failures or customer dissatisfaction.

Misrepresentation of Technical Specifications

Suppliers may exaggerate or falsify technical claims, such as bond strength, temperature resistance, or suitability for specific flooring types (e.g., hardwood, tile, or carpet). Without independent testing or verified certifications, buyers risk purchasing tapes that underperform in real-world applications, potentially leading to safety hazards like tripping or detachment.

Lack of Compliance with Safety and Environmental Standards

Carpet tapes must often comply with regional regulations such as REACH (EU), RoHS, or California Proposition 65, particularly regarding volatile organic compounds (VOCs) and phthalates. Sourcing from suppliers who do not adhere to these standards can result in shipment rejections, fines, or reputational damage, especially in commercial or public installations.

Intellectual Property Infringement

Sourcing generic or unbranded carpet tape doesn’t eliminate IP risks. Some manufacturers may replicate patented designs, adhesive formulations, or tape structures from well-known brands without authorization. Purchasing such products—knowingly or unknowingly—can expose the buyer to legal liability, especially if the goods are imported into markets with strict IP enforcement.

Counterfeit or Gray Market Products

Suppliers may offer branded carpet tapes at suspiciously low prices, which could indicate counterfeit or gray market goods. These products not only risk poor quality but also violate trademark laws. Buyers may face customs seizures, legal action from brand owners, or damage to their business reputation.

Inadequate Supplier Vetting and Traceability

Failing to conduct due diligence on suppliers increases the risk of partnering with manufacturers who lack proper quality control systems or ethical practices. Without transparency in the supply chain, it becomes difficult to trace materials or verify claims about sustainability, labor practices, or IP compliance.

Conclusion

To mitigate these pitfalls, buyers should conduct thorough supplier audits, request product samples and test reports, verify compliance certifications, and include IP indemnity clauses in sourcing agreements. Engaging third-party inspection services and legal counsel can further safeguard against quality and intellectual property risks when sourcing carpet tape.

Logistics & Compliance Guide for Carpet Tape

Product Classification & Regulatory Overview

Carpet tape, often used for securing rugs and mats, falls under adhesive products and may be classified differently depending on composition and intended use. Typically, it is categorized under adhesives (HS Code 3506) for customs purposes. Ensure correct classification based on regional trade regulations (e.g., HTS codes in the U.S., TARIC in the EU) to avoid delays or penalties.

Hazardous Materials & Safety Data Sheets (SDS)

Most carpet tapes are non-hazardous; however, solvent-based or flammable adhesive variants may be regulated under hazardous materials guidelines (e.g., DOT in the U.S., ADR in Europe). Always obtain and verify the Safety Data Sheet (SDS) from the manufacturer. If the product contains volatile organic compounds (VOCs) or flammable components, proper labeling, packaging, and transport documentation are required.

Packaging & Labeling Requirements

Carpet tape must be packaged securely to prevent damage during transit. Labels should include:

– Product name and description

– Net weight and dimensions

– Manufacturer or supplier information

– Batch or lot number

– Compliance marks (e.g., CE, UKCA, RoHS if applicable)

– Barcodes or SKUs for inventory tracking

Ensure labels are durable and legible throughout the supply chain.

Transportation & Shipping

Standard carpet tape can typically be shipped via general freight (air, ground, or sea). However:

– Air Freight: Comply with IATA regulations; non-hazardous tapes are generally permitted, but verify SDS classification.

– Ocean Freight: Follow IMDG Code if classified as hazardous. Use moisture-resistant packaging for container shipments.

– Ground Transport: Adhere to local regulations (e.g., FMCSA in the U.S.). Stackable packaging should support weight to prevent crushing.

Import/Export Compliance

- Documentation: Commercial invoice, packing list, bill of lading/air waybill, and certificate of origin may be required.

- Customs Clearance: Accurate HS codes and declared values are essential. Be aware of anti-dumping or countervailing duties in certain regions.

- Import Restrictions: Some countries may regulate adhesives due to chemical content. Verify compliance with local environmental and health standards (e.g., REACH in the EU, TSCA in the U.S.).

Environmental & Sustainability Regulations

Carpet tapes containing restricted substances (e.g., phthalates, heavy metals) may be subject to environmental regulations. Ensure compliance with:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals.

– RoHS (EU): Restriction of Hazardous Substances in electrical and electronic equipment (if applicable).

– Proposition 65 (California, U.S.): Requires warning labels if containing listed carcinogens or reproductive toxins.

Storage & Handling

Store carpet tape in a cool, dry place away from direct sunlight and extreme temperatures to prevent adhesive degradation. Use first-in, first-out (FIFO) inventory management. Protect rolls from dust and physical damage.

End-of-Life & Disposal

Non-hazardous carpet tape can typically be disposed of as regular waste, but check local waste regulations. For tapes with plastic backings or chemical adhesives, consider recyclability or special disposal procedures to meet environmental compliance standards.

Audit & Recordkeeping

Maintain records of SDS, shipping documents, compliance certifications, and import/export filings for a minimum of 5–7 years, depending on jurisdiction. Regular internal audits help ensure ongoing compliance with evolving regulations.

By following this guide, businesses can ensure smooth logistics operations and maintain compliance when distributing carpet tape globally.

In conclusion, sourcing carpet tape requires careful consideration of quality, durability, adhesive strength, and compatibility with different flooring types. It is essential to evaluate suppliers based on reliability, cost-effectiveness, and compliance with safety and environmental standards. Whether for residential, commercial, or industrial use, selecting the right carpet tape ensures safety, prevents shifting, and enhances overall flooring performance. By conducting thorough market research, comparing product specifications, and considering long-term value over initial cost, organizations can make informed procurement decisions that balance performance, safety, and budgetary goals. Establishing strong supplier relationships and implementing consistent quality checks will further support successful sourcing outcomes.