The global cardan shaft market is witnessing steady expansion, driven by increasing demand from automotive, aerospace, and industrial machinery sectors. According to a 2023 report by Mordor Intelligence, the global driveshaft market—of which cardan shafts are a critical component—was valued at USD 5.8 billion in 2022 and is projected to grow at a CAGR of 4.7% through 2028. This growth is fueled by rising vehicle production, particularly in emerging economies, and the need for more efficient power transmission systems in commercial and specialty vehicles. Additionally, Grand View Research highlights the expanding application of cardan shafts in renewable energy systems, such as wind turbines, further accelerating market demand. With technological advancements and increased customization capabilities, leading manufacturers are investing heavily in R&D and global supply chain expansion. As competition intensifies, identifying the top players becomes crucial for OEMs and industrial buyers seeking reliable, high-performance driveline solutions. Here, we present the top 9 cardan shaft manufacturers shaping the industry through innovation, global reach, and robust production capabilities.

Top 9 Cardan Shafts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Cardan Shaft

Domain Est. 2010

Website: cardanshaftsindia.com

Key Highlights: We Cardan Shaft India is leading manufacturers/ exporter/ trader being an iso 9001:2015 Certified Company, Near Industrial Focol Point, Mandi Gobindgarh, ……

#2 Uni

Domain Est. 1998

Website: uni-cardan.com

Key Highlights: Uni-Cardan® is your ideal OEM supplier for construction, repair and maintenance of drive shafts. Our wide product range includes standard sizes as well as heavy ……

#3 Welte Group

Domain Est. 2005

Website: welte-group.com

Key Highlights: We are the leading company in the cardan shaft, fluid and tube bending technology industries with several locations in Germany and Europe….

#4 Cardan Shaft Manufacturers,Propeller Shaft,Tie Rod Ends,Axle …

Domain Est. 2017

Website: cardanshaftmanufacturers.com

Key Highlights: We offer a comprehensive range of premium quality spare parts. Our manufactures & exports include: 1. Propeller shaft 2. Tie Rod Ends 3. Axle shafts 4. ……

#5 WUXI WEICHENG CARDANSHAFT CO., LTD

Domain Est. 2017 | Founded: 2005

Website: cardanchina.com

Key Highlights: WUXI WEICHENG CARDANSHAFT CO.,LTD was established in 2005, it integrates the development and production in the field of cardan shafts….

#6 Manufacturer of Cardan Shaft & Universal Joint Cross by Cardan …

Website: cardanshaftsindustries.com

Key Highlights: Established in year 2019, Cardan Shafts Industries is one of the leading Manufacturer and Wholesalers of Propeller Shafts, Flange Adaptor, Universal Joint Cross ……

#7 about

Website: cardan.md

Key Highlights: CardanService LLC is the official distributor in Moldova of the biggest producer of cardan shafts, WELTE-WENU GmbH company, Germany…

#8 Other cardan shafts

Domain Est. 1998

Website: cardan-service.com

Key Highlights: Other cardan shafts · Light vehicle/utility transmission · Constant Velocity Drive Shaft · Forklift transmission · Agricultural cardan shaft · Steer Axle Joint….

#9 Cardan Driveshafts

Domain Est. 2000

Website: rowlandcompany.com

Key Highlights: Gewes cardan shafts are high quality, low maintenance, and reliable. They transmit torque while allowing for misalignment between driving and driven shafts….

Expert Sourcing Insights for Cardan Shafts

2026 Market Trends for Cardan Shafts: Key Developments and Outlook

As the global industrial and automotive sectors evolve, the cardan shaft (also known as a driveshaft or propeller shaft) market is poised for transformation by 2026. Driven by technological advancements, sustainability mandates, and shifting industry demands, several key trends are expected to shape the landscape of this essential mechanical component.

1. Electrification Driving Redesign and Niche Specialization

The rapid adoption of electric vehicles (EVs) is reshaping drivetrain requirements. While traditional internal combustion engine (ICE) vehicles rely heavily on cardan shafts, EVs often use direct-drive systems that reduce or eliminate the need for long driveshafts. However, this trend is not leading to obsolescence—instead, it’s driving innovation. By 2026, cardan shaft manufacturers are expected to focus on high-performance EVs (especially electric trucks, off-road, and luxury SUVs) that require robust torque transmission between axles. Lightweight, high-strength composite and aluminum shafts will be in demand to offset battery weight and improve efficiency.

2. Lightweight Materials and Advanced Composites

To meet fuel efficiency standards and reduce emissions—even in hybrid and commercial segments—there is a growing shift toward lighter drivetrain components. By 2026, the use of carbon fiber-reinforced polymer (CFRP) and high-grade aluminum alloys in cardan shafts is projected to expand significantly. These materials offer superior strength-to-weight ratios, reduce rotational inertia, and enhance vehicle dynamics, particularly in aerospace, premium automotive, and heavy-duty off-highway applications.

3. Growth in Off-Highway and Industrial Applications

While automotive OEM demand may plateau due to electrification, the off-highway sector—including agriculture, mining, construction, and wind energy—will remain a strong growth driver. These applications require durable, high-torque transmission systems capable of operating under extreme conditions. By 2026, increased investments in infrastructure and renewable energy (e.g., wind turbines using cardan shafts in yaw and pitch systems) will boost demand for customized, heavy-duty driveshaft solutions.

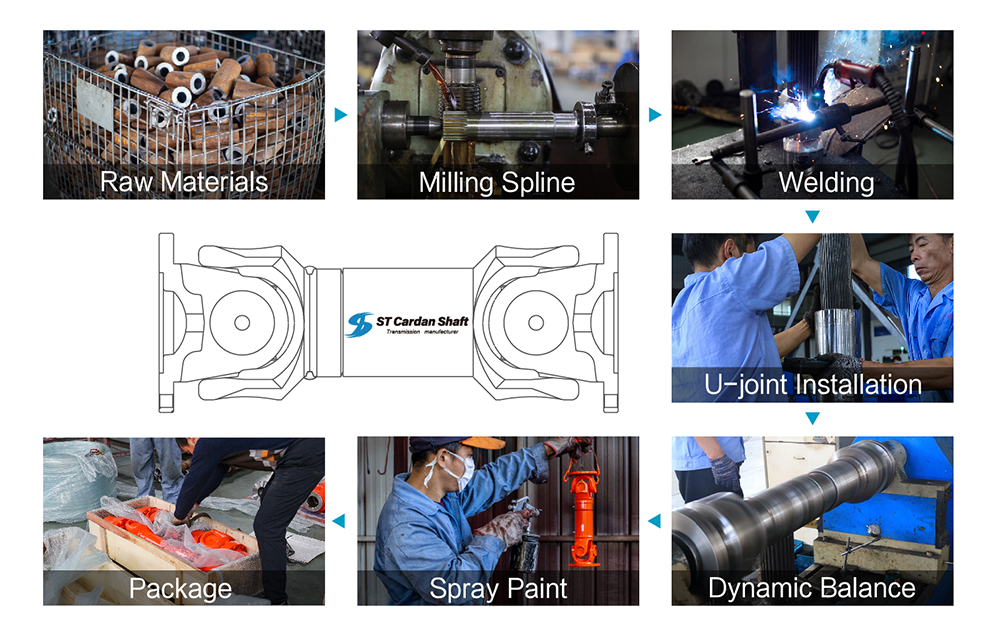

4. Advancements in Manufacturing and Smart Integration

Precision manufacturing techniques such as automated welding, laser alignment, and real-time balancing will become standard by 2026, improving reliability and reducing failure rates. Additionally, integration of sensors into cardan shafts for condition monitoring (e.g., vibration, temperature, torque load) is expected to grow. This “smart shaft” trend supports predictive maintenance in industrial and fleet operations, enhancing uptime and reducing lifecycle costs.

5. Regional Shifts and Supply Chain Localization

Asia-Pacific, particularly China and India, will continue to dominate both production and consumption due to expanding automotive and industrial sectors. However, geopolitical factors and supply chain resilience concerns will push manufacturers toward regionalization. By 2026, nearshoring and localized production hubs in North America and Europe will increase, especially to support EV and commercial vehicle OEMs with faster delivery and reduced logistics costs.

6. Sustainability and Circular Economy Considerations

Environmental regulations will influence material sourcing and end-of-life management. By 2026, recyclability of materials and energy-efficient manufacturing processes will become key competitive differentiators. Rebuilt and remanufactured cardan shafts are also expected to gain market share, particularly in aftermarkets, as businesses and consumers prioritize cost-effective and sustainable solutions.

In conclusion, while traditional automotive applications may face headwinds from electrification, the cardan shaft market in 2026 will be defined by innovation, diversification, and adaptation. Manufacturers that invest in lightweighting, smart technologies, and specialized industrial solutions will be well-positioned to capitalize on emerging opportunities across global markets.

Common Pitfalls When Sourcing Cardan Shafts: Quality and Intellectual Property Risks

Sourcing Cardan (or drives) shafts—critical components in power transmission systems—can present significant challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to operational failures, safety hazards, and legal complications. Below are key pitfalls to avoid.

Inadequate Quality Control and Material Standards

One of the most frequent issues in sourcing Cardan shafts is compromising on material quality and manufacturing precision. Low-cost suppliers may use substandard steel, improper heat treatments, or imprecise balancing techniques. This results in premature wear, vibration, misalignment, and potential catastrophic failure under load. Buyers must verify supplier certifications (e.g., ISO 9001), demand material test reports, and insist on dynamic balancing certifications to ensure longevity and performance.

Lack of Traceability and Documentation

Reputable suppliers provide full traceability, including heat numbers, inspection records, and compliance documentation. Sourcing from vendors who cannot supply such documentation increases the risk of receiving counterfeit or non-compliant parts. Without traceability, diagnosing field failures becomes difficult, and warranty claims may be denied.

Counterfeit or Reverse-Engineered Components

A major IP-related pitfall is inadvertently sourcing counterfeit or reverse-engineered Cardan shafts that infringe on patented designs or trademarks. Some suppliers replicate OEM (Original Equipment Manufacturer) designs without licensing, selling them as compatible replacements. While these may appear identical, they often lack rigorous testing and can violate intellectual property rights, exposing the buyer to legal liability and warranty voids.

Insufficient Testing and Validation

Many suppliers, especially in unregulated markets, do not perform comprehensive performance testing—such as torsional strength, fatigue resistance, or high-speed balance checks. Relying on visual inspection or basic dimensional checks is insufficient. Buyers should require third-party test reports or conduct in-house validation to confirm that shafts meet application-specific torque, RPM, and environmental requirements.

Misrepresentation of OEM Compatibility

Suppliers may falsely claim their Cardan shafts are “OEM equivalent” or “direct replacements” without proper engineering validation. This can lead to fitment issues, misalignment, and damage to connected components (e.g., gearboxes, differentials). Always verify compatibility through technical drawings and, if possible, physical sample testing before bulk procurement.

Ignoring IP Licensing and Legal Compliance

When sourcing aftermarket or replacement shafts, ensure the supplier has appropriate licensing for any patented technology (e.g., specialized joint designs, damping systems, or coupling mechanisms). Purchasing IP-infringing components can lead to cease-and-desist orders, product recalls, or legal action—particularly in regulated industries like automotive, aerospace, or rail.

Overlooking Geopolitical and Supply Chain Risks

Sourcing from regions with weak IP enforcement increases exposure to counterfeit goods and quality inconsistencies. Additionally, geopolitical tensions or export restrictions may disrupt supply. Diversifying suppliers and conducting on-site audits can mitigate these risks.

Conclusion

To avoid these pitfalls, establish rigorous supplier qualification processes, prioritize transparency and traceability, and consult legal experts when sourcing shafts with proprietary designs. Investing time upfront in vetting suppliers ensures reliable performance, compliance, and protection against IP-related liabilities.

Logistics & Compliance Guide for Cardan Shafts

This guide outlines the essential logistical considerations and compliance requirements for the safe and legal transportation, handling, and use of Cardan shafts (also known as drive shafts or propeller shafts).

Packaging and Handling

Cardan shafts must be packaged securely to prevent damage during transit. Use protective materials such as foam, wooden crating, or custom-fit containers to shield universal joints, splines, and balancing weights. Always handle shafts with care—avoid dropping or dragging, which can compromise alignment and balance. Use appropriate lifting equipment and slings to prevent bending or deformation.

Transportation Requirements

When shipping Cardan shafts, comply with carrier-specific regulations and international transport standards (e.g., IATA for air freight, IMDG for sea). Clearly label packages with handling instructions such as “Fragile,” “This Side Up,” and “Do Not Stack.” For oversized or heavy shafts, ensure proper load securing on pallets or in containers to prevent shifting. Maintain documentation including packing lists, shipping manifests, and weight distribution reports.

Import and Export Compliance

Verify all relevant customs regulations for the origin and destination countries. Provide accurate Harmonized System (HS) codes—typically under 8708.29 (components for propulsion units of motor vehicles) or 8483.60 (transmission shafts). Submit required documentation such as commercial invoices, certificates of origin, and export licenses where applicable. Ensure compliance with trade restrictions or embargoes.

Safety and Quality Standards

Cardan shafts must meet applicable safety and performance standards, such as ISO 5467 (road vehicles – Cardan shafts) or DIN 72000. Manufacturers should provide certification of conformance (CoC) and test reports for dynamic balance, torsional strength, and fatigue resistance. Use only shafts that comply with regional safety directives (e.g., ECE R79 in Europe for vehicle stability).

Environmental and Material Compliance

Ensure materials used in Cardan shafts (e.g., steel alloys, greases) comply with environmental regulations such as REACH (EU) and RoHS. Declare any restricted substances and provide Material Safety Data Sheets (MSDS) for lubricants. Follow proper disposal procedures for damaged or end-of-life shafts in accordance with local waste management laws.

Documentation and Traceability

Maintain full traceability for each Cardan shaft, including batch numbers, manufacturing dates, and test records. Provide end-users with installation, maintenance, and safety instructions. Retain compliance documentation for a minimum of 10 years to support audits and product liability inquiries.

Special Considerations for Aftermarket and Replacement Parts

Aftermarket Cardan shafts must meet or exceed OEM specifications. Clearly label replacements with compatibility information (vehicle make, model, engine type). Distributors and installers must verify fitment and ensure proper balancing during installation to avoid safety hazards.

Conclusion for Sourcing Cardan Shafts

In conclusion, sourcing cardan shafts requires a strategic approach that balances quality, reliability, cost-efficiency, and long-term performance. Cardan shafts (also known as drive shafts or universal joints) play a critical role in power transmission across various industries—including automotive, marine, agriculture, and industrial machinery—making the selection of the right supplier and product essential.

Key considerations such as material quality, precision engineering, torsional strength, and dynamic balancing must be evaluated to ensure optimal performance and durability. Additionally, choosing suppliers with certified manufacturing standards (such as ISO or DIN compliance), proven track records, and technical support capabilities enhances reliability and reduces downtime.

While cost is an important factor, prioritizing initial savings over quality can lead to increased maintenance, premature failure, and higher total cost of ownership. Therefore, a total value approach—factoring in lifespan, availability, technical compatibility, and after-sales service—is recommended.

Ultimately, successful sourcing of cardan shafts involves thorough market research, supplier vetting, and ongoing collaboration to ensure continuous supply chain efficiency and operational excellence. By focusing on these elements, organizations can secure high-performing cardan shafts that meet technical requirements and support long-term operational goals.