The global vending machine market is experiencing robust growth, driven by rising demand for cashless payment solutions and automated retail across urban centers. According to Mordor Intelligence, the global vending machines market was valued at USD 16.5 billion in 2023 and is projected to reach USD 23.8 billion by 2029, growing at a CAGR of 6.3% during the forecast period. A key segment within this expansion is card vending machines—devices increasingly deployed for distributing SIM cards, prepaid cards, gift cards, and government-issued smart cards in airports, retail hubs, and telecom outlets. With telecom operators and financial institutions shifting toward self-service distribution models, the demand for reliable, secure, and user-friendly card vending machines has surged. This growing ecosystem has given rise to specialized manufacturers offering advanced features such as IoT integration, real-time inventory tracking, and multi-language interfaces. Based on market presence, technological innovation, and global reach, the following are the top 10 card vending machine manufacturers shaping the future of automated card distribution.

Top 10 Card Vending Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

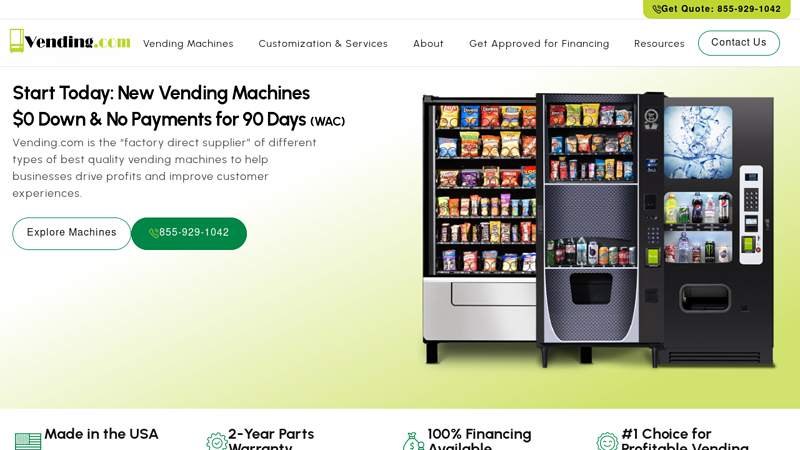

#1 Buy Vending Machines Online

Domain Est. 1994

Website: vending.com

Key Highlights: We offer a full line of new and factory “certified” re-manufactured combo, snack, cold drink, coffee, cold and frozen food, and custom vending machines….

#2 Cantaloupe, Inc.

Domain Est. 1996

Website: cantaloupe.com

Key Highlights: Upgrade your machines with cashless card readers. Engage more customers with secure cashless payments and vending management software. Offer more options for ……

#3 Prepaid Card Vending Machine

Domain Est. 1997

Website: technikmfg.com

Key Highlights: Our vending machine manufacturers design, build and support machines that dispense cards without the need to constantly pour resources (time and money) into ……

#4 Online Vending Machines, Inc

Domain Est. 1999 | Founded: 1976

Website: onlinevending.com

Key Highlights: 30-day returnsOnline Vending Machines, Inc. Leaders in selling and servicing Vending Machines since 1976, Buy Vending Machines Online today from onlinevending,com….

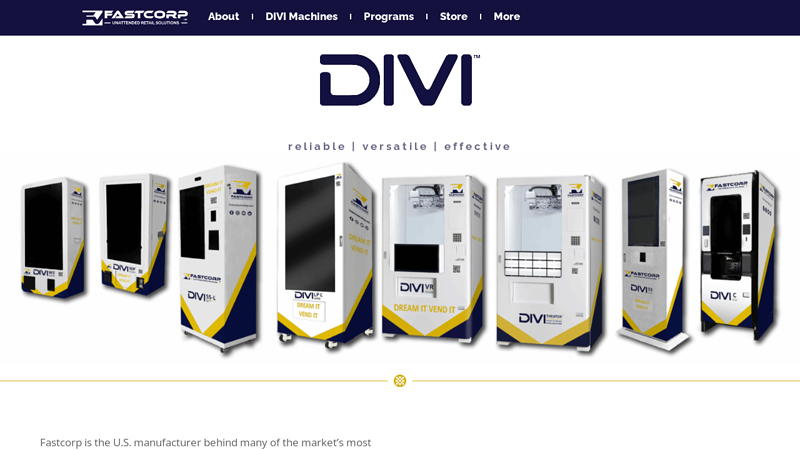

#5 Automated Vending Machines & Unattended Retail

Domain Est. 2000

Website: fastcorpvending.com

Key Highlights: Fastcorp is the U.S. manufacturer behind many of the market’s most reliable robotic vending programs. If your teams are expanding autonomous retail across ……

#6 Wittern

Domain Est. 1997 | Founded: 1931

Website: wittern.com

Key Highlights: The Wittern Group transforming the vending experience since 1931. Providing solutions that connect people to machines….

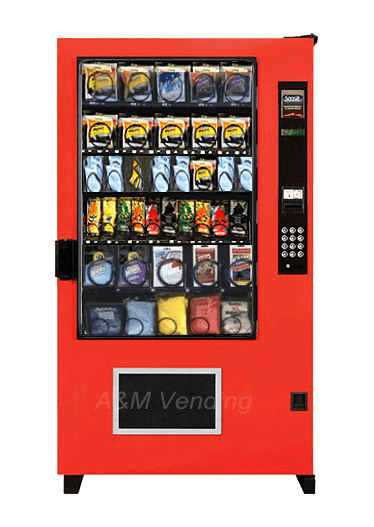

#7 AMS Vending

Domain Est. 2001

Website: amsvendors.com

Key Highlights: Book vending machines. Operates with tokens, money, credit cards and most University Cashless Systems. Use our Graphics or let us help you design your own….

#8 Silkron

Domain Est. 2004

Website: silkron.com

Key Highlights: On our vending machine marketplace, you can find various smart vending machines, touch screen vending machines, vending locker cabinets, smart vending fridges, ……

#9 Vending

Domain Est. 2013

Website: cranepi.com

Key Highlights: Our portfolio of vending solutions is specially designed to accommodate all shapes and sizes. Ask us now we can find the right fit for your products….

#10 Selectivend

Domain Est. 1998

Website: selectivend.com

Key Highlights: Buy vending machines from the #1 supplier in the USA. Get your vending machines with 100% financing & lifetime support. Start your vending business today!…

Expert Sourcing Insights for Card Vending Machine

2026 Market Trends for Card Vending Machines: Key Insights and Projections

Rising Demand for Self-Service and Cashless Transactions

The global Card Vending Machine (CVM) market is poised for significant growth by 2026, driven primarily by the increasing consumer preference for self-service solutions and the ongoing shift toward cashless economies. As financial institutions and telecom providers aim to reduce operational costs and enhance customer experience, automated card issuance through vending machines is becoming a strategic priority. These machines streamline the distribution of SIM cards, prepaid cards, debit/credit cards, and identification cards, offering faster service with minimal human intervention.

Expansion in Telecom and Financial Services Sectors

The telecommunications industry remains a major driver of CVM adoption, especially in emerging markets. With rising mobile penetration and government initiatives to expand digital connectivity, telecom operators are deploying CVMs in retail outlets, airports, and remote areas to enable instant SIM card activation. Similarly, banks and fintech companies are leveraging CVMs to issue payment cards on-demand, particularly in regions with limited branch infrastructure. By 2026, integration with digital KYC (Know Your Customer) verification and biometric authentication is expected to become standard, enhancing security and regulatory compliance.

Technological Advancements and AI Integration

Advancements in machine intelligence, IoT connectivity, and secure printing technologies are transforming CVM capabilities. By 2026, next-generation vending machines are expected to feature AI-driven user interfaces, real-time inventory tracking, predictive maintenance, and remote management systems. These innovations will improve uptime, reduce fraud, and personalize user experiences. Additionally, cloud-based platforms will allow operators to monitor and update thousands of machines simultaneously, optimizing deployment and scalability.

Regional Growth and Urbanization Trends

Asia-Pacific and Latin America are anticipated to be the fastest-growing regions for CVM deployment by 2026, fueled by rapid urbanization, rising smartphone adoption, and government support for digital inclusion. Countries like India, Indonesia, Brazil, and Mexico are investing heavily in digital infrastructure, creating fertile ground for automated card distribution. Meanwhile, North America and Europe will focus on modernizing existing systems, with an emphasis on sustainability, energy efficiency, and multi-functionality (e.g., machines that issue cards and accept deposits).

Challenges and Regulatory Considerations

Despite the positive outlook, the CVM market faces challenges such as cybersecurity risks, regulatory compliance (e.g., AML and GDPR), and initial deployment costs. Ensuring data privacy during automated card issuance and preventing identity fraud will remain critical. However, ongoing collaboration between technology providers, regulators, and financial institutions is expected to establish clearer frameworks, fostering trust and accelerating adoption.

Conclusion

By 2026, the Card Vending Machine market will be shaped by digital transformation, expanding financial inclusion, and technological innovation. As demand for instant, secure, and convenient card issuance grows across industries, CVMs will evolve into intelligent, connected kiosks central to modern service delivery ecosystems. Companies that invest in scalable, secure, and user-friendly solutions will be well-positioned to lead this dynamic market.

Common Pitfalls When Sourcing Card Vending Machines (Quality and Intellectual Property)

Sourcing Card Vending Machines (CVMs) for deployment in retail, transit, or telecom environments involves significant investment and operational risk. While cost and delivery timelines are often primary concerns, overlooking quality and intellectual property (IP) aspects can lead to long-term issues. Below are common pitfalls to avoid:

Poor Manufacturing Quality and Component Selection

Many low-cost suppliers cut corners by using substandard materials, unreliable electronic components, or inadequate environmental protection. This results in frequent machine failures, jammed cards, or susceptibility to dust and moisture—especially problematic in outdoor or high-traffic environments. Always request third-party quality certifications (e.g., ISO 9001) and conduct factory audits or sample testing before large-scale procurement.

Inadequate Software Reliability and Security

CVMs run on firmware that manages card dispensing, transaction logging, and communication with backend systems. Low-quality software can lead to crashes, data loss, or security vulnerabilities. Ensure the supplier provides regular firmware updates, uses secure boot mechanisms, and follows secure coding practices. Verify compliance with relevant cybersecurity standards (e.g., PCI DSS if handling payments).

Lack of IP Ownership or Licensing Clarity

Some suppliers use third-party firmware, user interfaces, or mechanical designs without proper licensing. When sourcing, confirm that the supplier either owns the IP or has legitimate rights to use and transfer it. Otherwise, your deployment could face legal challenges or be blocked due to IP infringement claims. Request written documentation on IP rights and software licensing terms.

Proprietary Systems with No Open Integration

Certain CVMs use closed, proprietary protocols that limit integration with existing management platforms or require expensive middleware. This reduces flexibility and increases long-term maintenance costs. Prioritize machines with open APIs, standard communication protocols (e.g., SNMP, HTTP/REST), and compatibility with common monitoring systems.

Insufficient After-Sales Support and Spare Parts Availability

Even high-quality machines require maintenance. Suppliers based overseas may offer poor technical support, delayed spare parts delivery, or no local service partners. Confirm the availability of technical documentation, spare parts lead times, and on-site support options before signing contracts.

Non-Compliance with Regional Standards

CVMs may need to meet local safety, electromagnetic compatibility (EMC), or data privacy regulations. Sourcing from generic manufacturers without region-specific certifications (e.g., CE, FCC, RoHS) can delay deployment or result in fines. Verify compliance with all applicable standards in your target markets.

Hidden Costs from Incomplete Solutions

Some vendors quote low unit prices but exclude essential features like remote monitoring software, anti-theft mechanisms, or environmental enclosures. This leads to unexpected additional expenses. Request a complete bill of materials and clarify what is included in the base price.

By addressing these quality and IP-related pitfalls during the sourcing process, organizations can ensure reliable, legally sound, and cost-effective deployment of Card Vending Machines.

Logistics & Compliance Guide for Card Vending Machine

This guide outlines key logistics and compliance considerations for deploying and operating Card Vending Machines (CVMs), ensuring smooth operations and adherence to legal and regulatory standards.

Site Selection and Installation Logistics

Selecting the right location is crucial for accessibility, security, and operational efficiency. Evaluate foot traffic, visibility, and proximity to target users (e.g., public transit hubs, retail centers, university campuses). Ensure reliable power supply and network connectivity (wired or cellular). Coordinate with property owners or facility managers for site access, permits, and installation schedules. Plan for physical security measures such as surveillance cameras, tamper-resistant enclosures, and secure mounting.

Transportation and Machine Deployment

Transport CVM units using secure, climate-controlled vehicles to prevent damage during transit. Use trained technicians for installation to ensure proper setup of hardware, software, and network configurations. Maintain a deployment checklist including firmware versions, machine ID registration, and initial testing of card dispensing and payment systems. Document installation details and obtain site sign-off.

Card Supply Chain Management

Establish a secure supply chain for prepaid or reloadable cards. Work with approved card manufacturers that comply with industry standards (e.g., ISO/IEC 7810, EMV). Implement inventory tracking from production to machine loading. Store cards in secure, access-controlled facilities. Use tamper-evident packaging during transport. Maintain audit trails for card batches, including serial numbers and distribution logs.

Secure Logistics for Cash and Cash Equivalents

If the CVM accepts cash, implement armored transport services for cash collection. Schedule regular cash reconciliation and machine servicing to avoid overfilling or out-of-service incidents. Use secure drop-safe mechanisms within the machine. For cashless systems, ensure payment gateways are PCI-DSS compliant and transaction data is encrypted.

Regulatory Compliance

Ensure CVM operations comply with local, national, and international regulations. Key areas include:

- Anti-Money Laundering (AML): Implement customer identification procedures if high-value cards are sold. Report suspicious transactions as required.

- Know Your Customer (KYC): For regulated card products (e.g., stored value cards above threshold limits), collect and verify user information per jurisdictional rules.

- Consumer Protection Laws: Provide clear pricing, terms of use, refund policies, and contact information on the machine interface.

- Accessibility Standards: Comply with ADA (U.S.) or equivalent accessibility standards, including screen readers, braille instructions, and proper height placement.

Data Privacy and Cybersecurity

Protect user data collected during transactions (e.g., payment details, phone numbers, ID verification). Ensure end-to-end encryption and secure storage in compliance with GDPR, CCPA, or other applicable data protection laws. Conduct regular security audits and penetration testing. Keep software and firmware up to date to address vulnerabilities.

Financial and Tax Compliance

Register CVM operations with relevant financial authorities if required (e.g., as a money service business). Collect and remit sales tax or VAT based on jurisdiction. Maintain accurate transaction records for auditing purposes. Reconcile daily sales reports with bank deposits and card issuance logs.

Maintenance and Servicing Logistics

Create a preventive maintenance schedule covering mechanical components, cash handling modules, card hoppers, and network systems. Train field technicians on safety and compliance procedures. Use remote monitoring tools to detect machine faults, low inventory, or connectivity issues. Respond promptly to service alerts to minimize downtime.

Incident Reporting and Audit Preparedness

Establish protocols for reporting security breaches, fraud, or machine malfunctions. Maintain logs of all incidents, responses, and resolutions. Prepare for regulatory audits by organizing records related to compliance, transactions, card distribution, and staff training. Retain documentation for the required retention period per local laws.

Environmental and Disposal Compliance

Dispose of expired, damaged, or returned cards securely through certified shredding services to prevent data leakage. Recycle machine components in accordance with e-waste regulations. Use energy-efficient models to reduce environmental impact and comply with energy standards.

Conclusion for Sourcing Card Vending Machines

Sourcing card vending machines is a strategic decision that can significantly enhance customer convenience, streamline operations, and expand revenue opportunities for businesses in sectors such as telecommunications, transportation, retail, and hospitality. After evaluating key factors such as machine functionality, reliability, cost, customization options, after-sales support, and compliance with regional regulations, it becomes clear that selecting the right supplier is critical to long-term success.

The ideal vending machine should offer secure, user-friendly access to SIM cards, gift cards, prepaid cards, or membership cards, with features like cashless payment integration, remote monitoring, and real-time inventory management. Partnering with a reputable supplier that provides scalable solutions, regular software updates, and responsive technical support ensures operational efficiency and minimizes downtime.

In conclusion, investing in high-quality card vending machines from trusted manufacturers not only improves customer experience through 24/7 availability and self-service convenience but also drives automation and digital transformation across service delivery channels. With careful vendor selection and proper deployment strategy, organizations can achieve a strong return on investment while positioning themselves at the forefront of innovation in automated retail and service solutions.