The global fuel system components market, driven by increasing vehicle production and stringent emissions regulations, is projected to grow at a CAGR of 4.8% from 2023 to 2030, according to Grand View Research. As engine efficiency becomes a pivotal focus for automakers, critical components like fuel pressure regulators play a vital role in optimizing fuel delivery and reducing emissions. Within this landscape, Carby—known for its precision-engineered fuel system solutions—has emerged as a notable player. With the aftermarket and OEM demand for reliable, high-performance regulators on the rise, particularly in emerging economies, the competition among manufacturers is intensifying. Based on market presence, technical innovation, and product reliability, here are the top 7 Carby fuel pressure regulator manufacturers shaping the industry’s future.

Top 7 Carby Fuel Pressure Regulator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Carbureted Adjustable Bypass Fuel Pressure Regulator

Domain Est. 1999

Website: tanksinc.com

Key Highlights: This billet aluminum fuel pressure regulator is machined from aircraft quality aluminum. Featuring a fluorosilicone diaphragm designed to withstand high ……

#2 Fuel Pumps, Filter and Regulators

Domain Est. 2023

Website: webercarburettor.com

Key Highlights: Sytec Fuel Pressure Gauge 0-15psi. £17.31 £20.77 inc. VAT. Add to basket Details. Weber Carburettor by JD Automotive Logo. J D Automotive Ltd The Granary, Manor ……

#3 Carbureted Fuel Pressure Regulators

Domain Est. 1995

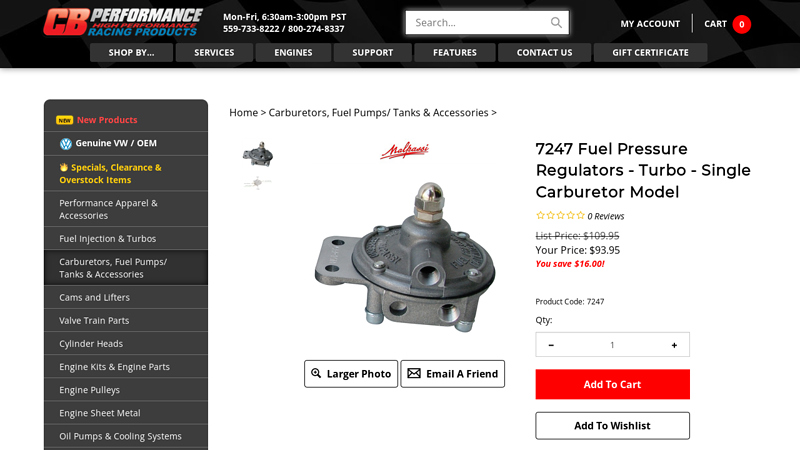

#4 7247 Fuel Pressure Regulators

Domain Est. 1996

#5 Carbureted Fuel Regulators

Domain Est. 1997

#6 Fuelab

Domain Est. 2005

Website: fuelab.com

Key Highlights: Featured Categories. Fuel Pumps · Fuel Filters · Fuel Pressure Regulators · Fuel Systems….

#7 carburetor regulators

Domain Est. 2010

Expert Sourcing Insights for Carby Fuel Pressure Regulator

H2: 2026 Market Trends for Carby Fuel Pressure Regulator

As the automotive industry evolves toward electrification and advanced fuel systems, the market for carbureted (carby) fuel pressure regulators is expected to experience a gradual decline by 2026. However, niche applications and legacy systems continue to sustain demand in specific segments. Below is an analysis of key market trends shaping the Carby Fuel Pressure Regulator landscape in 2026:

-

Declining Use in Modern Vehicles

With the global shift toward fuel-injected engines and electric powertrains, traditional carburetor-based fuel systems are being phased out in new vehicle production. As a result, demand for carby fuel pressure regulators in OEM (original equipment manufacturer) applications is shrinking. Regulatory pressures to reduce emissions and improve fuel efficiency have accelerated this transition, especially in North America, Europe, and China. -

Growth in Aftermarket and Restoration Markets

Despite declining OEM use, the aftermarket for carby fuel pressure regulators is expected to remain stable through 2026. Enthusiasts of classic cars, muscle cars, and vintage motorcycles are driving demand for authentic or upgraded carburetor components. Regions with strong car culture—such as the United States, Germany, and Japan—will continue to support a robust aftermarket for carbureted fuel system parts, including pressure regulators. -

Regional Demand Disparities

Emerging markets in Southeast Asia, Africa, and parts of Latin America may still rely on older vehicle models and small-engine applications (e.g., agricultural machinery, generators, and two-wheelers) that use carburetors. These regions could sustain modest demand for carby fuel pressure regulators, particularly in rural and off-grid applications where simplicity and ease of repair are valued over fuel efficiency. -

Integration with Performance Upgrades

Carby fuel pressure regulators are increasingly being marketed as performance-enhancing components in modified and racing vehicles. In the high-performance and off-road vehicle segments, manufacturers are offering precision-tuned regulators to optimize fuel delivery in carbureted setups. This trend supports a specialized, albeit limited, growth niche within the broader automotive performance market. -

Material and Design Innovations

To extend product relevance, suppliers are investing in improved materials (e.g., corrosion-resistant alloys and composite seals) and modular designs that enhance durability and compatibility with alternative fuels like ethanol blends. These innovations help meet the reliability expectations of both restoration and performance users. -

Competitive Landscape and Consolidation

The market is seeing consolidation among suppliers as larger automotive parts manufacturers shift focus to fuel injection and EV components. Smaller, specialized firms and aftermarket brands are filling the gap, often leveraging e-commerce platforms to reach global customers. Online retail and digital distribution channels are becoming critical for reaching niche buyers. -

Environmental and Regulatory Pressures

Increasing environmental regulations are limiting the use of carbureted systems in new applications. In many countries, emissions standards effectively ban carburetors in new vehicle production. This regulatory environment restricts market expansion but reinforces the importance of retrofit and upgrade solutions for existing carbureted fleets.

Conclusion

By 2026, the Carby Fuel Pressure Regulator market will be primarily driven by aftermarket demand, classic vehicle restoration, and performance applications rather than new vehicle integration. While overall market volume is expected to decline, opportunities remain in specialized segments and developing regions. Companies that focus on quality, compatibility, and digital engagement are likely to maintain a competitive edge in this mature but enduring niche.

Common Pitfalls When Sourcing Carby Fuel Pressure Regulators (Quality & IP)

Sourcing a fuel pressure regulator for carbureted (carby) engines involves navigating several critical pitfalls, particularly concerning quality and intellectual property (IP). Avoiding these is essential for performance, reliability, and legal compliance.

1. Compromised Quality Due to Material and Manufacturing Shortcuts

One of the most frequent pitfalls is selecting a regulator based solely on price, leading to components made from substandard materials or with poor manufacturing tolerances.

- Low-Grade Diaphragms and Seals: Inferior rubber or elastomer compounds degrade quickly when exposed to modern fuels (especially ethanol blends like E10/E15), leading to leaks, inconsistent pressure regulation, and failure. High-quality regulators use ethanol-resistant materials like Viton®.

- Poorly Machined Housing and Valves: Inconsistent machining of the valve seat or housing bores causes fuel leakage, pressure fluctuations, or complete regulator failure. Precision machining ensures a tight seal and smooth operation.

- Inaccurate Spring Tolerances: The spring determines the regulated pressure. Cheaply made springs may have wide tolerances or lose tension over time, resulting in incorrect fuel pressure that affects engine performance (rich/lean mixtures, hard starting, poor fuel economy).

- Lack of Quality Control: Reputable manufacturers implement rigorous testing (pressure testing, leak testing, cycle testing). Unbranded or budget imports often skip these steps, increasing the risk of early failure.

2. Misrepresentation of Specifications and Performance Data

Many low-cost or generic regulators lack accurate, verifiable performance data, making it difficult to ensure compatibility and reliability.

- Inflated or Vague Pressure Ratings: Claims like “Adjustable 1-7 PSI” may not reflect real-world stability across the range or under flow conditions. Actual performance might deviate significantly, especially at higher fuel flows.

- Absence of Flow Rate Specifications: Regulators have maximum flow limits. Exceeding this (e.g., with high-performance pumps or large carburetors) causes pressure drop and starvation. Quality regulators specify maximum flow capacity (e.g., GPH or LPH).

- No Durability or Cycle Life Data: Without information on expected lifespan or resistance to vibration/thermal cycling, long-term reliability is uncertain.

3. Intellectual Property (IP) Infringement and Counterfeiting

The automotive aftermarket is rife with IP violations, particularly involving designs from established brands.

- Direct Counterfeits: Some suppliers sell blatant copies of well-known regulators (e.g., Holley, Edelbrock, AED), using logos and part numbers without authorization. These often use inferior materials and construction, damaging the original brand’s reputation.

- Design Patent Infringement: Even without copying logos, many budget regulators replicate the functional design and shape of patented products, violating design or utility patents held by original manufacturers.

- Trademark Infringement: Using names or branding confusingly similar to established brands (e.g., “Holey” instead of “Holley”) misleads consumers and exploits brand equity.

- Consequences: Purchasing counterfeit or infringing parts supports illegal activity, voids warranties, and offers no recourse for failure. It also undermines innovation by legitimate manufacturers.

4. Inadequate Technical Support and Documentation

Low-cost or generic suppliers often lack the technical infrastructure to support their products.

- Missing Installation Instructions or Adjustments Guides: Improper installation (e.g., incorrect orientation, lack of return line) leads to malfunction. Quality suppliers provide clear instructions.

- No Access to Technical Expertise: When issues arise, users may find no support channel to troubleshoot problems or verify compatibility.

- Absence of Certifications: Reputable brands may provide compliance documentation (e.g., for fuel compatibility, emissions), which is typically missing from generic or counterfeit units.

5. Incompatibility with Modern Fuel Systems and Ethanol

Not all regulators are designed for today’s fuel environment.

- Ethanol Sensitivity: As mentioned, non-ethanol-resistant materials swell or crack, leading to leaks and failure. Always verify ethanol compatibility (e.g., up to E85 if required).

- Fuel Pump Compatibility: High-output electric pumps can overwhelm some regulators not designed for high inlet pressures, causing noise, chatter, or failure. Ensure the regulator is rated for your pump’s maximum pressure.

Conclusion

To avoid these pitfalls, prioritize sourcing from reputable manufacturers or authorized distributors. Verify material specifications (especially diaphragm type), demand accurate performance data, ensure compatibility with your fuel type and system, and be wary of deals that seem too good to be true—often signaling counterfeit or substandard products. Respecting IP not only ensures quality but also supports ongoing innovation in automotive performance components.

Logistics & Compliance Guide for Carby Fuel Pressure Regulator

Overview

This guide outlines the essential logistics and compliance considerations for the distribution, handling, and use of the Carby Fuel Pressure Regulator. Adherence to these guidelines ensures regulatory compliance, product integrity, and operational safety across the supply chain.

Regulatory Compliance Requirements

Emissions and Environmental Standards

The Carby Fuel Pressure Regulator must comply with applicable emissions control regulations, including but not limited to:

– EPA Part 1068 (U.S.): Regulates fuel system components to prevent evaporative and exhaust emissions.

– CARB Executive Order (California): Requires certification for aftermarket performance parts affecting emissions. Confirm EO number is listed and valid for the regulator model.

– EU End-of-Life Vehicles (ELV) and RoHS Directives: Ensure materials used (e.g., seals, housing) are free from restricted substances such as lead, mercury, and cadmium.

DOT and Transportation Safety

For domestic and international shipping:

– Classify under UN3363, Internal combustion engine (if shipped with vehicle) or as non-dangerous goods if standalone.

– Follow 49 CFR (U.S. Department of Transportation) for packaging, labeling, and documentation when transporting by road, rail, or air.

– For air freight, comply with IATA Dangerous Goods Regulations (DGR); confirm no residual fuel or pressurized components are present.

Customs and Import/Export Documentation

When shipping internationally:

– Provide accurate Harmonized System (HS) Code (e.g., 8413.30 for fuel pumps and regulators).

– Include Certificate of Conformity (CoC) and Material Safety Data Sheet (MSDS/SDS) upon request.

– Declare country of origin; U.S.-made units may qualify for preferential treatment under USMCA.

– Comply with ITAR/EAR if exported outside North America—verify no controlled technology is embedded.

Packaging and Handling Instructions

Packaging Standards

- Use anti-static, corrugated packaging with foam inserts to prevent mechanical damage.

- Seal individual units in moisture-resistant bags to prevent corrosion during transit.

- Label each package with:

- Product name and part number

- “Fragile – Handle with Care”

- “Do Not Stack” if applicable

Storage Conditions

- Store in a dry, climate-controlled environment (10°C to 30°C; 30%–60% relative humidity).

- Avoid exposure to direct sunlight, solvents, or corrosive chemicals.

- Shelf life: Up to 3 years when sealed; inspect seals and diaphragm before installation after long storage.

Shipping and Distribution

Domestic Logistics (U.S.)

- Use carriers compliant with FMCSA regulations (e.g., FedEx, UPS, or certified freight partners).

- Provide tracking numbers and delivery confirmation for all B2B shipments.

- Maintain records of shipment dates, destinations, and consignee information for traceability.

International Distribution

- Partner with logistics providers experienced in automotive parts compliance.

- Verify destination country import regulations (e.g., INMETRO for Brazil, PVoC for Kenya).

- Include multilingual labeling if required (e.g., French for Canada, Spanish for Latin America).

Quality Assurance and Traceability

Serial Number Tracking

- Each Carby Fuel Pressure Regulator must have a unique serial number for full traceability.

- Maintain a digital log of production batch, date, and testing results (e.g., pressure calibration, leak test).

Post-Market Surveillance

- Report any field failures or non-compliance issues to relevant authorities (e.g., NHTSA in the U.S.).

- Support recall procedures if required under 40 CFR Part 85 (emissions-related recalls).

Installation and End-User Compliance

Installation Guidelines

- Must be installed by certified technicians following OEM specifications.

- Use only compatible fuel types (e.g., gasoline, E10/E15); not approved for E85 or diesel without modification.

- Torque specifications: Refer to product manual (typically 15–20 ft-lbs for mounting bolts).

Warranty and Liability

- Warranty valid only if installed per Carby specifications and used in approved applications.

- Unauthorized modifications void emissions compliance and warranty coverage.

Conclusion

Proper logistics management and adherence to regulatory frameworks are critical for the safe and legal distribution of the Carby Fuel Pressure Regulator. Distributors, installers, and end-users must follow this guide to ensure compliance with environmental, transportation, and safety standards worldwide.

For updates or compliance inquiries, contact: [email protected]

Conclusion for Sourcing a Carburetor Fuel Pressure Regulator

In conclusion, sourcing the appropriate carburetor fuel pressure regulator is a critical step in ensuring optimal performance, reliability, and safety in a fuel delivery system—particularly in classic or performance vehicles utilizing carbureted engines. Unlike fuel-injected systems, carbureted setups require low fuel pressure (typically 4–7 psi), making a properly functioning regulator essential to prevent fuel flooding, vapor lock, or damage to the carburetor.

When sourcing a fuel pressure regulator, key considerations include compatibility with the engine’s fuel system (mechanical or electric fuel pump), precise pressure adjustment range, build quality, and resistance to fuel types (including ethanol blends). Additionally, ease of installation, adjustability, and reputable brand reliability should be factored into the decision.

After evaluating various suppliers, product specifications, and user reviews, it is recommended to select a regulator from a trusted manufacturer known for durability and consistent performance—such as Holley, AEM, or Edelbrock. Ensuring proper sizing, correct inlet/outlet configurations, and inclusion of necessary fittings will further streamline integration.

Ultimately, investing in a high-quality, appropriately specified fuel pressure regulator not only protects the carburetor and engine but also contributes to smoother operation, improved fuel efficiency, and enhanced engine responsiveness. Proper sourcing today prevents costly repairs and performance issues down the line.