The global carbon fiber market is experiencing robust expansion, driven by rising demand across aerospace, automotive, wind energy, and recreational sectors. According to Grand View Research, the market was valued at USD 4.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 10.2% from 2023 to 2030. This surge is fueled by the material’s high strength-to-weight ratio and growing adoption in lightweight vehicle manufacturing and renewable energy infrastructure. As demand escalates, innovation in carbon fiber materials—particularly in specialized weaves and resin-compatible shades—has positioned certain manufacturers as leaders in tailored, high-performance offerings. The following analysis highlights the top eight carbon fiber shade manufacturers shaping this evolving industry, selected based on production capabilities, technological advancements, application diversity, and compliance with next-generation design standards.

Top 8 Carbon Fiber Shades Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MONOCARBON

Domain Est. 2016

Website: monocarbontech.com

Key Highlights: Free delivery 30-day returnsMONOCARBON is a trailblazing brand dedicated to the innovation and design of carbon fiber products, seamlessly blending advanced technology with everyda…

#2 Carbon Fiber Sunglasses

Domain Est. 2007

Website: carbonfibergear.com

Key Highlights: We offer a variety of styles that will frame any face, all made from lightweight and durable carbon fiber….

#3 China Customized Forged Carbon Fiber Glasses …

Domain Est. 2012

Website: fcoptics.com

Key Highlights: Forged carbon fiber glasses are made from solid carbon fiber and are truly a sight to behold! The Graphite shades are meant to be all around, durable….

#4 POLARIZED CARBON FIBER HD SPECTRUM

Domain Est. 2013

Website: xevooptics.com

Key Highlights: Out of stockIt comes with a high-def spectrum polarized lens in a super lightweight and strong carbon fiber frame with stainless steel hinges….

#5 SPORT Real Carbon Fiber Sunglasses (Polarized Lens

Domain Est. 2014

#6 Carbon Fiber

Domain Est. 2014

#7 Carbiepoles: Carbon Fiber Poles

Domain Est. 2019

Website: carbiepoles.com

Key Highlights: Adjustable carbon fiber poles for boat shade, sandbar shades, bow poles, sail shade poles, sun shades, sunfly shades, for boats and marine….

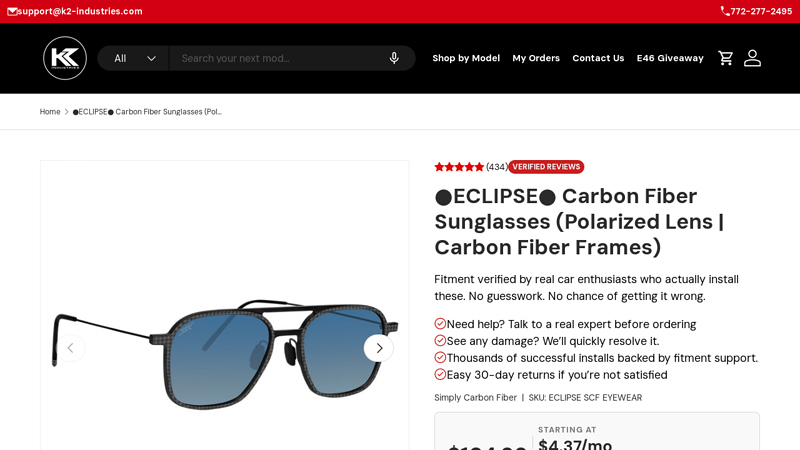

#8 ECLIPSE Carbon Fiber Sunglasses (Polarized Lens

Domain Est. 2020

Website: k2-industries.com

Key Highlights: Square shape frames Frame is made from Real Carbon Fiber Arms are made from Steel Weighs 20 grams UV400 polarized lenses Compatible with prescription lenses ……

Expert Sourcing Insights for Carbon Fiber Shades

H2: 2026 Market Trends for Carbon Fiber Shades

As we approach 2026, the market for carbon fiber shades—referring to window treatments, architectural shading systems, or automotive/aerospace sunshades incorporating carbon fiber materials or design aesthetics—is expected to reflect broader shifts in material innovation, sustainability demands, and high-performance design across key industries. While “carbon fiber shades” may denote physical products made with carbon fiber composites or designs emulating the signature weave and premium look of carbon fiber, the market is influenced by advancements in composite materials, energy efficiency standards, and consumer preferences for lightweight, durable, and aesthetically modern solutions.

-

Growth in Adoption Across Automotive and Aerospace Sectors

By 2026, the automotive and aerospace industries are projected to drive significant demand for carbon fiber-based shading solutions. High-end vehicles, electric cars (EVs), and private aircraft increasingly integrate carbon fiber components for weight reduction and thermal management. Carbon fiber sunshades and interior window treatments offer not only UV protection but also contribute to thermal insulation and cabin cooling efficiency—critical for extending EV battery life. OEMs are expected to adopt more such components as part of premium interior packages. -

Expansion in Architectural and Smart Building Integration

In commercial and luxury residential construction, carbon fiber-inspired shading systems are gaining traction for their sleek appearance and structural benefits. Though pure carbon fiber is less common due to cost and brittleness in large-scale applications, composite blends and carbon-fiber-look materials are being used in motorized blinds, louvers, and dynamic façade systems. Integration with smart building technologies—such as IoT-enabled sensors and AI-driven climate control—will allow carbon fiber-style shades to adjust automatically based on sunlight intensity, enhancing energy efficiency. This trend aligns with global green building certifications like LEED and BREEAM. -

Sustainability and Recyclability Challenges

Despite its performance benefits, carbon fiber remains expensive and difficult to recycle. However, by 2026, advancements in thermoplastic carbon fiber composites and closed-loop recycling initiatives are expected to alleviate some environmental concerns. Manufacturers are increasingly exploring bio-based resins and recycled carbon fiber content to meet ESG (Environmental, Social, and Governance) goals. This shift may open doors for more sustainable carbon fiber shade solutions in eco-conscious markets. -

Rise of Aesthetic Replication Using Alternative Materials

Due to cost constraints, many “carbon fiber shade” products in consumer markets utilize carbon fiber-look vinyl, fiberglass, or polymer films that mimic the distinctive weave. These materials offer the visual appeal of carbon fiber at a fraction of the cost and are widely used in automotive aftermarket accessories and interior décor. The 2026 market will likely see improved printing and texturing technologies, making these alternatives nearly indistinguishable from real composites while being more adaptable for flexible shading applications. -

Regional Market Dynamics

North America and Europe will remain key markets due to high demand in the luxury automotive and advanced construction sectors. Meanwhile, Asia-Pacific—especially China, Japan, and South Korea—is expected to experience rapid growth, driven by rising EV production, smart city development, and increased disposable income. Government incentives for energy-efficient buildings in countries like Germany and South Korea will further boost demand for high-performance shading solutions. -

Technological Convergence with Energy Harvesting

Emerging in 2026 is the integration of functional materials into shading systems. Some innovators are experimenting with carbon fiber composites embedded with photovoltaic elements or thermoelectric materials that convert solar heat into usable energy. While still in early stages, these hybrid systems represent a potential leap in multifunctional architectural components.

Conclusion:

By 2026, the carbon fiber shades market will evolve beyond mere aesthetics, becoming part of a broader ecosystem of lightweight, intelligent, and sustainable building and transportation solutions. While full carbon fiber products remain niche due to cost and manufacturing complexity, the convergence of design appeal, energy efficiency, and smart technology will drive innovation—making carbon fiber-inspired shading systems a symbol of high-performance modern living.

Common Pitfalls When Sourcing Carbon Fiber Shades (Quality, IP)

Sourcing carbon fiber shades—whether for automotive, aerospace, or consumer applications—requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance issues, legal risks, and reputational damage. Below are key pitfalls to avoid:

Poor Material Quality and Inconsistent Manufacturing

One of the most prevalent issues in sourcing carbon fiber shades is inconsistent or substandard material quality. Carbon fiber composites vary significantly based on fiber grade, resin system, weave type, and manufacturing process (e.g., hand lay-up vs. autoclave curing). Low-cost suppliers may use inferior-grade fibers, excessive resin content, or improper curing techniques, resulting in shades that are brittle, prone to delamination, or dimensionally unstable. This compromises both aesthetics and structural integrity, especially under temperature or UV exposure.

Misrepresentation of “Real” Carbon Fiber

Many suppliers market products as “carbon fiber” when they are actually using carbon fiber-look vinyl wraps or molded plastic with a printed pattern. These imitations lack the strength, heat resistance, and premium feel of genuine carbon fiber. Buyers may unknowingly pay a premium for faux materials, leading to customer dissatisfaction and brand damage. Always verify material authenticity through physical inspection, burn tests, or supplier certifications.

Lack of Quality Control and Traceability

Inadequate quality assurance processes—such as missing batch traceability, absence of material certifications (e.g., TDS, CoA), and lack of dimensional or mechanical testing—can result in inconsistent product performance. Without proper documentation, it’s difficult to diagnose failures or ensure compliance with industry standards (e.g., ISO, ASTM).

Intellectual Property Infringement Risks

Sourcing carbon fiber shades from unauthorized or third-party manufacturers poses significant IP risks. Many original designs (e.g., for automotive accessories or custom parts) are protected by design patents, trademarks, or copyrights. Using or distributing shades that replicate these designs without licensing can lead to legal disputes, customs seizures, or forced product recalls. Always verify that suppliers have the right to produce and sell the designs you’re sourcing.

Inadequate Tooling and Design Ownership

When custom tooling is required, a common pitfall is failing to secure ownership or usage rights to molds and CAD files. Some suppliers retain control over tooling, limiting your ability to switch manufacturers or scale production. Ensure contracts explicitly transfer IP rights for custom designs and tooling to avoid future dependencies or disputes.

Supply Chain and Compliance Gaps

Carbon fiber production involves complex supply chains with raw materials sourced globally. Ethical sourcing, environmental compliance, and export controls (especially for high-performance grades) are often overlooked. Non-compliance with regulations such as REACH, RoHS, or ITAR can disrupt shipments and expose buyers to liability.

To mitigate these risks, conduct thorough due diligence on suppliers, request material samples and certifications, audit manufacturing facilities, and consult legal experts on IP and compliance matters before finalizing procurement.

Logistics & Compliance Guide for Carbon Fiber Shades

Product Classification and HS Codes

Carbon fiber shades are typically classified under specific Harmonized System (HS) codes for international trade. Common classifications include:

– HS 7018.90: For glass fiber or similar non-metallic fiber products in shades or sheets (may apply depending on composition).

– HS 3926.90: For articles of plastics, including carbon fiber-reinforced polymer (CFRP) components.

– HS 8548.10: If shades contain integrated electronic components (e.g., motorized systems).

Note: Final classification should be confirmed with customs authorities based on full product specifications.

Import/Export Regulations

- Country-Specific Requirements: Verify import regulations in destination markets (e.g., U.S. CBP, EU customs, etc.). Some countries impose restrictions on composite materials.

- Export Controls: Carbon fiber may be subject to dual-use export control regulations (e.g., Wassenaar Arrangement). Confirm whether your product falls under controlled categories, especially for aerospace-grade materials.

- Documentation: Prepare commercial invoices, packing lists, certificates of origin, and bill of lading/airway bill. Include detailed product descriptions (material composition, dimensions, weight).

Packaging and Handling

- Use protective, non-abrasive packaging (e.g., foam inserts, padded wraps) to prevent surface scratches or delamination.

- Label packages with “Fragile,” “This Side Up,” and “Protect from Moisture.”

- Ensure packaging complies with ISPM 15 standards if using wooden crates or pallets (heat-treated and marked).

Shipping and Transportation

- Mode of Transport: Air freight is faster but costlier; sea freight is economical for bulk shipments. Consider temperature and humidity sensitivity during transit.

- Temperature and Humidity: Store and transport in dry, climate-controlled environments to prevent resin degradation or fiber warping.

- Hazardous Materials: Carbon fiber shades are generally non-hazardous but may conduct electricity—avoid contact with sensitive electronics during shipping.

Compliance with Safety and Environmental Standards

- REACH (EU): Ensure no restricted substances (e.g., certain catalysts or resins) are present above permissible limits.

- RoHS (EU/UK): If shades include electrical components, confirm compliance with restrictions on hazardous substances.

- Proposition 65 (California, USA): Disclose if any components contain listed chemicals (e.g., carbon black).

- WEEE Directive (EU): If shades are part of electrical systems, producers may need to register and support end-of-life recycling.

Labeling and Marking

- Include product identification, batch/lot number, country of origin, and manufacturer details.

- Apply CE marking (if applicable), UKCA (for UK), or FCC (if electronic integration exists).

- Provide care and handling instructions, especially for static sensitivity or UV resistance.

End-of-Life and Recycling

- Carbon fiber composites are challenging to recycle. Provide guidance for proper disposal.

- Partner with certified recyclers familiar with CFRP materials.

- Consider take-back programs to support sustainability compliance.

Certifications and Testing

- Maintain test reports for mechanical strength, UV resistance, and fire retardancy (e.g., UL 94, ASTM E84).

- Obtain third-party certifications as required by target markets (e.g., ISO 9001, ISO 14001).

Adhering to this guide ensures smooth logistics operations and regulatory compliance for carbon fiber shades across global markets. Always consult local legal and customs experts for up-to-date requirements.

In conclusion, sourcing carbon fiber shades requires a strategic approach that balances quality, cost, and reliability. When selecting suppliers, it is essential to evaluate factors such as material authenticity, manufacturing capabilities, compliance with industry standards, and scalability. Establishing relationships with reputable manufacturers—whether domestic or international—can ensure consistent product performance and durability, which are critical for high-end applications in industries like automotive, aerospace, and consumer electronics.

Additionally, conducting thorough due diligence, including material testing and supply chain transparency, helps mitigate risks related to counterfeit or substandard carbon fiber. Sustainability and ethical sourcing considerations are also becoming increasingly important, influencing long-term supplier partnerships.

Ultimately, a well-informed sourcing strategy that emphasizes quality assurance, innovation, and supply chain resilience will enable organizations to procure high-performance carbon fiber shades efficiently and sustainably, supporting both operational excellence and competitive advantage.