The global automotive emissions control market is experiencing robust growth, driven by increasingly stringent environmental regulations and the rising demand for fuel-efficient vehicles. According to Grand View Research, the global evaporative emission control systems market size was valued at USD 4.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. A critical component within this ecosystem is the carbon canister solenoid valve, which plays a vital role in managing fuel vapor emissions by controlling the flow of vapors from the fuel tank to the engine intake manifold. With automakers worldwide intensifying efforts to meet Euro 7, Bharat Stage VI, and EPA Tier 3 standards, the demand for high-performance solenoid valves is on the rise. As the market becomes more competitive, a select group of manufacturers are leading innovation, quality, and scalability. Based on market presence, technological advancement, and production capacity, the following seven companies have emerged as key players in the carbon canister solenoid valve landscape.

Top 7 Carbon Canister Solenoid Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Purge Valve

Domain Est. 2016

Website: tu-lok.com

Key Highlights: P0445 is a generic code used by purge valve manufacturers in India for denoting faults in Purge Control Valve, fuel cap, gas tank, and charcoal canister….

#2 Carbon Solenoid Valve Replacement Carbon Canister Solenoid …

Domain Est. 2016

Website: petroniatis.com

Key Highlights: It directly replaces OEM part numbers 31478962 and 32312435, and fits a bunch of Volvo models including XC90 (2016-2021), XC60 (2018-2021), V90/V90 Cross ……

#3 8653909

Domain Est. 1994

Website: usparts.volvocars.com

Key Highlights: Genuine Volvo Part # 8653909 (8653642) – Vapor Canister Purge Solenoid. VALVE. Fits C30, C70, S40, S60, S60 Cross Country, S80, V50, V60, V70, XC70….

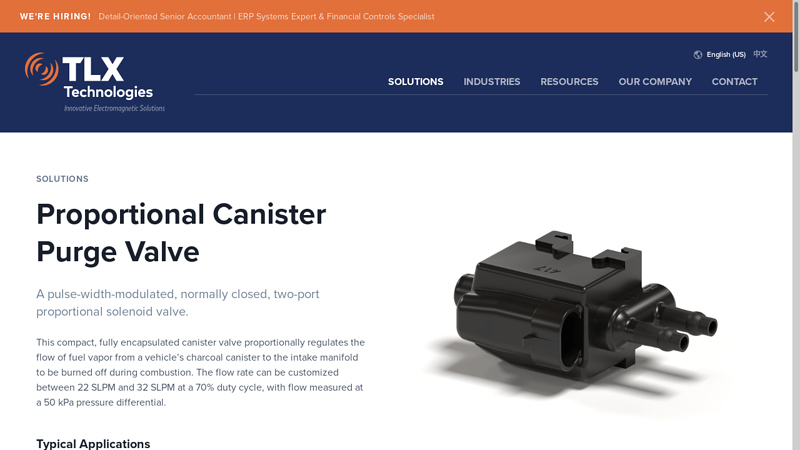

#4 Proportional Canister Purge Valve

Domain Est. 1999

Website: tlxtech.com

Key Highlights: This compact, fully encapsulated canister valve proportionally regulates the flow of fuel vapor from a vehicle’s charcoal canister to the intake manifold to ……

#5 Vapor Canister Purge Solenoids

Domain Est. 2002

Website: motorad.com

Key Highlights: The vapor canister purge solenoid is an essential component in a car’s emission control system, responsible for managing the flow of fuel vapors….

#6 Carbon canister purge valve solenoid

Domain Est. 2003

Website: picoauto.com

Key Highlights: The purpose of this test is to evaluate the operation of the carbon canister purge control valve solenoid control circuit and signal….

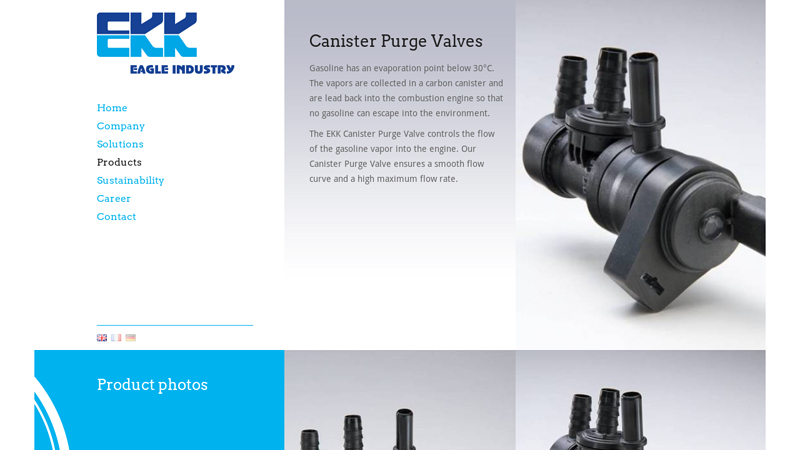

#7 EKK automotive Canister Purge Valves

Domain Est. 2014

Website: ekk-europe.com

Key Highlights: The EKK Canister Purge Valve controls the flow of the gasoline vapor into the engine. Our Canister Purge Valve ensures a smooth flow curve and a high maximum ……

Expert Sourcing Insights for Carbon Canister Solenoid Valve

H2: 2026 Market Trends for Carbon Canister Solenoid Valve

The global market for carbon canister solenoid valves is poised for significant transformation by 2026, driven by tightening emissions regulations, the rise of hybrid and electric vehicles, and advancements in fuel vapor management systems. These small but critical components, which control the flow of fuel vapors from the charcoal canister to the engine intake for combustion, are becoming increasingly sophisticated to meet evolving environmental standards and vehicle architectures.

One of the primary market drivers through 2026 is the enforcement of stricter emission norms worldwide—such as Euro 7 in Europe, China 6b, and enhanced Tier 3 standards in North America. These regulations limit evaporative emissions (EVAP), compelling automakers to adopt high-precision solenoid valves with improved sealing, faster response times, and greater durability. As a result, demand for electronically controlled, duty-cycle-modulated solenoid valves is rising over traditional on/off variants.

Another key trend is the adaptation of carbon canister solenoid valves for hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs). In these platforms, fuel systems operate intermittently, increasing the complexity of vapor management. Solenoid valves must now function reliably under irregular engine cycles and vacuum conditions. Manufacturers are responding with smart valves capable of real-time diagnostics and integration with vehicle control units (VCUs), enhancing overall evaporative system efficiency.

Additionally, lightweighting and miniaturization are influencing design trends. Suppliers are focusing on compact, lightweight solenoid valves made from advanced polymers and corrosion-resistant alloys to reduce vehicle weight and improve fuel efficiency. This is particularly relevant as automakers strive to meet fleet-wide CO₂ reduction targets.

Regionally, Asia-Pacific is expected to lead market growth by 2026, fueled by rapid automotive production in China, India, and Southeast Asia, along with aggressive clean air policies. Meanwhile, North America and Europe remain strong markets due to existing regulatory rigor and high vehicle replacement rates.

In summary, the 2026 outlook for carbon canister solenoid valves reflects a shift toward smarter, more durable, and highly regulated components. Innovation in materials, electronics integration, and compliance with global emissions standards will define competitive advantage in this niche but essential automotive segment.

Common Pitfalls Sourcing Carbon Canister Solenoid Valve (Quality & IP)

Sourcing Carbon Canister Solenoid Valves (CCSVs) for automotive applications requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to significant risks. Here are the key pitfalls to avoid:

Quality-Related Pitfalls

-

Inadequate Material Selection & Durability:

- Pitfall: Suppliers using substandard plastics, elastomers, or metals that degrade prematurely when exposed to fuel vapors, temperature extremes (-40°C to +120°C+), or under-hood chemicals.

- Consequence: Valve leakage (venting fuel vapors), sticking, cracking, or complete failure, leading to emissions test failures (EVAP system faults), fuel odor, and potential safety hazards.

- Mitigation: Demand material specifications (e.g., UL94 V-0 flammability rating, fuel resistance data), require rigorous environmental testing data (thermal cycling, vibration, salt spray, fluid exposure), and audit manufacturing processes.

-

Poor Manufacturing Consistency & Process Control:

- Pitfall: Inconsistent coil winding, sealing processes (O-rings, welds), plunger machining, or assembly leading to high reject rates, inconsistent flow characteristics, or premature wear.

- Consequence: High warranty costs, field failures (stuck open/closed), inconsistent purge flow rates impacting engine performance and emissions.

- Mitigation: Require robust quality management systems (IATF 16949 certification is essential), detailed SPC data, rigorous incoming inspection protocols, and on-site production audits.

-

Insufficient Performance Testing & Validation:

- Pitfall: Relying solely on basic “go/no-go” functional tests instead of comprehensive validation against OEM specifications (e.g., flow rates at various pressures, response time, duty cycle endurance, leak rates).

- Consequence: Valves that pass basic checks but fail under real-world operating conditions or degrade quickly, causing diagnostic trouble codes (P0440, P0441, etc.) and recalls.

- Mitigation: Specify comprehensive test requirements in the purchase order, demand certified test reports (including lifecycle testing – e.g., 100K+ cycles), and conduct independent sample validation testing.

-

Inadequate Sealing & Leak Integrity:

- Pitfall: Poor design or manufacturing of seals (O-rings, gaskets) or housing welds, leading to micro-leaks.

- Consequence: Fuel vapor leaks exceeding strict evaporative emission standards (e.g., <20mg/h), triggering OBD-II monitors and failure to pass emissions certification.

- Mitigation: Mandate stringent leak testing protocols (e.g., helium mass spectrometry or equivalent sensitivity) during production, require leak rate specifications, and verify test results.

-

Electromagnetic Interference (EMI) Susceptibility:

- Pitfall: Poor coil design or lack of shielding causing the valve to malfunction due to EMI from other vehicle systems or to emit excessive EMI itself.

- Consequence: Erratic valve operation, ECU communication errors, or failure to meet vehicle-level EMC requirements.

- Mitigation: Require compliance with relevant EMC standards (e.g., CISPR 25, ISO 11452), demand test reports, and ensure robust coil design and potential shielding.

Intellectual Property (IP) Related Pitfalls

-

Sourcing Counterfeit or Grey-Market Parts:

- Pitfall: Unintentionally purchasing valves that are counterfeit copies or diverted genuine parts (grey market) from unauthorized channels, often lacking proper IP licenses.

- Consequence: Severe quality and reliability risks (see above), potential legal liability for IP infringement (patent, trademark), supply chain disruption, and reputational damage.

- Mitigation: Source only from authorized distributors or directly from reputable OEMs/qualified Tier 1 suppliers. Conduct rigorous supplier qualification and traceability checks. Avoid “too good to be true” pricing.

-

Lack of IP Clearance for Design-Specific Valves:

- Pitfall: Using a valve design (especially for aftermarket or replacement) that infringes on active patents held by the original equipment manufacturer (OEM) or a Tier 1 supplier.

- Consequence: Legal injunctions halting sales/production, significant financial damages (royalties, lost profits), product recalls, and reputational harm.

- Mitigation: Conduct thorough patent searches (freedom-to-operate analysis) before finalizing a design or sourcing a specific valve model. Obtain written confirmation of IP clearance from the supplier. Work with legal counsel specializing in IP.

-

Unclear Ownership of Custom Designs:

- Pitfall: Developing a custom valve specification with a supplier without a clear contract defining IP ownership (e.g., who owns the tooling, design modifications, test data?).

- Consequence: Disputes over rights to use the design, inability to switch suppliers easily, supplier leveraging IP for higher prices, or even the supplier selling the design to competitors.

- Mitigation: Establish clear IP ownership clauses in the development and supply agreement before work begins. Typically, the buyer (OEM) should retain ownership of custom designs and tooling paid for.

-

Inadequate Protection of Sensitive Specifications:

- Pitfall: Sharing detailed performance, material, or test specifications without proper Non-Disclosure Agreements (NDAs) in place.

- Consequence: Competitors gaining access to proprietary design knowledge or performance targets, potentially leading to reverse engineering or unfair competition.

- Mitigation: Implement robust NDA processes with all potential and existing suppliers before sharing sensitive technical information. Classify and control access to critical specifications.

By proactively addressing these common quality and IP pitfalls through rigorous supplier qualification, clear contractual agreements, thorough testing, and diligent IP management, companies can ensure a reliable, compliant, and legally secure supply of Carbon Canister Solenoid Valves.

H2: Logistics & Compliance Guide for Carbon Canister Solenoid Valve

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legal handling, transportation, storage, and disposal of Carbon Canister Solenoid Valves throughout their supply chain lifecycle.

H3: Logistics Management

- Packaging & Labeling:

- Protective Packaging: Use anti-static bags (ESD-safe) for individual valves to prevent damage to electronic components. Securely pack multiple units in sturdy, cushioned inner packaging (e.g., foam inserts, bubble wrap) within robust outer cardboard boxes to withstand handling and transit.

- Clear Labeling: Boxes must be clearly labeled with:

- Product Name/Part Number (e.g., “Carbon Canister Solenoid Valve – P/N 123456”)

- Quantity

- Net Weight

- “Fragile” and “This Side Up” handling symbols.

- Manufacturer/Supplier Name and Address.

- Batch/Lot Number (for traceability).

- ESD-Sensitive symbol (if applicable).

- “Do Not Crush” or similar warnings.

- Storage Conditions:

- Environment: Store in a clean, dry, temperature-controlled environment (typically 5°C to 40°C / 41°F to 104°F, consult manufacturer specs). Avoid direct sunlight, excessive humidity (>75% RH), and corrosive atmospheres.

- Shelving: Store on pallets or shelves off the floor. Keep away from heat sources, water pipes, and areas prone to flooding or leaks.

- Orientation: Store boxes upright as labeled. Avoid stacking beyond the manufacturer’s specified limit.

- Inventory Management: Implement FIFO (First-In, First-Out) rotation. Monitor shelf life if specified by the manufacturer.

- Transportation:

- Mode: Suitable for standard road, air (passenger & cargo), and sea freight. Confirm specific regulations for air/sea if transporting hazardous materials (see Compliance).

- Handling: Use appropriate material handling equipment (pallet jacks, forklifts) with care. Prevent dropping, rolling, or crushing of packages. Secure loads in vehicles.

- Documentation: Ensure shipping documents (Bill of Lading, Air Waybill) accurately reflect contents, quantities, and declared value. Include commercial invoice with detailed description.

H3: Regulatory Compliance

- Environmental Regulations (Primary Focus):

- EPA (USA): The valve itself is a component of the Evaporative Emissions Control (EVAP) system regulated under the Clean Air Act (40 CFR Part 86). While the valve isn’t typically regulated in transport as a standalone hazardous material, ensure the final vehicle/assembly it’s used in complies with EPA EVAP standards. Crucially, valves removed from vehicles (end-of-life) may contain residual hydrocarbons and require proper hazardous waste handling (see Disposal).

- EU End-of-Life Vehicles (ELV) Directive 2000/53/EC: Regulates the treatment and recycling of end-of-life vehicles. Components like solenoid valves containing potentially hazardous substances (e.g., lead in solder, residual fuel) must be treated accordingly during vehicle dismantling. Proper de-pollution (including draining fluids) is mandatory before dismantling.

- REACH (EU): Ensure the valve complies with REACH regulations regarding the registration, evaluation, authorization, and restriction of chemicals (SVHC list). Suppliers must provide Safety Data Sheets (SDS) if required.

- RoHS (EU): Verify compliance with the Restriction of Hazardous Substances directive (2011/65/EU), limiting substances like lead, mercury, cadmium, etc., in electrical/electronic equipment. Applies to the valve’s construction.

- Transportation of Dangerous Goods (If Applicable):

- General Rule: New, unused solenoid valves are typically not classified as dangerous goods for transport (UN number, hazard class) under IATA DGR, IMDG Code, or ADR. They contain no significant quantities of flammable liquids, gases, or other regulated hazardous materials in their new state.

- Exception – Used/Contaminated Valves: Valves removed from vehicles may contain residual gasoline vapors or liquid hydrocarbons absorbed in the canister material (if attached) or within the valve body. These MAY be classified as:

- UN 1203, GASOLINE or PETROL, Class 3, PG II or III (Flammable Liquid).

- Proper Shipping Name: “Combustible liquid, n.o.s.” or “Flammable liquid, n.o.s.” depending on flash point.

- Handling: Requires packaging meeting performance standards (e.g., IBC, drums, approved boxes), hazard labeling (Class 3 Flammable Liquid), and appropriate transport documentation (Dangerous Goods Note). Consult SDS and regulations based on actual contamination level.

- Safety Data Sheets (SDS):

- Obtain a current SDS from the manufacturer/supplier. While often “Not classified” for major hazards in new condition, the SDS will detail:

- Composition (confirming RoHS/REACH compliance).

- Handling and storage precautions (ESD, environmental conditions).

- Disposal considerations.

- Information on potential hazards if contaminated (e.g., flammability of residues).

- Obtain a current SDS from the manufacturer/supplier. While often “Not classified” for major hazards in new condition, the SDS will detail:

- Waste Disposal:

- New/Unused Valves: Typically non-hazardous electronic waste (e-waste). Dispose of according to local e-waste recycling regulations. Do not landfill.

- Used/Contaminated Valves: Treat as hazardous waste due to potential hydrocarbon contamination. Follow strict procedures:

- Collect in approved, sealed, labeled containers (e.g., UN-certified drums for flammable liquids).

- Store in designated hazardous waste areas.

- Dispose of through licensed hazardous waste contractors following local regulations (e.g., RCRA in the US, Waste Electrical and Electronic Equipment – WEEE in the EU which overlaps with ELV). Never pour residues down drains or into the environment.

H3: Documentation & Traceability

- Maintain records of:

- Supplier Certificates of Conformity (RoHS, REACH, etc.).

- SDS copies.

- Shipping manifests and transport documents.

- Batch/Lot numbers for traceability (critical for recalls).

- Waste disposal manifests (for hazardous waste).

Disclaimer: This guide provides general information. Specific requirements can vary significantly based on your location, the specific valve model, its condition (new vs. used), and the quantity being handled. Always consult the manufacturer’s specifications, Safety Data Sheets (SDS), and relevant local, national, and international regulations for definitive compliance requirements.

Conclusion on Sourcing Carbon Canister Solenoid Valve

In conclusion, sourcing a carbon canister solenoid valve requires a strategic approach that balances quality, cost, compliance, and supply chain reliability. As a critical component of the evaporative emission control system (EVAP), the solenoid valve must meet stringent automotive standards to ensure vehicle performance, fuel efficiency, and environmental compliance.

After evaluating potential suppliers, it is evident that sourcing from manufacturers with ISO/TS 16949 (or IATF 16949) certification, robust quality control processes, and proven experience in automotive applications is essential. Both OEM and aftermarket options should be assessed based on durability, compatibility with vehicle systems, and adherence to OBD-II and emissions regulations.

A dual-sourcing strategy may be beneficial to mitigate supply chain risks, while long-term partnerships with reliable suppliers can lead to cost savings, improved lead times, and better technical support. Additionally, considering regional regulations and environmental standards—such as those set by the EPA, Euro 6, or China 6—is crucial to ensure global market compliance.

Ultimately, the optimal sourcing decision should prioritize component reliability and regulatory adherence, supported by thorough supplier audits, sample testing, and lifecycle cost analysis. By doing so, manufacturers and fleet operators can ensure emission system integrity, reduce warranty claims, and support sustainable automotive operations.