The global cardboard tubes market is experiencing steady growth, driven by rising demand for sustainable packaging solutions across industries such as construction, textiles, food & beverage, and chemicals. According to Grand View Research, the global paper packaging market—of which cardboard tubes are a key component—was valued at USD 408.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. This growth is underpinned by increasing environmental awareness and regulatory support for recyclable materials, particularly as businesses shift away from plastic-based alternatives. Cardboard tubes, known for their durability, versatility, and 100% recyclability, are gaining traction as eco-friendly solutions for cores, spools, and protective shipping containers. With North America and Europe leading in sustainable packaging adoption and Asia-Pacific emerging as a fast-growing region due to industrial expansion, the demand for high-quality cardboard tube manufacturers is on the rise. In this competitive landscape, selecting manufacturers that combine innovation, scalability, and environmental responsibility is critical. Based on market presence, production capacity, and sustainability practices, here are the top 10 cardboard tubes manufacturers shaping the industry’s future.

Top 10 Carboard Tubes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Paper Tube Manufacturer for Retail & Industrial Applications

Domain Est. 1997

Website: papertube.com

Key Highlights: A leading paper tube manufacturer for retail and industrial applications, Jonesville Paper Tube creates custom paper tubes for your exact needs….

#2 Industrial Cardboard Tube Manufacturers and Suppliers

Domain Est. 2012

Website: cardboardtubemanufacturers.com

Key Highlights: Find cardboard tube manufacturers and suppliers that can design, engineer, and manufacture all kinds of industrial cardboard tubes….

#3 Tubes and Cores

Domain Est. 1995

Website: sonoco.com

Key Highlights: Sonoco engineers high-performance tubes and cores with precise technology to fit your unique market, product and process. With piloting capabilities, radio ……

#4 Callenor: Leaders in Paperboard Product Supply

Domain Est. 1999

Website: callenor.com

Key Highlights: For over 70 years, our expertise as a leading paper tube manufacturer has set the standard in producing spiral paper tubes and cores, large cardboard tubes, ……

#5 Paper Tubes and Sales Manufacturing

Domain Est. 2000

Website: pts-mfg.com

Key Highlights: Welcome to Paper Tubes and Sales Manufacturing, where we design, fabricate and sell industrial and consumer paper tubes, composite cans and paper cores….

#6 Paper Tube Manufacturers

Domain Est. 2002

Website: paper-tubes.net

Key Highlights: Chicago Mailing Tube is a premier manufacturer of custom paper tubes, containers, and cores, providing products that are both high quality and economical….

#7 Producer of Paperboard Products

Domain Est. 2014

Website: oxindustries.com

Key Highlights: We are the largest independently owned, vertically integrated producer of paperboard, paper tube and core, specialty paper, and protective packaging products….

#8 Corex Group

Domain Est. 2006

Website: corexgroup.com

Key Highlights: Every year our 29 companies, spread across 15 countries, produce some 300 000 tonnes of cardboard tubes, cores, edge protectors and consumer……

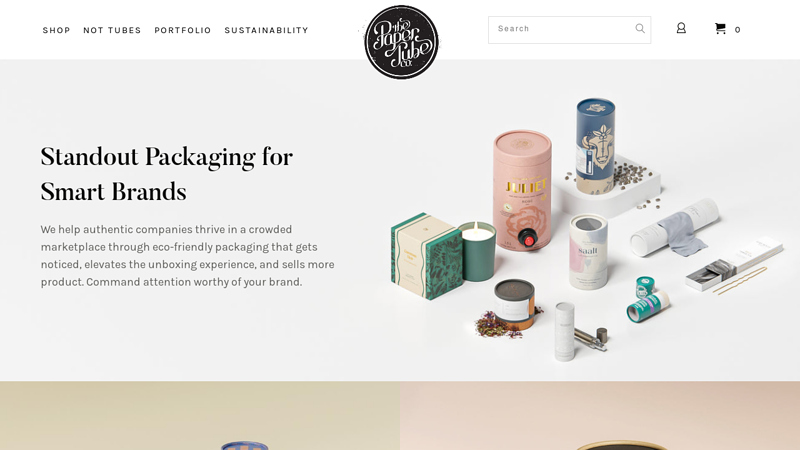

#9 Paper Tube Co.

Domain Est. 2013

Website: papertube.co

Key Highlights: We design, engineer, and manufacture custom paper tube packaging that stands out, gets noticed, and sells more products. Used by global consumer brands and ……

#10 News

Domain Est. 1997

Website: custompapertubes.com

Key Highlights: Custom Paper Tubes, one of the nation’s leading manufacturers … Paper Tubes officially launched a new, streamlined website to the public….

Expert Sourcing Insights for Carboard Tubes

H2: 2026 Market Trends for Cardboard Tubes

The cardboard tubes market is poised for dynamic shifts by 2026, driven by sustainability imperatives, evolving packaging demands, and technological advancements. Here are the key trends shaping the industry:

1. Surge in Sustainable Packaging Demand:

Environmental regulations and consumer preference for eco-friendly solutions will be the primary growth driver. Cardboard tubes, being 100% recyclable, biodegradable, and often made from recycled content, are increasingly favored over plastic alternatives. By 2026, industries such as cosmetics, food, and consumer electronics are expected to adopt cardboard tubes for packaging premium and sustainable products, accelerating market expansion.

2. Technological Innovation in Tube Manufacturing:

Advancements in production technologies—including high-speed winding systems, digital printing integration, and moisture-resistant coatings—will enhance the functionality and aesthetic appeal of cardboard tubes. These innovations allow for customized branding, improved durability, and suitability for sensitive products, broadening their application scope beyond traditional uses.

3. Growth in E-Commerce and Product Protection:

With the continued rise of online retail, the need for robust, lightweight packaging is growing. Cardboard tubes offer excellent crush resistance and are ideal for shipping fragile or elongated items (e.g., posters, architectural plans, or premium gifts). Their efficient design reduces shipping volume and material waste, aligning with e-commerce logistics optimization goals.

4. Expansion in Niche and Premium Applications:

Beyond industrial and packaging uses, cardboard tubes are gaining traction in niche markets such as luxury gift packaging, eco-conscious fashion (e.g., for rolled garments or accessories), and sustainable home goods. Brands are leveraging the premium look and tactile appeal of printed cardboard tubes to enhance unboxing experiences and brand perception.

5. Regional Market Growth and Supply Chain Localization:

Asia-Pacific is expected to lead market growth due to rising manufacturing activity and packaging demand in countries like China and India. Meanwhile, North America and Europe will focus on circular economy models, with increased investment in local recycling infrastructure to support sustainable cardboard tube production and reduce carbon footprints.

6. Regulatory and Compliance Pressures:

Stricter global regulations on single-use plastics (e.g., EU Single-Use Plastics Directive) will further incentivize the shift to paper-based solutions. Cardboard tubes will benefit from favorable legislation, while manufacturers may face compliance requirements related to sourcing, recyclability labeling, and carbon reporting.

Conclusion:

By 2026, the cardboard tubes market will be defined by sustainability, innovation, and diversification. Companies that invest in eco-design, digital customization, and efficient production will be best positioned to capitalize on the growing demand across consumer, industrial, and luxury segments.

Common Pitfalls Sourcing Cardboard Tubes (Quality, IP)

Sourcing cardboard tubes may seem straightforward, but overlooking key quality and intellectual property (IP) considerations can lead to significant problems, including product failure, supply chain disruptions, reputational damage, and legal liabilities. Here are the most common pitfalls to avoid:

Inadequate Quality Specifications and Testing

One of the foremost pitfalls is failing to define and enforce clear, measurable quality standards. Generic descriptions like “strong” or “durable” are insufficient. Without detailed specifications covering dimensions (inner/outer diameter, length, wall thickness), compression strength (crush resistance), burst strength, moisture resistance, and surface finish, suppliers may deliver subpar products. Additionally, skipping third-party or in-house quality testing—such as edge crush tests (ECT), burst tests, or drop tests—can result in tubes that collapse under load or fail during shipping, leading to damaged goods and customer dissatisfaction.

Overlooking Material Composition and Sustainability Claims

Many buyers assume all cardboard tubes are eco-friendly, but inconsistencies in material sourcing and manufacturing processes can undermine sustainability goals. Pitfalls include accepting vague claims like “recycled” or “biodegradable” without verifying the percentage of post-consumer waste, certifications (e.g., FSC, PEFC), or compliance with environmental regulations. Using non-compliant materials may expose the buyer to greenwashing accusations or fail to meet corporate sustainability targets.

Ignoring Tolerances and Dimensional Consistency

Cardboard tubes that vary even slightly in diameter or length can cause assembly line jams, improper fit in packaging, or misalignment in automated machinery. Suppliers with poor process control may deliver inconsistent batches, especially if they lack precision cutting and winding equipment. Establishing tight tolerance ranges and conducting regular batch inspections are critical to avoid downstream production delays.

Supply Chain and Lead Time Risks

Relying on a single supplier or one located in a high-risk geographic region can expose procurement to disruptions due to raw material shortages, logistical issues, or political instability. Long lead times combined with poor communication can result in stockouts or rushed, lower-quality alternatives. Developing a diversified supplier base and maintaining safety stock mitigates these risks.

Intellectual Property (IP) Infringement

A less obvious but serious pitfall is inadvertently sourcing tubes that infringe on patented designs or proprietary technologies. Some suppliers may replicate patented tube structures—such as specialized locking seams, reinforced layers, or unique core designs—without licensing them. If a buyer incorporates these infringing components into their product, they could face legal action, product recalls, or cease-and-desist orders. Always require suppliers to confirm that their designs do not violate existing patents, and consider conducting IP due diligence for custom or high-volume applications.

Lack of Traceability and Documentation

In regulated industries (e.g., food, pharmaceuticals), tubes must meet specific hygiene and safety standards. Sourcing without proper documentation—such as certificates of compliance, material safety data sheets (MSDS), or food-grade certifications (e.g., FDA, EU 10/2011)—can result in non-compliance. Poor traceability also complicates recalls or quality investigations, as it becomes difficult to identify the source of defective batches.

Underestimating Customization Costs and MOQs

Custom-sized or printed tubes often come with high minimum order quantities (MOQs) and extended setup costs. Buyers may overlook these financial and logistical implications, leading to excess inventory or unexpected project expenses. Clear communication about volume requirements and cost structures during the sourcing phase is essential.

By proactively addressing these pitfalls—through rigorous specifications, supplier vetting, quality assurance, and IP diligence—buyers can ensure reliable, compliant, and cost-effective sourcing of cardboard tubes.

Logistics & Compliance Guide for Cardboard Tubes

Cardboard tubes are widely used for packaging textiles, paper products, films, and industrial materials. Efficient logistics and adherence to compliance standards are essential for safe handling, transportation, and regulatory acceptance. This guide outlines key considerations for shipping and managing cardboard tubes across supply chains.

Product Characteristics & Handling

Cardboard tubes are typically cylindrical, hollow, and made from recycled or virgin paperboard. Their structural strength varies based on wall thickness, diameter, and length. Due to their shape, they are susceptible to bending, crushing, and moisture damage if not handled properly.

- Fragility: Long or thin-walled tubes may require internal support (e.g. plugs) or external banding.

- Moisture Sensitivity: Exposure to humidity or water can weaken tube integrity. Use moisture-resistant coatings or protective wrapping when necessary.

- Stacking: Avoid stacking heavy loads directly on tubes unless designed for vertical load-bearing. Use pallets and dunnage for stability.

Packaging & Unitization

Proper packaging ensures product protection during transit and facilitates efficient handling.

- Individual Wrapping: Use stretch film, kraft paper, or corrugated end caps to protect tube ends and surfaces.

- Banding and Strapping: Apply horizontal or diagonal straps (plastic or steel) to secure grouped tubes on pallets.

- Palletization: Place tubes horizontally or vertically on wooden or plastic pallets. Use edge protectors and corner boards to prevent damage.

- Load Securing: Use stretch wrap, shrink film, or lashing to prevent shifting during transport.

Transportation & Freight Considerations

Cardboard tubes often require special attention during shipping due to their length and diameter.

- Mode of Transport: Suitable for truck, rail, sea, and air freight. Long tubes may require specialized trailers or flatbeds.

- Length Restrictions: Confirm carrier limitations for oversized loads (e.g., tubes longer than 12 ft may require permits).

- Loading Techniques: Avoid overhanging loads. Use cradles or supports for long tubes in containers or trailers.

- Temperature & Humidity Control: For sensitive applications, consider climate-controlled containers to prevent warping or delamination.

Regulatory & Compliance Requirements

Compliance ensures legal shipment and environmental responsibility.

- ISPM 15 (International Standards for Phytosanitary Measures No. 15): Applies if wooden pallets or dunnage are used in international shipments. Requires heat treatment or fumigation and stamping.

- REACH & RoHS (EU Regulations): Ensure inks, coatings, or adhesives used on tubes comply with chemical restrictions.

- FDA Compliance (USA): Required if tubes contact food (e.g., for food-grade wrapping paper). Must be made from FDA-compliant materials.

- FSC or SFI Certification: Demonstrates sustainable sourcing of paper materials. Often required by eco-conscious customers.

- Recyclability & Labeling: Clearly label tubes as recyclable. Avoid non-separable plastic components that hinder recycling.

Documentation & Marking

Accurate documentation supports traceability and customs clearance.

- Shipping Labels: Include product description, quantity, weight, dimensions, and handling instructions (e.g., “Fragile,” “This Side Up”).

- Bill of Lading (BOL): Specify tube dimensions and any special handling needs.

- Commercial Invoice & Packing List: Required for international shipments. Include material composition and origin.

- Safety Data Sheets (SDS): Provide if tubes include chemical coatings or adhesives.

Sustainability & Environmental Compliance

Environmental standards are increasingly critical in packaging logistics.

- Recycled Content: Use tubes with high post-consumer recycled content to meet sustainability goals.

- Waste Reduction: Optimize tube dimensions to reduce material use and transport volume.

- End-of-Life Management: Promote recyclability and provide disposal guidance to customers.

Best Practices Summary

- Inspect tubes for defects before shipping.

- Use protective packaging tailored to transport conditions.

- Train staff on proper handling and stacking techniques.

- Partner with carriers experienced in long or bulky cargo.

- Maintain compliance documentation for audits and certifications.

By following this guide, companies can ensure the safe, efficient, and compliant logistics of cardboard tubes across domestic and international supply chains.

Conclusion for Sourcing Cardboard Tubes:

Sourcing cardboard tubes requires a strategic approach that balances cost, quality, sustainability, and reliability. After evaluating potential suppliers, considering material specifications, production capabilities, and logistical factors, it is clear that selecting the right partner is crucial to ensuring consistent product performance and supply chain efficiency. Prioritizing suppliers who use eco-friendly materials and adhere to sustainable manufacturing practices not only supports environmental goals but also enhances brand reputation. Additionally, building strong relationships with reputable suppliers ensures flexibility, timely delivery, and the ability to scale production as needed. In conclusion, a well-structured sourcing strategy for cardboard tubes—focused on quality, sustainability, and long-term partnerships—will contribute significantly to operational success and customer satisfaction.