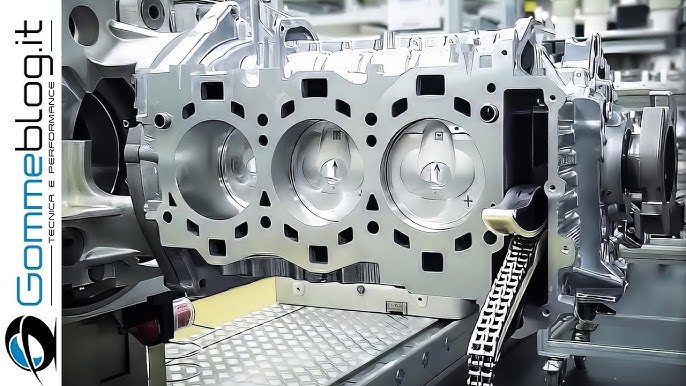

The global market for automotive thermal management systems, including car heating blocks, is experiencing robust growth driven by rising vehicle production, stricter emission regulations, and increasing demand for enhanced cabin comfort—especially in colder climates. According to Grand View Research, the global automotive HVAC market was valued at USD 42.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth trajectory is further supported by innovations in electric vehicle (EV) thermal systems, where efficient heating solutions like heating blocks are critical for battery performance and passenger comfort without draining power excessively. Mordor Intelligence also highlights a CAGR of over 5.8% for the automotive HVAC market through 2028, citing rising consumer demand for advanced climate control and integrated energy efficiency. As automakers and Tier-1 suppliers seek reliable, high-performance components, manufacturers of car heating blocks are playing an increasingly vital role in modern vehicle design. The following analysis identifies the top 8 car heating block manufacturers leading this evolution through innovation, scale, and global supply chain integration.

Top 8 Car Heating Block Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Kelvion

Domain Est. 2005

Website: kelvion.com

Key Highlights: Kelvion, your manufacturer for heat exchangers & cooling & heating solutions: plate heat exchangers, cooling heat exchangers & more!…

#2 Block Heaters, Engine Block Heater Manufacturer and Supplier

Domain Est. 2012

Website: vvkb.com

Key Highlights: Vvkb Block Heaters feature innovation technologies for rapid and short warm-up of vehicle engines, eliminating engine wear due to cold starting….

#3 Leading Diesel heater & Engine Block Heater Manufacturer

Domain Est. 2017

Website: warmda.com

Key Highlights: Warmda LLC: Expert in diesel heater & engine block heaters. 27 years of innovation. Trusted globally. Explore our quality range for vehicles & boats….

#4 Innovative heating solutions from Webasto for all types of vehicles

Domain Est. 1997

Website: webasto.com

Key Highlights: Webasto offers versatile heating solutions for cars, buses, boats, motorhomes and more. Experience comfort and reliability wherever you are….

#5 Mitsubishi Heavy Industries, Ltd. Global Website

Domain Est. 1998

Website: mhi.com

Key Highlights: Welcome to the global website of Mitsubishi Heavy Industries, Ltd. Introduce Mitsubishi Heavy Industries and its group companies….

#6 Zerostart Block Heaters

Domain Est. 2001

Website: phillipsandtemro.com

Key Highlights: Engine block heaters designed and tested for each individual engine application. Manufactured under the Zerostart / Temro brands….

#7 Frost heater

Domain Est. 2004

Website: frostheater.com

Key Highlights: For over 25 years we have been designing, developing, and producing Custom Engine Heaters for Volkswagens, Audis, Super Duty Fords, and Sprinter….

#8 Kats Black Heater

Domain Est. 2014

Website: katsblockheater.com

Key Highlights: Kats Block Heater | Katsblockheater.com. This domain is for sale and has good traffic counts and search engine ranking, as of the writing of this….

Expert Sourcing Insights for Car Heating Block

H2: 2026 Market Trends for Car Heating Blocks

The global market for car heating blocks is poised for significant transformation by 2026, driven by evolving automotive technologies, regulatory pressures, and shifting consumer demands. Car heating blocks—also known as engine block heaters—are increasingly being adapted to meet the needs of modern vehicles, especially in colder climates where cold-start performance and fuel efficiency are critical. Below is an analysis of key market trends expected to shape the car heating block industry in 2026.

-

Electrification and Integration with EVs

With the global push toward electric vehicles (EVs), traditional internal combustion engine (ICE) heating blocks are being reimagined. In 2026, car heating block technology is increasingly being integrated into EV thermal management systems. Pre-heating battery packs and cabin spaces using electric heating elements improves charging efficiency and range in cold weather. As a result, manufacturers are developing low-power, smart heating blocks compatible with EV architectures. -

Smart and Connected Features

The 2026 market sees a surge in smart heating blocks equipped with Wi-Fi, Bluetooth, and mobile app integration. Consumers can remotely activate heating systems via smartphones, optimizing start-up conditions and energy use. These IoT-enabled devices often feature scheduling, temperature monitoring, and energy consumption tracking, enhancing user convenience and energy efficiency. -

Energy Efficiency and Sustainability Regulations

Governments in North America, Europe, and parts of Asia are enforcing stricter energy efficiency standards for vehicle auxiliary systems. This is driving innovation in low-wattage, high-efficiency heating blocks. In 2026, manufacturers prioritize eco-friendly materials and energy-saving designs to comply with environmental regulations and appeal to sustainability-conscious consumers. -

Cold Climate Demand Remains Strong

Despite advancements in all-weather engine technologies, demand for heating blocks remains robust in regions with harsh winters—such as Canada, Scandinavia, Russia, and northern U.S. states. In these markets, heating blocks are considered essential for vehicle maintenance and fuel economy, supporting steady market growth. -

Aftermarket Expansion and OEM Partnerships

The aftermarket segment continues to grow, with consumers retrofitting older vehicles with modern heating solutions. At the same time, original equipment manufacturers (OEMs) are incorporating heating blocks as standard or optional features in new vehicle models, particularly in premium and commercial vehicle segments. Strategic partnerships between heating block suppliers and OEMs are expected to increase by 2026. -

Technological Advancements in Materials and Design

Innovations in heating element materials—such as ceramic and carbon fiber—lead to faster warm-up times, improved durability, and reduced power consumption. Modular and universal-fit designs are becoming more common, allowing for easier installation across different vehicle makes and models. -

Impact of Global Supply Chains and Raw Material Costs

The market faces challenges related to fluctuating prices of copper, aluminum, and rare earth elements used in heating components. However, by 2026, many manufacturers are mitigating risks through localized production, recycling programs, and supply chain diversification.

In summary, the 2026 car heating block market reflects a convergence of traditional utility and modern innovation. While rooted in the need for cold-weather vehicle operation, the sector is evolving rapidly due to electrification, digitalization, and sustainability imperatives. Companies that adapt to these trends—by investing in smart technologies, EV compatibility, and energy-efficient designs—are likely to lead the market in the coming years.

Common Pitfalls When Sourcing Car Heating Blocks (Quality & IP)

Sourcing car heating blocks—critical components in vehicle thermal management systems—requires careful attention to both quality assurance and intellectual property (IP) protection. Overlooking these areas can lead to product failures, legal disputes, and reputational damage. Below are the most common pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Supplier Vetting

Many buyers select suppliers based solely on cost or lead time, neglecting audits of manufacturing capabilities, quality control processes, and certifications (e.g., IATF 16949). This increases the risk of receiving inconsistent or substandard heating blocks prone to overheating, short circuits, or premature failure.

2. Poor Material Specification Compliance

Heating blocks must use high-temperature-resistant, electrically insulated materials. Suppliers may cut costs by substituting inferior alloys or thermal interface materials, compromising performance, safety, and longevity—especially under extreme automotive operating conditions.

3. Lack of Rigorous Testing Protocols

Failing to enforce comprehensive testing—including thermal cycling, dielectric strength, vibration resistance, and long-term durability—can allow defective units to enter the supply chain. Suppliers may perform only basic checks, missing latent defects.

4. Inconsistent Manufacturing Processes

Without strict process controls (e.g., automated welding, consistent resistor placement), even certified suppliers can produce units with variable performance. This inconsistency leads to unpredictable heating patterns and higher field failure rates.

5. Insufficient Documentation and Traceability

Missing or incomplete production records, batch traceability, and test reports make it difficult to investigate failures or ensure compliance. This is particularly critical for automotive OEMs requiring full component traceability.

Intellectual Property (IP)-Related Pitfalls

1. Weak or Unclear IP Ownership Agreements

Without explicit contractual terms, suppliers may retain rights to design modifications or reverse-engineer your specifications. This can lead to unauthorized resale of your designs or loss of competitive advantage.

2. Risk of Design Theft and Reverse Engineering

Sharing detailed technical drawings or prototypes with unveted suppliers exposes proprietary heating block designs. Unscrupulous manufacturers may replicate and sell your product to competitors, especially in regions with lax IP enforcement.

3. Inadequate Protection of Trade Secrets

Failing to implement NDAs, secure data transfer protocols, or access controls during the sourcing process increases the risk of confidential thermal management algorithms or integration methods being leaked.

4. Infringement of Third-Party Patents

Suppliers may use patented technologies (e.g., specific heating element layouts or control circuits) without licensing them. Sourcing from such vendors exposes your company to litigation, even if unintentional.

5. Lack of IP Audits in Supplier Selection

Many buyers overlook whether a supplier has freedom-to-operate or is involved in ongoing IP disputes. Partnering with such suppliers can result in supply chain disruptions or legal entanglements.

Mitigation Strategies

- Conduct thorough supplier audits and on-site quality assessments.

- Require IATF 16949 certification and regular third-party testing.

- Define exact material and performance specifications in procurement contracts.

- Use legally binding IP agreements that assign all rights to your company.

- Limit technical disclosure to “need-to-know” information and use watermarked design files.

- Perform IP landscape analyses before finalizing designs and suppliers.

By proactively addressing these quality and IP pitfalls, automotive manufacturers and Tier suppliers can ensure reliable performance, maintain competitive differentiation, and reduce legal and operational risks in their heating block supply chain.

Logistics & Compliance Guide for Car Heating Block

Product Classification & Regulatory Overview

Car heating blocks, also known as engine block heaters or car pre-heaters, are electrical devices designed to warm an engine prior to startup, particularly in cold climates. Proper classification under international trade frameworks is essential for compliance. These devices typically fall under:

– HS Code (Harmonized System): 8543.70 (Electrical apparatus for electric heating of non-industrial use) or 8516.79 (Other electro-thermic appliances), depending on design and use.

– Country-Specific Codes: Verify with local customs authorities (e.g., HTSUS in the U.S., TARIC in the EU).

Ensure accurate classification to determine import duties, restrictions, and conformity requirements.

Safety & Electrical Compliance Standards

Car heating blocks must meet region-specific electrical safety and performance standards:

– North America:

– UL 499 (Standard for Electric Heating Appliances) – Mandatory for U.S. market.

– CSA C22.2 No. 46 – Required for Canada.

– FCC Part 15 compliance if device includes electronic controls or wireless features.

– European Union:

– CE Marking under Low Voltage Directive (LVD 2014/35/EU) and Electromagnetic Compatibility (EMC 2014/30/EU).

– Compliance with EN 60335-1 (Safety of household electrical appliances) and EN 60335-2-30 (Particular requirements for room heaters).

– Other Regions:

– UKCA Marking (UK), PSE Mark (Japan), RCM Mark (Australia/New Zealand), KC Certification (South Korea).

Documentation such as test reports from accredited laboratories and Declaration of Conformity (DoC) must be maintained.

Packaging, Labeling & Marking Requirements

Proper labeling ensures regulatory compliance and safe usage:

– Mandatory Labels:

– Voltage, wattage, model number, serial number, and manufacturer details.

– Safety warnings (e.g., “Do not use with extension cords,” “For outdoor use only”).

– Country of origin marking (e.g., “Made in China”).

– Language Requirements: Labels and user manuals must be in the official language(s) of the destination country (e.g., English/French in Canada, German in Germany).

– Packaging: Must protect against moisture and mechanical damage during transit. Use recyclable materials where possible to meet environmental regulations.

Transportation & Shipping Considerations

- Mode of Transport: Typically shipped via air or sea freight. Air freight is preferred for small volumes due to speed; sea freight for bulk shipments.

- Hazard Classification: Not classified as hazardous under IATA/IMDG unless containing lithium batteries (e.g., in smart models). Verify battery inclusion and compliance with UN 3481 or UN 3091 if applicable.

- Temperature Sensitivity: Store and transport in dry, temperature-controlled environments to prevent damage to electrical components.

- Documentation: Commercial invoice, packing list, bill of lading/air waybill, and certificates of conformity must accompany shipments.

Import/Export Controls & Duties

- Export Controls: Verify if the product contains dual-use technologies (e.g., advanced sensors) subject to export regulations like EAR (U.S.) or EU Dual-Use Regulation.

- Import Duties & Taxes: Rates vary by country. Example: U.S. import duty for HS 8543.70 is typically 1.3%; EU rates vary by member state (commonly 0–2.7%).

- Customs Clearance: Provide full technical specifications, test reports, and compliance certificates to avoid delays. Use a licensed customs broker for complex markets.

Environmental & Sustainability Regulations

- RoHS (EU and similar laws): Restricts use of hazardous substances (e.g., lead, cadmium, mercury). Applies to electrical components.

- REACH (EU): Requires disclosure of Substances of Very High Concern (SVHCs) in articles.

- WEEE (EU): Producers must register and provide take-back solutions for end-of-life products.

- Energy Efficiency: While not typically regulated for heating blocks, energy consumption data should be transparent in marketing materials.

After-Sales & Market Surveillance

- Warranty & Support: Provide local customer support and warranty service in target markets.

- Incident Reporting: Monitor for field failures and comply with mandatory reporting under regulations such as EU’s RAPEX or U.S. CPSC guidelines.

- Recalls: Establish a product recall plan aligned with regional requirements in case of non-compliance or safety issues.

Summary & Best Practices

To ensure smooth logistics and compliance:

1. Confirm correct HS code and regulatory classification.

2. Obtain necessary safety certifications before market entry.

3. Prepare multilingual labeling and technical documentation.

4. Partner with experienced freight forwarders and customs brokers.

5. Maintain compliance records for audits and market surveillance.

Adhering to this guide minimizes delays, avoids penalties, and supports safe, sustainable distribution of car heating blocks globally.

Conclusion for Sourcing Car Heating Blocks

In conclusion, sourcing car heating blocks requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. As vehicle performance in cold climates becomes increasingly critical, selecting the right heating block solution is essential for ensuring engine reliability, reducing wear, and improving fuel efficiency during cold starts.

Through thorough supplier evaluation, consideration of technical specifications (such as wattage, voltage compatibility, materials, and durability), and assessment of certifications (like ISO, CE, or RoHS), businesses can identify reliable manufacturers capable of consistent production and timely delivery. Additionally, prioritizing suppliers with strong R&D capabilities and experience in automotive applications ensures long-term adaptability and innovation.

Nearshoring or regional sourcing may offer logistical advantages and faster response times, while Asian suppliers—particularly from China—can provide cost-effective solutions if quality control measures are strictly enforced. Engaging in long-term partnerships, implementing quality audits, and leveraging supply chain diversification further mitigate risks.

Ultimately, a well-structured sourcing strategy for car heating blocks not only supports operational efficiency and product performance but also enhances customer satisfaction and brand reputation in the competitive automotive market.